Kirkland Lake Gold: More Juice In The Rally

Strong financial growth likely in FY18 backed by higher gold prices, marginally higher production and lower AISC.

Robust financial flexibility with ample cash buffer, sustained free cash flows and zero debt.

Clear growth visibility from core assets beyond FY18.

Investment Overview

Kirkland Lake Gold (NYSE:KL) has been in my coverage radar since April 18, 2017. After initiating coverage on the gold mining stock with a strong buy, I provided update coverage on August 16, 2017, when the stock was 30% higher as compared to date of initiating coverage.

Since the update coverage in August, Kirkland Lake Gold has again trended higher by 50% and this has been backed by strong fundamental developments.

This thesis will discuss the factors that make Kirkland Lake Gold an interesting buy even at current levels.

Besides the point that Kirkland Lake Gold is not extensively covered, the reason for writing again on this stock is as follows:

With US airstrikes against the Syrian regime, geopolitical tensions are likely to remain escalated and this will support gold at higher levels. Kirkland Lake Gold has a decent production growth target for FY18 and the stock still remains undervalued based on forward earnings. This will be elaborated in the thesis. Gold is trending higher and Kirkland Lake Gold has guided for lower all-in-sustaining cost for 2018. This implies expanded EBITDA margin and potentially higher dividends (resulting in stock re-rating). Kirkland Lake Gold has a strong organic growth base coming from Fosterville and Macassa assets. This will ensure strong production growth beyond FY18 without stress on the balance sheet. A factor that makes Kirkland Lake Gold attractive for the next 12-24 months.Strong Financial Growth

For FY17, Kirkland Lake Gold reported production of 596,405ozs, which was 90% higher than FY16 production of 313,653ozs.

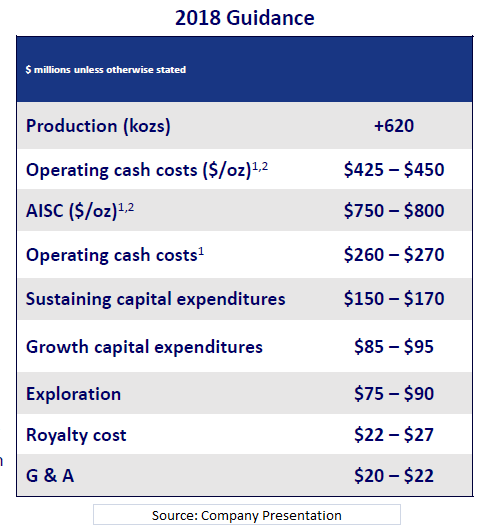

While it's unrealistic to expect similar production growth on a sustained basis, Kirkland Lake Gold expects FY18 production to be 4% higher at 620,000ozs.

The company is targeting potentially higher production growth, but even with these numbers, financial growth is likely to be robust considering the following factors:

Average realized gold price for FY18 is likely to be higher as compared to FY17. Just to put things into perspective, gold price averaged $1,257 an ounce in 2017, and for YTD 2018, gold prices have averaged above $1,300 an ounce. With escalating geopolitical tensions, gold is likely to remain firm. For FY17, Kirkland Lake Gold reported AISC of $812 an ounce that was in line with the company's guidance of $800 to $825 an ounce AISC. Kirkland Lake Gold expects 2018 AISC to be in the range of $750 to $800 an ounce. At mid-range of the guidance, AISC is likely to be $775 an ounce. EBITDA margin expansion is therefore likely on lower AISC. Margin expansion will further be supported by higher realized gold price. For 2017, Kirkland Lake Gold reported operating cash flow of $310 million. It's clear from the above two points that OCF is likely to be significantly higher in FY18. With the company's sustaining and growth capital expenditure at $250 million for FY18 (mid-range of guidance), Kirkland Lake Gold is well positioned to deliver robust free cash flows. Potentially higher dividends will follow. The point I am trying to make is already evident from the company's initial reporting of 1Q18 numbers. Cash in hand has swelled from $232 million in 4Q17 to $275 million in 1Q18.Attractive Valuation

While I will further discuss on the growth visibility for Kirkland Lake Gold beyond FY18, the valuations discussion will elaborate why the stock remains interesting at current levels.

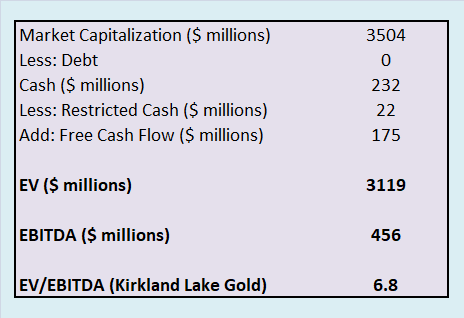

The table below gives the EV/EBITDA valuation for Kirkland Lake Gold.

The free cash flow assumption is as follows: Kirkland Lake Gold reported 1Q18 increase in cash and equivalents by $43.8 million. I have assumed the same FCF for the coming quarters. This is a conservative estimate as Kirkland Lake Gold expects higher production in 2H18 as compared to 1H18.

The EBITDA assumption for FY18 has been sourced from 4-traders.

Detour Gold Corporation (OTCPK:DRGDF) is the company's closest peer according to market capitalization and Detour trades at 2018 EV/EBITDA of 5.95. While Kirkland trades at a premium, it can be justified by the following points:

Detour Gold has provided 2018E guidance for AISC at $1,100 an ounce. Kirkland Lake Gold's AISC guidance is $775 an ounce. Therefore, EBITDA margin is likely to be significantly higher for Kirkland. Also, in case of gold downside, Kirkland has greater buffer for cash flow as compared to Detour Gold. According to revenue and EBITDA estimates from 4-traders, Detour Gold is likely to see decline in these two metrics in FY19 as compared to FY18. On the other hand, Kirkland Lake Gold is on a sustained growth path.Growth Beyond 2018

Considering the company's financial muscles, production reported in 1Q18 and advantage of higher gold prices, it is very likely that production target for FY18 will be met or exceeded.

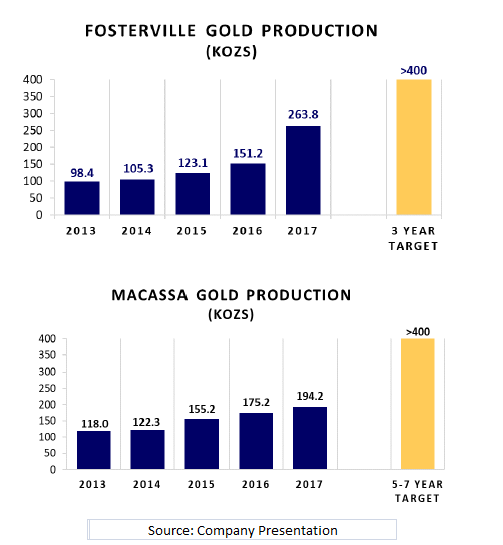

However, Kirkland Lake Gold is attractive beyond the next 12 months considering the organic growth visibility coming from Fosterville and Macassa.

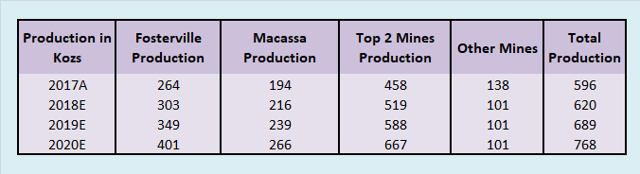

The chart below puts things into perspective with historical production data from these assets and the production growth visibility. In the next 2-3 years, these two assets are likely to remain the revenue and EBITDA growth drivers.

To further elaborate on the growth beyond 2018, the table below gives the production visibility for 2018E to 2020E based on the company's guidance for 2 key assets. The estimate for 2019 and 2020 assumes that production from other mines remains the same as 2018.

Clearly, Kirkland Lake Gold has growth visibility in terms of production and a 10% to 15% growth in production is likely for 2019 and 2020 (driven by 2 key assets).

The following points also support growth beyond 2018:

1) Kirkland Lake Gold has zero debt and that provides opportunity for inorganic growth.

2) It is worth mentioning here that Kirkland Lake Gold has pursued inorganic growth in the past by the way of merger. If gold remains firm (very likely), the company has ample financial resources to accelerate growth through the inorganic route.

3) In December 2017, Kirkland Lake Gold made a strategic investment in Novo Resources through acquisition of 25.8 million shares, representing 16.98% ownership interest. The company has also acquired 14 million common share purchase warrants. These investments set stage for growth beyond 2020 through the inorganic route.

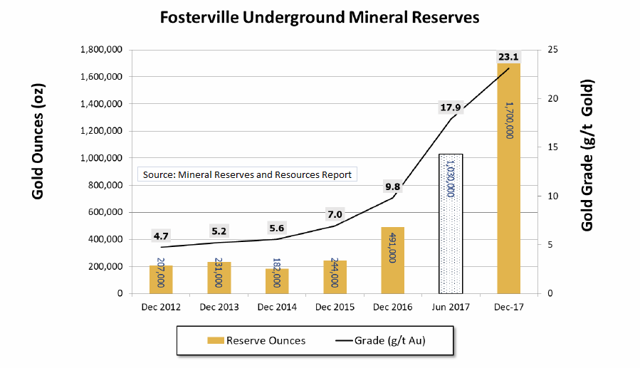

4) In existing assets, Kirkland Lake Gold has demonstrated the ability to significantly ramp-up mineral reserves through exploration at new sites. The chart below underscores my point, and as growth investments continue in 2018, existing assets can potentially add to the long-term production potential.

While I have presented my view on potential organic and inorganic growth, the following comment from the management puts things into perspective:

Our strategy is focused on achieving year-over-year production growth and making Kirkland Lake Gold a million ounce per year producer within the next five to seven years. We are also encouraged by recent exploration success in the Northern Territory, which is supporting our efforts to establish a five-year mine plan that generates attractive returns and warrants a resumption of operations at the Cosmo mine and Union Reefs mill.

Risk Factors

Gold Price Volatility: I see medium probability of occurrence for this external risk factor. Geopolitical tensions are the key reason for this view. Further, Russia and China have been buying gold as a part of their reserves diversification strategy and that supports gold prices. Kirkland Lake Gold also has an attractive AISC, and even if gold declines from current levels, EBITDA margin is likely to remain healthy.

Low Financial Risk: Kirkland Lake Gold is probably among the best positioned companies from a financial perspective. With zero debt, swelling cash reserves and clear visibility for free cash flows, I don't see any financial risk even if gold were to decline by $50 to $100 an ounce from current levels.

Low Operational Risk: Kirkland Lake Gold has exceeded production target for FY17 and the company's 1Q18 production numbers have been robust. The company's focus is on two game changing assets, and with ample flexibility for investment, I don't see any operational risk that impacts production growth targets.

Conclusion

The stock momentum for Kirkland Lake Gold has been bullish in the recent past and that's supported by preliminary 1Q18 numbers coupled with gold moving higher. With Kirkland expecting 2H18 to be even better in terms of production, I see the stock remaining bullish.

Further, valuations still remain attractive and the company's growth visibility remains strong for FY19 and FY20. These factors make Kirkland Lake Gold an interesting buy at current levels with an investment horizon of 12-24 months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Street Smart Investor and get email alerts