Aclara delivers a positive PEA for its Carina Project in Goi?s, Brazil

After-tax NPV8 of US$1.2 billion and IRR of 29%

TORONTO, Jan. 23, 2024 /CNW/ - Aclara Resources Inc. ("Aclara" or the "Company") (TSX: ARA) is pleased to announce the results of a preliminary economic analysis (the "PEA") on its regolith-hosted ion adsorption clay project located in the State of Goiás, Brazil, known as the Carina Module (the "Project").

The technical report titled "Preliminary Economic Assessment - Carina Rare Earth Element Project - Nova Roma, Goiás, Brazil" (the "Report" or "Carina Module PEA") and dated January 12, 2024 and was prepared in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects ("NI 43-101") by G21 Consultoria Mineral ("GE21"), a specialized, independent mineral consulting company located in Belo Horizonte, Brazil. The Report, which has an effective date of November 3, 2023, supports the disclosure made by Aclara in its December 12, 2023 press release announcing the maiden mineral resources estimate (MRE) for the Project ("December 2023 Press Release"). There are no material differences in the mineral resources or results of the preliminary economic assessment as described in the Report and the results disclosed in the December 2023 Press Release. The Report has been filed, and can be found under the Company's profile, on SEDAR+ (www.sedarplus.ca) and on Aclara's website (www.aclara-re.com).

Highlights

- Robust economics

- After-tax Net Present Value of ~US$1.2 billion using an 8% discount rate

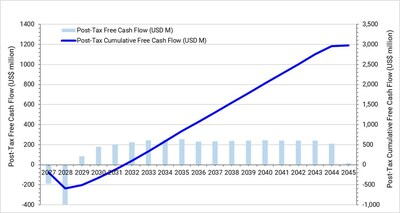

- 29% internal rate of return over the 17-year life of mine

- Low initial capital costs of US$576 million with a payback period of 3.6 years

- Average annual1 net revenue and EBITDA of US$474 million and US$340 million, respectively

- Low average production cost of US$13.1 per tonne

- Long-term rare earth price forecasts provided by Argus Media and Adamas Intelligence, underpinned by compelling supply/demand fundamentals

- Significant production of magnetic REEs

- Average annual1 production of 208 tonnes DyTb representing approximately 13.7% of China's 2023 official production2

- Average annual1 production of 1,190 tonnes NdPr contributing to a balanced mix of light and heavy REEs in the final product

- High product quality

- Concentration of REEs in the mixed carbonate of 91.9%3

- Very high content of DyTb and NdPr at 4.7% and 26.4%, respectively

- High purity product facilitates further separation and recoveries

- Low environmental impact

- Process designed to minimize environmental impact: it does not use explosives; there is no crushing nor milling; approximately 95% of the water used is recirculated; the main reagent is a common fertilizer; no liquid residue is produced, negating the need of a tailings dam

- Minimal CO2 footprint is supported by a combination of low energy consumption and a high percentage of renewable energy within the Goiás power grid

- Expedited path to early production

- The pilot plant, currently in operation, de-risks metallurgical recoveries

- The State of Goiás has fully approved another ionic clay REE producer (Serra Verde), thereby establishing a significant precedent that provides a positive permitting background for new projects in this State

- Commissioning estimated to commence in 2029

- Upside potential

- Drilling campaign underway to increase mineral resources

- Metallurgical optimizations have been identified

________________________________________________ |

1 Annual average does not consider the first year of ramp-up and the last year of ramp-down. |

2 The Chinese Ministry of Industry and Information Technology published their 2023 rare earth oxides quotas for mining production in China at 255,000 tonnes (235,857 tonnes for light REEs and 19,143 tonnes for heavy REEs). The resulting production of DyTb is approximately 1,520 tonnes. |

3 Purity is expressed as REO equivalent. |

"We extend our gratitude to our dedicated team for the swift progress achieved in bringing the Carina Project to this pivotal stage. As a company committed to making a lasting impact in the rare earths market, our strategic focus on sustainability and responsible production aligns with the success seen in the Project PEA. The positive results of the Carina Module PEA showcase a robust economic profile with an after-tax NPV of US$1.2 billion and an IRR of 29%, setting a strong foundation for the module's future development.

We recognize the importance of minimizing environmental impact. The Project design emphasizes eco-friendly practices, avoiding explosives and milling, maximizing water recirculation, and employing a common fertilizer as the main reagent. With a process designed to minimize its CO2 footprint, we are dedicated to ensuring that our operations align with sustainable practices and global environmental standards.

As we embark on an ambitious drilling campaign and identify metallurgical optimizations, our sights are set on maximizing the upside potential of the Project. Permitting, a key aspect to be addressed in our expedited path to production, is expected to be well supported by our patented flowsheet, our focus on social development and maintaining a close relationship with the forward-looking State of Goiás. With commissioning estimated by 2029, we are confident that the Project will play a pivotal role in meeting the growing demand for high-quality rare earths, further solidifying our position as a key supplier of these critical elements."

On Tuesday January 23rd, 2024, Aclara will host a conference call to discuss the Carina Module PEA.

The call will include remarks from Aclara Resources' CEO Ramon Barua, and other members of the Company's management team. It will also feature a question-and-answer session.

REGISTER HERE: https://register.gotowebinar.com/register/7962331592457482332

A replay of the call, together with supporting presentation slides, will be made available on Aclara's website at www.aclara-re.com. After registering, you will receive a confirmation email containing information about joining the webinar. |

Table 1 lists the relevant parameters associated with the Project's operating and financial metrics.

Table 1: Key Project Operating & Financial Parameters

Unit | Total | Annual Average* | |

Mining and Processing | |||

Life of Mine | years | 17 | - |

Total Process Plant Feed | million tonnes (dry) | 149.5 | 9.6 |

Total Waste Mined | million tonnes (dry) | 43.3 | 2.6 |

Strip Ratio | - | 0.3 | 0.3 |

Production | |||

Total Rare Earth Oxides | tonnes | 70,307 | 4,498 |

Neodymium & Praseodymium (NdPr) | tonnes | 18,546 | 1,190 |

Dysprosium (Dy) | tonnes | 2,802 | 178 |

Terbium (Tb) | tonnes | 479 | 30 |

Financials | |||

Net Revenue | US$ million | 7,355 | 474 |

Net Smelter Return | US$/t | 49.2 | - |

Production Cost | US$ million | 1,965 | 125 |

Unit Cost | US$/t | 13.1 | - |

EBITDA | US$ million | 5,243 | 340 |

EBITDA Margin | % | 71 | - |

Income Tax | US$ million | 1,532 | 101 |

Effective Tax Rate | % | 36.2 | - |

Initial Capital | US$ million | 576 | - |

Royalty Purchase Cost | US$ million | 6.5 | - |

Sustaining Capital | US$ million | 106 | - |

Financial Returns | |||

Pre-Tax Net Present Value (8%) | US$ million | 1,880 | - |

Pre-Tax Internal Rate of Return | % | 35.7 | - |

Post-Tax Net Present Value (8%) | US$ million | 1,186 | - |

Post-Tax Internal Rate of Return | % | 28.6 | - |

Payback Period | years | 3.6 | - |

*Note: Annual average does not include the first year of ramp-up and the last year of ramp-down |

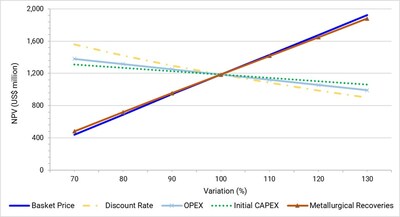

A sensitivity analysis was undertaken to evaluate the impact on NPV by varying the following attributes:

- basket list price

- discount rate

- CAPEX

- OPEX

- metallurgical recoveries

The discount rate was evaluated by varying its value from 4 to 12% while the remaining attributes were evaluated by varying their values from 80 to 120% (Figure 2).

The mineral resource has been estimated using the results obtained from 201 auger drill holes (1,630 m) and 1,418 samples. At a US$7.4/t NSR cut-off, the mineral resource is estimated to contain 168.1 million tonnes ("Mt") in the Inferred category @ 1,510 ppm TREO containing an average Dy and Tb grade of 42.1 ppm and 6.9 ppm, respectively (Table 2). The mineral resource is reported in accordance with the requirements of NI 43-101.

Table 2. Carina Module Inferred Mineral Resource Estimate (Effective November 3, 2023)

Mineral Classification | Mass (Mt) | Total Oxide Grade (ppm) | Oxide Content (t) | ||||||

TREO | NdPr | Dy | Tb | TREO | NdPr | Dy | Tb | ||

Inferred | 168.1 | 1,510 | 296.5 | 42.1 | 6.9 | 253,853 | 49,832 | 7,077 | 1,163 |

Total | 168.1 | 1,510 | 296.5 | 42.1 | 6.9 | 253,853 | 49,832 | 7,077 | 1,163 |

Notes: |

1. CIM (2014) definitions were followed for mineral resources. |

2. Mineral resources are estimated above a net smelter return value of 7.4 US$/t. |

3. Mineral resources are estimated using average long term metal prices and metallurgical recoveries (see Carina Module PEA for details). |

4. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

The Project is based on standard open pit extraction techniques using conventional hydraulic excavators and 44-t payload haulage trucks to extract and deliver the clays to the process plant. The process plant has been located close to the centre of mass of the mining operation to minimise the total haulage distance over the life of the mine. Given the friable nature of the clays and the shallow depth of the extraction zones, no aggressive nor energy-intensive techniques such as drilling and blasting are required to extract the clays from the pits. Table 3 list the key input parameters used in the mine design.

Table 3: Key Mine Design Parameters

Description | Unit | Value |

Pit Optimization | ||

Overall Slope Angle | degree | 25 |

Reference Mining Cost | US$/t mined | 2.13 |

Mining Recovery | % | 95 |

Mining Dilution | % | 5 |

Processing Cost | US$/t processed | 10.46 |

Selling Cost | US$/kg REO | 7.032 |

Federal Royalty | % of revenue | 2 |

REO Price | US$/kg REO | variable by REO |

Pit design | ||

Bench Height | m | 4 |

Berm Width | m | 3.5 |

Bench Slope Angle | degree | 38 |

Ramp Width | m | 12 |

Ramp Gradient | % | 10 |

Scheduling | ||

Minimum Operational Area | m | 25 |

Plant feed | Mt/year | 9.5 |

Mining Recovery | % | 98.5 |

Mining Dilution | % | 1.5 |

Once the clay is delivered to the process plant, it will be washed using an ammonium sulfate solution to extract the REEs from the clay surfaces. No crushing, grinding nor milling is needed to free the REEs from the clays as they are extracted through a non-invasive ion-exchange reaction process whereby ammonium sulfate ions replace REE ions on the surface of the clay thereby liberating the REEs into solution. The REEs in solution are then removed through a pH-adjusted precipitation process and then passed through a high-pressure filter to remove any remaining liquids, resulting in the production of a high-purity REE carbonate ready for shipment to a separation facility. The process plant will have an average production rate of 4,498 t/year of REO within the concentrates.

Any unwanted impurities such as aluminium and calcium that have been extracted from the clays during the ion exchange process are similarly removed through a precipitation process and then recombined with the washed clays before being transported to a dry stacking storage facility for the first five years of the life of mine. Beginning in Year 6, the washed clays will be back-filled to the mined-out extraction zones to initiate the mine closure process.

A water recovery system integrated into the process plant cleans and regenerates the remaining process liquors such that they can be reintroduced into the feed. The treated water is reused in a closed circuit to reduce water consumption thereby preventing the release of process water into the environment. This allows the process plant to operate with the minimum of make-up water and allows the main reagents to be regenerated and reused within the process plant.

Before the barren clays exit the process plant, they are washed with clean water within standard plate-and-frame filter presses. This will remove any residual ammonium sulfate from the clays before they are returned to either a dry stacking facility or used to back-fill the extraction zones to be safely used during revegetation.

The Project include the necessary infrastructure to provide of make-up water for the process plant, supply power to the site, and provide a road network to service the operation, amongst others.

Electrical power for the processing plant, truck shop, administration offices, and other facilities will be supplied by the national power utility through overhead power transmission lines from a sub-station located approximately 90 km from the Project site.

Vehicle electrification, wind turbines and the transition to renewable energy sources will continue to drive demand for REEs in terms of volume and, especially, value. This will primarily affect the REEs used in alloys to fabricate permanent magnets: Dy, Nd, Pr, and Tb. The supply of clean heavy REEs, especially Dy, has become problematic because few projects target heavy REE deposits. For the medium term, the market will continue to rely on China and Myanmar for heavy REE feedstocks.

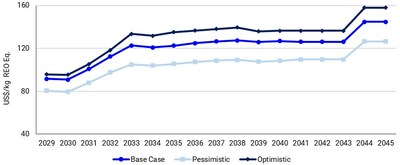

The near-term forecast is for further price gains and the average prices of permanent magnet REEs are expected to be 15–25% higher in 2024 than 2023. In the medium to long term, Argus Media expects permanent magnet REE prices to increase steadily for the remainder of the decade, with the possibility that they could pick up more quickly in the early 2030s without more supply from new projects. Dy prices are expected to continue to outperform the general permanent magnet REE market due to a significant supply/demand imbalance in the early 2030s (Table 4, Figure 3).

Table 4: Dysprosium Price Forecast

2022 | 2023 | 2025 | 2028 | 2033 | |

Price (US$/kg) Base Case | 384 | 330 | 415 | 510 | 945 |

Price (US$/kg) Optimistic | 384 | 330 | 435 | 520 | 1,140 |

Price (US$/kg) Pessimistic | 384 | 330 | 395 | 465 | 760 |

Total supply (1,000 t REO) | 1.9 | 2.8 | 3.1 | 3.8 | 4.0 |

Total demand (1,000 t REO) | 2.8 | 3.4 | 4.3 | 5.3 | 7.0 |

Surplus/deficit index (2018=100) | 98 | 97 | 93 | 84 | 60 |

_________________________ |

4 Argus Media |

Two external factors could affect future REE prices, both with the potential to push prices upwards: so-called 'green' premiums; and critical material policies (especially in Europe and the USA). While there is currently no system or regulation for green premiums in the REE sector, Europe's Carbon Border Adjustment Mechanism (CBAM) is pointing the way in terms of carbon emissions. There will be a gradual phase-in of the CBAM from 2026 to 2034 the effect of which can already been seen in steel pricing forecasts.

Perhaps even more relevant to future REE prices are the critical materials policies/regulations being enacted globally, specifically the EU Critical Raw Materials Act and the US Inflation Reduction Act. These regulations/legislations are focussed on creating raw material supply chains that are not reliant on China, which should provide advantages to non-Chinese suppliers of REEs in terms of market access and, potentially, pricing premiums. In May 2023, the US Department of Energy identified Dy as the most critical mineral in terms of its importance to the energy sector and the risks of supply chain disruption.

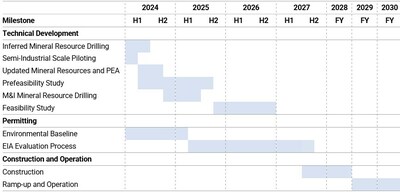

The permitting process is already underway and the technical development of the Project will continue with a bankable feasibility study scheduled to be delivered in 2026 and the commencement of operations in 2030 (Table 5).

Proposed Next Steps

- Q1 2024: produce REE carbonate samples by processing the Project's ionic clays at Aclara's pilot plant in Chile

- Q1 2024: initiate environmental baseline, radiography, archeological, speleological (cave) and hydrogeological studies

- Q2 2024: commence prefeasibility study

- Q2 2024: complete a 9,090-meter reverse circulation drilling campaign across the Project's mineral resource to test the extension of the mineralization at depth. Currently, 1,374 meters within 52 drill holes have already been executed with an average saprolite mineralization depth of 22 meters

The technical information in this press release has been reviewed and approved by geologist Fábio Xavier and mining engineer Porfírio Cabaleiro Rodriguez, both associated with GE21 Consultoria Mineral, as well as Chemical Engineer Stuart J Saich of Promet101 Consulting Pty Ltd. GE21 is a specialized, independent mineral consulting company based in Belo Horizonte, Brazil, and Promet101 is an independent process engineering consulting company based in Santiago, Chile.

Mr. Xavier is a Member of Australian Institute of Geoscientists (MAIG #5179) and is a Qualified Person as defined under NI 43-101. He is responsible for the mineral resource estimate and has reviewed and approved the scientific and technical information related to the mineral resource estimate contained in this press release.

Mr. Rodriguez is a fellow of the Australian Institute of Geoscientists (FAIG #3708) and is a Qualified Person as defined under NI 43-101. He has more than 40 years of experience in mineral resource/reserve estimation and is the leader of the Project acting as overall supervisor with respect to the objectives of the Report.

Messrs. Rodriguez and Xavier visited the Project from August 16 to August 18, 2023, during the execution of the auger drilling campaign conducted by the GE21 team under the coordination of Geologist André Costa (FAIG#7967). The visit was supported by Aclara's Exploration Manager, Luiz Jorge Frutuoso Junior.

Mr. Saich is a professional chemical engineer with more than 37 years' relevant experience in metallurgy and process design development. He is with a member of the Australian Institute of Mining and Metallurgy (FAUSIMM, (#222028), the Canadian Institute of Mining (CIM # 631368), the Society for Mining, Exploration & Metallurgy (SME# 04101270) and is a Qualified Person as defined under NI 43-101.

Aclara Resources Inc. (TSX: ARA) is a development-stage company that focuses on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. The Company currently has two projects under development: the Penco Module in the Bio-Bio Region of Chile, and the Carina Project in the State of Goiás, Brazil.

Aclara's REE extraction process offers several environmentally attractive features. It does not involve blasting, crushing, or milling, and therefore does not generate tailings, thus eliminating the need for a tailings storage facility. The extraction process developed by Aclara minimizes water consumption through high levels of water recirculation made possible by the inclusion of a water treatment facility within its patented process design. The ionic clay feedstock is amenable to leaching with a common fertilizer, ammonium sulfate. Further, harmful levels of radionuclides, typical of hard rock rare earth deposits, are not concentrated within the Aclara flowsheet.

Simultaneously, alongside the development of the Carina and Penco projects, the Company intends to identify and evaluate further opportunities to increase future production of heavy REEs. This will involve greenfield exploration programs and the development of additional projects within the Company's concessions in Brazil, Chile, and Peru.

This press release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, methodology, development timeline, production timing and upside at the Carina Module, the Company's exploration plan, drilling campaigns and activities in Brazil and the expectations of the Company's management as to the results of such exploration works and drilling activities; timing, cost and scope in respect of the exploration activities in Brazil, the results and interpretations of its maiden MRE relating to the Carina Module, the timing and issuance of a prefeasibility study for the Carina Module, the initiation and timing of environmental, archeological and geological studies for the Carina Module and the contemplated development of greenfield targets and expected reduction in permitting risk. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Chile and Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Penco Module and/or the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 28, 2023, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

Aclara Resources has engaged Reflex Media to provide marketing services in connection with a digital marketing campaign aimed at increasing the knowledge and awareness of the Company to new audiences. |

SOURCE Aclara Resources Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2024/23/c7907.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2024/23/c7907.html