AFRICAN GOLD GROUP ANNOUNCES HIGH-GRADE DRILLING RESULTS AT KOBADA GOLD PROJECT, INCLUDING 3.59G/T GOLD OVER 9.80M AND CLOSES FIRST TRANCHE OF PRIVATE PLACEMENT

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

TORONTO, March 17, 2020 (GLOBE NEWSWIRE) -- African Gold Group, Inc. (TSX-V: AGG) (“AGG” or the “Company”) is pleased to provide an update from the Company's Kobada Gold Project located in southern Mali, including additional high grade intercepts in the northern extension of the main shear zone.

Highlights Include (Table 1):

- High grade intersections located outside of the known mineralization, highlight the expansion potential at Kobada

- The Company is targeting to release an updated mineral resource statement in the coming weeks

- Drill hole KB19_P2_22 returned 3.59g/t Au over 9.80 metres (m) including 30g/t over 1.10m

- Drill hole KB19_P2_23 returned 5.33g/t Au over 3.20m, 21.60g/t Au over 1.0m, 15.70g/t Au over 1.2m and 11.00g/t Au over 1.04m

- Drill hole KB19_P2_26 returned 1.64g/t Au over 2.16m and 6.20g/t over 1.40m

- Drill hole KB19_P2_27 returned 3.63g/t Au over 1.0m

“Yet again we have exceeded expectations by repeatedly intersecting grades above 30g/t,” says Dr. Andreas Rompel, Vice President Exploration, “and we have confirmed our interpretation that the mineralization extends further north. We are excited to further explore the mineralization of this northern extension of the yet open-ended Kobada shear zone.”

The Kobada Gold Project is a fully licensed and permitted advanced development project located in the prolific Birimian Greenstone belt in Southern Mali. The Company is working towards delivering the definitive feasibility study (the “DFS”) in Q2 2020 as a part of the final process before commencement of construction.

Following on from the previously reported drill holes of the Phase 2 drilling program, the next batch of assay results received from SGS laboratory in Bamako continue to demonstrate the large extent of the mineralization along strike and down dip along the highly prolific and auriferous Kobada shear zone. Results from the Phase 2 drilling program will be incorporated into an updated mineral resource statement targeted to be released within the next few weeks.

To date, the Company has not discovered the northern end of mineralization. Furthermore, AGG intends to step away from the Kobada Shear to test the neighbouring and parallel striking Gosso Shear, which has been exposed by shallow artisanal mining.

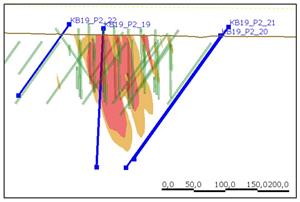

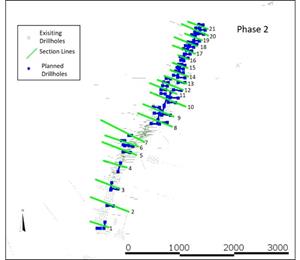

- Drill hole 22 is part of the Section Line 10 (Figure 2) and drill hole 23 is part of Section Line 11.

- Figures 2 and 3 show that the drill holes are stepping out of the existing main shear zone testing the width of the mineralized zone and progressing further northwards.

- The Company is targeting only oxides that extend to an average depth of 150m.

Figure 1: Kobada exploration targets with Phase 1 and Phase 2 section lines is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4b1d124a-e399-409d-a292-93e72af6fb48

| Mineralized Zone | Includes | ||||||||

| BHID | Ore Body | From | To | Composite Length (m) | Composite Grade (g/t) | From | To | Includes (m) | Includes (g/t) |

| KB19_P2_22 | Main Shear North | 5.50 | 15.30 | 9.80 | 3.59 | 5.50 | 6.60 | 1.10 | 30.00 |

| KB19_P2_23 | Main Shear North | 26.20 | 193.20 | 167.00 | 0.90 | 48.20 | 51.40 | 3.20 | 5.33 |

| 54.80 | 55.80 | 1.00 | 21.60 | ||||||

| 95.00 | 96.20 | 1.20 | 15.70 | ||||||

| 153.76 | 154.80 | 1.04 | 11.00 | ||||||

| KB19_P2_26 | Main Shear North | 93.30 | 95.46 | 2.16 | 1.64 | ||||

| 116.50 | 117.90 | 1.40 | 6.20 | ||||||

| KB19_P2_27 | Main Shear North | 121.40 | 122.40 | 1.00 | 3.63 | ||||

Table 1: Highlights

Figure 2: Section showing the drill holes KB19_P2_19, 20, 21 and 22 (blue) intersecting the mineralized Kobada Shear Zone (orange and red) is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0b32ae74-5601-4a85-a457-d6a4db31bf57

Figure 3: Drill hole locations and section lines in the central, southern and northern part of the Kobada Main Shear Zone is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0b1fd697-3df3-48c1-bbbd-177ef3005dd8

Closing of First Tranche of Private Placement

The Company is pleased to announce that it has closed its first tranche of a previously announced non-brokered private placement financing of common shares (the “Offering”) for gross proceeds of C$250,000.00 (the “First Tranche”).

Pursuant to the First Tranche, the Company issued 1,250,000 units of the Company (each a “Unit” and collectively, the “Units”) at a price of C$0.20 per Unit for gross proceeds of C$250,000.00. Each Unit consists of one common share of the Company and one half of a common share purchase warrant (each whole common share purchase warrant, a “Warrant”). Each Warrant will entitle the holder to acquire one additional Common Share of the Company at an exercise price of C$0.25 per Common Share until March 17, 2022.

In connection with the closing of the First Tranche, the Company has paid aggregate finder’s fees of $12,500.00 in cash. The Company intends to use the proceeds of the First Tranche for the advancement of the Kobada Gold Project and for general corporate purposes.

The securities offered under the Offering have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed, prepared and approved by Dr. Andreas Rompel, PhD, Pr. Sci. Nat. (400274/04), FSAIMM, Vice President Exploration of AGG, who is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and by Mr. Uwe Engelmann (BSc (Zoo. & Bot.), BSc Hons (Geol.), Pr.Sci.Nat. No. 400058/08, MGSSA), a director of Minxcon (Pty) Ltd and a member of the South African Council for Natural Scientific Professions.

About African Gold Group

African Gold Group is a Canadian listed exploration and development company on the TSX Venture Exchange (TSX-V: AGG) with its focus on developing a gold platform in West Africa. Its principal asset is the Kobada Project in southern Mali. For more information regarding African Gold Group visit our website at www.africangoldgroup.com.

For further information please contact:

Daniyal Baizak

VP Corporate Development

(416) 861 2966

Forward-Looking Statements

This press release contains "forward looking information" within the meaning of applicable Canadian securities legislation. Forward looking information includes, but is not limited to, management’s, the Company’s development and exploration plans for the Kobada Gold Project, expectation of grade and resources at the Kobada Gold Project, the timeline for delivery of the DFS , completion of metallurgical testwork, progress of the Phase 2 drilling campaign and the updated resource-reserve model, expectations for mineralization and location of extensions at the Kobada Gold Project and expected mining methods at the Kobada Gold Project, the intended use of proceeds and other matters relating to the Offering and the closing of the First Tranche and other statements with respect to the future plans or intentions of the Company. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", “aims”, "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of exploration activities; regulatory risks; risks inherent in foreign operations; and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Table 2: Assay results from the main mineralized zone (reported length measured along the holes)

| Mineralized Zone | Includes | ||||||||

| BHID | Ore Body | From | To | Composite Length (m) | Composite Grade (g/t) | From | To | Includes (m) | Includes (g/t) |

| KB19_P2_22 | Main Shear North | 5.50 | 15.30 | 9.80 | 3.59 | 5.50 | 6.60 | 1.10 | 30.00 |

| KB19_P2_23 | Main Shear North | 26.20 | 193.20 | 167.00 | 0.90 | 48.20 | 51.40 | 3.20 | 5.33 |

| 54.80 | 55.80 | 1.00 | 21.60 | ||||||

| 59.00 | 60.00 | 1.00 | 1.71 | ||||||

| 95.00 | 96.20 | 1.20 | 15.70 | ||||||

| 98.00 | 99.40 | 1.40 | 1.17 | ||||||

| 105.00 | 108.00 | 3.00 | 1.39 | ||||||

| 115.20 | 117.60 | 2.40 | 1.77 | ||||||

| 120.27 | 121.27 | 1.00 | 1.77 | ||||||

| 139.60 | 141.00 | 1.40 | 1.42 | ||||||

| 146.00 | 147.40 | 1.40 | 1.12 | ||||||

| 153.76 | 154.80 | 1.04 | 11.00 | ||||||

| 156.10 | 157.60 | 1.50 | 4.16 | ||||||

| 158.60 | 161.24 | 2.64 | 1.14 | ||||||

| 176.00 | 178.50 | 2.50 | 1.48 | ||||||

| 183.50 | 187.50 | 4.00 | 1.52 | ||||||

| 190.00 | 193.20 | 3.20 | 3.36 | ||||||

| 201.50 | 204.00 | 2.50 | 0.35 | ||||||

| 227.50 | 228.50 | 1.00 | 0.45 | ||||||

| 234.20 | 235.40 | 1.20 | 0.39 | ||||||

| 239.00 | 240.00 | 1.00 | 0.74 | ||||||

| KB19_P2_26 | Main Shear North | 93.30 | 95.46 | 2.16 | 1.64 | ||||

| 116.50 | 117.90 | 1.40 | 6.20 | ||||||

| KB19_P2_27 | Main Shear North | 0.00 | 14.50 | 14.50 | 0.31 | ||||

| 30.00 | 32.00 | 2.00 | 0.45 | ||||||

| 88.00 | 97.50 | 9.50 | 0.25 | ||||||

| 110.00 | 113.90 | 3.90 | 0.77 | 112.50 | 113.90 | 1.40 | 1.54 | ||

| 121.40 | 122.40 | 1.00 | 3.63 | ||||||

| 141.70 | 157.30 | 15.60 | 0.44 | 141.70 | 142.90 | 1.20 | 2.85 | ||

| 153.00 | 154.10 | 1.10 | 1.03 | ||||||

| 169.00 | 170.00 | 1.00 | 1.04 | ||||||

| 196.60 | 217.70 | 21.10 | 0.86 | 199.00 | 202.70 | 3.70 | 1.45 | ||

| 207.20 | 215.20 | 8.00 | 1.31 | ||||||

Cumulative Mineralization Widths

| BHID | Cumulative Mineralization Width (m) | Mean Grade (g/t) |

| KB19_P2_22 | 9.80 | 3.59 |

| KB19_P2_23 | 172.70 | 0.88 |

| KB19_P2_26 | 3.56 | 3.44 |

Significant Intersections (Above 1 g/t)

| BHID | From | To | Intersection Length (m) | Au Grade (g/t) |

| KB19_P2_22 | 5.50 | 6.60 | 1.10 | 30.00 |

| KB19_P2_23 | 48.20 | 51.40 | 3.20 | 5.33 |

| KB19_P2_23 | 54.80 | 55.80 | 1.00 | 21.60 |

| KB19_P2_23 | 59.00 | 60.00 | 1.00 | 1.71 |

| KB19_P2_23 | 95.00 | 96.20 | 1.20 | 15.70 |

| KB19_P2_23 | 98.00 | 99.40 | 1.40 | 1.17 |

| KB19_P2_23 | 105.00 | 108.00 | 3.00 | 1.39 |

| KB19_P2_23 | 115.20 | 117.60 | 2.40 | 1.77 |

| KB19_P2_23 | 120.27 | 121.27 | 1.00 | 1.77 |

| KB19_P2_23 | 139.60 | 141.00 | 1.40 | 1.42 |

| KB19_P2_23 | 146.00 | 147.40 | 1.40 | 1.12 |

| KB19_P2_23 | 153.76 | 154.80 | 1.04 | 11.00 |

| KB19_P2_23 | 156.10 | 157.60 | 1.50 | 4.16 |

| KB19_P2_23 | 158.60 | 161.24 | 2.64 | 1.14 |

| KB19_P2_23 | 176.00 | 178.50 | 2.50 | 1.48 |

| KB19_P2_23 | 183.50 | 187.50 | 4.00 | 1.52 |

| KB19_P2_23 | 190.00 | 193.20 | 3.20 | 3.36 |

| KB19_P2_27 | 112.50 | 113.90 | 1.40 | 1.54 |

| KB19_P2_27 | 141.70 | 142.90 | 1.20 | 2.85 |

| KB19_P2_27 | 153.00 | 154.10 | 1.10 | 1.03 |

| KB19_P2_27 | 199.00 | 202.70 | 3.70 | 1.45 |

| KB19_P2_27 | 207.20 | 215.20 | 8.00 | 1.31 |