African Gold Group Announces Updated DFS With 66% Reserve Increase and 100koz per Year for First 10 Years

TORONTO, Sept. 29, 2021 (GLOBE NEWSWIRE) -- African Gold Group, Inc. (TSX-V: AGG, OTCQX: AGGFF, FRA: 3A61) (“AGG” or the “Company”) is pleased to announce the results of the Definitive Feasibility Study (the “2021 DFS” or the “Study”) for the Kobada Gold Project (the “Project” or “Kobada”) in Southern Mali. The DFS was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and will be filed by the Company during October.

Highlights include:

- Significant Production Potential

- 3 Mtpa operation producing 1.2 Moz of gold over a 16-year Life-of-Mine (“LOM”)

- Average annual gold production of 100,000 oz over the first 10 years

- Strong Economics

- Pre-tax NPV5% of US$506 million with an IRR of 45%

- Post-tax-NPV5% of US$355 million (57% increase compared to 2020 DFS) with an IRR of 38%

- Pre-production capital requirement of approximately US$152 million (excl. working capital and contingencies)

- Total project cash flow pre-tax of US$733 million with net cash flow after tax and capital expenditure of US$550 million

- Capital payback of 2.3 year upon production commencement

- Environmentally and Socially Responsible

- A hybrid thermal and solar photovoltaic power plant with battery energy storage, will be funded by an independent power producer

- Power rate of estimated US$0.20 per kWh results in estimated savings annually resulting from a 43% reduction in fuel requirement versus conventional thermal power plants

- Substantial reduction in greenhouse gas emissions through utilisation of hybrid power plant, including 39% less carbon dioxide, 34% less carbon monoxide, 39% less sulfur dioxide and 26% less nitrogen oxides than conventional thermal power plant

- Growing Resource with Substantial Exploration Upside

- Total proven and probable mineral reserve has increased to 1,252,522 ounces of gold, a 66% increase from the mineral reserve estimate in the previous definitive feasibility study report titled “NI 43-101 Technical Report on Kobada Gold Project in Mali” with an effective date of June 17, 2020 (the “2020 DFS”)

- Total measured and indicated resource increase by 44% to 1.71 million ounces and a Total resource (including inferred resources) increase to 3.1 million ounces

- High measured and indicated resource to reserve conversion rate of 73%

- Further potential remains to significantly increase the resource and reserve along strike and depth at the Kobada Gold Project

- Over 5,500 hectares of prospective mineral trends within trucking distance yet to be explored

- Over 50 km of new potential mineralised shear zones identified on Kobada and Kobada Est concessions

- Faraba concession renewed for 3 years with early exploration indicating the potential to extend shear zones even further

- Total proven and probable mineral reserve has increased to 1,252,522 ounces of gold, a 66% increase from the mineral reserve estimate in the previous definitive feasibility study report titled “NI 43-101 Technical Report on Kobada Gold Project in Mali” with an effective date of June 17, 2020 (the “2020 DFS”)

Danny Callow, CEO of African Gold Group, commented:

“Over the past two years we have worked tirelessly to demonstrate that the Kobada Gold Project has the potential to be one of the largest new gold projects in West Africa. Since the implementation of management changes in August 2019, and with new drilling campaigns totalling around 18,000 metres, we have managed to increase our reserve base by 144% (66% increase over the 2020 DFS).

With our updated 2021 DFS we have shown that Kobada has the potential to produce over 1.2 mln oz of gold over a 16 year mine life while delivering solid economics with post-tax NPV5% of US$355 million and an IRR of 38%.

Kobada is a predominantly free-dig operation, requires limited blasting, and processing of ore will be through a very simple and proven gravity plus CIL plant with recoveries over 95% in both oxides and sulphides. The inclusion of sulphides in this updated DFS, which are free milling and easy to process, opens significant future opportunities within the sulphide resource as well as continuing growth possibilities in the oxides. We are confident in the capital estimates as compared to recent similar completed projects in the region, and these costs remain very competitive for a project of this size. The potential to produce significant free cash flows after tax and low capital expenditure highlights very attractive economics of our Kobada project.

Based upon our detailed understanding and integrity of the current resource, on only 4 km of our 55 km of identified shear zones we believe that there continues to be significant potential to increase our 3.1 million ounce total resource substantially further. Kobada is now positioned as a great construction opportunity, in a prolific gold-producing area of West Africa”

The 2021 DFS has been prepared with input from a number of independent consultants:

| Minxcon Group (South Africa) | Mineral resources |

| DRA Americas (Canada) | Mining, mineral reserves |

| Maelgwyn Mineral Services (South Africa) | Metallurgical test work |

| ABS-Africa (South Africa) | Environmental and social |

| Epoch Resources (South Africa) | Tailings Storage facility |

| SENET (South Africa) | Processing plant and infrastructure including economic valuation and report compilation |

Kobada Gold Project Overview

The Kobada Gold Project is located in southern Mali, approximately 125 km in a straight-line south-southwest of the capital city Bamako and is situated adjacent to the Niger River and the international border with Guinea.

The Kobada Gold Project is based on one mining exploitation permit (Kobada) of 136 km2 and two exploration permits (Faraba and Kobada Est) of 77 km2 and 45 km2, which are wholly owned by AGG Mali SARL, the local Malian company, a 100% owned subsidiary of African Gold Group.

AGG has completed 114,357 metres of diamond, reverse circulation, air core and auger drilling between 2005 and 2012. In 2015, AGG completed a further 1,398 metres of diamond core drilling over 13 diamond drill holes. The current AGG exploration re-commenced in August 2019 and an additional 18,000 metres of exploration drilling has been completed.

Gold mineralization is present in the laterite, saprolite, and quartz veins that comprise the project, and in the sulphidic hard rock underneath. There are also placer style deposits in the region.

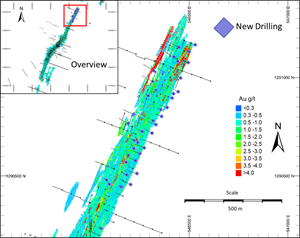

2020 Drilling Campaign

The 2020 drilling campaign, running from September 2020 until January 2021, consisted of 43 drillholes totalling 6,364 m. Of these, 4 drillholes (522 m) were drilled at the Gosso target and the remaining 39 drillholes (5,842 m) were drilled in the “gap” area and northern extents of the northern domain of the Kobada main shear. The drillholes at the Gosso target were all completed using diamond drilling while the drilling at Kobada was a combination of diamond drilling (8 holes @ 1,258 m) and RC drilling (21 holes @ 2,890 m) with selected RC drillholes being completed with diamond tail (10 holes @ 1,221 m RC and 473 m diamond) to drill into the sulphides.

The main focus of the drilling was to confirm and improve the confidence in the geological model to enable additional mineral resource conversion of the oxides to the measured and indicated resource categories. The drilling was also used to test and confirm the depth extension of the saprolitic (soft) material, the transition zone and the sulphides at depth.

For the Kobada main shear drilling, 34 drillholes intersected the mineralised zones and had an average accumulated mineralisation width of 29 m @ 1.22 g/t. The drilling campaign has significantly contributed to the increase in the indicated resource in the northern domain of the Kobada main shear, and also highlighted areas of deeper weathering with oxide material extending further down to a depth of approximately 160 m in places, approximately 60 to 80 m deeper than originally anticipated.

The drillholes at Gosso target confirmed the mineralisation observed in the historical drillholes with the 4 drillholes having an average accumulated mineralisation width of 12 m @ 1.11 g/t.

Figure 1: 2020 Drilling Campaign is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/68c8ecaf-6dd4-4025-b26d-8cb2db71dc3c

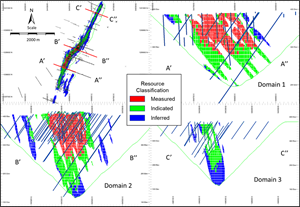

Figure 2: Section views of the Mineral Resource Classification of the Main Orebody is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d071587a-9c81-45c5-8d2b-2f069af9434b

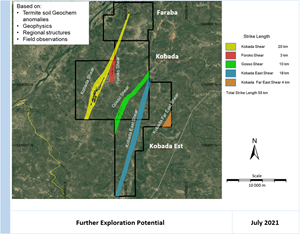

Status of Exploration

Upside potential remains in the short term at the Kobada Main Shear to upgrade some additional inferred mineral resources to the indicated category. In addition to this, the Project has significant upside potential in the 55 km strike length of potential mineralised shear zones. These shear zones are shown in Figure 3. Of these, the Gosso target is considered the most prospective due to its similar mineralisation profile to Kobada Main Shear and close proximity to the processing plant. To date, only limited drilling has been completed (21 drillholes) at Gosso, with exciting drill results such as 1.15 g/t Au over 12.5 m, including 7.19 g/t Au over 1.3 m. In addition, initial field investigations by the AGG geologists, in early 2021, have highlighted significant upside potential at the Kobada Est targets where artisanal mining has exposed mineralised structural features.

The Faraba exploration permit, renewed in August 2021 for a further 3 years, shows potential continuation of the Main Shear zone in a north-north-east direction opening up further exploration potential.

Figure 3: Exploration Potential is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ad0d5a84-28ba-4725-b231-3edef0674d64

Mineral Resource

| Resource Classification | Tonnage (Mt) | Grade (g/t) | Contained Gold (kg) | Contained Gold (koz) |

| Measured | 21.40 | 0.83 | 17,784 | 572 |

| Indicated | 40.15 | 0.88 | 35,425 | 1,139 |

| Measured & Indicated | 61.54 | 0.86 | 53,209 | 1,711 |

| Inferred | 42.03 | 1.06 | 44,564 | 1,433 |

Notes:

| ||||

Table 1: Kobada`s Mineral Resource Estimate as of 1 July 2021

Mine Planning

DRA Americas undertook the mine planning process, based on the measured and indicated mineral resources delineated to date at the Kobada Gold Project. Pit optimizations were undertaken using the following parameters:

| Gold price | US$1,610/oz (base case) | |

| Mining Costs | US$ 2.5/t to US$3.0/t | |

| Processing Costs | US$ 9.41/t to US$15.08/t | |

| Mining dilution | 5% | |

| Mining recovery | 95% | |

| Pit slopes | 40° overall slope angle | |

| Metallurgical recovery | Laterite Oxide ore | 96.5% |

| Saprolite Oxide ore | 96.5% | |

| Transitional ore | 90.5% | |

| Sulphide ore | 95.4% | |

Table 2: Pit Optimization Parameters

The Kobada Gold Project deposit is planned to be mined utilising standard open-pit mining methods using articulated trucks and a hydraulic loader (hydraulic shovel or excavator). Approximately 66% of the raw material to be mined is contained in the saprolite and laterite ores, and the vast majority will be free digging with no blasting required.

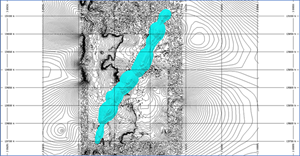

The final pit design for the Kobada Gold Project deposit is approximately 4.3 km long, with a maximum width of 500 m and a maximum depth of 180 m as shown in Figure 4.

Figure 4: Kobada Final Pit Design is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bb003886-2e9a-4f12-a67e-ac16f0177eb0

The open pit mining operation will last approximately eleven years, during which the lower-grade material will be stockpiled on a pad close to the primary crusher location.

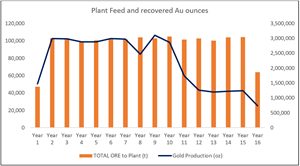

The mine plan targets higher grade oxide ore zones at the early phase of the project to feed into the process plant in order to produce an average of 100,000 oz per annum for the first 10 years, and thereafter lower production output as the grade drops and stockpiles are treated. Further targeted drilling will aim to improve the output from Years 11 to 16 by drilling the inferred resources in and around the existing pit shell. Management remains confident that further drilling will yield additional measured and indicated ounces to convert into additional reserves.

Over the life of the Project, 45 Mt of ore will be mined and delivered to the processing facility, and a total of 158 Mt of material will be mined and placed on the waste dumps, representing a life of mine stripping ratio of 3.5:1.

The mining operations will be undertaken by a specialized contractor selected by the Company. This contractor will be responsible for the management and maintenance of its own mining fleet and operators, while AGG will oversee the mine planning and geological grade control aspects of the operation. There remains an option for owner mining through leasing of mining equipment, and these options will be looked at as part of the detailed engineering design process.

Mineral Reserve

This updated mineral reserve and resource estimate at the Kobada Gold Project, as summarized in Table 1 and Table 3, was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum “CIM” (2014) Definition Standards incorporated by reference in NI 43-101 and is the result of 17,355 meters (108 drill holes) of drilling completed by the Company between H2-2019 and H1-2021 in addition to the historical drilling completed in previous years.

| Reserve Classification | Tonnage 1 (Mt) | Grade (g/t) | Contained Gold (kg) | Contained Gold (oz) |

| Proven 2 | 20.26 | 0.91 | 14,963 | 527,800 |

| Probable 2 | 24.77 | 0.87 | 20,545 | 724,700 |

| Proven and Probable 2,3,4 | 45.03 | 0.87 | 35,508 | 1,252,522 |

Notes:

| ||||

Table 3: Kobada`s Mineral Reserve Estimate

Mine Schedule

The mining schedule has focused on maximising gold production at an average annualized rate of 100,000 oz per annum, but also targeting the lower capital-intensive oxides initially before mining and processing the sulphides. The updated optimised mining schedule is indicated in Figure 5.

Figure 5: Gold Production over LOM is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/808904cf-69d6-4f57-b8f3-9c90abc0d57e

Processing

In 2019/2020 comprehensive metallurgical tests inclusive of variability were conducted on saprolite/laterite ore types to establish the optimum processing route. This test work was conducted by Maelgywn Mineral Services (“MMS”) in South Africa under SENET’s supervision. Results from this test work indicated that the saprolite/laterite ore:

- Easy to treat, with expected recoveries in the order of 96% for both saprolite and laterite ore types.

- The ore is extremely soft (low hardness and abrasion), which will result in low power requirement and low wear on liners and mill media.

- Low deleterious elements resulting in low reagent use, and lower operating cost.

- Low oxygen demand which will not require oxygen sparging in the leach tanks.

- Low reagent consumption.

In 2021, further comprehensive metallurgical tests were conducted on the sulphides which previously were not tested. The test work involved investigating the suitability of the processing route using the flowsheet developed for saprolite/laterite and conducting variability tests. Results obtained for sulphides showed the following:

- The ore is easy to treat with expected recoveries in the order of 95%.

- The ore is medium hard which will result in moderate milling power demand.

- Low deleterious elements resulting in low reagent use, and lower operating costs.

- Low oxygen demand will not require oxygen sparging in the leach tanks.

- Low cyanide and lime consumptions.

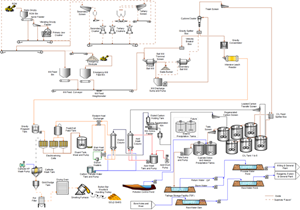

The proposed process plant design is based on a proven and established gravity/carbon-in-leach (“CIL”) technology, which consists of crushing, milling, and gravity recovery of free gold, followed by leaching/adsorption of gravity tailings, elution and gold smelting, and tailings disposal. Services to the process plant will include reagent mixing, storage and distribution, water, and air services. The plant will treat 3 Mtpa of saprolite/laterite/sulphide ore to produce an average of 100,000 oz per annum. The crushing and milling circuits will be constructed in two phases: the first phase will be to treat oxide ore only, followed by a second phase later in the life of mine to treat sulphides and/or a blend of sulphides and oxides.

When treating oxide ore, only the primary crushing stage will be in use while three crushing stages will be required when treating the sulphide ore. When treating saprolite/laterite, the milling circuit will utilize a single-stage ball mill while an additional secondary mill will be added in the later part of the mine life to treat sulphides. The process plant was designed on the following principles:

- Simplified, compact process plant, minimising the requirement of expensive and long lead front-end process equipment.

- Easy to upgrade in future.

- Simple to operate and cost effective, in terms of capital and operating costs.

- The flexibility to exceed 100,000 oz per year of output based upon input feed grade and tonnage.

- Highly flexible process able to treat varying ore grades and ore types with no significant increase in reagent consumption.

Figure 6: Process Plant Flowsheet is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9f1cbea8-2686-49eb-9ff7-9b9efcca93c4

Power

Due to the relatively poor electrical infrastructure in the region, tying into the national grid is not a feasible solution. SENET therefore undertook studies to investigate the potential for a standalone 21 MW power plant for the 2021 DFS.

An in-depth study found that the development of a hybrid solar photovoltaic (“PV”), battery energy storage system (“BESS”) and thermal power plant funded by an Independent Power Producer (“IPP”) to be the best option. This will reduce the CAPEX required, lowering the initial investment as the equipment is owned by the IPP an in addition lowers the operational risk with a very competitive power purchase rate.

The inclusion of the hybrid solar PV along with the thermal power plant will not only save on energy cost but will also significantly reduce the mine’s environmental footprint in the region. The BESS will provide additional redundancy to the thermal plant and the system will be fully integrated with mining operations to ensure de-risked mining revenue generation.

This option will not only compliment AGG’s environmental strategy, but also presents an opportunity to reduce costs over the life of the Kobada Gold Project with improved reliability, cost-effectiveness, and redundancy to the total power requirements.

Highlights of the hybrid power system include significant emissions reduction compared to a conventional thermal plant with:

- 43% less fuel consumption,

- 39% less carbon dioxide,

- 34% less carbon monoxide,

- 22% less unburned hydrocarbons,

- 39% less sulfur dioxide and

- 26% less nitrogen oxides.

In addition to the environmental benefits, the significant fuel offset from the renewable energy component of the hybrid power system also de-risks the mine against fuel cost fluctuations.

Water

Raw water supply shall be achieved by a combination of raw water abstraction from the Niger River, and supplementary water supply from the eight open pit outer perimeter dewatering boreholes.

The water from these supplies shall be stored in a newly constructed 20,000 m3 raw water buffer dam located mid-way between the process plant and the Niger River. The process plant shall feature additional water storage facilities in terms of a 3,500 m3 raw water pond, a 10,600 m3 process water pond and a 4,500 m3 stormwater pond, respectively. Process water will be supplied by pumping supernatant water back from the TSF (as defined below).

Tailings Management

Epoch Resources (Pty) Ltd undertook the study design associated with the Tailings Storage Facility (“TSF”). The TSF is a HDPE lined, full containment valley type arrangement, with a LOM tailings storage requirement of 45.15 Mt at a deposition rate of 3 million dry tonnes per annum. The TSF infrastructure includes a slurry distribution pipeline, catchment paddocks, toe drain system, underdrainage system, curtain drain system, blanket drain system, solution collection pipeline, collection sumps and manholes, seepage cut-off trench, storm-water diversion trenches, emergency spillway, access roads and perimeter fence-line. A floating barge decants supernatant tailings slurry water and stormwater from the TSF back to the plant.

The TSF is to be constructed in phases over the LOM, utilizing open pit overburden material, in five downstream lifts following the construction of the initial starter embankment. The construction of Phase 1 has been split into Phase 1A in the first year of construction and Phase 1B in the second year of construction.

The full containment TSF design was adopted to take cognisance of the Global Tailings Standards and International Commission on Large Dams Tailings Dams Safety, the latter in draft status, both refer to robust TSF designs and potentially liquefiable tailings.

Accessibility and Transport/Logistics

SENET and Bolloré Logistics have undertaken surveys with detailed analysis of access routes to the Kobada project site for plant and equipment as well as ongoing production materials and consumables.

Based on the international routes and climate conditions, as well as size of cargo to be transported, either of the two major routes (i.e., from Abidjan or Dakar) will be used for the project to gain access to Bamako and the Kobada site. These routes are via:

- International ports to Abidjan (Côte D’Ivoire) by sea, and Abidjan to site by road freight (for containers).

- International ports to Dakar (Senegal) by sea, and Dakar to site by road freight (for abnormal loads/break bulk).

- Alternatively, international airports to Bamako Airport (Mali) via commercial airlines (for airfreight).

From Bamako, transportation of materials and consumables to the site will be via the existing roads that link Bamako to Kobada village and the AGG camp comprising two distinct access routes. The preferred access route to the Kobada site is accessible in approximately 3–4 hour’s drive in a south-west direction from Bamako. After crossing the Niger River by barge there is approximately 8 km of untarred roads.

An alternate access route from Bamako to the Kobada mine site is via the RN7 (Bamako–Sikasso) for 80 km to the Sélingué road junction, thereafter an additional 60 km of paved road to Sélingué. Thereafter there is 52 km of laterite road to site. The construction of a new low-level bridge across the Fié River was addressed in the 2021 DFS and included in the capital expenditure.

Refining

There is no gold refining capability in Mali and thus doré produced at Kobada is to be refined outside the country, either in South Africa, Europe, or Dubai. Initial discussions have been held with refineries and although no agreements have been entered into, it is anticipated that the doré will be treated at the Rand Refinery in South Africa.

Environmental and Social Aspects

ABS Africa (Pty) Ltd (“ABS Africa”), together with Africa and Business Consulting Mali (“ABCOM”) and Insuco Limited (“Insuco”), have been appointed to undertake an Environmental and Social Impact Assessment (“ESIA”) for the Kobada Gold Project. The ESIA for the Kobada oxides feasibility study was completed during Q3 2021 and is currently awaiting approval. Delays to this were due to the global coronavirus pandemic during 2020 and part of 2021 and subsequent lockdowns which prevented community consultation taking place. These consultations were completed with overwhelming support for the Kobada Gold Project, and the final ESIA report has been submitted to the Malian Government. The assessment included the undertaking of a series of baseline studies, as well as the undertaking of an impact assessment and associated management plan, together with the required consultation and disclosure process.

Consultations with the relevant interested and affected parties indicated positive support for the project, while the ESIA has been accepted by the relevant authorities, with the permitting process being finalised.

An ESIA amendment only is required for the Kobada sulphide feasibility study. Various specialist studies have been completed as part of the sulphide feasibility study, and the ESIA amendment will be commissioned and once the oxide ESIA is approved an environmental permit updated.

Key Impacts

Key environmental and social impacts identified to date as part the ESIA process, are summarized as follows:

- Employment opportunities during the construction and operational phase. This will translate into an improved standard of living for those hired and their families.

- National, regional, and local businesses and contractors will benefit both directly and indirectly from Kobada Gold Project-related construction and operational activities due to the purchase of goods and services.

- Project development has the potential to provide increased availability and opportunity for a wide range of skills development and job training, particularly for women and local youth.

- During all the phases of the Kobada Gold Project, payment of dividends, tax on taxable income, royalties and surface rent will contribute to the fiscus.

- Implementation of a Resettlement Action Plan and Livelihood Restoration Plan for community members directly affected by the project infrastructure.

- Impacts on the biological, physical and social environment that can be mitigated as part of the Environmental and Social Management Plan.

In order to achieve the appropriate environmental management standards and ensure that the findings of the environmental studies are implemented through practical measures, the recommendations from the ESIA have been used to compile an Environmental and Social Management Plan (“ESMP”). The role of the ESMP is to assist AGG in reducing potential impacts and risks and achieving its environmental objectives as well as fulfilling its commitment to the environment. The ESMP will be used to ensure compliance with environmental specifications, monitoring and management measures.

AGG will develop a series of Environmental Action Plans, in order to manage anticipated impacts as per the requirements of the IFC`s Sustainability Framework.

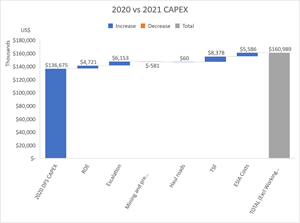

Capital Costs

The tables below summarize the estimated capital costs for the Kobada Gold Project as estimated by the independent consultants. These costs were in almost all cases built up from quotations and proposals from equipment and service providers.

The 2021 DFS costs currently utilize a contractor owned and operated mining fleet. The contractor mining option was found to be the preferred option for the project given the lower upfront capital cost.

The process plant will be developed in two phases; first phase will enable processing of saprolite/laterite ore for the first 7 years and additional crushing and milling capacity will be added to enable processing of sulphides and/or blend of oxides and sulphides.

The TSF will be developed in five distinct phases corresponding to “lifts” of the full containment dam wall. This has allowed for the costs to be allocated to the initial capital expenditure budget for the first phase and for sustaining capital for phases two and three.

All financial analysis for the life of mine includes the total design, construction and commissioning, production, sustaining and closure.

| Description | Capital Cost | Contingency | Total Capital Cost |

| US$ | US$ | US$ | |

| Initial Capital | |||

| Mining Pre-Production and Establishment | 27,094,882 | 352,000 | 27,446,882 |

| Plant and Infrastructure | 82,883,293 | 5,788,140 | 88,671,434 |

| TSF Phase 1 | 26,750,301 | 2,675,030 | 29,425,331 |

| Owner`s Cost | 14,198,934 | 2,150,949 | 16,349,883 |

| Working Capital | 4,348,043 | 434,804 | 4,782,847 |

| Total Initial Capex | 155,275,453 | 11,400,924 | 166,676,377 |

Table 4: Total Initial Project Capital Costs

| Description | Capital Cost |

| US$ | |

| Mining | 7,002,058 |

| TSF Phases 2 and 3 | 28,458,836 |

| Mine Wide -Resettlement | 60,833,324 |

| Mine Wide-Rehab and Closure | 25,435,654 |

| Mine Wide Post Closure Costs | 5,641,917 |

| Total Sustaining Capital | 127,371,789 |

Table 5: Total Sustaining Project Capital Costs

Figure 7: Capital Cost Comparison is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5bcb5942-2a47-482a-b3da-9801c005a88b

Operating Cash Costs

The following operating cash costs were estimated and incorporated into the financial analysis:

| LOM | ||

| US$/t processed | US$/oz | |

| Mining | 11.25 | 421.24 |

| Processing | 8.55 | 320.39 |

| G & A | 2.23 | 83.34 |

| Refining & Transport | 0.10 | 3.70 |

| Royalties | 1.40 | 52.46 |

| Total | 23.53 | 881.13 |

Table 6: Total Operating Cash Costs LOM

“OPEX has increased based upon significantly higher global costs of steel and fuel, which impacts power generation and mining costs specifically. Mining costs have increased by around $120/oz. The main contributor to this increase is the additional direct cost of mining waste and ore, accounting for approximately 50% of this increase. In addition, the impact of an extended life of mine and the contractor overheads associated with this, additional grade control, and drilling and blasting costs in more competent ore accounts for a further 25% increase. Finally, the impact of an increase in diesel cost used as an input parameter accounts for a further 25% increase. Despite these global increases the project delivers a very impressive post-tax free cash flow of US$550 million,” commented Danny Callow, CEO of African Gold Group.

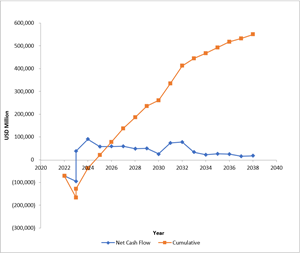

Financial Analysis

The Kobada Gold Project financial analysis was prepared using the discounted cash flow model. In preparing this model there have been several assumptions and material factors that have been employed which are presented in Table 7.

| Description | Unit | Assumption |

| Revenue | ||

| Gold Price | US$/oz | 1,750 |

| Refining Losses | % | 0.08% |

| Discount Rate | % | 5.0% |

| Fuel Prices | ||

| Diesel Price | US$/L | 0.797 |

| HFO Price | US$/L | 0.68 |

| Fiscal | ||

| Government Royalty | % | 3% |

| Tax Holiday | yrs | 3 |

| Tax Rate (after tax holiday) | % of profits | 30% |

| Tax Rate if there is loss | % of annual turnover | 1% |

| Dividend Tax | % | 10% |

| Depreciation | % | 10% over 10 years |

| Kilograms to Ounces | kg/troy oz | 32.1505 |

| Diesel SG | t/m3 | 0.85 |

| HFO SG | t/m3 | 0.97 |

| Other Charges | ||

| Bullion Transport & Refining Costs | US$/oz | 3.70 |

| Exchange Rates | Rand/US$ | 14.50 |

| US$/£ | 0.93 | |

| US$/A$ | 1.57 | |

| US$/C$ | 0.81 | |

| CFA/€ | 655 | |

| CFA/US$ | 561 |

Table 7: Financial Model Assumptions

The findings of the model are summarized in Table 8.

| DESCRIPTION | PRE-TAX | AFTER TAX | |

| LOM Tonnage Ore Processed | t (000) | 45,028 | 45,028 |

| LOM Feed Grade Processed | g/t | 0.868 | 0.868 |

| Production Period | yrs | 16 | 16 |

| LOM Gold Recovery | % | 95.6% | 95.6% |

| LOM Gold Production | Oz (000) | 1,202 | 1,202 |

| LOM Payable Gold After Refining Losses | Oz (000) | 1,201 | 1,201 |

| Gold Price | US$/oz | 1,750 | 1,750 |

| Revenue | US$ million | 2,102 | 2,102 |

| LOM Operating Costs | US$/oz | 881 | 881 |

| AISC | US$/oz | 972 | 972 |

| NPV | US$ million | 506 | 355 |

| IRR | % | 44.8% | 37.6% |

| Discount Rate | % | 5.0% | 5.0% |

| Discounted Payback Period | Years | 2.33 | 2.33 |

| Project Net Cash | US$ million | 773.1 | 549.9 |

Table 8: Summary of Financial Findings

Figure 8: Cash Flow Projections is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d280160c-5202-44c8-8bfe-c73282ed0593

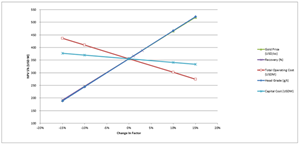

The following tables detail the NPV and IRR sensitivities of the project to gold price, CAPEX, OPEX, recovery and feed grade. Before these the sensitivity analysis percentages are shown.

Figure 9: NPV and IRR Sensitivities is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7958c9a9-30fc-49d3-a4e6-97cc04a4020a

| Average Gold Price (US$/oz) | US$/oz | 1,488 | 1,575 | 1,750 | 1,925 | 2,013 |

| NPV @ 5% (After Tax) | US$M | 191 | 246 | 355 | 465 | 520 |

| IRR | % | 23.2% | 28.1% | 37.6% | 47.0% | 51.7% |

| Cash Flow Payback | Years | 3.87 | 3.22 | 2.33 | 1.76 | 1.55 |

| Maximum Funding | US$M | 170.29 | 169.99 | 169.37 | 168.76 | 168.46 |

Table 9: Key project metric sensitivity to gold price

| NPV @ 5% (After Tax) | Discount Rate | |||

| US$M | 0% | 5% | 10% | |

| Ave Gold Price US$/oz | 1,488 | 324 | 191 | 109 |

| 1,575 | 399 | 246 | 150 | |

| 1,750 | 550 | 355 | 234 | |

| 1,925 | 700 | 465 | 317 | |

| 2,013 | 776 | 520 | 359 | |

Table 10: Gold price and discount rate sensitivity analysis

| NPV @ 5% (After Tax) | Average Gold Price (US$/oz) | |||||

| US$M | 1,488 | 1,575 | 1,750 | 1,925 | 2,013 | |

| Average Head Grade g/t | 0.738 | 46 | 93 | 189 | 281 | 328 |

| 0.782 | 95 | 145 | 244 | 343 | 392 | |

| 0.868 | 191 | 246 | 355 | 465 | 520 | |

| 0.955 | 286 | 346 | 466 | 587 | 648 | |

| 0.999 | 333 | 396 | 522 | 648 | 712 | |

Table 11: Gold price and head grade sensitivity analysis

| NPV @ 5% (After Tax) | Average Gold Price (US$/oz) | |||||

| US$M | 1,488 | 1,575 | 1,750 | 1,925 | 2,013 | |

| Change in OPEX | -15% | 272 | 327 | 436 | 546 | 601 |

| -10% | 246 | 300 | 409 | 519 | 574 | |

| 0% | 191 | 246 | 355 | 465 | 520 | |

| 10% | 136 | 192 | 301 | 411 | 466 | |

| 15% | 108 | 164 | 275 | 384 | 439 | |

Table 12: Gold price and operating costs sensitivity analysis

| NPV @ 5% (After Tax) | Average Gold Price (US$/oz) | |||||

| US$M | 1,488 | 1,575 | 1,750 | 1,925 | 2,013 | |

| Change in CAPEX | -15% | 214 | 268 | 377 | 487 | 542 |

| -10% | 206 | 261 | 370 | 480 | 535 | |

| 0% | 191 | 246 | 355 | 465 | 520 | |

| 10% | 177 | 231 | 341 | 450 | 505 | |

| 15% | 169 | 224 | 333 | 443 | 498 | |

Table 13: Gold price and capital costs sensitivity analysis

| NPV @ 5% (After Tax) | Average Gold Price (US$/oz) | |||||

| US$M | 1,488 | 1,575 | 1,750 | 1,925 | 2,013 | |

| Recovery % | 80.6% | 49 | 96 | 192 | 285 | 332 |

| 85.6% | 96 | 147 | 246 | 345 | 394 | |

| 95.6% | 191 | 246 | 355 | 465 | 520 | |

| 96.6% | 201 | 256 | 366 | 477 | 532 | |

| 98.6% | 210 | 265 | 377 | 489 | 545 | |

Table 14: Gold price and percentage recovery sensitivity analysis

Project Opportunities

The DFS has been completed based upon drilling of only 4 km of the main shear zone. Several other geologically similar shear zone structures totalling more than 55 km have been identified on the concession and these are yet to be drilled. There exists a significant opportunity to increase the size of the measured and indicated resource through targeted limited infill drilling in the inferred resources which would be an opportunity to increase mine life.

The Company, with the assistance of SENET, has advanced the engineering of the project past the level that is required for a DFS. A large part of the process plant is designed to a detailed engineering level, including earthworks and civil engineering drawings issued for construction. Ongoing schedule optimization may result in reducing the construction schedule and bringing first gold forward by a number of months.

Development Timetable

Construction of the process plant and associated infrastructure including Phase 1 of the TSF for the Kobada Gold Project is expected to take 19 months. First gold will be achieved where after the process plant will be ramped up to produce nameplate capacity within the following 2 production months. The mine is designed with ease of construction and operation as a priority. The simplified and compact process plant flowsheet minimizes the requirement for expensive and long lead process equipment, thereby substantially reducing the construction time.

“Utilising known technology to develop a robust plant flowsheet suitable for West African conditions, yet simple and flexible in design, has allowed us to fast-track the development of the engineering to a stage where much of the plant is now at detailed design level. This allows us to shorten the schedule significantly and save on engineering costs” says Danny Callow, Chief Executive Officer of AGG.

The Company also intends to outsource key specialised components of the plant from the best-in-class providers, including a state-of-the-art hybrid, solar PV, thermal and BESS, fuel storage and supply, and the mining and TSF contract.

Qualified Person

This DFS was prepared under the supervision of Nick Dempers, Principal Process Engineer at SENET and a “Qualified Person,” as such term is defined in NI 43-101.

The contents of this press release have been reviewed and approved by:

- Nicholas Dempers, MSc Eng (Chem), BSc Eng (Chem), BCom (Man), Pr.Eng (RSA), Reg.No 20150196, FSAIMM (RSA), Principal Process Engineer of SENET (Pty) Ltd with respect to processing and infrastructure,

- Uwe Engelmann, BSc (Zoo. & Bot.), BSc Hons (Geol.), Pr.Sci.Nat. No. 400058/08, MGSSA, a director of Minxcon (Pty) Ltd. with respect to mineral resources,

- Ghislain Prévost, BSc Eng. (Mining), MScA Eng. (Mining) and P. Eng. (OIQ #119054), a Principal Mining Engineer with DRA Americas Inc. with respect to mineral reserves and mining methods,

- Guy John Wild, BSc Eng., MSc Eng. and P. Eng (#940269), a Director and Senior Tailings Dam Engineer at Epoch Resources with respect to the tailings dam,

- Stephanus Coetzee, B.Sc Hons (Environmental Management), Pr.Sci.Nat. No 40044/04, Director of ABS Africa with respect to the ESIA.

Each of the aforementioned individuals are independent Qualified Person as defined by NI 43-101.

About African Gold Group

African Gold Group is a TSX Venture Exchange (TSX-V: AGG) listed exploration and development company with a focus on building Africa’s next mid-tier gold producer. The Company has a highly experienced board and management team with a proven track record in the African mining sector operating mines from development through to production. AGG’s principal asset is the Kobada Project in southern Mali, which is in an advanced stage of development having completed the 2020 DFS and is targeting gold production of 100,000 oz per annum. As well as the initial Kobada Gold Project, other exploration locations have been identified on the Kobada, Farada and Kobada Est concessions, offering potential for an increase in resource. For more information regarding African Gold Group visit our website at www.africangoldgroup.com.

For more information:

| Danny Callow President and Chief Executive Officer + (27) 76 411 3803 Danny.Callow@africangoldgroup.com | Daniyal Baizak Vice President, Corporate Development +1 (647) 835 9617 Daniyal.Baizak@africangoldgroup.com |

| Scott Eldridge Non-Executive Chairman of the Board +1 (604) 722 5381 Scott.Eldridge@africangoldgroup.com | Camarco (Financial PR) Gordon Poole / Nick Hennis +44 (0) 20 3757 4997 AfricanGoldGroup@camarco.co.uk |

Cautionary statements

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements regarding, the 2021 DFS, production potential and economics of the Project, upside potential of the Project, drilling and exploration plans of the Company, mine plan, mine schedule, processing of materials, power and water infrastructure, tailings management, logistics, refining, environmental and social aspects, key impact, capital costs, operating costs, financial metrics, project opportunities and development timetable with respect the Project. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of AGG to be materially different from those expressed or implied by such forward-looking information, including but not limited to: receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages; available infrastructure and supplies; the COVID-19 pandemic and other risks of the mining industry. Although AGG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. AGG does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.