African Gold Group Delivers a 44% Increase in Measured and Indicated Mineral Resource for the Kobada Gold Project to 1.71 Million Ounces

“We are delighted to announce these phenomenal results from our Kobada Gold Project in Mali. With the inclusion of significant exploration drilling within our oxides and fresh rock, we have achieved a substantial increase in total resource to more than 3.1 million ounces, which includes a 44% increase in Measured and Indicated resource of 1.71 million ounces, and a 26% increase in Inferred resource of 1.43 million ounces,” commented Danny Callow, CEO of African Gold Group

Highlights:

- A 44% increase in the Measured and Indicated Mineral Resource to 1.71 million Au ounces.

- A 26% increase in the Inferred Mineral Resource to 1.43 million Au ounces.

- Significant additional upside in the Inferred Mineral Resource.

- Gosso target drilling confirmed that the mineralisation and grades are higher than that observed at the Kobada main shear with an average grade of 1.11 g/t.

- Confidence in the geological model continues to increase with every exploration campaign and holes drilled over the Kobada Gold Project.

- Recent metallurgical test work completed as part of the feasibility study has revealed the sulphides are free milling and treatable through the same process circuit.

- Revised Kobada definitive feasibility study expected by the end of September 2021.

TORONTO, Sept. 02, 2021 (GLOBE NEWSWIRE) -- African Gold Group, Inc. (TSX-V: AGG, OTC: AGGFF, FRA: 3A61) (“AGG” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (“MRE”) for its Kobada Gold Project (the “Project” or “Kobada”) located in southwestern Mali, Africa. The MRE update is based on additional drilling completed on the Kobada main shear from September 2020 until January 2021, which will form part of a revised definitive feasibility study (expected to be delivered by the end of September) (the “2021 DFS”). Additionally, the Company has engaged various advisors to outline potential corporate opportunities.

The drilling campaign was focused on the “gap” area and the northern portion of the Kobada main shear, as well as testing the Gosso target for future potential. The drilling has once again increased the confidence in the geological model even further and resulted in a substantial increase in the Mineral Resource Estimate.

Danny Callow, CEO of African Gold Group, commented:

“With very little additional drilling on the Phase 4A drill programme, we have proven the continued significant upside in our Kobada asset. These results are substantially better than those in the July 2020 Definitive Feasibility Study, and we are very excited to see this continued growth in measured and indicated resources. From this new drilling, we have added additional shallow, easily accessible inferred resources, and through further targeted drilling programmes, in Phase 4B and 4C we believe there is substantial further upside in resource growth.

We have always stated that there is significant upside in Kobada, and with more than 50 km of shear zones still untested with the drill bit, we believe we are sitting on a substantial world class resource.”

2020 Drilling Campaign

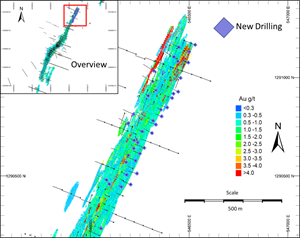

The 2020 drilling campaign, running from September 2020 until January 2021, consisted of 43 drillholes totaling 6,364 m. Of these, four drillholes (522 m) were drilled at the Gosso target and the remaining 39 drillholes (5,842 m) were drilled in the “gap” area and northern extents of the northern domain of the Kobada main shear. The Gosso drillholes were all completed using diamond drilling while the Kobada drilling was a combination of diamond drilling (8 holes @ 1,258 m) and RC drilling (21 holes @ 2,890 m) with selected RC drillholes being completed with diamond tail (10 holes @ 1,221m RC and 473 m diamond) to drill into the sulphides.

The main focus of the 2020 drilling campaign was to confirm the geological model and improve the confidence in the model even more to enable additional Mineral Resource conversion of the oxides to the measured and indicated resource categories. The drilling was also used to test and confirm the depth extension of the lateritic (soft) material, the transition zone and the sulphides at depth.

For the Kobada main shear drilling, 34 drillholes intersected the mineralised zones and had an average accumulated mineralisation width of 29m @ 1.22 g/t. This drilling has significantly contributed to the increase in the indicated resource in the northern domain of the Kobada main shear. The drilling also highlighted areas of deeper weathering with oxide material extending further down to a depth of approximately 160 m in places, approximately 60 to 80 m deeper than originally anticipated.

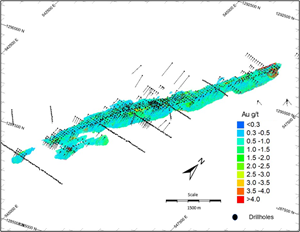

The Gosso drillholes confirmed the mineralisation observed in the historical drillholes with the four drillholes having an average accumulated mineralisation width of 12 m @ 1.11 g/t.

Figure 1: https://www.globenewswire.com/NewsRoom/AttachmentNg/42a59cfd-0722-4d87-b6ff-73f7076b31fd

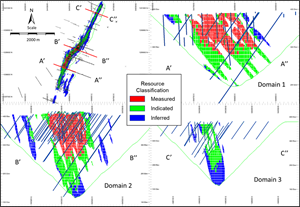

Figure 2: https://www.globenewswire.com/NewsRoom/AttachmentNg/3767dd3c-1416-45a6-94c0-81c676d44a53

Mineral Resource

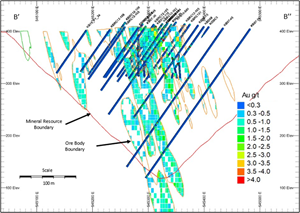

The geological model was revised with the additional 2020 drilling campaign information. The biggest impact was in the inferred category of the wireframes, the deepening of the oxide and sulphide transition depth, and not modelling the weathering zones as individual subdomains. The model is divided into five structural and grade-constrained domains which are further split into weathering zones of laterite, saprolite, transition and sulphide. The 2020 Definitive Feasibility Study used a sub-domaining for the weathering profile. However, this was reinvestigated and the mean gold grades per weathering profile show a natural decrease with depth and the log probability plots of the total composites show a good correlation and do not indicate that the orebody should be split into sub domains for estimation purposes. Drillholes were composited to a 1 m length to standardise the sample support size. A capping analysis of the 1 m composited data was conducted per domain to identify any outliers in that dataset. The outlier grade results were capped per domain and the capping represents the 99th or 98th percentile. The search ellipse for the domains were set from the strike and dip directions obtained from the orebody wireframe generation and variograms were generated for all domains. The block model was based on the kriging neighbourhood analysis (KNA) and had a parent estimation cell of 5 m x 10 m x 10 m in the x, y, and z. Grade estimation was conducted using Ordinary Kriging (“OK”) based on the variograms and the estimation was done per structural domain.

Geological losses of 5% for measured, 10% for indicated and 15% for inferred have been applied to the Mineral Resource. Only resources falling within a resource open pit shell based on a gold price of USD 1,800 / oz have been declared.

Figure 3: https://www.globenewswire.com/NewsRoom/AttachmentNg/7dd6eb1c-ae66-46ea-8db7-978d05e7b860

Figure 4: https://www.globenewswire.com/NewsRoom/AttachmentNg/0f008d9c-f769-4e3a-806e-9b5a397ce7a0

The two tables below detail the updated Mineral Resource Estimate for 2021.

| Mineral Resource Classification | Tonnes | Au | Au | Au |

| Mt | g/t | kg | koz | |

| Measured | 21.40 | 0.83 | 17,784 | 572 |

| Indicated | 40.15 | 0.88 | 35,425 | 1,139 |

| Measured & Indicated Total | 61.54 | 0.86 | 53,209 | 1,711 |

| Inferred Total | 42.03 | 1.06 | 44,564 | 1,433 |

Notes:

| ||||

Table 1: Kobada Project Mineral Resources as of 1 July 2021

| Rock Type | Mineral Resource Classification | Tonness | Au | Au | Au |

| Mt | g/t | kg | koz | ||

| Laterite | Measured | 0.33 | 0.79 | 258 | 8 |

| Indicated | 1.18 | 0.90 | 1,062 | 34 | |

| Measured & Indicated Total | 1.51 | 0.87 | 1,320 | 42 | |

| Inferred | 1.30 | 1.01 | 1,308 | 42 | |

| Oxide | Measured | 11.73 | 0.88 | 10,308 | 331 |

| Indicated | 16.16 | 0.94 | 15,113 | 486 | |

| Measured & Indicated Total | 27.89 | 0.91 | 25,421 | 817 | |

| Inferred | 10.83 | 1.14 | 12,373 | 398 | |

| Transitional | Measured | 1.89 | 0.84 | 1,595 | 51 |

| Indicated | 4.43 | 0.89 | 3,936 | 127 | |

| Measured & Indicated Total | 6.33 | 0.87 | 5,531 | 178 | |

| Inferred | 4.60 | 0.95 | 4,345 | 140 | |

| Total Excluding Sulphides | Measured | 13.95 | 0.87 | 12,161 | 391 |

| Indicated | 21.78 | 0.92 | 20,110 | 647 | |

| Measured & Indicated Total | 35.73 | 0.90 | 32,271 | 1,038 | |

| Inferred | 16.72 | 1.08 | 18,027 | 580 | |

| Sulphide | Measured | 7.45 | 0.76 | 5,623 | 181 |

| Indicated | 18.37 | 0.83 | 15,315 | 492 | |

| Measured & Indicated Total | 25.81 | 0.81 | 20,938 | 673 | |

| Inferred | 25.31 | 1.05 | 26,537 | 853 | |

| Total Including Sulphides | Measured | 21.40 | 0.83 | 17,784 | 572 |

| Indicated | 40.15 | 0.88 | 35,425 | 1,139 | |

| Measured & Indicated Total | 61.54 | 0.86 | 53,209 | 1,711 | |

| Inferred | 42.03 | 1.06 | 44,564 | 1,433 | |

Notes:

| |||||

Table 2: Kobada Mineral Resources per Weathering Zone as of 1 July 2021

The increase in the Mineral Resource from 2020 to 2021 is primarily due to the improved gold price which improved the reasonable prospects of eventual economic extraction by allowing for a larger and deeper resource pit to include more sulphides, the additional drilling information which improved geological confidence and assisted in converting Inferred Mineral Resource to Indicated Mineral Resource.

| Year | Resource Classification | Tonnes | Au | Au | Au | ||||

| Mt | g/t | Kg | Koz | ||||||

| 2020 | Measured | 23.25 | 0.79 | 18 379 | 591 | ||||

| Indicated | 19.70 | 0.95 | 18 673 | 600 | |||||

| M&I Total | 42.95 | 0.86 | 37 053 | 1 191 | |||||

| Inferred | 26.71 | 1.33 | 35 421 | 1 139 | |||||

| Variance | M&I Total | 43 | % | 0 | % | 44 | % | 44 | % |

| Inferred | 57 | % | -20 | % | 26 | % | 26 | % | |

| 2021 | Measured | 21.40 | 0.83 | 17 784 | 572 | ||||

| Indicated | 40.15 | 0.88 | 35 425 | 1 139 | |||||

| M&I Total | 61.54 | 0.86 | 53 209 | 1 711 | |||||

| Inferred | 42.03 | 1.06 | 44 564 | 1 433 | |||||

Table 3: Kobada Mineral Resource Reconciliation

Quality Assurance / Quality Control

The 2020 drilling campaign was undertaken by AMCO and supervised by Minxcon (Pty) Limited of South Africa. The drilling was a combination of diamond drilling (NQ) as well as RC drilling. Diamond drilling core was split and either sampled in one metre intervals or along lithological or structural contacts. The RC drilling was sampled in one metre increments and riffle split for assay samples. All samples were analysed at SGS (Bamako) Laboratory, a certified commercial laboratory. A strict QA/QC program was applied to all samples; which include insertion of either certified reference material (CRM’s), a blank sample or duplicate every 10th sample (i.e. a rate of 10% of submitted samples). The gold analyses were by fire-assay on 50 grams aliquot with AAS finish.

Upside Potential

Upside potential remains at the Kobada main shear to upgrade some additional inferred mineral resources to indicated. In addition to this, the Kobada Project has significant upside potential in the 55 km strike of potential mineralised shear zones. Of these, the Gosso Target is the more advanced with limited drilling completed (21 drillholes) with mineralisation in 16 of these drillholes with the latest 2020 drilling confirming mineralisation at this target. Initial field investigations by the AGG geologists, in early 2021, has highlighted the potential at the Kobada Est targets where artisanal mining has exposed mineralised structural features.

Figure 5: https://www.globenewswire.com/NewsRoom/AttachmentNg/64e09f48-8b00-40a0-abb0-bcd17308c7e9

Qualified Person

The scientific and technical information contained in this press release has been reviewed, prepared and approved by Dr. Andreas Rompel, PhD, Pr. Sci. Nat. (400274/04), FSAIMM, Vice President Exploration of AGG, who is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and by Mr. Uwe Engelmann (BSc (Zoo. & Bot.), BSc Hons (Geol.), Pr.Sci.Nat. No. 400058/08, MGSSA), a director of Minxcon (Pty) Ltd and a member of the South African Council for Natural Scientific Professions.

About African Gold Group

African Gold Group is a TSX Venture Exchange (TSX-V: AGG) listed exploration and development company with a focus on building Africa’s next mid-tier gold producer. The Company has a highly experienced board and management team with a proven track record in the African mining sector operating mines from development through to production. AGG’s principal asset is the Kobada Project in southern Mali, which is in an advanced stage of development having completed the 2020 Definitive Feasibility Study and is targeting gold production of 100,000 oz per annum. As well as the initial Kobada Gold Project, other exploration locations have been identified on the Kobada, Farada and Kobada Est concessions, offering potential for an increase in resource. For more information regarding African Gold Group visit our website at www.africangoldgroup.com.

For more information:

| Danny Callow President and Chief Executive Officer + (27) 76 411 3803 Danny.Callow@africangoldgroup.com | Daniyal Baizak Vice President, Corporate Development +1 (647) 835 9617 Daniyal.Baizak@africangoldgroup.com |

| Scott Eldridge Non-Executive Chairman of the Board +1 (604) 722 5381 Scott.Eldridge@africangoldgroup.com | Camarco (Financial PR) Gordon Poole / Nick Hennis +44 (0) 20 3757 4997 AfricanGoldGroup@camarco.co.uk |

Cautionary statements

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements regarding, the MRE, the 2021 DFS, engagement of advisors, upside potential at the Kobada Gold Project and drilling and explorations plans of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of AGG to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages and other risks of the mining industry. Although AGG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. AGG does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.