Alacer Gold Announces Further Positive Drill Results for the Ardich Gold Project, Including 29.0 Meters at 4.81 Grams Per Tonne

TORONTO, Aug. 26, 2019 (GLOBE NEWSWIRE) -- Alacer Gold Corp. (“Alacer” or the “Company”) [TSX: ASR and ASX: AQG] is pleased to announce additional positive results from the diamond drilling program for the Ardich Gold Project (the “Ardich Project” or “Ardich”). In April 2019, Alacer announced a maiden Indicated and Inferred Mineral Resource of 639koz and 96koz from the first 100 diamond core drill holes at Ardich1. An additional 34 holes are reported in this release, extending the mineralized strike length to over 1,200m. The new holes are located to the west, east and southeast of the previously reported Ardich resource area. The majority of the new drill holes intersected predominantly oxide gold mineralization, many with impressive grades, including holes:

- AR117: 33.1m @ 4.21 g/t Au from 131.4m, including 10.6m @ 10.03 g/t Au from 133.1m

- AR133: 50.6m @ 2.73 g/t Au from 122.9m, including 10.3m @ 8.04 g/t Au from 148.7m

- AR134: 29.0m @ 4.81 g/t Au from 113.7m, including 7.0m @ 11.74 g/t Au from 119.7m

Rod Antal, Alacer’s President and Chief Executive Officer, stated, “This is another exciting set of drill results for Ardich and more than doubles the mineralized strike length. We are continuing the step-out drilling program and expect that the mineralization will continue and become shallower to the southeast. Concurrently, our development team is working on the study and permitting requirements to allow us to accelerate access to a starter pit. The objective is to fast track Ardich, leveraging off the existing infrastructure, and provide options to sustain the oxide ore production from the Çöpler District. Ardich has the potential to become a significant component of the Alacer growth story and is our highest priority development project.”

Alacer is in the process of preparing an interim resource update which is expected to be released in late 2019. The objective of the ongoing exploration program is to first define, by step-out drilling, the extent of the mineralization. Once the mineralized system dimensions and geology are better understood, a more comprehensive infill drilling program will be started with the aim of defining an expanded resource and a reserve estimate.

Heap Leach Pad Capacity

A recent scoping study to determine the optimal pathway for the expansion of the heap leach oxide processing capacity in the Çöpler District identified various options (at both Ardich and Çöpler) for standalone facilities and heap leach pads of varying size (some >50Mt), along with low-cost incremental expansion options at Çöpler (~20Mt of additional heap leach capacity). These options provide pathways to both accelerate low-cost, near-term development of Ardich or other Çöpler District prospects, as well as options for a new separate mine development should the Ardich deposit grow to the full extent of the mineralized target.

It has been determined that the Çöpler heap leach pad expansion can be executed in two phases. Engineering for phase one will be completed in Q3 2019 for the first ~6 million tonnes of capacity. The existing Environmental Impact Assessment allows for phase one to be constructed and site works are targeted to be completed in 2020. This development plan ensures that there is no short to medium-term restriction to oxide plant production. Detailed engineering and permitting for the second phase are progressing in parallel.

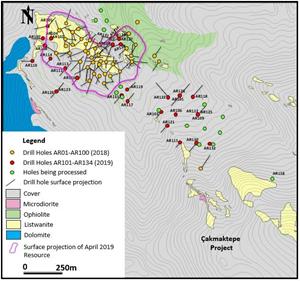

Figure 1. Location map of the Ardich Gold Project. The haul road constructed for the Çakmaktepe oxide ore is 2km to Ardich.

https://www.globenewswire.com/NewsRoom/AttachmentNg/e74a4044-4957-4d41-a047-de4b4b54da62

Overview of Mineralization Style

The Ardich Project is characterized by development of gold mineralized listwanite and dolomite rock units in the target area within a northwest-southeast structural zone (Figure 2). The gold mineralization is closely associated with low angle thrust fault zones between listwanites, dolomites and ophiolites that are intruded by series of microdioritic dykes. The mineralization is related to silica rich listwanite and dolomite rock units as well as with smaller zones of jasperoid developments. The mineralization is predominantly in the form of oxide with sulfide mineralization confined to limited pyrite rich jasperoid sections. Based on the latest drill data, the main mineralization zone appears to be tabular and almost flat lying ore body with small displacements due to the normal faulting.

Figure 2. Drill hole locations and surface reflection of mineralized zones.

https://www.globenewswire.com/NewsRoom/AttachmentNg/f131c711-a154-4ce2-b4dd-8bb0a88b14fb

Drilling

Alacer drilled 134 diamond core holes totaling 21,364.2m between August 2017 and July 2019. The vast majority of drill holes were drilled within Alacer’s 80% owned and managed licenses and greater than 99% of the April 2019 Mineral Resource2 was within the Alacer 80% areas. Alacer owns 50% of Kartaltepe (Alacer 50% and Lidya 50%) in which the remaining holes were located. Alacer announced a maiden Mineral Resource on December 10, 2018 based on 55 core holes with an Indicated Mineral Resource of 294koz gold at an average grade of 1.32 Au g/t (6.9MT). The Company announced a 117% increase to the Ardich Indicated Mineral Resource on April 3, 2019 based on 100 diamond core holes. The updated Mineral Resource estimate consists of predominantly oxide ore, with some sulfide ore totaling:

- Indicated Mineral Resource of 639,000 ounces of gold at an average grade of 1.50 Au g/t (13.2MT)

- Inferred Mineral Resource estimate of 96,000 ounces at an average grade of 1.16 Au g/t (2.6MT)

Highlights of previously announced holes include2:

On February 26, 2018:

- Hole AR09 with 67.7m averaging 4.08 g/t gold from 53.3m depth (including 14.2m at 7.21 g/t)

On July 25, 2019:

- Hole AR31 with 68.6m averaging 2.21 g/t gold from 36.0m depth (including 17.0m at 5.5 g/t)

- Hole AR41 with 50.2m averaging 3.01 g/t gold from 43.4m depth (including 7.9m at 8.81 g/t)

On November 7, 2018:

- Hole AR52 with 57.7m averaging 3.84 g/t Au from 121.3m depth (including 11.9m at 6.4 g/t)

- Hole AR54 with 61.4m averaging 2.22 g/t gold from 5m depth (including 6.4m at 7.75 g/t)

On April 3, 2019:

- Hole AR69 with 113.0m averaging 1.75 g/t gold from 24m depth (including 10m at 4.95 g/t)

- Hole AR80 with 50.6m averaging 2.99 g/t gold from 33.5m depth (including 11.9m at 8.07 g/t)

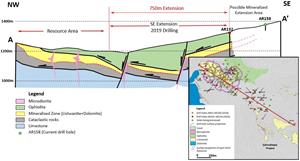

Alacer currently has 4 diamond drill rigs at Ardich with 34 holes (one abandoned hole) totaling 5,598.6m completed between April and July 2019 (AR101-AR134). These additional holes improved the west, east and southeastern extension of the gold mineralization defined by the earlier 100 diamond holes. Fourteen drill holes are located to the southeast of the known resource area and have intersected significant gold mineralization underneath barren ophiolites expanding the known mineralization about 750m to the southeast. This demonstrates possible continuation of gold mineralization to the southeast of the Ardich Project covered by ophiolites that do not have any surface geochemical signature. The main Ardich mineralization gently dips towards southeast and gets deeper due to normal faulting. Three holes were drilled further towards the southeast and indicate that the mineralization gets shallower again and continues towards the southeast (Figure 2). Alacer is currently drilling hole AR158 located 450m southeast of AR132 to test the continuation of gold mineralization in this direction (Figure 3).

All drilling outlined below was diamond core drilling using either HQ (63.5mm in diameter) or PQ (85mm in diameter) core sizes.

Figure 3. Ardich NW-SE conceptual section showing southeast extension of the gold mineralization.

https://www.globenewswire.com/NewsRoom/AttachmentNg/b757950f-be96-452a-9231-4f2a1f3ab2fe

Drill Highlights

Significant results are down hole length and include:

- AR103: 29.2m @ 4.75 g/t Au from 130.53m, including 11.2m @ 8.09 g/t Au from 134.5m and 6m @ 4.95 g/t Au from 152.7m

- AR113: 21.4m @ 3.06 g/t Au from 52.6m, including 7.7m @ 5.97 g/t Au from 66.3m

- AR114: 26.7m @ 2.39 g/t Au from 13.3m, including 5m @ 5.77 g/t Au from 22.6m

- AR116: 14.2m @ 2.39 g/t Au from 82m, including 3m @ 4.42 g/t Au from 87m

- AR117: 33.1m @ 4.21 g/t Au from 131.4m, including 10.6m @ 10.03 g/t Au from 133.1

- AR119: 14.1m @ 3.45 g/t Au from 112.1m, including 4m @ 8.09 g/t Au from 115.4m

- AR120: 19.6m @ 2.90 g/t Au from 8m, including 3m @ 4.64 g/t Au from 16.3m

- AR125: 23.5m @ 1.68 g/t Au from 177m, including 3m @ 4.52 g/t Au from 183m

- AR133: 50.6m @ 2.73 g/t Au from 122.9m, including 10.3m @ 8.04 g/t Au from 148.7m

- AR134: 37.6m @ 1.39 g/t Au from 68.3m and 29m @ 4.81 g/t Au from 113.7m, including 7m @ 11.74 g/t Au from 119.7m

Table 1. Significant gold intercepts at the Ardich Project.

| Hole ID | From (m) | To (m) | Interval (m) | Au g/t | Remarks | Depth (m) | Comments |

| AR101 | 192.00 | 222.60 | 30.60 | 1.05 | Oxide | 256.10 | 197.50-199.00 Sulfide |

| including | 218.60 | 220.60 | 2.00 | 7.29 | Sulfide | ||

| AR102 | 0.00 | 10.00 | 10.00 | 0.33 | Oxide | 180.00 | 4.00-5.00 Sulfide |

| 18.00 | 49.30 | 31.30 | 0.82 | Oxide | 19.00-20.00 Sulfide | ||

| AR103 | 130.50 | 159.70 | 29.20 | 4.75 | Sulfide | 210.50 | Includes isolated intervals of core loss totalling 0.4m, 130.50-134.50 Oxide |

| including | 134.50 | 145.70 | 11.20 | 8.09 | Sulfide | ||

| including | 152.70 | 158.70 | 6.00 | 4.95 | Sulfide | ||

| AR104 | 0.00 | 8.00 | 8.00 | 0.43 | Oxide | 90.40 | |

| 24.00 | 59.00 | 35.00 | 0.77 | Oxide | 29.00-30.00 Sulfide | ||

| AR105 | 60.00 | 69.40 | 9.40 | 1.02 | Oxide | 149.50 | 60.00-61.00 Sulfide |

| 79.40 | 122.20 | 42.80 | 0.70 | Oxide | 88.00-89.00 and 118.00-119.00 Sulfide | ||

| AR106 | 194.40 | 199.40 | 5.00 | 0.47 | Oxide | 248.00 | |

| 221.00 | 227.00 | 6.00 | 0.42 | Sulfide | |||

| AR107 | 9.00 | 33.00 | 24.00 | 0.90 | Oxide | 148.00 | |

| AR108 | 0.00 | 36.00 | 36.00 | 1.50 | Oxide | 101.00 | |

| AR109 | 150.00 | Abandoned at 150m and re-drilled as AR112 | |||||

| AR110 | 3.50 | 22.00 | 18.50 | 1.37 | Oxide | 152.70 | 15.00-18.00 Sulfide |

| AR111 | 29.00 | 60.30 | 31.30 | 1.17 | Oxide | 149.50 | 31.00-34.00m Sulfide |

| 134.30 | 139.30 | 5.00 | 0.49 | Mixed | 67/33 Oxide-Sulfide | ||

| AR112 | 151.00 | 185.80 | 34.80 | 0.83 | Oxide | 190.30 | 173.00-174.00 Sulfide, includes isolated intervals of core loss totalling 1.0m |

| including | 151.00 | 153.00 | 2.00 | 3.91 | Oxide | ||

| AR113 | 40.80 | 47.60 | 6.80 | 1.28 | Oxide | 119.50 | |

| 52.60 | 74.00 | 21.40 | 3.06 | Oxide | 73.30-74.00 Sulfide | ||

| including | 66.30 | 74.00 | 7.70 | 5.97 | Oxide | 73.30-74.00 Sulfide | |

| 86.00 | 91.00 | 5.00 | 0.60 | Sulfide | |||

| AR114 | 13.30 | 40.00 | 26.70 | 2.39 | Oxide | 132.60 | 20.60-21.60 Sulfide |

| Including | 22.60 | 27.60 | 5.00 | 5.77 | Oxide | ||

| 86.40 | 95.90 | 9.50 | 0.64 | Mixed | 79/21 Oxide-Sulfide | ||

| AR115 | 158.40 | 192.00 | 33.60 | 0.80 | Oxide | 230.00 | Includes isolated intervals of core loss totalling 1.0m |

| 196.00 | 203.00 | 7.00 | 0.66 | Oxide | |||

| AR116 | 82.00 | 96.20 | 14.20 | 2.39 | Oxide | 165.00 | |

| including | 87.00 | 90.00 | 3.00 | 4.42 | Oxide | ||

| 120.50 | 126.50 | 6.00 | 1.83 | Oxide | 123.50-124.50 Sulfide | ||

| AR117 | 131.40 | 164.50 | 33.10 | 4.21 | Oxide | 188.00 | 135.10-139.10 Sulfide |

| including | 133.10 | 143.70 | 10.60 | 10.03 | Oxide | 135.10-139.10 Sulfide | |

| AR118 | 164.40 | 175.50 | 11.10 | 1.51 | Oxide | 277.50 | |

| 180.00 | 190.00 | 10.00 | 0.87 | Oxide | |||

| AR119 | 112.10 | 126.20 | 14.10 | 3.45 | Oxide | 148.00 | Includes isolated intervals of core loss totalling 0.4m. 117.40-118.00 and 119.40-120.40 Sulfide |

| including | 115.40 | 119.40 | 4.00 | 8.09 | Oxide | Includes isolated intervals of core loss totalling 0.4m. 117.40-118.00 Sulfide | |

| AR120 | 8.00 | 27.60 | 19.60 | 2.90 | Oxide | 131.00 | 12.50-16.30 Sulfide |

| including | 16.30 | 19.30 | 3.00 | 4.64 | Mixed | 67/33 Oxide-Sulfide | |

| 47.50 | 55.50 | 8.00 | 0.50 | Sulfide | |||

| AR121 | 158.30 | 180.60 | 22.30 | 0.65 | Oxide | 191.60 | 168.50-169.50 Sulfide |

| AR122 | 199.20 | 249.50 | 50.30 | 0.97 | Sulfide | 260.60 | 205.70-207.70 Oxide |

| AR123 | 149.00 | 165.00 | 16.00 | 0.78 | Oxide | 203.00 | 162.00-165.00 Sulfide |

| 196.40 | 203.00 | 6.60 | 0.44 | Sulfide | |||

| AR124 | 36.10 | 46.70 | 10.60 | 1.48 | Oxide | 131.70 | 39.10-40.10 and 42.20-43.50 Sulfide |

| 53.70 | 92.50 | 38.80 | 0.97 | Oxide | 60.50-61.50, 63.50-64.50 and 72.60-73.70 Sulfide | ||

| including | 65.50 | 67.50 | 2.00 | 5.15 | Oxide | ||

| AR125 | 177.00 | 200.50 | 23.50 | 1.68 | Oxide | 215.60 | 180.00-183.00 Sulfide |

| including | 183.00 | 186.00 | 3.00 | 4.52 | Oxide | ||

| AR126 | 168.60 | 185.00 | 16.40 | 1.24 | Oxide | 285.00 | |

| AR127 | 19.10 | 31.90 | 12.80 | 1.95 | Oxide | 86.00 | Includes isolated interval of core loss totalling 0.2m, 21.00-23.10 and 31.30-31.90 Sulfide |

| AR128 | - | - | - | - | - | 176.50 | No consecutive 5m mineralization (N.S.I.) |

| AR129 | 35.80 | 47.00 | 11.20 | 3.02 | Oxide | 92.00 | 39.70-40.70 Sulfide |

| including | 41.70 | 44.70 | 3.00 | 9.23 | Oxide | ||

| AR130 | 87.00 | 90.40 | 3.40 | 3.07 | Oxide | 213.90 | |

| 103.60 | 116.00 | 12.40 | 2.07 | Oxide | 103.60-105.60 and 106.60-107.60 Sulfide Includes isolated intervals of core loss totalling 0.5m | ||

| 131.50 | 158.80 | 27.30 | 0.59 | Oxide | |||

| AR131 | 8.80 | 13.80 | 5.00 | 1.52 | Oxide | 104.00 | |

| 54.20 | 58.40 | 4.20 | 1.68 | ||||

| AR132 | 83.00 | 97.80 | 14.80 | 2.06 | Oxide | 164.60 | |

| including | 84.00 | 89.00 | 5.00 | 4.15 | Oxide | ||

| 114.00 | 122.00 | 8.00 | 0.85 | Sulfide | |||

| AR133 | 122.90 | 173.50 | 50.60 | 2.73 | Mixed | 186.00 | 62/38 Oxide-Sulfide |

| including | 148.70 | 159.00 | 10.30 | 8.04 | Oxide | 154.30-155.30 Sulfide | |

| AR134 | 6.00 | 11.00 | 5.00 | 1.11 | Oxide | 175.10 | |

| 68.30 | 105.90 | 37.60 | 1.39 | Mixed | Includes isolated intervals of core loss totalling 3.0m, 80/20 Oxide-Sulfide | ||

| 113.70 | 142.70 | 29.00 | 4.81 | Mixed | 83/17 Oxide-Sulfide | ||

| including | 119.70 | 126.70 | 7.00 | 11.74 | Mixed | 40/60 Oxide-Sulfide |

Significant gold intervals reported at a nominal 0.3 g/t gold cut-off and with a maximum 3.5m contiguous dilution are given in Table 1. All thicknesses are down hole length and true widths are not known at this stage.

To view the complete drill assay results and further technical information relating to this news release, please visit the Company’s website at www.alacergold.com.

About Alacer

Alacer is a leading low-cost intermediate gold producer whose primary focus is to leverage its cornerstone Çöpler Gold Mine and strong balance sheet as foundations to continue its organic multi-mine growth strategy, maximize free cash flow and therefore create maximum value for shareholders. The Çöpler Gold Mine is located in east-central Turkey in the Erzincan Province, approximately 1,100 kilometers (“km”) southeast from Istanbul and 550km east from Ankara, Turkey’s capital city. Alacer owns an 80% interest in the world-class Çöpler Gold Mine (“Çöpler”) in Turkey operated by Anagold Madencilik Sanayi ve Ticaret A.S. (“Anagold”), and the remaining 20% owned by Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya Mining”).

Alacer continues to pursue opportunities to further expand its current operating base to become a sustainable multi-mine producer with a focus on Turkey. The Çöpler Mine is processing ore through two producing plants. With the recent completion of the sulfide plant, the Çöpler Mine will produce over 3.5 million ounces at first quartile All-in Sustaining Costs, generating robust free cash flow for approximately the next 20 years.

The systematic and focused exploration efforts in the Çöpler District have been successful as evidenced by the newly discovered Ardich deposit. The Çöpler District remains the focus, with the goal of continuing to grow oxide resources that will deliver production utilizing the existing Çöpler infrastructure. In the other regions of Turkey, targeted exploration work continues at a number of highly prospective exploration targets.

Alacer is a Canadian company incorporated in the Yukon Territory with its primary listing on the Toronto Stock Exchange. The Company also has a secondary listing on the Australian Securities Exchange where CHESS Depositary Interests trade.

Technical Procedural Information

Sampling, Assaying and QA/QC

The Ardich drilling program started in 2017. Diamond drill core is sampled as half core at 1m intervals. The samples were submitted to ALS Global laboratories in Izmir, Turkey for sample preparation and analysis which is of an ISO/IEC 7025:2005 certified and accredited laboratory. Bureau Veritas (Acme) laboratory, Ankara is being used as for umpire check sample analysis. Gold was analyzed by fire assay with an AAS finish, and the multi-element analyses were determined by four acid digestion and ICP-AES and MS finish. For gold assays greater than or equal to 10g/t, fire assay process is repeated with a gravimetric finish for coarse gold. Alacer's drill and geochemical samples were collected in accordance with accepted industry standards. Alacer conducts routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks, field duplicates, and umpire laboratory check assays. External review of data and processes relating to the Ardich Project have been completed by independent Consultant Dr. Erdem Yetkin, P.Geo. in August 2019. There were no adverse material results detected and the QA/QC indicates the information collected is acceptable, and the database can be used for further studies.

Metallurgical Test Work

Metallurgy test program is completed for the area described in December 2018 Exploration update and further study continues for the SE extension of the Ardich deposit and results will be provided in upcoming 2019 Ardich resource update release.

Qualified Person

Dr. Mesut Soylu, P.Geo., who is a Qualified Person as defined under National Instrument 43-101 and qualifies as a Competent Person as defined in the JORC Code 2012, has reviewed and approved the scientific and technical information contained in this news release.

The information in this release which relates to exploration results is based on, and fairly represents, information and supporting documentation prepared by Mesut Soylu, PhD Geology, P.Geo., Eurgeol, who is a full-time employee of Alacer. Dr. Soylu has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and a qualified person pursuant to National Instrument 43-101. Dr. Soylu consents to the inclusion in this announcement of the matters based on this information in the form and context in which it appears.

The information in this release which relates to the Ardich Mineral Resource is based on, and fairly represents, the information and supporting documentation prepared by Messrs. Ligocki and Statham who are Qualified Persons pursuant to NI 43-101 and Competent Persons as defined in the JORC Code. Further information is available in the press release entitled “Alacer Gold announces a 117% increase to the Ardich indicated mineral resource located in the Çöpler Mining District” dated April 3, 2019. Alacer confirms that it is not aware of any new information or data that materially affects the information included in that press release and that all material assumptions and technical parameters underpinning the Mineral Resource continue to apply and have not materially changed.

External review of data and processes relating to the Ardich Project was completed in August 2019 by independent Consultant Dr. Erdem Yetkin, P.Geo. a Qualified Person as defined by National Instrument 43-101 and a Competent Person as defined by the JORC Code 2012. There were no adverse material results detected and Dr. Yetkin is of the opinion that the QA/QC indicates the information collected is acceptable, and the database can be used for announcing the exploration results.

Cautionary Statements

Except for statements of historical fact relating to Alacer, certain statements contained in this press release constitute forward-looking information, future oriented financial information, or financial outlooks (collectively “forward-looking information”) within the meaning of Canadian securities laws. Forward-looking information may be contained in this document and other public filings of Alacer. Forward-looking information often relates to statements concerning Alacer’s outlook and anticipated events or results, and in some cases, can be identified by terminology such as “may”, “will”, “could”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “projects”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts.

Forward-looking information includes statements concerning, among other things, preliminary cost reporting in this document; production, cost, and capital expenditure guidance; the ability to expand the current heap leach pad; the results of any gold reconciliations; the ability to discover additional oxide gold ore; the generation of free cash flow and payment of dividends; matters relating to proposed exploration; communications with local stakeholders; maintaining community and government relations; negotiations of joint ventures; negotiation and completion of transactions; commodity prices; mineral resources, mineral reserves, realization of mineral reserves, the existence or realization of mineral resource estimates; the development approach; the timing and amount of future production; the timing of studies, announcements, and analysis; the timing of construction and development of proposed mines and process facilities; capital and operating expenditures; economic conditions; availability of sufficient financing; exploration plans; receipt of regulatory approvals; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, environmental, regulatory, and political matters that may influence or be influenced by future events or conditions.

Such forward-looking information and statements are based on a number of material factors and assumptions, including, but not limited in any manner to, those disclosed in any other of Alacer’s filings, and include the inherent speculative nature of exploration results; the ability to explore; communications with local stakeholders; maintaining community and governmental relations; status of negotiations of joint ventures; weather conditions at Alacer’s operations; commodity prices; the ultimate determination of and realization of mineral reserves; existence or realization of mineral resources; the development approach; availability and receipt of required approvals, titles, licenses and permits; sufficient working capital to develop and operate the mines and implement development plans; access to adequate services and supplies; foreign currency exchange rates; interest rates; access to capital markets and associated cost of funds; availability of a qualified work force; ability to negotiate, finalize, and execute relevant agreements; lack of social opposition to the mines or facilities; lack of legal challenges with respect to the property of Alacer; the timing and amount of future production; the ability to meet production, cost, and capital expenditure targets; timing and ability to produce studies and analyses; capital and operating expenditures; economic conditions; availability of sufficient financing; the ultimate ability to mine, process, and sell mineral products on economically favorable terms; and any and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, geopolitical, regulatory and political factors that may influence future events or conditions. While we consider these factors and assumptions to be reasonable based on information currently available to us, they may prove to be incorrect.

You should not place undue reliance on forward-looking information and statements. Forward-looking information and statements are only predictions based on our current expectations and our projections about future events. Actual results may vary from such forward-looking information for a variety of reasons including, but not limited to, risks and uncertainties disclosed in Alacer’s filings on the Company’s website at www.alacergold.com, on SEDAR at www.sedar.com and on the ASX at www.asx.com.au, and other unforeseen events or circumstances. Other than as required by law, Alacer does not intend, and undertakes no obligation to update any forward-looking information to reflect, among other things, new information or future events.

For further information on Alacer Gold Corp., please contact:

Lisa Maestas – Director, Investor Relations at +1-303-292-1299

____________________________________

1 Detailed information, including complete drill hole data, can be found in the press release entitled “Alacer Gold Announces A 117% Increase to the Ardich Indicated Mineral Resource Located in the Çöpler Mining District”, filed on April 3, 2019 (the “Ardich Resource Update”) available on www.sedar.com and on www.asx.com.au.

2 See Ardich Resource Update.