Alamos Gold Reports Best Intersection from Surface Directional Drilling Program Further Extending High-Grade Mineralization at Island Gold Mine

TORONTO, Nov. 05, 2018 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported new results from surface and underground exploration drilling at the Island Gold Mine from the second half of 2018. Ongoing drilling continues to extend high-grade gold mineralization along-strike and down-plunge from existing Mineral Reserves and Resources across all three main areas of focus: the Main Extension, the Eastern Extension, and the Western Extension. All reported drill widths are true width of the mineralized zones, unless otherwise stated.

- Main Extension: best surface directional drilling intersection to date (MH13) extending high-grade gold mineralization 60 metres (“m”) east of the nearest intersection. High-grade mineralization now extends nearly 1,000 m east of current mine workings and remains open to the east and down-plunge. New highlights include:

- 118.58 g/t Au (39.99 g/t cut) over 6.66 m;

- 21.50 g/t Au (13.70 g/t cut) over 7.80 m; and

- 31.70 g/t Au (14.51 g/t cut) over 3.81 m.

- Western Extension: high-grade mineralization extended laterally and down-plunge from existing Inferred Mineral Resources. New highlights include:

- 78.26 g/t Au (67.74 g/t cut) over 2.29 m; and

- 19.69 g/t Au (19.69 g/t cut) over 2.79 m.

- Eastern Extension: high-grade mineralization extended below and east of existing Inferred and Indicated Mineral Resources and remains open down-plunge. New highlights include:

- 46.13 g/t Au (44.17 g/t cut) over 2.83 m; and

- 13.72 g/t Au (13.72 g/t cut) over 7.60 m.

Note: Drillhole composite intervals reported as “cut” may include higher grade samples which have been cut to 225 g/t Au, 100 g/t Au, or 80g/t Au depending on the zone. Refer to drill hole composite interval summary tables in this release for more information.

“Island Gold continues to impress. In less than a year since we acquired the mine, we’ve seen a 17% increase in Mineral Reserve grades and significant growth in Mineral Reserves and Resources across all categories. Ongoing exploration success across all three extensions of the ore body, including the best surface directional hole drilled to date, demonstrate strong potential for this to continue,” said John A. McCluskey, President and Chief Executive Officer.

2018 Drilling Program – Island Gold Mine

The focus of the 2018 exploration drilling program is to expand the down-plunge and lateral extensions of the Island Gold deposit with the objective of adding new near mine Mineral Resources. Drilling continues to be conducted across three main areas of focus along the two-kilometre long Island Gold Main Zone including; the Main Extension; the Eastern Extension; and the Western Extension (Figure 1).

Year-to-date drilling has been successful in extending high grade gold mineralization across all three areas resulting in significant growth in both Mineral Reserves and Resources as detailed in the mid-year 2018 update (see press release dated September 5, 2018). Since the acquisition of Island Gold in November 2017, Mineral Reserves have increased 28%, or 207,000 ounces, net of mining depletion, and Mineral Reserve grades have increase 17% to 10.69 g/t Au. Measured and Indicated Mineral Resources have also increased 142%, or 130,000 ounces, and Inferred Mineral Resources have increased 18%, or 184,000 ounces.

A total of 102,500 m of drilling in 556 holes was completed during the first three quarters of 2018, including 37,100 m since the mid-year Mineral Reserve and Resource update. Year-to-date drilling has included 37,200 m of surface directional exploration drilling, 2,700 m of regional exploration drilling and 22,800 m of underground exploration drilling. New highlight intercepts since the mid-year Mineral Reserve and Resource update can be found in Figures 1 to 4 and Tables 1 to 3 at the end of this release.

A further 42,900 m of drilling has been budgeted for the remainder of 2018 with the primary objective of extending high grade mineralization and adding near-mine Mineral Resources across all three areas of focus. A significant portion of the surface exploration drilling in the second half of 2018 is either too broadly spaced to define Inferred Mineral Resources or focused on regional targets.

2018 Drilling Program – Island Gold Mine

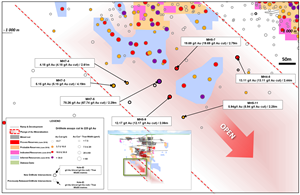

Main Extension

As detailed in the mid-year 2018 Mineral Reserve and Resource update, a total of 390,000 ounces of Inferred Mineral Resources were added within the Main Extension area. The bulk of the increase was down-plunge from existing mine workings where gold mineralization has been extended nearly 1 kilometre. Exploration drilling continues to target the lateral and down-plunge continuation of gold mineralization below existing Mineral Reserves and outside of the Inferred Mineral Resources reported in the mid-year Mineral Reserve and Resource update. Drilling since the June 30, 2018 update has been successful in further extending gold mineralization with a drill hole spacing ranging from 75 to 100 m (Figure 2). Highlights from the new drill results include (Table 1):

- 118.58 g/t Au (39.99 g/t cut) over 6.66 m (MH13);

- 21.50 g/t Au (13.70 g/t cut) over 7.80 m (MH12-2);

- 31.70 g/t Au (14.51 g/t cut) over 3.81 m (MH9-12);

- 9.67 g/t Au (9.67 g/t cut) over 4.60 m (MH10-10); and

- 15.08 g/t Au (15.08 g/t cut) over 2.66 m (MH12-1).

This east-plunging high-grade ore shoot remains open both laterally and down-plunge. Drill holes MH12-1 and MH12-2 are of particular interest because the intersections confirm that gold mineralization extends vertically below a currently known Inferred Mineral Resource block containing 372,600 ounces grading 10.22 g/t Au.

Hole MH13 is also significant in that it returned the best intersection to date from the surface directional drilling program at 118.58 g/t Au (39.99 g/t cut) over 6.66 m. It also confirms extension of the high-grade mineralization to the east with the nearest previously drilled intersection located 60 m to the west.

The ongoing exploration program is focused on further extending high-grade mineralization with the objective of defining additional Mineral Resources. Four diamond drill rigs are active in the Main Extension target area.

Western Extension

Surface drilling in the Western Extension area (Figure 3) was successful in adding 30,000 ounces of Inferred Mineral Resources as reported in the mid-year Mineral Reserve and Resource update with only two holes completed during the first half of the year. Drilling completed since then has continued to extend high-grade mineralization laterally and down-plunge from existing Inferred Mineral Resources.

Highlights from the new drill results include (Table 1):

- 78.26 g/t Au (67.74 g/t cut) over 2.29 m (MH7-5);

- 19.69 g/t Au (19.69 g/t cut) over 2.79 m (MH5-7); and

- 13.11 g/t Au (13.11 g/t cut) over 2.44 m (MH4-8);

Holes MH5-7 and MH7-5 confirmed that gold mineralization is present between two previously defined Inferred Mineral Resource blocks. The Company has two drill rigs focused on the Western Extension area using 75 to 100 m spaced step-out drilling with the objective of expanding the high-grade mineralization where it remains open both laterally and down-plunge.

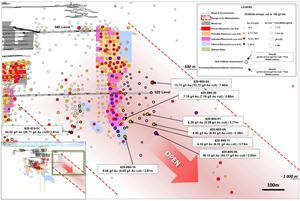

Eastern Extension

An objective of the 2018 underground exploration drilling program is to expand the high-grade zone defined from exploration drifts established at the eastern extent of the Island Gold Mine underground infrastructure (Figure 4). Drilling during the first half of the year was successful in adding 77,000 ounces of Indicated Mineral Resources. Since then, drilling from the 620 exploration drift has continued to intersect high-grade mineralization at depth and to the east.

Highlights from the new results include (Table 2):

- 46.13 g/t Au (44.17 g/t cut) over 2.83 m (620-605-06); and

- 13.72 g/t Au (13.72 g/t cut) over 7.60 m (620-605-04).

Hole 620-605-06 is the eastern most hole drilled at depth from the 620-level. It intersected high-grade gold values (44.17 g/t Au cut over 2.83 m) between existing Mineral Resource blocks in the Eastern portion of the Island Gold Mine (between the 340 and 840 levels) and previously reported high grade intersections from surface drill holes drilled further to the east, (Figure 4), which include:

- 17.85 g/t Au (14.25 g/t cut) over 2.18m (GD-620-01);

- 57.43 g/t Au (25.37 g/t cut) over 4.37 m (GD-630-01);

- 18.03 g/t Au (14.16 g/t cut) over 11.53m (GD-640-05);

- 15.20 g/t Au (8.16 g/t cut) over 2.06 m (GD-640-04); and

- 43.26 g/t Au (11.72 g/t cut) over 2.13m (GD-640-05-5).

Drilling will continue to test this area for the balance of the year from underground drill bays established on the 620-level exploration drift. In addition, directional drilling from surface is also planned in the Eastern Extension area between 850 and 1150 m vertical depth to further explore this area which cannot be drilled from existing underground exploration drifts.

Underground Delineation Drilling

Underground delineation drilling is also being carried out from the 620 and 840 levels with the focus on converting Inferred Mineral Resources to Indicated Mineral Resources.

New highlight drill intercepts include (Table 3):

- 84.02 g/t Au (28.71 g/t cut) over 2.61 m (620-574-51);

- 23.53 g/t Au (23.53 g/t cut) over 2.79 m (840-542-02);

- 17.20 g/t Au (17.20 g/t cut) over 2.60 m (840-542-09);

- 16.46 g/t Au (16.46 g/t cut) over 2.52 m (840-542-13); and

- 16.05 g/t Au (16.05 g/t cut) over 4.76 m (840-542-22).

The results from the infill definition drilling within existing Inferred Mineral Resource blocks confirm the continuity of the high-grade gold mineralization and are expected to support the conversion of the Mineral Resources in these areas.

Other Zones

The Island Gold Deposit consists of a number of subparallel mineralized zones, with the majority of Mineral Reserves and Resources being defined in the C Zone and E1E Zones which constitutes the main production horizons at the Island Gold mine. Highlights of new intersections in parallel zones and zones in which the lateral continuity is not yet established (“Unknown”) include (reported composite intervals are core lengths):

- 127.16 g/t Au (73.66 g/t cut) over 3.10 m (620-598-18);

- 34.25 g/t Au (18.06 g/t cut) over 3.71 m (620-598-10);

- 11.88 g/t Au (10.84 g/t cut) over 3.78 m (620-598-03);

- 16.17 g/t Au (15.36 g/t cut) over 2.69 m (620-604-06); and

- 11.46 g/t Au (11.46 g/t cut) over 3.61 m (620-598-15).

Additional drilling will be required to further evaluate these high-grade intersections and their potential in both the footwall and hanging wall of the main C and E1E Zones.

Surface Regional Exploration Drilling

A 12,000 m regional exploration drill program commenced in September to drill test targets along the Goudreau Deformation Zone to the west of the main Island Gold Mine deposit. Drilling is also planned to test a previous high-grade intercept of 9.71 g/t Au over 5.95 m below the Kremzar gold deposit.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”).

Exploration programs at the Island Gold Mine are directed by Raynald Vincent, P.Eng., M.G.P., Chief Geologist at the Island Gold Mine and a Qualified Person within the meaning of NI 43-101.

Quality Control

Assays for the delineation and exploration drilling were completed at LabExpert in Rouyn-Noranda, Quebec. The Corporation inserts at regular intervals quality control (QC) samples (blanks and reference materials) to monitor laboratory performance. Cross check assays are done on a regular basis in a second accredited laboratory. The Quality Assurance / Quality Control procedures are more completely described in the Technical Report filed on Sedar by Richmont Mines, July 13, 2017.

Upcoming Catalysts and News Flow

- Q4 2018 – La Yaqui Grande EIA Submission

- Q4 2018 – Cerro Pelon EIA Approval

- Q1 2019 – Q4 2018 Production and 2019 Guidance

- Q1 2019 – Q4 2018 Earnings and 2018 Mineral Reserve and Resource Update

- Q1 2019 – Lynn Lake Optimization Study

- H1 2019 – End of 5% NSR Royalty at Mulatos

- Q2 2019 – Island Gold Exploration Update

- Q2 2019 – La Yaqui Grande EIA Approval

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from four operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos and El Chanate mines in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons | |

| Vice President, Investor Relations | |

| (416) 368-9932 x 5439 |

All amounts are in United States dollars, unless otherwise stated.

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

This News Release includes certain statements that constitute forward-looking information within the meaning of applicable securities laws "forward-looking statements". All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are “forward-looking statements”. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as "expects", is expected", "anticipates", "plans" or “is planned”, “trends”, "estimates", "intends" or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. Forward-looking statements in this news release include the statements with respect to planned exploration programs, costs and expenditures, changes in Mineral Resources and conversion of Mineral Resources to Proven and Probable Mineral Reserves, and other information that is based on forecasts and projections of future operational, geological or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as "Inferred" or "Indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "Indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category of Mineral Resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Mineral Reserves.

The risks and uncertainties that may cause actual results to differ materially from Alamos' expectations include, among others, risks related to obtaining the permits required to carry out planned exploration or development work, the actual results of current exploration activities, conclusions of economic and geological evaluations and changes in project parameters as plans continue to be refined, changes to the price of gold, as well as those factors discussed in the section entitled "Risk Factors" in Alamos' Annual Information Form and other disclosures by Alamos and its predecessors available on the SEDAR website at www.sedar.com or on EDGAR at www.sec.gov. Although Alamos has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to put undue reliance on forward-looking statements which are not guarantees of future events, and speak only as of the date made. All of the forward-looking statements made in this press release are qualified by these cautionary statements.

Cautionary Note to U.S. Investors – Mineral Reserve and Resource Estimates

All Mineral Resource and Reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms "Mineral Reserve", "Proven Mineral Reserve" and "Probable Mineral Reserve" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in SEC Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933, as amended, and the Exchange Act. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the "SEC"). Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Mineral Reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a Mineral Resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Table 1: Island Gold – Previously Unreleased Select Composite Intervals from Surface Exploration Drilling

Composite intervals greater than 3 g/t Au weighted average, capping values per zone: Zone C @ 225 g/t Au; Zone E1E @ 100 g/t Au; Zone Unknown @ 70 g/t.

Target area: Main Extension (Main Ext), Western Extension (Western Ext).

| Hole ID | Zone | Target Area | From (m) | To (m) | Core Length (m) | True Width (m) | Au Uncut (g/t) | Au Cut (g/t) | Vertical Depth |

| MH9-12 | E1E | Main Ext | 1497.70 | 1503.30 | 5.60 | 3.81 | 31.70 | 14.51 | 1416 |

| MH10-6 | E1E | Main Ext | 1536.80 | 1541.50 | 4.70 | 3.93 | 6.59 | 6.59 | 1420 |

| MH10-10 | E1E | Main Ext | 1518.00 | 1523.10 | 5.10 | 4.60 | 9.67 | 9.67 | 1397 |

| MH12-1 | E1E | Main Ext | 1521.50 | 1524.50 | 3.00 | 2.66 | 15.08 | 15.08 | 1395 |

| MH12-2 | E1E | Main Ext | 1523.00 | 1532.10 | 9.10 | 7.80 | 21.50 | 13.70 | 1391 |

| MH13 | E1E | Main Ext | 1537.60 | 1544.70 | 7.10 | 6.66 | 118.58 | 39.99 | 1346 |

| MH4-8 | C | Western Ext | 1281.60 | 1284.60 | 3.00 | 2.44 | 13.11 | 13.11 | 1054 |

| MH5-7 | C | Western Ext | 1315.90 | 1319.45 | 3.55 | 2.79 | 19.69 | 19.69 | 1087 |

| MH5-9 | C | Western Ext | 1378.00 | 1380.70 | 2.70 | 2.06 | 12.17 | 12.17 | 1171 |

| MH5-11 | C | Western Ext | 1415.00 | 1419.10 | 4.10 | 2.28 | 5.94 | 5.94 | 1232 |

| MH7-3 | C | Western Ext | 1454.70 | 1459.60 | 4.90 | 4.19 | 5.15 | 5.15 | 1139 |

| MH7-4 | C | Western Ext | 1438.00 | 1441.00 | 3.00 | 2.61 | 4.18 | 4.18 | 1130 |

| MH7-5 | C | Western Ext | 1451.40 | 1454.00 | 2.60 | 2.29 | 78.26 | 67.74 | 1126 |

| MH5-6 | G1 | Western Ext | 1237.70 | 1248.10 | 10.40 | 9.18 | 3.83 | 3.83 | 1003 |

| MH5-7 | G1 | Western Ext | 1278.00 | 1280.00 | 2.00 | 1.66 | 10.23 | 10.23 | 1059 |

| MH10-10 | Unknown | Main Ext | 1566.80 | 1569.50 | 2.70 | 3.19 | 3.19 | 1437 | |

| MH14 | Unknown | Main Ext | 1463.70 | 1466.00 | 2.30 | 9.98 | 9.98 | 1319 | |

| MH5-8 | Unknown | Western Ext | 1394.80 | 1397.65 | 2.85 | 5.85 | 5.85 | 1156 |

Note: Unknown zone corresponds to gold intercepts outside known ore zones and for which continuity is not yet established and therefore true width has not been calculated.

Table 2: Island Gold – Previously Unreleased Select Composite Intervals from Underground Exploration Drilling

Composite intervals greater than 3 g/t Au weighted average, capping values per zone: Zone C @ 225 g/t Au; Zone E1E @ 100 g/t Au; Zone Unknown @ 70 g/t.

Target area: Main Extension (Main Ext), Eastern Extension (Eastern Ext), Western Extension (Western Ext).

| Hole ID | Zone | Target Area | From (m) | To (m) | Core Length (m) | True Width (m) | Au Uncut (g/t) | AuCut (g/t) | Vertical Depth |

| 730-464-20 | C | Western Ext | 133.00 | 136.00 | 3.00 | 2.08 | 17.58 | 17.58 | 597 |

| 620-598-06 | E1E | Eastern Ext | 101.00 | 105.10 | 4.10 | 3.32 | 4.42 | 4.42 | 598 |

| 620-598-11 | E1E | Eastern Ext | 228.50 | 237.40 | 8.90 | 3.73 | 6.32 | 6.32 | 725 |

| 620-598-18 | E1E | Eastern Ext | 299.90 | 306.50 | 6.60 | 2.61 | 9.05 | 9.05 | 795 |

| 620-604-01 | E1E | Eastern Ext | 206.00 | 213.50 | 7.50 | 3.77 | 6.29 | 6.29 | 691 |

| 620-604-06 | E1E | Eastern Ext | 215.70 | 221.50 | 5.80 | 2.78 | 4.61 | 4.61 | 710 |

| 620-604-11 | E1E | Eastern Ext | 235.10 | 240.00 | 4.90 | 2.50 | 3.05 | 3.05 | 721 |

| 620-605-01 | E1E | Eastern Ext | 206.00 | 215.10 | 9.10 | 4.95 | 3.65 | 3.65 | 679 |

| 620-605-04 | E1E | Eastern Ext | 103.00 | 112.00 | 9.00 | 7.60 | 13.72 | 13.72 | 546 |

| 620-605-05 | E1E | Eastern Ext | 258.00 | 269.40 | 11.40 | 3.39 | 6.50 | 6.50 | 738 |

| 620-605-06 | E1E | Eastern Ext | 302.90 | 309.60 | 6.70 | 2.83 | 46.13 | 44.17 | 778 |

| 840-542-01 | E1E | Main Ext | 267.90 | 271.60 | 3.70 | 2.18 | 3.75 | 3.75 | 1029 |

| 840-542-05 | E1E | Main Ext | 227.70 | 231.00 | 3.30 | 2.43 | 8.63 | 8.63 | 983 |

| 620-598-09 | Unknown | Eastern Ext | 53.93 | 60.20 | 6.27 | 5.97 | 5.97 | 613 | |

| 620-598-10 | Unknown | Eastern Ext | 60.98 | 65.20 | 4.22 | 34.25 | 18.06 | 555 | |

| 620-598-15 | Unknown | Eastern Ext | 70.80 | 76.50 | 5.70 | 11.46 | 11.46 | 529 | |

| 620-598-18 | Unknown | Eastern Ext | 131.00 | 136.00 | 5.00 | 127.16 | 73.66 | 683 | |

| 620-598-20 | Unknown | Eastern Ext | 63.10 | 70.40 | 7.30 | 3.34 | 3.34 | 609 | |

| 620-604-05 | Unknown | Eastern Ext | 92.33 | 98.00 | 5.67 | 18.27 | 17.31 | 665 | |

| 620-604-06 | Unknown | Eastern Ext | 27.00 | 30.70 | 3.70 | 16.17 | 15.36 | 610 | |

| 620-604-06 | Unknown | Eastern Ext | 96.65 | 101.10 | 4.45 | 9.11 | 8.34 | 647 | |

| 620-605-06 | Unknown | Eastern Ext | 109.15 | 113.20 | 4.05 | 7.52 | 7.52 | 663 |

Note: Unknown zone corresponds to gold intercepts outside known ore zones and for which continuity is not yet established and therefore true width has not been calculated.

Table 3: Island Gold – Previously Unreleased Select Composite Intervals from Underground Delineation Drilling.

Composite intervals greater than 3 g/t Au weighted average, capping values per zone: Zone C @ 225 g/t Au; Zone E1E @ 100 g/t Au; Zone Unknown @ 70 g/t. Target area: Main Extension (Main Ext), Eastern Extension (Eastern Ext), Western Extension (Western Ext).

| Hole ID | Zone | Target Area | From (m) | To (m) | Core Length (m) | True Width (m) | Au Uncut (g/t) | Au Cut (g/t) | Vertical Depth |

| 660-467-01 | C | Western Ext | 50.10 | 55.60 | 5.50 | 2.59 | 9.77 | 9.77 | 635 |

| 660-467-04 | C | Western Ext | 28.60 | 32.90 | 4.30 | 3.63 | 18.79 | 18.79 | 661 |

| 660-470-01 | C | Western Ext | 31.20 | 34.60 | 3.40 | 2.61 | 3.00 | 3.00 | 657 |

| 660-470-05 | C | Western Ext | 46.00 | 55.20 | 9.20 | 4.70 | 11.61 | 11.61 | 635 |

| 660-470-06 | C | Western Ext | 35.00 | 42.70 | 7.70 | 4.74 | 8.80 | 8.80 | 648 |

| 660-470-01 | B | Western Ext | 8.20 | 15.00 | 6.80 | 5.24 | 6.06 | 6.06 | 667 |

| 620-574-48 | E1E | Eastern Ext | 160.10 | 163.50 | 3.40 | 2.32 | 3.34 | 3.34 | 653 |

| 620-574-49 | E1E | Eastern Ext | 183.10 | 186.60 | 3.50 | 2.15 | 5.58 | 5.58 | 678 |

| 620-574-50 | E1E | Eastern Ext | 240.00 | 246.00 | 6.00 | 2.30 | 6.80 | 6.80 | 745 |

| 620-574-51 | E1E | Eastern Ext | 272.03 | 276.00 | 3.97 | 2.61 | 84.02 | 28.71 | 775 |

| 620-574-52 | E1E | Eastern Ext | 223.50 | 228.60 | 5.10 | 2.11 | 3.78 | 3.78 | 727 |

| 620-598-25 | E1E | Eastern Ext | 295.50 | 301.50 | 6.00 | 2.02 | 7.55 | 7.55 | 789 |

| 620-598-27 | E1E | Eastern Ext | 187.00 | 190.50 | 3.50 | 2.07 | 5.00 | 5.00 | 675 |

| 620-598-29 | E1E | Eastern Ext | 258.90 | 265.20 | 6.30 | 3.00 | 8.60 | 6.25 | 755 |

| 620-598-30 | E1E | Eastern Ext | 215.20 | 221.00 | 5.80 | 3.98 | 7.19 | 7.19 | 711 |

| 620-543-65A | E1E | Main Ext | 214.10 | 217.80 | 3.70 | 2.81 | 6.44 | 6.44 | 718 |

| 840-542-02 | E1E | Main Ext | 238.30 | 243.00 | 4.70 | 2.79 | 23.53 | 23.53 | 989 |

| 840-542-03 | E1E | Main Ext | 178.60 | 181.60 | 3.00 | 2.46 | 8.44 | 8.44 | 897 |

| 840-542-09 | E1E | Main Ext | 217.90 | 221.20 | 3.30 | 2.60 | 17.20 | 17.20 | 957 |

| 840-542-13 | E1E | Main Ext | 186.30 | 190.80 | 4.50 | 2.52 | 16.46 | 16.46 | 912 |

| 840-542-14 | E1E | Main Ext | 175.00 | 178.00 | 3.00 | 2.76 | 4.50 | 4.49 | 890 |

| 840-542-15 | E1E | Main Ext | 223.00 | 226.00 | 3.00 | 2.13 | 11.56 | 11.56 | 977 |

| 840-542-16 | E1E | Main Ext | 255.80 | 258.90 | 3.10 | 2.04 | 9.63 | 9.63 | 1026 |

| 840-542-18 | E1E | Main Ext | 235.00 | 239.80 | 4.80 | 3.52 | 6.94 | 6.94 | 995 |

| 840-542-21 | E1E | Main Ext | 141.60 | 144.00 | 2.40 | 2.36 | 4.22 | 4.22 | 840 |

| 840-542-22 | E1E | Main Ext | 149.10 | 154.60 | 5.50 | 4.76 | 16.05 | 16.05 | 860 |

| 840-542-23 | E1E | Main Ext | 189.90 | 195.50 | 5.60 | 4.73 | 3.28 | 3.28 | 919 |

| 840-542-24 | E1E | Main Ext | 210.00 | 214.00 | 4.00 | 2.99 | 6.84 | 6.84 | 959 |

| 840-542-25 | E1E | Main Ext | 283.45 | 288.20 | 4.75 | 2.14 | 5.35 | 5.35 | 1057 |

| 840-542-29 | E1E | Main Ext | 152.35 | 155.25 | 2.90 | 2.77 | 3.15 | 3.15 | 807 |

| 620-598-03 | Unknown | Eastern Ext | 77.80 | 85.00 | 7.20 | 11.88 | 10.84 | 515 |

Note: Unknown zone corresponds to gold intercepts outside known ore zones and for which continuity is not yet established and therefore true width has not been calculated.

Table 4: Surface exploration drill holes; azimuth, dip, drilled length, and collar location at surface (UTM NAD83).

| HOLE-ID | Azimuth (°) | Dip (°) | Drilled Length (m) | Easting | Northing | Elevation (m) | Comments |

| MH10-10 | 347.8 | -72.9 | 548.7 | 692033.4 | 5351123.2 | 395.4 | cut from MH10-9 at 1160 m downhole |

| MH10-6 | 347.8 | -72.9 | 684.5 | 692033.4 | 5351123.2 | 395.4 | cut from MH10-5 at 1166 m downhole |

| MH12-1 | 341.8 | -64.2 | 1052.0 | 691310.1 | 5350974.7 | 394.5 | cut from MH12 at 578 m downhole |

| MH12-2 | 341.8 | -64.2 | 746.0 | 691310.1 | 5350974.7 | 394.5 | cut from MH12-1 at 903 m downhole |

| MH13 | 336.9 | -71.6 | 1700.0 | 692074.0 | 5351046.0 | 389.0 | mother-hole |

| MH14 | 359.0 | -67.3 | 1571.0 | 691521.9 | 5351123.4 | 393.6 | mother-hole |

| MH4-8 | 336.5 | -58.2 | 650.0 | 690949.1 | 5350863.5 | 392.1 | cut from MH4-7 at 864 m downhole |

| MH5-11 | 333.9 | -62.3 | 623.0 | 690818.5 | 5350823.7 | 393.1 | cut from MH5-10A at 897m downhole |

| MH5-6 | 333.9 | -62.3 | 717.0 | 690818.5 | 5350823.7 | 393.1 | cut from MH5 at 695 m downhole |

| MH5-7 | 333.9 | -62.3 | 567.0 | 690818.5 | 5350823.7 | 393.1 | cut from MH5-6 at 884 m downhole |

| MH5-8 | 333.9 | -62.3 | 729.0 | 690818.5 | 5350823.7 | 393.1 | cut from MH5-7 at 921 m downhole |

| MH5-9 | 333.9 | -62.3 | 723.0 | 690818.5 | 5350823.7 | 393.1 | cut from MH5-6 at 777 m downhole |

| MH7-3 | 333.0 | -61.4 | 769.0 | 690526.5 | 5350564.1 | 381.0 | cut from MH7-2 at 695 m downhole |

| MH7-4 | 333.0 | -61.4 | 947.0 | 690526.5 | 5350564.1 | 381.0 | cut from MH7 at 645 m downhole |

| MH7-5 | 333.0 | -61.4 | 689.0 | 690526.5 | 5350564.1 | 381.0 | cut from MH7-4 at 876 m downhole |

| MH9-12 | 338.1 | -71.8 | 789.6 | 691536.4 | 5351166.1 | 393.3 | cut from MH9-11 at 957 m downhole |

Table 5: Underground drill holes; azimuth, dip, drilled length, and collar location (UTM NAD83)

| Hole-ID | Azimuth (°) | Dip (°) | Drilled Length (m) | Easting | Northing | Elevation (m) |

| 620-543-65A | 159.0 | -31.0 | 237.0 | 690967.3 | 5351871.9 | -226.5 |

| 620-574-48 | 148.0 | -20.0 | 192.0 | 691256.6 | 5351965.6 | -217.2 |

| 620-574-49 | 148.0 | -26.0 | 219.0 | 691256.6 | 5351965.7 | -217.4 |

| 620-574-50 | 161.0 | -37.0 | 282.0 | 691256.2 | 5351965.4 | -217.8 |

| 620-574-51 | 159.0 | -41.0 | 381.0 | 691256.3 | 5351965.4 | -217.7 |

| 620-574-52 | 148.0 | -35.0 | 279.0 | 691256.5 | 5351965.7 | -217.6 |

| 620-598-03 | 170.0 | 70.0 | 147.0 | 691475.4 | 5352063.9 | -209.2 |

| 620-598-06 | 162.0 | -4.0 | 141.0 | 691476.0 | 5352061.4 | -212.1 |

| 620-598-09 | 155.0 | -19.0 | 201.0 | 691476.3 | 5352061.7 | -212.8 |

| 620-598-10 | 155.0 | 35.0 | 123.0 | 691476.2 | 5352061.7 | -209.7 |

| 620-598-11 | 153.2 | -34.6 | 264.0 | 691476.4 | 5352061.9 | -213.2 |

| 620-598-15 | 141.0 | 57.0 | 135.0 | 691477.2 | 5352063.2 | -208.7 |

| 620-598-18 | 159.0 | -41.0 | 420.0 | 691476.4 | 5352061.9 | -213.3 |

| 620-598-20 | 157.0 | -13.0 | 183.0 | 691476.2 | 5352061.7 | -212.7 |

| 620-598-25 | 167.0 | -42.0 | 351.0 | 691477.1 | 5352062.0 | -213.0 |

| 620-598-27 | 163.0 | -27.0 | 225.0 | 691477.1 | 5352062.0 | -213.0 |

| 620-598-29 | 160.0 | -39.0 | 309.0 | 691477.1 | 5352062.0 | -213.0 |

| 620-598-30 | 159.0 | -33.0 | 265.0 | 691476.5 | 5352061.7 | -212.9 |

| 620-604-01 | 146.0 | -29.0 | 366.0 | 691531.5 | 5352086.4 | -212.1 |

| 620-604-05 | 158.0 | -48.0 | 591.0 | 691531.4 | 5352086.5 | -212.4 |

| 620-604-06 | 158.0 | -33.0 | 342.0 | 691531.5 | 5352086.5 | -212.2 |

| 620-604-11 | 146.0 | -33.0 | 309.0 | 691531.5 | 5352086.5 | -212.2 |

| 620-605-01 | 141.7 | -25.1 | 279.0 | 691539.0 | 5352103.1 | -211.0 |

| 620-605-04 | 130.0 | 25.0 | 141.0 | 691539.0 | 5352103.3 | -209.8 |

| 620-605-05 | 145.1 | -34.0 | 372.0 | 691538.8 | 5352102.8 | -212.2 |

| 620-605-06 | 144.0 | -39.0 | 375.0 | 691539.0 | 5352102.6 | -212.6 |

| 660-467-01 | 311.0 | 42.0 | 84.0 | 690323.4 | 5351451.2 | -288.4 |

| 660-467-04 | 342.0 | 22.0 | 48.0 | 690324.6 | 5351451.5 | -290.3 |

| 660-470-01 | 338.0 | 28.0 | 45.0 | 690346.0 | 5351457.7 | -290.1 |

| 660-470-05 | 8.0 | 46.0 | 87.0 | 690346.0 | 5351457.7 | -289.6 |

| 660-470-06 | 12.0 | 37.0 | 75.0 | 690346.3 | 5351457.9 | -289.9 |

| 730-464-20 | 181.0 | 61.0 | 162.0 | 690244.5 | 5351545.1 | -332.4 |

| 840-542-01 | 149.0 | -42.0 | 315.0 | 690972.7 | 5351831.4 | -465.9 |

| 840-542-02 | 149.0 | -35.0 | 280.0 | 690972.7 | 5351831.4 | -465.7 |

| 840-542-03 | 150.1 | -16.2 | 205.0 | 690972.9 | 5351831.1 | -465.0 |

| 840-542-05 | 162.0 | -35.0 | 261.0 | 690972.2 | 5351830.9 | -465.8 |

| 840-542-09 | 148.0 | -30.0 | 246.0 | 690972.9 | 5351831.4 | -465.5 |

| 840-542-13 | 154.0 | -20.0 | 210.0 | 690973.3 | 5351831.4 | -465.0 |

| 840-542-14 | 153.5 | -14.3 | 199.4 | 690972.8 | 5351831.0 | -464.9 |

| 840-542-15 | 163.9 | -35.4 | 252.0 | 690972.3 | 5351831.0 | -465.7 |

| 840-542-16 | 165.2 | -43.3 | 300.0 | 690972.3 | 5351831.1 | -466.0 |

| 840-542-18 | 164.0 | -39.0 | 270.0 | 690972.3 | 5351831.1 | -465.9 |

| 840-542-21 | 161.0 | 2.0 | 174.0 | 690972.7 | 5351830.9 | -464.4 |

| 840-542-22 | 161.0 | -6.0 | 183.0 | 690972.7 | 5351830.9 | -464.6 |

| 840-542-23 | 161.0 | -22.0 | 210.0 | 690973.0 | 5351831.1 | -464.5 |

| 840-542-24 | 161.0 | -32.0 | 234.0 | 690972.6 | 5351831.2 | -465.5 |

| 840-542-25 | 158.0 | -47.0 | 336.0 | 690972.7 | 5351831.4 | -466.1 |

| 840-542-29 | 148.0 | 14.0 | 174.0 | 690973.2 | 5351831.2 | -463.4 |

Photos accompanying this announcement are available at http://www.globenewswire.com/NewsRoom/AttachmentNg/fdaa8627-3e02-49db-aa8e-7d2b6c69ffe3

http://www.globenewswire.com/NewsRoom/AttachmentNg/5e1f4f4b-6fcb-43b4-a463-ba2a98529f48

http://www.globenewswire.com/NewsRoom/AttachmentNg/10d10c96-185e-46ff-b8b2-a98854c659e3

http://www.globenewswire.com/NewsRoom/AttachmentNg/eb0aad20-226a-411f-90f6-24dc10782347