Alamos Gold Reports Fourth Quarter and Year-End 2021 Results

TORONTO, Feb. 23, 2022 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its financial results for the quarter and year ended December 31, 2021.

“Our Canadian operations performed well in the fourth quarter driving a stronger finish to 2021 and meeting our revised full year production and cost guidance. Young-Davidson had a record year in terms of mining rates and free cash flow and Island Gold had another strong year operationally while advancing the Phase III expansion, offsetting the temporary challenges at Mulatos,” said John A. McCluskey, President and Chief Executive Officer.

“We look forward to delivering on our 2022 milestones, all of which support our longer-term objective of growing production at substantially lower costs. Our global reserves increased 4% over the past year driven by growth at all three mines, demonstrating increasing value within our operating base. La Yaqui Grande remains on track to achieve commercial production in the third quarter and will be key to driving near-term production higher and costs lower. The updated and optimized mine plan for Island Gold to be released mid-year, is expected to improve already impressive economics and highlight further low-cost growth. We are well positioned to fund these growth projects internally, which will in turn support growing returns to shareholders over the long term,” Mr. McCluskey added.

Fourth Quarter 2021

- Production of 112,500 ounces of gold, a 7% increase from the third quarter of 2021 with strong performances at Young-Davidson and Island Gold offsetting weaker production at Mulatos. Full year production was in-line with revised guidance

- Young-Davidson achieved record mining rates of 8,240 tonnes per day ("tpd"), driving production of 51,900 ounces of gold and mine-site free cash flow1 of $30.4 million

- Island Gold produced 37,500 ounces and generated mine-site free cash flow1 of $15.8 million

- Consolidated total cash costs1 of $843 per ounce, all-in sustaining costs ("AISC")1 of $1,237 per ounce and cost of sales of $1,225 per ounce, all increased from earlier in the year reflecting higher costs at Mulatos, as previously guided. Full year total cash costs and AISC were in-line with revised guidance

- La Yaqui Grande remains on track for commercial production in the third quarter of 2022, and is expected to significantly reduce the cost profile at Mulatos starting in the second half of 2022

- Sold 112,966 ounces of gold at an average realized price of $1,798 per ounce for revenues of $203.1 million

- Generated cash flow from operating activities of $88.1 million ($91.8 million, or $0.23 per share, before changes in working capital1)

- Free cash flow1 was negative in the quarter, driven by higher capital spending mainly related to La Yaqui Grande and the Phase III expansion at Island Gold

- Realized adjusted net earnings1 of $36.7 million, or $0.09 per share1, which includes adjustments for an unrealized foreign exchange loss of $3.3 million recorded within deferred taxes and foreign exchange and other losses of $3.9 million

- Recorded net earnings of $29.5 million, or $0.08 per share

- Ended the quarter with cash and cash equivalents of $172.5 million, equity securities of $23.9 million, and no debt

- Paid a quarterly dividend of $9.8 million, or US$0.025 per share (annualized rate of US$0.10 per share) and repurchased an additional 783,300 shares in the quarter at a cost of $5.7 million under the Company's Normal Course Issuer Bid ("NCIB"). The NCIB was renewed for another year on December 20, 2021

- Repurchased a Net Profits Interest ("NPI") royalty on Island Gold for $15.7 million which was applicable to certain claims that made up the majority of Mineral Reserves and Resources on the property

- Reported results from the ongoing exploration program at Island Gold including extending high-grade gold mineralization up to 300 metres (“m”) down-plunge from existing Inferred Mineral Resources in Island East as well as to a depth of more than 1,700 m in the deepest hole drilled to date

- Provided an exploration update for Lynn Lake, highlighting the potential for further Mineral Reserve and Resource growth around the existing deposits as well as a new greenfields discovery

- Achieved a top 15% ranking within Canadian corporate boards in the 2021 Globe and Mail Board Games in recognition of strong governance practices. This included ranking as the third highest company in the materials sector listed on the Toronto Stock Exchange

- Received a Medium ESG Risk Rating from Sustainalytics, positioning Alamos in the top 20th percentile of its industry; in addition, received a B- climate change score from the Carbon Disclosure Project ("CDP"), ahead of the industry average

Full Year 2021

- Produced 457,200 ounces of gold, meeting revised production guidance. Young-Davidson and Island Gold performed well with both meeting full year initial guidance, offsetting temporary weaker production at Mulatos

- Young-Davidson produced 195,000 ounces, driving record mine-site free cash flow1 of $100.3 million

- Island Gold produced 140,900 ounces, generating $53.1 million of mine-site free cash flow1 net of $23.5 million of exploration expenditures and $101.2 million of capital spending, primarily related to the Phase III expansion

- Sold 457,517 ounces of gold at an average realized price of $1,800 per ounce for record revenues of $823.6 million

- Total cash costs1 of $794 per ounce, AISC1 of $1,135 per ounce and Cost of sales of $1,167 per ounce were in line with revised guidance

- Realized adjusted net earnings1 for the year of $162.1 million, or $0.41 per share1. Adjusted net earnings include adjustments for the non-cash, after tax impairment charge of $213.8 million on the Company's Turkish projects incurred in the second quarter, unrealized foreign exchange losses recorded within both deferred taxes and foreign exchange of $7.8 million, and other losses totaling $7.2 million

- Reported a net loss of $66.7 million, or $0.17 per share, reflecting the impairment charge on the Turkish projects

- Cash flow from operating activities of $356.5 million (including a record $410.9 million, or $1.05 per share, before changes in working capital1), a 7% increase from 2020

- Declared $39.1 million in dividends, a 53% increase compared to 2020. Combined with 1.6 million shares repurchased at a cost of $11.7 million, the Company returned $50.8 million to shareholders in 2021

- During the year, the Company generated $25.8 million in cash on the liquidation of certain equity securities and realized an after-tax gain of $12.0 million (recorded within equity)

- In the second quarter of 2021, filed an investment treaty claim against the Republic of Turkey for expropriation and unfair and inequitable treatment with respect to its Turkey projects.

- Reported inaugural three-year guidance in January 2022, outlining a strong outlook with growing production at significantly lower costs over the next three years. This includes AISC decreasing to a range of $950 to $1,050 per ounce in 2024, an 18% improvement from 2022 (based on the mid-point of guidance)

- Reported year end 2021 Mineral Reserves of 10.3 million ounces of gold, a 4% increase from the end of 2020 with growth at all three operating mines more than offsetting mining depletion. This included a 5% increase in global Mineral Reserve Grades reflecting higher grade additions at Island Gold and Mulatos. Island Gold continues to grow with combined Mineral Reserves and Resources increasing 8% to 5.1 million ounces of gold, net of mining depletion, marking a key milestone for the operation and highlighting its significant upside potential

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

Highlight Summary

| Three Months Ended December 31, | Years Ended December 31, | |||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||

| Financial Results (in millions) | ||||||||||

| Operating revenues | $ | 203.1 | $ | 226.6 | $ | 823.6 | $ | 748.1 | ||

| Cost of sales (1) | $ | 138.4 | $ | 135.8 | $ | 534.1 | $ | 482.0 | ||

| Earnings (Loss) from operations | $ | 49.8 | $ | 81.3 | $ | 14.9 | $ | 227.6 | ||

| Earnings (Loss) before income taxes | $ | 43.6 | $ | 85.8 | $ | 2.3 | $ | 218.2 | ||

| Net earnings (loss) | $ | 29.5 | $ | 76.9 | ($ | 66.7 | ) | $ | 144.2 | |

| Adjusted net earnings (2) | $ | 36.7 | $ | 58.2 | $ | 162.1 | $ | 156.5 | ||

| Earnings before interest, depreciation and amortization (2) | $ | 88.0 | $ | 133.6 | $ | 402.0 | $ | 381.7 | ||

| Cash provided by operations before working capital and cash taxes(2) | $ | 91.8 | $ | 126.5 | $ | 410.9 | $ | 382.9 | ||

| Cash provided by operating activities | $ | 88.1 | $ | 131.4 | $ | 356.5 | $ | 368.4 | ||

| Capital expenditures (sustaining) (2) | $ | 32.2 | $ | 27.5 | $ | 113.4 | $ | 82.1 | ||

| Capital expenditures (growth) (2) (3) (5) | $ | 51.2 | $ | 41.9 | $ | 218.0 | $ | 151.2 | ||

| Capital expenditures (capitalized exploration) (4) | $ | 8.2 | $ | 4.0 | $ | 27.0 | $ | 12.8 | ||

| Free cash flow (2) | ($ | 3.5 | ) | $ | 58.0 | ($ | 1.9 | ) | $ | 122.3 |

| Operating Results | ||||||||||

| Gold production (ounces) | 112,500 | 120,400 | 457,200 | 426,800 | ||||||

| Gold sales (ounces) | 112,966 | 121,831 | 457,517 | 424,325 | ||||||

| Per Ounce Data | ||||||||||

| Average realized gold price | $ | 1,798 | $ | 1,860 | $ | 1,800 | $ | 1,763 | ||

| Average spot gold price (London PM Fix) | $ | 1,795 | $ | 1,874 | $ | 1,799 | $ | 1,770 | ||

| Cost of sales per ounce of gold sold (includes amortization) (1) | $ | 1,225 | $ | 1,115 | $ | 1,167 | $ | 1,136 | ||

| Total cash costs per ounce of gold sold (2) | $ | 843 | $ | 733 | $ | 794 | $ | 761 | ||

| All-in sustaining costs per ounce of gold sold (2) | $ | 1,237 | $ | 1,030 | $ | 1,135 | $ | 1,046 | ||

| Share Data | ||||||||||

| Earnings (Loss) per share, basic and diluted | $ | 0.08 | $ | 0.20 | ($ | 0.17 | ) | $ | 0.37 | |

| Adjusted earnings per share, basic and diluted(2) | $ | 0.09 | $ | 0.15 | $ | 0.41 | $ | 0.40 | ||

| Weighted average common shares outstanding (basic) (000’s) | 392,333 | 392,720 | 392,649 | 391,675 | ||||||

| Financial Position (in millions) | ||||||||||

| Cash and cash equivalents(5) | $ | 172.5 | $ | 220.5 | ||||||

(1) Cost of sales includes mining and processing costs, royalties, and amortization expense.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) Includes growth capital from operating sites. Growth capital excludes an Island Gold Net Profits Interest royalty repurchased in December 2021 for $15.7 million, a Net Smelter Return royalty repurchased in March 2020 for $54.8 million, and the acquisition of Trillium Mining Corp for $19.5 million in December 2020.

(4) Includes capitalized exploration at Island Gold, Young-Davidson and Mulatos.

(5) Includes capital advances of $nil and $9.8 million for the three and twelve months ended December 31, 2021 ($nil for the three and twelve months ended December 31, 2020).

| Three Months Ended December 31, | Years Ended December 31, | |||||||

| 2021 | 2020 | 2021 | 2020 | |||||

| Gold production (ounces) (1) | ||||||||

| Young-Davidson | 51,900 | 48,000 | 195,000 | 136,200 | ||||

| Island Gold | 37,500 | 41,200 | 140,900 | 139,000 | ||||

| Mulatos | 23,100 | 31,200 | 121,300 | 150,800 | ||||

| Gold sales (ounces) | ||||||||

| Young-Davidson | 53,006 | 48,094 | 194,937 | 134,987 | ||||

| Island Gold | 38,101 | 42,605 | 139,946 | 139,614 | ||||

| Mulatos | 21,859 | 31,132 | 122,634 | 149,724 | ||||

| Cost of sales (in millions)(2) | ||||||||

| Young-Davidson | $ | 62.6 | $ | 60.8 | $ | 244.4 | $ | 201.3 |

| Island Gold | $ | 33.1 | $ | 33.7 | $ | 112.3 | $ | 111.9 |

| Mulatos | $ | 42.7 | $ | 41.3 | $ | 177.4 | $ | 168.8 |

| Cost of sales per ounce of gold sold (includes amortization) | ||||||||

| Young-Davidson | $ | 1,181 | $ | 1,264 | $ | 1,254 | $ | 1,491 |

| Island Gold | $ | 869 | $ | 791 | $ | 802 | $ | 801 |

| Mulatos | $ | 1,953 | $ | 1,327 | $ | 1,447 | $ | 1,127 |

| Total cash costs per ounce of gold sold (3) | ||||||||

| Young-Davidson | $ | 775 | $ | 792 | $ | 846 | $ | 1,019 |

| Island Gold | $ | 575 | $ | 481 | $ | 529 | $ | 451 |

| Mulatos | $ | 1,473 | $ | 986 | $ | 1,013 | $ | 816 |

| Mine-site all-in sustaining costs per ounce of gold sold (3),(4) | ||||||||

| Young-Davidson | $ | 1,017 | $ | 934 | $ | 1,072 | $ | 1,214 |

| Island Gold | $ | 871 | $ | 676 | $ | 863 | $ | 660 |

| Mulatos | $ | 1,899 | $ | 1,426 | $ | 1,240 | $ | 1,032 |

| Capital expenditures (sustaining, growth, capitalized exploration and capital advances) (in millions)(3) | ||||||||

| Young-Davidson(5) | $ | 24.8 | $ | 19.5 | $ | 88.6 | $ | 101.7 |

| Island Gold (6) | $ | 27.4 | $ | 26.9 | $ | 120.0 | $ | 80.8 |

| Mulatos(7) | $ | 34.2 | $ | 20.5 | $ | 128.3 | $ | 42.1 |

| Other | $ | 5.2 | $ | 6.5 | $ | 21.5 | $ | 21.5 |

(1) Production for the three and twelve months ended December 31, 2020 included nil and 800 ounces, respectively, from El Chanate which transitioned to the reclamation phase of the mine life in 2019. There was no production from El Chanate for the three and twelve months ended December 31, 2021.

(2) Cost of sales includes mining and processing costs, royalties, COVID-19 costs, and amortization.

(3) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(4) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(5) Includes capitalized exploration at Young-Davidson of $1.3 million and $3.8 million for the three and twelve months ended December 31, 2021 ($nil for the three and twelve months ended December 31, 2020).

(6) Includes capitalized exploration at Island Gold of $5.2 million and $18.8 million for the three and twelve months ended December 31, 2021 ($3.8 million and $11.9 million for the three and twelve months ended December 31, 2020); Island Gold capital expenditures exclude the NPI royalty repurchased in December 2021 for $15.7 million, a Net Smelter Return royalty repurchased in March 2020 for $54.8 million and the acquisition of Trillium Mining Corp for $19.5 million in December 2020.

(7) Includes capitalized exploration at Mulatos of $0.3 million and $1.7 million for the three and twelve months ended December 31, 2021 ($0.2 million and $0.9 million for the three and twelve months ended December 31, 2020).

Environment, Social and Governance Summary Performance

Health and Safety

- Recordable injury frequency rate1 of 2.77 in the quarter and 2.46 for the year, an increase from 2.25 in 2020

- Lost time injury frequency rate1 of 0.25 in the quarter and 0.21 for the year, an increase from 0.14 in 2020

- Performed over 100,000 COVID-19 tests in 2021 on employees, contractors and visitors as part of enhanced screening practices

During the fourth quarter of 2021, the recordable injury frequency rate increased with 33 recordable injuries, up from 29 in the third quarter of 2021. Three lost time injuries were reported in the quarter, down from four in the third quarter of 2021, resulting in an overall decrease to the Company’s lost time injury frequency rate from the previous quarter. Alamos strives to maintain a safe, healthy working environment for all, with a strong safety culture where everyone is continually reminded of the importance of keeping themselves and their colleagues healthy and injury-free. During the quarter, the Company finalized and introduced three new safety standards to its sites, part of the Company’s ongoing development of its Sustainability Performance Management Framework which includes standards specific to safety leadership and managing higher-risk activities. The Company’s flagship Home Safe Every Day safety leadership program was also restarted at both the Young-Davidson and Mulatos mines following their temporary suspension for safety reasons due to COVID-19. The Company’s overarching commitment is to have all employees and contractors return Home Safe Every Day.

The World Health Organization declared COVID-19 a pandemic on March 11, 2020. The Company responded rapidly and proactively and implemented several initiatives to help protect the health and safety of our employees, their families and the communities in which we operate.

Specifically, each mine site activated established crisis management plans and developed site-specific plans that have enabled them to meet and respond to changing conditions associated with COVID-19. The Company has adopted the advice of public health authorities and is adhering to government regulations with respect to COVID-19 in the jurisdictions in which it operates

The following measures have been instituted at sites to prevent the potential spread of the COVID-19 virus:

- Medical screening for all personnel prior to entry to site for symptoms of COVID-19

- Testing of personnel at all operating sites prior to starting their work rotation

- Vaccinations offered to employees at Island Gold and Mulatos given their unique camp set-up

- Training on proper hand hygiene and social distancing

- Remote work options have been implemented for eligible employees

- Social distancing practices have been implemented for all meetings, huddles and transportation

- Mandatory use of personal protective equipment for employees where social distancing is not practicable

- Rigid camp and site hygiene protocols have been instituted and are being followed

- In addition, since the COVID-19 pandemic began the Company’s teams in Canada, Mexico, and Turkey have donated their time, medical supplies, and funds to help combat the effects and spread of the virus

COVID 19 - Impact on Operations

Given the significant precautionary measures taken by the Company, and thanks to the dedication of its employees, contractors and stakeholders, operations remain relatively unaffected by COVID-19. All the Company's operations continue to incur additional costs related to testing of personnel, lodging and transportation, which have been included in mining and processing costs. These incremental costs have increased total cash costs globally by approximately $25 per ounce.

Environment

- Zero significant environmental incidents in the fourth quarter and for the year

- Advanced permitting of the Lynn Lake Project and the Phase III expansion of Island Gold – a project that will significantly increase automation and reduce fleet diesel usage resulting in 35% lower life-of-mine greenhouse gas ("GHG") emissions

- Advanced the power line project at the Mulatos and La Yaqui Grande which will connect the operations to grid power and eliminate the need for site diesel power generation, reducing GHG emissions

Sixteen minor spills occurred during the fourth quarter, including one at Young-Davidson, ten at Island Gold and five at Mulatos. All spills were immediately cleaned and remediated with no anticipated long-term effects. The Company is committed to preserving the long-term health and viability of the natural environment that surround its operations and projects. This includes investing in new initiatives to reduce our environmental footprint with the goal of minimizing the environmental impacts of our activities and offsetting any impacts that cannot be fully mitigated or rehabilitated.

Community

- Donated time, medical supplies, food supplies and funds across select operations and projects to help combat the effects and spread of COVID-19 in local communities

- Young-Davidson employees participated in the Great Cycle Challenge in support of the Sick Kids Foundation, raising money through sponsorship and participation with the Company matching all contributions

- Continued partnership with Tech Manitoba and the Northern Manitoba Sector Council to deliver digital literacy classes in Lynn Lake, and continued to support the Mining Matters charitable organization in providing the Lynn Lake high school with educational resources and curriculum related to Earth sciences, the minerals industry and their roles in society

- Together with community representatives, completed an annual evaluation of the Mi Matarachi Program to review our progress and shape community development efforts for 2022 and beyond

- Continued to support local students in Sahuaripa, Matarachi and Hermosillo, Mexico with 180 students supported through the Company’s Scholarship Program

- In addition to ongoing COVID-19 and influenza vaccination clinics, and community nutrition programs, several new health initiatives were introduced during the quarter in collaboration with the Matarachi community. These included a breast cancer awareness campaign, healthy eating campaign, and training to the Matarachi Community Health Committee on using a defibrillator that we donated to the Matarachi Health Clinic

- Made various donations to local communities including medicine, cleaning and hygiene equipment, fans, toys, and school supplies for teachers and students returning to classrooms

Alamos believes that excellence in sustainability provides a net benefit to all stakeholders. The Company continues to engage with local communities to understand local challenges and priorities, and to offer support during the COVID-19 pandemic. Ongoing investments in local infrastructure, health care, education, cultural and community programs have continued through the COVID-19 pandemic, with appropriate health and safety protocols.

Governance and Disclosure

- Finalized 12 sustainability standards during the quarter and 22 to date as part of Alamos’ Sustainability Performance Management Framework that addresses governance, health & safety, security, environment and community relations management

- Achieved a top 15% ranking within Canadian corporate boards in the 2021 Globe and Mail Board Games in recognition of strong governance practices. This included ranking as the third highest company in the materials sector listed on the Toronto Stock Exchange

- Received a B- climate change score from the Carbon Disclosure Project in response to the Company's 2021 CDP Report, ahead of the industry C average

- Received a Medium ESG Risk Rating from Sustainalytics, positioning Alamos in the top 20th percentile of its industry

- Received a BBB ESG rating within Alamos’ most recent MSCI ESG Ratings Report

Alamos maintains the highest standards of corporate governance to ensure that corporate decision-making reflects its values, including the Company’s commitment to sustainable development. During the quarter, the Company continued to advance its implementation of the Responsible Gold Mining Principles, developed by the World Gold Council as a framework that sets clear expectations as to what constitutes responsible gold mining.

(1) Frequency rate is calculated as incidents per 200,000 hours worked.

Outlook and Strategy

| 2022 Guidance | |||||||||

| Young-Davidson | Island Gold | Mulatos | Other (2) | Total | |||||

| Gold production (000’s ounces) | 185 - 200 | 125 - 135 | 130 - 145 | 440 - 480 | |||||

| Cost of sales, including amortization (in millions)(4) | $610 | ||||||||

| Cost of sales, including amortization ($ per ounce)(4) | $1,325 | ||||||||

| Total cash costs ($ per ounce)(1) | $850 - $900 | $550 - $600 | $1,225 - $1,275 | — | $875- $925 | ||||

| All-in sustaining costs ($ per ounce)(1) | $1,190 - $1,240 | ||||||||

| Mine-site all-in sustaining costs ($ per ounce)(1)(3) | $1,125 - $1,175 | $850 - $900 | $1,325 - $1,375 | — | |||||

| Capital expenditures (in millions) | |||||||||

| Sustaining capital(1) | $50 - $55 | $35 - $40 | $5 - $10 | — | $90 - $105 | ||||

| Growth capital(1) | $5 - $10 | $145 - $160 | $50 - $55 | $15 | $215 - $240 | ||||

| Total Sustaining and Growth Capital(1) | $55 - $65 | $180 - $200 | $55 - $65 | $15 | $305 - $345 | ||||

| Capitalized exploration(1) | $4 | $20 | — | $3 | $27 | ||||

| Total capital expenditures and capitalized exploration(1) | $59 - $69 | $200 - $220 | $55 - $65 | $18 | $332 - $372 | ||||

(1) Refer to the "Non-GAAP Measures and Additional GAAP" disclosure at the end of this press release and associated MD&A for a description of these measures.

(2) Includes growth capital and capitalized exploration at the Company's development projects (Lynn Lake and Esperanza).

(3) For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites.

(4) Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance.

The Company’s objective is to operate a sustainable business model that can support growing returns to all stakeholders over the long-term through growing production, expanding margins, and increasing profitability. This includes a balanced approach to capital allocation focused on generating strong ongoing free cash flow while re-investing in high-return internal growth opportunities and supporting higher returns to shareholders.

The Company continues to deliver on its key long-term objectives, with strong performances at its Canadian operations and significant progress made on its high-return growth projects. Young-Davidson and Island Gold both met full year production guidance and revised cost guidance. This included a record performance from Young-Davidson with the operation achieving record mining rates and mine-site free cash flow. Mulatos had a challenging year as the operation works through a transitional phase with higher costs while making excellent progress on the development of the higher-grade, low-cost La Yaqui Grande project. La Yaqui Grande remains on track achieve commercial production in the third quarter of 2022 and is expected drive costs significantly lower in the second half of the year. Finally, the Phase III expansion at Island Gold continues to advance while ongoing exploration success drove another substantial increase in Mineral Reserves and Resources to more than five million ounces. This represents another key milestone for the operation and highlights the significant upside potential to the Phase III expansion study ("Phase III Study") with Mineral Reserves and Resources having increased 37% since the completion of the study in 2020.

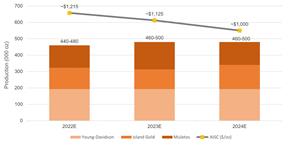

The Company provided inaugural three-year production and operating guidance in January 2022, which outlined growing production at significantly lower costs over the 2022 to 2024 period. Refer to the Company’s January 17, 2022 guidance press release for a summary of the key assumptions and related risks associated with the comprehensive 2022 guidance and three-year production, cost and capital outlook. Production is expected to be between 440,000 and 480,000 ounces of gold in 2022, consistent with 2021, and increase approximately 4% (based on the mid-point of guidance) to between 460,000 and 500,000 ounces in 2023 and 2024. Total cash costs and AISC are expected to increase in 2022 compared to 2021, reflecting industry-wide cost inflation and a temporary increase in costs at Mulatos. La Yaqui Grade is expected to drive Mulatos and consolidated costs lower in the second half of 2022 and will be a key contributor to an expected 18% decrease in AISC between 2022 and 2024. The Company expects a further reduction of costs following the completion of the Phase III expansion at Island Gold in 2025, and over the longer term.

As outlined in the Company's 2022 guidance, first quarter gold production is expected to be the lowest of the year at approximately 100,000 ounces, with costs well above annual guidance. Production is expected to increase and costs decrease through the year, particularly in the second half of the year with the start of low-cost production from La Yaqui Grande.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c340c398-f260-4eec-9cae-2700fdfd968e

Capital spending at producing mines (excluding Lynn Lake and other development projects) is expected to decrease from between $290 to $330 million in 2022 to between $220 and $260 million in 2023. This represents a 23% decrease reflecting the completion of construction of La Yaqui Grande. Total capital is expected to decrease further following the completion of the Phase III expansion at Island Gold in 2025. La Yaqui Grande and the Phase III expansion are expected to be fully funded through ongoing cash flow and existing cash.

Young-Davidson is expected to produce between 185,000 and 200,000 ounces in 2022, consistent with 2021, reflecting similar grades, mining and processing rates. Total cash costs and mine-site AISC are expected to increase from 2021 primarily reflecting industry-wide cost inflation, partially offset by operational improvements. Production and costs are expected to remain at similar levels over the next three years. Capital spending in 2022 (excluding exploration) is expected to range between $55 and $65 million, a 27% decrease from 2021 with construction of the new life of mine tailings facility (“TIA 1”) completed in the fourth quarter of 2021. Capital spending is expected to remain at similar levels in 2023 and decrease slightly in 2024. Young-Davidson generated record mine-site free cash flow of $100 million in 2021. With the lower mine expansion complete and a 15 year Mineral Reserve life, Young-Davidson is expected to generate similar mine-site free cash flow in 2022 and over the long term.

Island Gold is expected to produce between 125,000 and 135,000 ounces in 2022, consistent with the Phase III Study. Total cash costs and mine-site AISC are expected to increase relative to the Phase III Study reflecting industry-wide cost inflation and the stronger Canadian dollar. Capital spending at Island Gold (excluding exploration) is expected to increase to between $180 and $200 million in 2022, reflecting the ramp up of construction activities as outlined in the Phase III Study. Consistent with the study, capital spending is expected to decrease slightly in 2023 and 2024 before decreasing closer to sustaining levels following the completion of the expansion in 2025.

The exploration budget for Island Gold in 2022 of $22 million will follow up on the successful drilling campaign in 2021 that drove an 8% increase in high-grade Mineral Reserves and Resources to 5.1 million ounces of gold. Since the completion of the Phase III Study, Mineral Reserves and Resources have increased 37%, or 1.4 million ounces demonstrating the significant growth in size and value of operation. This ongoing growth will be incorporated into an optimized mine plan to be released mid-2022.

Combined gold production from the Mulatos District (including La Yaqui Grande) is expected to be between 130,000 and 145,000 ounces in 2022. With the start of production from La Yaqui Grande in the third quarter and increasing grades from the El Salto portion of the Mulatos pit, approximately 65% of 2022 production is expected in the second half of the year at substantially lower costs. Total cash costs and mine-site AISC are expected to be well above annual guidance during the first half of 2022 and trend significantly lower during the second half of the year, driven by low-cost production growth from La Yaqui Grande. Costs are expected to improve further in 2023 and 2024 with La Yaqui Grande representing the majority of Mulatos production. Capital spending is expected to total $55 to $65 million in 2022 with the majority being growth capital to complete construction of La Yaqui Grande, which remains on track to achieve commercial production in the third quarter of 2022. Capital spending is expected to trend lower in the second half of 2022 and down closer to sustaining capital levels in 2023 and 2024.

The total capital budget for Lynn Lake in 2022 is $14 million, including $11 million for development activities and $3 million for exploration. Development activities will be focused on environmental work in support of permitting, detailed engineering and other site access upgrades. The approval of the Environmental Impact Statement (“EIS”) for the project is expected in the second half of 2022 following which the Company expects to make a construction decision.

A total of $40 million has been budgeted for exploration in 2022 with Island Gold continuing to account for the largest portion of the budget at $22 million, followed by $7 million at Mulatos, $5 million at Young-Davidson and $3 million at Lynn Lake. This follows a widely successful 2021 program with Mineral Reserves more than replaced at all three operations. This drove a 4% increase in Mineral Reserves to 10.3 million ounces of gold with grades also increasing 5% reflecting higher grade increases at Island Gold and Mulatos.

The Company's liquidity position remains strong, ending the year with $172.5 million of cash and cash equivalents, $23.9 million in equity securities, and no debt. Additionally, the Company has a $500 million undrawn credit facility, providing total liquidity of $672.5 million. Combined with strong ongoing cash flow generation, the Company's high-return internal growth initiatives are fully funded, with the capacity to increase production by more than 60% and reduce AISC by over 30% by 2025.

Fourth Quarter and Year-End 2021 results

Young-Davidson Financial and Operational Review

| Three Months Ended December 31, | Years Ended December 31, | |||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| Gold production (ounces) | 51,900 | 48,000 | 195,000 | 136,200 | ||||||||

| Gold sales (ounces) | 53,006 | 48,094 | 194,937 | 134,987 | ||||||||

| Financial Review (in millions) | ||||||||||||

| Operating Revenues | $ | 95.2 | $ | 89.3 | $ | 350.5 | $ | 239.4 | ||||

| Cost of sales (1) | $ | 62.6 | $ | 60.8 | $ | 244.4 | $ | 201.3 | ||||

| Earnings from operations | $ | 31.9 | $ | 28.5 | $ | 105.4 | $ | 38.1 | ||||

| Cash provided by operating activities | $ | 55.2 | $ | 50.3 | $ | 188.9 | $ | 101.3 | ||||

| Capital expenditures (sustaining) (2) | $ | 12.8 | $ | 6.8 | $ | 43.8 | $ | 26.1 | ||||

| Capital expenditures (growth) (2) | $ | 9.3 | $ | 12.7 | $ | 38.3 | $ | 75.6 | ||||

| Capital expenditures (capitalized exploration) (2) | $ | 2.7 | $ | — | $ | 6.5 | $ | — | ||||

| Mine-site free cash flow (2) | $ | 30.4 | $ | 30.8 | $ | 100.3 | ($ | 0.4 | ) | |||

| Cost of sales, including amortization per ounce of gold sold (1) | $ | 1,181 | $ | 1,264 | $ | 1,254 | $ | 1,491 | ||||

| Total cash costs per ounce of gold sold (2) | $ | 775 | $ | 792 | $ | 846 | $ | 1,019 | ||||

| Mine-site all-in sustaining costs per ounce of gold sold (2),(3) | $ | 1,017 | $ | 934 | $ | 1,072 | $ | 1,214 | ||||

| Underground Operations | ||||||||||||

| Tonnes of ore mined | 758,089 | 703,898 | 2,879,662 | 1,956,198 | ||||||||

| Tonnes of ore mined per day | 8,240 | 7,651 | 7,889 | 5,345 | ||||||||

| Average grade of gold (4) | 2.47 | 2.20 | 2.31 | 2.24 | ||||||||

| Metres developed | 3,116 | 3,223 | 12,367 | 12,549 | ||||||||

| Mill Operations | ||||||||||||

| Tonnes of ore processed | 723,247 | 729,747 | 2,883,241 | 2,181,324 | ||||||||

| Tonnes of ore processed per day | 7,861 | 7,932 | 7,899 | 5,960 | ||||||||

| Average grade of gold (4) | 2.47 | 2.21 | 2.31 | 2.08 | ||||||||

| Contained ounces milled | 57,459 | 51,774 | 213,769 | 145,733 | ||||||||

| Average recovery rate | 91 | % | 91 | % | 91 | % | 92 | % | ||||

(1) Cost of sales includes mining and processing costs, royalties and amortization.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Grams per tonne of gold ("g/t Au").

Young-Davidson finished the year strongly with production of 51,900 ounces of gold in the fourth quarter of 2021, an 8% increase from the prior year period due to higher grades mined. This brought full year production to 195,000 ounces for the year, in line with guidance and a 43% increase from the prior year.

Underground mining rates continued to perform extremely well, increasing to average a record 8,240 tpd in the quarter, and 7,889 tpd for the full year. Mining rates are expected to average design rates of 8,000 tpd going forward.

As anticipated, grades mined increased in the fourth quarter to average 2.47 g/t Au. Full year grades mined were slightly below budget and reserve grade primarily due to mine sequencing. Mill throughput averaged 7,861 tpd in the fourth quarter, lower than tonnes mined due to planned mill maintenance. The resulting stockpile will be processed through the first half of 2022. Mill recoveries averaged 91% in the quarter, consistent with guidance and the prior year.

Financial Review

Fourth quarter revenues of $95.2 million were 7% higher than the prior year period driven by more ounces sold. For the full year, Young-Davidson sold 194,937 ounces for record revenues of $350.5 million, a 46% increase from 2020 due to higher realized gold prices and an increase in ounces sold.

Cost of sales (which includes mining and processing costs, royalties, and amortization expense) of $62.6 million in the fourth quarter were higher than the prior year period, due to increased underground mining rates, partially offset by lower unit mining costs. Similarly, cost of sales for the full year were higher than the prior year given lower mining rates during the temporary shutdown which occurred in 2020. Underground unit mining costs were CAD $42 per tonne in the quarter, an improvement from the prior year and the lowest quarterly unit mining costs of the year driven by economies of scale from averaging a record 8,240 tpd mined.

Total cash costs of $775 per ounce in the fourth quarter were 2% lower than the prior year period driven by higher throughput and lower mining and processing costs per tonne, partially offset by a stronger Canadian dollar. Mine-site AISC of $1,017 per ounce in the fourth quarter were 9% higher than the prior year period primarily reflecting higher sustaining capital, partially offset by lower total cash costs. Full year total cash costs of $846 per ounce and mine-site AISC of $1,072 per ounce were consistent with revised annual guidance, and well below the prior year driven by higher mining rates and lower unit mining costs, partially offset by the stronger Canadian dollar in 2021. The stronger Canadian dollar increased total cash costs by approximately $45 per ounce and mine-site AISC by approximately $60 per ounce, relative to both prior year and initial guidance.

Capital expenditures in the quarter included $12.8 million of sustaining capital and $9.3 million of growth capital. In addition, $2.7 million was invested in capitalized exploration as part of the first significant exploration program at the operation since 2011. Capital expenditures totaled $88.6 million for the full year, including $6.5 million of capitalized exploration. This represented a 13% decrease from the prior year reflecting the completion of the lower mine expansion in July 2020. Capital expenditures were slightly above annual guidance due to the impact of the stronger than budgeted Canadian dollar on capital costs.

Young-Davidson has consistently met or exceeded expectations since transitioning to the new lower mine infrastructure in mid-2020, driving production higher, costs lower, and significant free cash flow growth. This included mine-site free cash flow of $30.4 million in the fourth quarter, and a record $100.3 million for the full year. At current gold prices, Young-Davidson is positioned to generate similar mine-site free cash flow in 2022 and over the long term.

Island Gold Financial and Operational Review

| Three Months Ended December 31, | Years Ended December 31, | |||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| Gold production (ounces) | 37,500 | 41,200 | 140,900 | 139,000 | ||||||||

| Gold sales (ounces) | 38,101 | 42,605 | 139,946 | 139,614 | ||||||||

| Financial Review (in millions) | ||||||||||||

| Operating Revenues | $ | 68.6 | $ | 79.6 | $ | 252.0 | $ | 247.0 | ||||

| Cost of sales (1) | $ | 33.1 | $ | 33.7 | $ | 112.3 | $ | 111.9 | ||||

| Earnings from operations | $ | 34.0 | $ | 45.4 | $ | 135.0 | $ | 134.1 | ||||

| Cash provided by operating activities | $ | 43.2 | $ | 58.7 | $ | 173.1 | $ | 182.2 | ||||

| Capital expenditures (sustaining) (2) | $ | 11.2 | $ | 8.3 | $ | 46.7 | $ | 29.0 | ||||

| Capital expenditures (growth) (2) (5) | $ | 11.0 | $ | 14.8 | $ | 54.5 | $ | 39.9 | ||||

| Capital expenditures (capitalized exploration) (2) | $ | 5.2 | $ | 3.8 | $ | 18.8 | $ | 11.9 | ||||

| Mine-site free cash flow (2) | $ | 15.8 | $ | 31.8 | $ | 53.1 | $ | 101.4 | ||||

| Cost of sales, including amortization per ounce of gold sold (1) | $ | 869 | $ | 791 | $ | 802 | $ | 801 | ||||

| Total cash costs per ounce of gold sold (2) | $ | 575 | $ | 481 | $ | 529 | $ | 451 | ||||

| Mine-site all-in sustaining costs per ounce of gold sold (2),(3) | $ | 871 | $ | 676 | $ | 863 | $ | 660 | ||||

| Underground Operations | ||||||||||||

| Tonnes of ore mined | 109,541 | 113,540 | 438,731 | 412,169 | ||||||||

| Tonnes of ore mined per day ("tpd") | 1,191 | 1,234 | 1,202 | 1,126 | ||||||||

| Average grade of gold (4) | 10.98 | 10.77 | 10.27 | 11.18 | ||||||||

| Metres developed | 1,906 | 1,854 | 7,472 | 6,168 | ||||||||

| Mill Operations | ||||||||||||

| Tonnes of ore processed | 114,689 | 105,509 | 435,297 | 386,591 | ||||||||

| Tonnes of ore processed per day | 1,247 | 1,147 | 1,193 | 1,056 | ||||||||

| Average grade of gold (4) | 10.51 | 11.88 | 10.35 | 11.62 | ||||||||

| Contained ounces milled | 38,742 | 40,305 | 144,804 | 144,378 | ||||||||

| Average recovery rate | 96 | % | 97 | % | 96 | % | 97 | % | ||||

(1) Cost of sales includes mining and processing costs, royalties, COVID-19 costs and amortization.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Grams per tonne of gold ("g/t Au").

(5) Includes capital advances of $nil and $1.4 million for the three and twelve months ended December 31, 2021 (($nil for the three and twelve months ended December 31, 2020).

Island Gold produced 37,500 ounces in the fourth quarter of 2021, a decrease from the fourth quarter of 2020 reflecting lower grades processed. For the full year, Island Gold produced 140,900 ounces, consistent with the prior year, and at the mid-point of production guidance.

Underground mining rates averaged 1,191 tpd in the fourth quarter and 1,202 tpd for the full year, consistent with annual guidance. As previously guided, underground grades increased from the third quarter, averaging 10.98 g/t Au, increasing full year grades mined to 10.27 g/t Au.

Mill throughput averaged 1,247 tpd in the fourth quarter, and 1,193 tpd for the full year, in line with annual guidance of 1,200 tpd. Mill recoveries averaged 96% in the quarter and 96% year-to-date, consistent with annual guidance.

Financial Review

Island Gold generated revenues of $68.6 million in the fourth quarter, a 14% decrease compared to the prior year period, reflecting less ounces sold and lower realized gold prices. Full year revenues were $252.0 million, consistent with the prior year.

Cost of sales (includes mining and processing costs, royalties and amortization expense) of $33.1 million in the fourth quarter and $112.3 million during the full year were consistent with the prior year periods. Higher mining and processing rates for the full year and a stronger Canadian dollar in 2021 were offset by lower unit mining costs and lower amortization charges.

Total cash costs of $575 per ounce in the fourth quarter were significantly higher than the prior year period, due to lower grades processed and the impact of the stronger Canadian dollar. Mine-site AISC of $871 per ounce in the fourth quarter were 29% higher than in the prior year reflecting higher sustaining capital spending with increased underground development. For the full year, total cash costs and mine-site AISC were both higher than the prior year largely reflecting the stronger Canadian dollar in 2021, as well as increased sustaining capital spending. The Canadian dollar increased total cash costs by approximately $30 per ounce and mine-site AISC by approximately $50 per ounce, relative to the prior year and initial guidance.

Total capital expenditures were $27.4 million in the fourth quarter, including $5.2 million of capitalized exploration. Spending was focused on lateral development, engineering and early procurement for the Phase III expansion project, and surface infrastructure. Full year capital spending totaled $118.6 million, including $18.8 million of capitalized exploration. In addition, Island Gold advanced $1.4 million for long lead time items supporting the Phase III expansion.

In the fourth quarter of 2021, the Company acquired and canceled a net profit interest ("NPI") royalty payable on production from certain claims at the Island Gold mine for consideration of $15.7 million. Over the past two years, the Company has acquired both an NPI and an NSR royalty on Island Gold that have significantly enhanced the long term value of the operation.

Island Gold generated mine-site free cash flow of $15.8 million in the fourth quarter and $53.1 million for the full year, net of all capital spending on the Phase III expansion. Given the planned ramp up in capital spending on the Phase III expansion, Island Gold is not expected to generate mine-site free cash flow in 2022.

Mulatos Financial and Operational Review

| Three Months Ended December 31, | Years Ended December 31, | |||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| Gold production (ounces) | 23,100 | 31,200 | 121,300 | 150,800 | ||||||||

| Gold sales (ounces) | 21,859 | 31,132 | 122,634 | 149,724 | ||||||||

| Financial Review (in millions) | ||||||||||||

| Operating Revenues | $ | 39.3 | $ | 57.7 | $ | 221.1 | $ | 261.7 | ||||

| Cost of sales (1) | $ | 42.7 | $ | 41.3 | $ | 177.4 | $ | 168.8 | ||||

| (Loss) earnings from operations | ($ | 5.0 | ) | $ | 14.8 | $ | 36.4 | $ | 88.7 | |||

| Cash (used) provided by operating activities | ($ | 6.3 | ) | $ | 24.6 | $ | 32.1 | $ | 110.5 | |||

| Capital expenditures (sustaining) (2) | $ | 8.2 | $ | 12.4 | $ | 22.9 | $ | 27.0 | ||||

| Capital expenditures (growth) (2) (7) | $ | 25.7 | $ | 7.9 | $ | 103.7 | $ | 14.2 | ||||

| Capital expenditures (capitalized exploration) (2) | $ | 0.3 | $ | 0.2 | $ | 1.7 | $ | 0.9 | ||||

| Mine-site free cash flow (2) | ($ | 40.5 | ) | $ | 4.1 | ($ | 96.2 | ) | $ | 68.4 | ||

| Cost of sales, including amortization per ounce of gold sold (1) | $ | 1,953 | $ | 1,327 | $ | 1,447 | $ | 1,127 | ||||

| Total cash costs per ounce of gold sold (2) | $ | 1,473 | $ | 986 | $ | 1,013 | $ | 816 | ||||

| Mine site all-in sustaining costs per ounce of gold sold (2),(3) | $ | 1,899 | $ | 1,426 | $ | 1,240 | $ | 1,032 | ||||

| Open Pit Operations | ||||||||||||

| Tonnes of ore mined - open pit (4) | 660,576 | 1,270,425 | 3,116,492 | 5,641,346 | ||||||||

| Total waste mined - open pit (6) | 2,496,896 | 3,913,900 | 9,060,201 | 9,534,900 | ||||||||

| Total tonnes mined - open pit | 3,157,472 | 5,184,324 | 12,176,694 | 15,176,245 | ||||||||

| Waste-to-ore ratio (operating) | 0.55 | 0.61 | 1.23 | 0.68 | ||||||||

| Crushing and Heap Leach Operations | ||||||||||||

| Tonnes of ore stacked | 1,760,629 | 1,969,732 | 7,074,460 | 7,308,457 | ||||||||

| Average grade of gold processed (5) | 0.85 | 0.83 | 0.99 | 1.08 | ||||||||

| Contained ounces stacked | 48,133 | 52,281 | 225,551 | 253,736 | ||||||||

| Average recovery rate | 48 | % | 60 | % | 54 | % | 59 | % | ||||

| Ore crushed per day (tonnes) - combined | 19,100 | 21,400 | 19,400 | 20,000 | ||||||||

(1) Cost of sales includes mining and processing costs, royalties, and amortization.

(2) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

(3) For the purposes of calculating mine-site all-in sustaining costs, the Company does not include an allocation of corporate and administrative and share based compensation expenses.

(4) Includes ore stockpiled during the quarter.

(5) Grams per tonne of gold ("g/t Au").

(6) Total waste mined includes operating waste and capitalized stripping, but excludes tonnes mined at La Yaqui Grande.

(7) Includes capital advances of $nil and $8.4 million for the three and twelve months ended December 31, 2021 (($nil for the three and twelve months ended December 31, 2020).

Mulatos produced 23,100 ounces in the fourth quarter, lower than the prior year period though consistent with the third quarter. Production in the second half of 2022 was impacted by longer leach cycles for stockpiled ore stacked and lower production from Cerro Pelon with the deposit being depleted in the quarter. For the year, Mulatos produced 121,300 ounces, a 20% decrease from the prior year driven by lower grades mined, primarily from Cerro Pelon, as well as longer leach times for ore stacked in the second half of the year.

Ore mined in the fourth quarter decreased significantly compared to the prior year period, with mining activities within the main Mulatos pit focused on pre-stripping the El Salto portion of the pit. The majority of ore mined in the quarter was from Cerro Pelon and San Carlos, which were depleted by the end of the year. Total tonnes mined of 3,157,472 is exclusive of pre-stripping activities at La Yaqui Grande, where an additional 6.4 million tonnes of waste was mined in the quarter.

Total crusher throughput in the fourth quarter averaged 19,100 tpd for a total of 1,760,629 tonnes stacked at a grade of 0.85 g/t Au. Crusher throughput was 11% below the prior year period, though improved compared to the third quarter which had been impacted by above average rainfall. Tonnes stacked in the quarter exceeded tonnes mined due to the processing of surface stockpiles, which comprised the majority of tonnes stacked in the fourth quarter. For the full year, tonnes stacked were relatively consistent year-over-year, but at lower grades.

The increased proportion of stockpiles stacked in the quarter, combined with stacking on higher lifts of the leach pad, resulted in a longer than anticipated leach cycle which contributed to a lower recovery rate of 48%. The Company expects an improvement in production over the next two quarters as these previously stacked ounces are recovered; however, at higher processing costs given the additional reagents required. Total cash costs are expected to remain at similar levels of approximately $1,500 per ounce during the first half of 2022 reflecting the higher costs associated with processing the stockpiles as well as lower grades from the El Salto. Production rates are expected to increase in the second half of 2022 at substantially lower costs with the start of production from La Yaqui Grande and higher grades from El Salto.

Financial Review

Revenues of $39.3 million in the fourth quarter were lower than the prior year period driven by fewer ounces sold. For the full year, revenues of $221.1 million were lower than the prior year, as fewer ounces sold were partially offset by a higher realized gold price.

Cost of sales (includes mining and processing costs, royalties and amortization expense) of $42.7 million in the fourth quarter were higher than in the comparative period, primarily due to higher processing costs related to surface stockpiles and higher amortization charges. Amortization per ounce was higher in the quarter given the proportion of ore coming from Cerro Pelon which carries a higher amortization charge, as well as the impact of straight line depreciation on lower sales in the quarter. Total cash costs of $1,473 per ounce were higher than in the prior year period as a result of less tonnes stacked, and an increasing proportion of surface stockpiles processed which carry a higher cost per ounce given increased reagents consumption. The surface stockpiles also include historical inventory costs of approximately $150 per ounce, which were incurred in previous years when these tonnes were mined. Mine-site AISC of $1,899 per ounce in the quarter were higher than in the prior year period, consistent with the increase in total cash costs. Full year total cash costs and mine-site AISC were also higher than the prior year due to the increasing proportion of surface stockpiles stacked.

Capital spending totaled $34.2 million in the fourth quarter, of which $8.2 million was sustaining capital primarily related to capitalized stripping at El Salto. Growth capital of $25.7 million was primarily related to pre-stripping and construction activities at La Yaqui Grande. During the year, Mulatos incurred $119.9 million of capital spending, including $102.0 million on construction of La Yaqui Grande. Given the significant level of spending on La Yaqui Grande, Mulatos generated negative mine-site free cash flow of $40.5 million in the quarter and negative $96.2 million for the year. Full year mine-site free cash flow also was impacted by $26.9 million of tax payments in the first half of the year given the strong profitability in 2020.

Fourth Quarter 2021 Development Activities

Island Gold (Ontario, Canada)

Phase III Expansion Study

On July 14, 2020 the Company reported results of the positive Phase III Study conducted on its Island Gold mine. Based on the results of the study, the Company is proceeding with an expansion of the operation to 2,000 tpd. This follows a detailed evaluation of several scenarios which demonstrated the shaft expansion as the best option, having the strongest economics, being the most efficient and productive, and the best positioned to capitalize on further growth in Mineral Reserves and Resources. The Phase III expansion is expected to drive average annual gold production to 236,000 ounces per year upon completion of the shaft in 2025, representing a 70% increase from 2020 production. This will also reduce total cash costs to an average of $403 per ounce and mine-site all-in sustaining costs to $534 per ounce.

The Phase III Study was based on Mineral Reserves and Resources at Island Gold as of December 31, 2019 and does not include the significant growth subsequent to the study. This includes a 37%, or 1.4 million ounce increase in combined Mineral Reserves and Resources which now total 5.1 million ounces of gold. As a result, the Company is working on an updated Phase III expansion mine plan that will incorporate the significant growth in high-grade Mineral Reserves and Resources into an optimized mine plan which is expected to enhance already attractive economics and the value of the operation. The updated study is expected to be completed by mid-2022.

The Company is currently focused on permitting and detailed engineering of the shaft and associated infrastructure, including the hoisting plant and surface civil works, as well as the paste plant. Contract tendering and awarding remains ongoing, with significant contracts signed for the shaft sinking and headworks, shaft site surface works, and steel supply and fabrication. In addition, procurement of long lead time items is underway. Phase III permitting is anticipated to be completed during the first half of 2022 with the pre-sink for the shaft expected to begin mid-2022.

During the fourth quarter of 2021, the Company spent $11.0 million on surface infrastructure, capital development, detailed engineering and permitting activities. Growth capital spending through the year totaled $54.5 million, the majority of which relates to the Phase III expansion.

Mulatos District (Sonora, Mexico)

La Yaqui Grande

On July 28, 2020, the Company reported results of an internal study completed on its fully permitted La Yaqui Grande project located in the Mulatos District in Sonora, Mexico. La Yaqui Grande is located approximately seven kilometres (straight line) from the existing Mulatos operation and adjacent to the past producing La Yaqui Phase I operation. As with La Yaqui Phase I, La Yaqui Grande is being developed with an independent heap leach pad and crushing circuit.

La Yaqui Grande is expected to produce an average of 123,000 ounces of gold per year starting in the third quarter of 2022, significantly reducing the Mulatos District mine-site AISC from approximately $1,675 per ounce in the first half of 2022 to $1,175 per ounce in the second half. This is expected to decrease even further in 2023 as higher cost production from the main Mulatos operation is displaced with lower-cost production from La Yaqui Grande.

Construction activities progressed well in the fourth quarter, with the project on schedule to achieve commercial production in the third quarter of 2022. In 2021, approximately $102.0 million was spent on the project (including capital advances).

Fourth quarter highlights at La Yaqui Grande included:

- Over 21 million tonnes of waste mined in 2021 with the fourth quarter averaging 70,000 tpd;

- Primary, secondary and tertiary crushers are more than 90% complete; agglomeration system 80% complete;

- Crusher circuit commissioning is scheduled for Q2 2022;

- Heap leach construction is 85% complete;

- Carbon columns and ADR plant construction is 70% complete;

- Water treatment plant engineering and earthwork has been completed

La Yaqui Grande - Pit: https://www.globenewswire.com/NewsRoom/AttachmentNg/dfca1b42-8db9-4b5e-8562-1fbfc191857d

La Yaqui Grande - Crusher area: https://www.globenewswire.com/NewsRoom/AttachmentNg/b6075925-44ef-4409-a343-791e941b25ea

La Yaqui Grande - Leach Pad: https://www.globenewswire.com/NewsRoom/AttachmentNg/8a1ba811-18de-4ab4-9bc1-08ce0f6f2506

Lynn Lake (Manitoba, Canada)

The Company released a positive Feasibility Study on the Lynn Lake project in December 2017 outlining average annual production of 143,000 ounces over a 10 year mine life at average mine-site all-in sustaining costs of $745 per ounce.

The project economics based on the 2017 Feasibility Study at a $1,500 per ounce gold price include an after-tax internal rate of return ("IRR") of 21.5% and an after-tax NPV of $290 million (12.5% IRR at a $1,250 per ounce gold price). During the second quarter of 2020, the Company filed the Environmental Impact Statement ("EIS") with the federal government. Approval of the EIS is expected in the second half of 2022 following which the Company expects to make a construction decision. Assuming a positive construction decision, development of Lynn Lake is expected to take approximately two years.

Development spending (excluding exploration) was $2.6 million in the fourth quarter of 2021 to support the ongoing permitting process and engineering, and $6.0 million for the full year.

Kirazlı (Çanakkale, Turkey)

On October 14, 2019, the Company suspended all construction activities on its Kirazlı project following the Turkish government's failure to grant a routine renewal of the Company’s mining licenses, despite the Company having met all legal and regulatory requirements for their renewal. In October 2020, the Turkish government refused the renewal of the Company’s Forestry Permit. The Company had been granted approval of all permits required to construct Kirazlı including the Environmental Impact Assessment approval, Forestry Permit, and GSM (Business Opening and Operation) permit, and certain key permits for the nearby Ağı Dağı and Çamyurt Gold Mines. These permits were granted by the Turkish government after the project earned the support of the local communities and passed an extensive multi-year environmental review and community consultation process.

On April 20, 2021, the Company announced that its Netherlands wholly-owned subsidiaries Alamos Gold Holdings Coöperatief U.A, and Alamos Gold Holdings B.V. (the “Subsidiaries”) would be filing an investment treaty claim against the Republic of Turkey for expropriation and unfair and inequitable treatment, among other things, with respect to the Kirazlı, Ağı Dağı and Çamyurt gold development projects in Turkey. The claim was filed under the Netherlands-Turkey Bilateral Investment Treaty (the “Treaty”). Alamos Gold Holdings Coöperatief U.A. and Alamos Gold Holdings B.V. had its claim against the Republic of Turkey registered on June 7, 2021 with the International Centre for Settlement of Investment Disputes (World Bank Group).

In its effort to secure the renewal of its mining licenses, the Company has attempted to work cooperatively with the Turkish government, has raised with the Turkish government its obligations under the Treaty, has sought to resolve the dispute by good faith negotiations, and has made considerable effort to build support among stakeholders and host communities. The Turkish government has failed to provide the Company with a reason for the non-renewal of its licenses.

Bilateral investment treaties are agreements between countries to assist with the protection of investments. The Treaty establishes legal protections for investment between Turkey and the Netherlands. The Subsidiaries directly own and control the Company’s Turkish assets. The Subsidiaries invoking their rights pursuant to the Treaty does not mean that they relinquish their rights to the Turkish project, or otherwise cease the Turkish operations. The Company will continue to work towards a constructive resolution with the Republic of Turkey.

As a result, the Company incurred an after-tax impairment charge of $213.8 million in the second quarter of 2021. The non-cash impairment charge reflects the Company’s entire net carrying value of the Turkish mineral property, plant and equipment and certain other current assets.

In addition, the Company incurred approximately $2.5 million in the year for severances, legal costs, and ongoing holding costs which have been expensed, with the majority incurred in the second quarter following the announcement of the Treaty claim. Going forward, the Company expects holding costs will be approximately $1.0 to $2.0 million per year during the Treaty claim process.

Fourth Quarter 2021 Exploration Activities

Island Gold (Ontario, Canada)

The 2021 exploration drilling program was focused on expanding high-grade mineralization in the down-plunge and lateral extensions of the Island Gold deposit with the objective of adding new near-mine Mineral Resources across the two kilometre long Island Gold deposit. The most recent drill intercepts from the 2021 program were disclosed in a November 11, 2021 press release.

The Company continued its strong track record of exploration success and Mineral Reserve and Resource growth in 2021, with a 2% increase in Mineral Reserves to 1.3 million ounces of gold (4.1 mt grading 10.12 g/t Au), including a 4% increase in reserve grade, as well as an 8% increase in Inferred Mineral Resources to 3.5 million ounces (7.9 mt grading 13.59 g/t Au).

Four diamond drill rigs continued operating in the fourth quarter focused on the surface directional exploration program. One underground regular exploration diamond drill operated in the quarter and two diamond drill rigs were focused on underground directional drilling. A total of 4,020 m of surface directional drilling, 1,527 m of underground directional drilling and 2,628 m of standard underground exploration drilling was completed in the fourth quarter of 2021.

Surface exploration drilling

A total of 4,020 m of surface directional drilling was completed in seven holes during the fourth quarter. Surface directional drilling targeted areas peripheral to the Inferred Mineral Resource block in the Island East area between 1,400 m and 1,750 m below surface with drill hole spacing ranging from 75 m to 100 m.

Underground exploration drilling

During the fourth quarter of 2021, a total of 1,527 m of underground directional drilling was completed in three holes from the 740 and 840 levels. A total of 2,628 m of standard underground exploration drilling was completed in 9 holes from the 340 and 840 levels. The objective of the underground drilling is to identify new Mineral Resources close to existing Mineral Resource or Reserve blocks. A total of 205 m of underground exploration drift development was completed on the 490, 620, 790 and 840 levels during the fourth quarter of 2021.

Total exploration expenditures during the fourth quarter were $6.7 million, of which $5.2 million was capitalized. For the full year, $23.5 million of exploration expenditures were incurred, of which $18.8 million was capitalized.

Young-Davidson (Ontario, Canada)

The 2021 drill program represented the first significant exploration campaign at Young-Davidson since 2011, given the focus of the last several years on completing the lower mine expansion. Through a successful delineation drilling program, Mineral Reserves were more than replaced, increasing 5% to 3.4 million ounces (43.7 mt grading 2.42 g/t Au) at the end of 2021, and extending Young-Davidson's Mineral Reserve life to 15 years.

Underground exploration drilling during the fourth quarter was focused on four targets with 4,011 m completed in nine holes. Drilling from the 8960-level exploration drill bay established in the lower mine infrastructure tested the footwall stratigraphy to the north, followed by evaluation to the west and down-plunge of existing Mineral Reserves and Resources with one drill hole completed in the fourth quarter. Drilling is targeting syenite-hosted mineralization as well as continuing to test mineralization in the footwall sediments and in the hanging wall mafic-ultramafic stratigraphy. On the east side of the deposit, a second underground drill completed five holes from the 8900-level targeting an area down-dip from the existing Mineral Reserves and Resources. This drill also completed three holes from the 9710-level testing along strike to the east of existing Mineral Reserves and Resources.

As previously disclosed in a July 12, 2021 press release, the current drilling campaign has been successful in extending gold mineralization 150 m below existing Inferred Mineral Resources. This follows a 220 m extension of gold mineralization in 2020 which contributed to an increase in Inferred Mineral Resources in the 2020 year-end update. The 2021 campaign has also intersected high-grade mineralization 200 m outside of the syenite in the hanging wall, as well as in the footwall of the deposit highlighting significant near-mine exploration potential outside of the known ore body.

Exploration spending totaled $3.4 million of which $2.7 million was capitalized in the fourth quarter 2021 and $7.2 million of which $6.5 million was capitalized for the year.

Mulatos District (Sonora, Mexico)

The Company has a large exploration package covering 28,972 hectares with the majority of past exploration efforts focused around the Mulatos mine. Exploration has moved beyond the main Mulatos pit area and is focused on earlier stage prospects throughout the wider district.

During the fourth quarter of 2021, exploration activities were focused on the near-mine, Puerto del Aire trend with 1,179 m of drilling completed in two drill holes. Drilling at Puerto del Aire during the year was successful in establishing a new underground Mineral Reserve at Mulatos, consisting of 0.4 million ounces of gold (2.8 mt grading 4.67 g/t Au) as at December 31, 2021. Drilling also continued at the El Halcon targets with twelve drill holes completed totaling 3,259 m.

At Halcon west, geophysical work including magnetometry and induced polarization surveys were initiated. The option agreement with Aloro Mining Corp. was extended for a second year in order to further evaluate the Los Venados Property, which is immediately north of the Mulatos mine.

During the fourth quarter, the Company incurred $1.9 million of exploration spending, of which $0.3 million was capitalized. For 2021, $9.0 million was incurred, of which $1.7 million was capitalized.

Lynn Lake (Manitoba, Canada)

During the fourth quarter of 2021, interpretation of results from the 2021 drilling programs were ongoing with a focus on identifying resource expansion opportunities at MacLellan, Gordon, and Burnt Timber. Interpretation and targeting of data collected during the 2021 field season was also underway with the objective of advancing a pipeline of prospective regional exploration targets. This included follow-up exploration targeting at Tulune, a new greenfields discovery, disclosed in a December 16, 2021 press release. Exploration spending totaled $1.4 million in the fourth quarter, and $7.8 million in the year, which was capitalized.

Review of Fourth Quarter Financial Results

During the fourth quarter of 2021, the Company sold 112,966 ounces of gold for revenues of $203.1 million, a 10% decrease from the prior year period driven by lower realized gold prices and less ounces sold.

The average realized gold price in the fourth quarter was $1,798 per ounce, a 3% decrease compared to $1,860 per ounce realized in the prior year period. The average realized gold price was slightly above the London PM Fix price for the quarter of $1,795 per ounce.

Cost of sales were $138.4 million in the fourth quarter, 2% higher than the prior year period.

Mining and processing costs were $92.2 million, 7% higher than the prior year period. The increase in mining costs was primarily related to increased mining activity at Young Davidson, where mining rates were 8% higher than the prior year, as well as higher processing costs at Mulatos. Further, reported US dollar costs have been impacted by the stronger Canadian dollar in 2021.

Consolidated total cash costs of $843 per ounce and AISC of $1,237 per ounce in the quarter were both higher compared to the prior year period due to higher processing costs for stockpiled ore at Mulatos, a stronger Canadian dollar, and slightly lower grades mined at Island Gold, partially offset by lower unit mining costs at Young-Davidson.

Royalty expense was $3.0 million in the quarter, lower than the prior year period of $3.3 million due to lower ounces sold in the period.

Amortization of $43.2 million in the quarter was lower than the prior year period due to less ounces sold. Amortization of $382 per ounce was consistent with the prior year.

The Company recognized earnings from operations of $49.8 million in the quarter, a decrease from the prior year period as a result of less ounces sold, and lower operating margins driven by a 3% decrease in realized gold prices, and higher cash costs at Mulatos and Island Gold.

The Company reported net earnings of $29.5 million in the quarter, compared to net earnings of $76.9 million in the comparative period. The decrease in net earnings from the prior year period is mainly driven by lower operating margins and a higher effective tax rate resulting from foreign exchange losses recorded within taxes. Net earnings in the fourth quarter of 2020 benefited from a $13.7 million foreign exchange gain recorded within deferred tax expense. On an adjusted basis, earnings in the fourth quarter of 2021 were $36.7 million, or $0.09 per share.

Review of 2021 Financial Results

For the full year 2021, the Company sold 457,517 ounces of gold for record revenues of $823.6 million, a 10% increase from the prior year period driven by higher realized gold prices and more ounces sold. The 8% increase in ounces sold was primarily driven by higher production at Young-Davidson, as the prior year was impacted by the temporary shutdown of the Northgate shaft. In addition, the average realized gold price in 2021 of $1,800 per ounce was 2% higher than the realized gold price of $1,763 per ounce in the prior year.

Year-to-date cost of sales were $534.1 million, an increase from $482.0 million in the prior year.

Mining and processing costs increased to $351.5 million from $312.6 million in the prior year, driven by significantly higher mining rates at Young-Davidson in 2021. In addition, the stronger Canadian dollar and Mexican peso, as well as costs related to COVID-19 preventative measures at all three operations increased cost of sales compared to the prior year.

Consolidated total cash costs in the year were $794 per ounce compared to $761 per ounce in the prior year. The increase in total cash costs was primarily driven by higher processing costs at Mulatos and the impact of foreign exchange and COVID-19 preventative costs, partially offset by lower unit mining costs at Young-Davidson.

AISC of $1,135 per ounce was higher than the prior year, mainly due to higher sustaining capital spending at the operations.

Royalty expense was $11.7 million, a 15% increase compared to $10.2 million in the prior year, due to more ounces sold and a higher realized gold price.

Amortization of $170.9 million was higher than in the prior year, mainly driven by an increase in amortization per ounce to $374 per ounce, a 4% increase compared to 2020. Amortization cost per ounce was higher reflecting increased production at Cerro Pelon which carries a higher amortization rate, as well as the completion of the lower-mine tie-in at Young-Davidson in mid-2020, which resulted in amortization of the new lower-mine infrastructure.

In accordance with the Company’s accounting policy, assets are tested for impairment when events or changes in circumstances suggest that the carrying amount may not be recoverable. In April 2021, the Company proceeded with a bilateral investment treaty claim following the continued failure by the Republic of Turkey to renew the mining licenses since their expiry, and the continued failure of discussions with the Republic of Turkey to resolve the situation. As a result, the Company concluded that an impairment trigger for accounting purposes existed in the second quarter of 2021.

The recoverable amount relating to mineral properties was determined as nil, based on both the FVLCD and VIU methods. The FVLCD is considered to be nil on the basis that no other market participant would likely be able to progress the Project in the face of the Treaty claim and the current state of the Company’s mining licenses. A market approach was used in estimating the FVLCD as an income approach would not be considered to provide a reliable estimate of fair value. The VIU of the Project is also considered to be nil due to the current probability of resolving the dispute with the Republic of Turkey, and therefore the likelihood of the Project being developed, being now considered to be remote, and therefore no future positive cash flows can be expected to be generated.

As a result, the Company incurred an impairment charge of $224.3 million ($213.8 million after tax) in the second quarter of 2021. The non-cash impairment charge reflects the Company’s entire net carrying value of the Turkish mineral property, plant and equipment and certain other current assets. Refer to note 13 of the Company's consolidated financial statements for the year ended December 31, 2021 for further details.

The Company recognized earnings from operations of $14.9 million, compared to earnings of $227.6 million in the prior year. The decrease in earnings from operations was due to the impairment charge of $224.3 million related to the Turkish Projects.

The Company reported a net loss of $66.7 million for 2021 compared to net earnings of $144.2 million in the prior year. The net loss in the current year was driven by the impairment charge related to the Turkish Projects recorded in the second quarter. On an adjusted basis, earnings of $162.1 million or $0.41 per share in 2021 were 4% higher than in the prior year, driven by higher revenues. Adjusted earnings reflect adjustments for the Turkish impairment charge, other one-time gains and losses, as well as foreign exchange movements recorded in deferred taxes and foreign exchange of $6.9 million.

Associated Documents

This press release should be read in conjunction with the Company’s interim consolidated financial statements for the year ended December 31, 2021 and associated Management’s Discussion and Analysis (“MD&A”), which are available from the Company's website, www.alamosgold.com, in the "Investors" section under "Reports and Financials", and on SEDAR (www.sedar.com) and EDGAR (www.sec.gov).

Reminder of Fourth Quarter and Year-End 2021 Results Conference Call

The Company's senior management will host a conference call on Thursday, February 24, 2022 at 11:00 am ET to discuss the fourth quarter and year-end 2021 results. Participants may join the conference call via webcast or through the following dial-in numbers:

Toronto and International: (416) 406-0743

Toll free (Canada and the United States): (800) 898-3989

Participant passcode: 3966847#