Alamos Gold Reports Mineral Reserves and Resources for the Year-Ended 2019

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Feb. 18, 2020 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2019. For a detailed summary of Mineral Reserves and Resources by project, refer to the tables below.

Highlights

- Island Gold’s Mineral Reserves and Resources increased by a combined 921,000 ounces, net of mining depletion, including:

- 21% increase in Proven and Probable Mineral Reserves to 1.22 million ounces (3.6 million tonnes (“mt”) grading 10.37 grams per tonne of gold (“g/t Au”)), net of mining depletion

- 46% increase in Inferred Mineral Resources to 2.30 million ounces (5.4 mt grading 13.26 g/t Au) with grades also increasing 13% reflecting higher grade additions in Island East

- Combined Mineral Reserves and Resources now total 3.70 million ounces, double the 1.84 million ounces at the time of acquisition in 2017, net of 364,000 ounces of mining depletion

- Global Proven and Probable Mineral Reserves of 9.73 million ounces of gold (203 mt grading 1.49 g/t Au), up slightly from 9.70 million ounces at the end of 2018 with increases primarily at Island Gold offsetting 576,000 ounces of mining depletion

- Global Measured and Indicated Mineral Resources of 7.04 million ounces of gold (199 mt grading 1.10 g/t Au), down 3% reflecting the conversion to Mineral Reserves at Young-Davidson

- Global Inferred Mineral Resources increased 10% to 5.98 million ounces of gold (130 mt grading 1.43 g/t Au), with grades also increasing 10% driven by the 725,000 ounce increase at Island Gold

- Global exploration budget of $36 million in 2020, a 24% increase from the $29 million spent in 2019. This includes $21 million at Island Gold focused on defining additional near mine Mineral Reserves and Resources, $7 million budgeted at Mulatos and $5 million budgeted at Lynn Lake

“We had another tremendous year at Island Gold on all fronts with the asset continuing to evolve into a world class ore body. Over the past two years we have added more than two million ounces of Mineral Reserves and Resources, before mining depletion, with the deposit now approaching four million ounces in all categories. We see strong potential for this growth to continue with the deposit open laterally and down-plunge across multiple areas of focus,” said John A. McCluskey, President and Chief Executive Officer.

“The majority of this growth is being incorporated into a Phase III expansion study of Island Gold supporting what we expect will be a larger, increasingly profitable, long-life operation in one of the best mining jurisdictions in the world,” Mr. McCluskey added.

| TOTAL MINERAL RESERVES AND RESOURCES | |||||||||||||||

| Proven and Probable Gold Mineral Reserves | |||||||||||||||

| 2019 | 2018 | % Change | |||||||||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |||||||

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |||||||

| Young-Davidson - Surface | 100 | 1.31 | 4 | 219 | 0.83 | 6 | -54 | % | 57 | % | -28 | % | |||

| Young-Davidson - Underground | 37,610 | 2.60 | 3,142 | 37,720 | 2.69 | 3,256 | 0 | % | -3 | % | -4 | % | |||

| Total Young-Davidson | 37,710 | 2.60 | 3,146 | 37,939 | 2.67 | 3,262 | -1 | % | -3 | % | -4 | % | |||

| Island Gold | 3,643 | 10.37 | 1,215 | 3,047 | 10.28 | 1,007 | 20 | % | 1 | % | 21 | % | |||

| Mulatos Mine | 8,806 | 0.89 | 251 | 15,443 | 0.87 | 434 | -43 | % | 1 | % | -42 | % | |||

| Stockpiles | 10,531 | 1.25 | 424 | 10,663 | 1.25 | 429 | -1 | % | 0 | % | -1 | % | |||

| La Yaqui | 0 | 0.00 | 0 | 786 | 0.90 | 23 | -100 | % | -100 | % | -100 | % | |||

| La Yaqui Grande | 19,205 | 1.17 | 724 | 15,945 | 1.26 | 643 | 20 | % | -7 | % | 13 | % | |||

| Cerro Pelon | 2,630 | 1.94 | 164 | 3,121 | 1.88 | 189 | -16 | % | 3 | % | -13 | % | |||

| Total Mulatos | 41,172 | 1.18 | 1,563 | 45,958 | 1.16 | 1,717 | -10 | % | 2 | % | -9 | % | |||

| MacLellan | 23,254 | 1.61 | 1,206 | 23,254 | 1.61 | 1,206 | - | - | - | ||||||

| Gordon | 8,723 | 2.42 | 678 | 8,723 | 2.42 | 678 | - | - | - | ||||||

| Total Lynn Lake | 31,977 | 1.83 | 1,884 | 31,977 | 1.83 | 1,884 | - | - | - | ||||||

| Agi Dagi | 54,361 | 0.67 | 1,166 | 54,361 | 0.67 | 1,166 | - | - | - | ||||||

| Kirazli | 33,861 | 0.69 | 752 | 26,104 | 0.79 | 665 | 30 | % | -13 | % | 13 | % | |||

| Total Turkey | 88,222 | 0.68 | 1,918 | 80,465 | 0.71 | 1,831 | 10 | % | -4 | % | 5 | % | |||

| Alamos - Total | 202,724 | 1.49 | 9,726 | 199,386 | 1.51 | 9,702 | 2 | % | -1 | % | 0 | % | |||

| Measured and Indicated Gold Mineral Resources (exclusive of Mineral Reserves) | |||||||||||||||

| Young-Davidson - Surface | 1,739 | 1.24 | 69 | 1,739 | 1.24 | 69 | - | - | - | ||||||

| Young-Davidson - Underground | 9,535 | 3.68 | 1,128 | 11,374 | 3.53 | 1,291 | -16 | % | 4 | % | -13 | % | |||

| Total Young-Davidson | 11,273 | 3.30 | 1,197 | 13,113 | 3.23 | 1,361 | -14 | % | 2 | % | -12 | % | |||

| Island Gold | 879 | 6.51 | 184 | 696 | 8.77 | 196 | 26 | % | -26 | % | -6 | % | |||

| Mulatos Mine | 71,319 | 1.10 | 2,518 | 70,944 | 1.11 | 2,521 | 1 | % | -1 | % | 0 | % | |||

| La Yaqui Grande | 1,321 | 1.01 | 43 | 1,101 | 0.93 | 33 | 20 | % | 9 | % | 30 | % | |||

| Cerro Pelon | 243 | 1.41 | 11 | 179 | 1.56 | 9 | 36 | % | -10 | % | 22 | % | |||

| Carricito | 1,355 | 0.83 | 36 | 1,355 | 0.83 | 36 | - | - | - | ||||||

| Total Mulatos | 74,238 | 1.09 | 2,608 | 73,579 | 1.10 | 2,599 | 1 | % | -1 | % | 0 | % | |||

| Lynn Lake | 9,993 | 1.74 | 560 | 9,993 | 1.74 | 560 | - | - | - | ||||||

| Esperanza | 34,352 | 0.98 | 1,084 | 34,352 | 0.98 | 1,083 | - | - | - | ||||||

| Turkey | 55,664 | 0.60 | 1,068 | 58,574 | 0.59 | 1,108 | -5 | % | 1 | % | -4 | % | |||

| Quartz Mountain | 12,156 | 0.87 | 339 | 12,156 | 0.87 | 339 | - | - | - | ||||||

| Alamos - Total | 198,555 | 1.10 | 7,041 | 202,463 | 1.11 | 7,247 | -2 | % | -1 | % | -3 | % | |||

| Inferred Gold Mineral Resources | |||||||||||||||

| Young-Davidson - Surface | 31 | 0.99 | 1 | 31 | 0.99 | 1 | - | - | - | ||||||

| Young-Davidson - Underground | 1,329 | 2.43 | 104 | 3,498 | 2.75 | 310 | -62 | % | -12 | % | -66 | % | |||

| Total Young-Davidson | 1,360 | 2.40 | 105 | 3,528 | 2.74 | 311 | -61 | % | -12 | % | -66 | % | |||

| Island Gold | 5,392 | 13.26 | 2,298 | 4,178 | 11.71 | 1,573 | 29 | % | 13 | % | 46 | % | |||

| Mulatos Mine | 8,122 | 0.92 | 239 | 8,369 | 0.92 | 248 | -3 | % | -1 | % | -4 | % | |||

| La Yaqui Grande | 241 | 0.88 | 7 | 229 | 0.90 | 7 | 5 | % | -3 | % | 0 | % | |||

| Cerro Pelon | 37 | 0.62 | 1 | 70 | 0.70 | 2 | -47 | % | -12 | % | -50 | % | |||

| Carricito | 900 | 0.74 | 22 | 900 | 0.74 | 22 | - | - | - | ||||||

| Total Mulatos | 9,300 | 0.90 | 269 | 9,568 | 0.91 | 279 | -3 | % | -1 | % | -4 | % | |||

| Lynn Lake | 46,466 | 1.11 | 1,663 | 46,466 | 1.11 | 1,663 | - | - | - | ||||||

| Esperanza | 718 | 0.80 | 18 | 718 | 0.80 | 18 | - | - | - | ||||||

| Turkey | 27,245 | 0.55 | 482 | 25,240 | 0.54 | 438 | 8 | % | 2 | % | 10 | % | |||

| Quartz Mountain | 39,205 | 0.91 | 1,147 | 39,205 | 0.91 | 1,147 | - | - | - | ||||||

| Alamos - Total | 129,686 | 1.43 | 5,982 | 128,903 | 1.31 | 5,429 | 1 | % | 10 | % | 10 | % | |||

Mineral Reserves

Global Proven and Probable Mineral Reserves total 9.73 million ounces of gold as of December 31, 2019. This is up slightly from 9.70 million ounces at the end of 2018 with increases at Island Gold, Young-Davidson, La Yaqui Grande and Kirazlı offsetting mining depletion of 576,000 ounces in 2019.

Island Gold continues to be the driver of Mineral Reserve and Resource growth within Alamos with another significant increase in high-grade ounces. Mineral Reserves increased 21% in 2019 to 1.2 million ounces despite the focus being on extending high-grade mineralization and adding near mine Mineral Resources. A total of 361,000 ounces of Mineral Reserves were added, more than offsetting mining depletion of 153,000 ounces. Mineral Reserve grades also increased slightly to 10.37 g/t Au with higher grade additions more than offsetting the higher grades mined in 2019. Since the acquisition of Island Gold in November 2017, Mineral Reserves have increased 62%, net of depletion, with Mineral Reserve grades also increasing 13%.

Young-Davidson’s Mineral Reserve of 3.15 million ounces decreased 116,000 ounces from 2018 with mining depletion partially offset by an increase in Mineral Reserves in the lower mine. The additions were driven by conversion of existing Mineral Resources through stope definition drilling below current mining horizons. This contributed to a slight decrease in the Mineral Reserve grade to 2.60 g/t Au, from 2.67 g/t Au, at the end of 2018. No exploration drilling has been conducted at Young-Davidson since 2013 given the large Mineral Reserve base and the costly nature of drilling from surface. With the deposit open at depth and access now available to drill from the bottom of the mine, this will be an increasing focus going forward.

Mineral Reserves at Mulatos decreased 154,000 ounces to 1.56 million ounces with mining depletion partially offset by an 81,000 ounce increase at La Yaqui Grande. The majority of the exploration activities conducted in 2019 were focused on earlier stage work. The 2020 exploration budget has been increased to $7 million at Mulatos with more drilling planned around near mine targets as well as at La Yaqui Grande and El Carricito.

Mineral Reserves at Kirazlı increased 87,000 ounces to 0.75 million ounces reflecting the conversion of existing Mineral Resources. The conversion was the result of an optimized pit design which incorporated lower costs than utilized in the 2017 Feasibility Study, reflecting the weaker Turkish Lira and lower mining costs confirmed with the 2019 mining contract.

A $1,250 per ounce gold price assumption was used in estimating 2019 Mineral Reserves, unchanged from 2018. A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2019 is presented in Table 1 at the end of this press release.

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) totaled 7.0 million ounces as of December 31, 2019. This is down 206,000 ounces, or 3%, from 2018 largely reflecting the conversion of Mineral Resources to Reserves at Young-Davidson and Kirazlı.

Global Inferred Mineral Resources totaled 6.0 million ounces as of December 31, 2019, a 10% increase from 2018 with grades also increasing 10%. This was driven by the addition of 725,000 high-grade ounces at Island Gold.

The Company’s $1,400 per ounce gold price assumption for estimating Mineral Resources is unchanged from 2018. Detailed summaries of the Company’s Measured and Indicated Mineral Resources and Inferred Mineral Resources as of December 31, 2019 are presented in Tables 3 and 4, respectively, at the end of this press release.

Island Gold

Exploration drilling at Island Gold continues to successfully extend high-grade mineralization and add near mine Mineral Resources across the down-plunge and lateral extensions of the Island Gold deposit. This was particularly successful in the eastern portion of the deposit (“Island East”) where the bulk of the 2019 Mineral Resource growth occurred, including in the new area of focus.

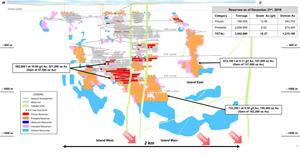

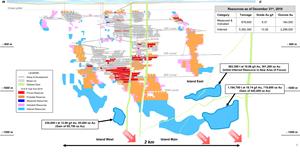

Island Gold’s Mineral Reserves increased to 1.2 million ounces, a 208,000 ounce or 21% increase from the end of 2018, net of mining depletion. This included a 361,000 ounce increase in Mineral Reserves, less mining depletion of 153,000 ounces, in 2019. Mineral Reserve grades also increased 1% to 10.37 g/t Au from the end of 2018 with the higher grade additions more than offsetting the higher grades mined in 2019 of 12.28 g/t Au. All of the gains were made within the Island Main and Island East portions of the deposit. (See Figure 1 at the end of this press release.)

Based on throughput rates of 1,200 tonnes per day (“tpd”), Island Gold has a current Mineral Reserve life of approximately eight years. With ongoing exploration success, an already large Mineral Resource base, and strong track record of conversion to Mineral Reserves, the Company expects Island Gold’s ultimate mine life will be significantly longer.

Measured and Indicated Mineral Resources decreased 6% to 184,000 ounces with grades also decreasing to 6.51 g/t Au from the end of 2018 reflecting the conversion to Mineral Reserves, primarily in the upper portion of Island East.

Inferred Mineral Resources increased 46%, or 725,000 ounces, to 2.3 million ounces with grades also increasing 13% to 13.26 g/t Au compared to the end of 2018. The strong increase in Mineral Resources and grade were driven by higher grade additions in Island East, including:

- An initial Inferred Mineral Resource of 301,000 ounces grading 16.06 g/t Au in the new area of focus. This area is located 180 m down-plunge from Mineral Reserves in Island East and had not seen any drilling prior to 2019. All 17 holes drilled to date in this area have intersected the Island Gold Main Zone with this area open both up- and down-plunge (see Figure 2)

- A 443,000 ounce increase in Inferred Mineral Resources, 200 m down-plunge from the new area of focus in the lower portion of Island East. This area now contains 720,000 ounces grading 18.74 g/t Au. This east plunging high-grade ore shoot remains open laterally, and up- and down-plunge

Testing the continuity of high-grade mineralization between the Mineral Reserves in the upper portion of Island East to Mineral Resources in the lower portion will be an ongoing focus of both surface and underground exploration drilling in 2020.

Since the acquisition of Island Gold in 2017,

- Mineral Reserves have increased 827,000 ounces before mining depletion, or 463,000 ounces net of mining depletion, with Mineral Reserve grades increasing 13%

- Measured and Indicated Mineral Resources have increased 102% or 93,000 ounces, with grades increasing 10%

- Inferred Mineral Resources have increased 131%, or 1,302,000 ounces, with grades increasing 30%

Reflecting the ongoing exploration success, the 2020 exploration budget at Island Gold has been increased to $21 million, up from $17 million spent in 2019. The ongoing focus remains on adding near-mine Mineral Resources and extending high-grade mineralization in the Western, Main and Eastern portions of the Island Gold deposit with each open laterally and down-plunge.

Young-Davidson

Mineral Reserves at Young-Davidson decreased 116,000 ounces to 3.2 million ounces of gold. This reflects mining depletion of 203,000 ounces, partially offset by an increase of 88,000 ounces in the lower mine through the conversion of existing Mineral Resources. The conversion of the Mineral Resources was at lower grades contributing to a slight decrease in the Mineral Reserve grade to 2.60 g/t Au from 2.67 g/t Au. Exploration has not been a priority the last several years given the large existing Mineral Reserve base and with the focus on completing the lower mine expansion. With the lower mine expansion expected to be completed in June 2020 and underground drill platforms now available at depth, exploration activities are expected to resume in 2020. With the deposit open at depth and to the west, Young-Davidson has excellent exploration potential.

Measured and Indicated Mineral Resources of 1.2 million ounces and Inferred Mineral Resources of 0.1 million ounces both decreased slightly from a year ago, in part reflecting the conversion of Mineral Resources to Reserves. The Company expects to continue converting Mineral Resources to Reserves through additional stope definition and infill drilling.

Based on expected underground mining rates, the remaining Mineral Reserve life of the Young-Davidson mine is approximately 13 years as of December 31, 2019.

Mulatos

Total Mulatos District Mineral Reserves (including La Yaqui Grande and Cerro Pelon) decreased 154,000 ounces to 1.6 million ounces with grades increasing slightly to 1.18 g/t Au. This reflects mining depletion partially offset by additions at La Yaqui Grande.

Mineral Reserves at La Yaqui Grande increased 13% to 724,000 ounces with Mineral Reserve grade decreasing 7% to 1.17 g/t Au. The increase was driven by an optimization of the open pit design which brought additional ounces into the mine plan, at slightly lower grades. La Yaqui Grande’s higher grades (relative to the Mulatos Mine) are expected to support lower cost production than currently from the Mulatos Mine. The Company expects to finalize the project economics for La Yaqui Grande and make a construction decision during the second quarter of 2020.

The remaining Mineral Reserve life of the Mulatos District is approximately six years as of December 31, 2019.

Measured and Indicated Mineral Resources of 2.6 million ounces and Inferred Mineral Resources of 0.3 million ounces at Mulatos are largely unchanged from a year ago.

The 2020 exploration budget for Mulatos has increased to $7 million and includes 14,000 m of drilling focused in the Mulatos near-mine, Carricito and La Yaqui Grande areas. A number of regional exploration targets have been identified in 2019 from the property-wide VTEM geophysical survey that was completed in late 2018. A focus of the 2020 regional exploration program will be to further evaluate these targets through systematic mapping, sampling, and ground geophysics.

Kirazlı

Mineral Reserves at Kirazlı increased 13%, or 87,000 ounces, to 752,000 ounces with grades decreasing 13% to 0.69 g/t Au. The increase was driven by an optimization of the open pit design through the application of lower mining contract rates and updated pit slope parameters.

Measured and Indicated Mineral Resources decreased reflecting the conversion to Mineral Reserves. Inferred Mineral Resources increased reflecting a larger Mineral Resource pit resulting from the new optimization parameters.

Lynn Lake, Ağı Dağı, Çamyurt, Esperanza and Quartz Mountain

Mineral Reserves and Resources for the Lynn Lake, Ağı Dağı, Çamyurt, Esperanza and Quartz Mountain projects are unchanged from a year ago.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Resources | ||

| Jeffrey Volk, CPG, FAusIMM | Director - Reserves and Resource, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Raynald Vincent, P.Eng., M.G.P. | Chief Geologist - Island Gold | Island Gold |

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, Carricito, Esperanza, Ağı Dağı, Kirazlı, Çamyurt, Quartz Mountain |

| Reserves | ||

| Chris Bostwick, FAusIMM | VP Technical Services, Alamos Gold Inc. | Young-Davidson, Lynn Lake |

| Nathan Bourgeault, P.Eng | Chief Engineer - Island Gold | Island Gold |

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | Mulatos Pits, Cerro Pelon, La Yaqui, Ağı Dağı, Kirazlı |

With the exception of Mr. Volk, Mr. Bostwick, Mr. Vincent, and Mr. Bourgeault each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,700 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons | |

| Vice President, Investor Relations | |

| (416) 368-9932 x 5439 |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This news release includes certain statements that constitute forward-looking information within the meaning of applicable Canadian and U.S. securities laws ("forward-looking statements"). All statements other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are forward-looking statements. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “continue”, "expect", "plan", "estimate", “target”, “budget” or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. Such statements in this news release include statements with respect to planned exploration programs, costs and expenditures, project economics, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of Mineral Resource. A Mineral Resource that is classified as "inferred" or "indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "Indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Reserves.

Alamos cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. These factors and assumptions include, but are not limited to: changes to current estimates of mineral reserves and resources; conclusions of economic and geological evaluations; changes in project parameters as plans continue to be refined; changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance, labour and contractor availability and other operating or technical difficulties); fluctuations in the price of gold; changes in foreign exchange rates (particularly the Canadian dollar, Mexican peso, Turkish Lira and U.S. dollar); the impact of inflation; employee and community relations (including maintaining social license to operate in Turkey); litigation and administrative proceedings; disruptions affecting operations; availability of and increased costs associated with mining inputs and labour; development delays at the Kirazlı project or the Young-Davidson mine; inherent risks associated with mining and mineral processing; the risk that the Company’s mines may not perform as planned; uncertainty with the Company’s ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development, the renewal of the Company’s mining concessions in Turkey; timely resumption of construction and development at the Kirazlı project; the risks of obtaining and maintaining necessary licenses, permits and authorizations for the Company’s development and operating assets; labour and contractor availability (and being able to secure the same on favourable terms); contests over title to properties; expropriation or nationalization of property; inherent risks and hazards associated with mining including environmental hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; changes in national and local government legislation (including tax legislation), controls or regulations in Canada, Mexico, Turkey, the United States and other jurisdictions in which the Company does or may carry on business in the future; risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; risks arising from holding derivative instruments; and business opportunities that may be pursued by the Company.

For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and MD&A, each under the heading “Risk Factors”, available on the SEDAR website at www.sedar.com or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Cautionary Note to U.S. Investors – Mineral Reserve and Resource Estimates

All resource and reserve estimates included in this news release or documents referenced in this news release have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms "Mineral Reserve", "Proven Mineral Reserve" and "Probable Mineral Reserve" are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in SEC Industry Guide 7 ("SEC Industry Guide 7") under the United States Securities Act of 1933, as amended, and the Exchange Act. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms "Mineral Resource", "Measured Mineral Resource", Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the "SEC"). Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Table 1: Total Proven and Probable Mineral Reserves as of December 31, 2019

| PROVEN AND PROBABLE GOLD RESERVES (as at December 31, 2019) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Young-Davidson - Surface | 100 | 1.31 | 4 | 0 | 0.00 | 0 | 100 | 1.31 | 4 |

| Young-Davidson - Underground | 18,993 | 2.67 | 1,628 | 18,617 | 2.53 | 1,514 | 37,610 | 2.60 | 3,142 |

| Total Young-Davidson | 19,093 | 2.66 | 1,632 | 18,617 | 2.53 | 1,514 | 37,710 | 2.60 | 3,146 |

| Island Gold | 786 | 13.48 | 341 | 2,857 | 9.52 | 874 | 3,643 | 10.37 | 1,215 |

| Mulatos Main Pits | 1,137 | 0.95 | 35 | 7,669 | 0.88 | 216 | 8,806 | 0.89 | 251 |

| Stockpiles | 10,531 | 1.25 | 424 | 0 | 0.00 | 0 | 10,531 | 1.25 | 424 |

| La Yaqui Grande | 0 | 0.00 | 0 | 19,205 | 1.17 | 724 | 19,205 | 1.17 | 724 |

| Cerro Pelon | 942 | 2.03 | 61 | 1,688 | 1.89 | 103 | 2,630 | 1.94 | 164 |

| Total Mulatos | 12,610 | 1.28 | 520 | 28,562 | 1.14 | 1,043 | 41,172 | 1.18 | 1,563 |

| MacLellan | 11,604 | 1.89 | 705 | 11,650 | 1.34 | 500 | 23,254 | 1.61 | 1,206 |

| Gordon | 2,311 | 2.82 | 210 | 6,412 | 2.27 | 468 | 8,723 | 2.42 | 678 |

| Total Lynn Lake | 13,916 | 2.05 | 915 | 18,061 | 1.67 | 968 | 31,977 | 1.83 | 1,884 |

| Agi Dagi | 1,450 | 0.76 | 36 | 52,911 | 0.66 | 1,130 | 54,361 | 0.67 | 1,166 |

| Kirazli | 670 | 1.15 | 25 | 33,191 | 0.68 | 727 | 33,861 | 0.69 | 752 |

| Total Turkey | 2,120 | 0.89 | 61 | 86,102 | 0.67 | 1,857 | 88,222 | 0.68 | 1,918 |

| Alamos - Total | 48,525 | 2.22 | 3,469 | 154,200 | 1.26 | 6,257 | 202,724 | 1.49 | 9,726 |

| PROVEN AND PROBABLE SILVER MINERAL RESERVES (as at December 31, 2019) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 0 | 0.00 | 0 |

| La Yaqui Grande | 0 | 0.00 | 0 | 19,205 | 15.88 | 9,805 | 19,205 | 15.88 | 9,805 |

| Cerro Pelon | 942 | 18.22 | 552 | 1,688 | 17.33 | 941 | 2,630 | 17.65 | 1,492 |

| MacLellan | 11,604 | 4.94 | 1,844 | 11,650 | 3.93 | 1,471 | 23,254 | 4.43 | 3,315 |

| Ağı Dağı | 1,450 | 6.22 | 290 | 52,911 | 5.39 | 9,169 | 54,361 | 5.41 | 9,459 |

| Kirazli | 670 | 16.94 | 365 | 33,191 | 9.27 | 9,892 | 33,861 | 9.42 | 10,257 |

| Alamos - Total | 14,666 | 6.47 | 3,051 | 118,645 | 8.20 | 31,278 | 133,311 | 8.01 | 34,328 |

Table 2: Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios

as of December 31, 2019

| Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios as of December 31, 2019 | |

| Project | Waste-to-Ore Ratio |

| Mulatos Mine | 2.55 |

| Cerro Pelon Pit | 2.08 |

| La Yaqui Grande Pit | 5.50 |

| Ağı Dağı Pits | 1.03 |

| Kirazlı Pit | 1.45 |

| Lynn Lake Pits | 7.59 |

Table 3: Total Measured and Indicated Mineral Resources as of December 31, 2019

| MEASURED AND INDICATED GOLD MINERAL RESOURCES (as at December 31, 2019) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Young-Davidson - Surface | 496 | 1.13 | 18 | 1,242 | 1.28 | 51 | 1,739 | 1.24 | 69 |

| Young-Davidson - Underground | 5,456 | 4.23 | 742 | 4,079 | 2.95 | 386 | 9,535 | 3.68 | 1,128 |

| Total Young-Davidson | 5,952 | 3.97 | 760 | 5,321 | 2.56 | 438 | 11,273 | 3.30 | 1,197 |

| Island Gold | 25 | 4.52 | 4 | 853 | 6.57 | 180 | 879 | 6.51 | 184 |

| Mulatos | 8,207 | 1.25 | 329 | 63,112 | 1.08 | 2,189 | 71,319 | 1.10 | 2,518 |

| La Yaqui Grande | 0 | 0.00 | 0 | 1,321 | 1.02 | 43 | 1,321 | 1.01 | 43 |

| Cerro Pelon | 60 | 1.65 | 3 | 183 | 1.29 | 8 | 243 | 1.41 | 11 |

| Carricito | 58 | 0.82 | 2 | 1,297 | 0.82 | 34 | 1,355 | 0.83 | 36 |

| Total Mulatos | 8,325 | 1.25 | 334 | 65,913 | 1.07 | 2,274 | 74,238 | 1.09 | 2,608 |

| MacLellan - Open Pit | 1,986 | 1.65 | 105 | 4,700 | 1.46 | 221 | 6,686 | 1.52 | 326 |

| MacLellan - Underground | 0 | 0.00 | 0 | 843 | 4.52 | 122 | 843 | 4.52 | 122 |

| Gordon | 9 | 1.72 | 0 | 451 | 1.96 | 28 | 460 | 1.95 | 29 |

| Burnt Timber | 0 | 0.00 | 0 | 1,021 | 1.40 | 46 | 1,021 | 1.40 | 46 |

| Linkwood | 0 | 0.00 | 0 | 984 | 1.16 | 37 | 984 | 1.17 | 37 |

| Total Lynn Lake | 1,994 | 1.65 | 106 | 7,999 | 1.77 | 455 | 9,993 | 1.74 | 560 |

| Esperanza | 19,226 | 1.01 | 622 | 15,126 | 0.95 | 462 | 34,352 | 0.98 | 1,084 |

| Ağı Dağı | 553 | 0.44 | 8 | 34,334 | 0.46 | 510 | 34,887 | 0.46 | 518 |

| Kirazli | 0 | 0.00 | 0 | 3,056 | 0.42 | 42 | 3,056 | 0.43 | 42 |

| Çamyurt | 513 | 1.00 | 16 | 17,208 | 0.89 | 492 | 17,721 | 0.89 | 508 |

| Total Turkey | 1,066 | 0.70 | 24 | 54,598 | 0.59 | 1,044 | 55,664 | 0.60 | 1,068 |

| Quartz Mountain | 214 | 0.95 | 7 | 11,942 | 0.87 | 333 | 12,156 | 0.87 | 339 |

| Alamos - Total | 36,803 | 1.57 | 1,856 | 161,752 | 1.00 | 5,185 | 198,555 | 1.10 | 7,041 |

| MEASURED AND INDICATED SILVER MINERAL RESOURCES (as at December 31, 2019) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | 0 | 0.00 | 0 | 1,321 | 8 | 340 | 1,321 | 8 | 340 |

| Cerro Pelon | 60 | 18.80 | 36 | 183 | 17 | 101 | 243 | 18 | 137 |

| MacLellan - Open Pit | 1,986 | 3.66 | 234 | 4,700 | 3.65 | 551 | 6,686 | 3.65 | 785 |

| MacLellan - Underground | 0 | 0.00 | 0 | 843 | 5.98 | 162 | 843 | 5.98 | 162 |

| Esperanza | 19,226 | 7.25 | 4,482 | 15,126 | 9.16 | 4,455 | 34,352 | 8.09 | 8,936 |

| Ağı Dağı | 553 | 1.59 | 28 | 34,334 | 2.19 | 2,417 | 34,887 | 2.18 | 2,445 |

| Kirazli | 0 | 0.00 | 0 | 3,056 | 2.71 | 266 | 3,056 | 2.71 | 266 |

| Çamyurt | 513 | 5.63 | 93 | 17,208 | 6.15 | 3,404 | 17,721 | 6.14 | 3,497 |

| Alamos - Total | 22,338 | 6.78 | 4,873 | 76,771 | 4.74 | 11,696 | 99,108 | 5.20 | 16,569 |

Table 4: Total Inferred Mineral Resources as of December 31, 2019

| INFERRED GOLD MINERAL RESOURCES (as at December 31, 2019) | |||

| Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | |

| Young-Davidson - Surface | 31 | 0.99 | 1 |

| Young-Davidson - Underground | 1,329 | 2.43 | 104 |

| Total Young-Davidson | 1,360 | 2.40 | 105 |

| Island Gold | 5,392 | 13.26 | 2,298 |

| Mulatos | 8,122 | 0.92 | 239 |

| La Yaqui Grande | 241 | 0.88 | 7 |

| Cerro Pelon | 37 | 0.62 | 1 |

| Carricito | 900 | 0.74 | 22 |

| Total Mulatos | 9,300 | 0.90 | 269 |

| MacLellan - Open Pit | 1,292 | 1.36 | 56 |

| MacLellan - Underground | 116 | 3.82 | 14 |

| Gordon | 615 | 1.30 | 29 |

| Burnt Timber | 23,438 | 1.04 | 781 |

| Linkwood | 21,004 | 1.16 | 783 |

| Total Lynn Lake | 46,466 | 1.11 | 1,663 |

| Esperanza | 718 | 0.80 | 18 |

| Ağı Dağı | 16,760 | 0.46 | 245 |

| Kirazli | 7,694 | 0.61 | 152 |

| Çamyurt | 2,791 | 0.95 | 85 |

| Total Turkey | 27,245 | 0.55 | 482 |

| Quartz Mountain | 39,205 | 0.91 | 1,147 |

| Alamos - Total | 129,686 | 1.43 | 5,982 |

| INFERRED SILVER MINERAL RESOURCES (as at December 31, 2019) | |||

| Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | 241 | 4.03 | 31 |

| Cerro Pelon | 37 | 3.66 | 4 |

| MacLellan - Open Pit | 1,292 | 2.43 | 101 |

| MacLellan - Underground | 116 | 3.13 | 12 |

| Esperanza | 718 | 15.04 | 347 |

| Ağı Dağı | 16,760 | 2.85 | 1,536 |

| Kirazli | 7,694 | 8.71 | 2,155 |

| Çamyurt | 2,791 | 5.77 | 518 |

| Alamos - Total | 29,649 | 4.93 | 4,704 |

Notes to Mineral Reserve and Resource Tables:

- The Company’s Mineral Reserves and Mineral Resources as at December 31, 2019 are classified in accordance with the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves, Definition and Guidelines” as per Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Reserve cut-off grade for the Mulatos Mine, the Cerro Pelon Pit, the La Yaqui Pit, the Kirazlı Pit and the Ağı Dağı Pit are determined as a net of process value of $0.10 per tonne for each model block

- All Measured, Indicated and Inferred open pit Mineral Resources are pit constrained with the exception of those outside the Mulatos Main Pits on the Mulatos property which have no economic restrictions and are tabulated by gold cut-off grade.

- Mineral Reserve estimates assumed a gold price of $1,250 per ounce and Mineral Resource estimates assumed a gold price of $1,400 per ounce. Metal prices, cut-off grades and metallurgical recoveries are set out in the table below.

| Mineral Resources | Mineral Reserves | ||||||

| Gold Price | Cut-off | Gold Price | Cut-off | Met Recovery | |||

| Mulatos: | |||||||

| Mulatos Main Open Pit | $1,400 | 0.5 | $1,250 | see notes | >50% | ||

| Cerro Pelon | $1,400 | 0.3 | $1,250 | see notes | 75% | ||

| La Yaqui Grande | $1,400 | 0.3 | $1,250 | see notes | 75% | ||

| Carricito | $1,400 | 0.3 | n/a | n/a | n/a | ||

| Young-Davidson - Surface | $1,400 | 0.5 | $1,250 | 0.5 | 91% | ||

| Young-Davidson - Underground | $1,400 | 1.3 | $1,250 | 1.9 | 91% | ||

| Island Gold | $1,400 | 4.0 | $1,250 | 2.82-4.89 | 96.5% | ||

| Lynn Lake - MacLellan | $1,400 | 0.42 | $1,250 | 0.47 | 91-92% | ||

| Lynn Lake - MacLellan Underground | $1,400 | 2.0 | n/a | n/a | n/a | ||

| Lynn Lake - Gordon | $1,400 | 0.62 | $1,250 | 0.69 | 89-94% | ||

| Esperanza | $1,400 | 0.4 | n/a | n/a | 60-72% | ||

| Ağı Dağı | $1,400 | 0.2 | $1,250 | see notes | 80% | ||

| Kirazlı | $1,400 | 0.2 | $1,250 | see notes | 81% | ||

| Çamyurt | $1,400 | 0.2 | n/a | n/a | 78% | ||

| Quartz Mountain | $1,400 | 0.21 Oxide, 0.6 Sulfide | n/a | n/a | 65-80% | ||

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a6dfb26-8bd3-4cde-af17-d040114229db

https://www.globenewswire.com/NewsRoom/AttachmentNg/fadfb99f-bf40-4da9-bf90-2a5094467daf