Alba Enters into Definitive Agreement for Torado Vanadium and Uranium Project: 100% Interest in 5 Prospective Vanadium and Uranium Properties with Historic Production and a 6th Option for a Property with a Known Historic Resource

VANCOUVER, BC / ACCESSWIRE / May 7, 2019 / Alba Minerals Ltd. ("Alba") (TSX - Venture: AA / Frankfurt: A117RU / OTC: AXVEF is pleased to announce that it has entered into an agreement with Journey Exploration Inc. ("Journey"), a private arms' length company, to acquire all of the issued and outstanding share capital of Journey. Journey holds a 100% interest in 5 prospective vanadium and uranium properties in Colorado and Utah in addition to an option to acquire 100% of a 6th property with a known historic resource. The properties are in and adjacent to the Uravan Mineral Belt which has seen extensive prospecting, exploration, drilling for and production of vanadium, uranium and radium since 1881.

The following is an overview of the assets that will be acquired by Alba upon completion of the transaction with Journey.

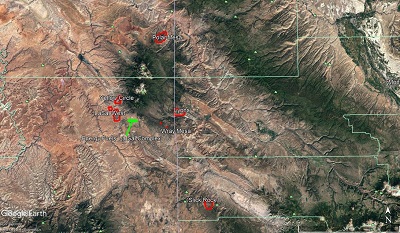

Figure 1 - Satellite view of locations of the 6 vanadium-uranium properties transferred by the agreement.

La Sal West Property

The La Sal West Property is comprised of 176 vanadium and uranium claims (3636.16 acres or 1472 hectares) located in the La Sal District of San Juan County, Utah approximately 20 miles (32km) southeast of Moab, Utah. The property is near the junction of US Highway 191 and Utah Highway 46 and can be easily accessed via dirt roads and 4-wheel drive trails leading off the highways. The La Sal West Property has seen considerable exploration and development over the years.

Lyons Property

The Lyons Property is comprised of 144 vanadium and uranium claims (2975.04 acres or (1204 hectares) located in the La Sal Creek Mining District of Montrose County, Colorado and abuts the Utah-Colorado border. The claims are adjacent to Colorado Highway 90, which is an extension of Utah Highway 46. The property is accessible by 4-wheel drives off the highway. Nine mines are shown within the Lyons claim block on the geologic map of the La Sal Quadrangle*.

Polar Mesa Property

The Polar Mesa Property is comprised of 181 vanadium and uranium claims (3,739.46 acres or 1513 hectares) located in the Gateway West Mining District of Grand County, Utah which lie north of the La Sal mountains. The Polar Mesa Property has seen extensive exploration and development over the years, of which, the estimated production from the Polar Mesa Camp to 1945 was reported to be 10,060 tons of ore at an estimated grade of 3.24% V2O5 and 0.46% U3O8 for a ratio of 1:7 of U3O8 to V2O5**.

Slick Rock Property

The Slick Rock Property is comprised of 158 vanadium and uranium claims (2604.28 acres or 1054 hectares) located in the Slick Rock Mining District of San Miguel County, Colorado. The claims occupy an area of undulating topography on a mesa that is covered in the most part by open grassy areas and scattered short scrubby trees. Elevation ranges from 7,000ft in the north to 8,080ft (2,130m - 2,460m) in the south eastern corner of the claim group. The area is readily accessible by roads, tracks and drill trails established by previous miners and explorers of the Spud Patch Group of Mines. Production from the Spud Patch area between 1940 and 1951 is reported to have been 24,000 tons at a grade of 2.2% V2O5 and 0.21% U3O8.

Yellow Circle Property

The Yellow Circle Property is comprised of 96 vanadium and uranium claims (2045.34 acres or 828 hectares) located in the Yellow Circle Mining District of San Juan County, Utah. Total production from the Yellow Circle Property is unknown, but in 1943 the mines were credited with 1,624 tons of ore averaging 1.65% V2O5***. During the Atomic Energy Commission's purchase program, 1948-70 inclusive, the Yellow Circle Mines produced 43,070 tons of ore that averaged 0.28% U3O8 and 1.52% V2O5****.

Wray Mesa Property

The Wray Mesa Property consists or two project areas, the Ajax and Dylan Projects, in the La Sal Trend of southeast Utah and southwest Colorado. The Ajax and Dylan are both located on the Utah side. Both projects have historic resource calculations conducted by Homeland Uranium, Inc. in 2007. At that time Homeland was focused on the uranium mineralization due to its higher value. They calculated the resource values listed in Table 1.

Table 1 - Homeland Uranium Inc. historic resource estimates.

Deposit | Measured Resource | Indicated Resource | Inferred Resource |

| Dylan | 85,501 | 211,713 | - |

| Ajax | 38,207 | 57,178 | 40,456 |

As with other deposits in the region, these deposits also carry strong vanadium values with ratios ranging from 4:1 to 14:1 V2O5:U3O8 and averaging 6:1 for deposits in the La Sal Quadrangle (Carter and Gualtieri, 1965).

The above values are presented here as documentation of a historical estimate for the Wray Mesa property. It is believed that these resource figures were created in 2007 by competent practitioners and are considered accurate for the timeframe in which they were created but have not been verified. There is insufficient information for the Qualified Person to classify these historical estimates as a resource under current CIM mineral resource standards and Alba is not treating them as current mineral resources.

Figure 2 - One of many accessible adits on the Yellow Circle claims.

Together, the properties total 762 mining claims covering approximately 15,697 acres (6352 hectares). All six of the properties have undergone historical exploration, development and/or production of vanadium and uranium.

Figure 3 - Vanadium mineralization (dark grey to black coloration) in one of the Yellow Circle underground workings.

These five properties (with option to acquire the 6th, Wray Mesa Property) are collectively referred to as the Torado Vanadium & Uranium Project. which are located in the vicinity of Energy Fuels Inc. Energy Fuels is currently producing a high-purity vanadium product at commercial rates from the tailings pond solutions at its 100%-owned White Mesa Mill (the "Mill"). The Mill is located within trucking distance of the Properties. Furthermore, Energy Fuels is currently considering going back into full production at the La Sal Complex where they are undergoing a test-mining program to recover vanadium, as further detailed in their release dated April 1, 2019 and available through SEDAR.

"Alba's mission to become a global player in the Green Energy revolution has been significantly advanced by this acquisition. The procurement of this high-profile portfolio of properties, all with historical workings, mines, excellent infrastructure and significant data is exceedingly rare and makes Alba a major force in the vanadium/uranium exploration, development and production space in Utah and Colorado. This acquisition complements Alba's existing portfolio of lithium properties as well as our significant investment in Noram's 143 million ton lithium resource in Clayton Valley, Nevada" stated Sandy MacDougall, Chairman and Director.

Journey is presently comprised of 32,000,000 shares issued and outstanding. Pursuant to the share exchange agreement dated May 6, 2019, Alba will acquire all of the issued and outstanding shares of Journey, thereby making Journey its wholly owned subsidiary, in consideration for which, Alba will issue the equivalent number of shares of Alba to the shareholders of Journey, subject to TSX Venture Exchange approval

This transaction remains subject to TSX Venture Exchange approval.

*Carter and Gualtieri, 1965

** Atomic Energy Commission, 1951

*** Huleatt, et al. 1946

**** Chenowith 1983

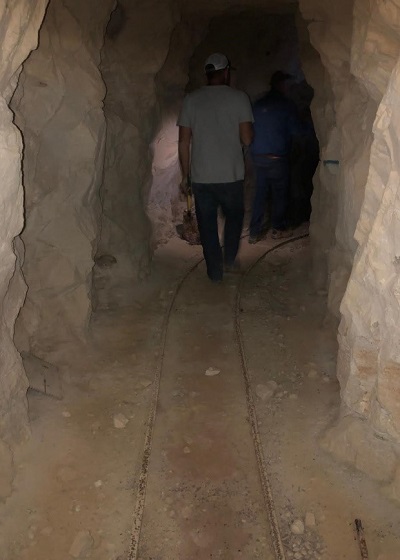

Figure 4.- example of historic cart tracks inside mines.

Figure 5 - example of infrastructure & workings inside mines

The technical information contained in this news release has been reviewed and approved by Bradley C. Peek, MSc and Certified Professional Geologist, who is a Qualified Person with respect to the Torado Vanadium & Uranium Project as defined under National Instrument 43-101.

About Alba Minerals Ltd.

Alba Minerals Ltd. is a Vancouver-based junior resource company with projects in North and South America. Alba is focused on the development of the following mineral properties:

3,800,000 common share ownership interest in Noram Ventures Ltd., a lithium exploration and development Company with a principal property known as the Zeus Property which hosts a 146,000,000 ton inferred resource in Clayton Valley, Nevada.

The Quiron II Lithium Property consists of 2,421 hectares of prospective lithium exploration in the Pocitos Salar, Province of Salta, Argentina. The Property is located approximately 12 km northeast from the Liberty One Lithium Corp and 19 km from Pure Energy Minerals Ltd.'s Pocitos prospects.

The Chascha Norte property consists of 2,843 hectares of prospective lithium exploration in the Southeastern part of the Salar de Arizaro, Salta, Argentina in closest vicinity to Argentina Lithium & Energy Corporation's and Lithium X's Arizaro lithium brine projects.

The Rainbow Canyon Gold Property consists of 417 hectares of prospective gold exploration in the Olinghouse mining district, in the Washoe County Nevada.

The Muddy Mountain property consists of 450.41 hectares of prospective lithium exploration in Muddy Mountains of Clark County, Nevada.

Please visit our web site for further information:www.albamineralsltd.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Sandy MacDougall"

Chairman & Director

Phone: (778) 999-2159

This news release contains projections and forward - looking information that involve various risks and uncertainties regarding future events. Such forward - looking information can include without limitation statements based on current expectations involving a number of risks and uncertainties and are not guarantees of future performance of the Company. The following are important factors that could cause the Company's actual results to differ materially from those expressed or implied by such forward looking statements; the uncertainty of future profitability; and the uncertainty of access to additional capital. These risks and uncertainties could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information. Actual results and future events could differ materially from anticipated in such information. These and all subsequent written and oral forward- looking information are based on estimates and opinions of management on the dates they are made and expressed qualified in their entirety by this notice. The Company assumes no obligation to update forward-looking information should circumstance or management's estimates or opinions change.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Alba Minerals Ltd.