Alianza Minerals and Cloudbreak Discovery Complete Option of the Klondike Property, Colorado, to Allied Copper

(TheNewswire)

Vancouver, BC – TheNewswire - February 3, 2022 - Alianza Minerals Ltd. (“Alianza”) (TSXV:ANZ) (OTC:TARSF) and Cloudbreak Discovery Plc (“Cloudbreak”) (LSE: CDL) (the “Alliance”) are pleased to announce that further to its press release of December 7, 2021, and pursuant to an option agreement (the “Option Agreement”) dated December 3, 2021 between Cloudbreak Discovery PLC (“Cloudbreak”), Cloudbreak Discovery (Canada) Ltd. (“Cloudbreak Subco”), Tarsis Resources US Inc. (“Tarsis”) and Alianza Minerals Ltd. (“Alianza” together with Cloudbreak Subco and Tarsis, the “Optionors”), as amended February 1, 2022, Allied Copper Corp. (“Allied”) (TSX-V: CPR) was granted an option (the “Option”) to acquire the Klondike Property (“Klondike”), located in Colorado, United States. The Klondike Property consists of 76 unpatented mining claims, a State of Colorado Exploration Permit and an exclusive right to a State lease.

Under the terms of the Option Agreement, Allied may exercise the Option to acquire a 100% interest in Klondike in exchange for:

-

Incurring an aggregate of $4,750,000 in exploration expenditures on Klondike over a period of four years, with at least $500,000 to be spent prior to the first anniversary of the closing date;

-

Making an aggregate of $400,000 in cash payments to Cloudbreak Subco and Alianza in accordance with their pro rata interest over a period of four years;

-

Issue an aggregate of 7,000,000 common shares (the Common Shares”) in the capital of Allied to Cloudbreak Subco and Alianza in accordance with their pro rata interest prior to the second anniversary of the closing of the transaction (the “Closing Date”);

-

Issue an aggregate of 3,000,000 Common Share purchase warrants (the Option Warrants”) to Cloudbreak Subco and Alianza in accordance with their pro rata interest, on the third anniversary of the date of the Option Agreement. Each Option Warrant entitles the holder thereof to acquire one Common Share for a period of three years from the date of issuance of such Option Warrant at an exercise price of the greater of: (i) $0.23; and (ii) the 10-day volume weighted average sale price (the “VWAP”) of the Common Shares in such date or during the applicable time period on the principal securities exchange on which such shares are then listed. The VWAP per share shall be determined by dividing the aggregate sale price of all common shares traded on such stock exchange or marker, as the case may be, during such ten consecutive trading days by the total number of Common Shares so traded;

-

In the event that the Option is exercised Allied will grant a 2% net smelter returns royalty (NSR”) in favour of the Optionors, subject to the ability of Allied to purchase 1% of the NSR (resulting in the remaining NSR being 1%) for a purchase price of $1,500,000 within 30 days of commercial production on Klondike.

-

In the event that Allied files on SEDAR an NI 43-101 technical report establishing the existence of a resource on any portion of Klondike of at least 50,000,000 tonnes of either copper or copper equivalent at a minimum cut-off grade of 0.50% copper or copper equivalent and categorized as a combination of inferred resources, indicated resources and measured resources, then Allied will also issue a further 3,000,000 Common Share purchase warrants (the Additional Warrants”) to Cloudbreak Subco and Alianza in accordance with their pro rata interest exercisable for a three year term at a price to the greater of (i) $0.23; and (ii) the 10-day volume weighted average sale price (the “VWAP”).

About the Klondike Property

The Klondike Property is located approximately 25 kilometres south of Naturita, Colorado. This property lies within the Paradox Copper Belt, which includes the producing Lisbon Valley Mining Complex. Numerous historical copper occurrences have been identified throughout the district, however, many of these have not been explored using modern exploration techniques.

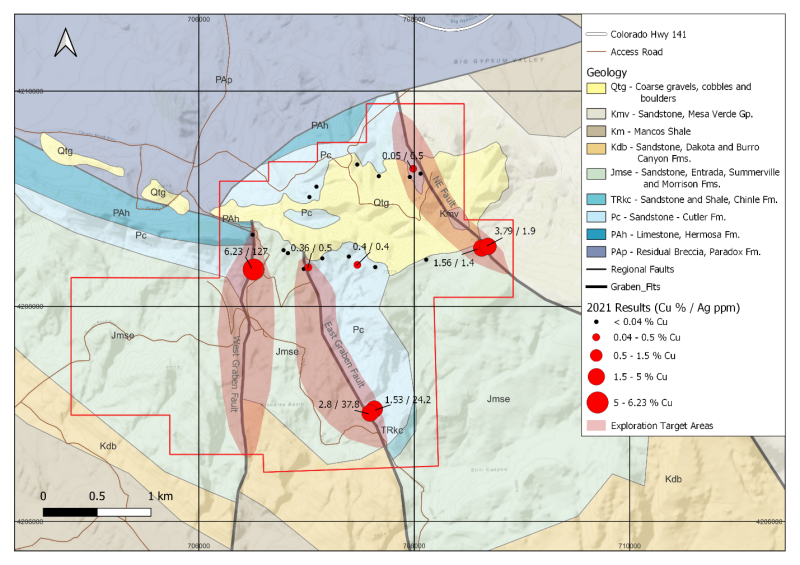

A recent reconnaissance program (see news release dated December 1, 2021) consisting of mapping, stream sediment sampling and rock sampling was undertaken at the Klondike Property to help define drill targets at the West Graben Fault and East Graben Fault targets. Rock sampling and mapping successfully expanded the footprint of both targets and identified a new target named the Northeast Fault. Sampling at the Northeast Fault returned 1.56% copper and 1.4 grams per tonne (“g/t”) silver over a 4.6 metre chip sample of bleached, bitumen spotted and altered Jurassic sandstones of the Saltwash member of the Morrison Formation.

Copper mineralized sandstones at the Northeast Fault target can be traced along the fault and outboard from it into the adjacent sandstones over an area 200 metres long by 100 metres wide before becoming obscured beneath gravel cover. Further anomalous copper, including 2.1 metres of 463 ppm copper, was encountered over one kilometre to the northwest where the structure and host strata next appear from beneath the same gravel cover.

At Klondike, documented copper exploration ceased in the 1960s with subsequent exploration targeting uranium the 1970s. Previous workers reported high-grade copper mineralization highlighted by results of 6.3% copper and 23.3 g/t silver in outcrop. In addition to its high-grade potential, disseminated copper-silver mineralization has been observed which may be amenable to modern open pit mining with Solvent Extraction Electro Winning (“SXEW”) processing similar to the Lisbon Valley Mining Complex. Sedimentary hosted copper deposits are an important contributor to world copper production, accounting for more than 20% of the world’s copper supply annually.

The project is road accessible year-round, traveling two kilometres of gravel road from paved highway. The project is comprised of 76 mining claims on Federal mineral rights managed by the BLM, in addition to an Exploration Permit and an exclusive right to a State lease from the State of Colorado.

Figure 1. Klondike Geology and Copper Results Map

About the Strategic Alliance

Under the terms of the Alliance, either Cloudbreak Discovery Plc or Alianza Minerals Ltd can introduce projects to the Alliance. Projects accepted into the Alliance will be held 50/50 but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party. Project expenditures are determined by committee, consisting of two senior management personnel from each party. Alianza is the operator of Alliance projects unless the Alliance steering committee determines, on a case-by-case basis, that Cloudbreak would be a more suitable operator. The initial term of the Alliance runs for two years and may be extended for an additional two years.

About Cloudbreak Discovery PLC

Cloudbreak Discovery PLC, is a leading natural resource project generator, working across a wide array of mineral assets that are being developed and managed by an experienced team with a proven track record. Value accretion within the projects being developed by Cloudbreak’s generative model enables a multi-asset approach to investing and exploration. Diversification within the mining sector and amongst resource classes is key to withstanding the cycles of natural resource investing.

About Allied Copper Corp.

Allied Copper Corp. is headquartered in Vancouver, BC Canada is a mineral exploration company focused on acquiring and developing potential long life, scalable copper-gold assets in the Western United States. The Company’s strategy is to focus on low cost and potential high growth operations in low-risk jurisdictions. Allied Copper’s management is committed to operating efficiently and with transparency in all areas of the business.

About Alianza Minerals Ltd.

Alianza employs a hybrid business model of joint venture funding and self-funded projects to maximize opportunity for exploration success. The Company currently has gold, silver and base metal projects in Yukon Territory, British Columbia, Colorado, Nevada and Peru. Alianza currently has one project (Tim, Yukon Territory) optioned out to Coeur Mining, Inc. and is actively seeking partners on other projects.

Alianza is listed on the TSX Venture Exchange under the symbol “ANZ” and trades on the OTCQB market in the US under the symbol “TARSF”.

Mr. Jason Weber, P.Geo., President and CEO of Alianza Minerals Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release.

For further information, contact:

|

Jason Weber, President and CEO Sandrine Lam, Shareholder Communications Tel: (604) 807-7217 Fax: (888) 889-4874 Renmark Financial Communications Inc. Scott Logan slogan@renmarkfinancial.com Tel: (416) 644-2020 or (212) 812-7680 To learn more visit: www.alianzaminerals.com |

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

Copyright (c) 2022 TheNewswire - All rights reserved.