Amarillo regional exploration indicates potential for satellite gold deposits at Mara Rosa

TORONTO, May 05, 2020 (GLOBE NEWSWIRE) -- A recently completed regional exploration program at Amarillo Gold Corporation’s (Amarillo or the Company) (TSXV: AGC, OTCQB: AGCBF) Mara Rosa Property shows potential to find near-surface gold deposits along its Posse North Gold Trend in Goiás State, Brazil.

“Discovering mineralization up to four kilometres northeast of the Posse Gold Deposit is very encouraging,” said Mike Mutchler, Amarillo’s Chief Executive Officer. “Posse remains open at depth to the southwest, and these mineralized targets to the northeast give us additional opportunities to expand the resources at Mara Rosa.”

Sixteen holes totalling 3,021 metres were drilled between November 2019 and February 2020, testing three priority targets along a 4.5-kilometre portion of the Posse North Trend: Araras, Speti 24, and Pastinho. Here are the key findings.

- All three exploration targets intersected elevated gold values in multiple intervals, implying that the gold system that hosts the Posse Gold Deposit is regional in scope. Highlights include:

- Araras — near-surface mineralization over widths like 7 metres grading 1.22 g/t gold in hole 19P097

- Speti 24 — encouraging intercepts like 2.5 metres grading 1.20 g/t gold in hole 20P103 and 7.5 metres grading 0.77 g/t gold in hole 20P101

- Pastinho — 1 metre grading 10 g/t in hole 20P108 and 8.0 metres grading 0.83 g/t gold (including 4.0 metres grading 1.15 g/t gold) in hole 90P109.

- Drilling at the Pastinho target has potentially extended the strike extent of the known gold mineralization six-fold, even as the target remains open along strike and ripe for future exploration. Pastinho is located on 6,000 hectares of new exploration tenements that Amarillo gained access to in December 2019. A previous operator defined a near-surface zone of gold mineralization of approximately 150 metres, while the results of the recent drilling are interpreted to have possibly increased the strike extent to 900 metres. Previous drill results included intercepts of 9.0 metres grading 0.79 g/t gold in hole LMR006A and 18.7 metres grading 0.87 g/t gold in hole LMR007A.

- Exploration potential on the Posse North Trend is prospective. The style and nature of its gold mineralization is extensive and similar in style to the gold mineralization found at the Posse Gold Deposit. The gold deposits at Araras, Speti 24, and Pastinho are structurally controlled and typically associated with biotite, sericite, carbonate, and quartz flooding usually with 1-2% disseminated pyrite, further suggesting a similar style and origin of mineralization to the Posse Gold Deposit.

The exploration program in detail

Purpose of program

The purpose of the program was to demonstrate that substantial exploration potential exists for finding near-surface gold deposits along the main Posse North Gold Trend and to drill-test three priority exploration targets.

Background and previous work

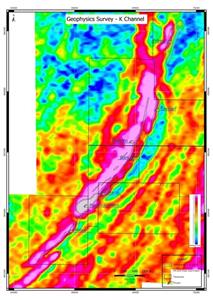

A previous radiometric survey has defined a strong regional-scale 10-kilometre long potassium anomaly that overlies the main northeast trending Posse structural corridor (see Figure 1). The potassium anomaly suggests underlying host rocks are hydrothermally altered, which is consistent with observations found at the Posse Gold Deposit. Posse has 1.1 million ounces of proven and probable gold reserves (see About Amarillo section on page 13 for details) and occurs in the southwest portion of the anomaly.

To view Figure 1: Location of Araras, Speti 24, and Pastinho drill targets relative to the Posse Gold Mining Project and to potassium radiometric and surface soil anomalies, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1320c571-8d95-4b60-b438-2d5959d8208e

Gold mineralization at Posse is typically associated with potassium-bearing alteration minerals including biotite and sericite combined with carbonate and quartz/silica flooding and 1-2% disseminated pyrite.

The regional exploration potential of the Posse North Gold Trend is demonstrated by drill holes completed by a previous operator at the Pastinho target that defined a near-surface zone of gold mineralization over a strike length of approximately 150 metres.

Historical drilling included:

- Hole LMR006A intersected 9.0 metres grading 0.79 g/t gold (including 5.0 metres grading 1.06 g/t gold). It was oriented with an azimuth of 106.9 degrees and dip of -50 degrees.

- Hole LMR007 intersected 18.7 metres grading 0.87 g/t gold (including 4.9 metres grading 2.05 g/t gold). It was oriented with an azimuth of 109.1 degrees and a dip of -50 degrees.

Note: historical results have not been independently verified by Amarillo, though the drill core has been inspected visually, and the previous operator’s drill logs have been reviewed. True widths are interpreted to be the same as mineralized intersections as the holes were drilled perpendicular to the dip of rock units.

How the targets were identified

The priority exploration targets were Araras, Speti 24, and Pastinho. They were identified by integrating surface geological mapping with the results from:

- historical exploration drilling

- soil geochemical anomalies greater than 100 ppb gold

- surface channel and rock sampling with grades higher than 0.5 ppm gold

- results from an aerial-drone magnetic survey that defined favourable structural settings.

Coincident soil geochemistry and geophysical anomalies guided the selection of favourable exploration targets for drilling.

Araras

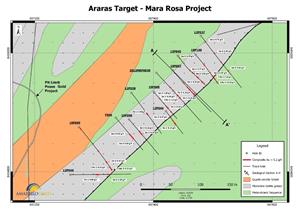

The Araras target is defined by a 500-metre-long northeast trending soil anomaly located slightly east of the main Posse Gold Deposit within the footwall amphibolite rocks.

The most recent program consisted of five diamond drill holes totalling 760.11 metres testing the zone throughout its strike length. The program was designed to follow up from encouraging drilling results generated in a 2012 program.

To view Figure 2: Plan view of Araras drill holes and gold intercepts, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ea4a727c-1564-4c16-8636-3016cb47a6c8

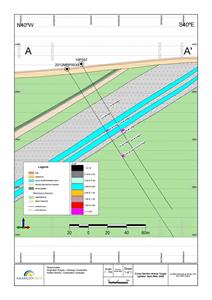

Figure 3 shows that the host rocks dip approximately 55 to 60 degrees northwest. Drill holes were collared in the hanging wall of the gold zone and drilled from northwest to southeast.

To view Figure 3: Northeast-facing cross-section of Araras, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cebd7e93-5505-4db2-910f-945f6b70ef8a

Table 1 summarizes drill results from the 2019-2020 exploration program with composite intervals above 0.2 g/t gold. Highlights include:

- hole 19P097 generated 7 metres grading 1.22 g/t gold from 81.0 to 88.0 metres

- hole 19P100 returned 2.5 metres grading 2.00 g/t gold from 100.0 to 102.5 metres.

For comparative purposes, Table 2 shows drilling results from the 2012 drilling program. Highlights include:

- hole 12P038 returned 5 metres over 3.02 g/t gold

- multiple gold intercepts in drill hole 12P045 including 2 metres grading 1.77 g/t gold and 4 metres grading 3.92 g/t gold.

Several holes intersected multiple sub-economic but anomalous gold tenors ranging from 1 metre grading 0.2 g/t gold to 4.1 metres grading 0.23 g/t gold. Zones of elevated gold mineralization are typically associated with areas of intense shearing and silica flooding with 1-2% disseminated pyrite. Typical alteration minerals include carbonate, biotite, and sericite.

The results suggest follow-up work is warranted to determine whether a higher-grade zone of mineralization can be located within this gold system/target.

Table 1: Summary of composite intervals grading more than 0.2 g/t gold cut-off in Araras drill target (2019-2020)

| Hole | Azimuth | Dip | From (metres) | To (metres) | Gold intervals in metres (m) | Estimated true width (metres) |

| 19P096 | 140 | -58 | 52.00 | 56.00 | 4 m at 0.22 g/t | 4.00 |

| 60.00 | 61.00 | 1 m at 0.75 g/t | 1.00 | |||

| 63.00 | 64.00 | 1 m at 0.26 g/t | 1.00 | |||

| 84.00 | 85.00 | 1 m at 0.31 g/t | 1.00 | |||

| 19P097 | 140 | -60 | 53.00 | 54.00 | 1 m at 0.42 g/t | 1.00 |

| 74.00 | 75.00 | 1 m at 0.69 g/t | 1.00 | |||

| 81.00 | 88.00 | 7 m at 1.22 g/t | 7.00 | |||

| 95.00 | 97.00 | 2 m at 0.20 g/t | 2.00 | |||

| 102.50 | 107.50 | 5 m at 0.41 g/t | 5.00 | |||

| 19P098 | 140 | -60 | 30.00 | 31.00 | 1 m at 0.20 g/t | 1.00 |

| 64.00 | 73.00 | 9 m at 0.25 g/t | 9.00 | |||

| 88.00 | 89.00 | 1 m at 0.24 g/t | 1.00 | |||

| 19P099 | 140 | -60 | 8.00 | 9.00 | 1 m at 0.48 g/t | 1.00 |

| 100.00 | 102.00 | 2 m at 0.26 g/t | 2.00 | |||

| 142.50 | 147.50 | 5 m at 0.47 g/t | 5.00 | |||

| 162.50 | 165.00 | 2.5 m at 0.42 g/t | 2.50 | |||

| 170.00 | 174.14 | 4.14 m at 0.23 g/t | 4.14 | |||

| 19P100 | 140 | -60 | 43.00 | 45.00 | 2 m at 0.27 g/t | 2.00 |

| 75.00 | 76.00 | 1 m at 0.20 g/t | 1.00 | |||

| 87.50 | 92.50 | 5 m at 0.47 g/t | 5.00 | |||

| 100.00 | 102.50 | 2.5 m at 2.00 g/t | 2.50 | |||

| 112.50 | 115.00 | 2.5 m at 0.43 g/t | 2.50 |

Table 2: Summary of composite intervals grading more than 0.2 g/t gold cut-off in Araras drill target (2012)

| Hole | Azimuth | Dip | From (metres) | To (metres) | Gold intervals in metres (m) | Estimated true width (metres) |

| 12P037 | 142 | -60 | 26.00 | 27.00 | 1 m at 0.71 g/t | 1.00 |

| 73.00 | 74.00 | 1 m at 0.43 g/t | 1.00 | |||

| 107.00 | 108.00 | 1 m at 0.33 g/t | 1.00 | |||

| 141.00 | 142.00 | 1 m at 0.42 g/t | 1.00 | |||

| 12P038 | 143 | -57 | 81.00 | 86.00 | 5 m at 3.02 g/t | 5.00 |

| 12P044 | 143 | -59 | 26.00 | 27.00 | 1 m at 0.22 g/t | 1.00 |

| 38.00 | 40.00 | 2 m at 0.47 g/t | 2.00 | |||

| 47.00 | 49.00 | 2 m at 0.32 g/t | 2.00 | |||

| 51.00 | 55.00 | 4 m at 0.22 g/t | 4.00 | |||

| 12P045 | 142 | -60 | 9.00 | 10.00 | 1 m at 2.35 g/t | 1.00 |

| 63.00 | 64.00 | 1 m at 0.28 g/t | 1.00 | |||

| 73.00 | 75.00 | 2 m at 1.77 g/t | 2.00 | |||

| 93.00 | 97.00 | 4 m at 3.92 g/t | 4.00 | |||

| 112.50 | 117.50 | 5 m at 0.35 g/t | 5.00 | |||

| 12P046 | 90 | -49 | 66.00 | 69.00 | 3 m at 0.34 g/t | 3.00 |

| 71.00 | 73.00 | 2 m at 1.28 g/t | 2.00 | |||

| 95.00 | 98.00 | 3 m at 0.68 g/t | 3.00 |

Speti 24

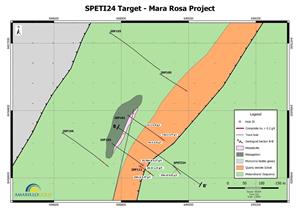

The Speti 24 target is located 2.2 kilometres northeast of the Posse Gold Deposit and interpreted to be hosted in the same northeast trending gold-bearing structure.

A surface soil gold anomaly has been defined over 400 metres of strike length along trend at Speti 24.

The diamond drill program totalled 1,256 metres and consisted of six drill holes.

To view Figure 4: Plan view of Speti 24 drill holes and gold intercepts, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e76cad04-3aa7-430e-afa4-4d4482c38dca

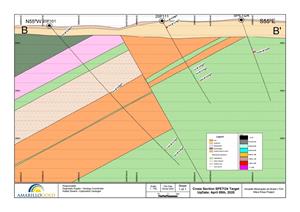

Figure 5 is a northeast facing cross section and shows the host rocks dip approximately 55 to 60 degrees to the northwest. Drill holes were collared in the hanging wall of the gold target and drilled from northwest to southeast.

Historical drill-testing of the target included drill hole Speti 24 that intersected 15 metres grading 0.62 g/t gold from 31.10 metres to 46.0 metres. This drill hole was oriented with an azimuth of 140 degrees and inclined at -70 degrees. The intersection width is estimated to be close to true width.

To view Figure 5: Northeast facing cross-section of Speti 24 target, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/00526dda-c4bb-4190-8ccb-caa24a27924b

Table 3 summarizes assay results that returned composite intervals grading more than a 0.2 g/t gold cut-off grade from the most recent drilling program.

Highlights of the drilling program include:

- hole 20P101 intersected 7.5 metres grading 0.77 g/t gold from 175.0 metres to 182.50 metres

- hole 20P103 returned 2.5 metres grading 1.20 g/t gold from 37.5 metres to 40.0 metres

- hole 20P111 generated 2 metres grading 1.14 g/t gold from 7.0 metres to 9.0 metres and 9 metres grading 0.47 g/t gold from 70 to 79 metres.

Multiple intervals of anomalous gold values were intersected within various drill holes over a strike-length of approximately 400 metres. The gold mineralization is characterized by strongly deformed and altered quartz-sericite schists hosting up to 1-2% disseminated pyrite.

Importantly, anomalous gold values bottomed in several holes and require follow-up work to better understand the nature and extent of this mineralization.

Table 3: Summary of Composite Intervals Grading More than 0.2 g/t gold cut-off in Speti 24 drill target (2019-20)

| Holes | Azimuth | Dip | From (metres) | To (metres) | Gold intervals in metres (m) | Estimated true width (metres) |

| 20P101 | 125 | -50 | 16.00 | 17.00 | 1 m at 0.20 g/t | 1.00 |

| 96.00 | 97.00 | 1 m at 0.29 g/t | 1.00 | |||

| 175.00 | 182.50 | 7.5 m at 0.77 g/t | 7.50 | |||

| 187.50 | 192.50 | 5 m at 0.42 g/t | 5.00 | |||

| 20P102 | 125 | -50 | 167.00 | 177.33 | 10.33 m at 0.27 g/t | 10.33 |

| 20P103 | 125 | -59 | 37.50 | 40.00 | 2.5 m at 1.20 g/t | 2.50 |

| 20P104 | 125 | -59 | 242.00 | 243.00 | 1 m at 0.26 g/t | 1.00 |

| 262.00 | 263.00 | 1 m at 0.28 g/t | 1.00 | |||

| 285.00 | 287.50 | 2.5 m at 0.23 g/t | 2.50 | |||

| 20P105 | 125 | -61 | 42.50 | 45.00 | 2.5 m at 0.30 g/t | 2.50 |

| 162.50 | 165.00 | 2.5 m at 0.38 g/t | 2.50 | |||

| 20P111 | 125 | -60 | 2.00 | 3.00 | 1 m at 0.24 g/t | 1.00 |

| 7.00 | 9.00 | 2 m at 1.14 g/t | 2.00 | |||

| 61.00 | 62.00 | 1 m at 0.22 g/t | 1.00 | |||

| 66.00 | 67.00 | 1 m at 0.41 g/t | 1.00 | |||

| 70.00 | 79.00 | 9 m at 0.47 g/t | 9.00 |

Pastinho

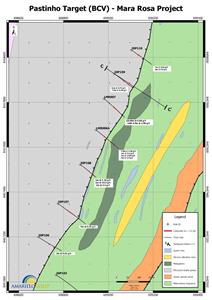

The Pastinho target is located about 3.5 kilometres northeast of the Posse Gold Project. The gold anomaly at Pastinho has a surface expression of about 1 kilometre.

Diamond drilling by a previous operator defined a near-surface gold zone over a strike length of 150 metres in two diamond drill holes:

- LMR006A returned an intercept of 9.0 metres grading 0.79 g/t gold, including 5.0 metres grading 1.06 g/t gold. It was oriented with an azimuth of 106.9 degrees and dip of -50 degrees.

- LMR007 intersected 18.7 metres grading 0.87 g/t gold, including 4.9 metres grading 2.05 g/t gold. It was oriented with an azimuth of 109.1 degrees and a dip of -50 degrees.

The purpose of Amarillo’s drilling program was to test and extend the strike length of this gold deposit.

To view Figure 6: Plan view of Pastinho drill holes and gold intercepts, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d771f62b-741d-4506-becc-5e98aeafe0fd

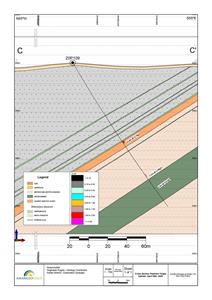

Figure 7 is a northeast facing cross-section and shows the rock units dip northwest approximately 55 to 60 degrees northwest. The drill holes were collared in the hanging wall to the gold zone and drilled from the northwest to the southeast.

To view Figure 7: Northeast facing cross-section of Pastinho, please visit the following link:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8b85cc9-0bd2-43fd-9a16-67d592619800

The recent drilling program completed by Amarillo Gold consisted of five diamond drill holes totalling 941.89 metres. Highlights of results from the drilling program are shown in Table 4 and include:

- hole 20P107 returned 9 metres grading 0.31 g/t gold

- hole 20P108 returned 1 metre grading 10 g/t gold and 2 metres grading 3.60 g/t gold

- hole 20P109 returned 8.0 metres grading 0.83 g/t gold, including 4 metres grading 1.15 g/t gold

- hole 20P110 returned 7.0 metres grading 0.64 g/t gold, including 5 metres grading 0.77 g/t gold.

Key conclusions from this drilling program include:

- The strike extent of the Pastinho gold zone is interpreted to have increased six-fold from 150 metres to 900 metres of strike length from drill hole 20P106 to 20P110

- Multiple narrow intercepts were generated in the southwestern portion of the Pastinho gold zone. The zone appears to thicken towards the northeast

- The gold zone remains open along strike and down-dip

- Follow-up exploration on this gold target is warranted.

Table 4: Summary of composite intervals grading more than 0.2 g/t gold cut-off at Pastinho drill target (2019-2020)

| Holes | Azimuth | Dip | From (metres) | To (metres) | Gold intervals in metres (m) | Estimated true width (metres) |

| 20P106 | 125 | -60 | 154.00 | 155.00 | 1 m at 0.22 g/t | 1.00 |

| 165.00 | 166.00 | 1 m at 0.62 g/t | 1.00 | |||

| 20P107 | 125 | -60 | 100.00 | 101.00 | 1 m at 0.22 g/t | 1.00 |

| 103.00 | 104.00 | 1 m at 0.24 g/t | 1.00 | |||

| 119.00 | 128.00 | 9 m at 0.31 g/t | 9.00 | |||

| 131.00 | 132.00 | 1 m at 0.62 g/t | 1.00 | |||

| 146.00 | 148.00 | 2 m at 0.26 g/t | 2.00 | |||

| 162.50 | 165.00 | 2.5 m at 0.35 g/t | 2.50 | |||

| 226.00 | 227.00 | 1 m at 0.57 g/t | 1.00 | |||

| 20P108 | 125 | -60 | 94.00 | 95.00 | 1 m at 1.26 g/t | 1.00 |

| 133.00 | 134.00 | 1 m at 10.00 g/t | 1.00 | |||

| 142.00 | 143.00 | 1 m at 0.38 g/t | 1.00 | |||

| 153.00 | 155.00 | 2 m at 3.60 g/t | 2.00 | |||

| 20P109 | 125 | -59 | 97.00 | 105.00 | 8 m at 0.83 g/t | 8.00 |

| 140.00 | 147.50 | 7.5 m at 0.49 g/t | 7.50 | |||

| 157.50 | 160.00 | 2.5 m at 0.21 g/t | 2.50 | |||

| 20P110 | 125 | -59 | 66.00 | 73.00 | 7 m at 0.64 g/t | 7.00 |

| 76.00 | 78.00 | 2 m at 0.90 g/t | 2.00 | |||

| 82.00 | 86.00 | 4 m at 0.25 g/t | 4.00 |

Summary and next steps

The Posse North Trend exploration program had two goals:

1 — determine whether the gold system that hosts the Posse Gold Deposit continues to the northeast along the Posse North structural trend

2 — drill-test three priority gold exploration targets with the goal of potentially defining a near-surface satellite economic gold deposit and therefore add to the mine life of the existing Posse Gold Project.

The Posse Gold Deposit is interpreted to be a Neoproterozoic structurally-controlled mesothermal gold system. The gold deposits found along the main Posse structure occur within a regionally extensive northeast trending fault structure that dips northwest. Regional northeast-trending faults formed during a period of northwest-southeast structural convergence. Hydrothermal alteration along the Posse Trend is extensive.

Results from drilling support that the gold system(s) along the Posse North Gold trend are similar in style and nature as the main Posse Gold Deposit. Therefore, the exploration potential along the gold trend remains promising.

Multiple intervals of elevated gold values were returned from all three targets tested — Araras, Speti 24 and Pastinho. Drilling results from the Pastinho deposit are noteworthy as the strike extent of the gold system has potentially been extended six-fold to about 900 metres. The deposit remains open along strike and down-dip and warrants follow-up work.

Future follow-up exploration work is planned along the Posse Trend. It may include on-going geological mapping and sampling, targeted gold soil surveys, airborne magnetic surveys, ground IP surveys, and the selection of priority gold targets for future drilling. A program of follow-up drilling is planned for the Speti 24 and Pastinho targets to better define the nature and extent of gold mineralization.

About Amarillo

Amarillo Gold Corporation (www.amarillogold.com) is developing an open pit gold resource at its Mara Rosa Property in the mining-friendly jurisdiction of Goiás State in Brazil. Mara Rosa includes the Posse Gold Deposit and Project, which has received the main permit giving it the social and environmental permission to mine and is working toward obtaining an installation permit.

An NI 43-101 Pre-Feasibility Study filed on SEDAR on September 13, 2018, estimates that Mara Rosa’s Posse Gold Deposit has total estimated reserves of 1,087,000 ounces of gold from 23.8 Mt at 1.42 g/t gold with:

- 513,000 ounces of gold in the Proven category from 9.6 Mt at 1.65 g/t gold

- 574,000 ounces of gold in the Probable category from 14.2 Mt at 1.26 g/t gold.

In addition to the Mara Rosa Property, Amarillo also has the Lavras do Sul Project, an advanced exploration stage property in Brazil with more than 22 prospects centered on historic gold workings. An NI 43-101 technical report filed on SEDAR on October 4, 2010, estimates an initial resource estimate at the Butia prospect of:

- 215,000 ounces of gold in the Indicated category from 6.4 Mt at 1.05 g/t gold

- 308,000 ounces of gold in the Inferred category from 12.9 Mt at 0.74 g/t gold.

Both the Mara Rosa and Lavras do Sul properties are in mining friendly states and have excellent nearby infrastructure.

Amarillo Gold Corporation trades on the TSXV under the symbol AGC, and on the OTCQB under the symbol AGCBF.

For further information, please contact

| Mike Mutchler President & CEO 416-294-0736 mike.mutchler@amarillogold.com | Annemarie Brissenden Investor Relations 416-844-6284 annemarie.brissenden@amarillogold.com |

Qualified Person

Michael Durose, P.Geo., Consulting Geologist for Amarillo Gold Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the scientific and technical information contained in this release.

Quality assurance and quality control

Sample handling, preparation and analysis are monitored through the implementation of formal chain-of-custody procedures and quality assurance/quality control programs designed to follow industry best practices.

All drillhole samples in this drilling program consist of split NQ diamond drill core.

Drillcore is logged and sampled in a secure facility located in Mara Rosa, Goiás State, Brazil. Drillcore samples for gold assay are cut in half using a diamond saw and submitted to ALS Laboratories Inc. in Goiania, Goiás State, Brazil for preparation by crushing to 70% passing 2.0 mm, riffle splitting to obtain 500 g aliquots, and pulverizing to 85% passing 75 microns.

Pulps are shipped to ALS Laboratories in Lima, Peru and analyzed by a 30 g fire assay and AAS finish. For assays above 10 ppm Au, a cut of the original pulp was re-assayed with a gravimetric finish.

Certified standards, non-certified blanks and field duplicates are inserted into the sample stream at regular intervals, so that QA/QC accounted for about 10% of the total samples. Results are routinely evaluated for accuracy, precision and contamination.

Forward-looking statements

This news release contains forward-looking statements regarding the Company’s current expectations regarding future events, including its business, operations and condition, and management’s objectives, strategies, beliefs and intentions.

Various factors may prevent or delay our plans, including but not limited to, the trading price of the common shares of the Company, capital market conditions, impacts from the coronavirus or other epidemics, counterparty risk, TSXV approval(s), contractor availability and performance, weather, access, mineral and gold prices, and success and failure of the exploration and development carried out at various stages of the program.

Permission from the government and community is also required to proceed with future mining production. Readers should review the Company’s ongoing quarterly and annual filings, as well as any other additional documentation comprising the Company’s public disclosure record, for additional information on risks and uncertainties relating to these forward-looking statements.

Readers should also review the risk factors applicable to junior mining exploration companies generally to better understand the variety of risks that can affect the Company. The Company undertakes no obligation to update publicly or otherwise revise any Forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the content of this news release.

PDF available: http://ml.globenewswire.com/Resource/Download/aa33b9b5-d816-408e-904b-5e9838535c83