Anaconda Mining Announces Updated and Expanded Mineral Resource for Stog'er Tight, Increasing Potential for Mine Life Extension at Point Rousse Operations

TORONTO, ON / ACCESSWIRE / October 19, 2021 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is pleased to announce an updated Mineral Resource Estimate ("Mineral Resource") for the Stog'er Tight Deposit, part of the Point Rousse Project ("Point Rousse"), prepared in accordance with National Instrument 43-101 ("NI 43-101") and 2019 CIM MRMR Best Practice Guidelines. The Mineral Resource was prepared by Independent Qualified Person Glen Kuntz, P.Geo., of Nordmin Engineering Ltd. ("Nordmin"). All dollar amounts are in Canadian dollars.

The Stog'er Tight Mineral Resource includes an Indicated Mineral Resource of 642,000 tonnes at a grade of 3.02 grams per tonne ("g/t") gold for 62,300 ounces and an Inferred Mineral Resource of 53,000 tonnes at a grade of 5.63 g/t gold for 9,600 ounces. These Mineral Resources are constrained within three open pits as well as adjacent to the past producing Stog'er Tight Mine. The Stog'er Tight deposit is located three kilometres from the Pine Cove mill along existing roads and was previously processed at the Pine Cove mill from June 2018 to January 2020, achieving an average recovery rate of 87%.

"The growth of the Stog'er Tight Deposit, now including 62,300 ounces of Indicated Mineral Resource and 9,600 ounces of Inferred Mineral Resource within constrained open pit shells, is a significant milestone in our strategy to expand the life of mine at our Point Rousse operations. Given the relative high grade nature of the Mineral Resource and its proximity to the Pine Cove mill and existing road networks, we have initiated development work required to enable us to convert these resources to reserves. We anticipate results from this work in the fourth quarter of 2021. Consequently, environmental baseline studies have been in progress throughout the 2021 field season and we anticipate the submission of an environmental registration document in the fourth quarter of 2021. We believe the Stog'er Tight resource combined with the recently announced Argyle Mineral Reserve demonstrate potential for an expanded mine life at the Point Rousse operation for several years. Given our history of discovery at Point Rousse and ongoing drill testing of additional targets at both the Point Rousse and Tilt Cove projects, we believe the Point Rousse Project has the potential for continued cash generation for several years and beyond."

~Kevin Bullock, President and CEO, Anaconda Mining Inc.

Stog'er Tight Development and Permitting

The Stog'er Tight Deposit is located three (3) kilometres east of the Pine Cove Mill and has been defined over a strike length of 1,250 metres to date. Anaconda produced a total of 17,102 ounces of gold from 349,942 tonnes of ore from the Stog'er Tight Mine between June 2018 and January 2020. Gold from Stog'er Tight was recovered through the Pine Cove Mill with an average head grade of 1.75 g/t gold at an overall recovery of approximately 87%.

Baseline studies to support an enhanced registration document were initiated in Spring 2021. These studies have included avifauna, bat, and rare plant surveys, as well as fish and fish habitat assessments and surface and groundwater monitoring Fish and fish habitat data will be used to support the development of a Fisheries Act Authorization application and a fish habitat offsetting plan, which are also expected to be submitted in Q1 of 2022.

Stog'er Tight Mineral Resource

The Mineral Resource was prepared by Independent Qualified Person, Glen Kuntz, P. Geo. of Nordmin. The Stog'er Tight Mineral Resource is based on validated results of 690 surface drill holes (506 diamond drill holes and 184 percussive drill holes), for a total of 37,584 metres of diamond drilling that was completed between 1988 and 2021 and the effective date of September 1, 2021. From these drill holes a total of 16,319 samples were analyzed for gold content. The Mineral Resource is defined at a 0.59 g/t gold cut-off and is based upon 1 metre assay composites using a variable gold grade cap. The Open pit constrained Mineral Resource (Table 1) uses the unit cost assumptions outlined in Table 2.

Table 1: Stog'er Tight Mineral Resource - Effective Date: September 1, 2021

| Type | Au (g/t) Cut -off | Category | Tonnes | Au g/t | Rounded Ounces |

| Open Pit | 0.59 | Indicated | 642,000 | 3.02 | 62,300 |

| Inferred | 53,000 | 5.63 | 9,600 |

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Open pit Mineral Resources are reported at a cut-off grade of 0.59 g/t gold that is based on a gold price of CAD$2,000/oz (approximately US$1,550/oz) and a gold processing recovery factor of 87%.

- Assays were capped on the basis of the three Domain types Flat, Steep and Background.

- SG was applied on a lithological basis after calculating weighted averages based on lithological groups.

- Mineral Resource effective date September 1st, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Reported from within a mineralization envelope accounting for mineral continuity.

- Excludes unclassified mineralization located within mined out areas.

Input Parameters for the Stog'er Tight Mineral Resource Open Pit Calculation

For the open pit Mineral Resource (Table 1) a pit limit analysis was undertaken using the Lerchs-Grossmann algorithm in Geovia's Whittle™ 4.7 software to determine physical limits for a pit shell constrained Mineral Resource. The parameters used to generate a pit shell are shown in Table 2.

Table 2: Physical Pit Limit Analysis Parameters

| PARAMETER | VALUE |

| Currency Used for Evaluation | CA$ |

| Block Size | 3m x 3m x 3m |

| Overall Slope Angle | Rock: Varied by Sector - Range 42o - 44o |

Overburden: 25o | |

| Mining Cost | 4.66$/tmined |

| Process Cost | 31.85/tprocessed |

| includes assumptions for Milling, G&A, tailings, additional haulage to mill | |

| Selling Cost | 68.19$/oz. |

| includes dore transportation, refining, and royalty | |

Metal Price | 1550 US$/oz. |

1US$ : 1.3CA$ | |

2000 CA$/oz. | |

| Process Recovery | 87% |

| Mining Loss & Dilution | 5% each |

| Resources Used for Pit Shell Generation | Indicated + Inferred |

| Pit Shell Selection | Revenue Factor RF 1.00 for Resource Pit Shell |

The milling cut-off grade is used to classify the material contained within the pit shell limits as open pit resource material. This break-even cut-off grade is calculated to cover the Process and Selling Costs. The open pit Mineral Resource cut-off grade is estimated to be 0.59 g/t gold. For resource cut-off calculation purposes, a mining recovery of 87% and 5% mining dilution were applied.

Geological Domaining Stog'er Tight Deposit

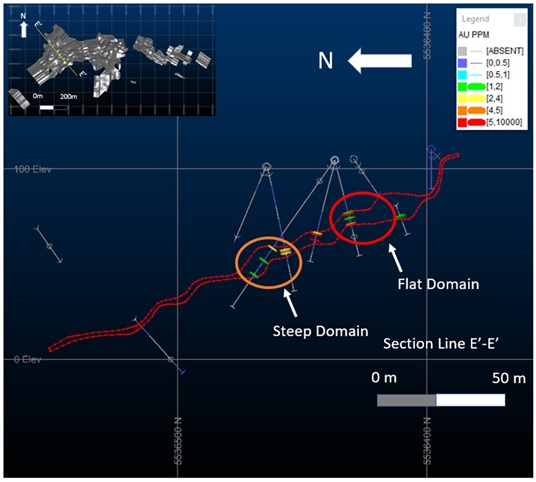

Nordmin undertook a full re-examination of the mineralogical, lithological, and structural correlations influencing the gold bearing structures present at the Stog'er Tight deposit. Detailed wireframing was carried out based on vertical 15 m spaced cross-sections and subsequently joined section to section. Each wireframe was given an individual numeric identifier, from there a domain type was assigned within based on the location and nature of the intercept (1=Flat, 2=Steep) Figure 1. A cut-off grade of 0.50 g/t Au was utilized in the creation of the wireframes at the Stog'er Tight deposit.

Explicit modelling was used to create the Mineral Resource, which allows for mineralization to better reflect the Deposit geology and associated geochemistry. Nordmin's opinion is that the explicit modelling approach minimizes risks compared to using implicit modelling for the Project.

Figure 1: Geological domains (Flat and Steep structures).

Exploratory Data Analysis

The exploratory data analysis was conducted on raw drill hole data to determine the nature of the gold distribution within the flat-steep mineralized trends, correlation of grades within individual domains, and the identification of high-grade outlier samples. Nordmin used a geostatistical package (X10 Geo) to complete various descriptive statistics, histograms, probability plots, and XY scatter plots to analyze the grade population data. The findings of the exploratory data analysis were used to help define modelling procedures and parameters used in the Mineral Resource Estimate.

Data received from the Company had been cleaned and edited prior to use in the resource estimate. No significant issues were noted in drill hole collar locations, survey, assay, and lithology data supplied to Nordmin.

Individual drill hole tables (collar, survey, assay, etc.) were merged to create one single master drill hole file. The process splits assay intervals to allow for all records in all tables to be included.

Stog'er Tight Compositing

The raw sample data was found to have a very consistent range of sample lengths. Samples captured within all wireframes were composited to 1.0 m regular intervals based on the observed modal distribution of sample lengths, which supports a 3.0 m x 3.0 m x 3.0 m block model (Northing x Easting x Elevation) with three sub-blocking levels (a minimum size of Northing = 0.375 m x Easting = 0.375 m x Variable Elevation). An option to use a slightly variable composite length was chosen to allow for backstitching shorter composites located along the edges of the composited interval. All composite samples were generated within each background low-grade, northwest-southeast, and east-west wireframe. There are no overlaps along boundaries. The composite samples were statistically validated to ensure no material loss of data or change to each sample population's mean grade.

Nordmin reviewed the previous historical estimate capping method and determined that a more appropriate method would be to assign capping values based on the geological and structural features present on site. Therefore, the assays were variably capped by domain type (flat, steep and background) Table 3.

Table 3: Stog'er Tight Deposit Cap Values

Capped | Uncapped | |||||||||||||

Domain | Metal | Cap | # of Samples | Min | Max | Mean | # Capped | % Capped | % Metal Lost | CV | Min | Max | Mean | CV |

(g/t) | ||||||||||||||

Flat | Au | 19.0 | 1050 | 0.003 | 19 | 2.73 | 19 | 1.80% | 7.2 | 1.43 | 0.003 | 74.4 | 2.94 | 1.82 |

Steep | Au | 30.0 | 1357 | 0.003 | 30 | 2.76 | 15 | 1.10% | 3.7 | 1.69 | 0.003 | 147.6 | 2.87 | 2.05 |

Background | Au | 1.0 | 13262 | 0.003 | 1 | 0.035 | 131 | 1.00% | 15 | 3.35 | 0.003 | 21.4 | 0.041 | 6.05 |

Stog'er Tight Assessment of Spatial Grade Continuity

Datamine and Sage 2001 was used to determine the geostatistical relationships for each deposit. Independent variography was performed on composite data for each domain. Experimental grade variograms were calculated from the capped/composited sample gold data to determine the approximate search ellipse dimensions and orientations.

The analyses considered the following:

- Downhole variograms were created and modelled to define the nugget effect;

- Experimental pairwise-relative correlogram variograms were calculated to determine directional variograms for the strike and down dip orientations;

- Variograms were modelled using an exponential with practical range;

- Directional variograms were modelled using the nugget defined in the downhole variography and the ranges for the along strike, perpendicular to strike, and down dip directions;

- Variograms outputs were re-oriented to reflect the orientation of the mineralization; and

- The analysis demonstrated that gold continuity could be appropriately defined by one main variogram across all domains.

A Technical Report prepared in accordance with NI 43-101 for the Point Rousse Project will be filed on SEDAR (www.sedar.com) within 40 days of this news release and will include updated Argyle Mineral Reserves (as announced on October 13, 2021) and the Stog'er Tight Mineral Resources for the Point Rousse Project. For readers to fully understand the information in this news release, they should read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Reserves. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Qualified Persons

This news release has been reviewed and approved by Kevin Bullock, P.Eng., President and CEO and Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., "Qualified Persons", and Glen Kuntz, P. Geo. and Joanne Robinson, P.Eng. of Nordmin, "Independent Qualified Persons", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

Glen Kuntz, P. Geo. of Nordmin is responsible for disclosure regarding the Stog'er Tight Mineral Resource Estimate.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project with Measured and Indicated Mineral Resources of 1.9 million ounces (16.0 million tonnes at 3.78 g/t) and Inferred Mineral Resources of 0.8 million ounces (5.3 million tonnes at 4.68 g/t) (Please see The Goldboro Gold Project Technical Report dated March 30, 2021), which is subject to an ongoing Feasibility Study. Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2020, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/668657/Anaconda-Mining-Announces-Updated-and-Expanded-Mineral-Resource-for-Stoger-Tight-Increasing-Potential-for-Mine-Life-Extension-at-Point-Rousse-Operations