Asanko Gold Outlines H2 2019 Exploration Program

VANCOUVER, British Columbia, July 23, 2019 (GLOBE NEWSWIRE) -- Asanko Gold Inc. (“Asanko” or the “Company”) (TSX, NYSE American: AKG) provides an overview of its planned exploration program for the second half of 2019 as operators of the Asanko Gold Mine (“AGM”) in Ghana, West Africa, which is a 50:50 Joint Venture between the Company and Gold Fields Limited (JSE, NYSE: GFI).

The Company’s drilling program for the second half of 2019 has two main objectives:

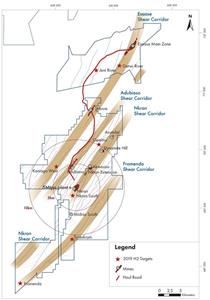

1. To delineate new resources within 10km of the 5Mtpa processing facility that can be brought into the near-term mine plan, initially targeting Tontokrom, Opeimu and Kaniago West (see figure 1).

2. To investigate the potential for a major discovery at Fromenda, a previously drilled exploration target located 20km south of the existing processing facility.

In addition, the Company expects to continue its generative exploration efforts to maintain and advance a balanced pipeline of projects in order to make new discoveries near the existing processing facility. During H2 2019, the program is expected to assess and advance three high priority near mine targets, Getwi River, Jeni River and Nkran South (see figure 1).

Greg McCunn, Chief Executive Officer, commented, “As the AGM transitions away from capital projects to a focus on free cash flow generation, the Company is committed to adding value through exploration. The AGM holds a district scale land package which hosts multiple multi-million ounce gold deposits. We have conducted extensive generative work on identifying high-priority targets along the Asankrangwa belt and are committed to an ongoing program aimed at both building near-term resources on existing mining leases as well as targeting another major discovery.”

Tontokrom Target

The Tontokrom target is located approximately 10km south of the AGM processing plant on the Miradani Mining Lease, along the Fromenda shear structure making up part of the northeast southwest Asankrangwa structural corridor, which hosts all nine of the AGM’s gold deposits. The area is highly prospective and the site of historic small scale and alluvial mining operations in multiple target areas along a 3km trend. Multiple historical geochemical anomalies are coincident with the targets, and primary and secondary structures known to control mineralization in the belt have been interpreted from the airborne VTEM and magnetic surveys and extensively mapped on the ground.

In H1 2019 the Company drilled 10 holes consisting of 3,140m total (1,080m reverse circulation and 2,060m diamond drill). For complete results, please see news releases dated April 8, 2019 and April 30, 2019.

Highlights from the drilling included:

- Hole TTPC19-008 intersected 74m at 1.93 grams per tonne gold from 185m

- Hole TTPC19-009 intersected 57m at 2.96 grams per tonne gold from 99m

- Hole TTPC19-010 intersected 44m at 1.72 grams per tonne gold from 191m

- Hole TTPC19-002 intersected 39.0m at 1.82 grams per tonne gold from 189m

The drilling program to date has demonstrated Tontokrom has encouraging widths of mineralization and grade in multiple parallel zones. With the deposit still open along strike to the southwest and plunging north, Tontokrom has the potential to become a bulk tonnage, open pit source of ore feed for the existing milling operations at the AGM. The H2 2019 program has an additional six drill holes planned to step out a further 250m along strike to the southwest and remains the Company’s top priority. The drill program envisions to extend the mineralized strike to over 550m with approximately 1300m of additional diamond and reverse circulation drilling.

Upon completion of the resource expansion drilling, it is expected that the deposit will be infill drilled to a detail suitable for a maiden resource estimate to be completed and mining permit applications to be initiated.

Currently the Company is working to resolve a boundary dispute with a local small-scale leaseholder which has introduced access challenges to certain portions of the concession. The Company is working with the Minerals Commission of Ghana to resolve the matter as expeditiously as possible. Until the matter is resolved, the Company has voluntarily moved its drilling efforts to the Opeimu Target.

Opeimu Target

Located 5.2 km north of the AGM processing plant on the Adubea Mining Lease, the Opeimu target is expected to be drilling during Q3 2019. Opeimu is a conceptual target located along the Adubiaso shear zone which is known to be endowed and hosts the Adubiaso pit that has previously been mined for oxides. The target is on an intersection between two important geological structures and lies along a major geological contact. Initial regional geochemical sampling was conducted by the Company, along with trenching that has indicated the presence of mineralized structures.

The objective of the H2 2019 program is to test the blind-to-surface target. The program is expected to consist of 6 drill holes in three fences of two holes each with approximately 750 metres of diamond and reverse circulation drilling. If successful, Opeimu would represent a new discovery.

Fromenda Target H2 2019

The Fromenda Target is located approximately 10km further southwest of the Tontokrom Target along the same highly prospective Fromenda Shear Corridor. Results from historic drilling were positive and identified mineralization. A 5,000m drill program has been designed to confirm the mineralization as well as to step out along strike and to depth.

In H2 2019, the Company expects to first drill approximately 500m over three drill holes to confirm historic drill holes and then follow on with a planned 5,000m program which is expected to carry on into 2020.

Kaniago West Target

The Kaniago West target is located 5.5 km west of the AGM processing plant on a Prospecting Lease. The target is situated at a triple intersection of controlling geological structures. Strong gold in soil geochem anomaly followed by an historic drilling campaign in 2011 and 2012 by Midlands Minerals Corporation (“Midlands”) covering 4,299m of reverse circulation and 606m of diamond drilling confirmed the presence of mineralization. During February 2018 the Company completed a re-logging, interpretation and mapping of the target. Drill results show strongest mineralization in the southwest of the area drilled and are open along strike and to depth.

The objective of the H2 2019 program is to confirm and step out on the encouraging historic results drilled by Midlands. The Company plans to drill approximately 1,000m of diamond and reverse circulation drilling in eight drill holes in four fences of two holes each.

A map accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f1f06bfa-76a6-47da-8f1d-5607f7875756

Qualified Person Statements

Benjamin Gelber (P.Geo), Group Geology Manager, is the Asanko Qualified Person, as defined by Canadian National Instrument 43-101 (Standards of Mineral Disclosure), who has approved the preparation of the technical contents of this news release.

About Asanko Gold Inc.

Asanko’s flagship project, located in Ghana, West Africa, is the jointly owned Asanko Gold Mine with Gold Fields Ltd, which Asanko manages and operates. The Company is strongly committed to the highest standards for environmental management, social responsibility, and health and safety for its employees and neighbouring communities. For more information, please visit www.asanko.com.

Forward-Looking and other Cautionary Information

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address estimated resource quantities, grades and contained metals, possible future mining, exploration and development activities, are forward-looking statements. Although the Company believes the forward-looking statements are based on reasonable assumptions, such statements should not be in any way construed as guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices for metals, the conclusions of detailed feasibility and technical analyses, the timely renewal of key permits, lower than expected grades and quantities of resources, mining rates and recovery rates and the lack of availability of necessary capital, which may not be available to the Company on terms acceptable to it or at all. The Company is subject to the specific risks inherent in the mining business as well as general economic and business conditions. For more information on the Company, investors should review the Company's Annual Form 40-F filing with the United States Securities Commission and its home jurisdiction filings that are available at www.sedar.com.

Neither Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Enquiries: Alex Buck – Investor & Media Relations Toll-Free (N.America): 1-855-246-7341 Telephone: +44 7932 740 452 Email: alex.buck@asanko.com