Asante Announces Technical Reports Delineating Annual Gold Production Near 450 Koz by 2025, Significant Resource Growth

VANCOUVER, British Columbia, May 01, 2024 (GLOBE NEWSWIRE) -- Asante Gold Corporation (CSE:ASE | GSE:ASG | FRANKFURT:1A9 | U.S.OTC:ASGOF) (“Asante” or the “Company”) announces the filing of updated technical reports for the Chirano and Bibiani mines in Ghana, delineating new Mineral Reserve and Mineral Resource estimates and life of mine plans based on proven and probable reserves. All dollar figures are in United States dollars unless otherwise indicated. References to years in this news release relate to the 12-month period commencing February of the applicable calendar year, consistent with the Company’s January 31 fiscal year-end. For example, “2025” refers to the 12-month period of February 2025 – January 2026.

HIGHLIGHTS

Consolidated Results

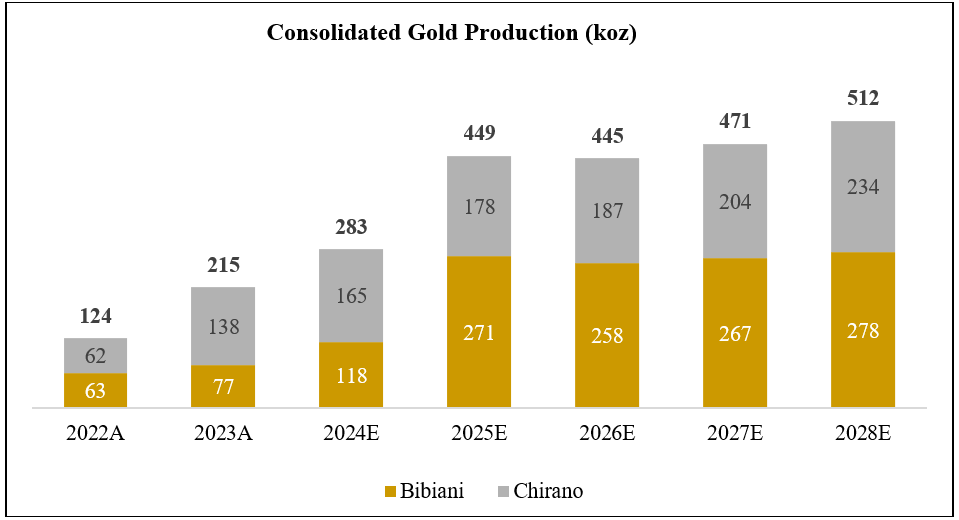

- Rapid production growth to 449koz in 2025 (+109% vs. 2023 actual) and >500koz in 2028

- Production of 2.2 million ounces over next five years, before considering resource conversion potential

- Significant increase in Mineral Resources at both mines, net of approximately two years of depletion:

- 4.6 million ounces (+34% vs. previous technical report) in Measured and Indicated category

- 2.2 million ounces (+200% vs. previous technical report) in Inferred category

- Excellent expansion and mine life extension opportunities at both mines underpinned by substantial resource base, track record of resource delineation and conversion, and planned exploration investment

Bibiani Technical Report

- Gold production of 271koz in 2025 (+254% vs. 2023 actual), enabled by cutting the Bibiani-Goaso highway, 2024 investments in main pit expansion, sulphide treatment plant to increase recovery to 92%

- Commencement of underground mine development in 2025 with first underground ore processed in 2026; robust underground mine plan underpinned by first-ever underground reserves delineated by Asante

- Significant unit cost reduction by 2025 reflecting reduced stripping requirements, increased scale, and increased gold recovery; AISC <$1,100/oz by 2027

- 2.5 million ounces (+9% vs. previous technical report) of Measured and Indicated Mineral Resources

- Reflects underground strategy with >0.9 million ounces of underground reserves

- 1.2 million ounces (+225% relative to previous technical report) of Inferred Mineral Resources

- Targeted areas for 2024 resource conversion / additions include Walsh/Strauss, Elisabeth Hill, Russell

Chirano Technical Report

- Gold production of 178koz in 2025 (+28% vs. 2023 actual) and >200koz by 2027

- Underground mine plan focused on expansion of the Obra and Suraw mines

- Lower unit costs from 2025 from increased throughput, efficiencies, improved use of capital

- 2.1 million ounces (+84% vs. previous technical report) of Measured and Indicated Mineral Resources

- 1.0 million ounces (+177% relative to previous technical report) of Inferred Mineral Resources

- Targeted areas for 2024 resource conversion and additions include depth extensions at Suraw, Akoti South, Tano, Sariehu, Akwaaba, Obra; upgrading resources at GAP, Aboduabo, and Magnetic Hinge

Dave Anthony, President and CEO stated, “We are excited to report the results of updated technical reports for the Bibiani and Chirano mines that demonstrate the significant production and margin growth at both operations. This includes a 109% increase in consolidated production to nearly 450,000 ounces in 2025 and a further increase to over 500,000 ounces by 2028 at lower costs. We are also pleased to report a significant increase in mineral resources at both mines, including delineation of the first-ever underground reserves at Bibiani under Asante ownership, which supports long-term strategic planning for expansion and mine life extension opportunities.”

Investors are invited to register for a live, interactive webinar to discuss the technical report results at 11:00 am Pacific Time / 2:00 pm Eastern time on Tuesday, May 7, 2024 to be hosted by CEO Dave Anthony and CFO David Wiens at the following link: https://events.6ix.com/preview/asante-gold-investor-update-2.

The updated technical reports entitled “NI 43-101 Technical Report and Updated Mineral Resource Estimate, Chirano Gold Mines Limited, Ghana, West Africa” dated April 30, 2024 (with an effective date of December 31, 2023) and “NI 43-101 Technical Report and Updated Mineral Resource Estimate, Mensin Gold Bibiani Limited” dated April 30, 2024 (with an effective date of December 31, 2023) were prepared in accordance with Canada’s National Instrument 43-101 – Standards for Disclosure for Mineral Projects (“NI 43-101”) and have been filed on the Company’s SEDAR+ profile (www.sedarplus.ca). The updated technical reports supersede the prior technical report for Bibiani dated August 31, 2022 (with an effective date of February 28, 2022) and the prior technical report for Chirano dated September 30, 2022 (with an effective date of December 31, 2021).

5-Year Outlook (Mineral Reserves Only) - Consolidated

Consolidated gold production from the Bibiani and Chirano mines is envisaged as follows:

This forecast based is solely on Proven and Probable reserves, without consideration of significant resource conversion, production expansion and cost optimization opportunities utilized in the Company’s strategic planning at both Bibiani and Chirano.

5-Year Outlook – Bibiani Mine (Mineral Reserves Only)

Key metrics at the Bibiani mine during the 2024-2028 period as envisaged in the technical report include:

| 2024 | 2025 | 2026 | 2027 | 2028 | 5-Year Total | 5-Year Average | |||||||||

| Operations | |||||||||||||||

| Ore mined - open pit (kt) | 2,594 | 4,631 | 4,126 | 2,285 | 1,227 | 14,863 | 2,973 | ||||||||

| Waste mined - open pit (kt) | 54,771 | 80,372 | 64,785 | 5,376 | 5,874 | 211,177 | 42,235 | ||||||||

| Total mined - open pit (kt) | 57,365 | 85,003 | 68,911 | 7,661 | 7,100 | 226,040 | 45,208 | ||||||||

| Strip ratio (waste:ore) | 21.1x | 17.4x | 15.7x | 2.4x | 4.8x | 14.2x | 14.2x | ||||||||

| Grade mined - open pit (g/t) | 1.90 | 2.10 | 1.95 | 2.29 | 2.20 | 2.06 | 2.06 | ||||||||

| Ore mined - underground (kt) | - | 58 | 812 | 1,910 | 2,639 | 5,419 | 1,084 | ||||||||

| Grade mined - underground (g/t) | - | 1.00 | 2.05 | 1.93 | 2.42 | 2.18 | 2.18 | ||||||||

| Ore milled (kt) | 2,661 | 3,832 | 4,000 | 4,000 | 4,003 | 18,497 | 3,699 | ||||||||

| Grade milled (g/t) | 1.76 | 2.39 | 2.18 | 2.25 | 2.34 | 2.21 | 2.21 | ||||||||

| Gold recovery (%) | 79% | 92% | 92% | 92% | 92% | 91% | 91% | ||||||||

| Production (koz) | 118 | 271 | 258 | 267 | 278 | 1,192 | 238 | ||||||||

| Cash Flow @ $1900/oz | |||||||||||||||

| Revenue | 225 | 515 | 490 | 507 | 527 | 2,265 | 453 | ||||||||

| Net operating cashflow | 55 | 299 | 216 | 232 | 240 | 1,042 | 208 | ||||||||

| Capex | 214 | 253 | 193 | 78 | 59 | 798 | 160 | ||||||||

| Net cash flow | (159) | 46 | 23 | 154 | 180 | 244 | 49 | ||||||||

| Net cash flow ($2,300/Oz) | (115) | 99 | 88 | 216 | 249 | 537 | 107 | ||||||||

| AISC ($/oz) (1) | 2,265 | 1,340 | 1,457 | 970 | 1,088 | 1,316 | 1,316 | ||||||||

Notes:

Figures expressed on a 100% basis; Asante owns 90% of the Bibiani Mine.

(1) 2024 AISC includes approximately $683 per ounce related to capitalized stripping.

The 5-year outlook for Bibiani envisages rapid production growth enabled by cutting of the Bibiani – Goaso highway, expansion of the main pit, an increase in fleet availability and completion of a plant upgrades in 2024 to drive gold production of 271,000 ounces in 2025, representing a 254% increase relative to 2023 actual production. This is envisaged to be followed by commencement of underground development and mining in the 2025-2026 period which underpins the majority of gold production from 2028 onwards.

The delineation of underground reserves at Bibiani and development of a combined open pit / underground mining plan is driven by the Company’s strategy to optimize economic value by reducing previously planned waste cuts in the open pit and providing earlier access to higher-grade underground ore. Supported by the updated resource model and external experts, and leveraging the Company’s in-house underground mining expertise and experience at the Chirano a robust underground design and mining strategy was developed during the course of 2023 and early 2024. The previous technical report envisaged mining in the open pit only to a depth of ~432 metres, while the revised mine plan envisages a terminal open pit depth of ~354 metres, below which underground mining will take place. This design includes establishment of an underground conveyor system in 2026 to feed the process plant area directly, and three access points into the main orebody to establish mine infrastructure and commence stoping operations.

Capital expenditures at Bibiani are elevated in the 2024-2026 period primarily as a result of capital projects to deliver (i) stripping related to an expansion of the Bibiani main pit, (ii) underground development activities, (iii) community and social projects, including the planned resettlement of the neighboring Old Town and Zongo communities, (iv) completion of a sulphide treatment plant and other plant upgrades (pebble crusher, jaw crusher, CIL and elution circuit upgrades) that support an increase in gold recovery to 92% and plant throughput to 4 million tonnes per year. In 2024 in particular, this will have a significant impact on reported AISC, with approximately $683 per ounce attributed to waste stripping.

External financing will be required in order to execute these capital projects in 2024. The Company has been in commercial discussions with potential financiers and has received preliminary term sheets which it is currently evaluating. There can be no certainty that the Company will be successful in securing sufficient financing on a timely basis.

While the technical report envisages gold production through 2032 based on mineral reserves, the Company’s strategy is to extend mine life well beyond this timeframe through resource conversion, extension of the underground mine, and delineation and expansion of new satellite pits. This strategy is underpinned by the significant resource base at the Bibiani mine (incremental to reserves), high prospectivity of regional geology, and the Company’s track record of resource replacement and growth.

5-Year Outlook – Chirano Mine (Mineral Reserves Only)

Key metrics at the Chirano mine during the 2024-2028 period as envisaged in the technical report include:

| 2024 | 2025 | 2026 | 2027 | 2028 | 5-Year Total | 5-Year Average | |||||||||

| Operations | |||||||||||||||

| Ore mined - open pit (kt) | 2,000 | 1,774 | 589 | - | - | 4,363 | 873 | ||||||||

| Waste mined - open pit (kt) | 14,857 | 10,954 | 1,593 | - | - | 27,404 | 5,481 | ||||||||

| Total mined - open pit (kt) | 16,857 | 12,728 | 2,182 | - | - | 31,767 | 6,353 | ||||||||

| Strip ratio (waste:ore) | 7.4x | 6.2x | 2.7x | - | - | 6.3x | 6.3x | ||||||||

| Grade mined - open pit (g/t) | 1.13 | 1.14 | 1.18 | - | - | 1.15 | 1.15 | ||||||||

| Ore mined - underground (kt) | 1,662 | 2,250 | 2,724 | 2,771 | 3,129 | 12,535 | 2,507 | ||||||||

| Grade mined - underground (g/t) | 1.94 | 1.88 | 1.91 | 2.36 | 2.49 | 2.15 | 2.15 | ||||||||

| Ore milled (kt) | 3,842 | 4,077 | 4,077 | 3,584 | 3,129 | 18,709 | 3,742 | ||||||||

| Grade milled (g/t) | 1.47 | 1.49 | 1.56 | 1.93 | 2.49 | 1.75 | 1.75 | ||||||||

| Gold recovery (%) | 90% | 91% | 91% | 92% | 93% | 92% | 92% | ||||||||

| Production (koz) | 165 | 178 | 187 | 204 | 234 | 968 | 194 | ||||||||

| Cash Flow @ $1900/oz | |||||||||||||||

| Revenue | 313 | 338 | 355 | 388 | 445 | 1,838 | 368 | ||||||||

| Net operating cashflow | 44 | 64 | 106 | 140 | 178 | 532 | 106 | ||||||||

| Capex | 57 | 50 | 49 | 16 | 8 | 180 | 36 | ||||||||

| Net cash flow | (13) | 13 | 58 | 124 | 170 | 352 | 70 | ||||||||

| Net cash flow ($2,300/Oz) | 27 | 56 | 103 | 174 | 227 | 588 | 118 | ||||||||

| AISC ($/oz) | 1,822 | 1,553 | 1,268 | 981 | 821 | 1,246 | 1,246 |

Note: Expressed on a 100% basis; Asante owns 90% of the Chirano Mine.

The technical report envisages Chirano open pit operations continuing through 2026, maintaining a feed balance with the underground mines to optimize its production profile. Underground production is supported by five mines, with a particular focus on the Suraw and Obra mines in the 2026-2028 period. The Company’s strategy includes comprehensive rebuild and replacement programs of the underground equipment fleet, to increase productivity and reduce mining costs by increasing equipment size.

While the technical report envisages continuation of production at Chirano through 2028 based on mineral reserves, the Company’s strategy is to extend the mine life well beyond this timeframe through resource conversion, development of infrastructure needed to extend the underground mines to lower depth, and delineation of new pits.

The Company also believes that there is a significant opportunity to connect Chirano’s northern mines through a conveyer system feeding directly to the process plant, which could provide significant savings through reduced trucking costs. The Company is currently evaluating this opportunity, which has not been included in the technical report.

Mineral Resource Estimate – Bibiani Mine

The following is a summary of the Bibiani Mineral Resource Estimate as of December 31, 2023:

| | Category | Open Pit | Underground | Total | ||||||

| (Kt) | Au (g/t) | Au (Koz) | (Kt) | Au (g/t) | Au (Koz) | (Kt) | Au (g/t) | Au (Koz) | ||

| Resources (inclusive) | Measured | 179 | 1.30 | 7 | 49 | 1.49 | 2 | 228 | 1.34 | 10 |

| Indicated | 15,856 | 2.27 | 1,155 | 17,678 | 2.33 | 1,325 | 33,534 | 2.30 | 2,481 | |

| M&I | 16,035 | 2.26 | 1,162 | 17,727 | 2.33 | 1,327 | 33,762 | 2.30 | 2,490 | |

| Inferred | 19 | 1.12 | 1 | 15,158 | 2.36 | 1,151 | 15,178 | 2.36 | 1,152 | |

| Reserves | Proven | 180 | 1.24 | 10 | 20 | 1.44 | 1 | 200 | 1.26 | 10 |

| Probable | 15,100 | 2.10 | 1,020 | 12,120 | 2.35 | 920 | 27,220 | 2.21 | 1,940 | |

| P&P | 15,280 | 2.09 | 1,030 | 12,140 | 2.35 | 921 | 27,420 | 2.21 | 1,950 | |

Notes:

(1) Tonnes and ounces have been rounded and this may have resulted in minor discrepancies.

(2) Mineral Resources are not Mineral Reserves.

(3) The Mineral Resources are reported inclusive of any Mineral Reserves that may be derived from them.

(4) 1 troy ounce = 31.1035g.

(5) A 0.5g/t gold reporting cut-off has been applied for OP Mineral Resources, constrained within a conceptual pit shell using US$1,950 gold price to satisfy RPEEE requirements.

(6) UG Mineral Resources are reported within conceptual MSO shapes prepared using a US$1,950 gold price and a cut-off grade of 0.80g/t Au to satisfy RPEEE requirements.

(7) Density values of 2.75t/m³, 2.50t/m³ and 2.00t/m³ have been applied to blocks flagged as fresh, transition and oxidised sediments respectively, for all block models.

(8) Geological losses and depletions have been applied.

(9) Inferred Mineral Resources have a lower level of confidence than that applying to Indicated Mineral Resources and have not been converted to Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(10) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

As noted above, delineation of the first-ever underground reserves at Bibiani under Asante ownership, and development of a combined open pit / underground mining plan, is driven by the Company’s strategy to optimize economic value by reducing excessive waste cuts in the open pit and provide earlier access to higher-grade underground ore. This approach leverages the Company’s in-house expertise and experience at the Chirano mine. The previous technical report envisaged mining in the open pit only, resulting in elevated strip ratios. Consistent with this strategy, a new resource model was built from which mining models were modified for dilution and mining losses, taking into account the transition point between open pit and underground mining. As noted above, the revised envisaged main pit depth is approximately ~78 metres shallower due to the transition to underground mining which results in lower open pit reserves and resources, and higher underground reserves and resources.

Over 12,000 metres of RC and diamond drilling is planned in 2024 with 7,500 metres allocated specifically for resource extension and definition. The primary focus will be on three main areas: Walsh/Strauss underground, Elisabeth open pit, and Russell underground.

Mineral Resource Estimate – Chirano Mine

The following is a summary of the Chirano Mineral Resource Estimate as of December 31, 2023:

| | Category | Open Pit | Underground | Total | ||||||

| (Kt) | Au (g/t) | Au (Koz) | (Kt) | Au (g/t) | Au (Koz) | (Kt) | Au (g/t) | Au (Koz) | ||

| Resources (inclusive) | Measured | 2,845 | 0.90 | 82 | 7,918 | 2.10 | 534 | 10,763 | 1.78 | 616 |

| Indicated | 12,052 | 1.09 | 421 | 17,085 | 1.91 | 1,051 | 29,137 | 1.57 | 1,472 | |

| M&I | 14,898 | 1.05 | 503 | 25,003 | 1.97 | 1,585 | 39,901 | 1.63 | 2,088 | |

| Inferred | 1,711 | 1.23 | 68 | 18,303 | 1.64 | 963 | 20,014 | 1.60 | 1,031 | |

| Reserves | Proven | 2,426 | 0.72 | 56 | 2,864 | 2.26 | 208 | 5,290 | 1.55 | 264 |

| Probable | 3,748 | 1.13 | 136 | 9,671 | 2.12 | 659 | 13,419 | 1.84 | 795 | |

| P&P | 6,174 | 0.97 | 192 | 12,535 | 2.15 | 867 | 18,709 | 1.76 | 1,059 | |

Notes:

(1) Mineral Resource Estimate expressed on a 100% basis; Asante owns 90% of the Chirano Mine

(2) Tonnes and ounces have been rounded and this may have resulted in minor discrepancies

(3) Mineral Resources are not Mineral Reserves

(4) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

(5) Mineral Resources are reported inclusive of Mineral Reserves

(6) 2024 Mineral Resource Estimates determined using $1,950/oz gold price, Mineral Reserve Estimates determined using $1,700/oz gold price;

(7) The Mineral Reserve estimates contained herein may be subject to legal, political, environmental or other risks that could materially affect the potential exploitation of such Mineral Reserves

The significant increase in resources at Chirano relative to the previous technical report is primarily a result of successful exploration results in 2022 and 2023. This included:

- Obra: inferred resource conversion into indicated, shoot extension along strike and down dip

- Suraw: resource conversion drilling to upgrade gaps and add inferred resources

- Aboduabo: drilling aimed at extension of shoots along strike, down dip continuity and infilling

- Upgrading of resources at Suraw and Obra

In 2024, planned exploration activities include approximately 34,000 meters of drilling to continue testing and upgrading resources on the mining lease and adjacent prospecting licenses with key focus on depth extensions at Suraw, Akoti South, Tano, Sariehu, Akwaaba and Obra; upgrading open pit resources at GAP, Aboduabo and Magnetic Hinge.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed and approved by the Qualified Persons (as defined under NI 43-101) and authors of the Technical Report, David Michael Begg of dMb Management Services Pty Ltd (South Africa), Clive Brown of BARA International, Galen White of Bara Consulting UK Limited, Glenn Bezuidenhout of GB Independent Consulting Pty Ltd, and Malcolm Titley of Maja Mining Limited. None of the Qualified Persons hold any interest in Asante, its associated parties, or in any of the mineral properties which are the subject of this news release.

Other scientific and technical information contained in this news release has been reviewed and approved by David Anthony, P.Eng., Mining and Mineral Processing, President and CEO of Asante, who is a "qualified person" under NI 43-101.

Non-IFRS Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS”), including “all-in sustaining costs” (or “AISC”), “earnings before interest, taxes, depreciation and amortization” (or “EBITDA”), and free cashflow. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction with Asante’s consolidated financial statements. Readers should refer to Asante's Management Discussion and Analysis under the heading "Non-IFRS Measures" for a more detailed discussion of how Asante calculates certain of such measures and a reconciliation of certain measures to IFRS terms.

About Asante Gold Corporation

Asante is a gold exploration, development and operating company with a high-quality portfolio of projects and mines in Ghana. Asante is currently operating the Bibiani and Chirano Gold Mines and continues with detailed technical studies at its Kubi Gold Project. All mines and exploration projects are located on the prolific Bibiani and Ashanti Gold Belts. Asante has an experienced and skilled team of mine finders, builders and operators, with extensive experience in Ghana. The Company is listed on the Canadian Securities Exchange, the Ghana Stock Exchange and the Frankfurt Stock Exchange. Asante is also exploring its Keyhole, Fahiakoba and Betenase projects for new discoveries, all adjoining or along strike of major gold mines near the centre of Ghana’s Golden Triangle. Additional information is available on the Company’s website at www.asantegold.com.

About the Bibiani Gold Mine

Bibiani is an operating open pit gold mine situated in the Western North Region of Ghana, with previous gold production of more than 4.5 million ounces. It is fully permitted with available mining and processing infrastructure on-site consisting of a newly refurbished 3 million tonne per annum process plant and existing mining infrastructure. Asante commenced mining at Bibiani in late February 2022 with the first gold pour announced on July 7, 2022. Commercial production was announced November 10, 2022.

For additional information relating to the mineral resource and mineral reserve estimates for the Bibiani Gold Mine, please refer to the 2024 Bibiani Technical Report filed on the Company’s SEDAR profile (www.sedarplus.ca) on April 30, 2024.

About the Chirano Gold Mine

Chirano is an operating open pit and underground mine located in the Western Region of Ghana, immediately south of the Company’s Bibiani Gold Mine. Chirano was first explored and developed in 1996 and began production in October 2005. The mine comprises the Akwaaba, Suraw, Akoti South, Akoti North, Akoti Extended, Paboase, Tano, Obra South, Obra, Sariehu and Mamnao open pits and the Akwaaba and Paboase underground mines.

For additional information relating to the mineral resource and mineral reserve estimates for the Chirano Gold Mine, please refer to the 2024 Chirano Technical Report filed on the Company’s SEDAR profile (www.sedarplus.ca) on April 30, 2024.

For further information please contact:

Dave Anthony, President & CEO

Frederick Attakumah, Executive Vice President and Country Director

info@asantegold.com

+1 604 661 9400 or +233 303 972 147

Cautionary Statement on Forward-Looking Statements

Certain statements in this news release constitute forward-looking statements, including but not limited to, production and all-in sustaining costs forecasts for the Bibiani and Chirano Gold Mines, estimated mineral resources, reserves, exploration results and potential, development programs, expansion and mine life extension opportunities, completion of plant upgrades and completion of external financing by the Company. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, the Company’s inability to obtain any necessary permits, consents or authorizations required for its planned activities, the Company’s inability to raise the necessary capital or to be fully able to implement its business strategies, and the price of gold. The reader is referred to the Company’s public disclosure record which is available on SEDAR (www.sedarplus.ca). Although the Company believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except as required by securities laws and the policies of the securities exchanges on which the Company is listed, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

LEI Number: 529900F9PV1G9S5YD446. Neither IIROC nor any stock exchange or other securities regulatory authority accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bafc10cd-720f-4efa-98a9-f6a280e578d3