Ascendant Resources Provides Update on Geological and Exploration Activities at Its Lagoa Salgada Property in Portugal

- Copper stockworks identified below Venda Nova North

- Discovery of copper rich enrichment zone at Venda Nova North

- Potential for new massive sulphide lens at Venda Nova South

- Additional geophysical anomalies identified on Lagoa Salgada Property

TORONTO, May 16, 2022 (GLOBE NEWSWIRE) -- Ascendant Resources Inc. (TSX: ASND) (OTCQB: ASDRF; FRA: 2D9) ("Ascendant" or the "Company”) is pleased to provide a summary of recent exploration work and geological interpretation of the Lagoa Salgada Property in Portugal, which includes:

| i) | Identification of copper rich stockworks below the North Zone at Venda Nova; |

| ii) | Identification of a Copper rich transition/enrichment zone at the North Zone at Venda Nova; |

| iii) | Identification of a potential massive sulphide lens lateral to the South Zone at Venda Nova; and |

| iv) | New drill ready geophysical anomalies identified from the results of the Deep Penetrating Electromagnetic Survey (“DPEM”). |

Mark Brennan, Chairman of Ascendant stated, “The infill drilling and DPEM programs have uncovered some very positive unexpected outcomes which solidify our long held belief that the Lagoa Salgada property is still in the very early discovery phase of exploration, with significant untapped resource growth remaining. The potential to grow both the North and South Zones of Venda Nova, which are approximately 400 metres apart, as well as a prospective new target to the northeast of the property has the potential to be transformational for the Company. We look forward to initiating future drilling programs as we look to expand the overall resource potential on the greater Lagoa Salgada land package.”

North Zone of Venda Nova: Copper Rich Stockwork

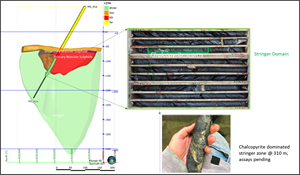

Based on recent drilling, a new potential copper zone has been identified at depth in the North Zone of Venda Nova (shown in Figure 2.).

The new Stockworks zone occurs downdip from the northern segment of the North Zone and has been identified as a result of visual intercepts from hole LS_MS-41 (assays pending). Visual inspection of the core identifies a potential Copper rich stringer zone with seams of semi massive chalcopyrite that spatially relates to the higher Copper grades in the massive sulphide, suggesting a possible feeder zone.

Copper feeders can generate high grade ore zones in VMS systems and can also include high gold values. The results of hole MS -41 will prompt follow up and a subdomain effort within the stringer zone that in the current resource model only contributes minor tonnage.

Figure 1. Drill core and cross section along hole LS_MS-41

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/74bc4e46-ca10-4a5f-a430-915598d7cefe

North Zone of Venda Nova: Copper Rich Secondary Enrichment Zone

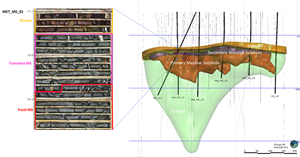

A new understanding of metal domaining has been developed as a result of the ongoing infill and metallurgical drill program at the North Zone; principally, the presence of an enriched copper blanket in the shallower part of the massive sulphide ore which is immediately below the gossan. The identification of this zone, which is rich in copper and silver (as highlighted by the results of MET_MS_01 previously reported in press release dated May 3rd, 2022) has a different mineral profile than the massive sulphides which has a potential for a significant impact on optimizing recoveries for the project.

Figure 2. Longitudinal 3D view of the North Zone

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fd337be7-b201-462d-b442-59c0e5f7e413

The enhanced understanding of the metal domaining has aided in further refinement of “Primary metal zoning” which is a common characteristic in Volcanic Massive Sulphide (“VMS”) systems, which tend to have Copper dominated ore spatially separated from Zinc/ lead Ore. Additionally, secondary processes (oxidation and metal re-distribution) can generate the gold rich gossan caps and related enriched secondary sulphide blankets in the upper levels of the massive sulphides.

The new sub domaining of the massive sulphide body follows Geochem proxies based on metal ratios. The Geochem proxies analysis is being extrapolated to the entire North Zone sector, making use of the historic geochemical database, preliminarily defining a continuous secondary horizon (Copper rich) underlying the Gossan and overlying the primary mineralization.

As we better understand the mineralogy and zoning of the deposit, we can further refine the metallurgical process and potential to enhance overall recoveries. These results are being built into the metallurgical testwork program that is currently underway.

South Zone of Venda Nova: Massive Sulphide Potential

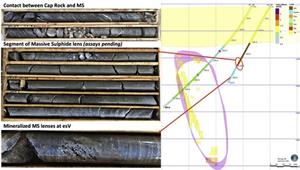

In the South Zone, new drill results have identified the presence of “Cap rocks” (Hanging wall volcanics similar to the massive sulphide lenses in the North) suggesting the potential proximity of a new zone of massive sulphides. The Cap rocks crossed in hole LS_ST-29 are overlying the Exhalative sedimentary unit that represents the hanging wall of the fissural ore (stockwork ore) of the South Zone (see Figure 3.). This stratigraphic observation is relevant as it reveals the potential of connecting the North and South Zones along a trend that is yet untested immediately to the east of the drilled pattern that has targeted mainly the fissural ore in the South Zone.

In fact, visual interpretation of hole LS_ST-29 (assays pending) identified in the immediate footwall of the cap rock contains massive pyrite dominated massive sulphide mineralization (see Figure 3). Moreover, Ascendant had previously highlighted the occurrence of some discrete massive sulphide lenses contained in the exhalative sedimentary horizon in the South Zone. This area will be followed up with additional holes that were part of the original infill program. Future follow up drilling will target the potential for a new massive sulphide zone in the South Zone to further expand the overall mineral endowment at Venda Nova.

Figure 3. Cross Section of LS_ST-29

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0c1af6ba-d41c-4520-817f-23b45c022c01

Lagoa Salgada: New Regional Geophysical Target

Ascendant retained International Geophysical Technology (“IGT”) to undertake 2 phases of Deep Penetrating Electromagnetic (“DPEM”) surveying over the Venda Nova deposit at Lagoa Salgada. Phase one included two large loops centered along strike of the known mineralization, both north and south sectors.

Phase one revealed a possible deep anomaly to the northeast of Venda Nova. To properly constrain and further model this East anomaly a third loop was completed (Phase 2) in March 2022 (see Figure 4).

Figure 4. Geophysical anomalies (EM & Chargeability)

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/97a3378f-dab0-4030-8c53-16058ceb0a31

As shown above, the Phase 2 program identified a new large target to the northeast of the Venda Nova deposit (“EM Anomaly B”) which the Company believes has the potential to host an additional massive sulphide lens. The Electromagnetic response in this area is partially affected by the conductive character of the tertiary overburden (140m sequence above the permissive volcanic). Results of the survey have been thoroughly modeled and every effort has been made to determine if EM Anomaly B is caused by the conductive overburden or by a combination of the overburden and a more highly conductive deep body, which could represent a Massive Sulphide lens. There are several compelling reasons to believe that this anomaly is caused by a conductive source which is separate but additional to the regional conductive overburden. The deep response has been modeled as a subvertical domain with a general azimuth of 330 and a possible depth of ~ 400 m. (See Figure 5.)

Figure 5. Cross section showing modeled plate (Anomaly B) and proximity to Venda Nova North

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8e8d1621-a6b9-4b74-b687-8f58265e81ed

Anomaly B defined by the Phase 2 work will be drill tested jointly with other targets using previous geophysical surveys (e.g., Induced Polarization). Chargeability anomalies along the contact between the tertiary and volcanic rocks are believed to represent Gossan zones as proved empirically at Venda Nova. Several zones have been identified when evaluating the IP 3D inversion over the tertiary contact surface. These anomalies resemble the Venda Nova footprints and will be systematically tested.

Additionally, Ascendant is planning borehole EM in the north sector to penetrate under the conductive gossan seem effectively reducing any masking and a possible 4th DPEM loop to test deeper roots of the chargeability anomalies mentioned above and outlined in Figure 4.

In summary the Company is pleased by the results to date of this year’s Geophysical programs confirming:

- Even though the tertiary overburden exhibits conductive seams that partially mask deeper responses, both EM and IP accurately footprint mineralization on bedrock immediately below the tertiary sedimentary sequence.

- Both chargeable and conductive zones respond either to gossan and/ or sulphides. The former being the oxidation product of primary mineralization.

- A notable new deep EM conductor has been defined to the northeast of Venda Nova. Relevant anomalies tend to be aligned and follow structural and stratigraphic trends warranting drill testing

- Refined stratigraphic framework reveals consistent sequence with key markers (e.g. Cap rock and massive sulphide) extending probably for the full combined strike length of the combined deposits: approximately 1.5 km.

- The relevance of this stratigraphic correlation is the extent of untested areas along the permissive stratigraphic horizon permissive for exhalative or immediate sub sea for massive sulphide development.

- Sub domaining of previous bulk domains (e.g. massive sulphide and Stringer) is a relevant tool for improving processing outcome, defining dominant metals and as a vectoring exploration tool

As a result of the enhanced understanding of Venda Nova and the regional exploration work, Ascendant is confident that considerable resource endowment upside remains on the property. As results of the infill program continue to become available, Ascendent will look to develop a separate exploration program to follow up on this potential.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Ascendant Resources Ltd, who is a Qualified Person as defined in National Instrument 43-101.

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. Through focused exploration and aggressive development plans, the Company aims to unlock the inherent potential of the project, maximizing value creation for shareholders.

The Venda Nova deposit at Lagoa Salgada contains over 10.33 million tonnes of Measured and Indicated Resources @ 9.06 % ZnEq and 2.50 million tonnes of Inferred Resources @ 5.93 % ZnEq in the North Zone; and 4.42 million tones of Indicated Resources @ 1.50 % CuEq and 10.83 million tonnes of Inferred resources @ 1.35 % CuEq in the South Zone. The deposit demonstrates typical mineralization characteristics of Iberian Pyrite Belt VMS deposits containing zinc, copper, lead, tin, silver and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 10,700ha property concession. The project also demonstrates compelling economics with scalability for future resource growth in the results of the Preliminary Economic Assessment. Located just 80km from Lisbon, Lagoa Salgada is easily accessible by road and surrounded by exceptional Infrastructure. Ascendant holds a 21.25% interest in the Lagoa Salgada project through its 25% position in Redcorp - Empreendimentos Mineiros, Lda, ("Redcorp") and has an earn-in opportunity to increase its interest in the project to 80%. Mineral & Financial Investments Limited owns the additional 75% of Redcorp. The remaining 15% of the project is held by Empresa de Desenvolvimento Mineiro, S.A., a Portuguese Government owned company supporting the strategic development of the country's mining sector. The Company's interest in the Lagoa Salgada project offers a low-cost entry to a potentially significant exploration and development opportunity, already demonstrating its mineable scale.

The Company's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant, please visit our website at www.ascendantresources.com.

Additional information relating to the Company, including the Preliminary Economic Assessment referenced in this news release, is available on SEDAR at www.sedar.com.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

| Mark Brennan | Nicholas Campbell, CFA |

| CEO, Executive Chairman, Founder | Manager, Corporate Development |

| Tel: +1-647-796-0023 | Tel: +1-905-630-0148 |

| mbrennan@ascendantresources.com | ncampbell@ascendantresources.com |

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). Forward-looking information is also identifiable in statements of currently occurring matters which may continue in the future, such as "providing the Company with", "is currently", "allows/allowing for", "will advance" or "continues to" or other statements that may be stated in the present tense with future implications. All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information in this news release includes, but is not limited to, statements regarding the exploration activities and the results of such activities at the Lagoa Salgada Project, the ability of the Company to advance the Lagoa Salgada Project to a feasibility, and the ability of the Company to fund the exploration with funds from operations. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by Ascendant at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The material factors or assumptions that Ascendant identified and were applied by Ascendant in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the success of the exploration activities at Lagoa Salgada Project, the Company advancing the project to a Preliminary Economic Assessment, the ability of the Company to fund the exploration program at Lagoa Salgada with funds from operations, and other events that may affect Ascendant's ability to develop its project; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets.