Atalaya Mining PLC Announces Update on Exploration Activities

Drilling results include a potential new massive sulphide discovery at the Mojarra Trend and a new high-grade zone at Masa Valverde

NICOSIA, CYPRUS / ACCESSWIRE / November 24, 2022 / Atalaya Mining Plc (AIM:ATYM)(TSX:AYM) is pleased to provide an update on the ongoing exploration programme at its projects in southern Spain which include Proyecto Masa Valverde ("PMV"), Proyecto Ossa Morena ("POM") and Proyecto Riotinto East ("PRE"). A total of four rigs are currently active, with three at PMV and one at POM.

Highlights

- Mojarra Trend at PMV: New potential discovery via intersection of 18.75m of polymetallic massive sulphides from the 2nd hole in a previously undrilled area

?EUR' MR02: 18.75m at 0.84% Cu, 0.63% Zn, 0.66% Pb and 76.24 g/t Ag including a higher-grade zone of 6.80m at 1.22% Cu and 101.60 g/t Ag

- Masa Valverde deposit at PMV: Step-out drilling in the western area has discovered a new high-grade zinc zone

?EUR' MJ54: Including a main mineralised interval of 18.00m at 0.25% Cu, 8.30% Zn, 2.49% Pb, 60.17 g/t Ag and 0.89 g/t Au (4.06% CuEq)

?EUR' New mineralised zone remains open laterally

- Campanario Trend at PMV: Resource definition drilling encountered new zones of shallow polymetallic mineralisation, including:

?EUR' CA42: 7.50m at 0.45% Cu, 1.09 g/t Ag and 6.67 g/t Au from 35m

?EUR' CA40: 9.80m at 0.44% Cu, 8.16 g/t Ag and 0.15 g/t Au from 11m

?EUR' Drillholes are located west and east of the historical Campanario mine where previously announced drilling defined shallow higher-grade zones

- Campanario Trend at PMV: Additional drilling around the historical Campanario mine confirmed the lateral and up-dip continuity of the previously defined mineralisation, including:

?EUR' CA25: 9.10m at 0.72% Cu, 3.60% Zn, 2.65% Pb, 73.79 g/t Ag and 0.99 g/t Au from 100.90m (2.90% CuEq)

- Hinchona Cu-Au prospect at POM: Initial results from a four-hole campaign included an intersection of 3.40m at 0.80% Cu, 1.84 g/t Ag and 479 ppm Co

- Riotinto East: First drilling is expected to commence shortly

Alberto Lavandeira, CEO, commented:

"The discovery of the Mojarra Trend is very promising and demonstrates the value of the systematic exploration approach being implemented by our geological team.

We acquired PMV in 2020, having discovered the small but high-grade polymetallic Majadales deposit, and in April 2022 announced a new NI 43-101 compliance resource estimate for the Masa Valverde and Majadales deposits. Since then we have defined new, shallow and potentially economic mineralisation at the Campanario Trend and have now made a potentially new discovery at the previously undrilled Mojarra Trend.

All of these achievements, together with the numerous geophysical targets that remain untested, confirm our belief that the ultimate resource potential of PMV is underexplored and far from defined.

At POM, the encouraging initial results at Hinchona provide confidence that further drilling is warranted, with a focus on finding new zones of economic mineralisation and also increasing the currently defined resources at the flagship Alconchel Cu-Au deposit.

Exploration will remain a key activity for Atalaya in 2023 and our exploration budget is expected to reflect our geological team's recent successes and the growing list of targets across our exploration portfolio. We remain focused on expanding our resource base and identifying higher grade material that could be processed at our Riotinto plant, potentially providing an uplift to copper production by increasing the blended head grade."

Ongoing Exploration Programmes

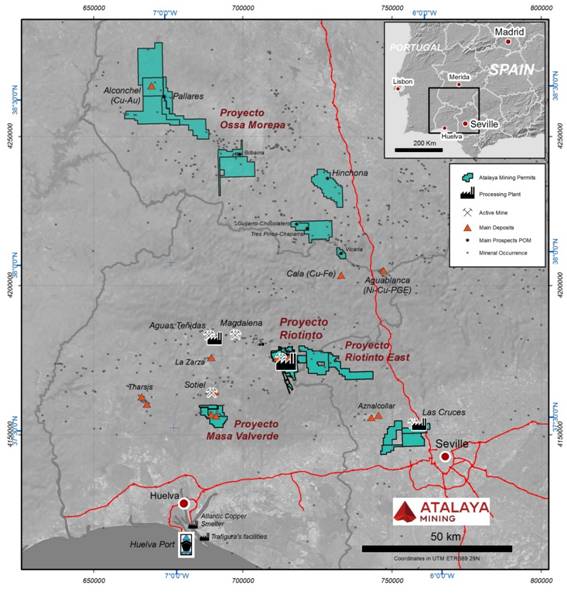

In the past years, Atalaya has assembled a substantial portfolio of exploration projects in southern Spain. These include PMV and PRE, which are located in the Riotinto District, as well as POM, which is located north of Riotinto. Exploration activities at these projects are consistent with Atalaya's strategy to develop its existing 15 Mtpa mill into a central processing hub for material sourced from its deposits in the region.

Figure 1: Atalaya Exploration Permits

PMV

Overview

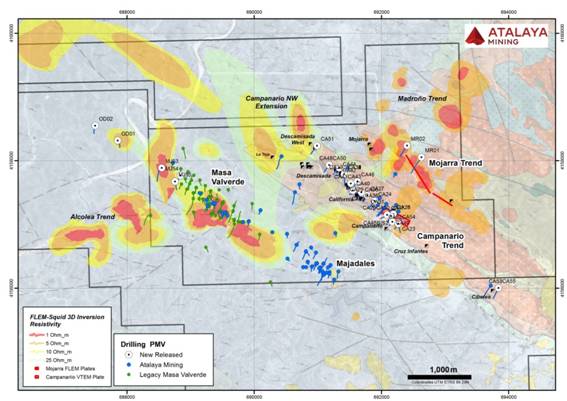

PMV is strategically located approximately 28km from Proyecto Riotinto, and consists of several volcanogenic massive sulphide ("VMS") type deposits including Masa Valverde ("MV"), Majadales, the Campanario Trend and now the Mojarra Trend. In April 2022, Atalaya announced a new independent resource estimate for MV and Majadales.

Three core rigs are currently active and focused on step-out drilling at MV, resource definition drilling at the Campanario Trend and drill testing the lateral continuity of the new discovery made at the Mojarra Trend.

Since the Company's last exploration update, 34 holes have been completed at Campanario, five at MV West Extension and two at Mojarra Trend for a total of about 20,871m.

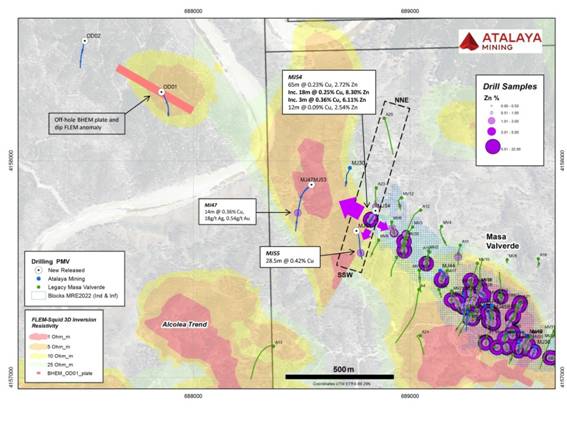

Figure 2: PMV Drill Hole Map and Geophysical Anomalies

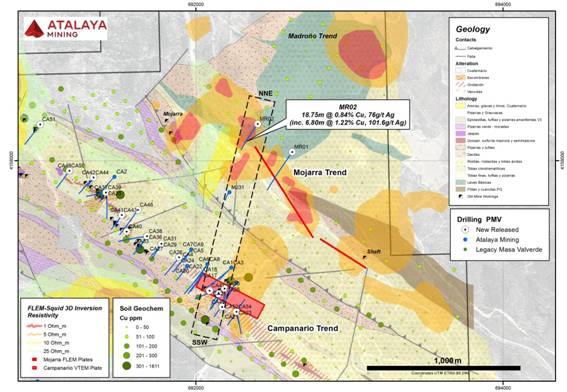

Mojarra Trend

The Mojarra Trend is a 2km long, north-west trending structural corridor, located 1km north of the Campanario Trend. It is defined by the presence of small, historical manganese and pyrite mines, elevated Cu values in soils and associated fix-loop electromagnetic ("FLEM") anomalies, all along a complex structural (low angle faulting) and stratigraphic (including basic volcanics) setting.

Figure 3: Mojarra Trend Drill Hole Map and Geophysical Anomalies

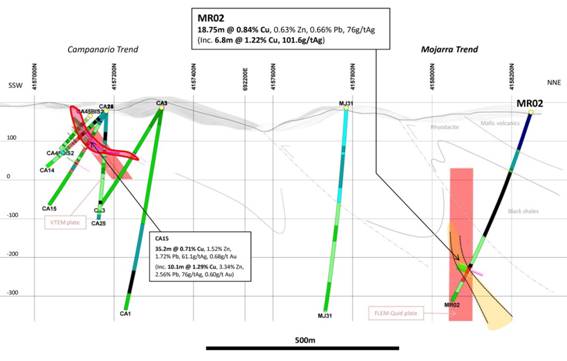

Two holes totalling 1,162m have been completed to date and one more hole is under way. The first hole (MR01) failed to hit any significant mineralisation but the second hole (MR02), located in the westernmost part of the FLEM anomaly, intersected 18.75m of massive sulphides at 434m depth. Pyrite is the predominant sulphide mineral, but is also associated with visible sphalerite, galena and chalcopyrite. Host rocks are graphitic black shales with felsic tuffs and minor volcanics interbedded. Assay results returned 18.75m at 0.84% Cu, 0.63% Zn, 0.66% Pb and 76.24 g/t Ag including a higher-grade interval of 6.80m at 1.22% Cu and 101.60 g/t Ag.

Figure 4: MR02 Discovery Hole Preliminary Section at Mojarra Trend

The next round of drilling will test the lateral continuity of this new zone which, if confirmed, could represent a significant discovery not only at PMV but also in the Iberian Pyrite Belt.

MV West Extension

Five holes totalling 5,034m were completed in the western part of the MV deposit with the aim of extending the known mineralisation in that direction (see Figure 5). The holes were distributed as follows:

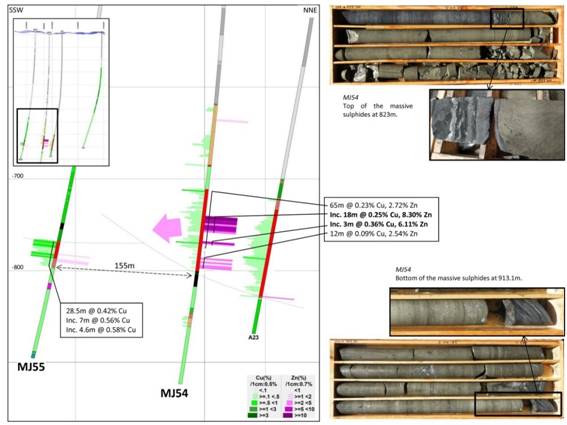

- Holes MJ54 and MJ55 were drilled in the westernmost section of the deposit which currently represents the west limit of the resource envelope

- Hole MJ53 was targeting the FLEM anomaly located 300m west of MV

- Holes OD01 and OD02 drill tested another FLEM anomaly located 1km west of MV

Figure 5: MV West Extension Drill Hole Map and Geophysical Anomalies

MJ54 and MJ55 hit wide intervals of massive sulphide mineralisation demonstrating that the system remains open to the west. Hole MJ54 intersected 90.10m from 823.00m depth while drill hole MJ55 hit 19.40m from 908.20m depth. In both cases, visible sphalerite, galena, and chalcopyrite is associated with the massive pyrite mineralisation.

Assay results for hole MJ54 returned two high grade mineralised intervals of 18.00m at 0.25% Cu, 8.30% Zn, 2.49% Pb, 60.17 g/t Ag and 0.89 g/t Au plus 3.00m at 0.36% Cu, 6.11% Zn, 0.22% Pb, 29.33 g/t Ag and 0.98 g/t Au. A separate lower grade interval returned 12.00m at 0.09% Cu, 2.54% Zn, 1.58% Pb, 51.08 g/t Ag and 0.75 g/t Au. Stockwork type mineralisation intersected above and below the massive sulphides returned low-grade results.

Assay results for hole MJ55 returned 28.50m at 0.42% Cu, 0.27% Zn, 0.20% Pb and 19.50 g/t Ag. Gold values are not yet available for this hole. A preliminary section through these holes is included in Figure 6.

Figure 6: MJ54 and MJ55 Sections at MV West Extension

Drill hole MJ53 was the second attempt to hit the core of the FLEM anomaly located 300m west of the western limit of MV deposit. However, and as occurred with previous hole MJ47, it failed due to severe drifting problems. Despite those issues, the first hole (MJ47) had intersected massive sulphides which returned 14m at 0.36% Cu, 0.61% Zn, 0.32% Pb, 18.04 g/t Ag and 0.54 g/t Au (0.78% CuEq).

Drill holes OD01 and OD02 failed to find any significant mineralisation. However, a down hole EM survey on those holes showed a moderate off-hole conductor immediately north of OD1 which will deserve further drill testing.

Mineralisation found in holes MJ54 and MJ55 has several positive exploration implications for the following main reasons:

- Improves the geological model in the west sector of the deposit providing more lateral continuity to the massive sulphide zones

- Suggests that several historical holes were stopped prematurely

- Confirms that mineralisation remains open laterally, especially to the west but, more importantly, with associated high-grade results which could be economic even at those depths

· Will help to target more accurately the two main FLEM anomalies west of the deposit

An additional step-out hole, MJ56, is currently in progress with the goal of proving the continuity of the high-grade zone encountered in hole MJ54 approximately 150m to the NW. Complete results from the MV West Extension are included in Table 1.

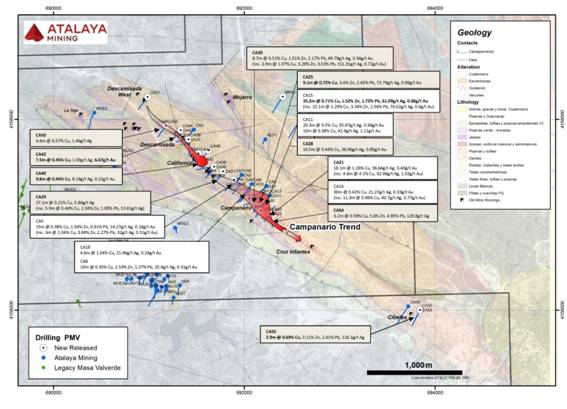

Campanario Trend

Resource definition drilling continues in progress at the Campanario Trend with one rig. Since the beginning of the programme, the Company completed a total of 14,676m in 56 holes (see Figure 7). Assay results for the first 22 holes were announced in July 2022 which corresponded to drilling around the historical Campanario mine, located in the central part of the Campanario Trend. Drilling since then has been distributed as follows:

- 20 holes on the western part of the Campanario Trend, mainly around the California, Descamisada and Descamisada West historical mines

- 11 holes around the Campanario historical mine to fill gaps in previously drilled sections to test lateral and up-dip continuities

- 3 holes around the Cibeles historical mine, situated in the easternmost part of the Campanario Trend

Figure 7: Campanario Trend Drill Hole Map and Main Intersections to Date

Most of the holes drilled at California, Descamisada and Descamisada West intersected narrow zones of massive, semi-massive and, in some cases, stockwork-type sulphide mineralisation. The structural and stratigraphic setting is similar to that at the central part of the Campanario Trend as well as the mineralogy and geochemistry. However, assay results received to date were in general lower grade than at Campanario except for some very high Au-Ag intercepts, such as in hole CA42. Among the best results were 7.50m at 0.45% Cu, 1.09 g/t Ag and 6.67 g/t Au (1.62% CuEq) from 35m depth in hole CA42 and 9.80m at 0.44% Cu, 8.16 g/t Ag and 0.15 g/t Au from 11m depth in hole CA40.

All the recent holes drilled around the Campanario historical mine hit massive sulphide zones and returned higher-grade polymetallic results, confirming the lateral and up-dip continuity of the previously defined mineralisation. Among the best results was 9.10m at 0.72% Cu, 3.60% Zn, 2.65% Pb, 73.79 g/t Ag and 0.99 g/t Au (2.90% CuEq) from 100.90m depth in hole CA25.

Of the three holes completed so far at Cibeles, located 1.8km east of the Campanario historical mine, one of them, CA55, intersected a narrow interval of massive sulphide mineralisation which returned 2.90m at 0.69% Cu, 0.11% Zn, 2.61% Pb and 118.10 g/t Ag. Gold values are not yet available for this hole. Complete results from the Campanario Trend are included in Table 2.

Based on the drilling conducted to date, the Company may conclude that the central and eastern sectors of the Campanario Trend are the most favourable areas to define a small but shallow and higher-grade mineral resource. Consequently, priority will be given to complete systematic drilling along the 1.8km gap between Cibeles and Campanario and where the promising Cruz Infantes historical mine is located.

PMV Exploration Potential

Several FLEM anomalies remain pending for drill testing inside the current limits of the property. Priority will be given to the anomalies located south of MV (Alcolea Trend), NW extension of the Campanario Trend (Campanario NW extension) and NE of the Mojarra Trend (Madroño Trend) as shown in Figure 2.

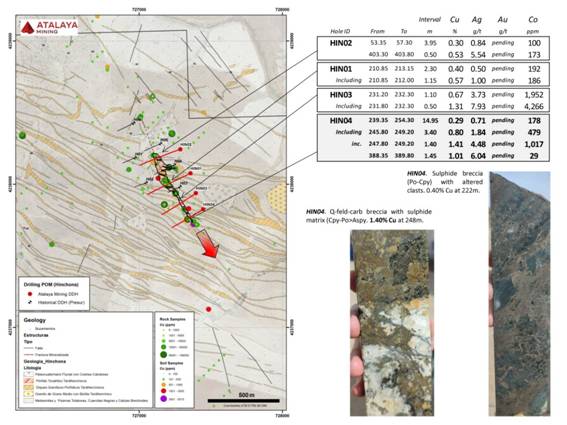

POM

A four-hole drilling programme totalling 1,874m was completed at the La Hinchona Cu-Au project, located in the central part of POM. Mineralisation at La Hinchona is related to a north-northwest trending structure which controls the emplacement of a diorite porphyry and associated alteration and hydrothermal mineralisation. The main target zone is 1km long as defined by the alignment of several small historical mines, soil geochemical and induced polarization anomalies. So far only 450m of the 1 km long target zone has been drill tested.

Figure 8: La Hinchona Drill Holes with Main Intersections and Mineralisation Styles

The four holes encountered centimetric to metric scale zones of hydrothermal alteration and pyrite, chalcopyrite, arsenopyrite and pyrrhotite mineralisation associated with quartz (+/-carbonate) veinlets, veins, breccia veins, stockworks and, in some cases, sulphide breccias.

The best results were obtained in the southernmost hole, HIN04, which returned several mineralised intervals such as 14.95m at 0.29% Cu from 239.35m depth and included two higher-grade intervals of 3.40m at 0.80% Cu, 1.84 g/t Ag and 479 ppm Co and 1.45m at 1.01% Cu and 6.04 g/t Ag. Gold values are not yet available.

Mineralisation found in hole HIN04 has positive exploration implications mainly because it represents a mineralogical, textural and geochemical vector towards better grades to the south. Complete results are included in Table 3.

Drilling has just started at the Chaparral Cu-Au prospect where previous drilling had intersected narrow intervals of high-grade Cu mineralisation (0.40m at 2.26 % Cu from 92.40m depth). Drilling at the flagship Alconchel-Pallares Cu-Au-Fe project is expected to start at the beginning of next year.

PRE

Final granting of the Peñas Blancas investigation permit was received in August 2022. Drill target definition work carried out to date, which included soil and rock geochemistry as well as re-interpretation of the original SkyTEM geophysical data, has evidenced a main east-west trending mineralised corridor, Coto Vicario, which will deserve immediate drill testing. This corridor is characterised by the alignment of several small historical mines (mainly pyrite), Cu soil geochemical and geophysical SkyTEM anomalies (see Figure 9). Grab samples taken from old dumps returned up to 10.25% and 5.90% Cu. Several historical holes drilled on this corridor encountered stockwork-type mineralisation, mainly pyritic, but results were not available.

Figure 9: PRE Target Definition Compilation and Coto Vicario Mineralised Corridor

Atalaya Exploration Programme Next Steps

Drilling will continue with four rigs until the end of the year. Priority will be given to:

- Investigate the lateral continuity of the new discovery at Mojarra Trend

- The area between Campanario and Cibeles historical mines where the potential to find more shallow, high-grade polymetallic sulphide mineralisation is high

- The west extension of the high-grade mineralisation discovered in hole MJ-54

· Drill testing the Chaparral Cu-Au prospect at POM and to commence infill and step-out drilling at the flagship Alconchel Cu-Au deposit

· Commence drilling at the Coto Vicario anomaly at PRE

An airborne gravity gradiometry ("AGG") and magnetic survey is planned to start before year end at PMV and subsequently at PRE. AGG is a leading technology in the search for buried mineral deposits, especially those of the size that is typical in the Pyrite Belt.

Table 1: Masa Valverde Deposit Drill Results Summary

Notes | Hole ID | Length | From | To | Interval | Cu | Zn | Pb | Ag | Au | CuEq 1 |

(m) | (m) | (m) | (m) | % | % | % | g/t | g/t | % | ||

2 | OD01 | 1017.10 | |||||||||

2 | OD02 | 1025.40 | |||||||||

2 | MJ53 | 914.80 | |||||||||

3 | MJ54 | 1037.40 | 796.80 | 797.90 | 1.10 | 0.49 | 0.19 | 0.13 | 12.00 | 0.89 | 0.76 |

823.00 | 888.00 | 65.00 | 0.23 | 2.72 | 0.81 | 42.68 | 0.84 | 1.64 | |||

Including | 852.00 | 870.00 | 18.00 | 0.25 | 8.30 | 2.49 | 60.17 | 0.89 | 4.06 | ||

Including | 880.00 | 883.00 | 3.00 | 0.36 | 6.11 | 0.22 | 29.33 | 0.98 | 2.87 | ||

898.00 | 910.00 | 12.00 | 0.09 | 2.54 | 1.58 | 51.08 | 0.75 | 1.59 | |||

4 | MJ55 | 1039.40 | 908.20 | 936.70 | 28.50 | 0.42 | 0.27 | 0.20 | 19.50 | n/a | 0.62 |

Including | 909.00 | 916.00 | 7.00 | 0.56 | 0.02 | 0.09 | 17.01 | n/a | 0.64 | ||

Including | 923.00 | 927.60 | 4.60 | 0.58 | 0.18 | 0.24 | 23.49 | n/a | 0.77 |

Note: Table showing detailed drilling results over 0.10% Cu.

1. Metal prices and recoveries used for CuEq calculation are: Cu $9,600/t, 80%; Zn $3,500/t, 80%; Pb $2,300/t, 60%; Ag $23/oz, 35%; Au $1,800/oz, 20%.

2. No significant intersection.

3. Assays from ALS laboratory.

4. Assays from Proyecto Riotinto's certified laboratory. Gold is not assayed in this laboratory and not included in the CuEq calculation.

Table 2: Campanario Trend and Mojarra Drill Results Summary

Notes | Hole ID | Length | From | To | Interval | Cu | Zn | Pb | Ag | Au | CuEq 1 |

(m) | (m) | (m) | (m) | % | % | % | g/t | g/t | % | ||

2 | CA14 | 218.00 | 78.10 | 92.70 | 14.60 | 0.28 | 1.72 | 1.74 | 74.86 | 1.33 | 1.67 |

78.10 | 83.10 | 5.00 | 0.49 | 4.26 | 3.48 | 78.26 | 0.52 | 3.01 | |||

90.20 | 92.70 | 2.50 | 0.60 | 0.94 | 2.80 | 139.00 | 0.64 | 2.01 | |||

100.40 | 103.50 | 3.10 | 0.47 | 6.60 | 4.32 | 104.13 | 0.43 | 4.07 | |||

114.40 | 116.00 | 1.60 | 1.03 | 0.49 | 0.57 | 23.88 | 0.23 | 1.42 | |||

123.20 | 125.00 | 1.80 | 0.32 | 0.06 | 0.16 | 14.61 | 0.07 | 0.43 | |||

2 | CA15 | 290.00 | 77.80 | 113.00 | 35.20 | 0.71 | 1.52 | 1.72 | 61.09 | 0.68 | 1.88 |

Including | 79.00 | 81.00 | 2.00 | 1.51 | 0.08 | 1.33 | 160.50 | 1.74 | 2.58 | ||

Including | 92.00 | 102.10 | 10.10 | 1.29 | 3.34 | 2.56 | 76.02 | 0.60 | 3.32 | ||

Including | 108.90 | 113.00 | 4.10 | 0.54 | 2.25 | 2.16 | 55.39 | 0.17 | 1.96 | ||

158.00 | 161.00 | 3.00 | 0.71 | 1.25 | 0.71 | 25.20 | 0.15 | 1.40 | |||

Including | 158.00 | 158.80 | 0.80 | 1.67 | 1.03 | 0.95 | 67.00 | 0.10 | 2.46 | ||

2 | CA16 | 179.40 | 88.00 | 118.00 | 30.00 | 0.42 | 0.14 | 0.26 | 21.27 | 0.33 | 0.64 |

Including | 88.00 | 99.30 | 11.30 | 0.96 | 0.09 | 0.28 | 40.70 | 0.77 | 1.29 | ||

Inc. | 90.80 | 93.30 | 2.50 | 2.25 | 0.14 | 0.65 | 76.56 | 1.01 | 2.83 | ||

2 | CA17 | 200.00 | 100.20 | 101.50 | 1.30 | 0.92 | 0.02 | 0.18 | 24.00 | 0.16 | 1.06 |

2 | CA18 | 227.00 | 104.50 | 109.10 | 4.60 | 1.04 | 0.04 | 0.13 | 21.96 | 0.24 | 1.18 |

2 | CA19 | 141.00 | 60.30 | 65.30 | 5.00 | 0.27 | 0.04 | 0.13 | 31.82 | 0.34 | 0.46 |

73.00 | 84.30 | 11.30 | 0.37 | 0.04 | 0.11 | 23.54 | 0.80 | 0.60 | |||

Including | 77.00 | 77.50 | 0.50 | 2.16 | 0.04 | 0.09 | 18.00 | 0.78 | 2.37 | ||

Including | 80.00 | 84.30 | 4.30 | 0.47 | 0.06 | 0.20 | 23.26 | 1.60 | 0.84 | ||

5 | CA20 | 157.10 | |||||||||

2, 4 | CA21 | 139.30 | 43.20 | 61.30 | 18.10 | 1.26 | 0.08 | 0.64 | 36.64 | 0.40 | 1.59 |

Including | 43.20 | 48.00 | 4.80 | 4.10 | 0.16 | 2.03 | 92.98 | 1.03 | 4.99 | ||

2 | CA22 | 298.80 | 105.60 | 117.00 | 11.40 | 0.13 | 1.04 | 0.53 | 23.05 | 0.25 | 0.72 |

5 | CA23 | 257.40 | |||||||||

2 | CA24 | 203.30 | 124.20 | 127.60 | 3.40 | 0.30 | 1.55 | 0.33 | 10.59 | 0.29 | 1.01 |

136.70 | 138.00 | 1.30 | 0.27 | 1.34 | 0.66 | 10.00 | 0.71 | 1.01 | |||

2 | CA25 | 281.20 | 100.90 | 110.00 | 9.10 | 0.72 | 3.60 | 2.65 | 73.79 | 0.99 | 2.90 |

Including | 105.90 | 109.00 | 3.10 | 0.98 | 5.67 | 3.37 | 88.71 | 0.99 | 4.10 | ||

2 | CA26 | 194.50 | 57.20 | 57.40 | 0.20 | 0.51 | 0.08 | 0.16 | 5.00 | 0.30 | 0.63 |

5 | CA27 | 169.80 | |||||||||

2 | CA28 | 218.00 | 117.80 | 128.30 | 10.50 | 0.44 | 0.06 | 0.17 | 36.96 | 0.85 | 0.74 |

Including | 121.30 | 125.30 | 4.00 | 0.72 | 0.07 | 0.33 | 78.88 | 1.17 | 1.25 | ||

2 | CA29 | 284.30 | 209.90 | 237.00 | 27.10 | 0.21 | 0.87 | 0.39 | 5.86 | 0.03 | 0.62 |

Including | 209.90 | 210.10 | 0.20 | 1.42 | 0.01 | 0.06 | 20.00 | 0.03 | 1.51 | ||

Including | 214.80 | 220.70 | 5.90 | 0.44 | 2.34 | 1.08 | 13.61 | 0.04 | 1.54 | ||

2 | CA30 | 290.30 | 62.00 | 70.70 | 8.70 | 0.51 | 2.51 | 2.17 | 49.79 | 0.34 | 2.03 |

Including | 67.80 | 70.70 | 2.90 | 1.07 | 3.28 | 3.53 | 111.31 | 0.72 | 3.38 | ||

87.90 | 90.70 | 2.80 | 0.42 | 2.96 | 3.19 | 53.21 | 0.35 | 2.30 | |||

Including | 87.90 | 88.90 | 1.00 | 1.33 | 2.88 | 5.92 | 118.00 | 0.83 | 3.97 | ||

6 | 92.70 | 100.60 | 7.90 | ||||||||

100.60 | 101.00 | 0.40 | 0.42 | 0.04 | 0.13 | 107.00 | 0.13 | 0.84 | |||

124.15 | 132.50 | 8.35 | 0.25 | 1.61 | 0.64 | 14.93 | 0.18 | 1.03 | |||

188.30 | 190.00 | 1.70 | 0.20 | 0.07 | 0.14 | 13.06 | 0.08 | 0.30 | |||

2 | CA31 | 290.40 | 187.90 | 191.50 | 3.60 | 0.39 | 2.79 | 0.89 | 20.89 | 0.07 | 1.65 |

197.40 | 198.00 | 0.60 | 0.23 | 0.92 | 0.47 | 9.00 | 0.11 | 0.70 | |||

2 | CA32 | 97.70 | 38.00 | 53.40 | 15.40 | 0.12 | 0.78 | 0.29 | 4.09 | 0.22 | 0.50 |

5 | CA33 | 298.30 | |||||||||

2 | CA34 | 112.60 | 45.00 | 48.00 | 3.00 | 0.16 | 0.84 | 0.05 | 3.33 | 0.07 | 0.50 |

5 | CA35 | 193.30 | |||||||||

5 | CA36 | 209.50 | |||||||||

2 | CA37 | 233.00 | 61.30 | 65.00 | 3.70 | 0.31 | 1.08 | 0.16 | 1.35 | 0.03 | 0.74 |

67.50 | 69.00 | 1.50 | 0.26 | 0.06 | 0.18 | 4.67 | 0.14 | 0.35 | |||

2 | CA38 | 265.80 | 253.00 | 256.00 | 3.00 | 0.17 | 0.00 | 0.00 | 0.00 | 0.01 | 0.17 |

2 | CA39 | 184.00 | 24.80 | 28.20 | 3.40 | 0.02 | 1.06 | 0.01 | 0.00 | 0.02 | 0.41 |

31.00 | 36.10 | 5.10 | 0.17 | 0.24 | 0.04 | 2.43 | 0.13 | 0.29 | |||

2 | CA40 | 91.70 | 11.00 | 20.80 | 9.80 | 0.44 | 0.06 | 0.07 | 8.16 | 0.15 | 0.52 |

Including | 13.60 | 16.00 | 2.40 | 1.05 | 0.08 | 0.15 | 8.00 | 0.17 | 1.16 | ||

2 | CA41 | 158.00 | 76.90 | 78.00 | 1.10 | 0.60 | 0.06 | 0.17 | 7.00 | 0.10 | 0.69 |

2 | CA42 | 195.60 | 35.00 | 42.50 | 7.50 | 0.45 | 0.42 | 0.02 | 1.09 | 6.67 | 1.62 |

Including | 37.10 | 38.10 | 1.00 | 2.22 | 1.50 | 0.03 | 4.00 | 0.20 | 2.82 | ||

Including | 38.10 | 41.80 | 3.70 | 0.12 | 0.06 | 0.01 | 0.00 | 13.02 | 2.11 | ||

5 | CA43 | 223.80 | |||||||||

2 | CA44 | 184.80 | 83.10 | 84.20 | 1.10 | 0.28 | 0.81 | 0.46 | 9.00 | 0.30 | 0.73 |

86.50 | 87.10 | 0.60 | 0.09 | 2.35 | 1.32 | 15.00 | 0.12 | 1.25 | |||

2 | CA45BIS2 | 119.40 | 29.70 | 30.90 | 1.20 | 0.94 | 4.00 | 3.18 | 91.00 | 0.60 | 3.37 |

6 | 30.90 | 38.10 | 7.20 | ||||||||

38.10 | 40.90 | 2.80 | 0.57 | 5.37 | 4.05 | 78.37 | 0.21 | 3.55 | |||

Including | 38.10 | 40.15 | 2.05 | 0.71 | 7.02 | 5.23 | 94.61 | 0.27 | 4.57 | ||

2 | CA46 | 269.00 | 114.00 | 117.00 | 3.00 | 0.17 | 0.09 | 0.04 | 1.33 | 0.03 | 0.22 |

6 | CA47 | 83.10 | 10.40 | 19.40 | 9.00 | ||||||

23.90 | 25.40 | 1.50 | |||||||||

41.80 | 54.60 | 12.80 | |||||||||

2 | CA48 | 186.60 | 71.10 | 71.40 | 0.30 | 1.80 | 0.00 | 0.01 | 1.00 | 0.26 | 1.84 |

2 | CA49 | 131.90 | 24.00 | 25.00 | 1.00 | 0.54 | 0.07 | 0.19 | 130.00 | 1.59 | 1.28 |

46.80 | 49.30 | 2.50 | 0.95 | 0.46 | 1.57 | 26.40 | 1.53 | 1.72 | |||

2 | CA50 | 134.90 | 17.20 | 21.80 | 4.60 | 0.57 | 0.03 | 0.03 | 1.46 | 0.05 | 0.60 |

Including | 19.00 | 20.00 | 1.00 | 1.04 | 0.04 | 0.05 | 3.00 | 0.08 | 1.09 | ||

5 | CA51 | 224.00 | |||||||||

3 | CA52 | 196.70 | 79.60 | 85.80 | 6.20 | 0.26 | 0.22 | 0.40 | 110.23 | n/a | 0.78 |

Including | 80.90 | 81.70 | 0.80 | 0.80 | 0.10 | 0.45 | 174.40 | n/a | 1.51 | ||

5 | CA53 | 260.00 | |||||||||

3 | CA54 | 211.90 | 85.80 | 89.00 | 3.20 | 0.59 | 5.60 | 4.95 | 129.79 | n/a | 3.96 |

3 | CA55 | 300.60 | 82.10 | 85.00 | 2.90 | 0.69 | 0.11 | 2.61 | 118.10 | n/a | 1.60 |

5 | MR01 | 542.00 | |||||||||

3 | MR02 | 620.00 | 434.05 | 452.80 | 18.75 | 0.84 | 0.63 | 0.66 | 76.24 | n/a | 1.45 |

Including | 441.00 | 444.00 | 3.00 | 0.68 | 2.41 | 1.50 | 63.99 | n/a | 2.04 | ||

Including | 446.00 | 452.80 | 6.80 | 1.22 | 0.07 | 0.22 | 101.60 | n/a | 1.63 |

Note: Table showing detailed drilling results over 0.10% Cu.

1. Metal prices and recoveries used for CuEq calculation are: Cu $9,600/t, 80%; Zn $3,500/t, 80%; Pb $2,300/t, 60%; Ag $23/oz, 35%; Au $1,800/oz, 20%.

2. Assays from ALS laboratory.

3. Assays from Proyecto Riotinto's certified laboratory. Gold is not assayed in this laboratory and not included in the CuEq calculation.

4. This intersection includes 3m not recovered, likely due to an adit from 55 to 58m. Metal content of this interval is considered as zero in the calculations of the intercepts.

5. No significant intersection.

6. Adit intercepted.

Table 3: La Hinchona Drill Results Summary

Notes | Hole ID | Length | From | To | Interval | Cu | Ag | Au | Co |

(m) | (m) | (m) | (m) | % | g/t | g/t | ppm | ||

1 | HIN01 | 538.00 | 43.80 | 44.60 | 0.80 | 0.24 | 1.00 | n/a | 41 |

173.45 | 174.80 | 1.35 | 0.20 | 2.00 | n/a | 91 | |||

210.85 | 213.15 | 2.30 | 0.40 | 0.50 | n/a | 192 | |||

Including | 210.85 | 212.00 | 1.15 | 0.57 | 1.00 | n/a | 186 | ||

297.80 | 298.40 | 0.60 | 0.41 | 2.00 | n/a | 36 | |||

355.45 | 355.80 | 0.35 | 0.33 | 1.00 | n/a | 52 | |||

1 | HIN02 | 475.20 | 53.35 | 57.30 | 3.95 | 0.30 | 0.84 | n/a | 100 |

262.00 | 263.65 | 1.65 | 0.22 | 1.22 | n/a | 49 | |||

265.70 | 266.85 | 1.15 | 0.20 | 1.46 | n/a | 99 | |||

353.35 | 355.20 | 1.85 | 0.15 | 0.92 | n/a | 33 | |||

403.30 | 403.80 | 0.50 | 0.53 | 5.54 | n/a | 173 | |||

1 | HIN03 | 457.00 | 63.65 | 65.00 | 1.35 | 0.38 | 3.58 | n/a | 104 |

231.20 | 232.30 | 1.10 | 0.67 | 3.73 | n/a | 1952 | |||

Including | 231.80 | 232.30 | 0.50 | 1.31 | 7.93 | n/a | 4266 | ||

258.30 | 260.35 | 2.05 | 0.18 | 0.96 | n/a | 80 | |||

269.95 | 270.30 | 0.35 | 0.11 | 0.53 | n/a | 97 | |||

1 | HIN04 | 404.00 | 111.35 | 111.80 | 0.45 | 0.17 | 1.00 | n/a | 68 |

201.85 | 202.30 | 0.45 | 0.26 | 0.02 | n/a | 217 | |||

221.75 | 223.30 | 1.55 | 0.34 | 1.13 | n/a | 230 | |||

228.65 | 230.45 | 1.80 | 0.29 | 0.00 | n/a | 284 | |||

239.35 | 254.30 | 14.95 | 0.29 | 0.71 | n/a | 178 | |||

Including | 245.80 | 249.20 | 3.40 | 0.80 | 1.84 | n/a | 479 | ||

Inc. | 247.80 | 249.20 | 1.40 | 1.41 | 4.48 | n/a | 1017 | ||

279.50 | 279.95 | 0.45 | 0.25 | 0.99 | n/a | 575 | |||

388.35 | 389.80 | 1.45 | 1.01 | 6.04 | n/a | 29 |

Note: Table showing detailed drilling results over 0.10% Cu.

1. Assays from Proyecto Riotinto's certified laboratory. Gold is not assayed in this laboratory.

Qualified Person Statement

Alberto Lavandeira has reviewed the technical information contained within this announcement in his capacity as a Qualified Person, as required under the AIM Rules for Companies. Alberto Lavandeira is the Chief Executive Officer for the Company and is a member of good standing with the Association of Mining Engineers of Spain, with over 40 years' experience.

Glossary of Terms

| Ag | Silver |

| AGG | Airborne Gravity Gradiometry |

| Au | Gold |

| Co | Cobalt |

| Cu | Copper |

| CuEq | Copper Equivalent |

| FLEM | Fixed Loop Electromagnetic Survey |

| g/t | Grams per tonne |

| Pb | Lead |

| PPM | Parts per million |

| Stockwork | Complex 3D network of structurally controlled or randomly oriented veins. They are common in many ore deposit types. They are also referred to as stringer zones. |

| Zn | Zinc |

Contacts:

| SEC Newgate UK | Elisabeth Cowell / Axaule Shukanayeva / Max Richardson | + 44 20 3757 6882 |

| 4C Communications | Carina Corbett | +44 20 3170 7973 |

Canaccord Genuity (NOMAD and Joint Broker) | Henry Fitzgerald-O'Connor / James Asensio | +44 20 7523 8000 |

BMO Capital Markets (Joint Broker) | Tom Rider / Andrew Cameron | +44 20 7236 1010 |

Peel Hunt LLP (Joint Broker) | Ross Allister / David McKeown | +44 20 7418 8900 |

About Atalaya Mining Plc

Atalaya is an AIM and TSX-listed mining and development group which produces copper concentrates and silver by-product at its wholly owned Proyecto Riotinto site in southwest Spain. Atalaya's current operations include the Cerro Colorado open pit mine and a modern 15 Mtpa processing plant, which has the potential to become a centralised processing hub for ore sourced from its wholly owned regional projects around Riotinto that include Proyecto Masa Valverde and Proyecto Riotinto East. In addition, the Group has a phased earn-in agreement for up to 80% ownership of Proyecto Touro, a brownfield copper project in the northwest of Spain, as well as a 99.9% interest in Proyecto Ossa Morena. For further information, visit www.atalayamining.com

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

CONTACT:

Atalaya Mining Plc

1 Lampousas Street

1095 Nicosia, Cyprus

Tel: +357 22442705

Fax: +357 22442708

www.atalayamining.com

SOURCE: Atalaya Mining PLC

View source version on accesswire.com:

https://www.accesswire.com/728197/Atalaya-Mining-PLC-Announces-Update-on-Exploration-Activities