Aton confirms the extension of the Abu Marawat Concession exploration licence until March 2020, including a 20% land relinquishment

Not for distribution to United States newswire services or for dissemination in the United States

|

|||||

VANCOUVER, April 02, 2019 (GLOBE NEWSWIRE) -- Aton Resources Inc. (AAN: TSX-V) (“Aton” or the “Company") is pleased to confirm the extension of its exploration licence at the Company’s 100% owned Abu Marawat Concession (“Abu Marawat” or the “Concession”), located in the Eastern Desert of Egypt, until March 2020. The Company also announces the relinquishment of 20% of the land area of the Concession.

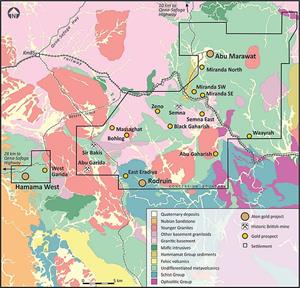

Figure 1: Revised area of the Abu Marawat Concession

http://www.globenewswire.com/NewsRoom/AttachmentNg/f91b95d6-8576-409a-847e-e80c691898d5

"We have now agreed a further land relinquishment at Abu Marawat with the Ministry of Petroleum and Mineral Resources (“MOP”) and the Egyptian Mineral Resources Authority (“EMRA”). At the same time, we have also been formally granted an extension on the exploration licence until March 2020, further extended from the previously advised January 2020 date," said Mark Campbell, President and CEO. "This is very positive news for Aton, as not only were we able to reduce our area by 20% to nearly 600 km2, allowing us to retain all of our exploration targets as well as other prospective areas within our licence, but it also gives us an even longer extension period for us to continue our work and to await the reforms to Egyptian exploration and mining that are coming. This is an important development for Aton."

Abu Marawat Concession extension and 20% relinquishment

The MoP and EMRA have now confirmed the extension of the Company’s Abu Marawat Concession exploration licence until March 5, 2020. The Company has also agreed to relinquish 20% of the area of the Concession, reducing its total area to 596.3 km2, now consisting of 2 non-contiguous blocks (see Figure 1). The relinquishment will allow the Company to focus its ongoing regional exploration activities at Abu Marawat on the main existing prospects and target areas, including new areas of interest identified in the northeastern area of the Concession, as well as progressing the advanced Rodruin project, which remains the Company’s top priority.

Extension to Private Placement

The Company also announces, further to its news releases of February 15 and March 1, 2019, that it intends to extend its non-brokered private placement financing of up to 100,000,000 units (the “Units”) at $0.05 per Unit for total proceeds of up to $5,000,000 (the “Offering”). Each Unit will consist of one common share in the capital of the Corporation (a “Common Share”) and one half of one common share purchase warrant (each whole warrant a “Warrant”). Each Warrant will be transferable and will entitle the holder to acquire one Common Share for three years from the closing date at a price of $0.10. The closing of the Offering is expected to occur on or about April 15, 2019, and is subject to approval by the TSX Venture Exchange (the “TSXV”). The net proceeds from the Offering will be used to fund continued exploration and development activities at Aton’s Abu Marawat concession, located in Egypt. All currency amounts are in Canadian dollars.

Additional Terms:

All securities issued pursuant to the Offering will be subject to a four-month hold period from the date of issuance under applicable Canadian securities laws. The Corporation may pay certain finders fees on certain of the gross proceeds raised from the sales of Shares pursuant to the Offering, yet to be determined and subject to the approval of the TSXV.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

| About Aton Resources Inc. Aton Resources Inc. (AAN: TSX-V) is focused on its 100% owned Abu Marawat Concession (“Abu Marawat”), located in Egypt’s Arabian-Nubian Shield, approximately 200km north of Centamin’s Sukari gold mine. Aton has identified a 40km long gold mineralised trend at Abu Marawat, anchored by the Hamama deposit in the west and the Abu Marawat deposit in the east, containing numerous gold exploration targets, including three historic British mines. Aton has identified several distinct geological trends within Abu Marawat, which display potential for the development of RIRG and orogenic gold mineralisation, VMS precious and base metal mineralisation, and epithermal-IOCG precious and base metal mineralisation. Abu Marawat is over 596km2 in size and is located in an area of excellent infrastructure; a four-lane highway, a 220kV power line, and a water pipeline are in close proximity. | Qualified person The technical information contained in this News Release was prepared by Javier Orduña BSc (hons), MSc, MCSM, DIC, MAIG, SEG(M), FGS, Exploration Manager of Aton Resources Inc. Mr. Orduña is a qualified person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects. For further information regarding Aton Resources Inc., please visit us at www.atonresources.com or contact: MARK CAMPBELL President and Chief Executive Officer Tel: +202-27356548 Email: mcampbell@atonresources.com | |

| Note Regarding Forward-Looking Statements Some of the statements contained in this release are forward-looking statements. Since forward-looking statements address future events and conditions; by their very nature they involve inherent risks and uncertainties. Actual results in each case could differ materially from those currently anticipated in such statements. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. | ||