Aura Announces 2022 Annual Financial and Operational Results and 2023 Guidance

ROAD TOWN, British Virgin Islands, Feb. 27, 2023 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) announces that it has filed its audited consolidated financial statements and management discussion and analysis (together, “Financial and Operational Results”) for the year ended December 31, 2022, which also contains the Annual Guidance (“2023 Guidance”). The full version of the Financial and Operational Results can be viewed on the Company’s website at www.auraminerals.com or on SEDAR at www.sedar.com. All amounts are in U.S. dollars unless stated otherwise.

Rodrigo Barbosa, President and CEO of Aura, commented: “2022 was marked by significant milestones and stable production, which have laid a solid foundation for future growth and enabled us to pay dividends while expanding. In Q4 of 2022, we achieved our second-highest production in a single quarter, demonstrating our ability to perform and deliver. Despite inflationary pressures impacting our sector, we also made significant progress with the construction of Almas, which is now nearing completion on time and on budget. Both achievements are a testament to our team’s ability to execute, and I thank them for their efforts.”

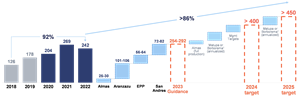

Mr. Barbosa continued, “Looking ahead to 2023, we anticipate further value creation with the expected ramp up of Almas initiating in April and the commencement of construction at Borborema in Q2. Together with our Matupá Project, we are confident in our ability to achieve our targeted production of 450,000 annualized GEO by 2025. Our focus remains on sustainable growth through the development of easy-to-build and operate mines that generate strong returns and ramping up our exploration across our portfolio to ensure longer term growth.”

Q4 2022 Financial and Operational Highlights:

- Total production reached 67,663 GEO1 during Q4 2022, Aura’s second highest production achieved in a single quarter, behind only its Q4 2021 production.

- At Aranzazu, production in GEO increased by 9% relative to Q3 2022 due to high tonnage processed (~ 100 kt per month) and increase in gold and copper grades related to mine sequencing.

- At EPP, production in GEO increased by 50% compared to Q3 2022 and 56% compared to Q4 2021, the highest quarterly production achieved to date. This was due to mining moving into Phase II of the Ernesto pit, resulting in higher grades.

- At San Andres production in GEO was 13% lower relative to Q3 2022 due to a longer than expected leaching cycle during the quarter; however, material mined increased by 44% compared to Q3 2022.

- Revenues reached a robust increase of 30% when compared to the Q3 2022. In Q4 2022, Revenues of $105,850 thousand, represents a slight decrease of 7% compared to the same period of 2021 (when Aura achieved record high revenues).

- Metal prices in GEO sold moved favorably when compared to Q3 2022, with appreciation for both gold, reaching an average selling price of $1,729/oz (+1% vs. Q3 2022), and copper, with an average selling price of $3.68/lb (+6% vs. Q3 2022).

- Adjusted EBITDA recovered in Q4 2022 and reached $ 36,584, an increase of 120% compared to Q3 2022.

- Cash costs during Q4 2022 were $826/GEO, representing an increase of 22% when compared to Q4 2021 ($676/GEO), but a significant decrease of 15% when compared to Q3 2022 ($971/GEO), despite continued operational challenges at San Andres.

- The Company is pleased to publish for the first time, all-in sustaining costs (“AISC”), widely adopted within the mining industry. Consolidated AISC in Q4 2022 reached $1,005/GEO.

- At the end of Q4 2022, the Company’s Net Debt position improved to $77,422 thousand driven by strong cash flows from operating activities, despite the payment of dividends of about $10 million in December and another $ 30 million invested in the growth of the Company. This is in line with the Company’s strategy to continue paying dividends while growing and generating positive cashflows.

2022 Financial and Operational Highlights

- Production reached 242,524 GEO, a 6% decrease compared to 2021 (excluding Gold Road) and only a 4% reduction at constant metal prices.

- Net revenues of $392,699 thousand represented a decrease of 7% compared to 2021, mainly due to lower metal prices.

- Net Income achieved $66,496 thousand in 2022; a robust 53% increase when compared to 2021, when the company achieved a net income of $43,503 thousand, negatively impacted by losses from discontinued operation (Gold Road).

- Gross Margins of $125,693 thousand, represented decrease of 33% compared to 2021, mainly due to lower metal prices and lower production at the San Andres mine.

- At the beginning of 2023, gold and copper were trading at significantly higher prices, with January 2023 averages of $1,899/oz for gold and $4.12/lb for copper.

- AISC for the year reached $1,118/GEO; despite operational challenges at San Andres, the Company estimates it was able to finish the year within the second quartile in the industry’s AISC curves published in an external study by Metals Focus2.

Growth Projects

2022 brought important milestones to support growth in the next years:

- Almas construction continues on budget and on schedule, with over 92% of the construction completed to date. Aura was proud to appoint its first female Director of Operations to lead the Almas team. The ramp-up is expected to start in April and commercial production is expected to be reached in July 2023.

- In September 2022, Aura closed the acquisition of 80% of Big River Gold Limited (the Borborema Project) and formed a joint venture with Dundee Resources. Borborema has JORC minerals resources of ~1.9 Moz of M&I and ~0.6 Moz of Inferred.

- In November, the Company filed the “Feasibility Study Technical Report (NI 43-101) for the Matupá Gold Project, Matupá Municipality, Mato Grosso, Brazil”3 which outlined strong economics (leveraged IRR of ~50% and simple payback of ~2.3 years). In addition, Aura advanced exploration at Serrinhas, increasing the geological potential of the target.

- Aura also recently acquired copper mineral rights and options in the State of Pará, Brazil, Carajás area. Carajás Mineral Province is one of the most important polymetallic districts in the world.

- Aura continued to expand its investments in exploration, with $22 million invested across all operations and projects in 2022. With this increased effort, the Company expects an increase in Mineral Resources and Mineral Reserves in its next AIF, to be published on or before March 31, 2023.

Corporate Milestones

- In September, Aura was awarded the #1 ranking on the TSX30™, based on dividend-adjusted share price appreciation. This was the second consecutive year the Company received this recognition and the only Company to ever achieve this milestone. In October, Aura qualified to trade on the OTCQX® Best Market thereby broadening awareness and access to U.S. investors.

- In 2022, the Company returned an additional $30 million to shareholders through a combination of dividends and share buybacks, resulting in a yield of approximately 6.0%. This demonstrates Aura’s commitment and ability to grow while prioritizing returning capital to shareholders.

- Aura continued to advance its 360 Culture and improved its Mandala. The process involved input from the leadership team and interviewing over 350 employees in four countries. Aura’s 360 Culture continues to serve its foundation for growth.

Operational And Financial Overview (US$ thousand):

| For the three months ended December 31, 2022 | For the three months ended December 31, 2021 | For the twelve months ended December 31, 2022 | For the twelve months ended December 31, 2021 | |||||

| Total Production1 (GEO) | 67,663 | 76,827 | 242,524 | 258,603 | ||||

| Sales2 (GEO) | 68,077 | 72,654 | 247,215 | 274,440 | ||||

| Net Revenue | 105,850 | 113,848 | 392,699 | 424,006 | ||||

| Adjusted EBITDA | 36,584 | 58,921 | 133,779 | 193,058 | ||||

| Cash costs per GEO sold | 826 | 676 | 897 | 765 | ||||

| Ending Cash balance | 127,901 | 161,490 | 127,901 | 161,490 | ||||

| Net Debt | 77,422 | (1,624 | ) | 77,422 | (1,624 | ) | ||

| Recurring Capex | (6,856 | ) | (13,994 | ) | (38,901 | ) | (63,978 | ) |

1 Considers capitalized production

2 Does not consider capitalized production

2023 Guidance

The table below details the Company’s guidance for 2023 by business unit4:

| Production (thousand GEO) 2023 | Cash Cost per GEO (US$) 2023 | AISC per GEO (US$) 2023 | ||||

| Low - High | Low - High | Low - High | ||||

| Almas | 25 -30 | 830 - 955 | 954 - 1,098 | |||

| Aranzazu | 101 - 116 | 685 - 788 | 898 - 1,033 | |||

| EPP Mines | 56 - 64 | 786 - 905 | 1,271 - 1,462 | |||

| San Andrés | 72 - 82 | 981 - 1,129 | 1,081 - 1,243 | |||

| Total | 254 - 292 | 806 - 927 | 1,037 - 1,193 | |||

Production of 254 to 292 kGEO in 2023, representing an increase when compared to 2022. A significant contributor to the increased production will result from Almas starting ramping-up in April and reaching commercial production in July 2023. Additional contributing factors include:

- Aranzazu: Anticipating another year of stable production. Exploration is expected to focus on the geological potential of new mineralized zones, such as Cabrestante, El Cobre and Limestone Bridge with 20,000 m of drilling planned to 2023. All targets are near mine, some of which have been drilled in the past and indicated skarn mineralization but requiring follow up drilling.

- EPP: Production is expected to reach between 56 and 64 koz in 2023 (70 koz in 2022) due to the depletion of ounces from the Elephant zone where higher grades were mined. The Company is currently exploring multiple near-mine targets including Nosde and Pombinhas, with the goal of increasing the life of mine and, potentially, increasing production volumes into 2024. A 36,000 m drilling program is ongoing. The EPP Complex consists of multiple pits. In late 2022, Aura acquired a new Mineral Right along strike of the Japonês pit, an area that had historical artisanal mining, to better understand the continuity of the mineralization towards west of Japonês pit.

- San Andres: Anticipating a return to more stable production when compared to the challenges faced in 2022 with an expected increase in production volume with increased ore mined. Grades are expected to remain relatively stable vs 2022.

In addition to the production guidance for 2023, management’s targets for production for 2024-2025 across its business units are presented below and in line with the latest projections.

Management maintains the previous annualized production target of more than 400,000 GEO annualized in the year ending December 31, 2024, and a target of more than 450,000 GEO annualized in the year ending December 31, 2025.

A chart accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f87a087b-22b3-4f96-80cf-876417be5511

1) Considering 80% of the ounces to be produced by the Borborema project

Notes: 2023 figures are based on current technical reports for the Company’s projects, except as otherwise noted. Please refer to the heading “Technical Information”. Figures for 2024 and 2025 are based on management’s expectations based on a variety of factors, including preliminary, high-level studies for each of the assets. These targets are management’s objectives only and are subject to certain risks and assumptions. See “Forward-Looking Information”. Includes ounces capitalized, when applicable.

Cash costs

- EPP: Due to the characteristics of its new mine operations agreement and due to the IFRS accounting standards, EPP is expected to capitalize about $ 14 million of its projected 2023 mining costs (“EPP Capitalization of Leases”), which should have a positive accounting impact of $215/oz to $245/oz in its 2023 cash costs. Otherwise, an increase in cash costs in 2023 would be expected, mainly due to the lower grades as discussed above.

- Almas: cash costs included in the table above are considered for only the period after Almas enters commercial production. As anticipated, Almas is expected to have lower costs than EPP Mines (excluding EPP Capitalization of Leases impact), despite being in the same country, being smaller in size to apply the use of the same recovery methodology (CIL), as a result of expected much lower strip ratio. Cash costs for the first year are expected anticipated to be higher than the cash cost indicated in the Almas Feasibility Study published in early 2021 for the following reasons: (a) inflation between the date of the Feasibility Study (the “FS”) (effective as of December 2020) and first year of production; (b) lower grades in the first year due to changes in the mine sequencing; (1.16 g/ton expected vs. 1.31 g/ton for year 1 in the FS) (c) only six months of commercial production in 2023 (vs. 12 months considered for first year in the FS). On the other hand, current gold prices (above $1,800/oz) are significantly higher than the assumption used in the study ($1,555/oz); as result, the Company expects the profitability to be achieved to remain in line with FS numbers.

- Aranzazu: Expected increase in cash costs compared to 2022 ($680/GEO) is mostly attributable to copper price assumptions (assumption of $3.70/lb in 2023 vs. $4.00/lb realized in 2022). At constant metal prices, Aranzazu cash costs are expected to be similar to 2022, despite inflation.

- San Andres: Significant cash cost decreases are anticipated when compared to 2022 actuals ($1,222/GEO). In addition, the Company expects San Andres to benefit from a full year of operations with a new mine contractor, at favorable commercial conditions, reducing mining costs.

All-In Sustaining Costs

- Almas: AISC included are considered for only the period from which Almas enters in commercial production. As anticipated, Almas is expected to have a lower AISC than the Company’s average, contributing to Aura’s consolidated AISC. AISC for Almas for the first year is expected to be higher than the AISC indicated in the FS published in early 2021 for the reasons stated above and anticipation of part of Sustaining Capex (initially expected for year 2) due to the rainy season.

- Aranzazu: AISC is expected to be in line when compared to 2022 ($914/GEO) despite unfavorable copper assumptions for 2023 ($3.70/lb in 2023 vs. $4.00/lb realized in 2022), due to lower sustaining capex as Aranzazu is able to reduce the pace of primary mine development without creating production risks.

- EPP: AISC is expected increase as described above. EPP Capitalization Leases are included in EPP’s 2023 AISC guidance.

- San Andres: Significant AISC decreases are expected as noted above, and Sustaining Capex is expected to decrease in 2023 when compared to 2022.

CAPEX

In 2023, the Company will continue to allocate capital to new projects and expansions. This primarily includes the final phase of construction and ramp-up of the Almas Project. The Company is anticipating approving the development of new greenfield projects (Borborema or Matupá) within in the first half of 2023. Therefore, this expansion was not included below yet. Further updates will be provided with respect to the start of new projects once available and the Company will inform the market and update is Expansion Capex guidance for 2023.

The table below shows the breakdown of estimated capital expenditures by type of investment:

| Capex (US$ million) 2023 | ||

| Low - High | ||

| New projects + Expansion | 34 - 40 | |

| Exploration | 11 - 13 | |

| Sustaining | 34 - 40 | |

| 80 - 93 | ||

Aura believes its properties have strong geological potential and management’s objective is to expand LOM across its business units. Therefore in 2023, Aura plans to invest another total of $22 million to $26 million in exploration which includes:

- $11 million to $13 million in capital expenditures (included in the table above) in areas where the Company has proven and probable mineral reserves, around existing mine infrastructure; and,

- Another $11 million to $13 million in exploration expenses, not capitalized, in areas where the Company does not yet have proven and probable mineral reserves, which includes regional targets for potential new discoveries (not included in the table above).

Main investments in Exploration in 2023 (either Capex or Opex) are expected to happen at the Matupá Project, Aranzazu mine, EPP mines and in the newly acquired mineral right at Carajás (Serra da Estrela Project).

Key Factors

The Company’s future profitability, operating cash flows, and financial position will be closely related to the prevailing prices of gold and copper. Key factors influencing the price of gold and copper include, but are not limited to, the supply of and demand for gold and copper, the relative strength of currencies (particularly the United States dollar), and macroeconomic factors such as current and future expectations for inflation and interest rates. Management believes that the short-to-medium term economic environment is likely to remain relatively supportive for commodity prices but with continued volatility.

To decrease risks associated with commodity prices and currency volatility, the Company will continue to evaluate and potentially implement available protection programs. For additional information on this, please refer to the AIF.

Other key factors influencing profitability and operating cash flows are production levels (impacted by grades, ore quantities, process recoveries, labor, country stability, plant, and equipment availabilities), production and processing costs (impacted by production levels, prices, and usage of key consumables, labor, inflation, and exchange rates), among other factors.

Non-GAAP Measures

In this press release, the Company has included Adjusted EBITDA, cash operating costs per gold equivalent ounce sold, AISC and net debt which are non-GAAP measures. These non-GAAP measures do not have any standardized meaning within IFRS and therefore may not be comparable to similar measures presented by other companies. The Company believes that these measures provide investors with additional information which is useful in evaluating the Company’s performance and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The below tables provide a reconciliation of the non-GAAP measures presented:

Reconciliation from Income for the Quarter for EBITDA and Adjusted EBITDA (US$ thousand):

| For the three months ended December 31, 2022 | For the three months ended December 31, 2021 | For the twelve months ended December 31, 2022 | For the twelve months ended December 31, 2021 | |||||

| Profit (loss) from continued operation | 12,313 | 30,874 | 56,247 | 92,663 | ||||

| Income tax (expense) recovery | 3,748 | 7,072 | 26,832 | 32,440 | ||||

| Deferred income tax (expense) recovery | (826 | ) | 6,649 | (1,088 | ) | 22,796 | ||

| Finance costs | 1,771 | 1,606 | 7,397 | 8,189 | ||||

| Other gains (losses) | 1,098 | 931 | (1,157 | ) | (169 | ) | ||

| Depreciation | 18,480 | 8,711 | 45,548 | 34,061 | ||||

| EBITDA | 36,584 | 55,843 | 133,779 | 189,980 | ||||

| Impairment | - | - | - | - | ||||

| ARO Change | - | 3,078 | - | 3,078 | ||||

| Adjusted EBITDA | 36,584 | 58,921 | 133,779 | 193,058 | ||||

Reconciliation from the consolidated financial statements to cash operating costs per gold equivalent ounce sold (US$ thousand):

| For the three months ended December 31, 2022 | For the three months ended December 31, 2021 | For the twelve months ended December 31, 2022 | For the twelve months ended December 31, 2021 | |||||

| Cost of goods sold | (74,671 | ) | (57,287 | ) | (267,006 | ) | (235,669 | ) |

| Depreciation | 18,437 | 8,868 | 45,187 | 33,688 | ||||

| COGS w/o Depreciation | (56,234 | ) | (48,419 | ) | (221,819 | ) | (201,981 | ) |

| Gold Equivalent Ounces sold(2) | 68,077 | 71,689 | 247,215 | 263,483 | ||||

| Cash costs per gold equivalent ounce sold excluding Gold Road | 826 | 676 | 897 | 765 | ||||

Reconciliation from the consolidated financial statements to all in sustaining costs per gold equivalent ounce sold (US$ thousand):

| For the three months ended December 31, 2022 | For the three months ended December 31, 2021 | For the twelve months ended December 31, 2022 | For the twelve months ended December 31, 2021 | |||||

| Cost of goods sold | (74,671 | ) | (57,287 | ) | (267,006 | ) | (235,669 | ) |

| Depreciation | 18,437 | 8,868 | 45,187 | 33,688 | ||||

| COGS w/o Depreciation | (56,234 | ) | (48,419 | ) | (221,819 | ) | (201,981 | ) |

| Capex w/o Expansion | 6,855 | 13,705 | 38,900 | 53,628 | ||||

| Site G&A | 1,658 | 2,254 | 8,181 | 7,967 | ||||

| Lease Payments | 3,644 | 226 | 7,658 | 984 | ||||

| Gold Equivalent Ounces sold(2) | 68,077 | 71,689 | 247,215 | 263,483 | ||||

| All In Sustaining costs per ounce sold | 1,005 | 904 | 1,118 | 1,005 | ||||

Reconciliation Net Debt (US$ thousand):

| December 31, 2022 | December 31, 2021 | |||

| Short Term Loans | 73,215 | 58,169 | ||

| Long-Term Loans | 140,827 | 99,862 | ||

| Plus / (Less): Derivative Financial Instrument | (8,119 | ) | 2,779 | |

| Less: Cash and Cash Equivalents | (127,901 | ) | (161,490 | ) |

| Less: Restricted Cash | (600 | ) | (944 | ) |

| Net Debt | 77,422 | (1,624 | ) | |

Qualified Person

Tiãozito V. Cardoso, FAusIMM, Technical Services Director for Aura Minerals Inc. has reviewed and confirmed the scientific and technical information contained within this news release and serves as the Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the EPP gold mine in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has the Tolda Fria gold project in Colombia and five projects in Brazil, of which four gold projects: Almas, which is under final phase of construction; Borborema and Matupá, which are in development; and São Francisco, which is on care and maintenance. Finally, the Company owns the Serra da Estrela copper project in Brazil, Carajás region, under exploration stage.

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including production levels (including production levels expressed in GEO); cash costs and AISC across its operations; the timing and effect of the Company’s Almas project entering production; the impact of new IFRS accounting standards; the ability of the Company to achieve its longer-term outlook; and expected capital expenditures. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties, and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented Financial Information

To the extent any forward-looking statements in this press release constitute “financial outlooks” within the meaning of applicable Canadian securities legislation, such information is being provided as certain estimated financial metrics and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such financial outlooks. Such information was approved by the company’s Board of Directors on February 27, 2023. Financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to various risks as set out herein. The Company’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, may differ materially from values provided in this press release.

_____________________________________

¹ Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and gold into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the gold equivalent ounces are based on the weighted average price of gold, silver and copper realized from sales at the Aranzazu Complex during the relevant period.

² Taking in consideration a study considering Q3 2022 results of 42 other companies which reported AISC

³ Available on the Company’s SEDAR profile dated November 18, 2022.

⁴ For the GEO calculation, the Company used the following assumptions on metal prices: gold prices: $1,781/oz; silver prices: $22.15/oz; copper prices: $3.70/lb.

For further information, please visit Aura’s website at www.auraminerals.com or contact: Rodrigo Barbosa President & CEO 305-239-9332