Aura Announces Q2 2023 Financial and Operational Results and Guidance Update

ROAD TOWN, British Virgin Islands, Aug. 08, 2023 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) announces that it has filed its unaudited consolidated financial statements and management discussion and analysis (together, “Financial and Operational Results”) for the period ended June 30, 2023 (“Q2 2023”), which also contains the Annual Guidance Update (“2023 New Guidance”) and maintenance of the 2025 production target (“2025 Production Target”). The full version of the Financial and Operational Results can be viewed on the Company’s website at www.auraminerals.com or on SEDAR at www.sedar.com. All amounts are in U.S. dollars unless stated otherwise.

Rodrigo Barbosa, President and CEO of Aura, commented: “During the quarter, we experienced a temporary dip in production, primarily attributed to lower grades in EPP. However, we are optimistic for the year, and our guidance for EPP remains unchanged, as we anticipate reaching higher grades in Q3 and Q4. As the initial part of the year also posed some challenges for San Andres, we reevaluated our guidance and now we aim to produce between 245,000 to 273,000 ounces for the year, representing a slight 5% reduction around the midpoint of the range. Despite these challenges, the upcoming quarters are expected to witness a substantial increase in production, driven by improved grades in EPP, continued production growth in San Andres, and the commencement of commercial production in Almas while Aranzazu should continue to have a stable production. Finally, despite experiencing lower production, we are pleased to report a robust operating cash flow during the semester. This strength in cash flow enabled us to fulfill our commitment to our shareholders by paying out US$10 million in dividends.

On the cost side, we have proactively implemented cost-reduction measures in San Andres, which have partially offset the impact of lower production on cash costs. Consequently, cost adjustments on guidance were kept minimal, with only a 3% revision when using the same exchange rate. On a positive note, the devaluation of the US Dollar against the Mexican Peso and Brazilian Reais has been balanced by the appreciating prices of metals, particularly Gold and Copper. This favorable market movement has more than offset the higher costs incurred in US Dollar terms per GEO.”

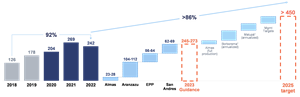

Rodrigo Barbosa continued: “Looking ahead, we are excited about our continued growth, particularly as we advance the Borborema Project towards the completion of the Feasibility Study and commencement of production. With long lead time items now ordered, including the mill, we anticipate production to commence in early 2025 while remaining on track to meet our 450,000 GEO annualized production by 2025. We look forward to providing further updates on our progress on Almas, Borborema and Matupá. Our focus continues to be on growing production, expanding exploration efforts, all while ensuring that dividends are paid and we are proud to be moving forward on all our strategic goals”.

Q2 2023 Financial and Operational Highlights:

- Total production in GEO decreased by 13% in Q2 2023 compared to Q2 2022, mainly due to mine sequencing at EPP Mines.

- At Aranzazu, production was 25,192 GEO in line with the Company’s expectations. Production was 4% lower compared to Q2 2022, due to metal prices. When calculated based on constant prices, production in GEO increased by 7% in Q2 2023 compared to Q2 2022.

- At EPP, production was 6,917 GEO, 45% lower in Q2 2023 than in Q2 2022, due to mine sequencing in areas with lower grade and higher strip ratios. With sequencing expected to move to higher-grade areas, the Company anticipates production to increase in the second semester, mainly in the last quarter of the year, which also occurred in the previous year. Aura remains on track to meet its production guidance of between 56,000 and 64,000 GEO for EPP in 2023.

- At San Andres, production was 16,413 GEO, production remained steady relative to Q2 2022, with a decrease of 2%. Production in GEO increased by 16% when compared to Q1 2023, confirming the Company’s expectation of gradual improvement quarter after quarter.

- Revenues were approximately $84,950 thousand in the second quarter of 2023, a decrease of 9% compared to the same period of 2022.

- Average gold sale prices had an increase of 4% compared to Q2 2022, increasing for gold, which reached an average of $1,966/oz (also +4% vs. Q1 2023).

- Sales volumes were 11% lower than Q1 2023, mainly due to mine sequencing, for the reasons discussed above.

- Adjusted EBITDA was approximately $26,596 thousand in Q2 2023, compared to approximately $ 36,505 thousand in Q1 2023, as a result of lower production and sales volume.

- AISC during Q2 2023 were $1,385/GEO, representing an increase of $229/GEO when compared to Q1 2023 ($1,156/GEO) mainly due mine sequencing at EPP, and higher costs at San Andres. Unfavorable exchange rates also impacted costs at Aranzazu and EPP. The Company expects AISC to decrease in H2 2023 as EPP reaches higher production volumes and operational performance at San Andres continues to improve.

- As of the end of Q2 2023, the Company’s Net Debt position was $113,532 thousand, an expected increase compared to $88,854 thousand recorded at the end of Q1 2023, primarily due to the expansion capex (“capital expenditure”) of about $22,566 thousand during the quarter. The capex was mainly related to investments in the final phase of Almas project construction and ramp-up. Additionally, the Company paid approximately $ 10,100 thousand of dividends in June.

Growth Projects

- Almas is currently in its final ramp-up phase and is expected to reach commercial production by Q3 2023.

- The Company is producing a NI 43-101 Feasibility Study (the “Borborema Technical Report”), which is expected to be released by Q3 2023. Aura also expects to announce a construction decision on Borborema shortly.

Operational and Financial Overview ($ thousand):

| For the three months ended June 30, 2023 | For the three months ended June 30, 2022 | For the six months ended June 30, 2023 | For the six months ended June 30, 2022 | |||||

| Total Production1 (GEO) | 48,522 | 55,645 | 101,787 | 116,686 | ||||

| Sales2 (GEO) | 47,950 | 55,655 | 101,836 | 121,175 | ||||

| Net Revenue | 84,950 | 93,384 | 181,937 | 205,660 | ||||

| Adjusted EBITDA | 26,596 | 30,322 | 63,194 | 80,534 | ||||

| AISC per GEO sold | 1,385 | 1,266 | 1,264 | 1,118 | ||||

| Ending Cash balance | 110,074 | 217,938 | 110,074 | 217,938 | ||||

| Net Debt | 113,532 | (10,318 | ) | 113,532 | (10,318 | ) | ||

| Realized average gold price per ounce sold, gross (US$/oz) | 1,966 | (12,060 | ) | 1,923 | (21,567 | ) | ||

| 1 Considers capitalized production | ||||||||

| 2 Does not consider capitalized production | ||||||||

| 3 Considering the average price in Aranzazu | ||||||||

2023 Guidance Update:

The Company’s updated gold equivalent production, AISC and cash operating cost per gold equivalent ounce sold, and CAPEX guidance for 2023 is detailed below.

Production

The table below details the Company’s updated GEO production guidance for 2023 by business unit, and a comparison to the previous guidance:

| Gold equivalent thousand ounces ('000 GEO) production - 2023 | |||

| Actuals Current Prices | Actuals Constant Prices | Previous Current Prices | |

| Aranzazu | 104-112 | 105-114 | 101-116 |

| EPP Mines | 56-64 | 56-64 | 56-64 |

| San Andres | 62-69 | 62-69 | 72-82 |

| Almas | 23-28 | 23-28 | 25-30 |

| Total | 245-273 | 246-274 | 254-292 |

Assumes for constant prices the constant metal prices for Aranzazu used in the previous guidance, being: Copper price = $3.60/lb; Gold Price = $1,740/oz; Silver Price = US$21,50/oz. For current prices, the Company considered: Copper price = $3.90/lb; Gold Price = $1,925/oz; Silver Price = $23,20/oz.

Factors that contributed to the change in the Company’s guidance include:

- Aranzazu: Production remains stable and in line with previous guidance.

- EPP Mines: The Company maintains its production guidance for EPP for 2023 to between 56,000 and 64,000 GEO as it transitions to higher-grade areas, and a significant production increase is forecasted for the second half of 2023, primarily in Q4, similar to the previous year's pattern.

- San Andres: The operation has been showing improvements compared to the first half of 2022, mainly in terms of stacking, better grades, and recoveries. Production volumes increased constantly from 12,171 oz in Q4 2022 to 14,116 oz in Q1 2023 and now 16,413 oz in Q2 2023. Production is expected to continue to increase during the second half of 2023, reaching and average of 15,700 to 19,200 oz per quarter between Q3 and Q4 2023, however, at a lower pace than previously expected. As a consequence, the production guidance has been reduced to 62,000 to 69,000 oz in 2023 to reflect the new expectations for the rest of the year.

- Almas: Completed on schedule and budget, has processed at the plant, around 46,000 tons of ore in June and 106,000 tons in July during its ramp-up phase, out of an installed capacity of 114,000 tons per month. This considerable increase indicates readiness for the start of commercial production in Q3 2023, as initially planned. Production guidance remains in line with previous guidance, with reduction of 2,000 GEO expected for this year as a consequence of increased precision in the mine and plant feed plan for the year.

All in all, production of 245,000 to 273,000 GEO at current prices in 2023, presents an increase of 3,000 to 31,000 GEO (+1% to +13%) when compared to 2022, mainly due to Almas reaching full production from Q3 2023, and a decrease when compared to the previous 2023 Guidance due to San Andres, despite the constant improvement of performance of this mine.

Long-Term Production Guidance Update

Aura is maintaining its annualized 2025 production guidance of 450,000 GEO, and it is withdrawing the full-year 2024 guidance. The Company previously expected the commencement of operations at the Borborema project to start by the end of 2024, however, due to longer than expected lead times for delivery of the ball mill delivery, the start-up operations are now expected to commence by early 2025. The Company already initiated the earth moving and the downpayment of the ball mill was already made.

Management’s annualized production target for the year ending December 31, 2025, across its business units are presented below:

Considering 80% of the ounces to be produced by the Borborema project

Notes: Please refer to the heading “Technical Information”. Figures for 2025 are based on management’s expectations based on a variety of factors, including preliminary, high-level studies for each of the assets. These targets are management’s objectives only and are subject to certain risks and assumptions. See “Forward-Looking Information”. Includes ounces capitalized from EPP projects and Gold Road in 2020 and 2021.

Cash costs

The table below shows the Company’s updated guidance for 2023 cash operating costs per GEO sold by business unit ($/GEO), and a comparison to the previous guidance:

| Cash Cost per equivalent ounce of gold sold - 2023 | |||

| Actuals Current Prices | Actuals Constant Prices & FX | Previous Current Prices | |

| Aranzazu | 783-842 | 710-769 | 685-788 |

| EPP Mines | 849-927 | 808-886 | 786-905 |

| San Andres | 1,137-1,222 | 1,137-1,222 | 981-1,129 |

| Almas | 865-995 | 822-952 | 830-955 |

| Total | 897-973 | 853-929 | 806-927 |

Assumes for constant prices:

- Aranzazu it applies for constant metal prices used in the previous guidance, being: Copper price = $3.60/lb; Gold Price = $1,740/oz; Silver Price = $21,50/oz. For current prices, the Company considered: Copper price = $3.90/lb; Gold Price = $1,925/oz; Silver Price = $23,20/oz. For constant foreign exchange prices used in the previous guidance, being: MXN 20.40=$1USD. For current prices, the Company considered: MXN 17.00=$1USD.

- In EPP Mines and Almas it applies for constant foreign exchange prices used in the previous guidance, being: R$5.20=$1USD. For current prices, the Company considered: R$4.90=$1USD.

Factors that contributed to the change in the Company’s guidance include:

- Aranzazu: The revision in Cash Cost guidance at Aranzazu is a result of lower copper prices during the first half of 2023, affecting the cash cost in $2 million ($21/GEO), and also the appreciation of the Mexican Peso against the US dollar during the same period, affecting the cash cost in $6 million ($52/GEO). Both factors influenced cost dynamics. At constant metal and foreign exchange prices, the changes in Aranzazu's cash cost are minimal.

- EPP Mines: Increase in cash costs at EPP is almost entirely attributable to the appreciation of the Brazilian Reais against the US dollar during Q1 and Q2 2023, which affected the cash cost and the 2023 projection in about $41/ GEO.

- San Andres: Cash Cost guidance at San Andres has been revised upward due to lower production than initially anticipated. As the operation continues to navigate a period of adjustments and improvements, the Company aimed at enhancing productivity and operational efficiency. As such, a strategic narrowing of the guidance compared to the previous one has been implemented to better reflect the current state of operations at San Andres.

- Almas: Cash costs included in the table above are considered for only the period after Almas enters commercial production. The changes in the cash cost projections are entirely attributable to the appreciation of the Brazilian Reais against the US dollar, affecting the cash cost in about $43/ GEO. Considering constant foreign exchange rates, Almas' cash cost remains nearly stable.

All In Sustaining Costs

The table below shows the Company’s updated 2023 guidance for all-in sustaining costs per GEO sold by Business Unit ($/GEO), and a comparison to the previous guidance:

| AISC per equivalent ounce of gold sold - 2023 | |||

| Actuals Current Prices | Actuals Constant Prices & FX | Previous Current Prices | |

| Aranzazu | 1,025-1,101 | 936-1,012 | 898-1,033 |

| EPP Mines | 1,342-1,463 | 1,277-1,398 | 1,271-,1462 |

| San Andres | 1,241-1,333 | 1,241-1,333 | 1,081-1,243 |

| Almas | 1,112-1,280 | 1,057-1,224 | 954-1,098 |

| Total | 1,162-1,261 | 1,105-1,204 | 1,037-1,193 |

Assumes for constant prices

- Aranzazu it applies for constant metal prices used in the previous guidance, being: Copper price = $3.60/lb; Gold Price = $1,740/oz; Silver Price = $21,50/oz. For current prices, the Company considered: Copper price = $3.90/lb; Gold Price = US$1,925/oz; Silver Price = $23,20/oz. For constant foreign exchange prices used in the previous guidance, being: MXN 20.40=$1USD. For current prices, the Company considered: MXN 17.00=$1USD.

- In EPP Mines and Almas it applies for constant foreign exchange prices used in the previous guidance, being: R$5.20=$1USD. For current prices, the Company considered: R$4.90=$1USD.

Factors that contributed to the change in the Company’s guidance include:

- Aranzazu: The increase in the AISC guidance for Aranzazu are for the same reasons that caused the increase in the cash costs (foreign exchange and metal price fluctuations). At constant metal and foreign exchange prices, Aranzazu's AISC remains in line with previous guidance.

- EPP Mines: The increase in EPP's AISC for 2023 is mainly due to the Brazilian Real appreciation against the US dollar in the first half of the year. At constant foreign exchange rates, there isa slight reduction in the AISC is seen due to lower expected sustaining capex.

- San Andres: The change in San Andres AISC guidance is due to lower production than previously expected, despite the constant and gradual performance improvement. Compared to 2022 AISC, which was $1,342/GEO, this year’s AISC is expected to be 8% (considering the low range of the guidance) to 1% (considering the high range of the guidance) lower in 2023 than last year, already reflecting cost savings obtained between 2022 and 2023.

- Almas: AISC included in the table above are considered for only the period after Almas enters commercial production. The changes in the AISC projections are attributable to the appreciation of the Brazilian Reais against the US dollar and higher sustaining capex mainly due to foreign exchange rates.

At constant prices and foreign exchange, Aura’s consolidated AISC guidance for the year would have been $68/GEO lower than the new guidance at current prices and foreign exchange rates. Although the recent foreign exchange fluctuations have put pressure on Aura’s 2023 AISC guidance, the expectation for increases in metal prices of $185/GEO more than compensates it, which results in an expected rise in the margin per GEO. This scenario, partially attributable to a weaker USD, provides a net positive impact for Aura, showcasing Aura's resilience and adaptability during market variations.

Capex:

The table below shows the Company’s updated breakdown of estimated capital expenditures by type of investment, and a comparison to the previous guidance:

| Capex (US$ million) - 2023 | |||

| Actuals Current Prices | Actuals Constant FX | Previous Current Prices | |

| New projects + Expansion | 44-45 | 42-43 | 34-40 |

| Exploration | 12-14 | 11-14 | 11-13 |

| Sustaining | 29-35 | 27-33 | 34-40 |

| Total | 85-95 | 80-90 | 80-93 |

Assumes for constant prices

Aranzazu: it applies for constant foreign exchange prices used in the previous guidance, being: MXN 20.40=$1USD . For current prices, the Company considered: MXN 17.00=$1USD. In EPP Mines and Almas: it applies for constant foreign exchange prices used in the previous guidance, being: R$5.20=$1USD. For current prices, the Company considered: R$4.90=$1USD

- New projects and expansions:

- The increase reflects mainly the capitalization of pre-stripping and ramp-up of the Almas Project, capacity increases at San Andres’ through new conveyor belts, and foreign exchange impacts.

- The Company is not including the development in its 2023 Expansion Capex of Borborema, which is under the final phase of its Feasibility Study and with the start of construction to be announced shortly.

- Exploration: Aura believes its properties have strong geological potential and management’s objective is to expand LOM (“Life of Mine”) across its business units. Therefore, in 2023, Aura plans to invest another total of $24 million to $28 million which includes:

- $12 million to $14 million in exploration capex (included in the table above), in areas where the Company has proven and probable mineral reserves, around existing mine infrastructure.

- $12 million to $14 million in exploration expenses (not included in the table above), not capitalized, in areas where the Company does not yet have proven and probable mineral reserves, which includes regional targets for potential new discoveries.

- Main investments in exploration in 2023 (either Capex or Opex) includes resource conversion at EPP, mineralization testing and potential deposit drilling at Aranzazu, regional target advancement at Matupá, initial exploration at Aura Carajás, and a Feasibility Study at Borborema.

- Sustaining: The revision in the sustaining capex guidance is primarily attributed to improvements for operational efficiencies and strategic resource allocation at EPP and San Andres, and also due to investments made for plant improvements, aimed at enhancing performance in Almas.

Key Factors

The Company’s future profitability, operating cash flows, and financial position will be closely related to the prevailing prices of gold and copper. Key factors influencing the price of gold and copper include, but are not limited to, the supply of and demand for gold and copper, the relative strength of currencies (particularly the United States dollar), and macroeconomic factors such as current and future expectations for inflation and interest rates. Management believes that the short-to-medium term economic environment is likely to remain relatively supportive for commodity prices but with continued volatility.

To decrease risks associated with commodity prices and currency volatility, the Company will continue to evaluate and potentially implement available protection programs. For further information, please see Company’s Annual Information Form for year the ended December 31, 2022 (“AIF”), available on www.sedar.com and the Company’s website.

Other key factors influencing profitability and operating cash flows are production levels (impacted by grades, ore quantities, process recoveries, labor, country stability, plant, and equipment availabilities), production and processing costs (impacted by production levels, prices, and usage of key consumables, labor, inflation, and exchange rates), among other factors.

Non-GAAP Measures

In this press release, the Company uses non-GAAP measures such as Adjusted EBITDA, cash operating costs per gold equivalent ounce sold, AISC and Net Debt. These non-GAAP measures do not have any standardized meaning within International Financial Reporting Standards (“IFRS”) and therefore may not be comparable to similar measures presented by other companies. The Company believes that these measures provide investors with additional information which is useful in evaluating the Company’s performance and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The below tables provide a reconciliation of the non-GAAP measures presented:

Reconciliation from income for the quarter for EBITDA and Adjusted EBITDA ($ thousand):

| For the three months ended June 30, 2023 | For the three months ended June 30, 2022 | For the six months ended June 30, 2023 | For the six months ended June 30, 2022 | |||||

| Profit (loss) from continued and discontinued operation | 11,369 | 3,675 | 30,029 | 43,864 | ||||

| Income tax (expense) recovery | 4,833 | 7,259 | 10,442 | 20,985 | ||||

| Deferred income tax (expense) recovery | (2,579 | ) | 972 | (7,418 | ) | (3,084 | ) | |

| Finance costs | 4,549 | 9,266 | 8,453 | (286 | ) | |||

| Other gains (losses) | (3,167 | ) | 232 | (2,644 | ) | 1,075 | ||

| Depreciation | 11,591 | 8,918 | 24,332 | 17,980 | ||||

| EBITDA | 26,596 | 30,322 | 63,194 | 80,534 | ||||

| Impairment | - | - | - | - | ||||

| ARO Change | - | - | - | - | ||||

| Adjusted EBITDA | 26,596 | 30,322 | 63,194 | 80,534 |

Reconciliation from the consolidated financial statements to cash operating costs per gold equivalent ounce sold ($ thousand):

| For the three months ended June 30, 2023 | For the three months ended June 30, 2022 | For the six months ended June 30, 2023 | For the six months ended June 30, 2022 | |||||

| Cost of goods sold | (59,706 | ) | (64,378 | ) | (122,594 | ) | (126,974 | ) |

| Depreciation | 11,320 | 8,861 | 23,654 | 17,870 | ||||

| COGS w/o Depreciation | (48,386 | ) | (55,517 | ) | (98,940 | ) | (109,104 | ) |

| Gold Equivalent Ounces sold | 47,950 | 55,655 | 101,836 | 121,175 | ||||

| Cash costs per gold equivalent ounce sold | 1,009 | 998 | 972 | 900 |

Reconciliation from the consolidated financial statements to all in sustaining costs per gold equivalent ounce sold ($ thousand):

| For the three months ended June 30, 2023 | For the three months ended June 30, 2022 | For the six months ended June 30, 2023 | For the six months ended June 30, 2022 | |||||

| Cost of goods sold | (59,706 | ) | (64,378 | ) | (122,594 | ) | (126,974 | ) |

| Depreciation | (11,320 | ) | 8,861 | 23,654 | 17,870 | |||

| COGS w/o Depreciation | (48,386 | ) | (55,517 | ) | (98,940 | ) | (109,104 | ) |

| Capex w/o Expansion | 11,668 | 12,060 | 20,349 | 21,567 | ||||

| Site G&A | 1,754 | 2,646 | 3,770 | 4,338 | ||||

| Lease Payments | 4,587 | 226 | 5,650 | 450 | ||||

| Gold Equivalent Ounces sold | 47,950 | 55,655 | 101,836 | 121,175 | ||||

| All In Sustaining costs per ounce sold | 1,385 | 1,266 | 1,264 | 1,118 |

Reconciliation Net Debt ($ thousand):

| For the three months ended June 30, 2023 | For the three months ended June 30, 2022 | For the six months ended June 30, 2023 | For the six months ended June 30, 2022 | |||||

| Short Term Loans | 113,434 | 60,284 | 113,434 | 60,284 | ||||

| Long-Term Loans | 126,758 | 155,761 | 126,758 | 155,761 | ||||

| Plus / (Less): Derivative Financial Instrument | (16,586 | ) | (7,825 | ) | (16,586 | ) | (7,825 | ) |

| Less: Cash and Cash Equivalents | (110,074 | ) | (217,938 | ) | (110,074 | ) | (217,938 | ) |

| Less: Restricted cash | - | (600 | ) | - | (600 | ) | ||

| Less: Short term investments | - | - | - | - | ||||

| Net Debt | 113,532 | (10,318 | ) | 113,532 | (10,318 | ) |

Qualified Person

Tiãozito V. Cardoso, FAusIMM, Technical Services Director for the Company has reviewed and approved the scientific and technical information contained within this news release and serves as the Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s four producing assets include the San Andres gold mine in Honduras, the EPP and the Almas gold mines in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has the Tolda Fria gold project in Colombia and four projects in Brazil, of which three gold projects: Borborema and Matupá, which are in development; and São Francisco, which is on care and maintenance. The Company also owns the Serra da Estrela copper project in Brazil, Carajás region, under exploration stage.

For further information, please visit Aura’s website at www.auraminerals.com or contact:

Rodrigo Barbosa

President & CEO

305-239-9332

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the Company’s exploration activities for 2023 and potential results thereof; expected production from, and the further potential of the Company’s properties production levels (including production levels expressed in GEO); cash costs and AISC across its operations; the timing and effect of the Company’s Almas project entering production; the impact of new IFRS accounting standards; the ability of the Company to achieve its longer-term outlook and results thereof; amounts of mineral reserves and mineral resources; and expected capital expenditure and mine production costs. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties, and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements if such risks, uncertainties or factors materialize. Specific reference is made to the most recent AIF on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented Financial Information

To the extent any forward-looking statements in this press release constitute “financial outlooks” within the meaning of applicable Canadian securities legislation, such information is being provided as certain estimated financial metrics and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such financial outlooks. Such information was approved by the Company’s Board of Directors on May 4, 2023. Financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to various risks as set out herein. The Company’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, may differ materially from values provided in this press release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/97cd97a8-ddf6-445d-9333-4182c6a83422