Aura Announces Q2 2024 Production Results, on Track to Deliver its 2024 Production Guidance and Highest LTM Production at Constant Prices in Company History

ROAD TOWN, British Virgin Islands, July 09, 2024 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA, B3: AURA33 and OTCQX: ORAAF) (“Aura” or the “Company”) is pleased to announce Q2 2024 preliminary production results from the Company’s four operating mines: Aranzazu, Apoena (EPP), Minosa (San Andres), and Almas. Total production in Q2 2024 reached 64,326 gold equivalent ounces (“GEO”)1, 6% below Q1 2024 and 33% above the same period last year, at constant metal prices. The highlight of the quarter was Minosa’s performance which achieved stable production at approximately 19k GEO per quarter after 5 consecutive quarterly production increases as result of operational improvements in 2023.

In the first semester of 2024, Aura's total production was 132,513 GEO, reaching the midpoint and remaining on track to achieve the 2024 Production Guidance range of 244,000 – 292,000 GEO.

Q2 2024 Highlights

- At Aranzazu, production was 24,692 GEO. Production was 4% lower compared to Q1 2024 and 1% below Q2 2023 at constant metal prices, and at current metal prices 1% and 2% below Q1 2024 and Q2 2023, respectively, due to mine sequencing and in line with the Company’s expectations, demonstrating stability and consistent performance quarter after quarter. In 1H 2024, production was 50,295 GEO at constant prices, 2% above 1H 2023, while at current prices, production was 49,693 GEO, 4% below 1H 2023.

- At Apoena (EPP), Q2 2024 production was 9,912 GEO, down 18% from Q1 2024 but up 43% from Q2 2023, driven by increased ore mining and higher grades. Production was in line with the Company’s expectations given current mine sequencing and development efforts focused on areas set to be explored during Q3 and Q4 2024. In 1H 2024, production was 22,017 GEO, 12% above 1H 2023.

- At Minosa (San Andres), Q2 2024 production was 19,142 GEO, remaining stable compared to the previous quarter and 17% higher than Q2 2023. This increase is primarily due to a higher volume of stacked ore, resulting from strategic investments to enhance operational efficiencies in 2023. In 1H 2024, production was 38,328 GEO, 26% above 1H 2023.

- At Almas, production in Q2 2024 reached 10,580 GEO, 11% lower than the previous quarter due to a change in the mine contractor during the period. The new contractor is already operating at the expected level, achieving 4,850 GEO in June, versus 2,220 GEO in May and 3,510 GEO in April, reinforcing the Company's confidence in meeting the 2024 production guidance. In 1H 2024, production was 22,475 GEO, 26% above 2H 2023, when the mine began operations.

Rodrigo Barbosa, Aura’s President and CEO commented, "We ended the first half of the year with 132,500 GEO (gold equivalent ounces) and anticipate a stronger second half, positioning us to deliver our guidance. We achieved a record-high LTM production this quarter, when measured at constant prices, and we expect continued growth as our Almas mine is now fully operational and other operations have stabilized. Additionally, we anticipate further increases next year as Borborema, currently on time and on budget, is expected to begin ramping up in the first quarter of 2025."

1 Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and gold into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the gold equivalent ounces are based on the weighted average price of gold, silver and copper realized from sales at the Aranzazu Complex during the relevant period.

Production Results

Preliminary GEO1,2 production volume for the three months ended June 30, 2024, compared to the previous quarter and the same period in the previous year is presented below:

| Q2 2024 | Q1 2024 | Q2 2023 | % change vs. Q1 2024 | % change vs. Q2 2023 | |

| Ounces produced (GEO1) | |||||

| Aranzazu | 24,692 | 25,001 | 25,192 | -1% | -2% |

| Apoena (EPP) Mines | 9,912 | 12,105 | 6,917 | -18% | 43% |

| Minosa (San Andres) | 19,142 | 19,186 | 16,413 | -0% | 17% |

| Almas | 10,580 | 11,895 | N/A | -11% | N/A |

| Total GEO produced - current prices | 64,326 | 68,186 | 48,522 | -5.66% | 32.57% |

| Total GEO produced - constant prices | 64,326 | 68,789 | 48,187 | -6.49% | 33.49% |

| [1] Includes ounces produced and which were capitalized for projects at pre-commercial production stages. | |||||

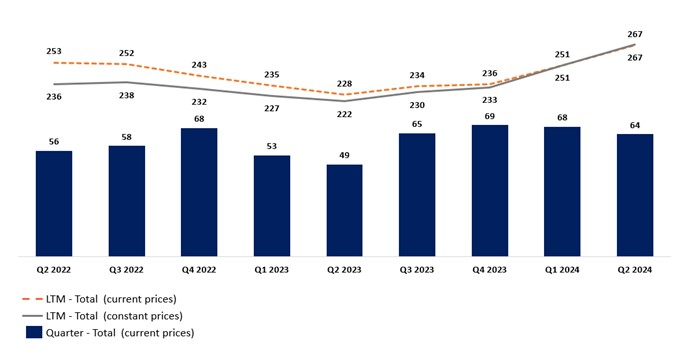

Production for the last twelve months (“LTM”) as of June 30, 2024, was 266,583 GEO and increased for the fourth quarter in a row and in line with the Company’s expectations as a result of production from Almas and consistent production improvements at Minosa. It was the second highest in the Company’s history at current prices and the highest at constant prices. The chart below shows the quarterly consolidated GEO production measured in current and constant prices since Q2 2022, as well as the LTM at the end of each reporting period:

Consolidated GEO Production per Quarter and LTM

(000’s GEO, current and constant prices as reported)

1 The total may not add due to rounding.

2 Applies the metal sale prices in Aranzazu realized during Q2 2024 to the previous quarters in all operations, being: Copper price = US$4.48/lb; Gold Price = US$2,354.94/oz; Silver Price = US$29.52/oz.

The table below shows production by each type of metal at Aranzazu. Production was in line with the Company’s expectations.

| Q2 2024 | Q1 2024 | Q2 2023 | % change vs. Q1 2024 | % change vs. Q2 2023 | |

| Gold Production (oz) | 6,175 | 6,518 | 6,479 | -5% | -5% |

| Silver Production (oz) | 120,447 | 135,485 | 120,730 | -11% | -0% |

| Copper Production (klbs) | 8,932 | 9,132 | 8,857 | -2% | 1% |

| Total GEO produced - current prices | 24,692 | 25,001 | 25,192 | -1% | -2% |

| Total GEO produced - constant prices | 24,692 | 25,604 | 24,856 | -4% | -1% |

Qualified Person

The scientific and technical information contained within this news release has been reviewed and approved by Farshid Ghazanfari, P.Geo. Mineral resources and Geology Director for Aura Minerals Inc. and serve as the Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on operating and developing gold and base metal projects in the Americas. The Company has 4 operating mines including the Aranzazu copper-gold-silver mine in Mexico, the Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San Andres) mine in Honduras. The Company’s development projects include Borborema and Matupá both in Brazil. Aura has unmatched exploration potential owning over 630,000 hectares of mineral rights and is currently advancing multiple near-mine and regional targets along with the Carajas (Serra da Estrela) copper project in the prolific Carajás region of Brazil.

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/01caeb38-373e-4f5e-895d-01baf5f740f9

For more information, please contact: Investor Relations ri@auraminerals.com www.auraminerals.com