Aura Releases its Second Quarter 2021 Financial Statements and Management Discussion and Analysis and Announces Updates to its 2021 Operational and Financial Guidance

ROAD TOWN, British Virgin Islands, Aug. 10, 2021 (GLOBE NEWSWIRE) -- Aura Minerals, Inc. (“Aura Minerals” or the “Company”) announces today that the Company has filed its unaudited interim consolidated financial statements for the quarter ended June 30, 2021, related management discussion and analysis and CEO and CFO Certificates.

In addition, the Company announces that it is also updating its gold equivalent production, cash cost per gold equivalent ounce (“GEO”) produced and capital expenditure (capex) guidance for 2021, further details on which can be found in its second quarter 2021 Management Discussion and Analysis.

Rodrigo Barbosa, President & CEO, comments: “We are glad to inform the market that we are updating our production guidance at the higher end of our initial projection. It is the result of a consistent and stable production from our gold and copper assets across our multiple jurisdictions.”

The Company expects improvements at its operations in the second half of 2021, as indicated below:

- EPP: the Ernesto pit is expected to be the main source of ore feed for the second half of 2021 and until 2022, with an increase in the average grade compared to the first half of 2021. The Japones pit will also be an important source of production for the rest of 2021 and, together with the Lavrinha and Nosde pits, it is expected to provide flexibility in the production at EPP with four operational pits.

- San Andres: Interruptions in the operations in July 2021 will have a negative impact on the projected production for the year, although the impact is expected to be limited. Esperanza is expected to remain the main source of ore for the rest of 2021. Improvements are expected to reduce leaching cycle in the plant and reduce average distances in the mine, increasing efficiency.

- Aranzazu: Over the first half of 2021, the implementation of improvements in the milling and flotation circuit increased throughput, with production reaching close to 100,000 tons on average per month during the second quarter. Higher production capacity throughout the entire second half of the year, combined with more favorable copper prices, is expected to have a positive impact on production and cash costs for the rest of 2021.

- Gold Road: The mine faced several challenges in the first half of 2021, including high employee turn-over, maintenance issues and other typical ramp-up challenges, all of which had a negative impact on production and cash costs when compared to the Company’s expectation. Aura expects Gold Road to be more stable in the second half of 2021 and to benefit from cost reduction initiatives and will focus on continuing increasing its geological knowledge of the mine.

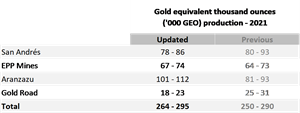

The comparison of the new guidance with the Company’s previous guidance is detailed below.

The table below details the Company’s updated GEO production guidance for 2021 by business unit:

https://www.globenewswire.com/NewsRoom/AttachmentNg/08d1dc4a-cbd1-4d0d-b4e9-48a2f793616f

For the updated GEO calculation for Aranzazu, the Company used realized metal prices for the January to June 2021 period and the following assumptions, based on market projection, on metal prices for July to December 2021 period: gold: US$1,801/ounce; silver: US$26.11/ounce; copper: US$4.22/pound.

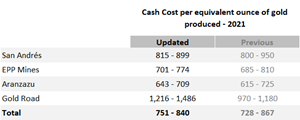

The table below shows the Company’s updated guidance on its estimated cash costs1 per equivalent ounce of gold for 2021 by Business Unit:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c64d7f9e-56b1-44e5-8f3f-d91c29be80c8

Capex:

The table below shows the breakdown of estimated capital expenditures by type of investment for the updated guidance:

| Capex (US$ million) - 2021 | ||

| Updated | Previous | |

| Sustaining | 45 - 50 | 45 - 50 |

| Exploration | 9 - 11 | 6 - 8 |

| New projects + Expansion | 28 - 30 | 42 - 46 |

| Total | 82 - 91 | 93 - 104 |

- The decrease of the Expansion Capex is mainly due to delays in the start date of construction of Almas.

- The increase in Exploration Capex is due to the shift from Exploration Expenses to Exploration Capex, as explained below.

Aura believes its properties have strong geological potential and management’s objective is to expand the life of mine across its business units. Therefore, in 2021, Aura plans to invest a total of US$24 million to US$28 million (previously: US$ 24 million to US$ 28 million) which includes:

- US$ 9 million to US$ 11 million (previously: US$ 6 million to US$ 8 million) in capital expenditures (included in the table above); and,

- US$15 million to US$ 17 million (previously: US$ 18 million to US$ 20 million) in exploration expenses, not capitalized (not included in the table above).

As noted above, the Company has kept its total exploration guidance unchanged compared to the previous indication but will capitalize more expenses than previously expected. The reason is that the Company has increased its knowledge of its mineral resources and has shifted efforts to near mine exploration in some of its properties.

Key Assumptions and Factors Underlying Guidance

- The Company’s future profitability, operating cash flows, and financial position will be closely related to the prevailing prices of gold and copper. Key factors influencing the price of gold and copper include, but are not limited to, the supply of and demand for gold and copper, the relative strength of currencies (particularly the United States dollar), and macroeconomic factors such as current and future expectations for inflation and interest rates. Management believes that the short-to-medium term economic environment is likely to remain relatively supportive for commodity prices but with continued volatility.

- To decrease risks associated with commodity prices and currency volatility, the Company will continue to evaluate and, if deemed appropriate, implement available protection instruments against commodity and currency markets uncertainty. For additional information on this, please refer to the AIF.

- Other key factors influencing profitability and operating cash flows are production levels (impacted by grades, ore quantities, process recoveries, labor, country stability, plant, and equipment availabilities), production and processing costs (impacted by production levels, prices, and usage of key consumables, labor, inflation, and exchange rates), among other factors.

Technical Disclosure

Reference should be made to the following technical reports for further details and assumptions with respect to certain of the properties described herein:

- the technical report with an effective date of January 31, 2018, entitled “Feasibility Study of the Re-Opening of the Aranzazú Mine, Zacatecas, Mexico,” prepared for Aura Minerals by F. Ghazanfari, P.Geo. (Farshid Ghazanfari Consulting), A. Wheeler, C.Eng. (Independent Mining Consultant), C. Connors, RM-SME (Aura Minerals Inc.), B. Dowdell, C.Eng. (Dowdell Mining Limited), P. Cicchini P.E. (Call & Nicholas, Inc.), G. Holmes, P.Eng. (Jacobs Engineering), B. Byler, P.E. (Wood Environment and Infrastructure Solutions), C. Scott, P.Eng. (SRK Canada), D. Lister, P.Eng. (Altura Environmental Consulting), F. Cornejo, P.Eng. (Aura Minerals Inc), available under the Company’s SEDAR profile;

- the technical report dated July 2, 2014, with an effective date of December 31, 2013, entitled “Mineral Resource and Mineral Reserve Estimates on the San Andrés Mine in the Municipality of La Union, in the Department of Copan, Honduras” prepared for Aura Minerals by Bruce Butcher, P.Eng.,former Vice President, Technical Services, Ben Bartlett, FAusiMM, former Manager Mineral Resources and Persio Rosario, P. Eng., former Principal Metallurgist, available under the Company’s SEDAR profile;

- the technical report dated January 13, 2017, with an effective date of July 31, 2016, entitled “Feasibility Study and Technical Report on the EPP Project, Mato Grosso, Brazil” prepared for Aura Minerals by a group of third-party consultants, including P&E Mining Consultants Inc., MCB Brazil and Knight Piesold Ltd., available under the Company’s SEDAR profile; and,

- the technical report dated May 3, 2018, titled “NI 43-101 Technical Report, Preliminary Economic Assessment of the Gold Road Mine, Arizona, USA” prepared for Soma Gold Corp. (formerly Para Resources Inc., the vendor of the Gold Road Project) by RPM Global, available under Soma’s Gold Corp.’s SEDAR profile.

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this news release which are not recognized under IFRS and do not have a standardized meaning prescribed by IFRS. Further details on non-IFRS financial measures are provided in the Company’s Management’s Discussion and Analysis accompanying its financial statements filed from time to time on SEDAR at www.sedar.com and at the Company’s website (ir.auraminerals.com).

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which include, without limitation, expected production from, and the further potential of the Company’s properties, and the ability of the Company to achieve its short-term outlook and the anticipated timing and results thereof, future production across the business units of the Company, cash cost of operation per ounce of gold equivalent produced and capital expenditures.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements if such risks, uncertainties or factors materialize. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements, which include, without limitation the ability of the Company to achieve its short-term outlook and the anticipated timing and results thereof, the ability to lower costs and increase production, the ability of the Company to successfully achieve business objectives, copper and gold or certain other commodity price volatility, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the Ernesto/Pau-a -Pique gold mine in Brazil, the Aranzazu copper-gold-silver mine in Mexico and the Gold Road mine in the United States. In addition, the Company has two additional gold projects in Brazil, Almas and Matupá, and one gold project in Colombia, Tolda Fria.

For further information, please visit Aura’s website at www.auraminerals.com or contact:

Rodrigo Barbosa

President & CEO

305-239-9332

__________________________________________

1 Cash operating cost per ounce produced is a non-GAAP performance measure that does not have a IFRS standardized meaning. For more information please refer to the section entitled “Non-GAAP Performance Measures” in the Company’s Management’s Discussion and Analysis.