Aura Reports Updated Mineral Reserves and Mineral Resources

ROAD TOWN, British Virgin Islands, March 31, 2023 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) is pleased to report updated Mineral Reserves and Mineral Resources (“MRMR”) estimates for its three operating mines: the San Andres Mine, Ernesto/Pau-a-Pique Mine (“EPP”) and Aranzazu Mine, as well as its development projects including, the Matupá Project and the Almas Project as reported in the Annual Information Form for the year ended December 31, 2022 (“2022 AIF”).

Readers are encouraged to read the 2022 AIF and Technical Reports (as defined herein), which have been filed on SEDAR at www.sedar.comwww.sedar.com.

Rodrigo Barbosa, President and CEO of Aura commented, “In 2022 we laid the groundwork to meet our robust growth objectives in the coming years to reach over 450,000 GEO1 annualized by 2025 through stable production, growth in Mineral Resources and Mineral Reserves, and adding to our pipeline through M&A. Given that we only started ramping up our investment in exploration in recent years, our strategy in 2022 focused on increasing Mineral Resources across our projects; we had a conversion rate of over 100% on Inferred Mineral Resources and added 865 kGEO in Measured & Indicated (“M&I”) Mineral Resources and 592 kGEO in Inferred Resources (both before depletion/conversion). We also saw an important increase in Mineral Reserves by adding 742 kGEO of Proven and Probable (“P&P”) Mineral Reserves in 2022 (before depletion), comfortably exceeding the 2022 depletion. We are focused on increasing our Mineral Reserves, and on making new discoveries.”

Mr. Barbosa continued, “Beyond our reported numbers, we expect imminent increases to our Mineral Resources base through a number of high priority opportunities. Firstly, at our Borborema Project, acquired in late 2022, which is in the feasibility study stage focused on converting the historic JORC Mineral Resources2 to NI 43-101 compliant Mineral Resources. Secondly at our EPP Mines, we see significant expansion opportunities where drilling at depth and connection between pits continues to show promise. We also acquired Japonês Oeste, an important area located along strike of the existing pits, where drilling continues. Thirdly we will focus regionally, at the Matupá Project we’ve only begun to understand the geological potential at the Serrinhas target 20 km from the X1 deposit, where we have Mineral Reserves, and at Serra de Estrela, we are enthusiastic to start our first exploration program soon within the world class Carajás region to enhance our exposure to copper. We look forward to providing additional updates on our various exploration initiatives and highlight our measured and diverse approach to growth in high quality ounces.”

2022 Highlights:

- The Company completed another robust exploration program totaling 123,895 meters of drilling across its material properties. In 2022, Aura invested approximately US$22 million in exploration with the initial goal of increasing Total Mineral Resources (M&I + Inferred), which is expected to be followed by an increase in P&P Reserves in the following stage.

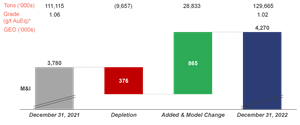

- The Company’s strategy to increase Mineral Resources was successfully achieved in 2022, with a total of 865 ounces of M&I Mineral Resources added (before depletion/conversion) and 592 ounces of Inferred Mineral Resources. This addition does not consider ounces for the Borborema Project, currently under feasibility study stage, and potential Mineral Resources from certain near-term targets, such as Serrinhas (Matupá) and Japonês Oeste (EPP), which are being further explored in 2023.

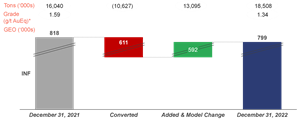

- Inferred Mineral Resource additions totaled 592 kGEO (before depletion/conversion). The small net reduction in Inferred Mineral Resources between 2021 and 2022 was primarily due to the successful conversion of over 100% of Inferred Mineral Resources to M&I Mineral Resources at the three operating mines.

3

A chart accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a33e71d-a17d-4c53-adea-f71a9c1af499

- Measured & Indicated Mineral Resource additions totaled 865 kGEO (before depletion/conversion). More than 100% of depleted metals were replaced at each of the sites by converting both Inferred Mineral Resources and previously undisclosed Mineral Resources into M&I Mineral Resources.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c9b70888-9b1d-45d3-9384-5bf2110a3f55

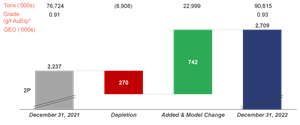

- Proven & Probable Mineral Reserves additions totaled 742 kGEO (before depletion). At the three operating mines, an increase of 433 kGEO (before depletion) comfortably exceeded our 2022 depletion on a consolidated basis. Additionally, 309 kGEO were added at Matupá following the previously reported feasibility study in November 2022.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bbeee140-f0ff-4ff4-9d54-e5569fd91496

In September 2022, Aura acquired Big River Gold Limited (the “Borborema Project”), located in the municipality of Currais Novos, Rio Grande do Norte state, in the northeast of Brazil. The Borborema Project is currently in the Feasibility Study stage. The Borborema Project has a JORC-compliant Measured and Indicated Mineral Resources of 1.8 Moz Au at 1.14 g/t Au and an additional Inferred Mineral Resource of 0.57 Moz Au at 1.0 g/t Au. This estimate is not prepared under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI43-101”). and is based on the “Definitive Feasibility Study Report, Borborema Gold Project. Cascar and Big River, November 19, 2019”. A “qualified person” (as defined in NI43-101) has not done sufficient work to classify this historic estimate as a current mineral resource under CIM guidelines. Accordingly, this historical estimate should not be relied upon as additional work is required to upgrade and verify the historical estimate as a current mineral resource.

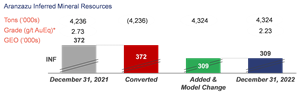

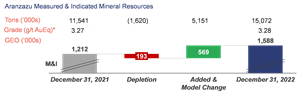

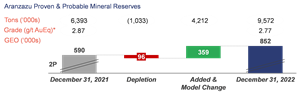

Aranzazu Mine, Mexico

At the Aranzazu Mine, the primary focus for infill and exploratory drilling has been at the Glory Hole (“GH”) and Cabrestante zones. At the time of the update of the MRMR of Aranzazu, several assay results were still pending from the infill and exploration drilling and were not included in the Mineral Resources update in 2022.

Changes in Mineral Resources include the conversion of 550,000 tonnes and 770,000 tonnes from the Inferred to M&I Mineral Resources in the GHFW4 and GHHW5 zones, respectively. Approximately 1.4 million tonnes were added to GHHW zone, and 390,000 tonnes were added to GHFW zone in the Inferred Resource category. Exploration and infill drilling in Cabrestante zone contributed an additional 567,000 tonnes to Inferred Mineral Resources and converted approximately 290,000 tonnes to M&I Mineral Resources with grades increasing 10% for copper, 52% for silver and 30% for gold.

Changes in P&P Mineral Reserves include an overall increase of 3.2 million tonnes in P&P (49.7%) with an increase of gold ounces (24.7%) and silver ounces (40%) and an increase of 9% on the Net Smelter Return (“NSR”) due to a slight increase in the copper price. This increase compensates for the entire 2022 depleted tonnes. There was an important change (35.5%) in the volume of the main body of Aranzazu (“GHFW zone”), which represents 63% of the current mineral reserve after infill drilling and converting Mineral Resources to Mineral Reserves by the end of 2022. GHHW zone had expanded after infill drilling and accounted for about 25% of the 2022 current Mineral Reserves.

The charts below show changes in Inferred Mineral Resources Estimates, M&I Mineral Resources Estimates and P&P Mineral Reserves Estimates for the Aranzazu Mine as of December 31, 2022 compared to December 31, 2021.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0280e0c3-c690-41f5-8c65-7a366e43806f

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e9624c6b-46ee-44e9-8c9d-ea720f4904fb

6

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d5c023ed-02af-4133-bd66-0ea0aaf6f37f

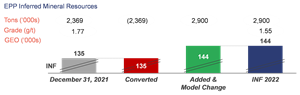

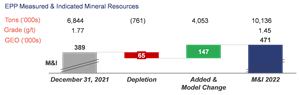

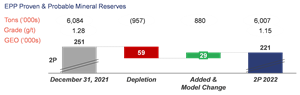

Ernesto and Pau-a-Pique, Brazil

During 2022, the infill and exploratory drilling campaign was focused at the Lavrinha mine, Nosde mine extensions at depth, and Ernesto mine. Near mine exploration drilling in Lavrinha and Nosde increased the mineral footprint and generated an integrated model which connects these mines from SE to NW at depth. The integrated model was established and used to report Inferred Mineral Resources for Lavrinha mine in 2022, resulting in an increase in Inferred Mineral Resources.

Changes in Mineral Resources include over 100% of the depleted M&I Mineral Resources being replaced, 147 koz added to M&I Mineral Resources supported by the drilling at the Nosde mine (adding 129 koz) and over 100% of the converted Inferred Mineral Resources replaced for 2.9 million tons containing 144 koz.

Changes in Mineral Reserves include the replacement of 49% of the of depleted P&P. However, the increase in Total Mineral Resources, along with pit optimization studies and new drilling programmed for 2023, present great prospects for P&P Mineral Reserves increase in the short-term.

In late 2022, Aura acquired a new mineral right, Japonês Oeste, along strike of the Japonês pit, an area that had historical artisanal mining, to better understand the continuity of the mineralization towards the west of the Japonês pit.

The charts below show changes in Inferred Mineral Resources Estimates, M&I Mineral Resources Estimates and P&P Mineral Reserves Estimates for the EPP Mines as of December 31, 2022 compared to December 31, 2021.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/78370c8c-c524-4bac-99a2-d90542a16257

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c4e1f5b9-2bc0-4de9-8a49-18cac4b03c45

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4724167b-ea86-4e15-ae56-a83b0dc52f9c

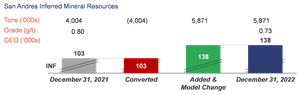

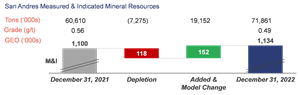

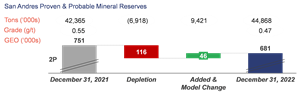

San Andres Mine, Honduras

As of December 31, 2022, Mineral Resources estimated by Aura totaled 71.86 Mt of M&I Mineral Resources at an average grade of approximately 0.49 g/t gold grade and Inferred Mineral Resources of 5.87 Mt at an average grade of 0.73 g/t gold, and a 0.20 g/t Au cut-off for oxide and a 0.27 g/t cut-off for mixed material. The Mineral Resources pit shell optimization did not consider any sulphide material. Note that the Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The new drilling at Esperanza areas and a decrease in cut-off grade supported the increase of M&I Mineral Resources replacing over 100% of depleted and converted ounces. The M&I Mineral Resources and Inferred Mineral Resources was limited by oxide and mixed material.

The charts below show changes in Inferred Mineral Resources Estimates, M&I Mineral Resources Estimates and P&P Mineral Reserves Estimates for the San Andres Mines as of December 31, 2022 compared to December 31, 2021.

A chart accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c46ac93-e77c-4db9-bad5-c4414852adba

A chart accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/27086abf-2442-478e-bda4-0a2636e61bda

A chart accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c136dc60-0387-4f5c-b9a7-d6e48e2cd7ed

Almas Project, Brazil

On March 10, 2021, the Company filed the Almas Technical Report (as defined herein) and expects to commence production in the second quarter of 2023. The Almas Project has an estimated Mineral Reserve of 21.8 Mt at an average grade of 0.92 g/t Au. The reserve classification reflects the level of accuracy of the Feasibility Study.

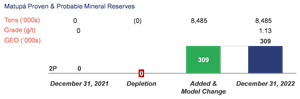

Matupá Project, Brazil

In November 2022, an updated feasibility study was completed with changes to the resource model and classification resulting in an updated Mineral Resources and an addition of P&P Mineral Reserves for the Project. The designed open-pit’s P&P Mineral Reserves of gold are estimated to be about 8.5 Mt, with an average grade of 1.13 g/t Au, totaling around 309,000 ounces of gold metal contained.

The Matupá Project Mineral Resources estimate is currently limited to the X1 Deposit. Aura conceptually believes the exploration upside in the project area is significant and that further exploration work may expand the Mineral Resources at the Project. In April 2022, drilling at the nearby Serrinhas target resulted in several wide and high-grade intercepts including, 80 meters @ 3.89g/t Au and 59 meters @ 3.14 g/t Au7. Follow up drilling is continuing.

The chart below show changes in P&P Mineral Reserves Estimates for the Matupá Project as of December 31, 2022 compared to December 31, 2021.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/418da21c-df98-4eec-96ee-18f91e5fc801

The complete 2022 Mineral Resources and Mineral Reserves estimates for all tonnage, metal grades, and metal content are shown below in the following tables:

Table 1: Inferred Mineral Resource Estimates

| Gold | ||||

| Property | Deposit | Inferred | ||

| Tonnes(kt) | Au(g/t) | Au('000 Oz) | ||

| Almas | Paiol | 3,504 | 1.23 | 139 |

| Almas | Vira Saia | 1,516 | 1.05 | 51 |

| Almas | Cata Funda | 330 | 1.48 | 16 |

| Apoena | Lavrinha | 1,062 | 1.78 | 61 |

| Apoena | Pau-a-Pique | 71 | 2.47 | 6 |

| Apoena | Ernesto | 542 | 1.94 | 34 |

| Apoena | Japones | 4 | 1.37 | 0 |

| Apoena | Nosde | 1,121 | 1.15 | 41 |

| Apoena | Ernesto Connection | 99 | 0.87 | 3 |

| Aranzazu | Aranzazu | 4,324 | 0.55 | 76 |

| San Andres | San Andrés | 5,871 | 0.73 | 138 |

| Matupa | X1 | 62 | 0.81 | 2 |

| Total | 18,508 | 0.95 | 565 | |

| Silver | ||||

| Property | DEPOSIT | Inferred | ||

| Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | ||

| Aranzazu | Aranzazu | 4,324 | 16.37 | 2,276 |

| Matupa | X1 | 62 | 3.04 | 6 |

| Total | 4,386 | 16.18 | 2,282 | |

| Copper | ||||

| Property | DEPOSIT | Inferred | ||

| Tonnes(kt) | Cu(%) | Cu('000 lbs.) | ||

| Aranzazu | Aranzazu | 4,324 | 1.04 | 99,051 |

| Total | 4,324 | 1.04 | 99,051 | |

Notes:

- The Mineral Resource estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The disclosure of the Mineral Resource estimates and related scientific and technical information has been prepared under the supervision or is approved by Farshid Ghazanfari, P.Geo. as a Qualified Person for Aranzazu, San Andres, EPP, Matupá and for the Paiol and Vira Saia deposits and HLP of Almas.

- The Mineral Resource estimate for the Cata Funda deposit of Almas was prepared by Adam Wheeler, C.Eng., a Qualified Person as that term is defined in NI 43-101.

- Contained metal figures may not add due to rounding.

- Mineral Resources stated at a cut-off of US$50/t NSR for Aranzazu.

- NSR values have been calculated using a long-term price forecast for copper (US$3.50/lb), gold (US$1,700/oz) and silver (US$22/oz), resulting in the following formula: NSR (US$/t) = (Cu% x US$ 57.376) + (Au g/t x US$38.746) + (Ag g/t x US$0.365) for Aranzazu.

- A density model based on rock types hosting mineralization was used for volume to tonnes conversion with averaging 3.04 tonnes/m3 for Aranzazu.

- The figures only consider material classified as sulphide mineralization for Aranzazu.

- The Mineral Resources estimate is based on optimized shell using US$1,900/oz gold for San Andres.

- The cut-off grade used was 0.20 g/t for oxide material and 0.27 g/t for mixed material in San Andres.

- A density model based on rock type was used for volume to tonnes conversion with averaging 2.34 tonnes/m3 in San Andres.

- Surface topography as of December 31, 2022, and a 200m river offset restrictions have been imposed in San Andres.

- Based on an optimized pit shell using US$1,900/oz gold and at a cut-off grade of 0.40 g/t Au in EPP, except Pau-A-Pique mine.

- Based on a cut-off grade of 1.34 g/t Au and minimum width of 2m in Pau-A-Pique mine (EPP).

- Mineral Resources are estimated from the 410m EL to the 65m EL, or from approximately 30m depth to 500m depth from surface in Pau-A-Pique mine (EPP).

- Surface topography based on December 31, 2022, in EPP, except Pau-A-Pique mine.

- End of the year mining depletion shapes used to estimate remaining resources in Pau-A-Pique mine (EPP).

- Density models based on rock types were used for volume to tonnes conversion with resources averaging 2.78 tonnes/m3 in Lavrinhas mine, 2.77 tonnes/m3 in Pau-A-Pique mine, 2.62 tonnes/m3 in Ernesto mine, 2.76 tonnes/m3 in Japonês mine, 2.73 tonnes/m3 in Nosde and Ernesto-Lavrinha Connection mines, all mines from EPP.

- The Mineral Resource estimate is based on an updated optimized shell using 1800 US$/oz gold price and cut-off grades of 0.29 g/t, 0.34 g/t and 0.31 g/t for Paiol, Cata Funda and Vira Saia respectively, in Almas.

- Surface topography based on December 31, 2016, in Almas.

- The Measured and Indicated Mineral Resources are contained within a limiting pit shell (using a gold price of US$ 1,800 per ounce Au) and comprise a coherent body in Matupá.

- The base case cut-off grade for the estimate of Mineral Resources is 0.35 g/t Au in Matupá.

- Surface topography used in the models was surveyed July 31, 2021 in Matupá.

- Inferred Mineral Resources disclosed for the Lavrinha mine (EPP) is exclusive from the same category in the Nosde mine (EPP) and reported from larger pit outline for both deposits with similar price and cut-off grade.

- Inferred Resources are reported in two parts for Ernesto mine (EPP), inferred (OP) which is mineable by an open pit operation and Inferred (UG) which only can be mined by an underground operation. Inferred (UG) Mineral Resources are reported at a cut-off grade of 1.5 g/t.

- Inferred Mineral Resources in Nosde mine are exclusive from Lavrinha mine and reported from same pit outline as of Indicated Mineral Resources.

Table 2: Measured and Indicated Mineral Resource Estimates

| Gold | ||||||||||||

| Property | Deposit | Measured | Indicated | M&I | ||||||||

| Tonnes(kt) | Au(g/t) | Au('000 Oz) | Tonnes(kt) | Au(g/t) | Au('000 Oz) | Tonnes(kt) | Au(g/t) | Au('000 Oz) | ||||

| Almas | Paiol | 4,367 | 1.03 | 145 | 13,181 | 0.96 | 408 | 17,548 | 0.98 | 552 | ||

| Almas | Vira Saia | 567 | 1.24 | 23 | 2,788 | 0.91 | 81 | 3,355 | 0.96 | 104 | ||

| Almas | Cata Funda | 482 | 1.97 | 31 | 356 | 1.39 | 16 | 838 | 1.72 | 46 | ||

| Almas | Heap Leach Pad (HLP) | 0 | 1,510 | 0.88 | 43 | |||||||

| Apoena | Lavrinha | 44 | 1.22 | 2 | 1,027 | 1.50 | 50 | 1,071 | 1.49 | 51 | ||

| Apoena | Pau-a-Pique | 242 | 3.19 | 25 | 602 | 2.71 | 52 | 844 | 2.85 | 77 | ||

| Apoena | Ernesto | 911 | 2.11 | 62 | 911 | 2.11 | 62 | |||||

| Apoena | Japones | 215 | 1.40 | 10 | 215 | 1.40 | 10 | |||||

| Apoena | Nosde | 5,863 | 1.19 | 224 | 5,863 | 1.19 | 224 | |||||

| Apoena | Ernesto Connection | 1,232 | 1.18 | 47 | 1,232 | 1.18 | 47 | |||||

| Aranzazu | Aranzazu | 10,200 | 1.03 | 339 | 4,872 | 0.84 | 132 | 15,072 | 0.97 | 471 | ||

| Matupa | X1 | 4,693 | 1.14 | 172 | 4,653 | 0.96 | 144 | 9,346 | 1.05 | 316 | ||

| San Andres | San Andrés | 16,886 | 0.49 | 263 | 54,975 | 0.49 | 863 | 71,861 | 0.49 | 1,126 | ||

| Total | 37,481 | 0.83 | 999 | 90,675 | 0.72 | 2,088 | 129,665 | 0.75 | 3,129.47 | |||

| Silver | ||||||||||||

| Property | DEPOSIT | Measured | Indicated | M&I | ||||||||

| Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | ||||

| Aranzazu | Aranzazu | 10,200 | 21.54 | 7,062 | 4,872 | 21.22 | 3,324 | 15,072 | 21.15 | 10,386 | ||

| Matupa | X1 | 4,693 | 3.85 | 581 | 4,653 | 4.39 | 656 | 9,346 | 4.12 | 1,238 | ||

| Total | 14,893 | 15.96 | 7,643 | 9,526 | 13.00 | 3,981 | 24,417 | 14.81 | 11,624 | |||

| Copper | ||||||||||||

| Property | DEPOSIT | Measured | Indicated | M&I | ||||||||

| Tonnes(kt) | Cu(%) | Cu('000 lbs.) | Tonnes(kt) | Cu(%) | Cu('000 lbs.) | Tonnes(kt) | Cu(%) | Cu('000 lbs.) | ||||

| Aranzazu | Aranzazu | 10,200 | 1.44 | 324,591 | 4,872 | 1.42 | 152,899 | 15,072 | 1.44 | 477,309 | ||

| Total | 10,200 | 1.44 | 324,591 | 4,872 | 1.42 | 152,899 | 15,072 | 1.44 | 477,309 | |||

Notes:

- The Mineral Resource estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The disclosure of the Mineral Resource estimates and related scientific and technical information has been prepared under the supervision or is approved by Farshid Ghazanfari, P.Geo. as a Qualified Person for Aranzazu, San Andres, EPP, Matupá and for the Paiol and Vira Saia deposits and HLP of Almas.

- The Mineral Resource estimate for the Cata Funda deposit of Almas was prepared by Adam Wheeler, C.Eng., a Qualified Person as that term is defined in NI 43-101.

- Contained metal figures may not add due to rounding.

- Mineral Resources stated at a cut-off of US$50/t NSR for Aranzazu.

- NSR values have been calculated using a long-term price forecast for copper (US$3.50/lb), gold (US$1,700/oz) and silver (US$22/oz), resulting in the following formula: NSR (US$/t) = (Cu% x US$ 57.376) + (Au g/t x US$38.746) + (Ag g/t x US$0.365) for Aranzazu.

- A density model based on rock types hosting mineralization was used for volume to tonnes conversion with averaging 3.04 tonnes/m3 for Aranzazu.

- The figures only consider material classified as sulphide mineralization for Aranzazu.

- The Mineral Resources estimate is based on optimized shell using US$1,900/oz gold for San Andres.

- The cut-off grade used was 0.20 g/t for oxide material and 0.27 g/t for mixed material in San Andres.

- A density model based on rock type was used for volume to tonnes conversion with averaging 2.34 tonnes/m3 in San Andres.

- Surface topography as of December 31, 2022, and a 200m river offset restrictions have been imposed in San Andres.

- Based on an optimized pit shell using US$1,900/oz gold and at a cut-off grade of 0.40 g/t Au in EPP, except Pau-A-Pique mine.

- Based on a cut-off grade of 1.34 g/t Au and minimum width of 2m in Pau-A-Pique mine (EPP).

- Mineral Resources are estimated from the 410m EL to the 65m EL, or from approximately 30m depth to 500m depth from surface in Pau-A-Pique mine (EPP).

- Surface topography based on December 31, 2022, in EPP, except Pau-A-Pique mine.

- End of the year mining depletion shapes used to estimate remaining resources in Pau-A-Pique mine (EPP).

- Density models based on rock types were used for volume to tonnes conversion with resources averaging 2.78 tonnes/m3 in Lavrinhas mine, 2.77 tonnes/m3 in Pau-A-Pique mine, 2.62 tonnes/m3 in Ernesto mine, 2.76 tonnes/m3 in Japonês mine, 2.73 tonnes/m3 in Nosde and Ernesto-Lavrinha Connection mines, all mines from EPP.

- The Mineral Resource estimate is based on an updated optimized shell using 1800 US$/oz gold price and cut-off grades of 0.29 g/t, 0.34 g/t and 0.31 g/t for Paiol, Cata Funda and Vira Saia respectively, in Almas.

- Surface topography based on December 31, 2016, in Almas.

- The Measured and Indicated Mineral Resources are contained within a limiting pit shell (using a gold price of US$ 1,800 per ounce Au) and comprise a coherent body in Matupá.

- The base case cut-off grade for the estimate of Mineral Resources is 0.35 g/t Au in Matupá.

- Surface topography used in the models was surveyed July 31, 2021 in Matupá.

Table 3: Proven & Probable Mineral Reserve Estimates

| Gold | ||||||||||||

| Property | Deposit | Proven | Probable | 2P | ||||||||

| Tonnes(kt) | Au(g/t) | Au('000 Oz) | Tonnes(kt) | Au(g/t) | Au('000 Oz) | Tonnes(kt) | Au(g/t) | Au('000 Oz) | ||||

| Almas | Paiol | 5,358 | 0.89 | 153 | 10,781 | 0.88 | 304 | 16,138 | 0.88 | 457 | ||

| Almas | Vira Saia | 646 | 0.88 | 18 | 3,134 | 0.91 | 92 | 3,780 | 0.91 | 110 | ||

| Almas | Cata Funda | 439 | 1.89 | 27 | 250 | 1.79 | 14 | 689 | 1.86 | 41 | ||

| Almas | Heap Leach Pad (HLP) | 0 | 1,275 | 0.9 | 37 | |||||||

| Apoena | Lavrinha | 54 | 0.92 | 2 | 261 | 1.10 | 9 | 315 | 1.07 | 11 | ||

| Apoena | Pau-a-Pique | 30 | 1.80 | 2 | 106 | 1.96 | 7 | 135 | 1.92 | 8 | ||

| Apoena | Ernesto | 873 | 2.04 | 57 | 873 | 2.04 | 57 | |||||

| Apoena | Japones | 245 | 1.04 | 8 | 245 | 1.04 | 8 | |||||

| Apoena | Nosde | 3,638 | 0.96 | 112 | 3,638 | 0.96 | 112 | |||||

| Apoena | Ernesto Connection | 801 | 0.95 | 25 | 801 | 0.95 | 25 | |||||

| Aranzazu | Aranzazu | 5,949 | 0.86 | 165 | 3,623 | 0.72 | 84 | 9,572 | 0.81 | 249 | ||

| Matupa | X1 | 3,799 | 1.31 | 160 | 4,686 | 0.99 | 149 | 8,485 | 1.13 | 309 | ||

| San Andres | San Andrés | 12,676 | 0.46 | 189 | 32,192 | 0.48 | 492 | 44,868 | 0.47 | 681 | ||

| Total | 28,950 | 0.77 | 715 | 60,589 | 0.69 | 1,354 | 90,814 | 0.72 | 2,106 | |||

| Silver | ||||||||||||

| Property | DEPOSIT | Proven | Probable | 2P | ||||||||

| Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | Tonnes(kt) | Ag(g/t) | Ag('000 Oz) | ||||

| Aranzazu | Aranzazu | 5,949 | 17.56 | 3 | 3,623 | 17.69 | 2 | 9,572 | 17.61 | 5 | ||

| Total | 5,949 | 17.56 | 3 | 3,623 | 17.69 | 2 | 9,572 | 17.61 | 5 | |||

| Copper | ||||||||||||

| Property | DEPOSIT | Proven | Probable | 2P | ||||||||

| Tonnes(kt) | Cu(%) | Cu('000 lbs.) | Tonnes(kt) | Cu(%) | Cu('000 lbs.) | Tonnes(kt) | Cu(%) | Cu('000 lbs.) | ||||

| Aranzazu | Aranzazu | 5,949 | 1.25 | 163,979 | 3,623 | 1.19 | 95,025 | 9,572 | 1.23 | 259,004 | ||

| Total | 5,949 | 1.25 | 163,979 | 3,623 | 1.19 | 95,025 | 9,572 | 1.23 | 259,004 | |||

Notes:

- The Mineral Reserve estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Reserves are the economic portion of the Measured and Indicated Mineral Resources. Mineral Reserve estimates include mining dilution and mining recovery. Mining dilution and recovery factors vary with specific reserve sources and are influenced by several factors including deposit type, deposit shape and mining methods.

- The estimate of Mineral Reserves may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The disclosure of the Mineral Reserve estimates and related scientific and technical information has been prepared under the supervision or is approved by Tiãozito V. Cardoso, FAusIMM as a Qualified Person for Aranzazu, San Andres and EPP.

- Mineral Reserve estimate for Almas and Matupá Gold Projects was prepared under the supervision of Luiz Pignatari, P.Eng. as a Qualified Person, competent to sign as defined by NI 43-101.

- The NSR cut-off US$64/t is based on the total predicted operating cost in Aranzazu.

- Ore NSR values have been calculated using 3.50 US$/lb for copper, 1,700 US$/oz for gold and 22 US$/oz for silver and 2022 operation performance for metallurgical recoveries of 92% for copper, 79% for gold, 61% for silver and 64.7% for arsenic. Dilution was applied in the in the form of planned and unplanned dilution from hanging wall and footwall end-wall. Dilution from backfill (for secondary stopes) was also included. All dilution material was assumed at zero grades. Total dilution is approximately 23%. All Aranzazu information.

- Ore NSR values have been calculated using following formula: NSR ($/t) = (Cu% x US$57.376) + (Au g/t x US$38.746) + (Ag g/t x US$0.365) in Aranzazu.

- Mining recoveries of 90% were applied to the stopes and ore development sill cuts respectively in Aranzazu.

- Mineral Reserves are calculated using pit designs, which have been optimized using only Measured and Indicated Resources at US$1,700/oz. gold price in San Andres and EPP.

- Mineral Reserves have been estimated at a cut-off grade of 0.23 g/t for oxide material and 0.30 g/t for mixed material, with dilution of 5% and mining recovery of 95% in San Andres.

- Mineral Reserves were estimated at a cut-off grade of 0.40 g/t Au and applying 40% dilution factor with 98% mining recovery in Lavrinha mine (EPP).

- Mineral Reserves were estimated at a cut-off grade of 0.47 g/t Au and applying 10 % dilution factor with 98% mining recovery in Ernesto mine (EPP).

- Mineral Reserve were estimated at cut-off grade of 0.47 g/t Au and applying 40% dilution factor and 98% mining recovery, in Japonês mine (EPP).

- Mineral Reserves were estimated at cut-off grade of 0.47 g/t Au and applying 20% dilution factor and 98% mining recovery in Nosde mine (EPP).

- Mineral Reserves were estimated at cut-off grade of 0.47 g/t Au and applying 40% dilution factor and 98% mining recovery in Ernesto-Lavrinha Connection mine (EPP).

- The Mineral Reserve estimate is based on an updated optimized shell using 1,500 US$/oz gold price, average dilution of 20%, mining recovery of 100% and break-even cut off grades of 0.29 g/t Au for Paiol, 0.31 g/t Au for Vira Saia and 0.34 g/t Au for Cata Funda in Almas.

- The Mineral Reserve Estimate is based on an updated optimized shell using US$1,500/oz gold price, average dilution of 3%, mining recovery of 100% and break-even cut off grades of 0.35 g/t Au for X1 pit in Matupá.

- Surface topography as of December 31, 2022, and a 200m river offset restrictions have been imposed, in San Andres.

- Surface topography based on December 31, 2022 in EPP.

- Surface topography based on December 31, 2016 in Almas.

- Surface topography as of July 31, 2021, in Matupá.

Quality Assurance and Quality Control

Aura incorporates a rigorous Quality Assurance and Quality Control (“QA/QC”) program for all of its three mines and exploration projects which conforms to industry best practices as outlined by NI 43-101.

For a complete description of Aura’s sample preparation, analytical methods and QA/QC procedures, please refer to 2022 AIF and the applicable Technical Report, a copy of which is available on the Company’s SEDAR profile at www.sedar.com.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager and Tiãozito V. Cardoso, FAusIMM, Technical Services Director, each of whom is an employee of Aura and a “qualified person” within the meaning of NI 43-101.

Technical Reports

All information of scientific and technical nature has been derived from the Technical Reports and any information arising since the date of the Technical Reports has been prepared under the supervision of Farshid Ghazanfari, P.Geo and Tiãozito V. Cardoso, FAusIMM. Readers are encouraged to read the following technical reports for the following mineral properties of the Company:

- San Andres: The technical report dated July 2, 2014, with an effective date of December 31, 2013, and entitled “Mineral Resource and Mineral Reserve Estimates on the San Andres Mine in the Municipality of La Union, in the Department of Copan, Honduras” prepared for Aura Minerals by Bruce Butcher, P.Eng., former Vice President, Technical Services, Ben Bartlett, FAusIMM, former Manager Mineral Resources and Persio Rosario, P. Eng., former Principal Metallurgist (the “San Andres Technical Report”);

- Aranzazu: The technical report with an effective date of January 31, 2018, and entitled “Feasibility Study of the Re-Opening of the Aranzazu Mine, Zacatecas, Mexico” prepared for Aura Minerals by F. Ghazanfari, P.Geo. (Farshid Ghazanfari Consulting), A. Wheeler, C.Eng. (Independent Mining Consultant), C. Connors, RM-SME (Aura Minerals Inc.), B. Dowdell, C.Eng. (Dowdell Mining Limited), P. Cicchini P.E. (Call & Nicholas, Inc.), G. Holmes, P.Eng. (Jacobs Engineering), B. Byler, P.E. (Wood Environment and Infrastructure Solutions), C. Scott, P.Eng. (SRK Canada), D. Lister, P.Eng. (Altura Environmental Consulting), F. Cornejo, P.Eng. (Aura Minerals Inc.) (the “Aranzazu Technical Report”);

- EPP: The technical report dated January 13, 2017, with an effective date of July 31, 2016, and entitled “Feasibility Study and Technical Report on the EPP Project, Mato Grosso, Brazil” prepared for Aura Minerals by a group of third-party consultants including P&E Mining Consultants Inc., MCB Brazil and Knight Piesold Ltd. (the “EPP Technical Report”);

- Almas: The technical report dated March 10, 2021, authored by F. Ghazanfari. P.Geo. (Aura Minerals), B. T. Hennessey (Micon International, Canada), L. Pignatari, P.Eng. (EDEM, Consultants, Brazil), T. R. Raponi, P.Eng. (Ausenco, Canada), I. Dymov, P.Eng., (Independent Consultant, Canada), P. C. Rodriguez, FAIG, (GE21 Consultants, Brazil) and A. Wheeler, C.Eng. (Independent Mining Consultant, UK) ,and titled “Updated Feasibility Study Technical Report (NI 43-101) for the Almas Gold Project, Almas Municipality, Tocantins, Brazil” (the “Almas Technical Report”; and

- Matupá: The Technical Report “Feasibility Study Technical Report (NI 43-101) for the Matupá Gold Project, Matupá Municipality, Mato Grosso, Brazil” dated November 18, 2022, with an effective date of August 31, 2022 by F. Ghazanfari. P.Geo. (Aura Minerals), L. Pignatari, P.Eng. (EDEM Consultants, Brazil), and H. Delboni P.Eng. (HDA-Independent Mining Consultant, Brazil), (the “Matupá Technical Report”) and together with the Aranzazu Technical Report, San Andres Technical Report, EPP Technical Report, and Almas Technical Report, the “Technical Reports”).

Caution Regarding Forward-Looking Information and Statements

This press release contains “forward-looking information” and “forward-looking statements”, as defined in applicable securities laws (collectively, “forward-looking statements”) which include, without limitation, expected production from, and the further potential of the Company’s properties; the ability of the Company to achieve its longer-term outlook and the anticipated timing and results thereof; the ability to lower costs and increase production; the economic viability of a project; strategic plans, including the Company’s plans with respect to its properties; amounts of mineral reserves and mineral resources; the amount of future production over any period; and capital expenditure and mine production costs.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements if such risks, uncertainties or factors materialize. The Company has made numerous assumptions with respect to forward-looking information contain herein, including among other things, assumptions from the Technical Reports, which may include assumptions on indicated mineral resources, measured mineral resources, probable mineral reserves and/or proven mineral reserves, which could also cause actual results to differ materially from those contained in the forward-looking statements if such assumptions prove wrong. Specific reference is made to the most recent 2022 AIF on file with certain Canadian provincial securities regulatory authorities and the Technical Reports for a discussion of some of the risk factors underlying forward-looking statements, which include, without limitation the ability of the Company to achieve its longer-term outlook and the anticipated timing and results thereof, the ability to lower costs and increase production, the ability of the Company to successfully achieve business objectives, copper and gold or certain other commodity price volatility, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

Caution Regarding Mineral Resource and Mineral Reserve Estimates

The figures for mineral resources and reserves contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that the mineral resources and reserves could be mined or processed profitably. Actual reserves, if any, may not conform to geological, metallurgical or other expectations, and the volume and grade of ore recovered may be below the estimated levels. There are numerous uncertainties inherent in estimating mineral resources and reserves, including many factors beyond the Company’s control. Such estimation is a subjective process, and the accuracy of any reserve or resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the mineral resources and reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Lower market prices, increased production costs, the presence of deleterious elements, reduced recovery rates and other factors may result in revision of its resource and reserve estimates from time to time or may render the Company’s resources and reserves uneconomic to exploit. Resource and reserve data is not indicative of future results of operations. If the Company’s actual mineral resources and reserves are less than current estimates or if the Company fails to develop its resource base through the realization of identified mineralized potential, its results of operations or financial condition may be materially and adversely affected.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the EPP gold mine in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has the Tolda Fria gold project in Colombia and five projects in Brazil, of which four gold projects: Almas, which is under final phase of construction; Borborema and Matupá, which are in development; and São Francisco, which is on care and maintenance. The Company also owns the Serra da Estrela copper project in Brazil, Carajás region, under exploration stage.

_________________________

1 Gold equivalent ounces (“GEO”) is calculated by converting the production of silver and copper into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the gold equivalent ounces are based on the weighted average price of silver and copper realized from sales at the Aranzazu Complex during the relevant period. The following prices were used to calculate the GEO presented in this Press Release:

2022 figures - Gold: US$ 1,700.00 / ounce; Silver: US$ 22.00 / ounce; Copper: US$ 3.50 / pound.

2 According to the Company’s Press Release announced on April 19, 2022 (Aura to Acquire Big River Gold via an Australian Scheme of Arrangement), available on Sedar.

3 * AuEq is a reference to Equivalent Gold, which grades from copper and silver are converted to gold grades to have a single and comparable grade of mines that only have gold.

4 GHFW: Glory Hole Footwall

5 GHHW - Glory Hole Hanging Wall

6 * AuEq is a reference to Equivalent Gold, which grades from copper and silver are converted to gold grades to have a single and comparable grade of mines that only have gold.

7 According to the Company’s Press Release announced on April 13, 2022 (Aura Reports Significant Drill Intersections at Serrinhas Area, Matupa Gold Project, Mato Grosso, Brazil), available on Sedar.

For further information, please visit Aura’s website at www.auraminerals.com or contact: Rodrigo Barbosa President & CEO 305-239-9332