Aurcana Announces Strategic Vision to Enhance Shareholder Value

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, June 19, 2019 (GLOBE NEWSWIRE) -- AURCANA CORPORATION ("Aurcana" or the "Company") (TSXV: AUN) is pleased to announce today its updated strategic vision to enhance shareholder value.

The Company’s strategic vision, which has been developed by the board and management of the Company in the context of current market conditions following successful completion of the Company’s transformative 2018 acquisition and financing transactions, focuses on a plan to increase mineral resources and reserves at the Company’s production ready Revenue-Virginius Mine in Ouray, Colorado (the “RV Mine”). This strategic plan will require significantly less capital in the near term than a full restart of the RV Mine. In conjunction with these efforts, the Company has also set a second goal to develop a plan for strategic options for the Shafter Project in Presidio County, Texas.

Management of the Company believes that the RV Mine is arguably the highest-grade silver mine in North America, as well as one of the highest-grade silver mines in the world with proven and probable mineral reserves. It has a 2018 feasibility study (the “2018 FS”) prepared in accordance with National Instrument NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) demonstrating an economic restart of the RV Mine. A copy of the 2018 FS is posted on the Company’s website and is also available on the Company’s profile on SEDAR at www.sedar.com.

The main components of the strategic vision are for the Company to:

- expand mineral resources and reserves at the RV Mine by proving up extensions of strike length on established vein systems, extending the life of mine and enabling an increase in throughput rate (thus improving the already strong economics of the 2018 FS);

- establish the optimal strategic and technical path at the Shafter Project to maximize shareholder value; and

- seek merger and acquisition opportunities by utilizing and leveraging the Aurcana technical team’s strong evaluation and operating expertise to develop future production opportunities.

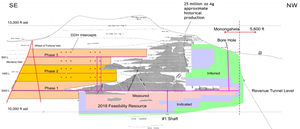

Resource and Reserve Expansion on the Virginius Vein at the RV Mine

The Company has developed, planned, and costed a program to potentially expand the RV Mine mineral resources and reserves with targeted diamond drilling and level development on the Virginius Vein adjacent to historic mining areas. The goal of this three-phase program will be to target a significant increase in mineral resources at the RV Mine as compared to the current mineral resources defined in the 2018 FS.

Given the Virginius vein average width over the expansion area to be evaluated (as shown below in Figure 1), Aurcana believes that between 450,000 to 676,000 tons is a reasonable estimate of the tonnage for this area. Assuming that this area would have similar grades to the Monongahela reserve stopes (for the tonnages noted above) this would equate to between 17 and 25.5(1) million ounces of Ag, 32 to 48 thousand ounces of Au, 55 to 82.5 million lbs Pb, and 39 and 58.5 million lbs of Zn. The foregoing potential quantity and grade is conceptual in nature as there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the foregoing exploration target being delineated as a mineral resource.

Each phase of the program is expected to last approximately 7 months and average $6.5 million per phase. The level development completed during this program can be utilized in future production and should also reduce future restart capital costs.

FIGURE 1: Resource and Reserve Expansion in Virginius Vein at the RV Mine

https://www.globenewswire.com/NewsRoom/AttachmentNg/38b75146-cb0b-4a6b-96f8-8e095be1f570

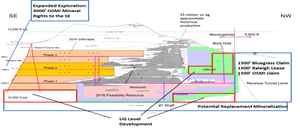

Resource Conversion and Additional Exploration Opportunities

The Company has also identified opportunities to potentially upgrade and additionally increase the RV Mine’s mineral resources as shown in Figure 2 by accomplishing the following:

- during production start-up development, converting the current inferred mineral resources to measured and indicated resources; and

- developing longer term exploration targets situated adjacent to the current mineral resources.

FIGURE 2: Resource Conversion and Additional Exploration Upside on the Virginius Vein

https://www.globenewswire.com/NewsRoom/AttachmentNg/671e36d3-b523-48f2-9ae0-fc6dd3e7e50a

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Val Pratico, P.Geo., of the Company and a “qualified person” within the meaning of NI 43-101.

Notes

(1)

Grades below are calculated from FS Model (SRK) and FS Stope design (OSMI). Average vein width is calculated from same model region as grade and averaged on a weighted basis off block tonnage. 1.5 ft' Avg vein width is a rounded average between V1/V2 intercepts and modeled width of a more representative area. There is no guarantee that the above averages will be realized in the new expansion zone.

| Au OPT | Ag OPT | Pb% | Cu% | Zn% | Width | |

| Monongahela V1 Stopes (with 1500 Inferred) | 0.07 | 37.70 | 6.10% | 0.40% | 4.32% | 1.94 |

ABOUT AURCANA CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA CORPORATION

“Kevin Drover”, President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

CAUTIONARY NOTES

This press release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words “anticipate”, “plan”, “continue”, “expect”, “estimate”, “objective”, “may”, “will”, “project”, “should”, “predict”, “potential” and similar expressions are intended to identify forward looking statements. In particular, this press release contains forward looking statements concerning, without limitation, the Company’s strategic plan, plans for mineral resource and reserve expansion on the Virginius Vein at the RV Mine, additional plans for mineral resource conversion and additional exploration opportunities and plans for potential M&A opportunities. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the receipt of regulatory or shareholder approvals, and risks related to the state of financial markets or future metals prices.

Management has provided the above summary of risks and assumptions related to forward looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company’s future operations. The Company’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

This press release does not constitute an offer for sale or a solicitation of an offer to buy, in the United States or to, or for the account or benefit of, any "U.S. Person" (as such term is defined in Regulation S under the U.S. Securities Act of 1933, as amended) of any equity or other securities of Aurcana.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.