Aya Gold & Silver Reports Record Quarterly Production of 459,061 Ounces

MONTREAL, Aug. 12, 2022 /CNW Telbec/ - Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) ("Aya" or the "Corporation") is pleased to report interim financial and operational results for the second quarter ended June 30, 2022. All amounts are in US dollars unless otherwise stated.

- Record operations in terms of silver ounces produced, mined, and recovered

- Produced 459,061 ounces ("oz") of silver ("Ag"), a 5% increase from Q2-2021 and a 49% increase from the previous quarter

- Mined 63,817 tonnes ("t") (701 tons per day ("tpd")) during the quarter including monthly record production of 809 tpd in June 2022

- Combined mill recovery of 87.9%, a 7% increase from Q2-2021

- Silver sales of 439,080 oz, a 5% increase from Q2-2021

- Revenue of $8.6 million, a 13% decrease from Q2-2021

- Operating cash flow for the period of $1.1 million, compared with $5.5 million in Q2-2021

- Cash costs per silver ounce sold (1) of $11.35 compared with $11.61 in Q2-2021

- Successful exploration program at Zgounder:

- Extended eastern zone and further defined the upper underground mine workings

- Returned Zgounder's best-ever intersection in terms of grade-thickness

- Completed geophysical airborne survey on Zgounder Regional together with mapping and sampling

- Exploration of rich regional portfolio located along the South Atlas Fault:

- Drilled 4,210 meters ("m") at Boumadine following completion of geophysical airborne survey

- Conducted a 624m diamond drill hole ("DDH") program on Imiter bis with full assay results expected in Q3-2022

- Advanced Zgounder production expansion on time and on budget:

- Completed 1,130m of lateral development work

- Delivered the front-end engineering design ("FEED") on schedule

- Received quotations for 21 mechanical equipment packages, including all key long-lead items

- Received over 90% (in value) of the mechanical equipment procurement offers, which re-confirm the process plant CAPEX and OPEX estimated in the feasibility study ("FS")

- Selected a supplier for the ball mill package

- Community initiatives with long-life impact

- Began supporting the local saffron-growing industry through plans for a garden nursery and educational farm

- Funded and conducted two mobile health clinics benefiting adults and children

- Increased board diversity through appointment of two independent directors from the Canadian mining and European banking sectors, respectively

- Robust financial position with $67.9 million of cash and restricted cash

(1) | The Corporation reports non-GAAP measures, which include cash costs per silver ounce, which are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and the methods used by the Corporation to calculate such measures may differ from methods used by other companies with similar descriptions. See "Non-GAAP Measures" on page 13 and 14 of the Corporation's Q2-2022 MD&A for a reconciliation of non-GAAP to GAAP measures. |

"Congratulations to the operations team for delivering a standout second quarter with record-setting production, which benefited from strong recoveries and best-ever throughput. As expected, Zgounder saw meaningful improvement in grade as we accessed richer ore and achieved greater mining capacity, positioning us well to achieve our full-year production guidance. We enjoyed additional exploration success this quarter with further resource delineation at Zgounder and the completion of airborne geophysical surveys on Zgounder Regional, Boumadine and Imiter bis. Considerable progress was also made on the Zgounder Expansion Project with the on-schedule delivery of the FEED, the first of our construction milestones," said Benoit La Salle, President and CEO.

"Last, but not least, I'm very proud of the progress we are making and the impact that we are having with our sustainability goals and initiatives. Specifically, we have increased board diversity, launched our first larger-scale community project, and demonstrated leadership in regard to local employment and procurement."

Q2-2022 Operational and Financial Highlights

Key Performance Metrics | Q2-2022 | Q2-2021 | Variation '22 vs '21 | |

Operational | ||||

Ore Processed (tonnes) | 59,995 | 56,318 | 7 % | |

Average Grade (g/t Ag) | 273 | 297 | (8 %) | |

Mill Recovery (%) | 87.9 % | 82.0 % | 7 % | |

Silver Ingots Produced (oz) | 219,762 | 174,786 | 26 % | |

Silver in Concentrate Produced (oz) | 239,299 | 264,363 | (9 %) | |

Total Silver Produced (oz) | 459,061 | 439,149 | 5 % | |

Silver Ingots Sold (oz) | 196,556 | 163,499 | 20 % | |

Silver in Concentrate Sold (oz) | 242,524 | 256,498 | (5 %) | |

Total Silver Sales (oz) | 439,080 | 419,997 | 5 % | |

Avg. Net Realized Silver ($/oz) | 19.53 | 23.51 | (17 %) | |

Cash Costs per Silver Ounce Sold (2) | 11.35 | 11.61 | (2 %) | |

Financial | ||||

Revenues | 8,573,549 | 9,873,276 | (13 %) | |

Cost of Sales | 5,780,483 | 4,922,434 | 17 % | |

Gross Margin | 2,793,066 | 4,950,842 | (44 %) | |

Operating (Loss) Income | 505,093 | 1,993,848 | (75 %) | |

Net (Loss) Income | 724,319 | 250,693 | 189 % | |

Operating Cash Flows | 1,100,810 | 5,493,640 | (80 %) | |

Cash and Restricted Cash | 67,944,805 | 36,874,048 | 84 % | |

Shareholders | ||||

Earnings (Loss) per Share – basic | 0.007 | 0.003 | NM | |

Earnings (Loss) per Share – diluted | 0.007 | 0.003 | NM |

(2) See footnote (1) on first page. |

The focus in the second quarter of 2022 was on accelerating development of the underground mine infrastructure to support the mine expansion. A total of 765m of permanent lateral infrastructure was completed in Q2-2022, for a total of 1,130m year to date, in line with the planned ramp-up. New mining equipment was received during the quarter to sustain production efforts and to accelerate ground support.

Due to the implementation of effective water measures, there was no water-related impact on production despite an exceptionally dry season compared to last year.

As part of the preparations for the expansion, detailed engineering of the tailings storage facility ("TSF") began and the plant FEED was completed by Lycopodium. The construction team was fully mobilised on site as earthworks are planned to start mid-Q3-2022. Negotiations are ongoing for the engineering procurement construction ("EPC") contract for the plant.

Mine & Milling Operations

During the second quarter, a production record of 459,061 oz was reached at a global silver recovery of 87.9%, another record for Zgounder. The cyanidation plant operated at 97.1% availability, and the flotation plant at 83.9% due to crusher maintenance, resulting in a total milling rate of 659 tpd. A total of 59,995t were milled at a grade of 273 g/t Ag. Silver grade significantly increased on a quarter-over-quarter basis as new stopes prepared during the first quarter came into operation.

During the second quarter, a mining production record of 63,817t was achieved, at a grade of 278 g/t for a production rate of 701 tpd including a monthly record of 809 tpd in June. This was primarily due to stope planning in the previous quarter and to a lesser degree, to the delivery of new mining equipment.

Capital Projects

The bulk of capital projects completed this quarter related to mine production. Two scoops, a dumper, two scissor lift platforms and jackhammers were delivered in Q2-2022 and incorporated into production. A temporary explosive storage facility was completed and commissioned to ensure timely commencement of the new mill's earthworks in Q3-2022. A platform was constructed for mobilisation of the CMAC mining contractor, responsible for vertical mine infrastructure. Commissioning of the cyanidation tailings thickener commenced, with its full impact on improving water and silver recoveries expected in Q3-2022.

The construction pace for mining infrastructure continues to closely track the planned development ramp-up: out of the 1,130m of infrastructure completed year-to-date, 765m were advanced in Q2-2022, double the amount of the first quarter. This is expected to continue to increase throughout the year.

In Q2, an on-site independent third-party sample preparation room was commissioned by African Laboratory for Mining and the Environment that will accelerate the turnover time of our sample analysis.

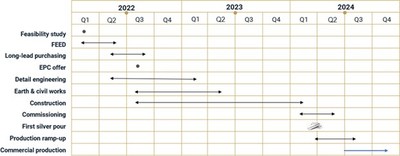

On February 22, 2022, Aya completed an expansion FS to grow Zgounder production from 700 tpd to 2,700 tpd capacity (see press release dated February 22, 2022) that includes a maiden reserve estimate of 8.59 Mt at an average grade of 257 g/t for 70.9 Moz silver. The initial estimated capital expenditures are $139.4 million, and the first silver pour is planned in Q1-2024. Post-expansion, the mine is expected to produce 7.9 Moz silver for an initial life of mine of 11 years at an all-in sustaining cost ("AISC") of $9.58/oz. Project economics, using a silver price of $22 per oz, indicate an after-tax 5% present value ("NPV") of $373 million and an after-tax Internal Rate of Return ("IRR") of 48%.

In the second quarter, Aya continued advancing the Zgounder Expansion Project towards a projected construction start-up by Q3-2022, notably by achieving the following items:

- Mine underground development on schedule and aligned with the FS at quarter-end:

- A total of 1,130m of lateral underground mine development completed to date

- Mobilised CMAC-Thyssen in July 2022 and start of vertical mine development in August 2022

- Completed the FEED on schedule in the quarter

- Simplified the general flowsheet of the process plant through additional metallurgical test work:

- The new, whole-ore-leach process plant flowsheet is designed to allow for better process water management and recycling. Furthermore, the counter-current decantation circuit aims to offer greater operational flexibility and leverage existing operating expertise

- Revised and optimized the process design criteria, mass and water balances, and the process flow diagrams

- Drafted the Initial piping and instrumentation diagrams and issued a preliminary process control philosophy document

- Received quotations for 21 mechanical equipment packages, including all key long-lead items, from a pre-approved list of vendors:

- More than 90% (in value) of the mechanical equipment procurement offers for the new process plant have been received and re-confirm the process plant CAPEX and OPEX estimated in the FS

- Selected a supplier for the ball mill package, and negotiations of final terms and conditions are ongoing. A purchase order is expected shortly.

- Awarded a contract for the earthworks for the new process plant and the new haulage road to a major Moroccan contractor

- Opened discussions with two engineering and project delivery companies regarding construction of the processing plant and received their offers in July 2022.

- Awarded the contract for the detailed design of the new TSF to a local Moroccan civil engineering firm

- Awarded the Engineer of Record ("EoR") mandate to a well-known South African civil engineering company. The companies have begun to collaborate on the detailed design of the first phase of the new TSF.

- Completed hiring for the internal construction team.

Zgounder

The second quarter saw the Corporation return high-grade DDH results that continued to expand the eastern zone and further defined the upper areas of the Zgounder Mine underground workings. During the period, three surface drills targeted the surface extensions of the eastern zones and the central portion of the Zgounder deposit. The objective was to increase the resources in the far eastern portion of the deposit for the proposed open pit designation. Several holes were also designed to confirm the vertical and lateral continuity of known mineralized envelopes.

Notably, near-surface hole TD28-22-2030-042 returned the thickest high-grade silver intercept publicly recorded on the property and significantly extended the work area by delineating a new area between two mineralized zones. Hole ZG- 22-47 confirmed the northern extension of mineralized body 8y1965-2110. Hole ZG-22-47 returned 47.9m (from 126.5m to 174.4m) of mineralization with several strikes of native silver (plating in joints and passages in dissemination) and sulfide (blend with mostly pyrite and galena in traces).

Zgounder Regional

The geophysical airborne survey of the Zgounder Regional permits was completed in June comprising a total of 8,543-line kilometers ("km"). Results will be combined with those from the mapping program and the hyperspectral data to generate targets for a drilling program planned to start in Q3-2022. Mapping and prospecting continued in the quarter. A total of 609 grab samples have been taken year to date, and several geological targets are already emerging.

Boumadine

A 349-line km airborne geophysical survey was completed in April comprising magnetic, radiometric, and electromagnetic surveys. The 7,500m DDH program commenced in May on the Central Zone, with a total of 4,210m completed by quarter-end. Massive sulphide mineralized zones have been intersected in many holes, confirming the extension of the Boumadine structures. Results are expected in the third quarter.

Imiter bis

Phase I of drilling at Imiter bis was completed in April 2022, with 624m of diamond drilling in Q2-2022, bringing the 2022 total to 4,754m. Assay results are expected to be fully received by early Q3-2022 and will inform Phase II which is scheduled for Q4-2022.

The airborne geophysical survey comprising magnetic, radiometric, and electromagnetic over 554km linear kilometers was completed in April.

The technical information relating to the Zgounder, Boumadine and Imiter bis Projects was reviewed and approved by David Lalonde, B. Sc, Head of Exploration, designated as a Qualified Person under National Instrument 43-101.

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco.

The only TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is exploring its properties along the prospective South-Atlas Fault, several of which have hosted past-producing mines and historical resources. Aya's Moroccan mining assets are complemented by its Tijirit Gold Project in Mauritania, which is being advanced to feasibility.

Aya's management team has been focused on maximising shareholder value by anchoring sustainability at the heart of its operations, governance, and financial growth plans.

For additional information, please visit Aya's website at www.ayagoldsilver.com.

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding Aya's future growth and business prospects (including the timing and development of new deposits and the success of exploration activities) and other opportunities. Wherever possible, words such as "will", "achieve", "plan", "expect", "continue", "increase", "accelerate", "projected", "designed to", "aims to", "objective", "guidance", extend", "growth", "advance", "expected", "increase", and similar expressions or statements that certain actions, events or results "may", "could", "would", "might", "will", or are "likely" to be taken, occur or be achieved, have been used to identify such forward-looking information. Specific forward-looking statements in this press release include, but are not limited to, statements and information with respect to the exploration and development potential of Zgounder and the conversion of Inferred Mineral Resources into Measured and Indicated Mineral Resources, future opportunities for enhancing development at Zgounder, executing on the planned expansion at the Zgounder mine, and timing for the release of the Company's disclosure in connection with the foregoing. Although the forward-looking information contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, Aya cannot be certain that actual results will be consistent with such forward-looking information. Such forward-looking statements are based upon assumptions, opinions and analysis made by management in light of its experience, current conditions, and its expectations of future developments that management believe to be reasonable and relevant but that may prove to be incorrect. These assumptions include, among other things, the closing and timing of financing, the ability to obtain any requisite governmental approvals, the accuracy of Mineral Reserve and Mineral Resource Estimates (including, but not limited to, ore tonnage and ore grade estimates), silver price, exchange rates, fuel and energy costs, future economic conditions, anticipated future estimates of free cash flow, and courses of action. Aya cautions you not to place undue reliance upon any such forward-looking statements.

The risks and uncertainties that may affect forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including government approvals and permitting, changes in economic conditions, changes in the worldwide price of silver and other key inputs, changes in mine plans (including, but not limited to, throughput and recoveries being affected by metallurgical characteristics) and other factors, such as project execution delays, many of which are beyond the control of Aya, as well as other risks and uncertainties which are more fully described in Aya's 2021 Annual Information Form dated June 16, 2022, and in other filings of Aya with securities and regulatory authorities which are available on SEDAR at www.sedar.com. Aya does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Nothing in this document should be construed as either an offer to sell or a solicitation to buy or sell Aya securities. All references to Aya include its subsidiaries unless the context requires otherwise.

SOURCE Aya Gold & Silver Inc

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/12/c7744.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/12/c7744.html