Azarga Metals Announces Updated Resource and PEA on Unkur Copper-Silver Project

HIGHLIGHTS:

- Base PEA Case proposes average annual production of 11.7ktpa copper and 2.9Mozpa silver in concentrates over a 14-year mine life

- 4-years open-pit mining at 2.75Mtpa followed by 10-years underground mining at 2.0Mtpa

- Use of SART processing in early years to process oxide material, followed by conventional sulphide flotation

- At Consensus prices (US$3.86/lb copper and US$25/oz silver), post-tax net present value ("NPV") of US$205.5M and internal rate of return ("IRR") of 26.7%

- May 21, 2021, Spot Prices (US$4.54/lb copper and US$28/oz), post-tax NPV of US$380.4M and IRR of 44.4%

- Post-tax NPVs of the updated PEA are 39-158% higher than the previous PEA prepared on Unkur in 2018 - Substantial improvements include: lower pre-production capital expenditure; higher average annual throughput; and a 75% longer mine life

- The PEA also considered an alternative Open-Pit Only Case to mine and process the oxide material only for 4 years with post-tax NPV of US$95.1M and IRR of 46.3% (at Consensus Prices) and NPV of US$162.2 million and IRR of 70.1% (at May 2021 Spot Prices)

- Positive PEA result based on updated 2021 Inferred Mineral Resource of 51.1Mt at 0.59% copper and 40g/t silver

VANCOUVER, BC / ACCESSWIRE / August 16, 2021 / AZARGA METALS CORP. ("Azarga Metals" or the "Company") (TSXV:AZR) announces the positive findings of an updated preliminary economic assessment ("PEA") for the development of its wholly owned Unkur Copper-Silver Project in the Zabaikalsky administrative region of Eastern Russia.

Gordon Tainton, 'Azarga Metals' President and CEO commented, "It's encouraging to see this 2021 PEA for Unkur incorporating 2019-2020 drilling substantially bettering the 2018 PEA. We can also see how relatively small additions of open-pit mineralization could potentially drive even better economic outcomes and we will have this in mind for our plans for additional exploration."

The following table summarizes key Unkur Project PEA metrics.

Table 1: Key Unkur Project PEA metrics for Base Case | |

Parameters / metrics | Amount 1 |

Production | |

- Total mill feed | 31.76 million tonnes LOM |

- Average annual mill feed | 2.75 million tonnes from open pit ("OP") and 2.0 million tonnes from underground ("UG") |

- Copper feed grade (ave) | 0.59% (OP) 0.77% (UG) |

- Silver feed grade (ave) | 48.24 g/t (OP) 53.11 g/t (UG) |

- Initial LOM | 14-years |

- LOM copper recovery | 58.8% (oxide) 89.1% (sulfide) |

- LOM silver recovery | 77.3% (oxide) 82.7% (sulfide) |

- Concentrate grade - copper (dry) | 68% (SART) 1 25.8% (sulfide) |

- Concentrate grade - silver (dry) | 6,642 g/t (SART) 1,634 g/t (sulfide) |

- Total copper production | 163,271 tonnes LOM / 11,700 tonnes per year (ave) |

- Total silver production | 38.87 million ounces 2 LOM / 2.8 million ounces per year (ave) |

- LOM waste to ore ratio | 8.87:1 (OP) |

Capital and costs | |

- Pre-production capital for OP and SART Heap Leach of oxide | US$152 million (including 15% contingency) |

- Capital for UG and Sulfide Concentrator | US$249 million (including 15% contingency) |

- LOM sustaining capital | US$50.39 million |

- Closure and reclamation costs | US$16 million |

- Copper C1 cash cost (excl. G&A) | US$0.30 per pound (assuming silver as a by-product) |

Project economics (post-tax) 3 | US$3.32 per pound (excluding by-product sales) |

- Copper price | US$3.86 per pound (Consensus Price) US$4.54 per pound (May 2021 Spot Price) |

- Silver price | US$25.0 per ounce (Consensus Price) US$28.0 per ounce (May 2021 Spot Price) |

- Russian Ruble | 74 per US$1 |

Base Case Scenario (OP and UG) | |

- NPV (at 8.0% discount rate) | US$205.5 million (Consensus Price) US$380.4 million (May 2021 Spot Price) |

- IRR | 26.7% (Consensus Price) 44.4% (May 2021 Spot Price) |

- Payback | 3.75 years |

Notes: 1. SART = sulphidization, acidification, recycling and thickening metallurgical process. 2. References to ???ounces' are troy ounces, 3. Assuming Unkur Project qualifies for Russian Far East & Siberian tax incentives for mineral extraction projects. | |

The updated resource estimate and PEA were independently prepared by Wardell Armstrong ("WAI").

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

A NI 43-101 technical report has been filed on SEDAR at www.sedar.com and on Azarga Metals' website at www.azargametals.com .

MINING AND PROCESSING

The mining method selected for the PEA is open-pit mining followed by underground mining, based upon owner mining of ore and waste.

The initial mine plan has been designed on a higher-grade sub-set of the 2021 Mineral Resource, comprising 16.1 million tonnes of oxide mineralization at a grade of 0.61% copper and 44g/t silver and 35 million tonnes of sulfide mineralization at a grade of 0.58% copper and 38g/t silver constrained for open pit and underground mining.

The annual production rate from an open pit will average approximately 2.75 million tonnes of ore per year, with a maximum of 3.5 million tonnes in Year 2 and 3. This is identical for Base and Open Pit Only Scenarios. The overall LOM waste to ore (i.e., strip) ratio from open pit is projected to be 8.87:1. However, it should be noted that much of the overburden is unconsolidated moraine material that will not require blasting.

The annual production rate from an underground operation will average 2 million tonnes of ore per year. It is applicable to Base Scenario.

WAI prepared additional scenarios to mine both oxide and sulfide mineralization from the open pit. These scenarios are linked to different processing options and require much higher capital expenditure with negative impact on NPV and IRR of the project, albeit remaining economic for potential consideration.

Preliminary metallurgical test work on a bulk sample demonstrated that most economically viable extraction of copper and silver from oxide mineralization can be achieved using a SART circuit in heap leach, accepted as a Base Scenario in the PEA. The PEA also considered a SART process in agitated leach and sequential SX-EW process in agitated and heap leach. The latter three options provide higher recoveries from oxide mineralization for both copper and silver. Although remaining economic, they require much higher capital expenditure as well as much higher operating costs, elongating the payback period for the project by additional 2 years, with lower NPV and IRR.

The Base Scenario assumes the proposed SART process plant will be based on heap leaching operation that will provide an average silver recovery of 77.3% and an average copper recovery of 58.8%, taking most recent tests and process efficiencies into account. The SART process is estimated to produce a high-grade copper and silver concentrate and to recycle cyanide that can be returned into the SART process.

The sulfide mineralization can be treated using conventional hydrometallurgical processing methods. Production of sulfide concentrate will be based on conventional gravity and flotation processing, with an average silver recovery of 82.7% and an average copper recovery of 89.1%

Tailings from the process plant will be pumped to a tailings management facility.

PRODUCT AND MARKETING

The SART process will produce synthetic minerals largely consisting of chalcocite (Cu 2 S) and acanthite (Ag 2 S), which will result in a high-grade copper concentrate of approximately 68.0% copper and 6,642g/t silver. This compares favourably with standard copper concentrates that are typically 22-24% copper and so it should make this product very attractive to smelters. The conventional sulfide concentrate from Unkur will contain 25.8% copper and 1,634g/t silver.

OUTBOUND LOGISTICS

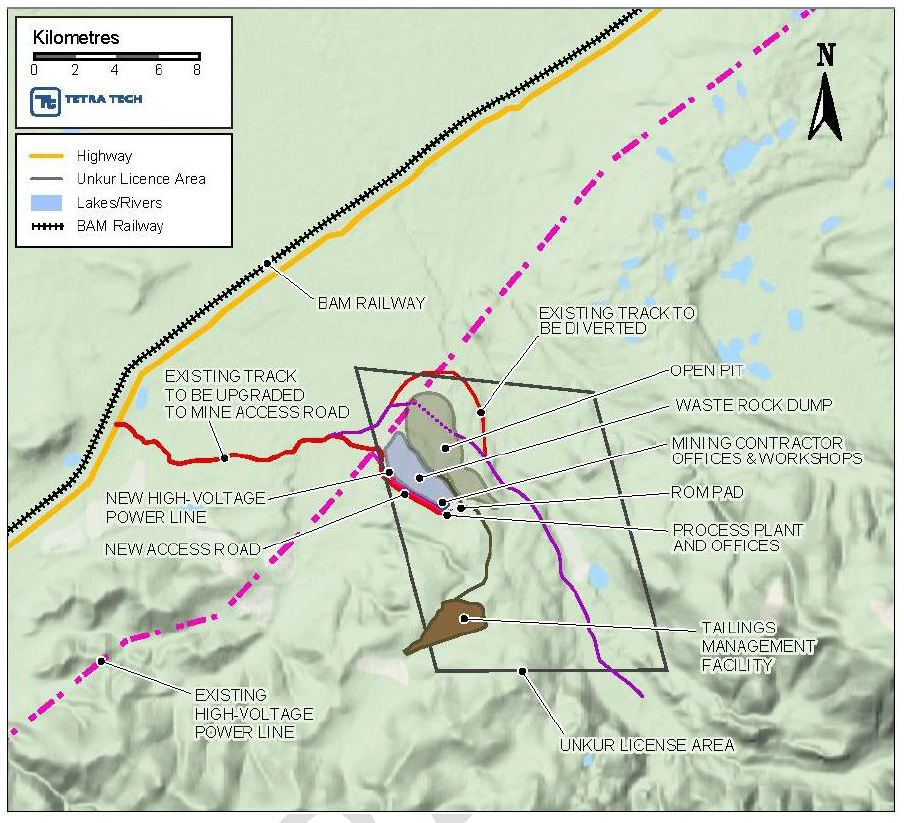

The PEA assumes 11 kilometers of oversite roads to be built from the existing highway, which is also where the Baikal-Amur Mainline railway is, as well as on site. The concentrate can either be sold within Russia, exported to China (via rail or road) or other international customers (assumed to be via rail to the Russian Pacific port of Vanino, some 2,300 kilometers).

INFRASTRUCTURE

Unkur Copper-Silver Project has access to infrastructure (Figure 1). The project site is situated within 20 kilometers of the town of Novaya Chara, with major road and rail access. A regional 220kVA power line runs across a corner of the Unkur license area, and the PEA assumes construction of a 4-kilometer overhead powerline and substation to connect the processing plant and main site to mains power.

The world's largest current copper project development is taking place at Udokan, approximately 30 kilometers south from Unkur. During Phase 1, Udokan is forecast to produce 120,000 tonnes of copper per annum starting from 2022. As a result, substantial investment in improved ancillary infrastructure is being made that will be of future benefit to Azarga Metals and Unkur, including a renovation of the regional airport, roads, and a significant expansion of facilities at Novaya Chara town.

Figure 1: Proposed indicative site layout, Unkur Project

PRE-DEVELOPMENT

The PEA assumes a one-year pre-development timeline prior to first production. Initial development in the first year consists mainly of infrastructure works, site preparation and commencement of plant construction. Pre-stripping will also occur in the first pre-development year along with completion of the processing plant. This is considered reasonable giving the heap leach treatment for oxide mineralization chosen under Base Scenario. Tailing's storage facility development will be completed before the project transits to underground mining, although some of the waste material generated during the first years of open pit mining will be used for construction of the tailing's facility.

ALTERNATIVE LOWER CAPITAL OPEN-PIT ONLY SCENARIO

The PEA also considered an alternative Open-Pit Only Case to mine and process the oxide material only for 4 years. The average open pit mining rate will be 2.75 million tonnes per annum using SART Heap Leaching.

This case will require a pre-production capital expenditure of US$152.4 million, including US$70 million for open pit equipment, US$52.3 million for oxide plant and US$10 million for general infrastructure plus contingency at 15%. The Open-Pit Only Case showed a post-tax NPV of US$95.1M and IRR of 46.3% (at Consensus Prices) and NPV of US$162.2 million and IRR of 70.1% (at May 2021 Spot Prices). The payback period for the standalone Oxide Open Pit operation is expected to be achieved in the first year of ore production (at May 2021 Spot Prices) or second year (at the Consensus Prices).

The Open-Pit Only Case provides attractive optionality for Unkur Project, depending on capital availability, with high IRR. However, Azarga considers that the above-described Base Case results in the highest overall economic value.

2021 MINERAL RESOURCE ESTIMATE REVIEW

The 2020 SRK Consulting (Russia) Ltd. ("SRK") model provided the basis of an Inferred Mineral Resource estimate totalling approximately 44Mt at 0.65% Cu and 44g/t Ag (1.04% Cu equivalent). Reporting from the SRK model was limited by a cut-off grade of 0.18% Cu equivalent inside an optimised open pit shell generated by suitable economic and technical parameters and by a cut-off grade of 0.57% Cu equivalent outside and below this pit shell to account for the possibility of underground extraction.

Following the data review, WAI was required to give an opinion on the models provided and the potential scope for the Inferred Mineral Resource to be increased as a basis for a Preliminary Economic Assessment (" PEA ") of the Unkur project. To complete this work, WAI:

- Reviewed the background to the Resource Estimates as a high-level gap analysis to identify

- any potential issue that would preclude the reporting of Mineral Resources at an Inferred level.

- Reviewed the Mineral Resource models against the geological model and exploration data used to generate those models; and

- Carried out additional open pit optimizations and reporting of potential Mineral Resources.

As a result of this review, WAI concludes that:

- An appropriate exploration license covers the area of the Mineral Resource estimate.

- The geological setting that acts as the basis of the Mineral Resource models is well understood and the exploration programs used as the basis for the Mineral Resource estimate have been completed in a manner to explore along the projected strike of the mineralized zones, intersecting these zones roughly perpendicular to their dip.

- Sample data acting as the basis of the Mineral Resource estimate was collected from diamond drilling completed by Azarga.

- Sample selection, preparation and analysis was carried out following international best practice. Analysis of primary samples was carried out by SGS in Chita; and

- QA/QC procedures included the insertion of certified reference materials and the analysis of check assays at an umpire laboratory (ALS Chita). Results of the QA/QC sample analysis were generally good.

Using SRK 2020 model for updated 2021 Inferred Mineral Resource, WAI estimated 51.1 million tonnes of mineralization at 0.59% copper and 40g/t silver, optimized for open pit and underground operation. The breakdown of updated 2021 Inferred Mineral Resource is shown in Table 2.

Table 2: Updated 2021 Inferred Mineral resources of the Unkur Project

Method | Type of mineralization | Cut-off grade (CuEq %) | Tonnes, million tonnes | Cu, % | Ag, g/t | CuEq, % |

Open pit | Oxide | 0.18 | 15.7 | 0.61 | 45 | 1.05 |

Sulphide | 17.1 | 0.59 | 49 | 1.03 | ||

Undergound | Oxide (North) | 0.54 | 0.4 | 0.51 | 23 | 0.73 |

Sulphide (North) | 14.2 | 0.55 | 30 | 0.83 | ||

Sulphide (South) | 3.7 | 0.64 | 20 | 0.82 | ||

TOTAL | Oxide | 16.1 | 0.61 | 44 | 1.04 | |

Sulphide | 35.0 | 0.58 | 38 | 0.93 | ||

All | 51.1 | 0.59 | 40 | 0.96 |

Notes:

- Figures have been rounded to reflect this is an estimate.

- Inferred Mineral Resources have been reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (" CIM ") definition standards for Mineral Resources and Reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101.

- No Measured or Indicated Resources have been estimated.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Mineral Resources are based on a CuEq grade of 0.18% for the Open Pit resources and of 0.54% for the Underground resources using metal prices of US$3.86/lb Cu and US$25/oz Ag, the equivalence formula for Oxide is CuEq = Cu + (0.0097 x Ag) and for Sulphide is CuEq = Cu + (0.009 x Ag).

- The Mineral Resource is effective as at 31 July 2021.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources may be subject to legal, political, environmental and other risks and uncertainties.

In summary, based upon the available data, WAI is of the opinion that the data used for the generation of the Mineral Resource has been collected in a suitable and robust manner with appropriate quality control measures in place. Analysis for copper and silver has been carried out at an internationally accredited laboratory. WAI agree that sufficient confidence can be placed in the exploration database for the reporting of Mineral Resources.

FUTURE PEA ENHANCEMENT

This updated PEA is based on the new 2021 Mineral Resource, which is largely the product of the modern exploration campaigns conducted by Azarga at Unkur Copper-Silver Project in 2016-2017 and 2019-2021. Azarga Metals considers that there is strong potential to grow the 2021 Mineral Resource. Mineralization is open in both directions along strike and at depth.

When considering the PEA outcomes, the Company is of the opinion that relatively small amounts of additional open-pit mineable Resources (even 1-2+ years' worth) could have a transformational beneficial impact on economics of both the Base Case and alternative Open-Pit Only scenarios. In that regard, new copper mineralization was discovered in 2020 in outcrops at Kemen, some 5 km east of the main Unkur deposit, and at Unkur Southwest, approximately 1 km from Unkur. Azarga Metals aims to continue to grow Mineral Resources at Unkur, with a particular focus on high-value near-surface material.

Qualified Person

The 2021 Mineral Resource has been prepared by Alan Clarke, an employee of Wardell Armstrong International. Mr. Clarke is a Chartered Geologist (CGeol) and Fellow of the Geological Society of London, and European Geologist (EurGeol) of the European Federation of Geologists and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Qualified Person as defined by NI 43-101.

The results of the 2021 Mineral Resources and PEA prepared by WAI have been reviewed by the Company's technical staff, including Alexander Yakubchuk, Ph.D., MoIMMM, the Company's Vice-President Exploration, a Qualified Person as defined by NI 43-101. Dr. Yakubchuk is also the person responsible for preparation of the technical information contained in this news release.

About Azarga Metals Corp.

Azarga Metals is a mineral exploration and development company that owns 100% of the Unkur Copper-Silver Project in the Zabaikalsky administrative region in eastern Russia. As announced on 14 July 2021 the Company announced it had signed a term sheet to undertake due diligence and negotiate formal agreements to pursue an acquisition of the Marg copper-rich VMS project, located in Central Yukon. Due diligence continues.

AZARGA METALS CORP.

Gordon Tainton, President and CEO

For further information please contact: Doris Meyer, at +1 604 536-2711 ext 6, or Gordon Tainton at +1 604 248 8389 or visit www.azargametals.com, or follow us on Twitter @AzargaMetals.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are based on the Corporation's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current planned exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Corporation disclaims any intent or obligation to update any forward-looking statement, whether because of new information, future events, or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: Azarga Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/659722/Azarga-Metals-Announces-Updated-Resource-and-PEA-on-Unkur-Copper-Silver-Project