Beatons Creek Updated Mineral Resource Estimate

VANCOUVER, British Columbia, Nov. 02, 2022 (GLOBE NEWSWIRE) -- Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) announces an updated Mineral Resource estimate (the “2022 MRE”) for the Beatons Creek gold project (“Beatons Creek”) located in the Nullagine region of Western Australia. The 2022 MRE incorporates extensive reverse circulation (“RC”) drilling completed between January 2020 and May 2022. The effective date of the 2022 MRE is June 30, 2022. A Technical Report (as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”)) in respect of the 2022 MRE will be filed under the Company’s SEDAR profile upon its completion.

KEY POINTS

- The 2022 MRE for Beatons Creek reports an Indicated Mineral Resource of 3.05 million tonnes at 2.4 g/t Au for 234,000 oz Au, and an Inferred Mineral Resource of 0.83 million tonnes at 1.6 g/t Au for 42,000 oz Au, reported above a 0.5 g/t Au cut-off within an optimized open pit shell, which complies with the principles of Reasonable Prospects of Eventual Economic Extraction (“RPEEE”).

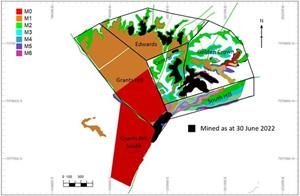

- The Grant’s Hill mining area (Figure 1) accounts for approximately 78% of Indicated Mineral Resources in the 2022 MRE.

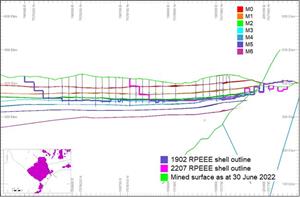

- The 2022 MRE (illustrated by mineralization area in Figure 2) reports decreases in both open pit tonnes and ounces, driven by revised mineralization wireframes which are based on a recent close-spaced (10 m by 10 m and 20 m by 20 m) RC drilling program, along with mining depletion, compared to the 2019 Mineral Resource estimate1 (the “2019 MRE”).

- Mineralization remains open to the north-west, with additional resource development drilling underway.

- Additional resource development drilling completed since May 30, 2022 will form the basis of a further Mineral Resource update, which Novo expects to release during H1 2023.

- In June 2022, the Company announced a pause in production at Beatons Creek, along with the commencement of works to prepare an updated Mineral Resource estimate2. Mining ceased in August 2022 and processing finished in September 2022.

- The Beatons Creek Feasibility Study has been deferred due to current uncertain economic and regulatory conditions affecting the project, and Beatons Creek is being transitioned into care and maintenance as a result.

https://www.globenewswire.com/NewsRoom/AttachmentNg/38bb572e-9612-43b0-8ebb-e69062406212

Figure 1. Beatons Creek Grant’s Hill area.

In this news release, the terms ‘Mineral Resource’, ‘Indicated Mineral Resource’, ‘Inferred Mineral Resource’ and ‘Feasibility Study’ have the meanings given in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by CIM Council (the “2014 CIM Definition Standards”).

2022 MINERAL RESOURCE ESTIMATE

The 2022 MRE for Beatons Creek (with an effective date of June 30, 2022 and which supersedes the PEA) has delivered an Indicated Mineral Resource of 3.05 million tonnes at 2.4 g/t Au for 234,000 oz Au, and an additional Inferred Mineral Resource of 0.83 million tonnes at 1.6 g/t Au for 42,000 oz Au as follows (Tables 1-3; Figures 2 and 3):

| Table 1. Total Mineral Resources: optimized open pit oxide and fresh. | |||||||||

| Cut-off Grade | Tonnes | Grade | Troy Ounces Au | ||||||

| Classification | (g/t Au) | (t) | (g/t Au) | ||||||

| Indicated | 0.5 | 3,050,000 | 2.4 | 234,000 | |||||

| Inferred | 0.5 | 830,000 | 1.6 | 42,000 | |||||

Table 2. Optimized open pit oxide Mineral Resources. | |||||||||

| Cut-off Grade | Tonnes | Grade | Troy Ounces Au | ||||||

| Classification | (g/t Au) | (t) | (g/t Au) | ||||||

| Indicated | 0.5 | 815,000 | 1.3 | 33,000 | |||||

| Inferred | 0.5 | 445,000 | 1.3 | 18,000 | |||||

Table 3. Optimized open pit fresh Mineral Resources. | |||||||||

| Cut-off Grade | Tonnes | Grade | Troy Ounces Au | ||||||

| Classification | (g/t Au) | (t) | (g/t Au) | ||||||

| Indicated | 0.5 | 2,240,000 | 2.8 | 201,000 | |||||

| Inferred | 0.5 | 385,000 | 1.9 | 24,000 | |||||

Notes:

- Open pit Mineral Resources contain oxide and fresh mineralization within a Whittle optimized shell and constrained within a mineralized wireframe. A cut-off grade of 0.5 g/t Au was applied.

- The pit shell was generated with the following parameters:

(a) A$2,600 / troy ounce (US$1,690 / troy ounce) of gold;

(b) Nominal process rate of 1.6 Mtpa for fresh mineralization with a recovery of 91%; and process rate of 1.8 Mtpa for oxide mineralization with a recovery of 93%;

(c) Bulk densities applied: oxide mineralization 2.50 t/m3 (oxide waste 2.50 t/m3) and fresh mineralization 2.80 t/m3 (fresh waste 2.75 t/m3);

(d) A$5.15 / tonne (US$3.35 / tonne) mining cost for oxide and A$5.45 / tonne (US$3.54 / tonne) for fresh;

(e) A$37.47 / tonne (US$24.36 / tonne) oxide and A$38.37 / tonne (US$24.94 / tonne) fresh processing cost (incl. G&A);

(f) 25% dilution and 5% mineralization loss;

(g) Royalties 5.25%;

(h) Discount factor of 6%; and

(i) A$ to US$ foreign exchange rate of 0.65:1.

https://www.globenewswire.com/NewsRoom/AttachmentNg/4532dd8b-5d99-4516-afd3-7de921aeeb2e

Figure 2. Beatons Creek 2022 MRE plan showing extents of mineralization and mined areas to June 2022.

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0f21469-6de2-4ec8-b692-42f319ed921a

Figure 3. Cross-section through the Grant’s Hill pit (pink = 2022 RPEEE shell; blue = 2019 RPEEE shell). Inset shows the Grant’s Hill 2022 RPEEE shell and location of the cross-section.

2022 RESOURCE MODELLING

The spatial extent of the 2022 MRE covers a surface area of over 2.5 km by 2.5 km (Figure 2). Mineralization exists as multiple sub-horizontal, narrow stacked conglomeritic horizons (referred to as “mineralized conglomerate”), which are interbedded with un-mineralized conglomerate, sandstones, and grits with minor intercalations of shale, mudstone, siltstone, and tuffs (Figure 3). The mineralized conglomerates vary from less than 1 m to several metres thick, and are continuous for up to 2 km. Wireframed mineralized domains differentiate between regionally continuous marine lags and localized stacked-channel conglomerates. A weathering profile has further split the estimate into oxide and fresh components.

Grade interpolation was performed using a three-pass Ordinary Kriging (“OK”) estimation method utilizing Dynamic Anisotropy providing variable dip and dip-direction ellipsoids within modelled conglomerate domains. All samples were composited to 1 m for estimation. Composites were analysed and top-cut (capped) per domain using statistical and graphical methods. OK was informed by variograms per domain, although some domains had too few samples to define an acceptable variogram. In such cases, the most appropriate domain variogram was applied based on geological similarity. Variograms contained nugget effects ranging from 35% to 68%. Three estimation block sizes were applied: 10 m by 10 m by 1 m; 20 m by 20 m by 1 m; and 40 m by 40 m by 1 m for relatively densely spaced data versus sparsely spaced data, respectively. All parent blocks were sub-blocked to 2.5 m by 2.5 m by 0.25 m. The block sizes and number of samples applied in search passes were chosen based on quantitative kriging neighbourhood analysis. Estimation was undertaken in three passes, with passes one and two being no more than the range defined by the variogram. Search pass three used up to three times the geostatistical range. The estimate was validated by visual comparison of samples and estimation block grade by domain, by moving window plots, and via global grade comparisons. Indicated Mineral Resources were classified based on passes one and two, and Inferred Mineral Resources classified based on pass three. As well as search passes, Mineral Resources were classified on the basis of geological continuity, drill spacing, sample data quality, the mix of different sample types, estimation quality (Kriging Efficiency and slope) and the quantity of bulk density data.

The 2022 MRE was reported within a Whittle optimized pit shell to satisfy the requirement for RPEEE criteria described in the 2014 CIM Definition Standards. The RPEEE test is important to demonstrate the robustness of a Mineral Resource estimate. As disclosed above, the input parameters for the Whittle optimization are:

- A$2,600 / troy ounce (US$1,690 / troy ounce) of gold;

- Nominal process rate of 1.6 Mtpa for fresh mineralization with a recovery of 91%; and process rate of 1.8 Mtpa for oxide mineralization with a recovery of 93%;

- Bulk density applied: oxide mineralization 2.50 t/m3 (oxide waste 2.50 t/m3) and fresh mineralization 2.80 t/m3 (fresh waste 2.75 t/m3);

- A$5.15 / tonne (US$3.35 / tonne) mining cost for oxide and A$5.45 / tonne (US$3.54 / tonne) for fresh;

- A$37.47 / tonne (US$24.36 / tonne) oxide and A$38.37 / tonne (US$24.94 / tonne) fresh processing cost (incl. G&A);

- 25% dilution and 5% mineralization loss;

- Royalties of 5.25%;

- Discount factor of 6%; and

- A$ to US$ foreign exchange rate of 0.65:1.

Mining costs are based on a conventional open pit truck/excavator mining fleet and actual contract rates scaled to planned future production, taking cognizance of the backfill requirement to cover any exposed fresh material to meet expected environmental obligations imposed as part of the approvals process. Mining dilution and loss factors are derived based on the style of mineralization and mining methods. Processing and G&A costs are based on real processing costs at the Company’s Golden Eagle plant (“Golden Eagle Plant”) averaged over a 12-month historical period. The oxide and fresh mineralization metallurgical recoveries are based on actual Golden Eagle Plant performance, and plant trials and test work, respectively. Royalties payable include, but are not limited to, the Western Australia State gross gold royalty of 2.5% and gross Native Title royalties totalling 2.75%.

A diamond core drilling programme was undertaken during May 2022, which resulted in nine metallurgical holes (743 m). The metallurgical holes provided 21 fresh mineralized conglomerate intersections (M0, M1, M2 and M3 across Grant’s Hill and Edwards areas), which were also PhotonAssayed for gold. Recovery and comminution testwork on variability and composite samples provided similar results to the 2019 programme, indicating that the fresh mineralization is amenable to gravity and cyanide leach recovery.

SUMMARY COMPARISON BETWEEN THE 2019 MRE AND 2022 MRE

In addition to mining depletion, the 2022 MRE incorporates updates to input assumptions which collectively result in an estimate that the Company believes is more robust overall and which aligns more closely with mining of the oxide Mineral Resource to date. The understanding of Beatons Creek mineralization controls has been an iterative process over the past two years and has been informed by an expanded geological mapping and drillhole dataset. Table 4 provides a global comparison between the 2019 and 2022 MREs.

Table 4. Global comparison between the 2019 and 2022 MREs.

| Mineral Resource Classification | 2019 MRE | 2022 MRE | ||||

| Tonnes (t) | Grade (g/t Au) | Troy ounces (oz Au) | Tonnes (t) | Grade (g/t Au) | Troy ounces (oz Au) | |

| Indicated (OP) | 6,645,000 | 2.1 | 457,000 | 3,050,000 | 2.4 | 234,000 |

| Inferred (OP) | 3,410,000 | 2.7 | 294,000 | 830,000 | 1.6 | 42,000 |

| Inferred (UG) | 885,000 | 5.3 | 152,000 | - | - | - |

Notes:

- Open pit (“OP”) MRE reported at a 0.5 g/t Au cut-off grade.

- The 2019 and 2022 OP MREs reported in different RPEEE pit shells.

- Underground (“UG”) MRE reported at a 3.5 g/t Au cut-off grade.

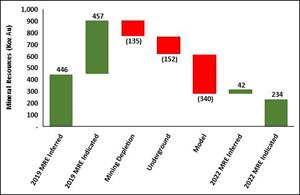

Figure 4 provides a waterfall graph showing changes in contained gold ounces at Beatons Creek between the 2019 and 2022 MREs. The “Mining Depletion” portion is the quantity of ounces depleted from the 2019 MRE using the June 2022 mined surface. The actual mined and processed mineralization from Beatons Creek was 2.51 Mt at 1.17 g/t Au for 94,248 oz Au contained3. The “Mining Depleted” ounces comprise the actual mined and processed (as above); changes to the model due to the removal of the channel samples; mining loss; and metallurgical recovery loss. The “Model” ounces in Figure 4 relate in aggregate to the ounces no longer reporting to the model due to the matters listed elsewhere in this news release.

https://www.globenewswire.com/NewsRoom/AttachmentNg/817b1eb7-2c5f-4936-89d4-108c81263e86

Figure 4. Waterfall graph showing the changes in contained gold ounces at Beatons Creek from 2019 MRE to the 2022 MRE.

The 2022 MRE includes decreases in open pit tonnes and contained ounces. The update also sees the removal of the underground Mineral Resource. These changes in the open pit Mineral Resource are driven by the following:

- Significant addition of 3,238 new close-spaced RC drillholes, providing an additional 22,116 samples used for estimation;

- Optimized “coarse gold” sampling protocol using PhotonAssay;

- Removal of 1,128 trench channel (costean) samples from the estimate;

- Inclusion of previously excluded RC data, adding 595 samples (only informing the Inferred Mineral Resource area);

- Revised geological interpretation, featuring more constrained mineralized conglomerate wireframes with local changes in width and position, based on drilling and experience from mining;

- Some changes in the location and orientation of faults that cut/bound the mineralized conglomerates, together with additional faults identified by pit mapping;

- Different block model sizes, with smaller blocks (e.g. 10 m by 10 m by 1 m) informed by grade control drilling (e.g. 10 m by 10 m);

- Updated variography based on the data set applied within new wireframes;

- Revised bulk density values based on additional data from the 2022 fresh diamond drilling programme;

- Updated oxide-fresh weathering surface based on drilling and pit mapping;

- Different pit shell based on new optimization parameters; and

- Depleted model based on mining activity to date.

The underground Inferred Mineral Resource included in the 2019 MRE (at Grant’s Hill, Grant’s Hill South, and South Hill) has been removed in the 2022 MRE. The reasons for this include:

- Addition of close-spaced RC drillholes, resulting in a lower grade estimate;

- Removal of trench channel (costean) samples, resulting in a lower grade estimate;

- Inclusion of previously excluded RC samples, which provides more data at lower grades;

- Different geological interpretation, resulting in more constrained mineralized conglomerate wireframes with local changes in width and position based upon drilling;

- Some changes in the locations and orientations of faults that cut/bound the mineralized conglomerates, together with additional faults identified by pit mapping, resulting in some higher-grade holes being excluded by changes in fault block interpretations;

- A change in estimation strategy, where the search is now restricted to an individual domain and where previously it searched across fault boundaries into the same domain due to limited data; and

- Some mineralization previously reported in the underground Mineral Resource now sits within the optimized pit shell.

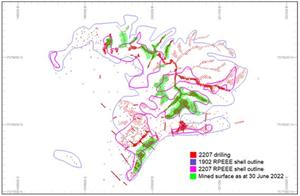

Figure 5 shows the superposition of the 2019 MRE and 2022 MRE RPEEE pit outlines, together with the 2022 MRE data spacing. The 2021-2022 mined portion is also shown.

https://www.globenewswire.com/NewsRoom/AttachmentNg/0419e699-8508-40d0-8e65-97cf8f672ab7

Figure 5. The 2019 MRE and 2022 MRE RPEEE pit outlines, together with the 2022 MRE data spacing. The 2021-2022 mined portion is also shown.

The 2022 MRE was estimated from 26,041 samples (17,650 composites), comprising 54 bulk samples (57 composites); 580 diamond core samples from 60 holes (354 composites); 25,350 RC samples from 3,877 holes (17,186 composites) and 57 trench ‘channel’ samples (53 composites). The pre-2020 assays used for the estimate were determined using the LeachWELL (cyanide leaching) technique (13%). Some samples were fire assay or screen fire assay (1% each respectively). Assays from 2020 onwards, and solely informing the Indicated Mineral Resource, are based on the PhotonAssay technique (85% of total assays used) using either a 2.5 kg (65% of PhotonAssays) or 5 kg (35% of PhotonAssays) assay charge, split into multiple individual 500 g samples and averaged.

In comparison, the 2019 MRE was estimated from 3,909 samples (3,767 composites), comprising 302 diamond core samples from 42 holes (229 composites); 2,422 RC samples from 481 holes (2,422 composites) and 1,185 costean ‘channel’ samples (1,116 composites). The assays used for the estimate were determined using the LeachWELL technique (88%), with other samples by fire assay or screen fire assay (7% and 5% each respectively).

The Qualified Persons (as defined in NI 43-101) have applied the principles of RPEEE.

Geostatistical analysis was undertaken using Snowden Supervisor [v8.14.3.3] software and estimation was undertaken in Datamine Studio RM PRO [v1.11.300] software. Pit optimization shells were generated using Geovia Whittle [v4.5.1].

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability; it is uncertain if applying economic modifying factors will convert Indicated Mineral Resources to Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues; however, no issues are known at this time. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resources. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. The Mineral Resources in this News Release were estimated using current Canadian Institute of Mining, Metallurgy and Petroleum standards, definitions, and guidelines.

FEASIBILITY STUDY UPDATE

As a result of numerous regulatory and economic factors including, but not limited to, the status of the Company’s Beatons Creek Fresh project mining approvals submission4, the current inflated cost environment in the mining industry, a tight Western Australian labour market, and COVID-19 related supply challenges, Novo has decided to defer completion of its Feasibility Study2 while it continues to review additional data from Beatons Creek and optimize the project. Importantly, the Company intends to incorporate assay results from RC drilling which occurred after May 2022 into an additional Mineral Resource update, expected in H1 2023.

The Company is awaiting an update from the Western Australian Office of the Appeals Convenor regarding a reply to the appeal received in response to the Western Australian Environmental Protection Authority’s (“EPA”) decision to not assess the Company’s proposed Phase Two Beatons Creek Fresh operations submission5 (the “Submission”). The Company advises that the Appeals Convenor process may be protracted which may ultimately cause final approval of the Submission to be delayed.

As a result of the above factors, the Company is transitioning Beatons Creek into care and maintenance until it has more certainty around the timing of approval of the Submission and completion of the Feasibility Study.

QUALIFIED PERSONS DISCLOSURE

Ms. Janice Graham, MAIG, has undertaken the 2022 MRE for Beatons Creek; she is independent of the Company for the purposes of NI 43-101. Ms. Graham is a Qualified Person as defined by NI 43-101.

Dr. Simon Dominy, FAusIMM(CP) FAIG(RPGeo) FGS(CGeol), has overseen the 2022 MRE for Beatons Creek; he is not independent of the Company for the purposes of NI 43-101. Dr. Dominy is a Qualified Person as defined by NI 43-101.

Mr. Jeremy Ison, FAusIMM, has contributed to the 2022 MRE for Beatons Creek; he is independent of the Company for the purposes of NI 43-101. Mr. Ison is a Qualified Person as defined by NI 43-101.

Mr. Royce McAuslane, FAusIMM, has contributed to the 2022 MRE for Beatons Creek; he is independent of the Company for the purposes of NI 43-101. Mr. McAuslane is a Qualified Person as defined by NI 43-101.

Ms. Graham, Dr. Dominy, Mr. Ison, and Mr. McAuslane are preparing a NI 43-101 Technical Report in respect of the 2022 MRE, which the Company is obligated under NI 43-101 to file on SEDAR within 45 days of the date this news release was disseminated.

The 2022 MRE was peer reviewed by Mr. Ian Glacken, FAusIMM(CP) FAIG, an Executive Consultant at Snowden Optiro. Mr. Glacken has endorsed the estimation approach and classification. In addition, the 2022 MRE was audited by Mr. Danny Kentwell, FAusIMM, a Principal Consultant of SRK Consulting. Mr. Kentwell has endorsed the estimation approach and classification. Both Mr. Glacken and Mr. Kentwell are independent of the Company for the purposes of NI 43-101.

Dr. Simon Dominy and Ms. Janice Graham are the Qualified Persons pursuant to NI 43-101 responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Dominy is not independent of the Company for the purposes of NI 43-101. Ms. Graham is independent of the Company for the purposes of NI 43-101.

CAUTIONARY STATEMENT

The decision by the Company to produce at Beatons Creek in 2021 was not based on a Feasibility Study of Mineral Reserves demonstrating economic and technical viability and, as a result, there was an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Production did not achieve forecast. Historically, such projects have a much higher risk of economic and technical failure. There was no guarantee that anticipated production costs would be achieved. Failure to achieve the anticipated production costs has had, and continues to have, a material adverse impact on the Company’s cash flow and profitability.

The Company cautions that its declaration of commercial production effective October 1, 20216 only indicated that Beatons Creek was operating at anticipated and sustainable levels, and it did not indicate that economic results would be realized.

ABOUT NOVO

Novo explores and develops its prospective land package covering approximately 10,500 square kilometres in the Pilbara region of Western Australia, including Beatons Creek, along with two joint ventures in the Bendigo region of Victoria, Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Michael Spreadborough”

Michael Spreadborough, Executive Co-Chairman & Acting CEO

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the estimation of Mineral Resources, that a Technical Report (as defined in NI 43-101) in respect of the 2022 MRE will be completed, that additional resource development drilling will form the basis of a further Mineral Resource update which is expected to be released during the first half of 2023, and that the Company is transitioning Beatons Creek into care and maintenance until it has more certainty around the timing of approval of the Submission and completion of the Feasibility Study. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, variations in the estimation of Mineral Resources, customary risks of the resource industry and the other risk factors identified in Novo’s management’s discussion and analysis for the six-month period ended June 30, 2022, which is available under Novo’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

Cautionary Note to U.S. Readers Regarding Estimates of Inferred, Indicated and Measured Resources

This news release uses the terms "Indicated" Mineral Resources and "Inferred" Mineral Resources. The Company advises U.S. investors that while these terms are recognized and required by Canadian securities administrators, they are not recognized by the U.S. Securities and Exchange Commission (the “SEC”). The estimation of "Indicated" Mineral Resources involves greater uncertainty as to their existence and economic feasibility than the estimation of Proven and Probable Mineral Reserves. The estimation of "Inferred" Resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of Mineral Resources. It cannot be assumed that all or any part of an "Inferred" or "Indicated" Mineral Resource will ever be upgraded to a higher category.

Under Canadian rules, estimates of "Inferred Mineral Resources" may not form the basis of Feasibility Studies, Pre-feasibility Studies or other economic studies, except in prescribed cases, such as in a Preliminary Economic Assessment under certain circumstances. The SEC normally only permits issuers to report mineralization that does not constitute "Mineral Reserves" as in-place tonnage and grade without reference to unit measures. Under U.S. standards, mineralization may not be classified as a "Mineral Reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part or all of an "Indicated" or "Inferred" Mineral Resource exists or is economically or legally mineable. Information concerning descriptions of mineralization and resources contained herein may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

______________________________

1 Refer to the Company’s news release dated April 30, 2021 and the report titled “Preliminary Economic Assessment on the Beatons Creek Gold Project, Western Australia” with an effective date of February 5, 2021 and an issue date of April 30, 2021 (the “PEA”). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

2 Refer to the Company’s news release dated June 14, 2022.

3 This figure differs from previously announced results because it excludes material processed from historical stockpiles which were available for processing subsequent to the Company’s acquisition of Millennium. Refer to the Company’s news releases dated August 4, 2020 and September 8, 2020.

4 Refer to the Company’s news release dated October 11, 2022.

5 Refer to the Company’s news release dated August 8, 2022.

6 Refer to the Company’s news release dated October 12, 2021.