Belmont Signs LOI to Acquire Athelstan-Jackpot Crown Grants In the Greenwood Gold Camp, B.C.

VANCOUVER, BC / ACCESSWIRE / February 24, 2020 / Belmont Resources Inc (TSXV:BEA) ("Belmont"), (or the "Company") is pleased to announce that it has entered into a Letter of Intent ("LOI") with Forty Ninth Ventures Ltd. (the "Vendor") whereby Belmont and the Vendor will finalize the terms of a definitive purchase agreement (the "Purchase Agreement") that will provide Belmont with an option to acquire a 100% interest in the Vendor's right, title and interest in and to the Crown Granted Claims known as the "Athelstan-Jackpot Property", located in the Greenwood Mining Division, British Columbia.

The proposed Athelstan-Jackpot acquisition part of the Company's continued focus to acquire and develop strategic gold properties in the prolific Greenwood mining district.

Background:

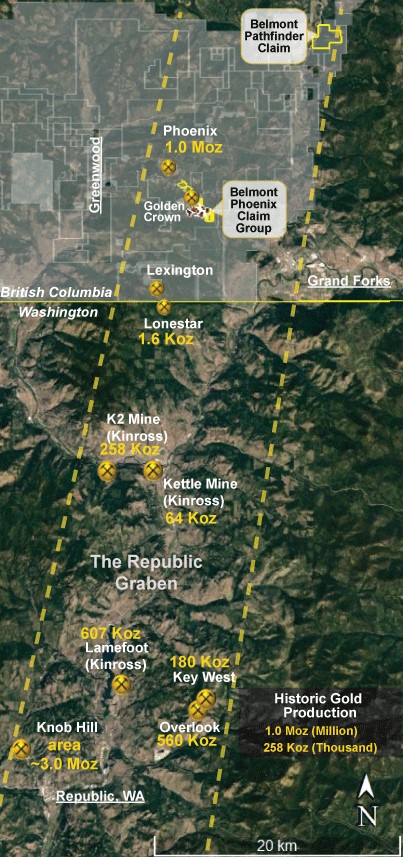

In adjacent Republic District of northern Washington State, Kinross Gold developed newly recognized metallogenic models, which resulted in the discovery and subsequent mining of several epithermal gold deposits.

In excess of 2.5 million ounces gold have been produced from epithermal gold veins in this region.

A similar geologic regime to that of the Republic district is present in the Greenwood area. Whereas previous exploration and development had primarily focused on Skarn type copper-gold deposits, comparatively little exploration has targeted epithermal type gold deposits.

Mr. George Sookochoff who recently became President & CEO Belmont Resources and is a GIS database specialist, has over the years digitally compiled geological, geochemical, geophysical and other analytical data from the Greenwood Camp dating back to the late 1800's into a single seamless GIS digital database.

Belmont is utilizing this extensive GIS database to assess the probability of occurrences of undiscovered epithermal gold deposits in the Greenwood Camp by analyzing the geological patterns of epithermal gold deposits in Washington State and looking for comparative characteristic in the Greenwood camp GIS database.

The Athelstan-Jackpot properties, as well as the other recently acquired properties by Belmont, have been selected based on in part this comparative analysis process.

View Republic District Mines Map

About The Athelstan-Jackpot Property:

The Athelstan-Jackpot property is located 8km west of Grand Forks B.C. and approximately 3kms south east of the former Phoenix Mine which produced during the period 1900 - 1976 27 million tonnes at a grade of 0.9% Cu and 1.12 g/t Au, from a number of different ore bodies

(Church, 1986). This amounts to over 1 million ounces of gold production from the Phoenix deposit.

View BEA Phoenix Claim Block Location Map

The property is situated at the intersection of two major, regional fault zones. The Lind Creek fault is an east-west trending, moderate north dipping, Jurassic thrust fault and has a close spatial relationship with much of the gold mineralization in Greenwood area.

A Jurassic aged quartz-feldspar porphyry also occurs along the Lind Creek fault at the Athelstan-Jackpot property. This intrusive has a regional association with gold mineralization in the Greenwood area.

The property was staked in the late 1890's, and was worked intermittently from 1901 through to 1940. Total production during this period was in the order of 33,200 tonnes of direct smelting ore at an average grade of about 5.4 g/t Au (~6,324 ozs) and 6.3 g/t Ag (~7,378 ozs) (Minfile 082ESE047)

A 2003 trenching and rock sampling program was managed by R. Walters of Spokane, Washington. Linda Caron, M.Sc., P. Eng of Grand Forks completed trench layout, geological mapping and reporting. The results were reported in a December 2003 Assessment report on the Athelstan-Jackpot Property authored by Linda Caron.

View Athelstan-Jackpot Claim Trenches

- In the 2003 program seven trenches were dug on 2 different targets (J-34 and B-1 Zones), for a total of 275 lineal metres of excavation.

- A total of 123 rock samples were collected from the 2003 trenches and from old workings

View Athelstan Trench J-34 Area Sampling

- An impressive zone of sulfide mineralization occurs in Trench J34-5, that returned 6.6 g/t Au, 12 g/t Ag and 6% As over a true thickness of 3.7 metres in one section sampled (samples 7585-7593).

- A second section sampled, a few metres to the west, returned 9.2 g/t Au, 18 g/t Ag and 6.6% As over a 2.5 metre true thickness (samples 7580-7584).

- The best result returned from a mineralized shear was from sample 7642, at the base of an inclined stope sampled returned 21.8 g/t Au, <5 g/t Ag and 16.7 % As across a 0.8 metre true width.

- Another sample obtained from this zone returned 8.0 g/t Au, 190 g/t Ag and 8.2% As over a true thickness of 1.3 metres (sample 7548).

- One sample, from the base of an old shaft, returned 28.4 g/t Au, 166 g/t Ag and 13% As across 0.3 metres (sample 7555).

A detailed property scale geological mapping program was completed in 2004 again by Linda Caron, M.Sc., P. Eng. and detailed in an August 2004 Assessment Report authored by the same.

The mandate of the program was to better understand the nature of mineralization, to understand the relationship between different zones of known mineralization, and to evaluate the potential for discovery of additional mineralization on the property.

- One of the distinct styles of mineralization observed on the property consists of low sulfidation epithermal quartz veinlets and silicification.

- One recommendation of the 2004 report was for drilling to test for low-grade bulk tonnage gold mineralization.

Belmont plans to review all previous exploration data from the Athelstan-Jackpot property and propose an exploration budget and program for 2020.

Terms of the Proposed Transaction:

Under the terms of the LOI, Belmont may acquire a 100% interest in the Athelstan-Jackpot Crown Grants by making certain staged cash payments and share payments of common shares in the capital of Belmont to the Vendor.

a. On TSX Venture Exchange ("Exchange") approval; 200,000 common shares of Belmont Resources, subject to 4 months +1 day hold period from issuance date upon signing of a final agreement;

b. After a period of one year from the signing of the final binding agreement a cash payment in the amount of US$50,000 plus an additional 200,000 common shares of Belmont Resources, subject to 4 months+1 day hold period from issuance date;

c. Belmont will have the option to issue common shares valued at US$25,000 in lieu of the cash payment of $25,000 of the total US$50,000 cash payment (b)

Share price will be determined by a 5 day trading average price preceding the one year option anniversary date.

d. Upon Belmont acquiring 100% right, title and interest to the Property, the Owner will retain a 2.0% NSR (Net Smelter Royalty) in the property;

e. Belmont will have the right to buy back 1% of the NSR for US$500,000

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by Laurence Sookochoff, P.Eng., a Qualified Person as defined by National Instrument 43-101.

Other Business:

(i) Stock Options:

The Company also announces it has granted 200,000 options to Directors & Officers at an exercise price of $0.05. The options are exercisable for three years. The options are granted pursuant to the Company's stock option plan, applicable regulatory policy, and subject to regulatory acceptance.

(ii) Investor Relations:

The Company also announces it has mutually agreed to terminate the Investor Relations Agreement with 360 Aviation Services Inc. ("360") effective December 31, 2019. The Company would like to thank 360 for their assistance since April 2016 in introducing the Company's Kibby Basin-Nevada lithium project to investors and financing during our exploration programs.

About Belmont Resources Inc.

Belmont Resources Inc. is a Canadian based resource company traded on the TSX-V under the symbol "BEA". The Company is systematically exploring and acquiring gold properties in Southern British Columbia and Northern Washington State.

ON BEHALF OF THE BOARD OF DIRECTORS

"George Sookochoff"

George Sookochoff, CEO/President

Ph: 604-683-6648

Email: george@belmontresources.com

Website: www.BelmontResources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This Press Release may contain forward-looking statements that may involve a number of risks and uncertainties, based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control. Forward looking statements in this news release include statements about the possible raising of capital and exploration of our properties. Actual events or results could differ materially from the Companies forward-looking statements and expectations. These risks and uncertainties include, among other things, that we may not be able to obtain regulatory approval; that we may not be able to raise funds required, that conditions to closing may not be fulfilled and we may not be able to organize and carry out an exploration program in 2020, and other risks associated with being a mineral exploration and development company. These forward-looking statements are made as of the date of this news release and, except as required by applicable laws, the Company assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements.

SOURCE: Belmont Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/577647/Belmont-Signs-LOI-to-Acquire-Athelstan-Jackpot-Crown-Grants-In-the-Greenwood-Gold-Camp-BC