Brixton Metals Drills 2m of 1898 g/t Silver and 5m of 547 g/t Silver at its Langis Project, Ontario

VANCOUVER, British Columbia, March 10, 2021 (GLOBE NEWSWIRE) -- Brixton Metals Corporation (TSX: BBB, OTCQB: BBBXF) (the “Company” or “Brixton”) is pleased to announce further high-grade silver results from its fall/winter exploration program at its wholly owned Langis Project located in the Cobalt Camp of Ontario, Canada. This press release includes assays from 78 shallow diamond drill core holes, LM-20-136 to LM-21-213 totaling 6,810.60m of NQ size core. The drill has been moved to the shaft 6 area where hole LM18-16 intercepted 2m of 10,584 g/t Ag in 2018.

Highlights

- LM-20-166 cut 2m of 1898 g/t Ag from 29.6m, including 1m of 3630 g/t (116.7 oz/t) Ag

- LM-20-165 cut 3m of 635 g/t Ag from 23.0m, including 1m of 1660 g/t Ag

- LM-20-136 cut 3m of 479 g/t Ag from 6.5m, including 1m of 1095 g/t Ag

- LM-21-205 cut 5m of 547 g/t Ag from 95.8m, including 1m of 2600 g/t Ag

- LM-21-207 cut 9m of 272 g/t Ag from 126.3m including 1m of 501 g/t Ag, 0.33% Co

Chairman and CEO of Brixton, Gary R. Thompson stated, “We have now completed the planned 20,000m drill campaign at Langis and are excited to see continued high-grade silver intercepts and meaningful widths from our drilling. While we are keen to reach a maiden resource, we believe that additional drilling and potential bulk sampling may be required to achieve this goal. We plan to determine the next steps for Langis once we have received all the data from this drill program.”

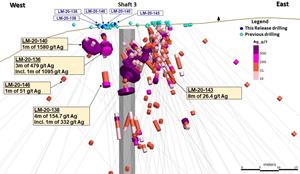

Click here for Figure 1. Location Maps of the Shaft 3 Area Drilling, Langis Project:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-1_9Mar2021.jpg

Table 1. Drilling Highlights (LM-20-136 to LM-21-197).

| Hole ID | From (m) | To (m) | Interval (m) | Ag (g/t) | Co (%) | Ag (g/t * m) |

| LM-20-136 | 6.50 | 9.50 | 3.00 | 479.00 | 1437 | |

| including | 7.50 | 8.50 | 1.00 | 1095.00 | 1095 | |

| LM-20-138 | 13.20 | 17.20 | 4.00 | 154.72 | 619 | |

| including | 16.20 | 17.20 | 1.00 | 332.00 | 332 | |

| LM-20-140 | 8.00 | 9.00 | 1.00 | 1580.00 | 0.10 | 1580 |

| LM-20-143 | 7.00 | 15.00 | 8.00 | 26.41 | 0.12 | 211 |

| including | 10.00 | 11.00 | 1.00 | 29.20 | 0.87 | 29 |

| LM-20-146 | 18.00 | 19.00 | 1.00 | 51.00 | 0.13 | 51 |

| LM-20-158 | 44.20 | 56.20 | 12.00 | 54.89 | 659 | |

| including | 54.20 | 55.20 | 1.00 | 128.00 | 128 | |

| including | 55.20 | 56.20 | 1.00 | 160.00 | 160 | |

| LM-20-165 | 23.00 | 26.00 | 3.00 | 635.00 | 0.02 | 1905 |

| including | 24.00 | 25.00 | 1.00 | 1660.00 | 0.05 | 1660 |

| LM-20-166 | 29.60 | 31.60 | 2.00 | 1898.00 | 0.03 | 3796 |

| including | 30.60 | 31.60 | 1.00 | 3630.00 | 0.06 | 3630 |

| LM-20-167 | 37.40 | 38.40 | 1.00 | 722.00 | 0.03 | 722 |

| LM-20-173 | 41.30 | 43.30 | 2.00 | 216.00 | 432 | |

| LM-21-186 | 45.30 | 46.10 | 0.80 | 289.00 | 231 | |

| LM-21-189 | 24.40 | 26.40 | 2.00 | 84.70 | 0.02 | 169 |

| LM-21-194 | 54.50 | 57.50 | 3.00 | 465.37 | 1396 | |

| including | 54.50 | 55.50 | 1.00 | 1290.00 | 1290 | |

| LM-21-195 | 20.40 | 28.40 | 8.00 | 111.46 | 892 | |

| including | 23.40 | 24.40 | 1.00 | 482.00 | 0.03 | 482 |

| including | 24.40 | 25.40 | 1.00 | 126.00 | 126 | |

| LM-21-197 | 62.00 | 66.50 | 4.50 | 293.23 | 0.07 | 1320 |

| including | 62.00 | 63.00 | 1.00 | 836.00 | 0.28 | 836 |

Table 2. Drilling Highlights (LM-21-198 to LM-21-213).

| Hole ID | From (m) | To (m) | Interval (m) | Ag (g/t) | Co (%) | Ag (g/t * m) |

| LM-21-198 | 61.50 | 69.50 | 8.00 | 56.40 | 451 | |

| including | 61.50 | 62.50 | 1.00 | 141.00 | 141 | |

| including | 65.50 | 66.50 | 1.00 | 135.00 | 135 | |

| LM-21-199 | 52.80 | 54.80 | 2.00 | 77.40 | 155 | |

| including | 52.80 | 53.80 | 1.00 | 125.00 | 125 | |

| LM-21-199 | 61.80 | 74.80 | 13.00 | 56.31 | 732 | |

| including | 65.80 | 66.80 | 1.00 | 153.00 | 153 | |

| including | 71.80 | 72.80 | 1.00 | 376.00 | 376 | |

| LM-21-200 | 47.50 | 51.90 | 4.40 | 38.93 | 0.02 | 171 |

| LM-21-201 | 51.20 | 70.20 | 19.00 | 39.77 | 756 | |

| including | 64.20 | 65.20 | 1.00 | 94.60 | 95 | |

| including | 65.20 | 66.20 | 1.00 | 94.90 | 95 | |

| LM-21-203 | 61.50 | 65.50 | 4.00 | 87.28 | 349 | |

| including | 61.50 | 62.50 | 1.00 | 257.00 | 257 | |

| LM-21-205 | 95.80 | 100.80 | 5.00 | 547.44 | 0.03 | 2737 |

| including | 98.80 | 99.80 | 1.00 | 2600.00 | 0.07 | 2600 |

| LM-21-206 | 139.90 | 146.90 | 7.00 | 170.50 | 0.08 | 1193 |

| including | 143.75 | 144.90 | 1.15 | 705.00 | 0.53 | 811 |

| LM-21-207 | 126.30 | 135.30 | 9.00 | 272.27 | 0.04 | 2450 |

| including | 126.30 | 127.30 | 1.00 | 982.00 | 982 | |

| including | 127.30 | 128.30 | 1.00 | 501.00 | 0.33 | 501 |

| including | 129.30 | 130.30 | 1.00 | 301.00 | 301 | |

| including | 130.30 | 131.30 | 1.00 | 422.00 | 422 | |

| LM-21-208 | 136.90 | 139.90 | 3.00 | 78.50 | 236 | |

| including | 137.90 | 138.90 | 1.00 | 149.00 | 0.02 | 149 |

| LM-21-208 | 156.90 | 157.90 | 1.00 | 416.00 | 416 | |

| LM-21-210 | 139.90 | 140.90 | 1.00 | 121.00 | 121 | |

| LM-21-211 | 178.00 | 180.00 | 2.00 | 66.25 | 133 |

Intervals represent drilled lengths and the true widths of the silver and cobalt mineralization have not been determined at this time.

Click here for Figure 2. Plan Map of Drilling Shaft 3 Area:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-2_9Mar2021.jpg

Click here for Figure 3. All Drilling with Assays West of Shaft 3 Area Langis Project:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-3_9Mar2021r.jpg

Click here for Figure 4. West of Shaft 3 Area Drilling Cross Section Langis Project:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-4_9Mar2021r.jpg

Click here for Figure 5. All Drilling with Assays Shaft 3 Area Close-up:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-5_9Mar2021.jpg

Click here for Figure 6. Core Photographs of Native Silver from this Batch of Assays, Langis Project:

https://brixtonmetals.com/wp/wp-content/uploads/2021/03/Figure-6_9Mar2021.jpg

Quality Assurance & Quality Control

Diamond drill holes were drilled with NQ size core. Samples were collected using 1m average sample length. Three quality control samples (one blank, one standard and one duplicate) were inserted into each batch of 20 samples. The drill core was cut in half and put in batches, sealed and shipped by the Company geologists to ALS Minerals preparation lab in Sudbury, Ontario. ALS Minerals Laboratories are registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Blank, duplicate and certified reference materials were inserted into the sample stream. All elements were analyzed by Aqua Regia Digest with ICP-AES finish. Silver over-limits were analyzed by fire assay with gravimetric finish. Base metal over-limits were analyzed with Aqua Regia Digest and AES finish. A copy of the QAQC protocols can be viewed at the Company’s website.

About the Langis Mine Project

Brixton’s wholly owned Langis Mine Project is a past producing mine located 500km north from Toronto, Ontario, Canada just north from the northern end of Lake Temiskaming with excellent infrastructure. The silver mineralization occurs as native silver and within steeply-moderately and in some cases shallow dipping veins, veinlets and as disseminations, rosettes and fracture infill and can be associated with calcite, hematite, pyrite, cobaltite, chalcopyrite, niccolite and gold. Mineralization is hosted within any of the three main rock types: Archean volcanics and metasediments, Coleman Member sediments and Nipissing diabase. The Langis Mine produced 10.6Moz of silver at 787 g/t Ag and 358,340 pounds of cobalt. Historically, the combined mines in the Cobalt Camp produced over 550 million ounces of silver with 30-50 million pounds of cobalt as a by-product.

Mr. Antonio Celis, P.Geo., who is a qualified person as defined by National Instrument 43-101, reviewed and approved the information in this press release.

About Brixton Metals Corporation

Brixton is a Canadian exploration and development company focused on the advancement of its mining projects toward feasibility. Brixton wholly owns four exploration projects, the Thorn copper-gold-silver Project, the Atlin Goldfields Projects located in NWBC, the Langis-HudBay silver-cobalt Project in Ontario and the Hog Heaven silver-gold-copper Project in NW Montana, USA now under JV with HPX. Brixton Metals Corporation shares trade on the TSX-V under the ticker symbol BBB, and on the OTCQB under the ticker symbol BBBXF. For more information about Brixton please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

Tel: 604-630-9707 or email: info@brixtonmetals.com

For Investor Relations, please contact:

Mitchell Smith, VP Investor Relations

Tel: 604-630-9707 or email: mitchell.smith@brixtonmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0f99081-3e6c-4f58-b90e-a8a69dd5e07b

https://www.globenewswire.com/NewsRoom/AttachmentNg/3df12783-c5c7-4cc0-9bcb-4b4aaf3c79f4

https://www.globenewswire.com/NewsRoom/AttachmentNg/470b8d7b-d8c7-4718-93b6-3e3b84b74475

https://www.globenewswire.com/NewsRoom/AttachmentNg/823dfa49-2545-4d98-a07a-15a6d353c826

https://www.globenewswire.com/NewsRoom/AttachmentNg/5eba54b8-ea7b-412e-b725-ba141d61c42b

https://www.globenewswire.com/NewsRoom/AttachmentNg/63e8f4a7-c1c4-42b2-8460-bafa42ae1261