Cameo Industries Corp Discusses Newly Acquired Starr Property and Announces $300,000 Private Placement

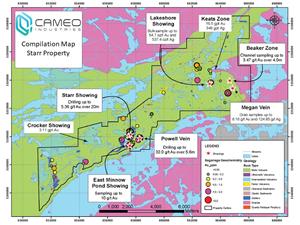

VANCOUVER, British Columbia, Dec. 09, 2020 (GLOBE NEWSWIRE) -- Cameo Industries Corp. (CSE: CRU) (OTC: CRUUF) (FWB: SY7N) (the “Company” or “Cameo”) is pleased to announce historical highlights from its recently acquired Starr gold and silver property (“Starr Property”) (formerly called the Saganaga Property) located 120 km west of Thunder Bay, Ontario (Figure 1) (refer to Cameo news release dated November 25, 2020). The Starr Property consists of 27 mineral claims (350 claim units) that cover a number of high-grade gold and silver occurrences within a 20 km long segment of the southwestern section of the Shebandowan Greenstone Belt in the Thunder Bay Mining District and is accessible year-round by highway and logging roads.

Starr Property Summary

The Starr Property (formerly called the Saganaga Property) is located in the southwestern extension of the Shebandowan Greenstone Belt, which is approximately 5 km wide and bounded to the north, east and south by granitoid complexes, and to the southeast by older Northern Lights metagneisses. The southeastern section of the Shebandowan Greenstone Belt is cut by two major NE-SW oriented faults; the Greenwater Lake and Knife Lake faults. The Greenwater Lake fault cuts the Starr Property with left lateral displacement along the fault system. These structures and related splays likely provide conduits for gold-bearing fluids in the region.

The Starr Property consists mainly of pillowed mafic flows and massive mafic volcanics intruded by several gabbroic plugs. In the eastern section of the property the mafic units are commonly interlayered with sedimentary sequences which include volcaniclastics and chemical sediments composed of magnetite-chert banded iron formation. In localized areas, particularly in the eastern portion of the property quartz-feldspar porphyry (QFP) dykes are commonly found to cut the mafic volcanics.

The Starr Property contains several historical gold showings discovered by previous operators including Teck Cominco and Benton Resources Inc. Gold has been found in a variety of geological settings, but typically occurs in spatial relationship with geological unit contacts along secondary/tertiary shear zones. Several of these gold showings are shown in Figure 1 and three of the most significant occurrences are detailed below.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a6db9b81-b78b-47b2-872a-0fdb25668eb6

The Lakeshore Showing was identified in 1934 and worked on sporadically by companies including Hemlo Gold Mines, Band-Ore Resources, Benton Resources, and Teck Cominco. Gold is hosted by a vertically dipping quartz vein, approximately 25 cm in width and striking N90E, which contains minor pyrite along with gold-silver tellurides. A 423 kg bulk sample collected in 1999 from selectively sampled high grade vein material returned a weighted average grade of 356.3 g/t Au and 850 g/t Ag. (Source: Mineral Deposit Inventory for Ontario MDI000000001080 – Cunniah Lake Gold Occurrence 2011 and Lakeshore Gold Occurrence 2014)

The Starr Zone

The Starr Zone was discovered in 1991 by Wye Resources. Significant exploration work has been completed since then including ground magnetic and induced polarization surveys, geological mapping, trenching, channel sampling, and diamond drilling. Gold is found both in albitized metavolcanics where hydrothermal pyrite is associated with disseminated gold as well as within quartz veins where higher grade gold has been identified. Significant drilling intercepts include up to 5.69 g/t Au over 20 m (Teck Cominco, 2006) and 5.51 g/t Au over 8.2 m (Benton Resources, 2012) (Source: Mineral Deposit Inventory for Ontario MDI000000001717 – Starr Zone 1991)

The Powell Zone

The Powell Zone was discovered in 1934 by the Powell Brothers (prospectors) of Saganaga Lake. Numerous exploration programs have been completed since then including stripping, mapping, channel sampling, ground and airborne geophysics, and diamond drilling. A gold-bearing quartz vein striking 40-55 degrees, varying in width from 0.9 to 6 m, has been exposed over a strike length of 121 m. Gold mineralization has been identified in a thick stratigraphic tuffaceous sequence with significant carbonate and silica alteration. Drilling by Benton Resources in 2009 returned drilling intercepts up to 2.5 g/t Au over 4.25 m and 2.3 g/t Au over 4.85 m (Source: Mineral Deposit Inventory for Ontario MDI52B07SW00007 – Powell Occurrence 1934).

Data Verification Statement

A Qualified Person has not fully verified the historical results disclosed above including any sampling, analytical, and test results underlying this information, other than reviewing the geological information and exploration results disclosed in the Mineral Deposit Inventory assessment files from previous operators referenced above for the Starr Project, and any available public information. The Company and a Qualified Person plan to complete a detailed review and verify the available scientific and technical information on the Starr Project as part of its exploration planning over the next several months. However, based on a preliminary assessment of this historical information it appears recent drilling and analytical results by Teck Cominco and Benton Resources were completed using industry best practices and QAQC protocols at the time. The historical information disclosed provides an indication of the exploration potential of the Starr Project but may not be representative of expected results once the Company completes its own exploration programs on the Starr Project.

Private Placement Financing

The Company is also pleased to announce a non-brokered private placement (the “Private Placement”) of up to of 2,000,000 units (the “Units”) of the Company at a price of $0.15 per Unit for gross proceeds of $300,000 (the “Offering”). Each Unit consists of one (1) common share (the “Common Share”) and one (1) transferable common share purchase warrant (a “Warrant”). Each Warrant entitles the holder thereof to purchase one (1) additional Common Share of the Company for a period of two years from closing at a price of $0.20 per common share. All securities issued pursuant to the Private Placement are subject to a statutory four-month hold period pursuant to applicable securities laws of Canada.

Proceeds from the Offering will be used to advance the Company’s exploration projects in Canada and for working capital purposes. In connection with the Offering, the Company may pay a finder’s fee subject to the policies of the Canadian Securities Exchange. Any insider participation in the Offering is unknown at this time.

Qualified Person Statement

All scientific and technical information contained in this news release was prepared and approved by Paul Ténière, M.Sc., P.Geo., CEO and Director of Cameo Industries Corp, who is a Qualified Person as defined in NI 43-101.

On behalf of the Board of Directors

CAMEO INDUSTRIES CORP.

Paul Ténière, M.Sc., P.Geo.

CEO and Director

Suite 810 - 789 West Pender Street

Vancouver, BC V6C 1H2

Ph: (604) 687-2038

For more information about Cameo, please visit the Company’s SEDAR profile at https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00005547

Forward-looking Information Statement

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the Company’s proposed acquisition, exploration program and the expectations for the mining industry. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in water disposal facility operations; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.