Centerra Gold Records $108 Million Net Earnings and Generates $217 Million Cash from Operations and Exceeds 2018 Consolidated Gold Production and Cost Guidance

This news release contains forward-looking information that is subject to the risk factors and assumptions set out under “Caution Regarding Forward-looking Information”. It should be read in conjunction with the Company’s audited financial statements and the notes thereto for the year ended December 31, 2018. The consolidated financial statements of Centerra Gold Inc. are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. All figures are in United States dollars and all production figures are on a 100% basis unless otherwise stated.

All references in this document denoted with NG, indicate a non-GAAP term which is discussed under “Non-GAAP Measures” and reconciled to the most directly comparable GAAP measure.

TORONTO, Feb. 22, 2019 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra”) (TSX: CG) today reported fourth quarter 2018 net earnings of $49.0 million or $0.17 per common share (basic) on revenues of $391.5 million, including a charge of $41.8 million ($0.14 per share) in reclamation expenses mainly at the Thompson Creek Mine which is currently on care and maintenance. During the same period in 2017, the Company reported net earnings of $130.0 million or $0.45 per common share (basic) on revenues of $358.2 million, including a tax benefit of $21.3 million as a result of a change in tax legislation enacted in the U.S. Adjusted earningsNG in the fourth quarter of 2018 were $49.0 million or $0.17 per common share (basic) compared to $108.7 million or $0.37 per common share (basic), which excludes the tax benefit, in the same period of 2017.

For the full year 2018, the Company recorded net earnings of $107.5 million or $0.37 per share (basic) on revenues of $1.1 billion compared to $209.5 million or $0.72 per share (basic) on revenues of $1.2 billion in 2017. The decrease in earnings in 2018 reflect the impact from Mount Milligan operating at reduced capacity for a portion of the year due to a shortage of water resources, slightly lower gold production at Kumtor and a charge of $40.4 million in reclamation expenses as compared to the prior year. In 2018, the Company recorded a gain of $28.0 million on the sale of the gold royalty portfolio, $9.4 million gain on receipt of proceeds from the sale of the ATO property, partially offset by an asset impairment of $8.4 million related to the sale of the Mongolian business unit and $4.4 million of costs incurred as part of the acquisition of AuRico Metals Inc. in January 2018. Excluding these items, adjusted earningsNG in 2018 were $77.8 million or $0.27 per share (basic). The 2017 net earnings include charges for a settlement reached with the Kyrgyz Republic Government of $60 million, an impairment charge relating to the Company’s Mongolian assets of $41.3 million ($39.7 million net of tax), a tax benefit of $21.3 million due to new tax legislation enacted in the United States, and a gain of $9.8 million ($6.9 million net of tax) on the sale of the ATO property in Mongolia. Excluding these items, adjusted earningsNG in 2017 were $281 million or $0.96 per share (basic).

2018 Fourth Quarter and Full Year Highlights

- Exceeded Company-wide 2018 gold production guidance producing 729,556 ounces; Kumtor produced 534,563 ounces exceeding the upper end of its favourably revised guidance, while Mount Milligan produced 194,993 ounces achieving the upper end of its revised gold production guidance.

- Mount Milligan produced 47.1 million pounds of copper during 2018, which was at the upper end of the revised guidance despite the mill being temporarily shutdown until early February and operating at a reduced capacity as it ramped up, and operating at a reduced rate in the fourth quarter due to a shortage of water resources in the milling process.

- Cash generated from operations totalled $217.5 million for the year (including $291.0 million from Kumtor and $37.4 million from Mount Milligan). In the fourth quarter 2018 cash generated from operations was $151.6 million (including $149.6 million from Kumtor and $39.3 million from Mount Milligan).

- Outperformed the low-end of Company-wide 2018 guidance for all-in sustaining costs on a by-product basis per ounce soldNG at $754, excluding revenue-based tax in the Kyrgyz Republic and income tax ($576 per ounce sold in the fourth quarter 2018).

- Proven and probable gold mineral reserves total an estimated 14.2 million ounces of contained gold (706.3 Mt at 0.6 g/t gold) at year-end, reflecting 2018 mining depletion and the impact of the sale of the Company’s Mongolian business unit.

- Proven and probable copper mineral reserves total an estimated 2,465 million pounds of contained copper (555 Mt at 0.202% copper) at year-end, reflecting 2018 mining depletion and the impact of geological model changes.

- Closed the AuRico Metals Inc. acquisition on January 8, 2018 and added the Kemess Project to the Company’s pipeline of projects.

- Started construction of the Öksüt Project in Turkey late-March, after receiving the pastureland permit, investment incentive certificate and Board approval. Construction was 38% complete at the end of 2018.

- On February 1, 2018, entered into a $500 million, four-year senior secured revolving credit facility with a lending syndicate of eight financial institutions as lenders, replacing prior facilities. See “Liquidity – Credit Facilities.”

- Sold the Company’s gold royalty portfolio on June 27, 2018 for $155 million, recognizing a gain of $28.0 million.

- Sold a silver stream on the Kemess Project on June 27, 2018 for $45 million with first of four stream payments to be received when a construction decision is made by the Board.

- Completed the sale of the Company’s Mongolian business unit on October 11, 2018 for net proceeds of $35 million.

- Received the final permit to allow construction of the Kemess Project on July 6, 2018, although a construction decision has not yet been made by the Board.

- Repaid net $105 million in 2018 on the Company’s credit facilities.

- Cash, cash equivalents, restricted cash and short-term investments at December 31, 2018 were $179.2 million.

Subsequent to December 31, 2018

- Extended long-stop date in connection with the Strategic Agreement with the Government of the Kyrgyz Republic to May 31, 2019.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “As a result of the strong fourth quarter operating performance at both operations, the Company exceeded its overall 2018 production and cost guidance producing 729,556 ounces of gold at an all-in sustaining costNG on a by-product basis of $754 per ounce sold, beating the low-end of our all-in-sustaining cost guidance for the year. Kumtor had another strong year exceeding its revised production guidance and beating its all-in-sustaining cost guidance, delivering 534,563 ounces of gold production at an all-in-sustaining cost on a by-product basis of $694 per ounce sold. In 2018, Mount Milligan achieved the upper end of both its gold and copper production guidance, producing 194,993 ounces of gold and 47.1 million pounds of copper and beat its all-in-sustaining cost guidance at all-in-sustaining cost on a by-product basis of $764 per ounce sold.

“Financially, the Company generated $336.6 million of cash from operations before changes in working capitalNG for the year, with both operations generating a meaningful amount of cash from operations before changes in working capitalNG, Mount Milligan generated $63.1 million and Kumtor generated $345.0 million. In 2018, Kumtor generated $128 million of free cash flowNG and Mount Milligan generated $2.5 million which enabled the Company to aggressively pay down its debt in the fourth quarter by approximately $139 million ($105 million over the 2018 year) ending the year with net debt of $46.0 million (excluding restricted cash).”

“For 2019, we are estimating consolidated gold production to be in the range of 690,000 to 740,000 ounces and 65 million to 75 million pounds of payable copper production from Mount Milligan. The guidance assumes reduced mill throughput in the first quarter of 2019 at Mount Milligan to properly manage its water balance until the spring melt runoff. Gold production at Kumtor is expected to be evenly weighted for the first three quarters of the year with the fourth quarter representing approximately 28% of the full year’s production forecast. Centerra’s projected consolidated all-in sustaining cost per ounce soldNG net of copper by-product for 2019 is expected to be in the range of $723 to $775 per ounce.”

“Our projected capital expenditures for 2019, excluding capitalized stripping, is estimated to be $275 million which includes $91 million of sustaining capitalNG and $184 million of growth capitalNG spending. Growth capital spending includes $123 million at the Öksüt Project in Turkey as we complete the construction of our next gold mine with an expected first gold pour to be in the first quarter of 2020, $26 million at the Kemess Underground Project and $21 million at the Greenstone Gold Property on pre-construction activities.” See “2019 Outlook” for further details.

This Management Discussion and Analysis (“MD&A”) has been prepared as of February 22, 2019, and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three and twelve months ended December 31, 2018 in comparison with the corresponding periods ended December 31, 2017. This discussion should be read in conjunction with the Company’s audited financial statements and the notes thereto for the year ended December 31, 2018 prepared in accordance with International Financial Reporting Standards (“IFRS”). In addition, this discussion contains forward-looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. See “Risk Factors” and “Caution Regarding Forward-Looking Information” in this discussion. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated. Additional information about Centerra, including the Company’s most recently filed Annual Information Form, is available at www.centerragold.com and on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

Overview

Centerra is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra’s principal operations are the Kumtor Gold Mine located in the Kyrgyz Republic and the Mount Milligan Gold-Copper Mine located in British Columbia, Canada. The Company is currently constructing its next gold mine, the Öksüt Project in Turkey and has two promising development properties in Canada as well as exploration joint ventures or properties in Canada, Finland, Mexico, Sweden, Turkey and the United States.

Centerra’s common shares are listed for trading on the Toronto Stock Exchange under the symbol CG. As of February 22, 2019, there are 292,123,716 common shares issued and outstanding and options to acquire 4,981,701 common shares outstanding under its stock option plan.

As of December 31, 2018, Centerra’s significant subsidiaries are as follows:

| Property | ||||

| Current | Ownership | |||

| Entity | Property - Location | Status | 2018 | 2017 |

| Kumtor Gold Company (“KGC”) | Kumtor Mine - Kyrgyz Republic | Operation | 100% | 100% |

| Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | Operation | 100% | 100% |

| Langeloth Metallurgical Company LLC (Molybdenum Processing Plant) | Langeloth - United States | Operation | 100% | 100% |

| Öksüt Madencilik A.S. (“OMAS”) | Öksüt Project - Turkey | Development | 100% | 100% |

| AuRico Metals Inc | Kemess Project - Canada | Pre- development | 100% | 0% |

| Greenstone Gold Mines LP | Greenstone Gold Property - Canada | Pre- development | 50% | 50% |

| Thompson Creek Mining Co. | Thompson Creek Mine - United States | Care and Maintenance | 100% | 100% |

| Thompson Creek Metals Company Inc. | Endako Mine - Canada | Care and Maintenance | 75% | 75% |

As at December 31, 2018, the Company has also entered into agreements to earn an interest in joint venture exploration properties located in Canada, Mexico and Finland. In addition, the Company has exploration properties in Canada, Turkey and the United States and has strategic alliance agreements with partners to evaluate potential gold opportunities in West Africa and Sweden.

Substantially all of Centerra’s revenues are derived from the sale of gold and copper. The Company’s revenues are derived from gold and gold/copper concentrate production from its mines and gold and copper prices realized upon the sale of these products. Gold doré production from the Kumtor mine is purchased by Kyrgyzaltyn JSC (“Kyrgyzaltyn”), a Kyrgyz Republic state owned refinery and significant shareholder of Centerra, for processing at its refinery in the Kyrgyz Republic while gold and copper concentrate produced by the Mount Milligan mine in Canada is sold to various smelters and off-take purchasers.

The Mount Milligan Mine in Canada is subject to a streaming arrangement whereby RGLD Gold AG and Royal Gold Inc. (collectively “Royal Gold”) is entitled to purchase 35% of the gold and 18.75% of the copper produced from the Mount Milligan Mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered (the “Mount Milligan Streaming Arrangement”).

The Company’s costs are comprised primarily of operating costs at the Kumtor and Mount Milligan mines and the Langeloth molybdenum processing facility, project development costs at the Öksüt Gold Project, the Kemess Project and the Greenstone Gold Property, care and maintenance costs at the Company’s molybdenum mines (Endako Mine and Thompson Creek Mine), exploration expenses relating to the Company’s own projects and its earn-in projects, administrative costs from offices worldwide and depreciation, depletion and amortization (“DD&A”).

There are many operating variables that affect the cost of producing an ounce of gold and a pound of copper. In the mine, unit costs are influenced by the ore grade and the stripping ratio. The stripping ratio is the ratio of the tonnage of waste material which must be removed per tonne of ore mined. Ore grade refers to the amount of gold and/or copper contained in a tonne of ore. The significant costs of mining include labour, diesel fuel and equipment maintenance.

At the mill, costs are impacted by the ore grade and the metallurgical characteristics of the ore, which can impact gold and copper recovery. For example, a higher-grade ore would typically result in a lower unit production cost. The significant costs of milling are labour, energy, grinding media, reagents, consumables and mill maintenance.

Mining and milling costs are also affected by the cost of labour, which depends mostly on the availability of qualified personnel in the region where the operations are located, the wages in those markets, and the number of people required. Mining and milling activities involve the use of many materials. The varying costs of acquiring these materials and the amount used in the processing of the ore also influence the cash costs of mining and milling. The non-cash costs (namely DD&A) are influenced by the amount of capital costs related to the mine’s acquisition, development and ongoing capital requirements and the estimated useful lives of capital items.

The Company’s 2018 production costsNG at its two operating mines totaled $598 million compared to $592 million in 2017. Production costs at Kumtor were 2.2% higher than 2017 ($368 million in 2018 compared to $360 million in 2017). The increase reflects the impact of higher mining costs, especially for diesel fuel (higher input prices and consumption). At Mount Milligan, production costs in 2018 were $230 million, similar to 2017, reflecting higher labour and environmental consulting costs, offset by lower drill and blast costs.

Over the life of each mine, another significant cost that must be planned for is the closure, reclamation and decommissioning of each operating site. In accordance with standard practices for international mining companies, Centerra carries out remediation and reclamation work during the operating period of the mine, where feasible, in order to reduce the final decommissioning costs. Nevertheless, the majority of rehabilitation work can only be performed following the completion of mining operations. Centerra’s practice is to record the estimated final decommissioning costs based on conceptual closure plans, and to accrue these costs according to the principles of IFRS. Kumtor has established a reclamation trust fund to pay for these costs from the revenues generated over the life of the mine. As required by Canadian provincial laws and US federal and state laws, the Company has provided reclamation bonds for mine closure obligations at its Canadian and U.S. sites.

The Company reports the results of its operations in U.S. dollars, however not all of its costs are incurred in U.S. dollars. As such, the movement in exchange rates between currencies in which the Company incurs costs and the U.S. dollar also impact reported costs of the Company.

Economic Indicators

Gold Price

The average quarterly gold spot price of $1,229 in the fourth quarter of 2018 was slightly above the quarterly average low point of $1,213 reached in the third quarter of 2018. The average gold spot price for 2018 was $1,269 per ounce, an increase of 1% over the average in 2017.

Copper Price

The average quarterly copper spot price dropped in the fourth quarter of 2018 to $2.80 per pound, a 11% decrease compared to the high of $3.16 per pound reached in the first quarter of the year. The average copper spot price for 2018 was $2.96 per pound, an increase of 6% over the average in 2017.

Currency

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/b7d33a22-6d6e-4984-bc09-313f930ef1db

Canadian Dollar

The Canadian Dollar (C$) exhibited a sustained downward trend in 2018, depreciating 8.5% relative to the U.S. Dollar and reaching C$1.36 per U.S. Dollar in December 2018 (December 31, 2017 C$1.26 per U.S. Dollar).

Kyrgyz Som

The Kyrgyz Som to U.S. Dollar exchange rate depreciated 1% over 2018. The Som value is driven by the economic growth and inflation expectations in the Kyrgyz Republic and influenced by the currencies of its main trading partners, mainly Russia and Kazakhstan.

Turkish Lira

The Turkish Lira (“TRY”) depreciated markedly in 2018, closing on December 31, 2018 at 5.29 per U.S. Dollar from 3.8 at December 31, 2017 (a deprecation of 39%). Following the United States’ announcement of doubling tariffs on Turkish steel and aluminum, the USD-TRY rate increased to 7.24 on August 13, 2018, the highest level in the last 30 years, and subsequently decreased prior to the end of the year.

Foreign Exchange Transactions

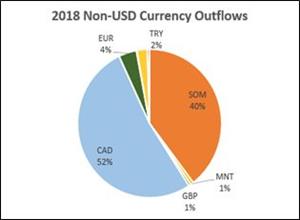

The Company generates its revenues through the sale of gold, copper and molybdenum in U.S. Dollars. The Company has significant operations in Canada (including its corporate head office), the Kyrgyz Republic, Turkey and the United States. During 2018, the Company incurred combined expenditures (including capital) of approximately $1,768 million. Approximately $624 million of this (35%) was in currencies other than the U.S. dollar. The percentage of Centerra’s non-U.S. Dollar costs by currency was as follows:

In 2018, Centerra’s non-U.S. dollar costs consisted of 52% Canadian Dollars, 40% Kyrgyz Soms, 4% Euros, 1% Mongolian Tugrik, 1% British Pound, and 2% Turkish Lira. The net impact of the currency movements in the year ended December 31, 2018, after factoring in the balances in non-USD currencies held at the beginning of the year, was to decrease annual costs by $14.5 million (increase of $9.1 million in the year ended December 31, 2017), inclusive of the currency hedging cost of $0.3 million ($1.2 million gain for the year ended December 31, 2017).

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/8850a92b-f921-46e5-9f78-8a14b1e3084f

Diesel Fuel Prices

One of the more significant movements in commodity prices in 2018 was the decline in the West Texas Intermediate (“WTI”) and Brent crude oil prices in the last quarter of the year.

According to the U.S. Energy Information Administration, Brent crude oil prices averaged $71/bbl in 2018, ending the year at $54/bbl (a decrease of $13/bbl from the end of 2017). WTI crude oil prices averaged $65/bbl in 2018, ending the year at $45/bbl (a decrease of $15/bbl from December 31, 2017).

Fuel costs represent a significant cost component for Centerra’s mining operations. Prices for Kumtor diesel fuel in 2018 generally reflected the price movements of Brent crude oil. The purchase price for diesel fuel for Kumtor in 2018 increased 26% when compared to 2017, averaging $0.53/l for the year. Kumtor sources its fuel from Russia either directly or through Kyrgyz distributors. Kumtor’s diesel prices include additional costs such as seasonal premiums for winterizing the diesel fuel and transportation costs from the Russian refineries. The increase in price was partially offset by the Company’s diesel hedging program, which offset costs with a $2.2 million gain in 2018.

To manage its exposure to fluctuations in diesel fuel prices, the Company has established a diesel fuel price hedge program. See “Financial Instruments – Fuel Hedges.”

Liquidity

Financial liquidity provides the Company with the ability to fund future operating activities and investments. The Company’s financial risk management policy focuses on cash preservation, while maintaining the liquidity necessary to conduct operations on a day-to-day basis and advance the Company’s pre-development and development projects. The Company manages counterparty credit risk, in respect of cash and short-term investments, by maintaining bank accounts with highly-rated U.S. and Canadian banks and investing only in highly-rated Canadian and U.S. Government bills, term deposits or banker’s acceptances with highly-rated financial institutions, and corporate direct credit of highly-rated, highly-liquid issuers.

Centerra generated $217.5 million in cash from operations in 2018 and has a balance of cash, cash equivalents and short-term investments of $151.7 million as at December 31, 2018.

As at December 31, 2018, the Corporate Facility (defined below), had an outstanding balance of $111 million at December 31, 2018, after net repayments of $79 million in 2018 (outstanding balance as at December 31, 2017 - $190 million). At December 31, 2018, the unutilized balance available to the Company under the Corporate Facility was $389 million.

In the second quarter of 2018, after satisfying all of the required conditions precedent, the Company began drawing on the $150 million OMAS Facility (defined below) relating to the Öksüt Project. As at December 31, 2018, the Company had drawn $49.7 million under the facility, leaving $100.3 million unutilized and available (see Credit Facilities – OMAS Facility).

The Company believes its cash on hand, cash flow from the Company’s Kumtor and Mount Milligan operations and cash from the Company’s existing credit facilities will be sufficient to fund its anticipated operating, construction and development cash requirements through to the end of 2019. See “Risks affecting our Business” and “Caution Regarding Forward-Looking Information.”

Capital Management

The Company’s primary objective with respect to its capital management is to provide returns for shareholders by ensuring that it has sufficient cash resources to maintain its ongoing operations, pursue and support growth opportunities, continue the development and exploration of its mineral properties, while satisfying debt repayment requirements and other obligations.

Management is aware that market conditions, driven primarily by metal prices, may limit the Company’s ability to raise additional funds. The Company is also required to maintain a number of financial covenants as part of its credit facilities, which may limit the Company’s ability to access future funding. These and other factors are considered when shaping the Company’s capital management strategy.

Credit Facilities

Centerra was in compliance with the terms of all of its credit facilities at December 31, 2018 and throughout 2018.

Centerra Revolving Term Corporate Facility

In the first quarter of 2018, the Company entered into a new $500 million four-year senior secured revolving credit facility (the "Corporate Facility"). with a lending syndicate led by The Bank of Nova Scotia and National Bank of Canada. The Corporate Facility is an amendment and restatement of a credit facility entered into by Centerra B.C. Holdings Inc. (the “Centerra B.C. Facility”), which had been entered in connection with the acquisition of Thompson Creek in October 2016, and also replaced the AuRico acquisition and EBRD facilities. The Corporate Facility is for general corporate purposes, including working capital, investments, acquisitions and capital expenditures. Funds drawn under the Corporate Facility are available to be re-drawn on a quarterly basis, at the Company’s discretion, and repayment of the loaned funds may be extended until February 2022.

As at December 31, 2018, the Corporate Facility had a drawn balance of $111 million.

OMAS Facility

In the second quarter of 2018, OMAS, a wholly-owned subsidiary of the Company that owns the Öksüt Project, satisfied all conditions precedent required under the $150 million five-year credit facility (the “OMAS Facility”) it has entered with European Bank for Reconstruction and Development and UniCredit Bank AG. The purpose of the OMAS Facility is to assist in financing the construction of the Company’s Öksüt Project. As a condition of the OMAS Facility, the Company placed $25 million in restricted accounts with the lenders, including $15 million which is restricted until the Öksüt Project mining lease has been extended and $10 million which is restricted during the construction phase.

As part of an amendment to the OMAS Facility in 2018, OMAS agreed to apply all of its excess cash flow towards debt prepayment under the OMAS Facility until the Öksüt Project’s mining license is extended beyond its current expiry date of January 16, 2023. OMAS intends to apply for an extension of its mining license as soon as permitted under Turkish legislation, which is two years prior to expiry of the mining license. In addition, Centerra will provide a limited guarantee of a portion of OMAS’ obligations under the OMAS Facility and will agree to comply with certain covenants which are consistent with the covenants under the Corporate Facility. The lenders under the OMAS Facility may call on Centerra’s guarantee if the Öksüt mining license is not extended beyond January 16, 2023.

The OMAS Facility expires on March 31, 2024 and as at December 31, 2018, had a drawn balance of $49.7 million. As at December 31, 2018, $6.2 million (December 31, 2017 - $4.8 million) of deferred financing fees are being amortized over the term of the OMAS Facility.

Caterpillar Financial Services Limited Promissory Note (“CAT Note”)

In 2016, as part of the Thompson Creek Metals Company Inc. (“TCM”) acquisition, the Company assumed TCM’s capital equipment lease obligations owed to Caterpillar Financial Services Limited (“Caterpillar”). The Company re-financed the leases in 2017, whereby the Company purchased the assets held under the finance leases through a loan payable to Caterpillar.

Interest on the CAT Note is at three-month LIBOR + 4.93% paid quarterly in arrears. The CAT Note is secured by assets previously held under the finance leases and contain certain non-financial covenants.

In 2018, an amendment was signed extending the CAT Note until March 25, 2020 with an initial principal repayment of $5 million, which was paid on January 25, 2019, at which time the interest rate reset to LIBOR + 3.50%.

As at December 31, 2018 the principle amount outstanding under the CAT Note is $32 million.

Other Facilities

On January 8, 2018, the Company entered into a $125 million acquisition facility (“AuRico Acquisition Facility”) with the Bank of Nova Scotia, as administrative agent, lead arranger and lender, in connection with the acquisition of AuRico Metals Inc. The AuRico Acquisition Facility was repaid and cancelled after the Company entered into the Corporate Facility.

In early 2018, the Company repaid the $76 million outstanding balance of its revolving credit facility with the European Bank for Reconstruction and Development and subsequently cancelled the facility.

Mineral Reserves and Mineral Resources

On February 22, 2019, the Company released the results of the updated mineral reserve and mineral resource estimates for the Kumtor mine, the Mount Milligan mine and re-iterated mineral reserve and mineral resource estimates for the Company’s other projects, including the Öksüt Project, the Kemess Property and the Hardrock deposit, all as of December 31, 2018. For additional details, please see the news release “Centerra Gold 2018 Year-End Statement of Mineral Reserves and Resources and Fourth Quarter Exploration Update” filed on SEDAR and posted on the Company’s website on February 22, 2019.

Mount Milligan’s mineral reserves and mineral resources are presented on a 100% basis. Sales of gold and copper from the Mount Milligan mine are subject to the Mount Milligan Streaming Arrangement whereby Royal Gold is entitled to 35% and 18.75% of gold and copper sales respectively. Under the Mount Milligan Streaming Arrangement this streaming arrangement, Royal Gold pays Centerra $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered.

Highlights:

Gold Mineral Reserves

- At December 31, 2018, Centerra’s proven and probable gold mineral reserves total an estimated 14.2 million contained ounces (706.3 Mt at 0.6 g/t gold), compared to 16.3 million contained ounces (746.8 Mt at 0.7 g/t gold) the prior year. During 2018, proven and probable gold mineral reserves decreased by 2.1 million contained ounces, after processing of 977,000 contained ounces and a net deletion of 1.1 million contained ounces. The decrease in gold mineral reserve contained ounces is primarily due to the Company’s sale of the Mongolian business unit (Gatsuurt Project) that represented 1.3 million contained ounces of mineral reserves. Excluding the impact of the sale of the Company’s Mongolian business unit gold mineral reserves decreased by 782,000 contained ounces in 2018. The 2018 year-end gold mineral reserves have been verified and estimated using a gold price of $1,250 per ounce.

Gold Mineral Resources

- Centerra’s measured and indicated gold mineral resources, exclusive of gold mineral reserves, increased by 2.1 million ounces of contained gold, excluding the impact of the sale of the Company’s Mongolian business unit (993,000 ounces of contained gold), to 11.3 million ounces of contained gold (758.8 Mt at 0.5 g/t gold), compared to the December 31, 2017. The increase is a result of exploration success at Kumtor and Mount Milligan and changes in the metal price assumptions at the Kemess Project.

- Centerra’s inferred gold mineral resource estimate totals 6.2 million contained ounces of gold (151 Mt at 1.3 g/t gold), a decrease of 629,000 contained ounces from December 31, 2017. The decrease is primarily a result of the reduction of 511,000 of contained ounces of gold as a result of the divestiture of the Mongolian assets in 2018. In addition, at Kemess East inferred mineral resources decreased by 357,000 contained ounces of gold from additional drilling that converted a portion of the inferred ounces to the indicated category. At Kumtor inferred mineral resources increased by 8,000 contained ounces because of exploration drilling and the generation of a new constraining economic pit shell. At Öksüt additional in-fill drilling in the Keltepe open pit converted 58,000 contained ounces to the measured and indicated categories. These decreases were offset by the addition of 252,000 contained ounces at the Kemess Underground project due to the change in resource metal prices assumptions.

| Gold (000s attributable ozs contained) (1)(4) | 2018 | 2017 |

| Total proven and probable mineral reserves | 14,223 | 16,321 |

| Total measured and indicated mineral resources (2) | 11,338 | 10,204 |

| Total inferred mineral resources(2)(3)(4) | 6,191 | 6,819 |

| (1) Centerra’s equity interests are as follows: Mount Milligan 100%, Kumtor 100%, Öksüt 100%, Kemess Underground and Kemess East 100% and Greenstone Gold properties (Hardrock, Brookbank, Key Lake, Kailey) 50%. The mineral reserves and mineral resources above reflect Centerra's equity interests in the applicable properties. | ||

| (2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability. | ||

| (3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category. | ||

| (4) Production at Mount Milligan is subject to a streaming agreement which entitles Royal Gold to 18.75% of copper sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay 15% of the spot price per metric tonne of copper delivered. Mineral resources for the Mount Milligan property are presented on a 100% basis. | ||

Copper Mineral Reserves

- Centerra’s proven and probable copper mineral reserves total an estimated 2,465 million pounds of contained copper (555 Mt at 0.202% copper). The copper mineral reserves have been estimated based on a copper price of $3.00 per pound for the Mount Milligan Mine and the Kemess Underground Project.

- At the Mount Milligan Mine, proven and probable copper mineral reserves total an estimated 1,836 million pounds of contained copper (448 Mt at 0.186% copper) at the end of December 2018, compared to 1,938 million contain pounds of copper (468 Mt 0.188% copper) as of December 31, 2017. Proven and probable copper mineral reserves decreased by 103 million contained pounds of copper, after processing 61 million contained pounds of copper in 2018. During 2018, mineral reserves decreased primarily due to mining depletion, but was also affected by geological model changes, modifications to the copper recovery curve and an increase in concentrate transportation costs.

- At the Kemess Property, proven and probable copper mineral reserves are unchanged at the Kemess Underground Project and are estimated to be 630 million pounds of contained copper (107 Mt at 0.266% copper) at the end of December 2018.

Copper Mineral Resources

- Centerra’s measured and indicated copper mineral resources, exclusive of mineral reserves, total an estimated 5,836 million pounds of contained copper (1,090 Mt at 0.243% copper). The copper mineral resources are located at the Mount Milligan Mine, the Berg Property, the Kemess Underground, and Kemess East properties that are all located in Canada.

- At Mount Milligan, measured and indicated mineral resources increased by 365 million pounds of contained copper to an estimated 1,028 million pounds of contained copper (342 Mt at 0.136% copper) at the end of December 2018 as a result of successful exploration drilling activities in 2018 and have been estimated based on a copper price of $3.50 per pound.

- Measured and indicated resources that are exclusive of reserves increased by an estimated 588 million contained copper pounds at the Kemess Project. This increase in copper pounds is attributable to an increase of 132 million pounds of contained copper at Kemess Underground that was due to a change to the metal price assumptions (changed to standardize them across our sites) and an increase of 456 million pounds of contained copper at Kemess East because of the standardization of corporate metal prices and to the results of 9 exploration drill holes that converted some inferred material to the indicated category. The Kemess Underground measured and indicated resources are 174 Mt at 0.182% copper or an estimated 697 million pounds of contained copper and Kemess East measured and indicated resources of 177.5 Mt at 0.360% copper or an estimated 1,410 million pounds of contained copper.

- Centerra’s inferred copper mineral resource estimate totals 607 million pounds of contained copper (132.0 Mt at 0.209% copper). This includes at Mount Milligan an estimated 115 million pounds of contained copper (41 Mt at 0.127% copper) that represents a year-over-year increase of 4 million pounds of contained copper that is attributable to additional in-pit drilling completed in 2018. At Kemess Underground this includes 210 million pounds of contained copper (47.7 Mt at 0.20% copper) and at Kemess East 203 million pounds of contained copper (29.3 Mt at 0.31%).

| Copper (million pounds contained) (1)(4) | 2018 | 2017 |

| Total proven and probable mineral reserves(2) | 2,465 | 2,568 |

| Total measured and indicated mineral resources(2) | 5,836 | 5,541 |

| Total inferred mineral resources(2)(3)(4) | 607 | 1,427 |

| (1) Centerra’s equity interests are as follows: Mount Milligan 100%, Kemess Underground 100%, Kemess East 100%, Berg 100%, Thompson Creek 100%, and Endako 75%. The mineral reserves and mineral resources above reflect Centerra's equity interest in the applicable properties. | ||

| (2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability. | ||

| (3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category. | ||

| (4) Production at Mount Milligan is subject to the Mount Milligan Streaming Arrangement. Under the Mount Milligan Streaming Arrangement, Royal Gold will pay 15% of the spot price per metric tonne of copper delivered. Mineral resources for the Mount Milligan property are presented on a 100% basis. | ||

Molybdenum Mineral Resources

- Centerra’s measured and indicated molybdenum mineral resources, exclusive of mineral reserves, total an estimated 636 million pounds of contained molybdenum (683 Mt at 0.042% molybdenum). The molybdenum mineral resources are located at the Berg Property, the Thompson Creek Mine, and the Endako Mine.

- Centerra’s inferred molybdenum mineral resource estimate totals 50 million pounds of contained molybdenum (62 Mt at 0.036% molybdenum).

| Molybdenum (million pounds contained) (1)(3)(4) | 2018 | 2017 |

| Total measured and indicated mineral resources(2) | 636 | 758 |

| Total inferred mineral resources(3) | 50 | 150 |

| (1) Centerra’s equity interests are Berg 100%, Thompson Creek 100%, and Endako 75%. | ||

| (2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability. | ||

| (3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category. | ||

| (4) Molybdenum mineral resources at Berg, Thompson Creek and Endako were estimated using a molybdenum price of $14.00 per pound. The exchange rate used at Berg and Endako was 1USD:1.25CAD. | ||

| Material assumptions used to determine mineral reserves and mineral resources are as follows: | |||

| 2018 | 2017 | ||

| Gold price | |||

| Gold mineral reserves ($/oz) | $1,250 | $1,250 | |

| Gold mineral resources ($/oz) (1) | $1,450 | $1,450 | |

| Copper price | |||

| Copper mineral reserves ($/lb) | $3.00 | $3.00 | |

| Copper mineral resources ($/lb) | $3.50 | $3.50 | |

| Foreign exchange rates | |||

| 1 USD : Cdn$ (2) | 1.25 | 1.25 | |

| 1 USD : Kyrgyz som | 65 | 65 | |

| 1 USD : Turkish Lira | 3.50 | 3.50 | |

| (1) Mineral resources at the Hardrock Project were estimated at C$1,625, while resource estimation at Brookbank and Kailey properties used $1,455. | |||

| (2) Cdn$ exchange rate used for the Hardrock Project was 1USD:1.30CAD and at Brookbank and Kailey properties a rate of 1USD:1.18CAD was used. | |||

| Consolidated Financial and Operational Highlights | ||||||||||

| Unaudited ($ millions, except as noted) | Three months ended December 31, | Year ended December 31, | ||||||||

| Financial Highlights | 2018 | 2017 | % Change | 2018 | 2017 | % Change | ||||

| Revenue | $ | 391.5 | $ | 358.2 | 9% | $ | 1,129.3 | $ | 1,199.0 | (6%) |

| Cost of sales | 232.2 | 180.8 | 28% | 761.4 | 682.1 | 12% | ||||

| Standby costs | - | - | 0% | 10.8 | - | 100% | ||||

| Earnings from mine operations | 155.3 | 171.7 | (10%) | 343.4 | 498.7 | (31%) | ||||

| Net earnings from continuing operations | 48.9 | 132.5 | (63%) | 113.5 | 251.8 | (55%) | ||||

| Net earnings (loss) from discontinued operations | 0.1 | (2.5) | (104%) | (5.9) | (42.3) | (86%) | ||||

| Net earnings | $ | 49.0 | $ | 130.0 | (62%) | $ | 107.5 | $ | 209.5 | (49%) |

| Adjusted earnings (3) | $ | 49.0 | $ | 108.7 | (55%) | $ | 77.8 | $ | 281.0 | (72%) |

| Cash provided by operations (4) | 151.6 | 170.4 | (11%) | 217.5 | 500.9 | (57%) | ||||

| Cash provided by operations before changes in working capital (3) (4) | 156.8 | 159.9 | (2%) | 336.6 | 512.6 | (34%) | ||||

| Capital expenditures (sustaining) (3) | 23.6 | 29.0 | (19%) | 88.5 | 91.8 | (4%) | ||||

| Capital expenditures (growth and development projects) (3) | 3.1 | 10.5 | (70%) | 70.7 | 32.0 | 121% | ||||

| Capital expenditures (stripping) | 36.0 | 31.9 | 13% | 138.8 | 200.2 | (31%) | ||||

| Total assets | $ | 2,826.7 | $ | 2,772.2 | 2% | $ | 2,826.7 | $ | 2,772.2 | 2% |

| Long-term debt and lease obligation | 183.5 | 211.6 | (13%) | 183.5 | 211.6 | (13%) | ||||

| Cash, cash equivalents and restricted cash | 179.2 | 416.6 | (57%) | 179.2 | 416.6 | (57%) | ||||

| Per Share Data | ||||||||||

| Net earnings from continuing operations per common share - $ basic(1) | $ | 0.17 | $ | 0.45 | 62% | $ | 0.39 | $ | 0.86 | (55%) |

| Net earnings from continuing operations per common share - $ diluted(1) | $ | 0.16 | $ | 0.44 | 63% | 0.38 | $ | 0.86 | (56%) | |

| Net earnings per common share - $ basic (1) | $ | 0.17 | $ | 0.45 | (62%) | $ | 0.37 | $ | 0.72 | (49%) |

| Net earnings per common share - $ diluted (1) | $ | 0.17 | $ | 0.44 | (62%) | $ | 0.36 | $ | 0.72 | (50%) |

| Adjusted earnings per common share - $ basic (1)(3) | $ | 0.17 | $ | 0.37 | (55%) | $ | 0.27 | $ | 0.96 | (72%) |

| Adjusted earnings per common share - $ diluted (1)(3) | $ | 0.17 | $ | 0.36 | (54%) | $ | 0.26 | $ | 0.96 | (73%) |

| Per Ounce Data (except as noted) | ||||||||||

| Average gold spot price - $/oz(2) | 1,228 | 1,275 | (4%) | 1,269 | 1,258 | 1% | ||||

| Average copper spot price - $/lbs(2) | 3.12 | 2.57 | 21% | 3.14 | 2.61 | 20% | ||||

| Average realized gold price (Kumtor) - $/oz(3) | 1,214 | 1,262 | (4%) | 1,244 | 1,245 | (0%) | ||||

| Average realized gold price (Mount Milligan - combined) - $/oz(3) (5) | 984 | 978 | 1% | 971 | 1,003 | (3%) | ||||

| Average realized gold price (consolidated) - $/oz(3) | 1,157 | 1,190 | (3%) | 1,175 | 1,171 | 0% | ||||

| Average realized copper price (consolidated) - $/lbs(3) | 1.76 | 2.23 | (21%) | 2.02 | 2.11 | (4%) | ||||

| Operating Highlights | ||||||||||

| Gold produced – ounces | 288,367 | 216,752 | 33% | 729,556 | 785,316 | (7%) | ||||

| Gold sold – ounces | 269,754 | 242,228 | 11% | 709,330 | 792,466 | (10%) | ||||

| Payable Copper Produced (000's lbs) | 11,796 | 12,261 | (4%) | 47,091 | 53,596 | (12%) | ||||

| Copper Sales (000's payable lbs) | 13,591 | 13,105 | 4% | 44,370 | 59,719 | (26%) | ||||

| Operating costs (on a sales basis) (3) (6) | 168.4 | 132.0 | 28% | 564.5 | 487.1 | 16% | ||||

| Unit Costs | ||||||||||

| Adjusted operating costs on a by-product basis - $/oz sold(3)(6) | $ | 372 | $ | 320 | 16% | $ | 440 | $ | 331 | 33% |

| Gold - All-in sustaining costs on a by-product basis – $/oz sold(3)(6) | $ | 576 | $ | 571 | 1% | $ | 754 | $ | 687 | 10% |

| Gold - All-in sustaining costs on a by-product basis (including taxes) – $/oz sold(3) (6) | $ | 709 | $ | 708 | 0% | $ | 889 | $ | 815 | 9% |

| Gold - All-in sustaining costs on a co-product basis (before taxes) – $/oz sold(3)(6) | $ | 573 | $ | 593 | (3%) | $ | 750 | $ | 737 | 2% |

| Copper - All-in sustaining costs on a co-product basis (before taxes) – $/pound sold(3)(6) | $ | 1.53 | $ | 1.70 | (10%) | $ | 1.77 | $ | 1.47 | 20% |

| (1) As at December 31, 2018, the Company had 291,999,949 common shares issued and outstanding (292,123,716 common shares as of February 22, 2019). As of February 22, 2019, Centerra had 4,981,701 share options outstanding under its share option plan with exercise prices ranging from US$2.83 per share to Cdn$22.28 per share, with expiry dates between 2019 and 2026. | ||||||||||

| (2) Average for the period as reported by the London Bullion Market Association (US dollar Gold P.M. Fix Rate) and London Metal Exchange (LME). This is a non-GAAP measure and is discussed under “Non-GAAP Measures.” | ||||||||||

| (3) Non-GAAP measure. See discussion under “Non-GAAP Measures.” | ||||||||||

| (4) Excludes Molybdenum business. | ||||||||||

| (5) Combines streamed and unstreamed amounts. | ||||||||||

| (6) Excludes Molybdenum business. | ||||||||||

Overview of Consolidated Results

Year ended December 31, 2018 compared to 2017

The Company recorded net earnings of $107.5 million in 2018, compared to $209.5 million in 2017. The earnings in 2018 were negatively impacted by lower volumes at Mount Milligan, resulting from a temporary shutdown in the first quarter of 2018 as well as reduced capacity in the first and fourth quarters of 2018 due to water shortages. The fourth quarter 2018 was also negatively impacted by a charge for reclamation expense of $41.8 million, mainly for additional water treatment costs at Thompson Creek Mine. Gold production at Kumtor in 2018 was also lower than the prior year due to lower grades processed. Results in 2018 included a gain of $28.0 million on the sale of the royalty portfolio, $9.4 million gain on the sale of the ATO property, partially offset by an asset impairment of $8.4 million related to the sale of the Mongolian business unit and $4.4 million of costs incurred as part of the acquisition of AuRico Metals Inc. in January 2018. The 2017 earnings include charges for a settlement reached with the Kyrgyz Republic Government of $60 million, an impairment charge relating to the Company’s Mongolian assets of $41.3 million ($39.7 million net of tax), a tax benefit of $21.3 million due to new tax legislation enacted in the United States and a gain of $9.8 million ($6.9 million net of tax) on the sale of the ATO property in Mongolia. Excluding these items, adjusted earningsNG in 2018 and 2017 were $77.8 million and $281.0 million respectively.

Production:

Gold production for 2018 totalled 729,556 ounces compared to 785,316 ounces for 2017. Gold production at Kumtor was 534,563 ounces in 2018, 5% lower than the 562,749 ounces produced in 2017. The decrease in ounces poured at Kumtor is a result of milling lower grade ore from stockpiles (3.29 g/t compared to 3.58 g/t) compared to 2017. During the year ended December 31, 2018, Mount Milligan produced 194,993 ounces of gold and 47.1 million pounds of copper, 12% lower than in 2017 for both metals.

Safety and Environment:

Centerra had twenty-three reportable injuries in 2018, including nine lost time injuries, ten medical aid injuries and four restricted work injuries.

There were no reportable releases to the environment in 2018.

Financial Performance:

Revenue decreased to $1,129.3 million in 2018 from $1,199.0 million in 2017, as a result of 10% fewer gold ounces sold (709,330 ounces compared to 792,466 ounces), 26% less copper pounds sold (44.4 million pounds compared to 59.7 million pounds) and lower average prices for both metals, partially offset by 42% higher molybdenum sales as compared to 2017.

Cost of sales increased in 2018 to $761.4 million compared to $682.1 million in 2017, mainly resulting from higher mining costs especially for diesel fuel at Kumtor, higher volumes in the molybdenum business, partially offset by lower sales volumes at Mount Milligan. Depreciation, depletion and amortization associated with production was $196.9 million in 2018 as compared to $195.0 million in 2017.

Standby costs of $10.8 million were recorded in the first quarter of 2018 representing overhead costs at Mount Milligan during the temporary mill shutdown and subsequent ramp-up period that were unrelated to normal processing volumes.

An increase in reclamation expenses of $41.8 million was recorded in the fourth quarter of 2018, mainly from a requirement for additional processing to treat water at Thompson Creek Mine.

In the second quarter of 2018, the Company recorded a pre-tax gain of $28.0 million as a result of the sale of the royalty portfolio and a gain of $9.4 million to recognize the final installments to be paid on the ATO sale.

The Company completed the sale of its Mongolian business unit on October 11, 2018 for net cash proceeds of $35 million. Given that the Mongolian business unit was a separate component of the Company, the net Mongolian activity in 2018 and in the comparative periods of 2017 have been classified as discontinued operations in the Company’s Statement of Earnings. As a result, the Company recorded a net loss of $5.9 million and $42.3 million from discontinued operations in 2018 and 2017 respectively. An impairment charge of $8.4 million was recorded in discontinued operations in 2018 to impair the carrying value of the Mongolian business unit to reflect its fair value (impairment of $39.7 million, net of tax, recorded in 2017).

Exploration expenditures in the year ended December 31, 2018 totalled $20.9 million compared to $11.3 million in 2017, reflecting the resumption of exploration activities at Kumtor ($6.1 million) in 2018 and increased spending on advanced projects, mainly at Öksüt, as compared to the prior year.

Corporate administration costs were $29.6 million in 2018, a decrease of $8 million compared to the same period of 2017, mainly due to a decrease in share-based compensation of $3.3 million resulting from a decline in the Company’s share price, lower costs for legal and consulting and lower employee costs, partially offset by additional administration costs associated with the acquisition of AuRico Metals Inc.

Operating Costs:

Operating costs (on a sales basis)NG increased to $564.5 million in 2018 compared to $487.1 million in 2017, which includes an increase in operating costs of $61.5 million in the molybdenum business, mainly as a result of increased volumes and prices.

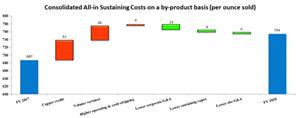

Centerra’s all-in sustaining costs on a by-product basis per ounce of gold soldNG, which excludes revenue-based tax and income tax, increased to $754 in 2018 from $687 in the comparative period mainly as a result of lower copper credits from lower Mount Milligan sales, higher mining costs at Kumtor and lower gold ounces sold, partially offset by lower capitalized stripping costs at Kumtor, lower sustaining capitalNG and lower administration costs in 2018 as compared to 2017.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/9526ac13-c062-454f-aa14-94a9d729f73c

Cash generation and capital management:

Cashflow

| Unaudited ($ millions, except as noted) | Year ended December 31, | |||

| 2018 | 2017 | % Change | ||

| Cash provided by operations before changes in working capitalNG | 336.6 | 512.6 | (34%) | |

| - Changes in working capital | (119.1) | (11.7) | 918% | |

| Cash provided by operating activities(1) | 217.5 | 500.9 | (57%) | |

| Cash used in investing activities: | ||||

| - Capital additions (cash) | (285.9) | (278.0) | 3% | |

| - Acquisition of AuRico Metals Inc., net of cash acquired | (226.8) | - | (100%) | |

| - Proceeds from sale of Mongolian segment | 35.0 | - | (100%) | |

| - Proceeds from sale of ATO Project | - | 9.8 | (100%) | |

| - Proceeds from sale of royalty assets | 155.5 | - | (100%) | |

| - (Increase) decrease in restricted cash | (26.8) | 248.0 | (111%) | |

| - Other investing items | (3.0) | 9.6 | (132%) | |

| Cash used in investing activities | (352.1) | (10.6) | 3210% | |

| Cash received from (used in) financing activities: | ||||

| - Net drawdown (repayment) of debt | (105.3) | (208.4) | 49% | |

| - Proceeds from equity issuances (net) | 1.0 | 2.2 | (54%) | |

| - Payment of interest and borrowing costs | (25.2) | (28.3) | (11%) | |

| Cash used in financing activities | (129.6) | (234.5) | 45% | |

| Increase (decrease) in cash and cash equivalents | (264.2) | 255.8 | (203%) | |

| (1) 2018 includes $4.2 million of cash used by discontinued operations ($9.5 million cash used in 2017) | ||||

Cash provided by operations decreased to $217.5 million in 2018, compared to $500.9 million in the comparative period, as a result of lower operating earnings and higher working capital levels in the current year. Comparing 2018 with 2017, Kumtor generated $291.0 million compared to $416.1 million, while Mount Milligan generated $37.4 million compared to $150.6 million, decreases mainly related to lower production at both operations. Working capital movements in 2018 reflect increased levels at all operating sites, especially for product inventory (increase in 2018 of $27.5 million at Kumtor, $19.0 million at Mount Milligan and $23.7 million in the Molybdenum business) due mainly to the timing of shipments and the purchase of feed material.

Cash used in investing activities totalled $352.1 million in 2018 as compared to $10.6 million in 2017. Included in 2018 is $226.8 million to acquire AuRico Metals Inc. and a total of $190.5 million net proceeds received from the sale of royalty assets and the sale of the Mongolian business unit. The comparative year of 2017 includes the release of Kumtor’s restricted cash of $248.0 million and net proceeds of $9.8 million from the sale of the ATO project.

Cash used in financing activities of $129.6 million in 2018 represents the net repayment of $155.0 million under the Corporate Facility, a drawdown of $49.7 million under the OMAS Facility to fund the Öksüt construction project, and payment of interest and borrowing costs of $25.2 million. The Company repaid $208.4 million on its debt and paid interest and borrowing costs of $28.3 million in 2017.

Cash, cash equivalents, restricted cash and short-term investments at December 31, 2018 totalled $179.2 million, as compared to $416.6 million at December 31, 2017.

Capital Expenditures

| Capital Expenditure (spent and accrued) | ||||

| $ millions | Year ended December 31, | |||

| 2018 | 2017 | Change | ||

| Consolidated: | ||||

| Sustaining capitalNG | 88.5 | 92.0 | (4%) | |

| Capitalized stripping (1) | 138.8 | 200.2 | (31%) | |

| Growth capitalNG | 16.7 | 18.1 | (8%) | |

| Öksüt Project development | 45.2 | 9.0 | 405% | |

| Greenstone Gold Property capital (2) | 10.0 | 5.0 | 100% | |

| Kemess Underground Project development | 30.9 | - | n/a | |

| Gatsuurt Project development | - | 1.8 | (100%) | |

| Total (3) | 330.1 | 326.1 | 1% | |

| (1) | Includes cash component of $103.9 million in the year ended December 31, 2018 ($149.4 million in 2017). | |||

| (2) | In accordance with the Company's accounting policy, the 50% share paid on behalf of Premier Gold Mines Limited in the project is capitalized as part of mineral properties in Property, Plant & Equipment. | |||

| (3) | Excludes capitalized equipment leases. | |||

Capital expenditures in 2018 totalled $330.1 million compared to $326.1 million in 2017, resulting mainly from reduced spending on capitalized stripping at Kumtor ($61.4 million) and lower sustaining capitalNG for equipment rebuilds and overhauls ($3.5 million), partially offset by higher spending on the Company’s development projects (mainly at Öksüt ($36.2 million), Kemess ($30.9 million) and Greenstone ($5.0 million)).

Financial Instruments

The Company seeks to manage its exposure to fluctuations in diesel fuel prices, commodity prices and foreign exchange rates by entering into derivative financial instruments from time-to-time.

Fuel Hedges:

The Company has a diesel fuel price hedging strategy using derivative instruments to manage the risk associated with changes in diesel fuel prices to the cost of operations at the Kumtor Mine. The Company hedges its exposure with crude oil futures contracts, as the price of diesel fuel closely correlates to the price of crude oil.

Gold and Copper Derivative Contracts:

The Company must satisfy its obligation under the Mount Milligan Streaming Arrangement by delivering refined physical gold and London Metal Exchange (“LME”) copper warrants to Royal Gold at the time of receiving payment from third-party purchasers who purchase concentrate from the Mount Milligan Mine. In order to hedge the metal price risk that arises when physical purchase and concentrate sales pricing periods do not match, the Company has entered into certain forward gold and copper purchases and forward sales contracts pursuant to which it purchases gold or copper at an average price during a future quotational period and sells gold or copper at the current spot price. These derivative contracts are not designated as hedging instruments.

Mount Milligan Gold and Copper Facility Hedges:

In 2017, the Company entered in a gold and copper hedge program as a condition precedent to draw on a credit facility.

As part of the amendment of the Corporate Facility in the first quarter of 2018, the hedging program is no longer required. In April 2018, the Company unwound a selection of hedges that were scheduled to settle in the second quarter of 2018. The Company realized a savings of $0.3 million when comparing the unwind cost to the amount that would have been due to counterparties had the unwound hedges settled in the normal course. In the third quarter, the Company unwound an additional 26.7 million pounds of copper zero-cost collars that were scheduled to settle through June 2019.

The hedge positions for each of these programs as at December 31, 2018 are summarized as follows:

| As at December 31, 2018 | ||||||

| Program | Instrument | Unit | Average strike price | Type | Settlement 2019 | Fair value gain (loss) ('000') |

| Fuel Hedges | Crude oil options(1) | Barrels | $63 | Fixed | 72,000 | $76 |

| Fuel Hedges | Zero-cost collars(2) | Barrels | $46/$59 | Fixed | 23,000 | $26 |

| Centerra B.C. Facility Hedging Program (Strategic Hedges): | ||||||

| Copper Hedges | Zero-cost collars(2) | Pounds | $2.50/$3.28 | Fixed | 12.6 million | ($26) |

| Gold Hedges | Zero-cost collars(2) | Ounces | $1,250/$1,368 | Fixed | 36,799 | $49 |

| Gold/Copper Hedges (Royal Gold deliverables): | ||||||

| Gold Derivative Contracts | Forward contracts(3) | Ounces | (4) | Float | 30,360 | $559 |

| Copper Derivative Contracts | Forward contracts(3) | Pounds | (4) | Float | 2.5 million | $296 |

| (1) Under crude oil options, the Company can buy fuel contracts at a specified price at a certain future date. | ||||||

| (2) Under the zero-cost collar: (i) the Company can put the number of gold ounces or copper pounds to the counterparty at the minimum price, if the price were to fall below the minimum, and (ii) the counterparty has the option to require the Company to sell to it the number of gold ounces or copper pounds at the maximum price, if the price were to rise above the maximum. | ||||||

| (3) Under the Royal Gold forward contracts, the Company must sell specified quantities of gold or copper, at a specified contract price at a future date. | ||||||

| (4) Royal Gold hedging program with a market price determined on closing of the contract. | ||||||

The remaining strategic hedging program settling in 2019 consists of 36,799 gold ounces of zero-cost collars at an average strike price range of $1,250 to $1,368 per ounce and 12.6 million pounds of zero-cost collars at an average strike price range of $2.50 to $3.28 per pound.

Centerra does not enter into off-balance sheet arrangements with special purpose entities in the normal course of its business, nor does it have any unconsolidated affiliates.

Operating Mines and Facilities

Kumtor Mine

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia operated by a Western-based gold producer. It has been in production since 1997 and has produced over 12.1 million ounces of gold to December 31, 2018.

Developments in 2018

- Kumtor produced 534,563 ounces of gold, exceeding the upper end of its favourably revised 2018 production guidance, at an all-in sustaining costs on a by-product basis per ounce soldNG of $694, excluding revenue-based tax, lower than its cost guidance.

- The Company continued to work with the Government of the Kyrgyz Republic to satisfy the conditions precedent to completion of the comprehensive settlement agreement entered into with the Government on September 11, 2017. The longstop date for satisfaction of all such conditions was extended a number of times by agreement of all parties and is now May 31, 2019. See “Other Corporate Developments – Kyrgyz Republic.”

Kumtor Operating Results

| ($ millions, except as noted) | Three months ended December 31, | Year ended December 31, | ||||||||

| 2018 | 2017 | % Change | 2018 | 2017 | % Change | |||||

| Financial Highlights: | ||||||||||

| Revenue - $ millions | 246.9 | 228.1 | 8% | 660.1 | 685.2 | (4%) | ||||

| Cost of sales (cash) | 57.7 | 44.9 | 28% | 195.3 | 146.0 | 34% | ||||

| Cost of sales (non-cash) | 51.3 | 39.7 | 29% | 154.6 | 145.7 | 6% | ||||

| Cost of sales (total) | 109.0 | 84.7 | 29% | 349.9 | 291.7 | 20% | ||||

| Cost of sales - $/oz sold (1) | 536 | 468 | 14% | 660 | 530 | 24% | ||||

| Cash provided by operations | 149.6 | 151.0 | (1%) | 291.0 | 416.1 | (30%) | ||||

| Cash provided by operations before changes in working capital(1) | 144.1 | 145.0 | (1%) | 345.0 | 424.3 | (19%) | ||||

| Operating Highlights: | ||||||||||

| Tonnes mined - 000s | 47,965 | 50,770 | (6%) | 180,331 | 181,878 | (1%) | ||||

| Tonnes ore mined – 000s | 2,235 | 2,607 | (14%) | 7,356 | 5,084 | 45% | ||||

| Average mining grade - g/t | 3.94 | 2.30 | 71% | 3.26 | 2.12 | 54% | ||||

| Tonnes milled - 000s | 1,445 | 1,668 | (13%) | 6,325 | 6,246 | 1% | ||||

| Average mill head grade - g/t | 5.49 | 3.76 | 46% | 3.29 | 3.58 | (8%) | ||||

| Mill Recovery - % | 87.5% | 80.4% | 9% | 79.3% | 79.1% | 0% | ||||

| Mining costs - total ($/t mined material) | 1.12 | 1.08 | 4% | 1.17 | 1.10 | 6% | ||||

| Milling costs ($/t milled material) | 12.70 | 9.16 | 39% | 10.65 | 10.69 | (0%) | ||||

| Gold produced – ounces | 228,096 | 158,165 | 44% | 534,563 | 562,749 | (5%) | ||||

| Gold sold – ounces | 203,388 | 180,703 | 13% | 530,448 | 550,134 | (4%) | ||||

| Average realized gold price (1) - $/oz sold | $ | 1,214 | $ | 1,262 | (4%) | $ | 1,244 | $ | 1,245 | (0%) |

| Capital Expenditures (sustaining) (1) - cash | 11.8 | 16.5 | (28%) | 43.7 | 60.6 | (28%) | ||||

| Capital Expenditures (growth) (1) - cash | 2.9 | 7.1 | (59%) | 16.7 | 18.1 | (8%) | ||||

| Capital Expenditures (stripping) - cash | 26.3 | 24.4 | 8% | 103.9 | 149.4 | (30%) | ||||

| Capital Expenditures (stripping) - non-cash | 9.7 | 7.5 | 30% | 34.9 | 50.9 | (31%) | ||||

| Capital expenditures (total) | 50.8 | 55.5 | (8%) | 199.2 | 279.0 | (29%) | ||||

| Operating Costs (on a sales basis)(2) | 57.7 | 44.9 | 28% | 195.3 | 146.0 | 34% | ||||

| All-in sustaining costs (including taxes) (1) | 138.0 | 127.4 | 8% | 461.1 | 480.6 | (4%) | ||||

| Adjusted operating costs (1)- $/oz sold | $ | 319 | $ | 298 | 7% | $ | 413 | $ | 313 | 32% |

| Operating Costs (on a sales basis)- $/oz sold(1) | $ | 286 | $ | 247 | 16% | $ | 370 | $ | 263 | 40% |

| Gold - All-in sustaining costs on a by-product basis - $/oz sold(1) | $ | 508 | $ | 526 | (3%) | $ | 694 | $ | 698 | (1%) |

| Gold - All-in sustaining costs on a by-product basis (including taxes) - $/oz sold(1) | $ | 679 | $ | 705 | (4%) | $ | 869 | $ | 874 | (1%) |

| (1) Non-GAAP measure. See discussion under “Non-GAAP Measures” | ||||||||||

| (2) Operating costs (on a sales basis) is a non-GAAP measure and is comprised of mine operating costs such as mining, processing, administration, royalties and production taxes (except at Kumtor where revenue-based taxes are excluded), but excludes reclamation costs and depreciation, depletion and amortization. | ||||||||||

Production:

During 2018, Kumtor focused on developing the Central Pit, through mining cut-backs 18 and 19, and unloading of ice. Mining of cut-back 18 was completed on November 12, 2018, ahead of schedule. Additionally, Kumtor carried out advanced work on cut-back 20 for pre-strip activities starting in September 2018.

Total waste and ore mined in 2018 was 180.3 million tonnes compared to 181.9 million tonnes in 2017, representing a slight decrease of 1%.

In 2018, the Company processed through the mill lower grade stockpiled ore remaining from cut-back 17 and stockpiled ore from the Sarytor Pit until August 2018, when it reached the Central Pit main ore body in cut-back 18, and started feeding the mill with high-grade ore. Kumtor produced 534,563 ounces of gold in 2018 compared to 562,749 ounces of gold in 2017. The decrease in ounces poured is as a result of blending hard ore from stockpiles with high preg-robbing Sarytor ore prior to reaching cut-back 18 high grade ore, compared to processing higher grade stockpiled ore from cut-back 17 in the comparative period of 2017. During 2018, Kumtor’s average mill head grade was 3.29 g/t with a recovery of 79.3% compared to 3.58 g/t and a recovery of 79.1% in 2017.

Operating costs and All-in Measures:

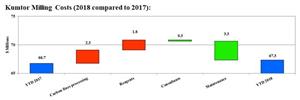

Operating costs (on a sales basis)NG, including capitalized stripping, increased in 2018 by $3.8 million to $299.2 million compared to $295.4 million in 2017. The movements in the major components of operating costs (mining, milling and site support), including capitalized stripping but before changes in inventory, is explained below:

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/258f7301-6bb0-4d07-ba84-24b26f46e665

Mining costs, including capitalized stripping, totalled $211.1 million in 2018 compared to $199.8 million in 2017. Increased costs in 2018 include higher diesel fuel costs ($21.4 million), which was due to higher fuel prices and higher consumption resulting from increased haulage distances. This was partially offset by lower maintenance cost on the haul trucks and the Liebherr shovels in 2018 as compared to 2017, lower camp catering costs and benefits from continuous improvement initiatives.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/d4a55c4e-9016-434f-9f3e-1c04f92ebdad

Milling costs amounted to $67.3 million in 2018 compared to $66.7 million in 2017 due to higher carbon fines processing costs ($2.3 million), which activities only commenced in 2018, and, higher mill reagents (carbon and cyanide) costs ($1.8 million) resulting from a higher consumption rate and higher grinding balls costs due to higher mill throughput. These were partially offset by lower maintenance costs ($3.3 million) resulting from decreased activities in 2018.

Site support Costs (2018 compared to 2017):

Site support costs in 2018 totalled $51.7 million compared to $45.1 million in the comparative year. This increase is attributable to camp charges which ceased to be allocated to mining and milling activities starting in 2018, partially offset by lower insurance premiums.

Other Cost movements:

Depreciation, depletion and amortization (“DD&A”) associated with sales increased to $154.6 million in 2018 from $145.7 million in the comparative period, mainly due to higher amortization of capitalized stripping associated with the early release of high grade ore from cut-back 18.

All-in sustaining costs on a by-product basis per ounce soldNG, which excludes revenue-based tax, was $694 in 2018 compared to $698 in 2017. The decrease was mainly due to lower capitalized stripping costs and decreased sustaining capital expenditures, partially offset by fewer ounces sold.

Including revenue-based taxes, all-in sustaining costs on a by-product basis per ounce soldNG was $869 in 2018 compared to $874 in the comparative year. The decrease was mainly due to lower all-in sustaining costsNG (explained above) and lower revenue based taxes resulted from decreases sales revenue in 2018.

Mount Milligan Mine

The Mount Milligan Mine is an open pit mine located in north central British Columbia, Canada producing a gold and copper concentrate. Production at Mount Milligan is subject to the Mount Milligan Streaming Arrangement pursuant to which Royal Gold is entitled to purchase 35% of the gold produced and 18.75% of the copper production at the Mount Milligan mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered.

Developments in 2018

On December 27, 2017, the Company reported that, due to a lack of sufficient water resources, mill processing operations at the Mount Milligan mine had been temporarily suspended. Mill processing operations resumed at partial capacity in February 2018 utilizing one ball mill to manage water requirements. The mill’s second ball circuit resumed operation in March 2018 after a build-up of sufficient water in the tailings storage facility (“TSF”) although the mill continued to operate at reduced capacity until the spring melt. Following the spring melt, Mount Milligan steadily improved mill throughput as additional water became available and improvements were made to the milling and maintenance processes.

Water Update

As noted earlier, starting in the fourth quarter of 2018, Mount Milligan reduced its milling throughput to properly manage its water balance during the winter season. The Company expects that the mill will return to a more normalized throughput following the onset of the 2019 spring melt in the second quarter.

In late 2018, the Company initiated a groundwater exploration drilling program at Mount Milligan. In December 2018, a five-hole (567 metres) Phase-1 scout drilling program was conducted east and north of the Tailing Storage Facility. This program followed-up results from Nuclear Magnetic Resonance (NMR) and Transient Electromagnetic (TEM) geophysical surveys completed between August and November 2018 that were designed to support water well targeting efforts for mill operations. Three of the five drill holes in two target areas (Alpine Lake and Lower Rainbow) produced low flow water, indicating good potential as areas for water well development.

Mount Milligan continues to seek approvals to access more sources of water in the medium and long-term. The Company has already obtained approvals to (i) pump from groundwater wells within Mount Milligan’s TSF, as well as from a single groundwater well outside of the TSF, for the entire life-of-mine, and (ii) pump up to 15% of the base flow from Philip Lake until April 30, 2019.

In addition, the Company expects to receive significant volumes of additional water from a number of sources (Philip Lake, Rainbow Creek, Meadows Creek and additional ground water sources within a radius of approximately 6 kilometres of the TSF). To that end, the Company has made applications to further amend its environmental assessment certificate as well as water license applications to enable drawing of water from such sources at rates that are protective of the environment. The Company continues its discussions with regulators, First Nations and other affected stakeholders regarding these applications and is seeking to have the amendments remain valid through September 2021. The approvals would enable the Company to benefit from spring melt flows for three seasons while a long-term updated water supply plan is developed.

With respect to the updated long-term water supply plan, the Company has retained a consultant to develop a methodology to assess water sources that are best able to supply water to the mill for life-of-mine while meeting environmental and other parameters. Formal applications and government review of that methodology is expected to commence shortly, and will be the subject of discussion with regulators, First Nations and other interested parties. The Company’s expectation is that its updated long-term water source (or sources) will be available from and after 2021 for the entire life-of-mine. See “Caution Regarding Forward-Looking Information.”

Mount Milligan Operating Results

| ($ millions, except as noted) | Three months ended December 31, | Year ended December 31, | ||||||||

| 2018 | 2017 | % Change | 2018 | 2017 | % Change | |||||

| Financial Highlights: | ||||||||||

| Gold sales | 65.2 | 61.7 | 6% | 173.5 | 242.9 | (29%) | ||||

| Copper sales | 23.9 | 29.2 | (18%) | 89.5 | 125.9 | (29%) | ||||

| Total Revenues | 89.1 | 90.8 | (2%) | 263.0 | 368.9 | (29%) | ||||

| Cost of sales (cash) | 57.0 | 51.6 | 10% | 176.4 | 209.7 | (16%) | ||||

| Cost of sales (non-cash) | 11.3 | 8.9 | 28% | 37.2 | 43.9 | (15%) | ||||

| Cost of sales (total) | 68.3 | 60.5 | 13% | 213.7 | 253.6 | (16%) | ||||

| Cash provided by (used in) operations | 39.3 | 29.2 | 35% | 37.4 | 150.6 | (75%) | ||||

| Cash provided by operations before changes in working capital(1) | 28.5 | 30.3 | (6%) | 63.1 | 138.6 | (54%) | ||||

| Operating Highlights: | ||||||||||

| Tonnes mined - 000s | 8,431 | 9,792 | (14%) | 33,225 | 41,966 | (21%) | ||||

| Tonnes ore mined – 000s | 3,678 | 4,776 | (23%) | 13,461 | 21,501 | (37%) | ||||

| Tonnes milled - 000s | 3,753 | 3,840 | (2%) | 13,556 | 17,743 | (24%) | ||||

| Mill Head Grade Copper (%) | 0.18% | 0.19% | (6%) | 0.20% | 0.18% | 12% | ||||

| Mill Head Grade Gold (g/t) | 0.76 | 0.75 | 1% | 0.71 | 0.64 | 11% | ||||

| Copper Recovery - % | 82.0% | 78.4% | 5% | 81.4% | 79.0% | 3% | ||||

| Gold Recovery - % | 67.0% | 64.3% | 4% | 64.5% | 62.4% | 3% | ||||

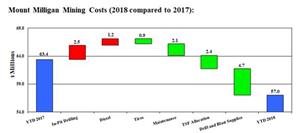

| Mining costs - total ($/t mined material) | $ | 2.22 | $ | 2.12 | 5% | $ | 2.22 | $ | 1.86 | 20% |

| Milling costs - total ($/t milled material) | $ | 5.81 | $ | 5.70 | 2% | $ | 6.26 | $ | 5.41 | 16% |

| Concentrate Produced (dmt) | 26,861 | 28,158 | (5%) | 105,998 | 121,502 | (13%) | ||||

| Payable Copper Produced (000's lbs) (4) | 11,796 | 12,261 | (4%) | 47,091 | 53,596 | (12%) | ||||

| Payable Gold Produced (oz) (4) | 60,271 | 58,587 | 3% | 194,993 | 222,567 | (12%) | ||||

| Gold Sales (payable oz)(4) | 66,366 | 61,524 | 8% | 178,882 | 242,331 | (26%) | ||||

| Copper Sales (000's payable lbs)(4) | 13,591 | 13,105 | 4% | 44,370 | 59,719 | (26%) | ||||

| Average Realized Price - Gold (combined) - $/oz (1) (3) | $ | 984 | $ | 978 | 1% | $ | 971 | $ | 1,003 | (3%) |

| Average Realized Price - Copper (combined) - $/lb (1) (3) | $ | 1.76 | $ | 2.23 | (21%) | $ | 2.02 | $ | 2.11 | (4%) |

| Capital Expenditures (sustaining) (1) - cash | 10.3 | 11.9 | (14%) | 42.7 | 30.0 | 42% | ||||

| Capital expenditures (total) | 10.3 | 11.9 | (14%) | 42.7 | 30.0 | 42% | ||||

| Operating Costs (on a sales basis) ('000s) (2) | 57.0 | 51.6 | 10% | 176.4 | 209.7 | (16%) | ||||

| Adjusted Operating costs- $/oz sold (1) | 533 | 385 | 38% | 519 | 370 | 40% | ||||

| Gold - All in Sustaining costs on a by-product basis - $/oz sold (1) | 689 | 594 | 16% | 764 | 505 | 51% | ||||

| Gold - All in Sustaining costs on a by-product basis (including taxes) - $/oz sold (1) | 707 | 612 | 16% | 779 | 525 | 48% | ||||

| Gold - All in Sustaining costs on a co-product basis - $/oz sold (1) | 676 | 706 | (4%) | 751 | 663 | 13% | ||||

| Copper - All in Sustaining costs on a co-product basis - $/pound sold (1) | 1.53 | 1.70 | (10%) | 1.77 | 1.47 | 20% | ||||

| (1) Non-GAAP measure. See discussion under “Non-GAAP Measures” | ||||||||||

| (2) Operating costs (on a sales basis) is comprised of mine operating costs such as mining, processing, site and regional office administration, royalties and production taxes, but excludes reclamation costs and depreciation, depletion and amortization. | ||||||||||

| (3) The average realized price of gold is a combination of market price paid by third parties and $435 per ounce paid by Royal Gold, while the average realized price of copper is a combination of market price paid by third parties and 15% of the spot price per metric tonne of copper delivered paid by Royal Gold, in each case under the Mount Milligan Streaming Arrangement. | ||||||||||