Centerra Gold Records Net Earnings of $167.4 million or $0.57 per Common Share, Adjusted Net Earnings (Non-GAAP) of $84.2 million or $0.28 per Common Share, Cash from Operations of $153.1 million and Free Cash Flow (Non-GAAP) of $72.1 million

All figures are in United States dollars and all production figures are on a 100% basis unless otherwise stated. This news release contains forward looking information regarding Centerra Gold’s business and operations. See “Caution Regarding Forward-Looking Information”. All references in this document denoted with NG, indicate a non-GAAP term which is discussed under “Non-GAAP Measures” and reconciled to the most directly comparable GAAP measure.

TORONTO, May 11, 2021 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE: CGAU) today reported its first quarter 2021 results. Key events and operating results of the first quarter included:

- Net earnings and adjusted net earningsNG of $167.4 million, $0.57 per common share (basic), and $84.2 million, $0.28 per common share (basic), respectively.

- Cash flow from operations and free cash flowNG of $153.1 million and $72.1 million, respectively.

- Cash position at quarter-end of $823.2 million with total liquidity of $1,223 million.

- Consolidated Production of 160,346 ounces of gold and 18.6 million pounds of copper.

- Gold production costs and copper production costs were $561 per ounce and $1.42 per pound, respectively.

- All-in sustaining costs on a by-product basisNG and All-in costs on a by-product basisNG were $745 per ounce and $1,073 per ounce, respectively.

- Finalized the sale of 50% interest in Greenstone Gold Mines Partnership for cash consideration of $210 million and contingent consideration of approximately $75 million. A gain of $72.3 million was recorded on the sale (excluding contingent consideration).

- Recent Kyrgyz Republic Developments resulted in several new legislative changes and legal claims affecting the Kumtor Mine, including a new Kyrgyz Republic law which could result in “external management” being imposed on Kumtor Gold Company (“KGC”), a $3 billion civil claim against KGC; various tax claims estimated at $352 million and several new and re-opened criminal investigations.

- Mount Milligan water permits extension received in April 2021, extending access to surface water sources to November 2023.

- Commenced trading on the New York Stock Exchange under the symbol “CGAU” on April 15, 2021.

- Quarterly Dividend declared of CAD$0.05 per common share.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “During the first quarter we continued to demonstrate positive safety performance as the Kumtor mine achieved one-year lost time injury free and Endako achieved six years reportable injury free. Across the organization we continue to stay vigilant with respect to the COVID-19 virus, proactively maintaining our rigorous safety protocols to prevent an outbreak and reduce the spread of the COVID-19 virus for the health and safety of our employees, contractors, communities and other stakeholders.”

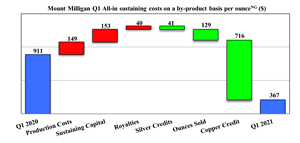

“In the first quarter, our three operating mines continued to deliver solid performances, including the Mount Milligan mine which generated record quarterly free cash flow. Company-wide our operations in the quarter delivered gold production of 160,346 ounces at all-in sustaining costsNG on a by-product basis of $745 per ounce. The Mount Milligan mine produced 42,576 ounces of gold and 18.6 million pounds of copper at all-in sustaining costsNG on a by-product basis of $367 per ounce, making it our lowest cost producer in the quarter. The Kumtor mine produced 90,169 ounces of gold at all-in sustaining costsNG on a by-product basis of $888 per ounce and the Öksüt mine produced 27,601 ounces of gold at all-in sustaining costsNG on a by-product basis of $804 per ounce as it now enters its first full year of commercial production.”

“Financially, the Company generated $153.1 million of cash from operations for the first three months of 2021, which includes $89.7 million from the Mount Milligan mine, $66.7 million from the Kumtor mine and $32 million from the Öksüt mine. Company-wide free cash flowNG generated in the first quarter of 2021 totalled $72.1 million, including $80.2 million from the Mount Milligan mine, $25.7 million from the Öksüt mine and $4 million from the Kumtor mine. With the proceeds of the disposition of the Greenstone property, we finished the quarter with a cash position of $823.2 million.”

“Based on the Company’s financial position, strong operating results and cash flows, the Board approved on May 10, 2021, a quarterly dividend of CAD$0.05 per share.”

“The Company notes that there is a great deal of uncertainty regarding future production and operations at the Kumtor Mine due to recent legislative changes in the Kyrgyz Republic relating to the Kumtor Mine. Accordingly, the 2021 guidance and previously disclosed 3-year outlook should be viewed with caution. We remain on track to achieve 2021 production and cost guidance at our Mount Milligan and Öksüt mines, and the Company is expected to generate $160 million (guidance midpoint) in free cashflow, excluding the Kumtor Mine.”

“The Company remains committed to trying to work with Kyrgyz Republic authorities to resolve these issues in accordance with the 2009 restated project agreements applicable to the Kumtor Mine, if the authorities are willing to do so. However, the Company will also use all legal avenues to defend itself against baseless environmental and tax cases in the Kyrgyz Republic as well against legislative changes that not only violate but fundamentally undermine the terms of the 2009 restated project agreements.”

“Recently, the Company successfully listed and commenced trading on the New York Stock Exchange to increase the Company’s visibility and exposure to investors in the United States.”

New York Stock Exchange Listing

Centerra’s common shares began trading on the New York Stock Exchange (NYSE) under the symbol “CGAU” on Thursday, April 15, 2021.

Kyrgyz Republic Update

As previously disclosed, the Kyrgyz Republic Parliament passed a law on May 6, 2021 which would enable the Kyrgyz Republic Government to impose “external management” on companies in the Kyrgyz Republic operating under concession agreements. The sponsor of the law, Mr. Akylbek Japarov, has acknowledged that the only project operating under a concession agreement in the Kyrgyz Republic is the Kumtor Mine and therefore this new law purports to regulate only the Kumtor Project. The Company understands that this newly adopted law on external management would apply in circumstances where Kumtor Gold Company (KGC) violates certain Kyrgyz laws relating to safety and thereby creates an immediate threat to the life or health of people. In such instances, the law would (i) enable the Prime Minister of the Kyrgyz Republic to appoint an external manager to take control of all management activities of KGC, including its bank accounts, and (ii) prohibit the Company or KGC’s board of directors from directing the external managers (or else face criminal sanctions).

Mr. A. Japarov is also the Chairman of the Kyrgyz Republic State Commission which was formed in February 2021 to review the activities of the Kumtor Mine and is expected to report its findings shortly.

The Company is also aware of other draft laws and decrees in the Kyrgyz Republic which seek to undermine the 2009 restated Kumtor project agreements and the tax and fiscal regime under which the Kumtor Mine has operated since 2009. It is unclear whether such drafts have progressed past the proposal stage.

On May 7, 2021, a Kyrgyz Republic court ruled against KGC in a case brought by four Kyrgyz Republic private citizens seeking a determination that KGC’s past practice of placing waste rock on glaciers was illegal. The court awarded damages of over U.S.$3 billion in favour of the Kyrgyz Republic. The Company notes that one of the claimants is the son of the current Director of the Kyrgyz Republic State Agency for Environment Protection and Forestry.

The Company has also received further tax assessments from the Kyrgyz Republic State Tax Service which when, combined with previous tax claims, amount to hundreds of millions of dollars.

As the Company has noted many times, the 2009 restated Kumtor project agreements provide a solid foundation for Kumtor’s operations and were approved by the Kyrgyz Republic Parliament and Constitutional Court in 2009. Those agreements were re-affirmed by the Government of the Kyrgyz Republic in 2017 when it entered into the Strategic Agreement on Environmental Protection and Investment Promotion which was completed and became fully effective in 2019. KGC’s operations and activities have always carefully adhered to those agreements and applicable laws. Furthermore, the Strategic Agreement included a release of the Company and KGC by the Kyrgyz Republic Government of all outstanding claims at such time, including damages for harm allegedly caused to the environment from storing production tails on glaciers. The Company therefore believes strongly that the claims advanced by the State Tax Service and such individual Kyrgyz Republic claimants are meritless and the new and draft Kyrgyz Republic laws noted above, if implemented, would clearly violate the 2009 restated project agreements and the 2009 Kyrgyz Republic laws which confirmed such agreements. The Kumtor Mine’s environmental performance adheres to international standards, including those of the European Bank for Reconstruction and Development, and has been audited multiple times by, among others, the Kyrgyz Government’s own environmental consultant, AMEC Foster Wheeler. AMEC’s reports have confirmed that the Kumtor Mine is operated in accordance with international best practice and its recommendations for improvements have been fully implemented by the Company in a manner agreed by the Kyrgyz Government in the 2017 Strategic Agreement. In terms of Kumtor’s safety record, the mine recently achieved, one year of operations free of any lost time injuries.

The Company believes that the actions of the Kyrgyz Republic authorities described above are a concerted effort to coerce Centerra to give up economic value or ownership of the Kumtor Mine or to falsely justify a nationalization of the Kumtor Mine. While the Company has benefited from a close and constructive dialogue with the Kyrgyz Republic authorities over many years and remains committed to trying to work with them to resolve any outstanding issues in accordance with the 2009 Restated Project Agreements applicable to the Kumtor Mine, it will not hesitate to use all legal avenues to protect its rights and interests and those of its shareholders and it intends to pursue its claim in international arbitration proceedings.

No assurances can be given that any of the current or future legal claims of the State Tax Service or individual claimants, disputes as to the application of current or future Kyrgyz Republic laws relating to the Kumtor Mine, the results of the State Commission review or any other future regulatory, civil or criminal claims impacting KGC or Centerra can be resolved without a material impact on the Company. See “Contingencies” for further information relating to these Kyrgyz Republic developments.

COVID-19 Update

Centerra continues to prioritize the health, safety and well-being of its employees, contractors, communities, and other stakeholders during the current outbreak of COVID-19 and to take steps to minimize the effect of the pandemic on its business. The Company has established strict COVID-19 protocols at its mine sites to help prevent infection and reduce the potential transmission of COVID-19. In addition, operating mine sites continue to assess the resiliency of their supply chains, maintaining increased mine site inventories of key materials. The Company has also implemented travel restrictions and has temporarily closed or limited office capacity at its various administration offices including its head office in Toronto.

In Turkey and the Kyrgyz Republic, the week-over-week status appears to be stabilizing, with the national daily COVID-19 case count in Turkey at approximately 25,000 (down from a high of 65,000 in recent weeks) and the national COVID-19 daily case count in the Kyrgyz Republic holding at approximately 300 cases per day. At the Öksüt mine, 17 individuals are in quarantine, primarily from the mine’s open pit mining contractor. The Turkish Government has declared a nine-day public holiday & stay-at-home period for the post Ramadan celebration in May 2021, during which blasting activities in the open pit at the Öksüt mine will be halted, resulting in a net two to three days of no mining activity. In the Prince George region of British Columbia, Canada, near the Mount Milligan mine, daily COVID-19 case counts at approximately 150, (down from a high of approximately 200 in recent weeks). As part of the roll-out of vaccinations across Northern British Columbia, COVID-19 vaccinations were made available to Mount Milligan employees in April 2021. The majority of the Molybdenum Business Unit is located in the United States have not been materially affected by COVID-19 due, in part, to a rapid COVID-19 vaccination roll-out.

COVID-19 has not materially affected Centerra’s operations as employee absences due to COVID-19 and other illnesses have so far been successfully managed. The Company notes that the effects of COVID-19 on its business continue to change rapidly. The measures enacted to date reflect the Company’s best assessment at this time but will remain flexible and be revised as necessary or advisable and/or as recommended by the public health and governmental authorities.

Exploration Update

Exploration activities in the first quarter of 2021 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Turkey, Finland, USA and the Kyrgyz Republic.

Exploration expenditures were $9.3 million in the first quarter of 2021 compared to $7.8 million in the same quarter of 2020. The increase in exploration expenditures was due to a significantly expanded drilling program at the Kumtor mine, drilling approximately 20,000 metres in the first quarter of 2021, as well as the recommencement of drilling activities at Öksüt and Mount Milligan earlier in than the prior period.

Selected drill program results and intercepts are highlighted in the supplementary data at the end of this news release. The drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/ebc019dc-6dc1-46a5-a948-2fde2391fd4f

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties in North America, Asia and other markets worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra operates three mines, the Kumtor mine in the Kyrgyz Republic, the Mount Milligan mine in British Columbia, Canada and the Öksüt mine in Turkey. Centerra's shares trade on the Toronto Stock Exchange (TSX) under the symbol CG and on the New York Stock Exchange (NYSE) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

Conference Call

Centerra invites you to join its 2021 first quarter conference call on Tuesday, May 11, 2021 at 8:30 AM Eastern Time. The call is open to all investors and the media. To join the call, please dial toll-free in North America: (800) 582-1443. International participants may access the call at: +1 (212) 231-2910. Results summary presentation slides are available on Centerra Gold’s website at www.centerragold.com. Alternatively, an audio feed webcast will be broadcast live by Intrado and can be accessed live at Centerra Gold’s website at www.centerragold.com. A recording of the call will be available on www.centerragold.com shortly after the call and via telephone until midnight Eastern Time on May 18, 2021 by calling: +1 (416) 626-4100 or 1 (800) 558-5253 and using passcode 21993267.

For more information:

John W. Pearson

Vice President, Investor Relations

Centerra Gold Inc.

(416) 204-1953

john.pearson@centerragold.com

Additional information on Centerra Gold is available on the Company’s web site at www.centerragold.com and at SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

A PDF accompanying this announcement is available at: http://ml.globenewswire.com/Resource/Download/496ad340-125b-4cfd-afdd-b55846342aab

Management’s Discussion and Analysis

For the Period Ended March 31, 2021

This Management Discussion and Analysis (“MD&A”) has been prepared as of May 10, 2021 and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three months ended March 31, 2021 in comparison with the corresponding period ended March 31, 2020. This discussion should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three months ended March 31, 2021 prepared in accordance with International Financial Reporting Standards (“IFRS”). This MD&A should also be read in conjunction with the Company’s audited annual consolidated financial statements for the years ended December 31, 2020 and 2019, the related MD&A and the Annual Information Form for the year ended December 31, 2020 (the “2020 Annual Information Form”). The Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three months ended March 31, 2021, the 2020 Annual Report and the 2020 Annual Information Form are available at www.centerragold.com, on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and on the Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) www.sec.gov/edgar. In addition, this discussion contains forward looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. See “Caution Regarding Forward-Looking Information” in this discussion. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated. All references in this document denoted with NG indicate a non-GAAP term which is discussed under “Non-GAAP Measures” and reconciled to the most directly comparable GAAP measure.

Caution Regarding Forward-Looking Information

Information contained in this document which are not statements of historical facts, and the documents incorporated by reference herein, may be “forward-looking information” for the purposes of Canadian securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward looking information. The words “believe”, “expect”, “anticipate”, “contemplate”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule”, “understand” and similar expressions identify forward-looking information. These forward-looking statements relate to, among other things: statements regarding 2021 Guidance, including guidance on production, cost and capital spend in 2021, and the assumptions used in preparing; the impact, if any, of the Kyrgyz State Commission, new and proposed Kyrgyz legislation which appears to provide a means of temporary or permanent nationalization of the Kumtor Mine, other Kyrgyz Republic developments to date including the tax claims and requests to re-audit initiated by Kyrgyz Republic State Tax Services, the citizens claim commenced in Kyrgyz courts claiming for damage caused by the historical practice of placing waste rock on glaciers, and criminal investigations commenced or re-opened by the Kyrgyz Republic authorities; pursuit of the Company’s claims against the Kyrgyz Republic in international arbitration; planned exploration in 2021; possible impacts to its operations relating to COVID-19; the Company’s expectations regarding having sufficient liquidity for 2021; the Company’s expectation regarding having sufficient water at the Mount Milligan mine in the medium term, and its plans for a long term solution; expectations regarding the receipt of a forestry permit for the Öksüt mine and plans to access the Güneytepe deposit in 2022; and expectations regarding litigation involving the Company.

Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable by Centerra, are inherently subject to significant technical, political, business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking information. Factors and assumptions that could cause actual results or events to differ materially from current expectations include, among other things: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in the Kyrgyz Republic, Turkey and Canada; the failure of the Kyrgyz Republic Government to comply with its continuing obligations under the Strategic Agreement, including the requirement that it comply at all times with its obligations under the Kumtor Project Agreements, allow for the continued operation of the Kumtor mine by KGC and KOC and not take any expropriation action against the Kumtor mine including through imposition of external management appointed by the Kyrgyz Republic Government; actions by the Kyrgyz Republic Government or any state agency or the General Prosecutor's Office that serve to restrict or otherwise interfere with the payment of funds by KGC and KOC to Centerra; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates or its current or former employees, including the interaction of claims of harm to the environment or human health with a new Kyrgyz Republic law that could enable imposition of external management on the Kumtor Mine by the Kyrgyz Republic Government; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company, including the potential failure to negotiate a mutually acceptable outcome of disputes relating to the Kumtor Mine; risks that an arbitrator will reject the Company’s claims against the Kyrgyz Republic or that such claims may not be practically enforceable against the Kyrgyz Republic; the impact of the delay by relevant government agencies to provide required approvals, expertise and permits; potential impact on the Kumtor mine of investigations by Kyrgyz Republic instrumentalities; the impact of constitutional changes in the Kyrgyz Republic and/or Turkey; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Russian and Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; the presence of a significant shareholder that is a state-owned company of the Kyrgyz Republic; risks related to anti-corruption legislation; risks related to the concentration of assets in Central Asia; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper and other mineral prices, the use of provisionally-priced sales contracts for production at the Mount Milligan mine, reliance on a few key customers for the gold-copper concentrate at the Mount Milligan mine, use of commodity derivatives, the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on, the accuracy of the Company’s production and cost estimates, the impact of restrictive covenants in the Company’s credit facilities which may, among other things, restrict the Company from pursuing certain business activities or making distributions from its subsidiaries, the Company’s ability to obtain future financing, the impact of global financial conditions, the impact of currency fluctuations, the effect of market conditions on the Company’s short-term investments, the Company’s ability to make payments including any payments of principal and interest on the Company’s debt facilities depends on the cash flow of its subsidiaries; and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including the stability of the pit walls at our operations, the movement of the Davidov Glacier, waste and ice movement and continued performance of the buttress at the Kumtor mine; the occurrence of further ground movements at the Kumtor mine and mechanical availability; the risk of having sufficient water to continue operations at the Mount Milligan mine and achieve expected mill throughput; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational risks; mechanical breakdowns; the Company’s ability to replace its mineral reserves; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully re-negotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic including, but not limited to, the COVID-19 pandemic; seismic activity in the vicinity of the Company’s properties; long lead times required for equipment and supplies given the remote location of some of the Company’s operating properties; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; the Company’s ability to accurately predict decommissioning and reclamation costs; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; and the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns and project resources. For additional risk factors, please see section titled “Risks Factors” in the Company’s most recently filed Annual Information Form available on SEDAR at www.sedar.com and EDGAR www.sec.gov/edgar.

There can be no assurances that forward-looking information and statements will prove to be accurate, as many factors and future events, both known and unknown could cause actual results, performance or achievements to vary or differ materially from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained herein or incorporated by reference. Accordingly, all such factors should be considered carefully when making decisions with respect to Centerra, and prospective investors should not place undue reliance on forward looking information. Forward-looking information is as of May 10, 2021. Centerra assumes no obligation to update or revise forward-looking information to reflect changes in assumptions, changes in circumstances or any other events affecting such forward-looking information, except as required by applicable law.

TABLE OF CONTENTS

| Overview | 11 |

| Consolidated Financial and Operational Highlights | 12 |

| Overview of Consolidated Results | 13 |

| Outlook | 14 |

| Financial Performance | 18 |

| Balance Sheet Review | 19 |

| Market Conditions | 20 |

| Financial Instruments | 22 |

| Operating Mines and Facilities | 23 |

| Pre-Development Projects | 32 |

| Quarterly Results – Previous Eight Quarters | 33 |

| Related party transactions | 34 |

| Contingencies | 34 |

| Accounting Estimates, Policies and Changes | 38 |

| Disclosure Controls and Procedures and Internal Control Over Financial Reporting | 39 |

| Non-GAAP Measures | 39 |

| Qualified Person & QA/QC – Non-Exploration (including Production information) | 45 |

Overview

Centerra is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra’s principal operations are the Kumtor Gold mine located in the Kyrgyz Republic, the Mount Milligan Gold-Copper mine located in British Columbia, Canada, and the Öksüt Gold mine located in Turkey. The Company has one property in Canada in the pre-development stage, the Kemess Underground Gold Property. The Company sold its interest in the Greenstone Gold Mines Partnership, which included its interest in the Hardrock deposit, effective January 19, 2021. The Company owns exploration properties in Canada, the United States of America and Turkey and has options to acquire exploration joint venture properties in Canada, Finland, Turkey, and the United States of America. The Company owns various assets within its Molybdenum Business Unit, particularly the Langeloth metallurgical processing facility in Pennsylvania, United States of America and two primary molybdenum mines currently on care and maintenance, the Thompson Creek Mine in Idaho, United States of America, and the Endako Mine (75% ownership) in British Columbia, Canada.

As of March 31, 2021, Centerra’s significant subsidiaries are as follows:

| Current | Property | ||

| Entity | Property - Location | Status | Ownership |

| Kumtor Gold Company (“KGC”) | Kumtor Mine - Kyrgyz Republic | Operation | 100% |

| Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | Operation | 100% |

| Öksüt Madencilik A.S. (“OMAS”) | Öksüt Mine - Turkey | Operation | 100% |

| Langeloth Metallurgical Company LLC | Langeloth - United States | Operation | 100% |

| AuRico Metals Inc. | Kemess Underground Project - Canada | Pre-development | 100% |

| Thompson Creek Mining Co. | Thompson Creek Mine - United States | Care and Maintenance | 100% |

| Thompson Creek Metals Company Inc. | Endako Mine - Canada | Care and Maintenance | 75% |

The Company’s common shares are listed on the Toronto Stock Exchange and trade under the symbol CG and, effective April 15, 2021, on the New York Stock Exchange and trade under the symbol CGAU.

As of May 10, 2021, there are 296,696,357 common shares issued and outstanding, options to acquire 3,551,054 common shares outstanding under its stock option plan and 1,034,191 units outstanding under its restricted share unit plan (exercisable on a 1:1 basis for common shares).

The Company reports the results of its operations in U.S. dollars, however not all of its costs are incurred in U.S. dollars. As such, the movement in exchange rates between the currencies in which the Company incurs costs and the U.S. dollar impacts the reported costs of the Company.

Consolidated Financial and Operational Highlights

| Unaudited ($ millions, except as noted) | Three months ended March 31 | |||||

| Financial Highlights | 2021 | 2020 | % Change | |||

| Revenue | $ | 401.9 | $ | 378.8 | 6 | % |

| Production costs | 169.7 | 169.4 | 0 | % | ||

| Standby costs | - | 6.8 | (100 | %) | ||

| Depreciation, depletion, and amortization | 72.9 | 73.0 | (0 | %) | ||

| Earnings from mine operations | $ | 159.3 | $ | 129.6 | 23 | % |

| Net earnings | $ | 167.4 | $ | 20.0 | 737 | % |

| Adjusted net earnings(1) | $ | 84.2 | $ | 46.4 | 81 | % |

| Cash provided by operations | 153.1 | 121.1 | 26 | % | ||

| Cash provided by operations before changes in working capital | 183.4 | 143.3 | 28 | % | ||

| Free cash flow(1) | 72.1 | 77.0 | (6 | %) | ||

| Sustaining capital expenditures(2) | 20.8 | 14.5 | 44 | % | ||

| Non-sustaining capital expenditures(2)(3) | 22.2 | 13.4 | 66 | % | ||

| Capitalized stripping(2) | 41.7 | 40.0 | 4 | % | ||

| Total assets | 3,327.7 | 2,792.9 | 19 | % | ||

| Long-term debt and lease obligations | 13.7 | 150.6 | (91 | %) | ||

| Cash, and cash equivalents | 823.2 | 193.9 | 325 | % | ||

| Per Share Data | ||||||

| Earnings per common share - $/share basic (4) | $ | 0.57 | $ | 0.07 | 714 | % |

| Adjusted net earnings per common share - $/share basic (1)(4) | $ | 0.28 | $ | 0.16 | 75 | % |

| Per Ounce Data (except as noted) | ||||||

| Average gold spot price ($/oz)(5) | 1,797 | 1,582 | 14 | % | ||

| Average realized gold price ($/oz )(1)(6) | 1,627 | 1,487 | 9 | % | ||

| Average copper spot price ($/lb)(5) | 3.86 | 2.57 | 50 | % | ||

| Average realized copper price ($/lb )(1)(6) | 2.72 | 1.61 | 69 | % | ||

| Operating Highlights | ||||||

| Gold produced (oz) | 160,346 | 190,474 | (16 | %) | ||

| Gold sold (oz) | 180,519 | 203,258 | (11 | %) | ||

| Copper produced (000's lb) | 18,609 | 20,072 | (7 | %) | ||

| Copper sold (000's lb) | 22,783 | 20,423 | 12 | % | ||

| Unit Costs | ||||||

| Gold production costs ($/oz) | $ | 561 | $ | 437 | 28 | % |

| All-in sustaining costs on a by-product basis ($/oz)(1)(6) | $ | 745 | $ | 718 | 4 | % |

| All-in costs on a by-product basis ($ /oz)(1)(6) | $ | 1,073 | $ | 1,024 | 5 | % |

| Gold - All-in sustaining costs on a co-product basis($/oz)(1) | $ | 876 | $ | 676 | 30 | % |

| Copper production costs ($/lb) | $ | 1.42 | $ | 1.37 | 4 | % |

| Copper - All-in sustaining costs on a co-product basis – ($/lb)(1) | $ | 1.68 | $ | 1.52 | 11 | % |

| (1) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (2) | Capital expenditures are presented as spent and accrued. Capitalized stripping includes non-cash of $6.8 million in the first quarter of 2021 (2020: $10 million). |

| (3) | Non-sustaining capital expenditures are distinct projects designed to have a significant increase in the net present value of the mine. In the current year, non-sustaining capital expenditures included costs related to the mine expansion at Kumtor and construction costs at the Öksüt mine. |

| (4) | At March 31 2021, the Company had 296,511,550 common shares issued and outstanding. |

| (5) | Average for the period as reported by the London Bullion Market Association (US dollar Gold P.M. Fix Rate) and London Metal Exchange (LME). |

| (6) | Includes the impact of reduced metal prices resulting from the Mount Milligan Streaming Arrangement, and the impact of copper hedges. |

Overview of Consolidated Results

First Quarter 2021 compared to First Quarter 2020

Net earnings of $167.4 million were recognized in the first quarter of 2021, compared to net earnings of $20 million in the first quarter of 2020. The increase in net earnings was due to the increase in ounces of gold sold at the Öksüt and Mount Milligan mines, a 9% higher average realized gold price, and a 69% higher average realized copper price, compared to the same prior year period, as well as a gain of $72.3 million in the current quarter, on the sale of Centerra’s 50% interest in the Greenstone Gold Mines Partnership, partially offset by less gold ounces sold at the Kumtor mine.

Adjusted net earningsNG in the first quarter of 2021 was $84.2 million after adjusting for the $72.3 million gain on the sale of Centerra’s 50% interest in the Greenstone Gold Mines Partnership and the $10.9 million gain resulting from the reduction in the reclamation liability due to favourable discount rate movements. Adjusted net earningsNG in the first quarter of 2020 was $46.4 million, after adjusting for the $26.4 million charge resulting from the increase in the reclamation liability due to unfavourable discount rate movements.

Cash provided by operations was $153.1 million in the first quarter of 2021, compared to $121.1 million in the first quarter of 2020. The increase in cash provided by operations was due to increased earnings from mine operations at the Öksüt mine which recorded a full quarter of operations and the Mount Milligan mine which recognized its highest quarterly cash from mine operations since it commenced production. The comparative first quarter of 2020 included the receipt of a tax refund of $11.4 million collected at the molybdenum business unit.

Free cash flowNG of $72.1 million was recognized in the first quarter of 2021, compared to $77 million in the first quarter of 2020. The decrease in free cash flowNG was due to higher capital expenditures including the purchase of haul trucks for the life of mine extension at the Kumtor mine and major planned equipment rebuilds at the Mount Milligan mine, partially offset by higher cash provided by operations.

Safety and Environment

During the first quarter of 2021, the Kumtor mine achieved one-year lost time injury free, and the Endako mine achieved six years reportable injury free. In addition, Centerra experienced zero reportable injuries and zero significant incidents Company-wide in the month of March 2021.

There were four reportable injuries company-wide in the first quarter of 2021, including one lost time injury, two medical aid injuries and one restricted work injury.

Centerra has implemented a number of proactive measures to prevent infection and reduce the spread of COVID-19 for the health and safety of its employees, contractors, communities and other stakeholders.

There were no reportable incidents to the environment in the first quarter of 2021.

Outlook

The Company notes that there is a great deal of uncertainty regarding future production and operations at the Kumtor Mine due to recent legislative changes in the Kyrgyz Republic, public rhetoric regarding nationalization, and tax and legal claims and investigations relating to the Kumtor Mine. Accordingly, the following 2021 guidance and previously disclosed 3-year outlook should be viewed with caution and may be materially different as a result of the foregoing and similar matters. For further information, please refer to “Caution Regarding Forward-Looking Information” and “Contingencies”.

2021 Production Guidance

Centerra’s 2021 consolidated gold production guidance remains unchanged and is expected to be between 740,000 to 820,000 ounces. Production from the Kumtor, Mount Milligan and Öksüt mines is expected to be weighted to the second half of the year, representing up to 60% of 2021 annual gold production. Öksüt’s second quarter production volumes are expected to represent 15% of its 2021 annual gold production due to the sequencing of lower-grade ore onto the leach pad, with meaningfully higher-grade ore stacking expected in the second half of the year.

Centerra’s 2021 production forecast is unchanged from previous guidance and is as follows:

| Units | Kumtor | Mount Milligan(1) | Öksüt | Centerra Consolidated | |

| Gold | |||||

| Unstreamed Gold Production | (Kozs) | 470-510 | 117-130 | 90-110 | 677-750 |

| Streamed Gold Production(1) | (Kozs) | - | 63-70 | - | 63-70 |

| Total Gold Production(2) | (Kozs) | 470-510 | 180-200 | 90-110 | 740-820 |

| Copper | |||||

| Unstreamed Copper Production | (Mlb) | - | 57-65 | - | 57-65 |

| Streamed Copper Production(1) | (Mlb) | - | 13-15 | - | 13-15 |

| Total Copper Production(3) | (Mlb) | - | 70-80 | - | 70-80 |

| (1) | The Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively, from the Mount Milligan mine. Under the Mount Milligan Streaming Arrangement, Royal Gold will pay $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered. |

| (2) | Gold production assumes recoveries of 81.9% at Kumtor, 63.9% at Mount Milligan and approximately 75% at Öksüt. |

| (3) | Copper production assumes 78.8% recovery for copper at Mount Milligan. |

2021 Sales, All-in Sustaining and All-in Unit Costs GuidanceNG

Centerra’s 2021 sales and cost metrics are unchanged from the previous guidance and are as follows:

| Units | Kumtor | Mount Milligan | Öksüt | Centerra Consolidated(2) | |

| Ounces of gold sold | (Kozs) | 470 - 510 | 180 - 200 | 90 - 110 | 740 - 820 |

| Gold production costs | ($/oz) | 400 - 450 | 650 -700 | 500 - 550 | 475 - 525 |

| All-in sustaining costs on a by-product basis(1) | ($/oz) | 950 - 1,000 | 530 - 580 | 730 - 780 | 850 - 900 |

| Revenue-based taxes | ($/oz) | 250 - 255 | - | - | 160 - 165 |

| All-in sustaining costs on a by-product basis, including revenue-based taxes (1), (2), (3) | ($/oz) | 1,200 - 1,255 | 530 - 580 | 730 - 780 | 1,010 - 1,065 |

| All-in costs on a by-product basis(1),(2),(3) | ($/oz) | 1,365 - 1,420 | 590 - 640 | 790 - 840 | 1,175 - 1,230 |

| Gold - All-in sustaining costs on a co-product basis(1),(2) | ($/oz) | 950 - 1,000 | 910 - 1,025 | 730 - 780 | 950 - 1,055 |

| Copper production costs | ($/lb) | - | 1.30-1.45 | - | 1.30-1.45 |

| Copper - All-in sustaining costs on a co-product basis (1),(2) | ($/lb) | - | 1.75-1.95 | - | 1.75-1.95 |

| (1) | All-in sustaining costs and all-in costs on a by-product and co-product basis are non-GAAP measures and are discussed under “Non-GAAP Measures”. Gold production cost per ounce is different from the all-in sustaining costs on a by-product basis measure and is considered the nearest GAAP measure. |

| (2) | Mount Milligan production and ounces sold are on a 100% basis (the Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively). Unit costs and consolidated unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costs and all-in sustaining costs including revenue-based taxes. Production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and metal deductions, subject to metal content, levied by smelters. |

| (3) | Includes revenue-based taxes at Kumtor. |

2021 Taxes

In April 2021, the Government of Turkey enacted a corporate tax rate increase from 20% to 25% for 2021. As a result of the tax benefits available under the Company’s Investment Incentive Certificate, income tax in 2021 for the Öksüt mine is expected to be unchanged from previous guidance of between $1 to $2 million.

2021 Sensitivities

Centerra’s revenues, earnings, and cash flows for 2021 are sensitive to changes in certain key inputs or currencies. The Company has estimated the impact of any such changes on revenues, net earnings, and cash flows for the remaining nine months of 2021 as follows:

| Impact on ($ millions) | Impact on ($ per ounce sold) | |||||||

| Production Costs & Taxes | Capital Costs | Revenues | Cash flows | Net Earnings (after tax) | AISC(2)(3) on by-product basis | |||

| Gold price | $50/oz | 3.5 - 4.0 | - | 26.0 - 29.5 | 22.5 - 25.5 | 22.5 - 25.5 | 1.5 - 2.0 | |

| Copper price(4) | 10% | 0.1 - 0.2 | - | 1.5 - 4.5 | 1.4 – 4.3 | 1.4 – 4.3 | 6.5 - 7.5 | |

| Diesel fuel(3) | 10% | 4.5- 5.0 | 9.0 - 11.0 | - | 13.5 - 16.0 | 4.5 - 5.0 | 25.0 - 28.5 | |

| Kyrgyz som(1) | 1 som | 0.5 - 1.0 | - | - | 0.5 - 1.0 | 0.5 - 1.0 | 1.5 - 2.0 | |

| Canadian dollar(1)(3) | 10 cents | 8.0 – 9.5 | 1.5 - 2.0 | - | 9.5 – 11.5 | 8.0 – 9.5 | 18.0 – 20.5 | |

| Turkish lira(1) | 1 lira | 2.5 - 3.0 | 0.5 - 1.0 | - | 3.0 - 4.0 | 2.5 - 3.0 | 6.5 - 7.0 | |

| (1) | Appreciation of currency against the U.S. dollar will result in higher costs and lower cash flow and earnings, depreciation of currency against the U.S. dollar results in decreased costs and increased cash flow and earnings. |

| (2) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (3) | Includes the effect of hedging programs. |

| (4) | 2021 copper sales are hedged up to 95%. |

Production, cost and capital forecasts for 2021 are forward-looking information and are based on key assumptions and subject to material risk factors that could cause actual results to differ materially, and which are discussed herein under the headings “2021 Material Assumptions” and “Caution Regarding Forward-Looking Information” in this document and under the heading “Risks That Can Affect Our Business” in this document and the Company’s most recently filed Annual Information Form. The Company notes that there is a great deal of uncertainty regarding future production and operations at the Kumtor Mine due to recent legislative changes in the Kyrgyz Republic relating to the Kumtor Mine. Accordingly, the 2021 guidance and previously disclosed 3-year outlook should be viewed with caution. The recent legislative changes are discussed herein under the heading “Contingencies”.

2021 Material Assumptions

Material assumptions or factors used to forecast production and costs for 2021, after giving effect to the hedges in place at December 31, 2020, are unchanged and include the following:

- a market gold price of $1,750 per ounce and an average realized gold price at Mount Milligan of $1,290 per ounce after reflecting the Mount Milligan Streaming Arrangement (35% of Mount Milligan’s gold at $435 per ounce).

- a market copper price of $3.36 per pound and an average realized copper price at Mount Milligan of $2.82 per pound after reflecting the Mount Milligan’s Streaming Arrangement (18.75% of Mount Milligan’s copper at 15% of the spot price per metric tonne).

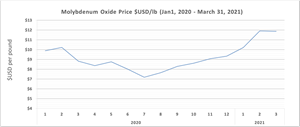

- a molybdenum price of $9 per pound.

- exchange rates:

- $1USD:$1.31 Canadian dollar,

- $1USD:80 Kyrgyz som,

- $1USD:7.50 Turkish lira.

- diesel fuel price assumption:

- $0.44/litre at Kumtor,

- $0.69/litre (CAD$0.90/litre) at Mount Milligan.

Kumtor Fuel

The assumed diesel price of $0.44/litre at the Kumtor mine assumes that no Russian export duty will be paid on the fuel exports from Russia to the Kyrgyz Republic. Diesel fuel for the Kumtor mine is sourced from separate Russian suppliers. The diesel fuel price assumes a price of oil of approximately $53 per barrel. Crude oil is a component of diesel fuel purchased by the Company, such that changes in the price of Brent crude oil generally impacts diesel fuel prices.

Mount Milligan Streaming Arrangement

The Mount Milligan mine is an open pit mine located in north central British Columbia, Canada producing a gold and copper concentrate. Production at the Mount Milligan mine is subject to an arrangement with RGLD Gold AG and Royal Gold, Inc. (together, “Royal Gold”) pursuant to which Royal Gold is entitled to purchase 35% of the gold produced and 18.75% of the copper production at the Mount Milligan mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered (the “Mount Milligan Streaming Arrangement”). To satisfy its obligations under the Mount Milligan Streaming Arrangement the Company purchases refined gold and copper warrants and arranges for delivery to Royal Gold. The difference between the cost of the purchases of refined gold and copper warrants, and the corresponding amounts payable to the Company under the Mount Milligan Streaming Arrangement is recorded as a reduction of revenue and not a cost of operating the mine.

Other Material Assumptions

Other material assumptions used in forecasting production and costs for 2021 can be found under the heading “Caution Regarding Forward-Looking Information” in this document.

Financial Performance

First Quarter 2021 compared to First Quarter 2020

Revenue of $401.9 million was recognized in the first quarter of 2021 compared to $378.8 million in the first quarter of 2020. The increase in revenue was due to 27,584 gold ounces sold at the Öksüt mine, which commenced commercial production on May 31, 2020, higher average realized gold and copper prices and increased gold ounces sold at the Mount Milligan mine, partially offset by fewer gold ounces sold at the Kumtor mine.

Total gold production was 160,346 ounces in the first quarter of 2021 compared to 190,474 ounces in the first quarter of 2020. Gold production in the first quarter of 2021 included 90,169 ounces at the Kumtor mine, 41% less ounces than the comparable prior year period, due to the anticipated lower grades and recoveries. The Mount Milligan mine produced 42,576 ounces of gold in the first quarter of 2021, 26% more ounces than the first quarter of 2020, due to higher gold grades and recoveries. The Öksüt mine, which was not in commercial production in the first quarter of 2020, produced 27,601 ounces of gold in the first quarter of 2021.

Copper production at the Mount Milligan mine was 18.6 million pounds in the first quarter of 2021 compared to 20.1 million pounds in the first quarter of 2020. The decrease in copper production was due to lower copper grades, which were partially offset by higher copper recoveries.

Gold production costs were $561 per ounce in the first quarter of 2021 compared to $437 per ounce in the first quarter of 2020. The increase was primarily due to lower ounces of gold sold at the Kumtor mine, compared to the same prior year period.

Copper production costs were $1.42 per pound in the first quarter of 2021 compared to $1.37 per pound in the first quarter of 2020. The increase in copper pounds sold in the first quarter of 2021, was offset by a higher allocation of production costs to copper as a result of the relative strength of the copper price compared to the gold price.

All-in sustaining costs on a by-product basisNG were $745 per ounce in the first quarter of 2021 compared to $718 per ounce in the first quarter of 2020. The increase was due to lower ounces sold, increased sustaining capital at the Mount Milligan mine and greater capitalized stripping at the Kumtor mine, partially offset by increased copper credits due to a 69% increase in the average realized price of copper.

All-in costs on a by-product basisNG were $1,073 per ounce in the first quarter of 2021 compared to $1,024 per ounce in the first quarter of 2020. The increase was due to higher all-in sustaining costs on a by-product basisNG, explained above, and the planned purchase of haul trucks for the life of mine extension at the Kumtor mine, partially offset by lower revenue-based taxes paid by Kumtor.

The Langeloth Facility roasted 2.7 million pounds of molybdenum in the first quarter of 2021 compared to 4.4 million pounds in the first quarter of 2020. This decrease was the result of a decline in demand for industrial products that use molybdenum.

Exploration expenditures of $9.3 million were recognized in the first quarter of 2021 compared to $7.8 million in the first quarter of 2020. The increase in exploration expenditures was due to a significantly expanded drilling program at the Kumtor mine, drilling approximately 20,000 metres in the first quarter of 2021, as well as the recommencement of drilling activities at Öksüt and Mount Milligan earlier in than the prior period.

Financing costs of $1.8 million were recognized in the first quarter of 2021 compared to $3.6 million in the first quarter of 2020. The decrease was due to the corporate revolving credit facility remaining undrawn during the first quarter of 2021.

Corporate administration costs of $4.9 million were recognized in the first quarter of 2021 compared to $3.4 million in the first quarter of 2020. The increase was primarily due to an increase in advisory and legal fees.

A gain on sale of $72.3 million (excluding contingent consideration) was recognized in the first quarter of 2021 on the disposal of the Company’s 50% interest in the Greenstone Gold Mines Partnership.

Balance Sheet Review

| $ millions | As at | |||

| Consolidated: | March 31, 2021 | December 31, 2020 | %Change | |

| Cash | 823.2 | 545.2 | 51% | |

| Accounts receivable | 106.4 | 66.1 | 61% | |

| Inventories | 542.0 | 580.6 | (7%) | |

| Assets held for sale(1) | - | 140.0 | (100%) | |

| Other current assets | 44.2 | 40.9 | 8% | |

| Property, plant and equipment | 1,724.2 | 1,686.1 | 2% | |

| Other non-current assets | 88.1 | 77.1 | 14% | |

| Total Assets | 3,328.1 | 3,136.0 | 6% | |

| Current liabilities | 295.2 | 256.7 | 15% | |

| Provision for reclamation | 338.8 | 352.2 | (4%) | |

| Other non-current liabilities | 70.1 | 61.1 | 15% | |

| Total Liabilities | 704.1 | 670.0 | 5% | |

| Total Equity | 2,624.0 | 2,466.0 | 6% | |

| Total Liabilities and Equity | 3,328.1 | 3,136.0 | 6% | |

| (1) Centerra’s 50% interest in the Greenstone Gold Mine Partnership | ||||

Cash at March 31, 2021 was $823.2 million compared to $545.2 million at December 31, 2020. The increase was due to the receipt of $210 million as consideration for the disposal of the Company’s 50% interest in the Greenstone Gold Mines Partnership and free cash flowNG of $72.1 million generated in the first quarter of 2021.

Accounts receivable at March 31, 2021 was $106.4 million compared to $66.1 million at December 31, 2020. The increase is due to a shipment of gold from the Kumtor mine in late March 2021, for which the funds were collected in April 2021.

Total inventories at March 31, 2021 were $542.0 million compared to $580.6 million at December 31, 2020. Total inventory includes stockpiles of ore, gold in-circuit, gold doré, copper and gold concentrate and molybdenum inventory (collectively “Product Inventory”) of $323.6 million and supplies inventory of $218.4 million, compared to $373.1 million and $207.5 million, respectively, at December 31, 2020. The decrease in Product Inventory was primarily due to the Kumtor mine processing from stockpiles during a major stripping period in 2021.

At March 31, 2021, the Product Inventory balance consisted of 429,172 contained gold ounces on surface in stockpiles at Kumtor (9.9 million tonnes of ore with a grade of 1.337 g/t gold), of which roughly 51% is expected to be processed in 2021, 87,051 contained gold ounces and 20.3 million contained pounds of copper in surface stockpiles at Mount Milligan (6.5 million tonnes of ore at a grade of 0.42 g/t gold and 0.14% copper), of which roughly 15% is expected to be processed in 2021 and at the Öksüt mine 3,083 contained gold ounces in solution at the absorption, desorption and recovery (ADR) plant and 644 contained gold ounces on surface and stacked (0.1 million tonnes of ore at a grade of 0.13 g/t gold in surface stockpiles and 1.32 g/t gold stacked on the heap leach pad), which is expected to be processed in 2021.

The book value of property, plant and equipment at March 31, 2021 was $1.72 billion compared to $1.69 billion at December 31, 2020. The increase was due to higher capitalized stripping and the purchase of haul trucks at the Kumtor mine.

The provision for reclamation at March 31, 2021 was $338.8 million compared to $352.2 million at December 31, 2020. An increase in the risk-free interest rate used to calculate the present value of reclamation costs at the Company’s North American sites was the primary reason for the reduction in the obligation.

In 1998, a reclamation trust fund was established to cover the future costs of reclamation at the Kumtor mine. At March 31, 2021, this fund had a balance of $53 million and is shown as long-term asset on the balance sheet.

The Company’s total liquidity position is $1,223.2 million, representing a cash balance of $823.2 million and $400 million available under the Corporate Credit Facility. The strong liquidity position and forecasted robust free cash flows from the Company’s Kumtor, Mount Milligan and Öksüt operations are expected to be sufficient to satisfy working capital needs, fund the Company’s activities and meet other liquidity requirements through the end of 2021. See “Caution Regarding Forward-Looking Information”.

Market Conditions

Commodity prices

The Company’s profitability is materially affected by the market price of metals. Metal prices fluctuate widely and are affected by numerous factors beyond the Company's control.

| Metal | Average spot price | Period end spot price | ||||||||||

| Three months ended March 31 | % Change | March 31, | December 31, | % Change | ||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| Gold (per oz) | $ | 1,797 | $ | 1,582 | 14% | $ | 1,708 | $ | 1,898 | (10%) | ||

| Copper (per lb) | 3.86 | 2.57 | 50% | 4.00 | 3.52 | 14% | ||||||

| Molybdenum (per lb) | 11.29 | 9.64 | 17% | 11.05 | 10.03 | 10% | ||||||

Foreign Exchange

The Company has operations in Canada, including its corporate head office, the Kyrgyz Republic, Turkey and the United States. The Company receives its revenue through the sale of gold, copper and molybdenum in U.S. dollars.

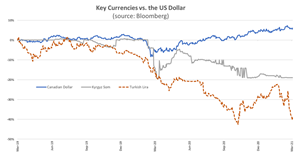

A significant cost driver of Centerra is the performance of key currencies relative to the U.S. dollar. The performance of these currencies over a 24-month period and at key reporting dates was as follows:

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3d78dc40-e9a0-4bc7-a8d2-12021d7ef3e6

| Currency | Average exchange rate | Period end exchange rate | ||||||||||

| Three months ended March 31 | % Change | March 31, | December 31, | % Change | ||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| USD-CAD | $ | 1.27 | $ | 1.34 | (5%) | $ | 1.26 | $ | 1.27 | (1%) | ||

| USD-Kyrgyz Som | 84.2 | 71.2 | 18% | 84.8 | 84.0 | 1% | ||||||

| USD-Turkish Lira | 7.4 | 6.1 | 21% | 8.3 | 7.4 | 12% | ||||||

The Company utilizes its foreign exchange hedging program in order to manage its exposure to adverse fluctuations in the Canadian dollar, relative to the U.S. dollar, see “Financial Instruments”. The Company does not currently hedge the Kyrgyz som or the Turkish lira.

Diesel Fuel Prices

Fuel costs represent a significant cost component for Centerra’s mining operations, representing 10% of production costs in the first quarter of 2021. Prices for each mine site’s fuel costs are dependent on regional fuel prices along with the associated transportation costs, seasonal premiums for winterizing fuel and any additional costs to meet regulatory requirements. The Company hedges its fuel exposures covering a portion of Kumtor and Mount Milligan’s production needs, utilizing regression analysis for fuel costs that closely track established market indices.

| Commodity | Average spot price | Period end spot price | ||||||||||

| Three months ended March 31 | % Change | March 31, | December 31, | % Change | ||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||

| Kumtor Diesel (per ltr) | $ | 0.44 | $ | 0.39 | 13% | $ | 0.48 | $ | 0.41 | 17% | ||

| ULSD (per bbl) | 73.13 | 64.76 | 13% | 74.39 | 62.00 | 20% | ||||||

| Brent (per bbl) | 61.17 | 50.82 | 20% | 63.54 | 51.80 | 23% | ||||||

The Company utilizes its diesel hedging program in order to manage its exposure to adverse fluctuations in diesel fuel prices, see “Financial Instruments”.

Financial Instruments

The Company seeks to manage its exposure to fluctuations in diesel fuel prices, commodity prices and foreign exchange rates by entering into derivative financial instruments from time-to-time.

The hedge positions for each of these programs as at March 31, 2021 are summarized as follows:

| Average Strike Price | Settlements (% of exposure hedged) | As at March 31, 2021 | |||||||||||

| Instrument | Unit | Type | 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | Total position (2) | Fair value($'000's) | |||

| FX Hedges | |||||||||||||

| USD/CAD zero-cost collars | CAD | Fixed | $1.33/$1.40 | $1.32/$1.38 | N/A | $166.8 M (37%) | $149.0 M (28%) | N/A | $315.8 M | 13,874 | |||

| USD/CAD forward contracts | CAD | Fixed | $1.35 | $1.30 | $1.27 | $101.0 M (23%) | $60.0 M (11%) | $40.0 M (31%) | $201.0 M | 7,309 | |||

| Total | $1.34 | $1.31 | $1.27 | $267.8 M (60%) | $209.0 M (39%) | $40.0 M (31%) | $516.8 M | 21,183 | |||||

| Fuel Hedges | |||||||||||||

| Brent Crude Oil zero-cost collars | Barrels | Fixed | $41/$47 | $44/$51 | $50/$62 | 59,474 (9%) | 96,966 (10%) | 22,000 (9%) | 178,440 | 1,876 | |||

| Brent Crude Oil swap contracts | Barrels | Fixed | $44 | $51 | $56 | 162,322 (26%) | 89,850 (9%) | 11,000 (4%) | 263,172 | 3,592 | |||

| ULSD zero-cost collars | Barrels | Fixed | $53/$59 | $58/$64 | $71/$77 | 58,124 (9%) | 125,066 (12%) | 22,000 (9%) | 205,190 | 2,550 | |||

| ULSD swap contracts | Barrels | Fixed | $58 | $64 | $73 | 160,492 (25%) | 121,850 (12%) | 22,000 (9%) | 304,342 | 4,236 | |||

| Total | 440,412 (69%) | 433,732 (43%) | 77,000 (31%) | 951,144 | 12,254 | ||||||||

| Copper Hedges (Strategic hedges)(1): | |||||||||||||

| Copper forward contracts | Pounds | Fixed | $3.38 | N/A | N/A | 41.8 M (90%) | N/A | N/A | 41.8 M | (25,704) | |||

| Copper zero-cost collars | Pounds | Fixed | N/A | $3.48/$4.71 | N/A | N/A | 27.0 M (37%) | N/A | 27.0 M | 1,627 | |||

| Gold/Copper Hedges (Royal Gold deliverables): | |||||||||||||

| Gold forward contracts | Ounces | Float | N/A | N/A | N/A | 23,963 | N/A | N/A | 23,963 | (2,149) | |||

| Copper forward contracts | Pounds | Float | N/A | N/A | N/A | 3.3 M | N/A | N/A | 3.3 M | 690 | |||

| (1) | The copper hedge ratio is based on the forecasted copper sales production, net of the streaming arrangement with Royal Gold. |

| (2) | Royal Gold hedging program with a market price determined on closing of the contract. |

The realized gains (losses) recorded in the first quarters of 2021 and 2020 were as follows:

| Hedge program | Realized gain(loss) (thousands) | |||||||

| Three months ended March 31 | % Change | |||||||

| 2021 | 2020 | |||||||

| FX Hedges | $ | 3,680 | $ | (1,259 | ) | 392% | ||

| Fuel hedges | 2,926 | (1,124 | ) | 360% | ||||

| Copper Hedges (Strategic hedges) | (9,025 | ) | N/A | N/A | ||||

As at March 31, 2021, Centerra has not entered into any off-balance sheet arrangements with special purpose entities, nor does it have any unconsolidated affiliates.

Operating Mines and Facilities

Kumtor Mine

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia. It has been in production since 1997 and has produced over 13.3 million ounces of gold to March 31, 2021.

Kumtor Operating Results

| Unaudited ($ millions, except as noted) | Three months ended March 31, | |||||||

| Financial Highlights: | 2021 | 2020 | % Change | |||||

| Revenue | $ | 175.7 | $ | 250.8 | (30 | %) | ||

| Production costs | 48.4 | 53.4 | (9 | %) | ||||

| Depreciation, depletion and amortization | 38.5 | 53.6 | (28 | %) | ||||

| Standby costs | - | 6.8 | (100 | %) | ||||

| Earnings from mine operations | $ | 88.8 | $ | 137.0 | (35 | %) | ||

| Revenue-based taxes | 24.6 | 35.1 | (30 | %) | ||||

| Exploration and development costs | 5.9 | 4.7 | 26 | % | ||||

| Other operating expenses | 2.2 | 11.4 | (81 | %) | ||||

| Earnings from operations | $ | 56.1 | $ | 85.8 | (35 | %) | ||

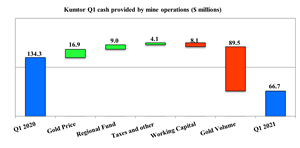

| Cash provided by mine operations | 66.7 | 134.3 | (50 | %) | ||||

| Cash provided by mine operations before changes in working capital | 94.5 | 142.6 | (34 | %) | ||||

| Free cash flow from mine operations (1) | 4.0 | 95.6 | (96 | %) | ||||

| Operating Highlights: | ||||||||

| Tonnes mined (000's) | 49,210 | 19,997 | 146 | % | ||||

| Tonnes ore mined (000's) | 885 | 571 | 55 | % | ||||

| Average mining grade (g/t) | 2.06 | 7.86 | (74 | %) | ||||

| Tonnes processed (000's) | 1,595 | 1,602 | (0 | %) | ||||

| Process plant head grade (g/t) | 2.41 | 3.53 | (32 | %) | ||||

| Recovery (%)(2) | 71.3 | % | 83.7 | % | (15 | %) | ||

| Mining costs ($/t mined material) | 1.00 | 1.77 | (44 | %) | ||||

| Processing costs ($/t processed material) | 10.17 | 10.89 | (7 | %) | ||||

| Gold produced (oz) | 90,169 | 152,307 | (41 | %) | ||||

| Gold sold (oz) | 98,437 | 160,090 | (39 | %) | ||||

| Average realized gold price ($/oz)(1) | 1,763 | 1,555 | 13 | % | ||||

| Sustaining capital expenditures(3) | 7.7 | 8.4 | (9 | %) | ||||

| Non-sustaining capital expenditures(3)(4) | 21.6 | 0.7 | 2986 | % | ||||

| Capitalized stripping(3) | 30.5 | 30.0 | 2 | % | ||||

| Capitalized stripping - non-cash | 6.8 | 10.0 | (32 | %) | ||||

| Capital expenditures - total | 66.6 | 49.1 | 36 | % | ||||

| Unit Costs: | ||||||||

| Gold production costs ($/oz) | $ | 492 | $ | 334 | 47 | % | ||

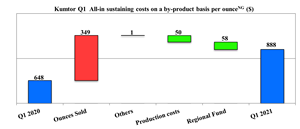

| All-in sustaining costs on a by-product basis ($/oz)(1) | $ | 888 | $ | 648 | 37 | % | ||

| All-in costs on a by-product basis ($ /oz)(1) | $ | 1,417 | $ | 902 | 57 | % | ||

| (1) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (2) | Metallurgical recoveries are based on recovered gold, not produced gold. |

| (3) | Capital expenditures are presented as spent and accrued. |

| (4) | Non-sustaining capital expenditures are distinct projects designed to have a significant increase in the net present value of the mine. In the current year, non-sustaining capital expenditures included costs related to the expansion of the mine. |

First Quarter 2021 compared to First Quarter 2020

Earnings from mine operations of $88.8 million were recognized in the first quarter of 2021 compared to earnings from mine operations of $137 million in the first quarter of 2020. The decrease was primarily due to 39% fewer gold ounces sold, primarily due to lower average process plant head grades and lower gold recoveries as the Kumtor mine continues to process ore from on-surface stockpiles, partially offset by 13% higher average realized gold prices, lower production, depreciation and revenue-based tax costs.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b59d1c93-963e-4ef0-b281-be9b1bdd7619

Cash provided by mine operations of $66.7 million was recognized in the first quarter of 2021 compared to $134.3 million in the first quarter of 2020. The decrease was primarily due to the lower earnings from mine operations mainly due to lower production, and lower cash from working capital as a result of inventory movements. In the first quarter of 2021, 55% more ore tonnes were mined which resulted in higher mining costs charged to stockpile inventory as compared to the comparative quarter.

Free cash flow from mine operationsNG of $4 million was recognized in the first quarter of 2021 compared to $95.6 million in the first quarter of 2020. The decrease was due to lower cash provided by mine operations and an increase in capital expenditure related to the purchase of additional haul trucks required for the life of mine extension. In the first quarter of 2021, Kumtor received seven of the eight haul trucks that it planned to purchase in 2021.

During the first quarter of 2021, the Kumtor mine continued mining in cut-back 20. Tonnes mined were 49.2 million in the first quarter of 2021 compared to 20 million tonnes in the first quarter of 2020. The increase was due to the suspension of mining operations in January 2020 due to the Lysii waste rock dump incident. Of the 49.2 million tonnes mined in the first quarter of 2021, 30.3 million were capitalized as waste stripping for the benefit of future gold production from cut-back 20.

Mining costs were $1.00 per tonne in the first quarter of 2021 compared to $1.77 per tonne in the first quarter of 2020. The decrease was primarily due to more tonnes mined and shorter haulage distances in 2021, partially offset by higher maintenance costs. Total mining costs were $49.1 million of which $30.5 million was capitalized in the first quarter of 2021, compared to $35.4 million in mining costs of which $30 million was capitalized in the first quarter of 2020.

Gold production was 90,169 ounces from on-surface stockpiled ore in the first quarter of 2021 compared to 152,307 ounces of gold produced in the first quarter of 2020. The decrease was primarily due to lower average process plant head grades and lower gold recoveries. During the first quarter of 2021, the Kumtor mine was processing ore with an average grade of 2.41 g/t and a recovery of 71.3% compared to ore from cut-back 19 with a higher average grade of 3.53 g/t and a recovery of 83.7% in the first quarter of 2020.

Processing costs were $10.17 per tonne in the first quarter of 2021 compared to $10.89 per tonne in the first quarter of 2020. The decrease was primarily due to lower costs associated with foreign contractors and carbon fine processing.

Gold production costs were $492 per ounce in the first quarter of 2021, compared to $334 per ounce in the first quarter of 2020. The increase was primarily due to lower ounces of gold sold.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a851c419-adb6-41b6-8056-b72c1fb81497

All-in sustaining costs on a by-product basisNG, which excludes revenue-based tax, were $888 per ounce in the first quarter of 2021 compared to $648 per ounce in the first quarter of 2020. The increase was primarily due to fewer ounces of gold sold.

All-in costs on a by-product basisNG were $1,417 per ounce in the first quarter of 2021 compared to $902 per ounce in the first quarter of 2020. The increase was due to an increase in all-in sustaining costs on a by-product basisNG and the planned purchase of additional haul trucks as required for the life of mine extension.

Mount Milligan Mine

The Mount Milligan Mine is an open pit mine located in north central British Columbia, Canada producing a gold and copper concentrate. Production at the Mount Milligan mine is subject to an arrangement with RGLD Gold AG and Royal Gold, Inc. (together, “Royal Gold”) pursuant to which Royal Gold is entitled to purchase 35% of the gold produced and 18.75% of the copper production at the Mount Milligan mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered. To satisfy its obligations under the Mount Milligan Streaming Arrangement the Company purchases refined gold and copper warrants and arranges for delivery to Royal Gold. The difference between the cost of the purchases of refined gold and copper warrants, and the corresponding amounts payable to the Company under the Mount Milligan Streaming Arrangement is recorded as a reduction of revenue and not a cost of operating the mine.

Water Update

Stored water inventory at the Mount Milligan mine is critical to the ability to process ore through the mill process plant on a sustainable basis. Stored water was in excess of 4.5 million cubic metres as at March 31, 2021. In addition to accessing water from surface water sources throughout the first quarter of 2021, the Mount Milligan mine continued to access ground water from the Lower Rainbow Valley wellfield as well as other groundwater wells near the tailings storage facility during the quarter. The Company expects the water inventory level to increase through the summer of 2021 following the spring melt.

Exploration activities continue to focus on extending the groundwater capacity in the vicinity of the existing infrastructure. The Company continues to pursue a longer-term solution to its water requirements at the Mount Milligan mine and is in discussions with regulators, First Nations partners and other stakeholders. In April 2021, the Company’s obtained an environmental assessment certificate amendment to access surface water sources for the Mount Milligan mine through November 2023, subject to the receipt of permits which are expected to be received shortly. The Company does not expect any interruptions to the Mount Milligan mine operations in the medium term when considering currently available water sources and inventory. See “Caution Regarding Forward-Looking Information”.

Mount Milligan Operating Results

| Unaudited ($ millions, except as noted) | Three months ended March 31, | |||||||

| Financial Highlights: | 2021 | 2020 | % Change | |||||

| Gold revenue | $ | 70.3 | $ | 48.9 | 44 | % | ||

| Copper revenue | 61.9 | 33.0 | 88 | % | ||||

| By-product revenue | 3.3 | 1.7 | 94 | % | ||||

| Total Revenues | $ | 135.5 | $ | 83.6 | 62 | % | ||

| Production costs | 69.1 | 62.3 | 11 | % | ||||

| Depreciation, depletion and amortization | 22.9 | 18.0 | 27 | % | ||||

| Earnings from mine operations | $ | 43.5 | $ | 3.3 | 1218 | % | ||

| Exploration and development costs | 0.9 | 0.5 | 82 | % | ||||

| Other operating expenses | 2.9 | 2.1 | 37 | % | ||||

| Earnings from operations | $ | 39.7 | $ | 0.7 | 5573 | % | ||

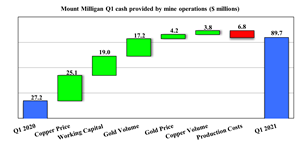

| Cash provided by mine operations | 89.7 | 27.2 | 230 | % | ||||

| Cash provided by mine operations before changes in working capital | 59.4 | 12.1 | 391 | % | ||||

| Free cash flow from mine operations(1) | 80.2 | 22.0 | 265 | % | ||||

| Operating Highlights: | ||||||||

| Tonnes mined (000's) | 10,673 | 10,889 | (2 | %) | ||||

| Tonnes ore mined (000's) | 5,122 | 4,689 | 9 | % | ||||

| Tonnes processed (000's) | 4,770 | 4,871 | (2 | %) | ||||

| Process plant head grade gold (g/t) | 0.43 | 0.37 | 17 | % | ||||

| Process plant head grade copper (%) | 0.23 | % | 0.26 | % | (11 | %) | ||

| Gold recovery (%) | 66.2 | % | 59.9 | % | 11 | % | ||

| Copper recovery (%) | 80.0 | % | 75.5 | % | 6 | % | ||

| Mining costs ($/t mined material) | 1.89 | 1.75 | 8 | % | ||||

| Processing costs - total ($/t processed material) | 5.93 | 4.93 | 20 | % | ||||

| Concentrate produced (dmt) | 41,904 | 45,087 | (7 | %) | ||||

| Gold produced (oz) (2) | 42,576 | 33,681 | 26 | % | ||||

| Copper produced (000's lb) (2) | 18,609 | 20,072 | (7 | %) | ||||

| Gold sold (oz)(2) | 54,498 | 40,353 | 35 | % | ||||

| Copper sold (000's lb)(2) | 22,783 | 20,423 | 12 | % | ||||

| Average realized gold price - combined ($/oz)(1)(2) | 1,291 | 1,213 | 6 | % | ||||

| Average realized copper price - combined ($/lb) (1)(2) | 2.72 | 1.61 | 69 | % | ||||

| Sustaining capital expenditures(3) | 11.3 | 5.3 | 115 | % | ||||

| Unit Costs: | ||||||||

| Gold production costs ($/oz) | $ | 675 | $ | 848 | (20 | %) | ||

| All-in sustaining costs on a by-product basis ($/oz) (1)(4) | $ | 367 | $ | 911 | (60 | %) | ||

| All-in costs on a by-product basis ($ /oz)(1)(4) | $ | 386 | $ | 923 | (58 | %) | ||

| Gold - All-in sustaining costs on a co-product basis ($/oz)(1) | $ | 802 | $ | 948 | (15 | %) | ||

| Copper production costs ($/lb) | $ | 1.42 | $ | 1.37 | 4 | % | ||

| Copper - All-in Sustaining costs on a co-product basis ($/lb)(1) | $ | 1.68 | $ | 1.52 | 11 | % | ||

| (1) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (2) | Mount Milligan production and sales are presented on a 100% basis. Under the Mount Milligan Streaming Arrangement, Royal Gold is entitled to 35% of gold ounces and 18.75% of copper. Royal Gold pays $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered. |

| (3) | Capital expenditures are presented as spent and accrued. |

| (4) | Includes the impact of reduced metal prices resulting from the Mount Milligan Streaming Arrangement, and the impact of copper hedges. |

First Quarter 2021 compared to First Quarter 2020

Earnings from mine operations of $43.5 million were recognized in the first quarter of 2021 compared to $3.3 million in the first quarter of 2020. The increase was primarily due to higher average realized gold and copper prices, and an increase in ounces of gold and pounds of copper sold, partially offset by an increase in production costs and depreciation.

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1c1b674b-585e-413c-a7dd-3449c36500b8

Cash provided by mine operations of $89.7 million was recognized in the first quarter of 2021 compared to $27.2 million in the first quarter of 2020. The increase was primarily due to higher net earnings from mine operations (explained above) and an increase in cash generated from working capital. Working capital levels decreased by approximately $19 million in the first quarter of 2021, as a result of lower product inventories and higher payables due to the timing of shipments and of payments, partially offset by an increase in receivables. The reduction in working capital in the first quarter of 2020 was approximately $8 million.

Free cash flow from mine operationsNG of $80.2 million was recognized in the first quarter of 2021 compared to $22 million in the first quarter of 2020, due to an increase in cash provided by mine operations, partially offset by an increase in capital expenditures related to major planned equipment rebuilds and tailings storage facility development.

During the first quarter of 2021, mining activities were carried out in phases 4, 5 and 8 of the open pit. Total tonnes mined were 10.7 million tonnes in the first quarter of 2021 compared to 10.9 million tonnes in the first quarter of 2020.