Centerra Gold Records Net Earnings of $33.4 Million or $0.11 Per Common Share (basic) on Revenues of $340.5 Million Generating Cash from Operations of $91.0 Million

All figures are in United States dollars and all production figures are on a 100% basis, unless otherwise stated.

All references in this document denoted with NG, indicate a non-GAAP term which is discussed under “Non-GAAP Measures” and reconciled to the most directly comparable GAAP measure.

TORONTO, July 30, 2019 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra”) (TSX: CG) today reported second quarter 2019 net earnings and adjusted earningsNG of $33.4 million ($0.11 per common share (basic)), compared to net earnings of $43.5 million ($0.15 per common share (basic)) and adjusted earningsNG of $1.0 million (nil per common share (basic)) in the same period of 2018, after adjusting for gains recognized on the sale the Company’s Mongolian operations and sale of a royalty portfolio in 2018. The Company generated cash from operations of $91.0 million and $30.7 million of free cash flowNG compared to cash from operations of $68.1 million and free cash flowNG of $(4.7) million in the second quarter of 2018.

2019 Second Quarter Highlights

- The Company reported net earnings of $33.4 million or $0.11 per common share (basic).

- Cash generated from operations was $91.0 million. Second quarter 2019 cash from operation included $92.7 million from Kumtor and $24.2 million from Mount Milligan, offset by costs incurred by the Molybdenum business and corporate costs.

- The Company produced 199,578 ounces of gold in the period, which includes 151,065 ounces at Kumtor and 48,513 ounces at Mount Milligan. Mount Milligan also produced 20.4 million pounds of copper.

- Mount Milligan, mill throughput averaged 53,500 tonnes per calendar day.

- Centerra has tightened the range and modestly increased Kumtor’s annual gold guidance to 550,000 – 575,000 ounces resulting in a revision to our 2019 consolidated gold production guidance to 705,000 – 750,000 ounces.

- The company’s full year gold and copper production guidance for Mount Milligan remains unchanged

- Mount Milligan’s water capture from the 2019 spring melt runoff was less than anticipated, creating a risk to the level of production in early 2020 until the spring melt occurs, similar to 2019. The Company continues to explore for additional groundwater sources and to work towards a long-term water solution.

- Consolidated cost of sales increased in the second quarter of 2019 to $238.5 million.

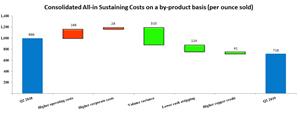

- Consolidated all-in sustaining costs per ounce soldNG for the second quarter 2019 were $716, including $562 at Kumtor and $938 at Mount Milligan.

- Favourably revised 2019 consolidated all-in sustaining costs per ounce soldNG guidance to $713 - $743 and lowered Kumtor’s all-in sustaining costs per ounce soldNG guidance to $635 - $685 Mount Milligan’s all-in sustaining costs per ounce soldNG for 2019 remains unchanged.

- Capitalized waste stripping guidance has been increased by $32 million as we mine the initial waste material on cut-back 20 at Kumtor. The change in mine plan, to defer mining of cut-back 19 East, where we were reaching ore, followed the identification of ground instability in the first quarter of 2019. No significant ground movement was identified in the second quarter 2019; we continue to study potential mitigation measures and the long-term impact on our mine plan and reserves of the deferral.

- Construction at the Öksüt Project in Turkey is now 64% complete and remains on schedule with first gold pour expected in January of 2020. The total construction cost is expected to be $20 million under budget.

- The revolving corporate credit facility was repaid in full during the quarter.

- Cash and cash equivalents available at June 30, 2019 were $140.0 million.

- Subsequent to June 30, 2019, we agreed with the Government of the Kyrgyz Republic to extend the long-stop date in connection with the Strategic Agreement to August 10, 2019.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “We are very pleased to report that our contract workforce at the Kumtor Mine achieved a significant safety milestone during the quarter in attaining one year of lost time incident-free operations. This milestone demonstrates our workforce’s commitment to Centerra’s Work Safe – Home Safe program and our drive to zero harm within the workplace.”

“The operations produced a total of 199,578 ounces of gold and 20.4 million pounds of copper in the quarter. Kumtor had another strong quarter producing 151,065 ounces of gold which was attributable to milling higher grades and achieving higher recoveries as compared to the comparative period. The northwest pit wall where instability was noted in the first quarter has stabilized and no significant ground movement was identified in the second quarter 2019.”

“Mount Milligan achieved production of 48,513 ounces of gold and 20.4 million pounds of copper during the quarter, as the mill returned to targeted full capacity (55,000 tonnes per day) in early May due to increased water availability from the spring melt, even though we experienced a less robust spring melt than anticipated. We continue to explore for additional groundwater sources as we work towards a long-term water solution. During the quarter, mill throughput averaged 53,500 tonnes per calendar day.”

“Company-wide our all-in sustaining costs (before taxes)NG were $716 per ounce sold for the quarter reflecting Kumtor achieving all-in sustaining costs (before taxes)NG of $562 per ounce.”

“With our second quarter earnings release today, the Company tightened the range and modestly increased its gold production guidance for Kumtor for the year to 550,000 – 575,000 ounces and Company-wide gold production to 705,000 to 750,000 ounces from 535,000-565,000 ounces and 690,000-740,000 ounces, respectively. We have also favourably lowered our expected all-in sustaining costs on a by-product basis (before taxes)NG at Kumtor to $635 to $685 per ounce sold, which reduces the Company’s consolidated all-in sustaining costs on a by-product basis (before taxes)NG to $713 to $743 per ounce sold. Mount Milligan’s production and cost guidance for 2019 remains unchanged.”

“Construction activity continued at the Öksüt Project in Turkey and the project is now 64% complete. The project remains on schedule with first gold pour now expected in January of 2020 and is projected to be $20 million under budget, including a $10 million reduction in contingencies.”

“Financially, the business delivered $91 million of cash from operations in the quarter. Kumtor and Mount Milligan generated $106 million and $11 million respectively, before working capital changesNG. During the second quarter, Kumtor generated $65 million of free cash flowNG and Mount Milligan generated $18 million of free cash flowNG which enabled the Company to repay in full the corporate credit facility reducing its debt in the quarter by $70 million and ending the quarter with cash and cash equivalents of $140 million (excluding restricted cash).”

Exploration Update

Exploration activities in the second quarter of 2019 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects targeting gold and copper mineralization in Turkey, Canada, Mexico, Sweden, Finland and Burkina Faso. Exploration expenditures totaled $6.3 million in the second quarter of 2019 compared to $4.8 million in the same quarter of 2018. The Company’s 2019 exploration program is primarily focused on brownfield exploration at Kumtor, Mount Milligan, Öksüt and Kemess.

Kyrgyz Republic

Kumtor Mine

At Kumtor, planned exploration work is aimed at defining additional resources on the flanks of the Central Pit focusing on the Hockey Stick Zone and the SB Zone deep extension to add to the open pit mine life. Exploration drilling is also focused on testing zones of gold mineralization near the surface for additional open pit resources in the corridor between the Central and Southwest pits and on the flanks of the Northeast target area. During the second quarter of 2019, 67 diamond drill holes for 16,223 metres were completed, including 1,866 metres of infill drilling in the SB Zone (drilled below the current ultimate open pit).

Central Pit

In the Hockey Stick Zone, 36 drill holes for 9,771 metres were completed. Results indicate that gold mineralization extends in a southwest direction and represents mineralization that may expand the area’s economic viability. The best intercepts are as follows:

| D1873A: | 13.1 metres @ 4.17 g/t Gold (“Au”) from 201.4 metres; Includes 3.7 metres @ 8.63 g/t Au from 204.0 metres; | |

| D1919A: | 43.8 metres @ 5.26 g/t Au from 199.4 metres. Includes 13.9 metres @ 11.66 g/t Au from 220.1 metres. | |

| D1920: | 15.4 metres @ 2.15 g/t Au from 161.9 metres. Includes 3.3 metres @ 4.66 g/t Au from 161.9 metres. |

Additional infill, geotechnical and metallurgical drilling (~20,000 metres of drilling, $6 million) was approved in the second quarter of 2019 to further delineate the Hockey Stick Zone to upgrade existing resources categories.

In the Northwest Wall, 10 drill holes were completed for a total 1,340 metres. The best intercept is as follows:

| DW1887: | 5.1 metres @ 2.34 g/t Au from 158.6 metres |

In SB Zone (below current open pit), infill drilling was carried out with the completion of eight drill holes for 1,866 metres. The best intercepts are as follows:

| D1876A: | 12.0 metres @ 11.48 g/t Au from 61.1 metres; | |

| D1876B: | 22.9 metres @ 8.45 g/t Au from 58.6 metres Includes 8.0 metres @ 17.32 g/t Au from 63.5 metres; | |

| D1878: | 41.1 metres @ 5.87 g/t Au from 36.2 metres Includes 8.0 metres @ 11.93 g/t Au from 47.3 metres Includes 5.0 metres @ 11.91 g/t Au from 64.3 metres; | |

| D1881: | 33.4 metres @ 6.68 g/t Au from 212.6 metres Includes 3.9 metres @ 14.05 g/t Au from 219.6 metres Includes 4.0 metres @ 14.11 g/t Au from 227.5 metres; | |

| D1882: | 67.5 metres @ 8.32 g/t Au from 322.5 metres; 29.5 metres @ 16.70 g/t Au from 357.0 metres; | |

| D1897: | 7.0 metres @ 18.06 g/t Au from 80.1 metres; 35.4 metres @ 8.12 g/t Au from 102.9 metres Includes 11.2 metres @ 16.67 g/t Au from 103.9 metres; |

Southwest Area

Three drill holes were completed between the Southwest and Central Pits for a total of 655 metres. The best intercepts are as follows:

| SW-19-282A: | 4.1 metres @ 3.69 g/t Au from 176.4 metres; | |

| SW-19-284: | 4.0 metres @ 1.36 g/t Au from 188.9 metres. |

Northeast Area

In Northeast area, 10 drill holes were completed for a total of 2,590 metres. The best intercepts are:

| DN1900: | 25.1 metres @ 3.23 g/t Au from 332.9 metres Includes 5.0 metres @ 6.46 g/t Au from 332.9 metres; 7.2 metres @ 5.37 g/t Au from 389.3 metres; | |

| DN1911: | 5.6 metres @ 2.87 g/t Au from 33.7 metres; 8.7 metres @ 2.09 g/t Au from 419.3 metres. |

The above mineralized intercepts were calculated using a cut-off grade of 1.0 g/t Au, minimum interval of 4.0 metres and a maximum internal dilution interval of 5.0 metres. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/cf7f0287-d1d6-49e8-a1fa-e26f578a7503

A complete listing of the drill results, drill hole locations and plan map for the Kumtor Mine have been filed on the System for Electronic Document Analysis and Retrieval (‘SEDAR’) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Canada

Mount Milligan Mine

At Mount Milligan, the 2019 exploration program is focused on initially expanding mineral resources to the west and at depth and other exploration targets adjacent to the mine lease. The 2019 near pit infill drilling program (22,500 metres planned) began in February. In the second quarter, a total of 8,896 metres in 24 drill holes were completed; including 16 holes (5,946 metres) in the Southern Star Zone and eight holes (2,950 metres) in the Saddle Zone. Year to date, a total of 10,936 metres have been drilled in the program. During the second quarter, assay results were received for 13 drill holes and the most significant intercepts are as follows:

Southern Star Zone

19-1133: 100.1 metres @ 0.57 g/t Au, 0.28% Cu from 18.9 metres

19-1133: 38.9 metres @ 0.52 g/t Au, 0.29% Cu from 198.0 metres;

19-1135: 123.0 metres @ 0.36 g/t Au, 0.37% Cu from 106.0 metres

19-1139: 57.6 metres @ 0.17 g/t Au, 0.15% Cu from 192.0 metres;

19-1139: 55.6 metres @ 0.18 g/t Au, 0.14% Cu from 254.3 metres;

19-1140: 149.3 metres @ 0.22 g/t Au, 0.13% Cu from 3.7 metres

19-1140: 77.3 metres @ 0.28 g/t Au, 0.26% Cu from 198.4 metres

Saddle Zone

19-1147: 40.1 metres @ 0.33 g/t Au, 0.14% Cu from 18.9 metres;

19-1147: 20.9 metres @ 0.34 g/t Au, 0.26% Cu from 183.4 metres;

19-1150: 39.2 metres @ 0.25 g/t Au, 0.16% Cu from 18.3 metres.

19-1150: 51.2 metres @ 0.23 g/t Au, 0.37% Cu from 62.5 metres.

19-1152: 10.0 metres @ 0.36 g/t Au, 0.23% Cu from 18.5 metres;

19-1152: 30.4 metres @ 0.33 g/t Au, 0.10% Cu from 315.5 metres.

The near pit infill program will continue until mid-September with drill holes planned in the Southern Star, Saddle, 66, Great Eastern Fault, MBX, and Oliver zones.

Brownfield exploration drilling

The 2019 brownfield (within mine lease, but outside ultimate pit) exploration drilling program at Mount Milligan (8,500 metres planned) began on May 1st. A total of 4,719 metres in 11 drill holes was completed during the second quarter; including three holes (1,814 metres) in the North Slope Zone, five holes (2,111 metres) in the Goldmark Zone and three holes (794 m) in the Saddle West Zone. Selected best assay results from the one drill hole returned during the second quarter are reported below.

North Slope Zone

19-1138: 14.5 metres @ 1.13 g/t Au, 0.02% Cu from 342.0 metres;

19-1138: 59.7 metres @ 0.13 g/t Au, 0.22% Cu from 469.7 metres;

19-1138: 8.36 metres @ 0.26 g/t Au, 0.24% Cu from 538.6 metres.

The above mineralized intercepts were calculated using a cut-off grade of 0.1 g/t Au and a maximum internal dilution interval of 4 metres. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/cf7f0287-d1d6-49e8-a1fa-e26f578a7503

A listing of the drill results, drill hole locations and plan map for the Mount Milligan Mine have been filed on the System for Electronic Document Analysis and Retrieval (‘SEDAR’) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Kemess Project

The 2019 Kemess exploration program ramped up in the second quarter focused on the Nugget target (1.5 km west of Kemess Underground (KUG) and KUG deep mineralization to delineate previously known copper/gold mineralization and to add to existing mineral resource inventory. Relogging of 12,128 metres of historic drill core from the Kemess Underground (KUG) deposit and Nugget Zone was completed in April and May. Drilling began in June with a total of 1,030 metres completed by June 30th (1,010 metres in the Nugget Zone and 20 metres in the KUG Zone). The program is expected to continue until late August with a total of approximately 6,200 metres of drilling in seven drill holes. No assay results from drilling have been returned yet.

Turkey

Öksüt Gold Project

At the Öksüt Gold Project, the 2019 diamond drilling program is principally designed to expand existing oxide gold resources and to explore for new oxide gold mineralization around the known deposits (Keltepe and Güneytepe). During the second quarter of 2019 drilling commenced with three rigs at the Keltepe, Keltepe NW and Büyüktepe prospects. Five drill holes (ODD0330 to ODD0334) have been completed for an aggregate of 1,423 metres. Testing for deeper mineralization (below current planned open pit), including supergene copper (Keltepe and Keltepe NW) and porphyry-style copper-gold (Boztepe W) targets, will also be undertaken in the third quarter.

Drilling highlights are:

Keltepe (Testing for oxide gold resource expansion in the west and supergene copper to the northwest of the Keltepe pit)

| ODD0332: | 24.5 metres @ 0.43 g/t Au from 253 metres; | |

| ODD0333: | 54.5 metres @ 2.35% Cu from 314.5 metres | |

| including 20 metres @ 5.12% Cu from 314.5 metres. |

In addition, in the second quarter an assessment of the 3D non-linear Induced Polarization (IP) geophysical survey, covering the Keltepe NW, Keltepe, Güneytepe and Yelibelen prospects, was completed. Assessment of the survey results has generated additional oxide gold targets for testing and confirmed deeper targets around the known deposits.

The above mineralized intercepts were calculated using a cut-off grade of 0.2 g/t Au and a maximum internal dilution interval of 5.0 metres. Drill collar locations and associated graphics are available at the following link: http://ml.globenewswire.com/Resource/Download/cf7f0287-d1d6-49e8-a1fa-e26f578a7503

A listing of the drill results, drill hole locations and plan map for the Öksüt Gold Project have been filed on the System for Electronic Document Analysis and Retrieval (‘SEDAR’) at www.sedar.com and are available at the Company’s web site www.centerragold.com.

Qualified Person & QA/QC

All mineral reserve and mineral resource estimates and other scientific and technical information in this news release were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and (except as set out below) were prepared, reviewed, verified and compiled by Centerra’s geological and mining staff under the supervision of Gordon Reid, Professional Engineer and Centerra’s Vice-President and Chief Operating Officer, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the drilling programs are consistent with industry standards and independent certified assay labs are used, with the exception of the Kumtor project as described in its technical report dated March 20, 2015.

Exploration information and other related scientific and technical information in this news release regarding the Kumtor Mine were prepared in accordance with the standards of NI 43-101 and were prepared, reviewed, verified and compiled by Boris Kotlyar, a member with the American Institute of Professional Geologists (AIPG), Chief Geologist, Global Exploration with Centerra Gold Inc., who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used. The Kumtor deposit is described in Centerra’s most recently filed Annual Information Form and a technical report dated March 20, 2015 (with an effective date of December 31, 2014), which are both filed on SEDAR at www.sedar.com.

Exploration information and other related scientific and technical information in this news release regarding the Mount Milligan Mine were prepared in accordance with the standards of NI 43-101 and were prepared, reviewed, verified and compiled by C. Paul Jago, Member of the Engineers and Geoscientists British Columbia, Exploration Manager at Centerra’s Mount Milligan Mine, who is the qualified person for the purpose of NI 43101. Sample preparation, analytical techniques, laboratories used and quality assurance quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used. The Mount Milligan deposit is described in Centerra’s most recently filed Annual Information Form and a technical report dated March 22, 2017 (with an effective date of December 31, 2016) prepared in accordance win NI 43-101, both of which are available on SEDAR at www.sedar.com.

Exploration information and other related scientific and technical information in this news release regarding the Öksüt Project were prepared, reviewed, verified and compiled in accordance with NI 43-101 by Mustafa Cihan, Member of the Australian Institute of Geoscientists (AIG), Exploration Manager Turkey at Centerra’s Turkish subsidiary Centerra Madencilik A.Ş., who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used. The Öksüt deposit is described in Centerra’s most recently filed Annual Information Form and in a technical report dated September 3, 2015 (with an effective date of June 30, 2015) prepared in accordance with NI 43-101 both of which are available on SEDAR at www.sedar.com.

TABLE OF CONTENTS

| 1. | Overview | 9 |

| 2. | Consolidated Financial and Operational Highlights | 10 |

| 3. | Overview of Consolidated Results | 11 |

| 4. | 2019 Outlook | 12 |

| 5. | Financial Performance | 17 |

| 6. | Balance Sheet Review | 19 |

| 7. | Market Conditions | 19 |

| 8. | Financial Instruments | 20 |

| 9. | Operating Mines and Facilities | 21 |

| 10. | Construction and Development Projects | 33 |

| 11. | Quarterly Results – Previous Eight Quarters | 35 |

| 12. | Contingencies | 36 |

| 13. | Accounting Estimates, Policies and Changes | 39 |

| 14. | Disclosure Controls and Procedures/Internal Control Over Financial Reporting | 40 |

| 15. | Non-GAAP Measures | 40 |

| 16. | Caution Regarding Forward-Looking Information | 48 |

This Management Discussion and Analysis (“MD&A”) has been prepared as of July 30, 2019, and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the three and six months ended June 30, 2019 in comparison with the corresponding periods ended June 30, 2018. This discussion should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2019 prepared in accordance with International Financial Reporting Standards (“IFRS”). This MD&A should also be read in conjunction with the Company’s audited annual consolidated financial statements for the years ended December 31, 2018 and 2017, the related MD&A and the Annual Information Form for the year ended December 31, 2018 (the “2018 Annual Information Form”). The Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2019, 2018 Annual Report and 2018 Annual Information Form are available at www.centerragold.com and on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com. In addition, this discussion contains forward-looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. See “Risk Factors” and “Caution Regarding Forward-Looking Information” in this discussion. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated.

1. Overview

Centerra is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra’s principal operations are the Kumtor Gold Mine located in the Kyrgyz Republic and the Mount Milligan Gold-Copper Mine located in British Columbia, Canada. The Company is currently constructing its next gold mine, the Öksüt Project in Turkey and is developing two properties in Canada, the Kemess Project and the Greenstone Gold Project (50% ownership), as well as options to acquire exploration joint ventures or properties in Canada, Finland, Mexico, Sweden, Turkey and the United States. The Company owns various assets included in its Molybdenum Business Unit being the Langeloth metallurgical processing facility and Thompson Creek Mine in the United States of America, and the Endako Mine in British Columbia, Canada. See “Operating Mines and Facilities”, “Development Projects” and “Contingencies” for further details.

Centerra’s common shares are listed for trading on the Toronto Stock Exchange under the symbol CG. As of July 30, 2019, there are 292,991,211 common shares issued and outstanding, options to acquire 5,006,030 common shares outstanding under its stock option plan and 1,260,039 units outstanding under its restricted share unit plan.

2. Consolidated Financial and Operational Highlights

| Unaudited ($ millions, except as noted) | Three months ended June 30 | Six months ended June 30 | ||||||||||

| Financial Highlights | 2019 | 2018 | % Change | 2019 | 2018 | % Change | ||||||

| Revenue | $ | 340.5 | $ | 243.3 | 40 | % | $ | 674.5 | $ | 478.7 | 41 | % |

| Cost of sales | 238.5 | 187.4 | 27 | % | 461.9 | 340.2 | 36 | % | ||||

| Earnings from mine operations | 98.9 | 52.5 | 88 | % | 206.7 | 121.4 | 70 | % | ||||

| Net earnings | $ | 33.4 | $ | 43.5 | (23 | %) | $ | 83.8 | $ | 52.6 | 60 | % |

| Adjusted earnings (3) | $ | 33.4 | $ | 1.0 | 3613 | % | $ | 83.8 | $ | 14.5 | 484 | % |

| Cash provided by operations | 91.0 | 68.1 | 34 | % | 209.8 | 28.3 | 641 | % | ||||

| Cash provided by operations before changes in working capital (3) | 101.4 | 47.6 | 113 | % | 215.6 | 114.1 | 89 | % | ||||

| Capital expenditures (sustaining) (3) | 20.8 | 20.5 | 1 | % | 40.6 | 44.8 | (9 | %) | ||||

| Capital expenditures (growth and development projects) (3) | 37.7 | 64.0 | (41 | %) | 62.8 | 74.6 | (16 | %) | ||||

| Capital expenditures (stripping) | 15.6 | 47.8 | (67 | %) | 38.5 | 86.3 | (55 | %) | ||||

| Total assets | $ | 2,887.9 | $ | 2,850.5 | 1 | % | $ | 2,887.9 | $ | 2,850.5 | 1 | % |

| Long-term debt and lease obligation | 90.6 | 257.5 | (65 | %) | 90.6 | 257.5 | (65 | %) | ||||

| Cash, cash equivalents and restricted cash | 167.5 | 215.5 | (22 | %) | 167.5 | 215.5 | (22 | %) | ||||

| Per Share Data | ||||||||||||

| Net earnings per common share - $ basic (1) | $ | 0.11 | $ | 0.15 | (24 | %) | $ | 0.29 | $ | 0.18 | 59 | % |

| Net earnings per common share - $ diluted (1) | $ | 0.11 | $ | 0.15 | (23 | %) | $ | 0.29 | $ | 0.18 | 59 | % |

| Adjusted earnings per common share - $ basic (1)(3) | $ | 0.11 | $ | - | 0 | % | $ | 0.29 | $ | 0.05 | 482 | % |

| Adjusted earnings per common share - $ diluted (1)(3) | $ | 0.11 | $ | - | 0 | % | $ | 0.29 | $ | 0.05 | 483 | % |

| Per Ounce Data (except as noted) | ||||||||||||

| Average gold spot price - $/oz(2) | 1,309 | 1,306 | 0 | % | 1,307 | 1,318 | (1 | %) | ||||

| Average copper spot price - $/lbs(2) | 2.77 | 3.12 | (11 | %) | 2.80 | 3.14 | (11 | %) | ||||

| Average realized gold price (Kumtor) - $/oz(3) | 1,289 | 1,294 | (0 | %) | 1,293 | 1,302 | (1 | %) | ||||

| Average realized gold price (Mount Milligan - combined) - $/oz(3) (5) | 1,058 | 966 | 10 | % | 1,032 | 981 | 5 | % | ||||

| Average realized gold price (consolidated) - $/oz(3) (5) | 1,237 | 1,178 | 5 | % | 1,233 | 1,225 | 1 | % | ||||

| Average realized copper price (consolidated) - $/lbs(3) (5) | 1.94 | 2.23 | (13 | %) | 2.15 | 2.23 | (4 | %) | ||||

| Operating Highlights | ||||||||||||

| Gold produced – ounces | 199,578 | 130,183 | 53 | % | 383,140 | 259,947 | 47 | % | ||||

| Gold sold – ounces | 198,287 | 140,427 | 41 | % | 394,738 | 272,859 | 45 | % | ||||

| Payable Copper Produced (000's lbs) | 20,397 | 16,449 | 24 | % | 31,837 | 22,591 | 41 | % | ||||

| Copper Sales (000's payable lbs) | 18,700 | 12,668 | 48 | % | 31,222 | 17,174 | 82 | % | ||||

| Unit Costs | ||||||||||||

| Adjusted operating costs on a by-product basis - $/oz sold(3)(4) | $ | 476 | $ | 529 | (10 | %) | $ | 450 | $ | 489 | (8 | %) |

| Gold - All-in sustaining costs on a by-product basis – $/oz sold(3)(4) | $ | 716 | $ | 996 | (28 | %) | $ | 693 | $ | 963 | (28 | %) |

| Gold - All-in sustaining costs on a by-product basis (including taxes) – $/oz sold(3) (4) | $ | 861 | $ | 1,157 | (26 | %) | $ | 837 | $ | 1,128 | (26 | %) |

| Gold - All-in sustaining costs on a co-product basis (before taxes) – $/oz sold(3)(4) | $ | 712 | $ | 1,027 | (31 | %) | $ | 705 | $ | 967 | (27 | %) |

| Copper - All-in sustaining costs on a co-product basis (before taxes) – $/pound sold(3)(4) | $ | 1.97 | $ | 1.87 | 5 | % | $ | 2.01 | $ | 2.17 | (7 | %) |

| (1) | As at June 30, 2019, the Company had 292,464,324 common shares issued and outstanding (292,991,211 common shares as of July 30, 2019). As of July 30, 2019, Centerra had 5,006,030 share options outstanding under its share option plan with exercise prices ranging from US$2.83 per share to Cdn$22.28 per share, with expiry dates between 2019 and 2027 and 1,260,039 units outstanding under its restricted share unit plan. |

| (2) | Average for the period as reported by the London Bullion Market Association (US dollar Gold P.M. Fix Rate) and London Metal Exchange (LME). This is a non-GAAP measure and is discussed under “Non-GAAP Measures”. |

| (3) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (4) | Excludes Molybdenum business. |

| (5) | Combines streamed and unstreamed amounts. |

3. Overview of Consolidated Results

Second quarter ended 2019 compared to Second Quarter 2018

The Company recorded net earnings of $33.4 million in the second quarter of 2019, compared to $43.5 million in the same period of 2018. Earnings in the second quarter of 2019 reflect a significant increase in ounces produced and sold at Kumtor, as a result of processing higher grade ore and achieving higher recoveries. At Mount Milligan throughput in the current quarter of 2019 improved with increased mill availability, resulting in increased production. The second quarter of 2018 included a pre-tax gain of $28.0 million as a result of the sale of the Company’s royalty portfolio and a gain of $9.4 million to recognize the final instalments to be paid on the sale of the Altan Tsagaan Ovoo (“ATO”) property in Mongolia. Excluding these gains, adjusted earnings for the second quarter of 2018 were $1.0 million reflecting lower gold production at both Kumtor and Mount Milligan. Adjusted earnings for the second quarter of 2019 were $33.4 million.

Cash provided by operations increased to $91.0 million in the second quarter of 2019, compared to $68.1 million in the comparative 2018 period, as a result of higher operating earnings and lower working capital levels in the current quarter. Comparing the second quarter of 2019 with the same period of 2018, Kumtor generated $92.7 million compared to $52.9 million, an increase mainly related to higher production. Mount Milligan’s cash flow from operations remained consistent with the comparative period at $24.2 million.

Cash and cash equivalents at June 30, 2019 was $140.0 million, as compared to $151.7 million at December 31, 2018. In the second quarter of 2019, the Company repaid its corporate credit facility (“Centerra Revolving Term Corporate Facility” or “Corporate Facility”) in full, leaving its $500 million Corporate Facility available as at June 30, 2019. The available balance on the Company’s $150 million five-year credit project financing facility for the Öksüt Project (“OMAS Facility”) at June 30, 2019 is $74.5 million.

Safety and Environment

Centerra had six reportable injuries in the second quarter of 2019, representing two lost-time injuries, two restricted work injuries and two medical aid injuries. On June 20, 2019, Kumtor achieved a milestone of one year without a lost time injury within its contractor workforce.

There were no reportable releases to the environment in the second quarter of 2019.

First Half 2019 compared to First Half 2018

The Company recorded net earnings of $83.8 million in the first half of 2019, compared to $52.6 million in the same period of 2018. Earnings in the first half of 2019 reflect increased production and sale at both Kumtor and Mount Milligan. At Kumtor, the significant increase in ounces produced and sold is as a result of processing higher grade ore and achieving higher recoveries. At Mount Milligan the increased production and sales levels reflect higher throughput, coupled with higher copper grades and gold recoveries. The first half of 2018 included a pre-tax gain of $28.0 million as a result of the sale of the Company’s royalty portfolio and a gain of $9.4 million to recognize the final instalments to be paid on the sale of the ATO property. Excluding these gains, adjusted earnings for the first half of 2018 were $14.5 million reflecting lower gold production at both Kumtor and Mount Milligan. Adjusted earnings for the first half of 2019 were $83.8 million.

Cash provided by operations was $209.8 million in the first half of 2019, compared to $28.3 million in the comparative period, as a result of higher operating earnings and relatively lower working capital levels in the current period. Comparing the first half of 2019 with the same period of 2018, Kumtor generated $212.7 million compared to $95.9 million, an increase mainly related to higher production, while Mount Milligan generated $36.6 million compared to $17.0 million used in operations in the comparative period. The increase in the current year is mainly attributable to higher mill availability resulting in higher production levels.

Safety and Environment

Centerra had eight reportable injuries, representing two lost-time injuries, two restricted work injuries and four medical aid injuries, in the first half of 2019.

During the first half of 2019 there were no reportable release to the environment.

4. 2019 Outlook

See “Material Assumption and Risks” for material assumptions or factors used to forecast production and costs for 2019.

2019 Production Guidance

The Company is favourably revising its 2019 consolidated gold production guidance to 705,000-750,000 ounces which reflects an increase in its gold production guidance for Kumtor to 550,000-575,000 ounces due to the better than expected performance in the first half of 2019. This compares to initial guidance of 690,000-740,000 ounces (consolidated) and 535,000-565,000 ounces (Kumtor) respectively. During September, Kumtor is planning a 6-day scheduled maintenance shutdown to replace the SAG, ball mill and regrind mill liners which is expected to impact production levels compared to the first and second quarter performance with approximately 27% of the production still expected in the fourth quarter. The Company maintains its gold production guidance for Mount Milligan (streamed and unstreamed) of 155,000-175,000 ounces for the year.

Centerra expects consolidated copper production from Mount Milligan (streamed and unstreamed) to be 65-75 million pounds, unchanged from the previous guidance.

Centerra’s 2019 production is currently forecast as follows:

| Units | Kumtor | Mount Milligan(1) | Centerra | ||

| Gold | |||||

| Unstreamed Gold Payable Production | (Koz) | 550 – 575 | 101 – 114 | 651 – 689 | |

| Streamed Gold Payable Production(1) | (Koz) | – | 54 – 61 | 54 – 61 | |

| Total Gold Payable Production(2) | (Koz) | 550 – 575 | 155 – 175 | 705 – 750 | |

| Copper | |||||

| Unstreamed Copper Payable Production | (Mlb) | – | 53 – 61 | 53 – 61 | |

| Streamed Copper Payable Production(1) | (Mlb) | – | 12 – 14 | 12 – 14 | |

| Total Copper Payable Production(3) | (Mlb) | – | 65 – 75 | 65 – 75 |

- Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively, from the Mount Milligan mine. Under the Mount Milligan Streaming Arrangement, Royal Gold will pay $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered.

- Gold production assumes 81.8% recovery at Kumtor and 62.1% recovery at Mount Milligan.

- Copper production assumes 81.4% recovery for copper at Mount Milligan.

2019 All-in Sustaining Unit Costs NG

The Company is favourably revising its 2019 consolidated all-in sustaining costs per ounce soldNG guidance to $713-$743, which reflects the revised guidance for Kumtor of $635-$685 as a result of the higher than expected production in the first half of 2019. This compares to initial guidance of $723-$775 (consolidated) and $666 to $703 (Kumtor). At Mount Milligan, all-in sustaining costs per ounce soldNG for 2019 remains unchanged at a range of $727 - $781. The Company maintains its guidance for corporate and administration cost of $31 million.

Centerra’s 2019 all-in sustaining costs per ounce sold NG are calculated on a by-product basis and are forecast as follows:

| Units | Kumtor | Mount Milligan(2) | Centerra(2) | |

| Ounces sold forecast | (Koz) | 550 – 575 | 155 – 175 | 705-750 |

| All-in sustaining costs on a by-product basis(1), (2) | ($/oz) | $635 - $685 | $727 - $821 | $713 – $743 |

| Revenue-based tax(3) and taxes(3) | ($/oz) | 186 – 195 | 21 - 24 | 148 – 157 |

| All-in sustaining costs on a by-product basis, including taxes (1), (2), (3) | ($/oz) | $821 – $880 | $748 – $845 | $861 – $900 |

| Gold - All-in sustaining costs on a co-product basis ($/ounce) (1),(2) | ($/oz) | $635 - $685 | $842 - $950 | $722 - $768 |

| Copper - All-in sustaining costs on a co-product basis ($/pound) (1),(2) | ($/lb) | – | $1.84 - $2.12 | $1.84 – $2.12 |

| 1) | All-in sustaining costs per ounce sold, all-in sustaining costs per ounce sold on a by-product basis, all-in sustaining costs on a by-product basis including taxes per ounce sold and all-in sustaining costs on a co-product basis (gold and copper) on a per unit basis are non-GAAP measures and are discussed under “Non-GAAP Measures”. |

| 2) | Mount Milligan payable production and ounces sold are on a 100% basis (the Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold and copper sales, respectively). Unit costs and consolidated unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costs and all-in sustaining costs plus taxes. The copper sales are based on a copper price assumption of $2.70 per pound sold for Centerra’s 81.25% share of copper production and the remaining 18.75% of copper revenue at $0.42 per pound (15% of spot price, assuming spot at $2.70 per pound), representing the Mount Milligan Streaming Arrangement. Payable production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and payable metal deductions, subject to metal content, levied by smelters. |

| 3) | Includes revenue-based tax at Kumtor and the British Columbia mineral tax at Mount Milligan based on a forecast gold price assumption of $1,300 per ounce sold. |

| 4) | Results in chart may not add due to rounding. |

2019 Capital Spending

Centerra’s 2019 guidance for capital spending, excluding capitalized stripping, remains at $275 million. However, sustaining capitalNG is now estimated at $100 million and growth capitalNG is now estimated at $175 million, compared to initial guidance of $91 million and $184 million, respectively. The expected increase in sustaining capital is related to Mount Milligan which is now expecting sustaining capital of $45 million compared to $37 million in the previous guidance, primarily due to additional site water management projects.

The change in growth capitalNG reflects a reduction in expected spending at Öksüt to $100 million from previous guidance of $123 million, due to the advanced stage of project construction, deferral of certain non-essential construction activities to after commissioning and a reduction of $10 million of contingency in the 2019 budget. The Öksüt project remains on schedule with first gold pour expected in January 2020 at a targeted level of 85% construction completion. Growth capitalNG at Kumtor for 2019 is expected to be $20 million compared to $14 million in the previous guidance due to additional spending on in-fill and geotechnical drilling in the Hockey Stick Zone. Expected spending at the Kemess Underground Project for 2019 has been revised to $35 million compared to the initial guidance of $26 million, primarily due to cost estimation complexity when building a Selen IX water treatment plant, as well as some rework on concrete foundations. The water treatment plant is expected to be commissioned in December 2019.

Projected capital expenditures (excluding capitalized stripping) include:

| Projects ($ millions) | 2019 Sustaining CapitalNG | 2019 Growth CapitalNG | ||

| Kumtor Mine | 45 | 20 | ||

| Mount Milligan Mine | 45 | - | ||

| Öksüt Project | - | 100 | ||

| Kemess Underground Project | - | 35 | ||

| Greenstone Gold Property | - | 20 | ||

| Other (Thompson Creek Mine, Endako Mine (75%), Langeloth facility and Corporate) | 10 | - | ||

| Consolidated Total | $100 | $175 | ||

| NG Sustaining capital and growth are non-GAAP measures and are discussed under “Non-GAAP Measures”. | ||||

Total capitalized stripping at Kumtor is expected to increase to $140 million, including a cash component of $110 million, from previous guidance of $108 million, including an $88 million cash component, related to the development of the open pit. The increase is primarily due to the mine plan revision during the quarter that divided cut-back 19 into cut-back 19 East and cut-back 19 West and shifted part of the mining fleet to focus on additional waste stripping in cut-back 20 which is capitalized until ore is released.

2019 Depreciation, Depletion and Amortization

Consolidated depreciation, depletion and amortization (DD&A) expense included in costs of sales expense for 2019 is forecasted to be in the range of $240 - $260 million compared to $220 - $240 million in the previous guidance. The increase in consolidated DD&A reflects an increase in Kumtor’s DD&A expense to $190 - $200 million from $170 - $180 million primarily due to higher ounces sold. In the second half of 2019 DD&A expense levels are expected to increase in comparison to the first half levels.

2019 Other Costs

Forecasted costs in 2019 for exploration and for income taxes remain unchanged from the previous guidance.

Financing Costs

The Company is currently estimating its financing costs at $16-$18 million in 2019. Financing costs consists of interest expenses, commitment fees and financing fees associated with the Corporate Facility, the OMAS Facility and the Caterpillar Promissory Note (“the Financing Facilities”). The financing costs are dependent on the amount of the drawdown balances on the Company’s financing facilities and also include accretion costs related to our reclamation liabilities.

Molybdenum Business Unit

In 2019, the Company expects that the Langeloth metallurgical roasting facility, forming part of the molybdenum business, will not generate sufficient operating margins to cover the costs of its two molybdenum mines on care and maintenance. Care and maintenance expenses related to the Molybdenum unit are currently estimated to be between $13 - $15 million for 2019.

Sensitivities

Centerra’s revenues, earnings and cash flows for the remaining six months of 2019 are sensitive to changes in certain key inputs or currencies. The Company has estimated the impact of any such changes on revenues, net earnings and cash from operations.

| Change | Impact on ($ millions) | Impact on ($ per ounce sold) | |||||

| Costs(3) | Revenues | Cash flows | Net Earnings (after tax) | AISC(2) on by- product basis | |||

| Gold price | $50/oz | 1.8 – 2.0 | 14.4 – 16.4 | 12.6 – 14.4 | 12.6 – 14.4 | 2 – 3 | |

| Copper price | 10% | 0.3 – 0.4 | 7.5 – 9.7 | 7.2 – 9.3 | 7.2 – 9.3 | 10 – 13 | |

| Diesel fuel | 10% | 2.4 – 3.1 | - | 2.4 – 3.1 | 2.4 – 3.1 | 3 – 4 | |

| Kyrgyz som(1) | 1 som | 0.6 – 1.1 | - | 0.6 – 1.1 | 0.6 – 1.1 | 1 – 2 | |

| Turkish Lira(1) | 1 lira | 0.6 – 0.9 | - | 0.6 – 0.9 | - | - | |

| Canadian dollar(1) | 10 cents | 6.4 – 9.3 | - | 6.4 – 9.3 | 5.7 – 8.4 | 8 - 11 | |

| (1) | Appreciation of currency against the U.S. dollar will result in higher costs and lower cash flow and earnings, depreciation of currency against the U.S. dollar results in decreased costs and increased cash flow and earnings. |

| (2) | Non-GAAP measure. See discussion under “Non-GAAP Measures”. |

| (3) | Includes capital costs. |

Material Assumptions and Risks

Material assumptions or factors used to forecast production and costs for the remaining six months of 2019 include the following:

- a gold price of $1,300 per ounce,

- a copper price of $2.70 per pound,

- a molybdenum price of $12 per pound,

- exchange rates:

° $1USD:$1.30 Canadian dollar,

° $1USD:69.0 Kyrgyz som,

° $1USD:5.50 Turkish lira,

° $1USD:0.88 Euro, - diesel fuel price assumption:

° $0.54/litre at Kumtor,

° $0.91/litre (CAD$1.10/litre) at Mount Milligan.

The assumed diesel price of $0.54/litre at Kumtor assumes that no Russian export duty will be paid on the fuel exports from Russia to the Kyrgyz Republic. Diesel fuel for Kumtor is sourced from separate Russian suppliers. The diesel fuel price assumptions are assuming the price of oil of approximately $86 per barrel. Crude oil is a component of diesel fuel purchased by the Company, such that changes in the price of Brent crude oil generally impacts diesel fuel prices. The Company established a hedging strategy to manage changes in diesel fuel prices on the cost of operations at the Kumtor mine. The Company targets to hedge up to 75% of crude oil component of monthly diesel purchases exposure over the last six months of 2019 (see 7. Financial Instruments for current hedged position).

Other material assumptions used in forecasting production, costs and capital forecasts for the remaining six months of 2019 are unchanged from the prior guidance disclosure of May 1, 2019. In addition, the Company’s forecast assumes that all required inspection approvals for the Öksüt Project are received in normal course.

Production, cost and capital forecasts for 2019 are forward-looking information and are based on key assumptions and subject to material risk factors that could cause actual results to differ materially and which are discussed herein under the headings “Material Assumptions & Risks” and “Caution Regarding Forward-Looking Information” in this document and under the heading “Risks That Can Affect Our Business” in the Company’s most recent Annual Information Form.

Qualified Person & QA/QC – Production Information

The production information and other scientific and technical information presented in this document, including the production estimates were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101 and (except as otherwise noted) were prepared, reviewed, verified and compiled by Centerra’s geological and mining staff under the supervision of Gordon Reid, Professional Engineer and Centerra’s Vice- President and Chief Operating Officer, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used.

5. Financial Performance

Second quarter ended 2019 compared to Second Quarter 2018

Revenue increased to $340.5 million in the second quarter of 2019 from $243.3 million in the second quarter of 2018, as a result of 41% more gold ounces sold (198,287 ounces compared to 140,427 ounces), 48% more copper pounds sold (18.7 million pounds compared to 12.7 million pounds) and 20% higher molybdenum sales as compared to 2018, partially offset by lower average realized prices for copper.

Gold production for the second quarter of 2019 was 199,578 ounces compared to 130,183 ounces for the same period of 2018. Gold production at Kumtor was 151,065 ounces in the second quarter of 2019, 80% higher than the 83,802 ounces produced in the same period of 2018. The increase in ounces produced at Kumtor is a result of milling more ore from higher grade stockpiles, contributing to an average mill head grade in the second quarter of 2019 of 3.48 g/t compared to 2.27 g/t in the second quarter of 2018. During the quarter ended June 30, 2019, Mount Milligan produced 48,513 ounces of gold and 20.4 million pounds of copper, 5% and 24% higher than in the same period of 2018 respectively, reflecting higher mill availability and throughput, higher copper grades and higher gold recoveries.

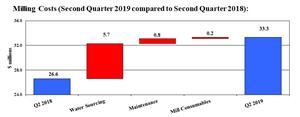

Cost of sales increased in the second quarter of 2019 to $238.5 million compared to $187.4 million in the same period of 2018, mainly resulting from higher sales volumes and higher operating costs at both operating mines, including abnormal water sourcing costs at Mount Milligan. In the molybdenum business, higher concentrate feed costs and volumes resulted in a 17% increase in cost of sales. Depreciation, depletion and amortization associated with production was $59.0 million in the second quarter of 2019 as compared to $43.5 million in the same period of 2018.

Centerra’s all-in sustaining costs on a by-product basis per ounce of gold soldNG, which excludes revenue-based tax and income tax, decreased to $716 in the second quarter of 2019 from $996 in the comparative period mainly as a result of higher ounces sold, higher copper credits and lower capitalized stripping costs at Kumtor, partially offset by higher administration costs.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b98c4f43-6204-4e88-a306-9c6dddd6cbbd

Exploration expenditures in the second quarter of 2019 were $6.3 million, a 35% increase compared to the $4.7 million in the same period of 2018, reflecting the resumption of exploration activities at Kumtor in mid-2018 and increased spending on advanced projects as compared to the comparative quarter.

Financing costs in the second quarter of 2019 were $3.7 million compared to $5.9 million in the comparative quarter of 2018, reflecting the Company’s repayment of the principal outstanding on its Corporate Facility.

Corporate administration costs were $13.7 million in the second quarter of 2019, an increase of $5.3 million compared to the same period of 2018, mainly due to an increase in share-based compensation of $6.8 million, driven by an increase in the Company’s share price, partially offset by lower administration costs associated with the Company’s recent acquisitions.

First Half 2019 compared to First Half 2018

Revenue increased to $674.5 million in the first half of 2019 from $478.7 million in the first half of 2018, as a result of 45% more gold ounces sold (394,738 ounces compared to 272,859 ounces), 82% more copper pounds sold (31.2 million pounds compared to 17.2 million pounds) and 14% higher molybdenum sales as compared to 2018, partially offset by lower average realized prices for copper.

Gold production for the first half of 2019 was 383,141 ounces compared to 259,947 ounces for the same period of 2018. Gold production at Kumtor was 301,373 ounces in the first half of 2019, 64% higher than the 184,023 ounces produced in the same period of 2018. The increase in ounces produced at Kumtor is a result of milling more ore from higher grade stockpiles, contributing to an average mill head grade of 3.60 g/t in the first six months of 2019 compared to 2.43 g/t in the same period of 2018, and achieving higher recoveries in the first half of 2019 as compared to 2018. During the first half of 2019, Mount Milligan produced 81,767 ounces of gold and 31.8 million pounds of copper, 8% and 41% higher than in the same period of 2018, reflecting higher mill availability and throughput, higher copper grades and higher gold recoveries, partially offset by lower gold grade.

Cost of sales increased in the first half of 2019 to $461.9 million compared to $340.2 million in the same period of 2018, mainly resulting from higher sales volumes and higher mining and milling costs at Mount Milligan (including higher water sourcing costs) and higher milling costs at Kumtor. Higher costs and volumes resulted in a 21% increase in cost of sales in the molybdenum business. Depreciation, depletion and amortization associated with production was $113.4 million in the first half of 2019 as compared to $85.2 million in the same period of 2018.

All-in sustaining costs on a by-product basis per ounce of gold soldNG, which excludes revenue-based tax and income tax, decreased to $693 in the first half of 2019 from $963 in the comparative period mainly as a result of higher ounces sold, higher copper credits and lower capitalized stripping costs at Kumtor, partially offset by higher administration costs in the first half of 2019 as compared to the first half of 2018.

Care and maintenance costs in the first half of 2019 totaled $14.2 million compared to $8.9 million in the same period of 2018. The increase in 2019 reflects increased activities at the Kemess site and the impact from exchange rate movements on Endako’s reclamation provision.

Exploration expenditures in the first half of 2019 were $11.3 million, a 59% increase compared to the $7.1 million in the same period of 2018, reflecting the resumption of exploration activities at Kumtor starting mid-2018 and increased spending on advanced projects as compared to the comparative period.

Financing costs in the first half of 2019 were $7.7 million compared to $20.5 million in the comparative period of 2018, reflecting the Company’s repayment of one of its outstanding credit facilities, which resulted in lower interest expense, lower financing costs and fees in 2019.

Corporate administration costs were $23.4 million in the first half of 2019, an increase of $4.6 million compared to the same period of first half of 2018, mainly due to an increase in share-based compensation of $7.1 million, driven by an increase in the Company’s share price in the second quarter of 2019, partially offset by lower administration costs associated with the Company’s recent acquisitions.

6. Balance Sheet Review

| Capital Expenditure | |||||||||

| $ millions | Three months ended June 30 | Six months ended June 30 | |||||||

| 2019 | 2018 | Change | 2019 | 2018 | Change | ||||

| Consolidated: | |||||||||

| Sustaining capitalNG | 20.8 | 20.5 | 1 | % | 40.6 | 44.8 | (9 | %) | |

| Capitalized stripping (1) | 15.6 | 47.8 | (67 | %) | 38.5 | 86.3 | (55 | %) | |

| Growth capitalNG | 4.5 | 5.9 | (24 | %) | 6.5 | 9.4 | (31 | %) | |

| Öksüt Project development | 20.0 | 10.1 | 99 | % | 35.3 | 15.9 | 123 | % | |

| Greenstone Gold Property capital (2) | 4.1 | 3.4 | 22 | % | 7.7 | 5.1 | 49 | % | |

| Kemess Underground Project development | 9.6 | 5.5 | 74 | % | 14.2 | 5.5 | 158 | % | |

| Total (3) | 74.6 | 93.2 | (20 | %) | 142.7 | 166.9 | (15 | %) | |

| (1) | Includes cash component of $12.1 million and $29.4 million in the three and six months ended June 30, 2019 ($36.6 million and $65.3 million in the comparative periods of 2018, respectively). | ||||||||

| (2) | In accordance with the Company's accounting policy, the 50% share of costs paid on behalf of Premier Gold Mines Limited is capitalized as part of mineral properties in Property, Plant & Equipment. | ||||||||

| (3) | Excludes capitalized equipment leases. | ||||||||

Capital expenditures in the second quarter of 2019 were $74.6 million compared to $93.2 million in the same period of 2018, resulting mainly from reduced spending on capitalized stripping at Kumtor ($32.2 million) and lower growth capitalNG ($1.4 million), partially offset by higher spending on the Company’s development projects (at Öksüt ($9.9 million) and Kemess ($4.1 million)).

Credit Facilities

Centerra was in compliance with the terms of all of its credit facilities as at June 30, 2019.

As at June 30, 2019, the Corporate Facility is undrawn.

The OMAS Facility expires on March 31, 2024 and as at June 30, 2019, had a drawn balance of $75.5 million. As at June 30, 2019, $6.3 million (December 31, 2018 - $6.2 million) of deferred financing fees are being amortized over the term of the OMAS Facility.

As at June 30, 2019 the principal amount outstanding under the Caterpillar Financial Services Limited Promissory Note (“CAT Note”) was $27 million.

7. Market Conditions

Gold Price

During the second quarter of 2019, the spot gold price fluctuated between a low of $1,271 per ounce and a high of $1,423 per ounce. The average spot gold price for the second quarter was $1,309 per ounce, an increase of $3 per ounce from the second quarter of 2018 average ($1,306 per ounce), and a $5 per ounce increase compared to the first quarter of 2019 average ($1,304 per ounce).

Copper Price

The average spot copper price in the second quarter of 2019 was $2.77 per pound, a $0.35 per pound decrease compared to the second quarter of 2018 average of $3.12 per pound, and a $0.05 per pound increase compared to the first quarter of 2019 average ($2.82 per pound).

Molybdenum Price

The average molybdenum price in the second quarter of 2019 was $12.18 per pound, a $0.45 per pound increase when compared to the second quarter of 2018 average of $11.73 per pound, and a $0.40 per pound increase compared to the first quarter of 2019 average ($11.78 per pound).

Foreign Exchange

The Company receives its revenues through the sale of gold, copper and molybdenum in U.S. dollars. The Company has operations in Canada, including its corporate head office, the Kyrgyz Republic, Turkey and the United States. During the first six months of 2019, the Company incurred combined expenditures (including capital) of approximately $563 million. Approximately $288 million of this (51%) was in currencies other than the U.S. dollar. Centerra’s non-U.S. dollar costs includes 62% in Canadian dollars, 29% in Kyrgyz soms, 5% in Euros and 2% in Turkish lira. The Canadian dollar and Kyrgyz som strengthened against the U.S. dollar by 3% and 0.2% on average from its value at December 31, 2018. The Turkish lira and the Euro depreciated against the U.S. dollar by approximately 6% and 2%, respectively, over the same period. The net impact of these movements in the six months ended June 30, 2019 was to increase costs in the period by $3.6 million (decrease of $2.5 million in the six months ended June 30, 2018).

USD to CAD

The average U.S. dollar to Canadian dollar exchange rate for the second quarter of 2019 of 1.34, weakened when compared to the average of the first quarter of 2019 (1.33), with rates in the second quarter ranging from 1.31 to 1.35.

USD to Kyrgyz Som

The average U.S. dollar to Kyrgyz som exchange rate for the second quarter of 2019 of 69.8 was the same as the average of the first quarter of 2019, with rates in the quarter ranging from 69.5 to 69.9.

USD to Turkish Lira

The average U.S. dollar to Turkish lira exchange rate for the second quarter of 2019 of 5.9, weakened when compared to the first quarter of 2019 (5.4) and 34% when compared to the average of the second quarter of 2018 (4.4). The exchange rate ranged from 5.5 to 6.2 in the second quarter of 2019.

8. Financial Instruments

The Company seeks to manage its exposure to fluctuations in diesel fuel prices, commodity prices and foreign exchange rates by entering into derivative financial instruments from time-to-time.

The hedge positions for each of these programs as at June 30, 2019 are summarized as follows:

| As at June 30, 2019 | As at June 30, 2019 | |||||||

| Program | Instrument | Unit | Average strike price | Type | Total Position (5) | Fair value gain (loss) ('000') | ||

| Fuel Hedges | ULSD zero-cost collars(1) | Barrels | $75/$82 | Fixed | 68,670 | $186 | ||

| Fuel Hedges | ULSD forwards(2) | Barrels | $77 | Fixed | 29,320 | $137 | ||

| Fuel Hedges | Brent Crude Oil zero-cost collars(1) | Barrels | $59/$69 | Fixed | 147,570 | $46 | ||

| Gold/Copper Hedges (Royal Gold deliverables): | ||||||||

| Gold Derivative Contracts | Forward contracts(3) | Ounces | -(4) | Float | 20,860 | $1,145 | ||

| Copper Derivative Contracts | Forward contracts(3) | Pounds | -(4) | Float | 4.1 million | $17 | ||

| FX Hedges | ||||||||

| USD/CAD Derivative Contracts | Zero-cost collars(2) | CAD Dollars | 1.31/1.36 | Fixed | 125.1 million | $763 | ||

| (1) | Under the fuel zero-cost collars, the Company retains the right to buy fuel barrels at the contract’s ‘ceiling’ price, if the market price was to exceed this price upon contract expiration, while requiring the Company to buy fuel barrels at the ‘floor’ price if the market price fell below this price upon expiration. At the end of each contract there is no exchange of the underlying item and it is financially settled. |

| (2) | Under the ULSD forward contracts, the Company agrees to buy a specified quantity of barrels at a specified contract price at a future date. At the end of each contract there is no exchange of the underlying item and it is financially settled. |

| (3) | Under the Royal Gold forward contracts, the Company must sell specified quantities of gold or copper, at a future market price on a specified date. |

| (4) | Royal Gold hedging program with a market price determined on closing of the contract. |

| (5) | Hedge positions as at end of June 2019 are due to settle by end of 2019. |

Centerra does not enter into off-balance sheet arrangements with special purpose entities in the normal course of its business, nor does it have any unconsolidated affiliates.

9. Operating Mines and Facilities

Kumtor Mine

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia operated by a Western-based gold producer. It has been in production since 1997 and has produced over 12.3 million ounces of gold to June 30, 2019.

Recent Developments

The Company continues to work with the Government of the Kyrgyz Republic (“Government”) to satisfy the conditions precedent to completion of the comprehensive settlement agreement entered into with the Government on September 11, 2017. The longstop date for satisfaction of all such conditions was extended a number of times by agreement of all parties and is now August 10, 2019. See “Contingencies”.

| Kumtor Operating Results | ||||||||||||||||

| ($ millions, except as noted) | Three months ended June 30, | Six months ended June 30, | ||||||||||||||

| 2019 | 2018 | % Change | 2019 | 2018 | % Change | |||||||||||

| Financial Highlights: | ||||||||||||||||

| Revenue - $ millions | 197.7 | 117.3 | 69 | % | 392.6 | 270.3 | 45 | % | ||||||||

| Cost of sales (cash) | 57.2 | 44.4 | 29 | % | 108.4 | 87.0 | 25 | % | ||||||||

| Cost of sales (non-cash) | 43.6 | 31.4 | 39 | % | 84.6 | 67.1 | 26 | % | ||||||||

| Cost of sales (total) | 100.8 | 75.8 | 33 | % | 193.0 | 154.1 | 25 | % | ||||||||

| Cost of sales - $/oz sold (1) | 658 | 837 | (21 | %) | 636 | 742 | (14 | %) | ||||||||

| Cash provided by operations | 92.7 | 52.9 | 75 | % | 212.7 | 95.9 | 122 | % | ||||||||

| Cash provided by operations before changes in working capital(1) | 105.9 | 52.0 | 104 | % | 215.7 | 136.6 | 58 | % | ||||||||

| Operating Highlights: | ||||||||||||||||

| Tonnes mined - 000s | 39,949 | 43,493 | (8 | %) | 89,143 | 90,807 | (2 | %) | ||||||||

| Tonnes ore mined – 000s | 2,630 | 957 | 175 | % | 4,507 | 2,361 | 91 | % | ||||||||

| Average mining grade - g/t | 1.45 | 1.72 | (15 | %) | 1.74 | 1.90 | (8 | %) | ||||||||

| Tonnes milled - 000s | 1,575 | 1,571 | 0 | % | 3,151 | 3,239 | (3 | %) | ||||||||

| Average mill head grade - g/t | 3.48 | 2.27 | 53 | % | 3.60 | 2.43 | 48 | % | ||||||||

| Mill Recovery - % | 82.3 | % | 70.3 | % | 17 | % | 82.1 | % | 71.4 | % | 15 | % | ||||

| Mining costs - total ($/t mined material) | 1.32 | 1.23 | 7 | % | 1.16 | 1.15 | 1 | % | ||||||||

| Milling costs ($/t milled material) | 11.51 | 10.55 | 9 | % | 11.22 | 9.89 | 13.4 | % | ||||||||

| Gold produced – ounces | 151,065 | 83,802 | 80 | % | 301,373 | 184,023 | 64 | % | ||||||||

| Gold sold – ounces | 153,307 | 90,620 | 69 | % | 303,574 | 207,539 | 46 | % | ||||||||

| Average realized gold price (1) - $/oz sold | $ | 1,289 | $ | 1,294 | (0 | %) | $ | 1,293 | $ | 1,302 | (1 | %) | ||||

| Capital Expenditures (sustaining) (1) - cash | 11.3 | 9.9 | 14 | % | 20.3 | 21.2 | (4 | %) | ||||||||

| Capital Expenditures (growth) (1) - cash | 4.5 | 5.9 | (24 | %) | 6.5 | 9.4 | (31 | %) | ||||||||

| Capital Expenditures (stripping) - cash | 12.1 | 36.6 | (67 | %) | 29.4 | 65.3 | (55 | %) | ||||||||

| Capital Expenditures (stripping) - non-cash | 3.5 | 11.2 | (69 | %) | 9.0 | 21.0 | (57 | %) | ||||||||

| Capital expenditures (total) | 31.4 | 63.6 | (51 | %) | 65.2 | 116.9 | (44 | %) | ||||||||

| Unit Costs: | ||||||||||||||||

| Adjusted operating costs (1)- $/oz sold | $ | 407 | $ | 555 | (27 | %) | $ | 391 | $ | 475 | (18 | %) | ||||

| Gold - All-in sustaining costs on a by-product basis - $/oz sold(1) | $ | 562 | $ | 1,071 | (47 | %) | $ | 557 | $ | 895 | (38 | %) | ||||

| Gold - All-in sustaining costs on a by-product basis (including taxes) - $/oz sold(1) | $ | 744 | $ | 1,254 | (41 | %) | $ | 739 | $ | 1,078 | (31 | %) | ||||

| (1) | Non-GAAP measure. See discussion under “Non-GAAP Measures” |

| (2) | Operating costs (on a sales basis) is a non-GAAP measure and is comprised of mine operating costs such as mining, processing, administration, royalties and production taxes (except at Kumtor where revenue-based taxes are excluded), but excludes reclamation costs and depreciation, depletion and amortization. |

Second quarter ended 2019 compared to Second Quarter 2018

Production:

During the second quarter of 2019, Kumtor continued mining cut-backs 19 West, 20 and 20A and ice unloading.

Total waste and ore mined in the second quarter of 2019 was 39.9 million tonnes compared to 43.5 million tonnes in the second quarter of 2018, representing a decrease of 8.1% mainly due to trucking delays from weather constraints in 2019.

Kumtor produced 151,065 ounces of gold in the second quarter of 2019 compared to 83,802 ounces of gold in the same period of 2018. The increase in the current quarter is primarily due to processing ore with higher grades from cut-back 18 and 19 stockpiles and higher recoveries, compared to lower grade stockpiled ore from cut-back 17 and Sarytor processed in the second quarter of 2018. During the second quarter of 2019, Kumtor’s average mill head grade was 3.48 g/t with a recovery of 82.3% compared to 2.27 g/t and a recovery of 70.3% for the same period in 2018.

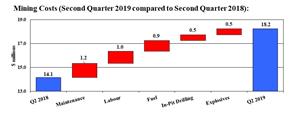

Mining Costs, including capitalized stripping:

Mining costs, including capitalized stripping, was $52.4 million in the second quarter of 2019, which was $0.8 million lower than the comparative quarter in 2018. Lower costs in the second quarter of 2019 includes lower diesel costs ($1.9 million), which was due to lower mine production and lower consumption rates resulting from decreased haulage distance and weather delays.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/27a8e781-b0a1-45c9-95ce-413a879c8e78

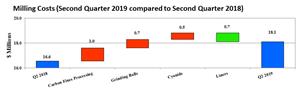

Milling costs amounted to $18.1 million in the second quarter of 2019 compared to $16.6 million in the comparative quarter of 2018. The increase is mainly due to higher carbon fines processing costs compared to the same period of 2018 (when carbon fines processing was not fully operational), higher grinding media costs due to the processing of a harder ore type and higher cyanide costs mainly due to higher prices and consumption rates. This was partially offset by lower liner costs due to the timing of mill liner replacements.

Site Support Costs:

Site support costs in the second quarter of 2019 was $12.0 million compared to $12.8 million in 2018. The decrease is attributable primarily due to lower contractors’ service costs ($0.6 million) resulted from fewer contractors, and lower costs for camp supplies.

Other Cost movements:

DD&A associated with sales increased to $43.6 million in the second quarter of 2019 from $31.0 million in the comparative period, mainly due to higher ounces sold and higher amortization of capitalized stripping resulting from the release of ore from cut-back 19.

All-in Sustaining Costs:

All-in sustaining costs on a by-product basis per ounce soldNG, which excludes revenue-based tax, was $562 in the second quarter of 2019 compared to $1,071 in the same period of 2018. The decrease was mainly due to higher ounces sold and lower capitalized stripping. The decrease in capitalized stripping resulted from accessing ore at cut-back 19 West in June 2019, earlier than we accessed ore in 2018) at which time capitalization of deferred stripping costs ceased, with subsequent stripping costs accounted for in inventory.

Including revenue-based taxes, all-in sustaining costs on a by-product basis per ounce soldNG was $744 in the second quarter of 2019 compared to $1,254 in the same period of 2018. The decrease was mainly due to lower all-in sustaining costsNG (explained above), partially offset by higher revenue-based taxes resulted from increased sales revenue achieved in the second quarter of 2019.

First Half 2019 compared to First Half 2018

Production:

During the first half of 2019 Kumtor focused on developing cut-backs 19 (East and West), 20 and 20A in the Central Pit and ice unloading.

Total waste and ore mined in the first half of 2019 was 89.1 million tonnes compared to 90.8 million tonnes in the comparative period of 2018 mainly due to a decrease in the average haulage distance in the first half of 2019.

Kumtor produced 301,373 ounces of gold in the first half of 2019 compared to 184,023 ounces of gold in the first half of 2018. The increase is primarily due to processing ore with higher grade and recovery from cut-back 18 and 19 stockpiles. During the first half of 2019, Kumtor’s mill head grade was 3.60 g/t with a recovery of 82.1%, compared with 2.43 g/t and a recovery of 71.4% for the same period in 2018.

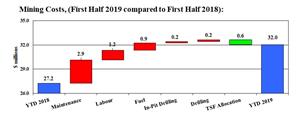

Mining Costs, including capitalized stripping:

Mining costs, including capitalized stripping, was $103.7 million in the first half of 2019 compared to $104.5 million in the comparative period of 2018. Mining costs decreased slightly due to lower diesel costs ($1.5 million), which was due to lower consumption resulting from a shorter haulage profile in 2019. This was partially offset by higher assay costs mainly due to an increased number of samples tested.

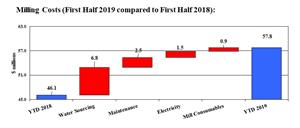

Milling Costs:

Milling costs of $35.4 million in the first half of 2019 compared to $32.0 million in the comparative period of 2018, reflecting higher carbon fines processing costs ($1.9 million) as the associated unit operation was ramping up in the first half of 2018, and higher grinding media costs ($1.4 million) due to the processing of a harder ore type.

Site Support Costs:

Site support costs in the first half of 2019 totaled $23.8 million compared to $25.7 million in the comparative year. The decrease is attributable primarily due to lower costs for camp supplies ($1.1 million) due to cost optimization and fewer contractors on site.

Other Cost movements:

DD&A associated with sales increased to $84.6 million in the first half of 2019 from $67.1 million in the comparative period, mainly due to higher ounces sold and higher amortization of capitalized stripping costs resulting from the release of ore from cut-back 19 West.

All-in Sustaining Costs:

All-in sustaining costs on a by-product basis per ounce soldNG, which excludes revenue-based tax, was $557 in the first half of 2019 compared to $895 in the same period of 2018. The decrease was mainly due to higher ounces sold and lower capitalized stripping. The decrease in capitalized stripping resulted from accessing ore at cut-back 19 West in June 2019, earlier than we accessed ore in 2018) at which time capitalization of deferred stripping costs ceased, with subsequent stripping costs accounted for in inventory.

Including revenue-based taxes, all-in sustaining costs on a by-product basis per ounce soldNG was $739 in the first half of 2019 compared to $1,078 in the same period of 2018. The decrease was mainly due to lower all-in sustaining costsNG (explained above), partially offset by higher revenue-based taxes resulting from increased sales revenue achieved in the first half of 2019.

Mount Milligan Mine

The Mount Milligan Mine is an open pit mine located in north central British Columbia, Canada producing a gold and copper concentrate. Production at Mount Milligan is subject to arrangement with RGLD AG and Royal Gold, Inc. (together, “Royal Gold”) pursuant to which Royal Gold is entitled to purchase 35% of the gold produced and 18.75% of the copper production at the Mount Milligan mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonnes of copper delivered (the “Mount Milligan Streaming Arrangement”).

Recent Developments

- At Mount Milligan average daily mill throughput together with copper and gold recoveries have met or exceeded expectations in the first half of the year.

- As water availability increased with the spring melt and the Company started accessing water from the newly permitted water sources in April 2019, the mill returned to full capacity in early May and mill throughput averaged 53,559 tonnes per calendar day (58,245 tonnes per operating day) during the second quarter of 2019.

- During the month of June, the mill averaged 60,576 tonnes per calendar day.

Water Update

As previously noted, the Company received amendments to its environmental assessment certificate to permit access to additional sources of surface water and groundwater until November 30, 2021. The Company is now permitted to obtain water for use in Mount Milligan’s milling operation from Philip Lake 1, Rainbow Creek and Meadows Creek until November 30, 2021 at set rates as well as water from groundwater sources within a radius of six kilometres of the Mount Milligan Mine for the life of the mine. The Company started accessing water from these newly permitted sources in April 2019. Weather conditions around the Mount Milligan Mine, and elsewhere in British Columbia, continue to be exceptionally hot and dry, which has affected precipitation levels as well as water flows in rivers, streams and other bodies of water. As a result, the amount of water that Mount Milligan captured from the 2019 spring melt runoff was less than anticipated. The Company is continuing to explore for additional groundwater sources to supply the Mount Milligan processing plant as well as continuing to work towards a long-term water solution. The Company estimates that if additional groundwater sources are not available and / or dry weather conditions persist in the second half of 2019, the Company may need to take steps to manage its production in the first quarter of 2020 to conserve water resources until the 2020 spring melt.

With respect to the updated long-term water supply plan, the Company continues to work with relevant stakeholders to identify and evaluate water sources that will best be able to supply Mount Milligan’s mill for the life-of-mine while meeting environmental and other parameters. Formal applications and government review are expected to commence later this year, and will be the subject of discussion with regulators, potentially affected Indigenous groups, local communities and other interested parties. The Company’s expectation is that its updated long-term water source (or sources) should be available after November 2021 for the entire life-of-mine, although there can be no assurance that it will have adequate sources of water over the long term. See “Caution Regarding Forward-Looking Information”.

Groundwater Exploration

In the second quarter of 2019, the groundwater exploration strategy shifted to refining target development through geophysics. The geophysics program focused on the Lower Rainbow target area, about 2.5 kilometres northeast of the Tailings Storage Facility (TSF) and the Meadows target area, two kilometres south of the TSF.

Four water wells were drilled in the second quarter in the Lower Rainbow target area and two continue to be developed for long-term groundwater yield. Preliminary results are encouraging and have encountered buried channel sand-and-gravel identified previously and what is now identified as the Rainbow Valley Aquifer. Water licenses have been applied for and engineering design initiated that would allow available water to be pumped to the TSF by October 1, 2019. However, there can be no certainty that licenses would be available in time to meet this schedule.

| Mount Milligan Operating Results | ||||||||||||||||

| ($ millions, except as noted) | Three months ended June 30, | Six months ended June 30, | ||||||||||||||

| 2019 | 2018 | % Change | 2019 | 2018 | % Change | |||||||||||

| Financial Highlights: | ||||||||||||||||

| Gold sales | 47.6 | 47.9 | (1 | %) | 93.9 | 64.0 | 47 | % | ||||||||

| Copper sales | 36.4 | 28.2 | 29 | % | 67.5 | 38.2 | 77 | % | ||||||||

| Total Revenues | 84.0 | 76.1 | 10 | % | 161.4 | 102.2 | 58 | % | ||||||||

| Cost of sales (cash) | 65.6 | 50.7 | 29 | % | 122.1 | 70.6 | 73 | % | ||||||||

| Cost of sales (non-cash) | 14.1 | 11.2 | 26 | % | 26.4 | 15.5 | 70 | % | ||||||||