Centerra Gold Reports Third Quarter Results

All figures are in United States dollars and all production figures are on a 100%-basis and continuing operations basis, unless otherwise stated. This news release contains forward-looking information regarding Centerra Gold’s business and operations. See “Caution Regarding Forward-Looking Information” in Centerra Gold’s Management’s Discussion & Analysis for the three and nine months ended September 30, 2022 (“MD&A”) included in this press release. All references in this document denoted with NG indicate a “specified financial measure” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. None of these specified measures is a standardized financial measure under International Financial Reporting Standards (“IFRS”) and these measures might not be comparable to similar financial measures disclosed by other issuers. See “Non-GAAP and Other Financial Measures” in the MD&A included in this press release for a discussion of the specified financial measures used in this document and a reconciliation to the most directly comparable IFRS measure.

TORONTO, Nov. 07, 2022 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG and NYSE: CGAU) today reported its third quarter of 2022 results.

Significant financial and operating results of the third quarter ended September 30, 2022 included:

- Net loss for the quarter of $33.9 million or $0.14 per common share (basic), including a deferred income tax expense of $27.6 million.

- Adjusted lossNG for the quarter of $15.9 million or $0.06 per common share (basic).

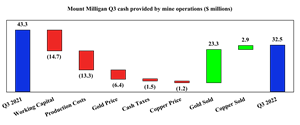

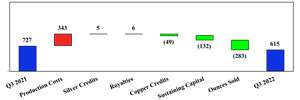

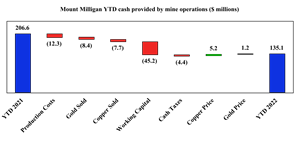

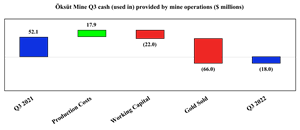

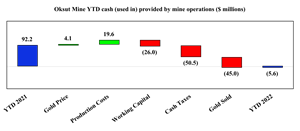

- Cash used in operating activities for the quarter of $17.0 million, was primarily due to a suspension of gold room operations at the ADR plant at the Öksüt Mine. No gold ounces were sold at the Öksüt Mine in the period but cash used in operating activities was $18.0 million with continued mining and stacking of ore. Mount Milligan Mine generated cash provided by mine operating activities of $33.4 million during the quarter.

- Free cash flow deficitNG for the quarter of $35.5 million.

- Gold production for the quarter of 54,134 ounces, solely from the Mount Milligan Mine. At the Öksüt Mine, approximately 40,000 ounces were processed into stored gold-in-carbon inventory during the quarter, increasing the total stored gold-in-carbon inventory balance to approximately 100,000 recoverable ounces at the end of September.

- Copper production for the quarter of 19.0 million pounds.

- Gold production costs for the quarter of $729 per ounce.

- Copper production costs for the quarter of $1.51 per pound.

- All-in sustaining costs on a by-product basisNG for the quarter of $941 per ounce was impacted by no gold ounces sold at the lower cost Öksüt Mine during the quarter, but partially offset by higher gold production and lower capital expenditures at the Mount Milligan Mine.

- All-in costs on a by-product basisNG for the quarter of $1,376 per ounce due to higher exploration and project development costs incurred primarily at the Company’s Goldfield project and existing operating mines.

- Strong balance sheet with a cash position at the quarter-end of $580.8 million.

- Öksüt Mine’s leaching operations were suspended in August but mining, crushing and stacking activities continue. Following discussions with Turkish officials relating to the Öksüt Mine’s Environment Impact Assessment (“EIA”) the Company has ceased leaching ore on its heap leach pad and using activated carbon to process gold into gold-in-carbon form effective August 2022. The Company’s mercury abatement retrofit to the ADR plant is expected to be completed in late 2022. In August 2022, the Company submitted an application to update its EIA and expects to make a further detailed submission, inclusive of all required technical studies, by the end of 2022. The Company expects to work with Turkish officials and other stakeholders thereafter on the regulatory review and approval of its EIA and such other permits that may be required to allow a timely full restart of all operations. For further details, see “Update on Öksüt Mine Operations”.

- Centerra closed the global arrangement agreement with Kyrgyzaltyn JSC (“Kyrgyzaltyn”) and Kyrgyz Republic to effect a separation of Centerra from Kyrgyzaltyn and the Kyrgyz Republic. The Company cancelled all of Kyrgyzaltyn’s 77.4 million Centerra common shares upon closing of the this transaction. For further details, see the Company’s news releases dated April 4, 2022 and July 29, 2022.

- Goldfield District Project drilling activities continue with four rigs currently at site at the end of the quarter. The Company is targeting an initial resource estimate by mid-year 2023 and an updated resource estimate accompanied by the completion of a feasibility study thereafter.

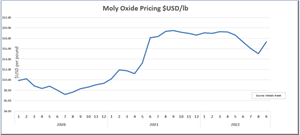

- The Molybdenum Business Unit continued to implement a new streamlined business plan at its Langeloth Facility, reducing inventories held and overall working capital to generate free cash flow from operationsNG of $7.2 million during the quarter. With improving molybdenum prices, the Company continues to evaluate strategic options for the business unit, including a potential restart of the Thompson Creek Mine.

- The Company announced a Normal Course Issuer Bid (“NCIB”) which was accepted by the Toronto Stock Exchange in October 2022. The Company expects to commence the market purchase of shares subsequent to filing its third quarter results, subject to market conditions.

- The Company announced the highlights of the new life of mine (“LOM”) plan for the Mount Milligan Mine with the mine life extended by over four years to 2033 and an increase in the proven and probable reserves of 1.1 million contained ounces of gold and 260 million contained pounds of copper. A detailed overview of the LOM can be found in the NI 43-101 Technical Report, titled “Technical Report on The Mount Milligan Mine” with an effective date of December 31, 2021, being filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar on November 7, 2022.

- 2022 guidance remains unchanged from the revised guidance issued in the second quarter. The Company remains on track for 2022 copper production guidance and cost guidance and is trending towards the lower end of gold production guidance.

- Quarterly Dividend declared of CAD$0.07 per common share.

CEO Discussion

Paul Wright, Interim President and Chief Executive Officer of Centerra stated, “Since accepting the role of Interim President and Chief Executive Officer on September 6, 2022, I’ve been able to use my first 60 days to visit all of our operating sites and engage many of our shareholders, The overarching impression that I’ve been left with is that we have solid operating teams managing our assets, and I’m excited for the future of the Company.”

“In the third quarter of 2022, the Company continued to demonstrate that safety remains Centerra’s top priority, with the Öksüt Mine’s team achieving one million hours without a lost time injury. Subsequent to the quarter-end, the Company announced highlights from the Mount Milligan Mine’s LOM, including an extension of the mine life to 2033 and an increase in proven and probable gold and copper reserves of 1.1 million contained ounces and 260 million contained pounds, respectively.”

“On the operational front, the Mount Milligan Mine produced 54,134 ounces of gold and 19.0 million pounds of copper in the third quarter, and at the Öksüt Mine, approximately 40,000 ounces were added to the stored in gold-in-carbon inventory. The Mount Milligan Mine 2022 gold and copper production remains on track and the mine continues to forecast strong cash flows for the year.”

“At the Öksüt Mine, the retrofit of the ADR plant remains on track to be completed in late 2022. The Company suspended leaching operations at the Öksüt Mine in August 2022 while it advances its applications for an updated EIA, but mining, crushing and stacking activities continue at the mine. The extent of mining, crushing and stacking activity for the remainder of the year will continue to be evaluated as the Company advances through the permitting process and may be reduced significantly prior to the end of the year.”

“Financially, in the third quarter, we recorded a consolidated free cash flow deficitNG of $35.5 million; however, the free cash flow from mine operationsNG generated at the Mount Milligan Mine of $20.9 million was able to offset a majority of the free cash flow deficit from mine operationsNG at the Öksüt Mine of $23.0 million. The Company ended the quarter with a cash position at the end of the period of $580.8 million. Based on the Company’s strong financial position, the Board approved a quarterly dividend of CAD$0.07 per share on November 4, 2022 to shareholders of record on November 18, 2022. In consideration of Centerra’s current market valuation and to increase shareholder returns, in October the Company also announced a normal course issuer bid.”

Update on Öksüt Mine Operations

On March 18, 2022, Centerra announced that it had suspended gold doré bar production at the Öksüt Mine due to mercury detected in the gold room at the ADR plant. An engineered solution was developed with the assistance of external consultants to ensure that mercury levels are detected, monitored and captured to prevent exposure to personnel and to safeguard the environment. The Company is currently constructing a mercury retort system to allow mercury to be safely vaporized from the sludge with the vapor condensed and collected in a fully contained system. The furnace off-gas system will also be replaced to ensure that any remaining mercury is scrubbed from the gas and captured.

All of the major equipment is mostly fabricated and has largely been delivered to site. Construction is progressing well and is expected to be completed in late 2022, with total capital costs expected to be approximately $5 million. The Company will work with relevant authorities to obtain the required approvals to restart gold room operations at the ADR plant which the Company now expects will occur once shortly after the new EIA for the Öksüt Mine is approved.

From the date of suspension of gold room operations through to August 2022, the Company continued to process ore into gold-in-carbon form and has approximately 100,000 recoverable ounces of stored gold-in-carbon as at September 30, 2022.

Permitting

In May 2022 the Öksüt Mine was inspected by the Ministry of Environment, Urbanization and Climate Change (the “Ministry of Environment”). The Ministry of Environment informed the Öksüt Mine of a number of deficiencies relating to the Öksüt Mine’s environmental impact assessment (“EIA”). The Company has worked to address the majority of the deficiencies and following several further discussions with the Ministry of Environment, the Company: (i) determined that an updated EIA should be prepared and submitted to clarify various production and other capacity limits and to align the EIA permit levels with expected operating plans; (ii) the Öksüt Mine suspended leaching of ore on the heap leach pad and ceased using activated carbon on site effective late August 2022 though mining, crushing and stacking activities continue in line with existing EIA limits. The extent of mining, crushing and stacking activity for the remainder of the year will continue to be evaluated as the Company advances through the permitting process and may be reduced significantly prior to the end of the year.

The Öksüt Mine’s application to update its EIA was submitted to regulators at the end of August 2022 and the full EIA submission, inclusive of all supporting technical studies, is expected to be submitted before the end of 2022. Following the final EIA submission, the Company expects to work with Turkish officials and other stakeholders on the regulatory review and approval of its EIA and such other permits that may be required to allow a timely full restart of all operations. Once operations resume, the ADR plant is expected to have sufficient production capacity to process up to approximately 35,000 ounces of gold per month, which would allow the stored gold-in-carbon inventory to be processed on a timely basis.

The Company is also in pursuit of other ordinary course permits, including: (i) an enlarged grazing land permit to allow expansion of the existing operation to the currently defined EIA boundary of the Keltepe and Güneytepe pits; and (ii) an extension of the Öksüt Mine’s overall operating license which is scheduled to expire in January 2023.

Exploration Update

Exploration activities in the third quarter of 2022 included drilling, surface sampling, geological mapping and geophysical surveying at the Company’s various projects and earn-in properties, targeting gold and copper mineralization in Canada, Türkiye, and the United States of America. Exploration expenditures in the third quarter of 2022 were $23.2 million. The activities were primarily focused on expanded drilling programs at the Mount Milligan Mine in British Columbia, the Öksüt Mine in Türkiye, the Goldfield Project in Nevada, and greenfield projects in the USA and Türkiye.

At the Mount Milligan Mine, 32 diamond drill holes, totalling 16,653 metres, were completed in the third quarter of 2022, including brownfield exploration drilling (11,801 metres in 22 drill holes) and resource expansion drilling (4,852 metres in 10 drill holes). The Company expects to continue exploration drilling in the fourth quarter of 2022.

At the Öksüt Mine, 43 drill holes and 18 reverse circulation (“RC”) drill holes, totalling 15,840 metres, were completed in the third quarter of 2022. Exploration drilling activities were mainly undertaken at the Keltepe, Güneytepe, Keltepe North, Keltepe Northwest, and Keltepe North-Northwest deposits with the aim of expanding known oxide gold mineralization resources. Drilling also continued testing peripheral targets, such as the Yelibelen and Büyüktepe prospects. The Company expects to continue this work in the fourth quarter.

At the Goldfield Project, exploration activities in the third quarter of 2022 included brownfield diamond core and RC drilling at the Gemfield and Goldfield Main deposits. Drill programs included infill, resource expansion, and exploration drilling, as well metallurgical, geotechnical, and hydrogeochemical drilling in support of the preparation of an initial resource estimate in 2023 and a feasibility study thereafter. Drilling comprised 12,400 metres of exploration drilling and technical services drilling in 54 drill holes, including 24 RC drill holes for 5,400 metres and 30 diamond drill holes for 7,000 metres. Late in the quarter, two additional rigs were added to increase drill production for the total of four rigs at site as of September 30, 2022. As of the end of the third quarter, 16,500 metres of exploration and technical services drilling have been completed in 80 drill holes in 2022. All assay results are pending. The Company expects to continue this work in the fourth quarter of 2022.

Selected drill program results and intercepts are highlighted in the supplementary data at the end of this news release. The drill collar locations and associated graphics are available at the following: https://ml.globenewswire.com/media/b54b7caa-fb95-4b8b-99ad-1ac639294106/document/?v=11042022080500.

About Centerra

Centerra Gold Inc. is a Canadian-based mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Goldfield District Project in Nevada, United States, the Kemess Underground Project in British Columbia, Canada, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra's shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

Conference Call

Centerra invites you to join its 2022 third quarter conference call on Monday, November 7, 2022 at 9:00 AM Eastern Time. The call is open to all investors and the media. To join the call, please dial toll-free in North America 1 (800) 750-9140. International participants may access the call at +1 (416) 981-0157. Results summary presentation slides are available on Centerra’s website at www.centerragold.com. Alternatively, an audio feed webcast will be broadcast live by Notified and can be accessed live at Centerra’s website at www.centerragold.com. A recording of the call will be available after the call and via telephone until midnight Eastern Standard Time on November 21, 2022 by calling +1 (416) 626-4100 or (800) 558-5253 and using passcode 22021107.

For more information:

| Toby Caron | Shae Frosst |

| Treasurer and Director, Investor Relations | Manager, Investor Relations |

| (416) 204-1694 | (416) 204-2159 |

| toby.caron@centerragold.com | shae.frosst@centerragold.com |

Additional information on Centerra is available on the Company’s website at www.centerragold.com and at SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

Management’s

Discussion and

Analysis

For the Three and Nine Months Ended September 30, 2022 and 2021

This Management’s Discussion and Analysis (“MD&A”) has been prepared as of November 4, 2022 and is intended to provide a review of the financial position and results of operations of Centerra Gold Inc. (“Centerra” or the “Company”) for the nine months ended September 30, 2022 in comparison with the corresponding period ended September 30, 2021. This discussion should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and nine months ended September 30, 2022 prepared in accordance with International Financial Reporting Standards (“IFRS”). The Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three and nine months ended September 30, 2022, are available at www.centerragold.com and on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and EDGAR at www.sec.gov/edgar. In addition, this discussion contains forward-looking information regarding Centerra’s business and operations. Such forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. See “Caution Regarding Forward-Looking Information” below. All dollar amounts are expressed in United States dollars (“USD”), except as otherwise indicated. All references in this document denoted with NG indicate a “specified financial measure” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. None of these measures is a standardized financial measure under IFRS and these measures might not be comparable to similar financial measures disclosed by other issuers. See section “Non-GAAP and Other Financial Measures” below for a discussion of the specified financial measures used in this document and a reconciliation to the most directly comparable IFRS measure.

Caution Regarding Forward-Looking Information

Information contained in this document which is not a statement of historical fact, and the documents incorporated by reference herein, may be “forward-looking information” for the purposes of Canadian securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. The words “believe”, “expect”, “anticipate”, “contemplate”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule”, “understand” and similar expressions identify forward-looking information. These forward-looking statements relate to, among other things: statements regarding 2022 Outlook, including production, costs, capital expenditures, depreciation, depletion and amortization expenses and taxes; the effects of inflation on the Company’s costs; the weakening of the Canadian dollar and Turkish lira relative to the U.S. dollar; expectations regarding copper credits and copper prices in the fourth quarter of 2022; the expected trend of the Company’s performance toward achieving guidance; expected cash outflows at the Oksut Mine for the fourth quarter of 2022; completion of mercury abatement, containment and safety work in the gold room of the ADR plant at the Öksüt Mine, including construction progress; the expected restart of gold room operations, related regulatory approvals and the expected timing thereof; the capacity of the Öksüt Mine’s ADR plant to process inventories of loaded gold in carbon ; preparation and timing of further submissions relating to the EIA amendment for the Öksüt Mine and further discussions and regulatory review thereof; progress on ordinary course permitting at the Öksüt Mine and the ability to mine the Keltepe and Guneytepe pits; expectations for continued mining, crushing and stacking operations at the Öksüt Mine in the fourth quarter of 2022; highlights of a new life of mine plan for the Mount Milligan Mine, including reserves and resources, costs, inflationary pressures and expectations regarding the release of further guidance; expectations for optimization of Mount Milligan Mine’s staged flotation reactors; strategic options for the Molybdenum BU, including a potential restart of the Thompson Creek Mine, net cash required to maintain the business and expectations for molybdenum prices; expectations for ongoing activities at the Goldfield project, including drilling, resource estimation and a feasibility study; expectations for market purchases under a normal course issuer bid; possible impact to operations relating to COVID-19; leadership transition of the Chief Executive Officer position; and expectations regarding contingent payments to be received from the sale of Greenstone Partnership.

Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable by Centerra, are inherently subject to significant technical, political, business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking information. Factors and assumptions that could cause actual results or events to differ materially from current expectations include, among other things: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada, including potential uncertainty created by upcoming presidential elections in Türkiye and their potential to disrupt or delay Turkish bureaucratic processes and decision making, including potential uncertainty created by upcoming presidential elections in Türkiye and their potential to disrupt or delay Turkish bureaucratic processes and decision making; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; risks of actions taken by the Kyrgyz Republic, or any of its instrumentalities, in connection with the Company’s prior ownership of the Kumtor Mine or the Global Arrangement Agreement; including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; the impact of constitutional changes or political events or elections in Türkiye; risks that Turkish regulators pursue aggressive enforcement of the Öksüt Mine’s current EIA and permits or that the Company experiences delay or disruption in its applications for new or amended EIA or other permits; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Russian and Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anti-corruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper and other mineral prices; the use of provisionally-priced sales contracts for production at the Mount Milligan Mine; reliance on a few key customers for the gold-copper concentrate at the Mount Milligan Mine; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; the impact of restrictive covenants in the Company’s credit facilities which may, among other things, restrict the Company from pursuing certain business activities or making distributions from its subsidiaries; changes to tax regimes; the Company’s ability to obtain future financing; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including the stability of the pit walls at the Company’s operations; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water where applicable; the risk of having sufficient water to continue operations at the Mount Milligan Mine and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks whether caused by decisions of third-party providers or force majeure events (including, but not limited to, flooding, wildfires, COVID-19, or other global events such as wars); the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic including, but not limited to, the COVID-19 pandemic; seismic activity; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; the Company’s ability to accurately predict decommissioning and reclamation costs; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns and project resources. For additional risk factors, please see section titled “Risks Factors” in the Company’s most recently filed Annual Information Form (“AIF”) available on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

There can be no assurances that forward-looking information and statements will prove to be accurate, as many factors and future events, both known and unknown could cause actual results, performance or achievements to vary or differ materially from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained herein or incorporated by reference. Accordingly, all such factors should be considered carefully when making decisions with respect to Centerra, and prospective investors should not place undue reliance on forward-looking information. Forward-looking information is as of November 4, 2022. Centerra assumes no obligation to update or revise forward-looking information to reflect changes in assumptions, changes in circumstances or any other events affecting such forward-looking information, except as required by applicable law.

TABLE OF CONTENTS

| Overview | 1 |

| Overview of Consolidated Financial and Operational Highlights | 2 |

| Overview of Consolidated Results | 3 |

| Outlook | 6 |

| Recent Events and Developments | 13 |

| Liquidity and Capital Resources | 16 |

| Financial Performance | 17 |

| Financial Instruments | 21 |

| Balance Sheet Review | 22 |

| Operating Mines and Facilities | 23 |

| Discontinued Operations | 34 |

| Quarterly Results – Previous Eight Quarters | 36 |

| Related Party Transactions | 36 |

| Accounting Estimates, Policies and Changes | 37 |

| Disclosure Controls and Procedures and Internal Control Over Financial Reporting | 37 |

| Non-GAAP and Other Financial Measures | 38 |

| Qualified Person & QA/QC – Production, Mineral Reserves and Mineral Resources | 45 |

Overview

Centerra’s Business

Centerra is a Canadian-based mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra’s principal continuing operations are the Mount Milligan gold-copper mine located in British Columbia, Canada (the “Mount Milligan Mine”), and the Öksüt gold mine located in Türkiye (the “Öksüt Mine”). The Company also owns the Goldfield District Project (the “Goldfield Project”) in Nevada, United States, the Kemess Underground Project (the “Kemess Project”) in British Columbia, Canada as well as exploration properties in Canada, the United States of America and Türkiye and has options to acquire exploration joint venture properties in Canada, Türkiye, and the United States. The Company owns and operates a Molybdenum Business Unit (the “Molybdenum BU”), which includes the Langeloth metallurgical processing facility, operating in Pennsylvania, USA (the “Langeloth Facility”), and two primary molybdenum mines on care and maintenance: the Thompson Creek Mine in Idaho, USA, and the Endako Mine (75% ownership) in British Columbia, Canada.

Prior to May 15, 2021, the Company also consolidated the results of the Kumtor mine, located in the Kyrgyz Republic, (the “Kumtor Mine”), through its wholly-owned subsidiary, Kumtor Gold Company CJSC (“KGC”). The seizure of the Kumtor Mine and the actions of the Kyrgyz Republic and Kyrgyzaltyn JSC (“Kyrgyzaltyn”) resulted in the following: (i) the carrying value of the net assets of the mine were derecognized from the Company’s balance sheet, (ii) no value was ascribed to the Company’s interest in KGC, (iii) the Company recognized a loss on the change of control in the second quarter of 2021, and (iv) results of the Kumtor Mine’s operations are now presented as a discontinued operation in the Company’s financial statements. The Company entered into a global arrangement agreement (“Arrangement Agreement”) dated April 4, 2022 with, among others, Kyrgyzaltyn and the Kyrgyz Republic to effect a separation of the parties, including through the disposition of Centerra’s ownership of the Kumtor Mine and its investment in the Kyrgyz Republic, the purchase for cancellation by Centerra of Kyrgyzaltyn’s Centerra common shares, the termination of Kyrgyzaltyn’s involvement in the Company, and the resolution of disputes (the “Transaction”). The Transaction closed on July 29, 2022.

As of September 30, 2022, Centerra’s significant subsidiaries were as follows:

| Entity | Property - Location | Current Status | Ownership | |||

| Thompson Creek Metals Company Inc. | Mount Milligan Mine - Canada | Operation | 100 | % | ||

| Endako Mine - Canada | Care and maintenance | 75 | % | |||

| Öksüt Madencilik A.S. | Öksüt Mine - Türkiye | Operation | 100 | % | ||

| Langeloth Metallurgical Company LLC | Langeloth - USA | Operation | 100 | % | ||

| Gemfield Resources LLC | Goldfield Project - USA | Advanced exploration | 100 | % | ||

| AuRico Metals Inc. | Kemess Project - Canada | Advanced exploration | 100 | % | ||

| Thompson Creek Mining Co. | Thompson Creek Mine - USA | Care and maintenance | 100 | % | ||

The Company’s common shares are listed on the Toronto Stock Exchange and the New York Stock Exchange and trade under the symbols “CG” and “CGAU”, respectively.

Following the completion of the Transaction on July 29, 2022, the number of the Company’s issued and outstanding common shares was reduced by 77,401,766. As of November 4, 2022, there are 220,355,953 common shares issued and outstanding, options to acquire 2,810,413 common shares outstanding under the Company’s stock option plan, and 728,653 restricted share units outstanding under the Company’s restricted share unit plan (exercisable on a 1:1 basis for common shares).

Overview of Consolidated Financial and Operating Highlights

| ($millions, except as noted) | Three months ended September 30, | Nine months ended September 30, | ||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | |||||||

| Financial Highlights (continuing operations basis, except as noted) | ||||||||||||

| Revenue | 179.0 | 220.5 | (19 | )% | 641.9 | 649.1 | (1 | )% | ||||

| Production costs | 132.0 | 121.6 | 9 | % | 416.5 | 355.7 | 17 | % | ||||

| Depreciation, depletion, and amortization ("DDA") | 14.4 | 30.4 | (53 | )% | 79.9 | 89.5 | (11 | )% | ||||

| Earnings from mine operations | 32.6 | 68.5 | (52 | )% | 145.5 | 203.9 | (29 | )% | ||||

| Net (loss) earnings from continuing operations | (33.9 | ) | 27.6 | (223 | )% | 52.9 | 172.1 | (69 | )% | |||

| Adjusted net (loss) earnings from continuing operations(1) | (15.9 | ) | 35.7 | (145 | )% | 4.3 | 113.9 | (96 | )% | |||

| Net loss from discontinued operations | — | — | — | % | — | (828.7 | ) | (100 | )% | |||

| Net (loss) earnings(2) | (33.9 | ) | 27.6 | (223 | )% | 52.9 | (656.6 | ) | 108 | % | ||

| Adjusted net (loss) earnings(1)(2) | (15.9 | ) | 35.7 | (145 | )% | 4.3 | 198.3 | (98 | )% | |||

| Cash (used in) provided by operating activities from continuing operations | (17.0 | ) | 62.4 | (127 | )% | 7.8 | 209.1 | (96 | )% | |||

| Free cash flow (deficit) from continuing operations(1) | (35.5 | ) | 41.0 | (187 | )% | (57.6 | ) | 139.7 | (141 | )% | ||

| Adjusted free cash flow (deficit) from continuing operations(1) | (29.5 | ) | 45.3 | (165 | )% | (36.7 | ) | 148.6 | (125 | )% | ||

| Cash provided by operating activities from discontinued operations | — | — | — | % | — | 143.9 | (100 | )% | ||||

| Net cash flow from discontinued operations(3) | — | — | — | % | — | 47.8 | (100 | )% | ||||

| Additions to property, plant and equipment (“PP&E”) | 11.7 | 24.8 | (53 | )% | 247.2 | 72.0 | 243 | % | ||||

| Capital expenditures - total(1) | 16.1 | 20.1 | (20 | )% | 57.8 | 65.2 | (11 | )% | ||||

| Sustaining capital expenditures(1) | 16.0 | 18.7 | (14 | )% | 55.8 | 62.3 | (10 | )% | ||||

| Non-sustaining capital expenditures(1) | 0.1 | 1.4 | (93 | )% | 2.0 | 2.9 | (31 | )% | ||||

| Net (loss) earnings from continuing operations per common share - basic(4) | (0.14 | ) | 0.09 | (256 | )% | 0.19 | 0.58 | (67 | )% | |||

| Net (loss) earnings per common share - $/share basic(2)(4) | (0.14 | ) | 0.09 | (256 | )% | 0.19 | (2.21 | ) | (109 | )% | ||

| Adjusted net (loss) earnings from continuing operations per common share - basic(1)(4) | (0.06 | ) | 0.12 | (150 | )% | 0.02 | 0.38 | (95 | )% | |||

| Adjusted net (loss) earnings per common share - $/share basic(1)(2)(4) | (0.06 | ) | 0.12 | (150 | )% | 0.02 | 0.67 | (97 | )% | |||

| Operating highlights (continuing operations basis) | ||||||||||||

| Gold produced (oz) | 54,134 | 76,913 | (30 | )% | 190,646 | 216,944 | (12 | )% | ||||

| Additions to stored gold-in-carbon inventory (Koz)(5) | 40-45 | — | 100 | % | 100-105 | — | 100 | % | ||||

| Gold sold (oz) | 56,245 | 75,721 | (26 | )% | 192,750 | 224,445 | (14 | )% | ||||

| Average market gold price ($/oz) | 1,728 | 1,790 | (3 | )% | 1,826 | 1,800 | 1 | % | ||||

| Average realized gold price ($/oz )(6) | 1,204 | 1,542 | (22 | )% | 1,580 | 1,477 | 7 | % | ||||

| Copper produced (000s lbs) | 19,045 | 17,861 | 7 | % | 56,955 | 56,282 | 1 | % | ||||

| Copper sold (000s lbs) | 19,647 | 18,512 | 6 | % | 58,019 | 60,833 | (5 | )% | ||||

| Average market copper price ($/lb) | 3.52 | 4.26 | (17 | )% | 4.12 | 4.17 | (1 | )% | ||||

| Average realized copper price ($/lb)(6) | 2.49 | 2.55 | (2 | )% | 2.82 | 2.73 | 3 | % | ||||

| Molybdenum sold (000s lbs) | 3,291 | 2,615 | 26 | % | 9,406 | 9,100 | 3 | % | ||||

| Average market molybdenum price ($/lb) | 16.12 | 19.06 | (15 | )% | 17.86 | 15.02 | 19 | % | ||||

| Unit costs (continuing operations basis) | ||||||||||||

| Gold production costs ($/oz) | 729 | 630 | 16 | % | 653 | 626 | 4 | % | ||||

| All-in sustaining costs on a by-product basis ($/oz)(1) | 941 | 781 | 20 | % | 826 | 672 | 23 | % | ||||

| All-in costs on a by-product basis ($/oz)(1) | 1,376 | 932 | 48 | % | 1,105 | 806 | 37 | % | ||||

| Gold - All-in sustaining costs on a co-product basis ($/oz)(1) | 1,190 | 928 | 28 | % | 1,062 | 916 | 16 | % | ||||

| Copper production costs ($/lb) | 1.51 | 1.50 | 1 | % | 1.63 | 1.44 | 13 | % | ||||

| Copper - All-in sustaining costs on a co-product basis – ($/lb)(1) | 1.78 | 1.95 | (9 | )% | 2.04 | 1.21 | 69 | % | ||||

(1) Non-GAAP financial measure. All per unit costs metrics are expressed on a metal sold basis. See discussion under “Non-GAAP and Other Financial Measures”.

(2) Inclusive of the results from the Kumtor Mine prior to the loss of control on May 15, 2021.

(3) Calculated as the sum of cash flow provided by operating activities from discontinued operations, cash flow used in investing activities from discontinued operations and cash flow used in financing activities from discontinued operations.

(4) As at September 30, 2022, the Company had 220,086,775 common shares issued and outstanding.

(5) Represents a portion of the recoverable ounces in the adsorption, desorption and recovery (“ADR”) inventory as at September 30, 2022.

(6) This supplementary financial measure within the meaning of 52-112 is calculated as a ratio of revenue from the consolidated financial statements and units of metal sold and includes the impact from the Mount Milligan Streaming Arrangement, copper hedges and mark-to-market adjustments on metal sold that had not yet been finally settled.

Overview of Consolidated Results

Although during 2021, the Company remained the legal owner of KGC, due to the seizure of the Kumtor Mine and the related actions by the Kyrgyz Republic and Kyrgyzaltyn, the Company derecognized the assets and liabilities of the Kumtor Mine in the statements of financial position and presented its financial and operating results prior to the loss of control as discontinued operations for the nine months ended September 30, 2021. As a result, the Company’s consolidated results from continuing operations discussed in this MD&A exclude the Kumtor Mine’s operations, unless otherwise noted.

Third Quarter 2022 compared to Third Quarter 2021

Net loss of $33.9 million was recognized in the third quarter 2022, compared to net earnings of $27.6 million in the third quarter 2021. Decrease in net earnings was primarily due to:

- earnings from mine operations of $32.6 million in the third quarter of 2022 compared to earnings from mine operations of $68.5 million in the third quarter of 2021 primarily due to no ounces of gold sold at the Öksüt Mine. In addition, there were higher production costs at the Mount Milligan Mine and the Molybdenum BU. Higher production costs at the Mount Milligan Mine were mainly due to higher mining, processing and administrative expenses due to the impact of rising inflation in Canada and onset of price pressures on input costs. Higher production costs at the Molybdenum BU were primarily due to higher average molybdenum prices paid for product in inventory, an increase in pounds of molybdenum roasted, and the effect of higher production costs from the mix of products produced and sold in the period. The decrease in earnings from mine operations was partially offset by higher ounces of gold sold and copper pounds sold at the Mount Milligan Mine, the weakening of the Canadian dollar relative to the US dollar between the periods, lower production costs and DDA at the Öksüt Mine due to the suspension of gold room operations at the ADR plant and lower DDA at the Mount Milligan Mine primarily attributable to the increase in proven and probable reserves,

- higher exploration and development costs primarily relating to various drilling activities and technical studies undertaken at the Goldfield Project and at the Mount Milligan Mine, and

- higher deferred income tax expense primarily resulting from the net impact of foreign exchange rate changes on the temporary differences between accounting and tax bases relating to the Mount Milligan Mine, the Kemess Project, and other comprehensive income components.

The decrease in net earnings was partially offset by a reclamation provision revaluation recovery of $7.7 million in the third quarter of 2022 compared to $0.9 million reclamation expense in the third quarter of 2021, resulting from an increase in the risk-free interest rates applied to discount the estimated future reclamation cash flows, partially offset by an increase in scope of planned reclamation activities and higher inflation applied to the reclamation cash flows at the Endako Mine and Thompson Creek Mine. In addition, there was a decrease in other non-operating expenses due to higher foreign exchange gains and interest income earned on the Company’s cash balance from rising interest rates as well as lower litigation and related costs incurred in connection with the seizure and the loss of control of the Kumtor Mine.

Adjusted net lossNG of $15.9 million was recognized in the third quarter of 2022, compared to adjusted net earningsNG of $35.7 million in the third quarter of 2021. The decrease in adjusted net earningsNG was primarily due to lower earnings from mine operations and higher exploration and development costs and income tax expense as outlined above.

The most significant adjusting items to net loss in the third quarter of 2022 were:

- $20.4 million income tax expense resulting from the impact of foreign exchange rate changes on the temporary differences between accounting and tax bases of the Mount Milligan Mine, the Kemess Project, and other comprehensive income components;

- $7.7 million reclamation provision revaluation recovery at sites on care and maintenance in the Molybdenum BU primarily attributable to an increase in the risk-free interest rates applied to discount the estimated future reclamation cash flows; and

- $5.3 million in legal and other costs directly related to the seizure of the Kumtor Mine.

The most significant adjusting items to net earnings from continuing operations in the third quarter of 2021 was $8.1 million of legal and other costs related to the seizure of the Kumtor Mine.

Cash used in operating activities was $17.0 million in the third quarter of 2022, compared to cash provided by operating activities of $62.4 million in the third quarter of 2021. The decrease in cash provided by operating activities was primarily due to no ounces of gold sold at the Öksüt Mine, lower average realized gold prices at the Mount Milligan Mine and lower average realized molybdenum prices at the Molybdenum BU. In addition, there were higher production costs at the Mount Milligan Mine primarily due to higher mining, processing and administrative costs, as noted above and an unfavourable working capital change at the Mount Milligan Mine as a result of the effect of timing of cash collection on concentrate shipments and the effect of timing of vendor payments. The overall decrease in cash provided by operating activities was partially offset by an increase in ounces of gold and pounds of copper and molybdenum sold and a favourable in working capital change at the Molybdenum BU.

Free cash flow deficitNG of $35.5 million was recognized in the third quarter of 2022, compared to free cash flowNG of $41.0 million in the third quarter of 2021. The decrease in free cash flowNG was primarily due to lower cash provided by operating activities as outlined above, partially offset by slightly lower sustaining capital expendituresNG.

Nine months ended September 30, 2022 compared to 2021

Net earnings of $52.9 million were recognized in 2022, compared to net loss of $656.6 million in 2021. The increase was primarily due to the loss of $926.4 million recognized on the change of control of the Kumtor Mine in 2021.

Net earnings from continuing operations of $52.9 million were recognized in 2022, compared to $172.1 million in 2021. The decrease was primarily due to:

- lower earnings from mine operations of $145.5 million in 2022 compared to $203.9 million in 2021 primarily due to lower ounces of gold sold at the Öksüt Mine. In addition, there were higher production costs at the Molybdenum BU from higher average molybdenum prices paid to obtain product inventory to be processed, an increase in pounds of molybdenum roasted, higher maintenance costs associated with an unplanned acid plant shutdown extending for longer than one month in the first quarter of 2022 and the effect of higher unit costs from the mix of products produced and sold in the period. In addition, there was a decrease in earnings from mine operations at the Mount Milligan Mine from higher production costs and lower gold ounces and copper pounds sold. The decrease in earnings from mine operations was partially offset by higher average realized gold, copper and molybdenum prices, the weakening of the Canadian dollar relative to the US dollar between the periods, and lower production costs and DDA at the Öksüt Mine due to the suspension of gold room operations at the ADR plant,

- higher exploration and development costs primarily due to various drilling activities and technical studies undertaken at the Goldfield Project, and brownfield exploration activities at the Mount Milligan,

- higher corporate administration costs primarily due to management changes and associated severance payments, an increase in consulting costs and software costs from various information technology projects, including the implementation of the Company-wide enterprise resource planning system and an increase in travel expenses. Partially offsetting an increase in corporate administration costs was a decrease in the provision for share-based compensation was primarily due to the effect of the decline in the Company’s share price,

- a gain of $72.3 million on the sale of the Company’s interest in the Greenstone Partnership recognized in 2021, and

- higher current income tax expense due to a smaller Investment Incentive Certificate benefit during 2022 and higher deferred income tax expense primarily resulting from the net impact of foreign exchange rate changes on the temporary differences between accounting and tax bases relating to the Mount Milligan Mine, the Kemess Project, and other comprehensive income components.

The decrease in net earnings from continuing operations was partially offset by a $90.6 million reclamation provision revaluation recovery at sites on care and maintenance in the Molybdenum BU primarily attributable to an increase in the risk-free interest rates applied to discount the estimated future reclamation cash flows. In addition, there was a decrease in other non-operating expenses from higher foreign exchange gains and interest income earned on the Company’s cash balance from rising interest rates, partially offset by an increase in litigation and related costs incurred in connection with the seizure and the loss of control of the Kumtor Mine.

The Company did not report any earnings related to discontinued operations in 2022. Net loss from discontinued operations was 828.7 million in 2021.

Adjusted net earnings from continuing operationsNG were $4.3 million in 2022, compared to adjusted net earningsNG from continuing operations of $113.9 million in 2021. The decrease in adjusted net earnings from continuing operationsNG was due to lower earnings from mine operations and higher corporate administration costs, exploration and development costs and income tax expense as outlined above.

Significant adjusting items to net earnings in 2022 include:

- $90.8 million reclamation provision revaluation at sites on care and maintenance in the Molybdenum BU, resulting primarily from the change in the estimated future reclamation cash flows and an increase in the discount rate applied to these cash flows;

- $27.2 million of deferred income tax adjustments mainly resulting from the effect of foreign exchange rate changes on the temporary differences between accounting and tax bases of the Mount Milligan Mine, the Kemess Project, and other comprehensive income; and

- $15.0 million of legal and other related costs directly related to the seizure of the Kumtor Mine.

The most significant adjusting items to net earnings from continuing operations in 2021 were a $72.3 million gain on the sale of Greenstone project and $14.2 million of litigation and other related costs related to the Kumtor Mine.

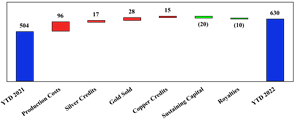

Cash provided by operating activities from continuing operations was $7.8 million in 2022 compared to $209.1 million in 2021. The decrease in cash provided by operating activities from continuing operations was primarily due to a decrease in gold ounces sold at the Öksüt Mine and an unfavourable change in working capital from the build up of stored gold-in-carbon inventories, higher cash taxes paid related to the Öksüt Mine from a withholding tax expense incurred on dividend distributions and taxation at the full statutory income tax rate due utilization of Öksüt’s Investment Incentive Certificate as of the end of 2021 and the recognition of taxable gains from the effect of foreign exchange rate changes on monetary assets and liabilities in taxable income. In addition, there was a decrease in gold ounces and copper pounds sold and higher production costs at the Mount Milligan Mine as noted above and an unfavourable working capital change from the effect of timing of vendor payments, partially offset by the effect of timing of cash collection on concentrate sales at the Mount Milligan Mine and higher average realized copper prices.

Free cash flow deficitNG from continuing operations of $57.6 million was recognized in 2022 compared to free cash flowNG from continuing operations of $139.7 million in 2021. The decrease in free cash flowNG was primarily due to lower cash provided by operating activities as outlined above, partially offset by slightly lower sustaining capital expendituresNG.

2022 Outlook

The Company remains on track to achieve its revised guidance for 2022 that was issued as part of the MD&A for the second quarter of 2022 (“Current Guidance”). The Mount Milligan Mine expects to achieve both gold and copper production Current Guidance for the 2022 year, though expects gold production to trend towards the lower end of the guidance range. Due to the suspension of leaching and gold room activities at the Öksüt Mine, no further gold production is expected from the Öksüt Mine in 2022. The mercury abatement retrofit at the ADR plant and the formal submission of an updated EIA are both in progress and expected to be completed by late 2022. Subsequent to the filing of the EIA, the Company will seek approval from regulators to restart full operations as quickly as possible. With mining, crushing, stacking and capital project activities continuing at the Öksüt Mine, the Company expects total cash outflows relating to the Öksüt Mine during the fourth quarter of 2022 to be similar to those incurred during the third quarter of 2022.

The full year 2022 outlook and comparative actual results for nine months ended September 30, 2022 are set out in the following table:

| Units | Mount Milligan(1) | Öksüt | Consolidated(2) | ||||||

| Nine months ended September 30, 2022 | 2022 Current Guidance | Nine months ended September 30, 2022 | 2022 Current Guidance | Nine months ended September 30, 2022 | 2022 Current Guidance | ||||

| Production | |||||||||

| Unstreamed gold production | (Koz) | 88 | 123 - 136 | 55 | 55 | 143 | 178 - 191 | ||

| Streamed gold production | (Koz) | 48 | 67 - 74 | — | — | 48 | 67 - 74 | ||

| Total gold production(3) | (Koz) | 136 | 190 - 210 | 55 | 55 | 191 | 245 - 265 | ||

| Unstreamed copper production | (Mlb) | 46 | 57 - 65 | — | — | 46 | 57 - 65 | ||

| Streamed copper production | (Mlb) | 11 | 13 - 15 | — | — | 11 | 13 - 15 | ||

| Copper production(3) | (Mlb) | 57 | 70 - 80 | — | — | 57 | 70 - 80 | ||

| Costs | |||||||||

| Gold production costs | ($/oz) | 759 | 775 - 825 | 386 | 386 | 653 | 675 - 725 | ||

| All-in sustaining costs on a by-product basisNG(4) | ($/oz) | 629 | 775 - 825 | 680 | 875 - 925 | 826 | 1,000 - 1,050 | ||

| All-in costs on a by-product basisNG(4) | ($/oz) | 713 | 825 - 875 | 732 | 950 - 1,000 | 1,105 | 1,225 - 1,275 | ||

| All-in sustaining costs on a co-product basisNG(4) | ($/oz) | 958 | 1,000 - 1,050 | 680 | 875 - 925 | 1,062 | 1,175 - 1,225 | ||

| Copper production costs | ($/lb) | 1.63 | 1.55 - 1.70 | — | — | 1.63 | 1.55 - 1.70 | ||

| All-in sustaining costs on a co-product basisNG | ($/lb) | 2.04 | 2.25 - 2.40 | — | — | 2.04 | 2.25 - 2.40 | ||

| Capital Expenditures | |||||||||

| Additions to PP&E | ($M) | 34.6 | 60 - 65 | 9.1 | 20 - 25 | 247.2 | 285 - 295 | ||

| Total Capital ExpendituresNG | ($M) | 44.7 | 70 - 75 | 11.4 | 20 - 25 | 57.8 | 95 - 105 | ||

| SustainingNG(5) | ($M) | 43.2 | 65 - 70 | 11.4 | 20 - 25 | 55.8 | 90 - 100 | ||

| Non-sustainingNG | ($M) | 1.5 | 5 | — | — | 2.0 | 5 | ||

| Other Costs | |||||||||

| Goldfield Project | ($M) | — | — | — | — | 15.3 | 17-20 | ||

| All other exploration projects | ($M) | 12 | 12 | 3 | 5 | 30.9 | 33-45 | ||

| Total Exploration and Project Development(5) | ($M) | — | — | — | — | 46.2 | 50 - 65 | ||

| Kemess Project | ($M) | — | — | — | — | 10.0 | 13 - 15 | ||

| Molybdenum BU | ($M) | — | — | — | — | 19.0 | 15 - 20 | ||

| Corporate administration | ($M) | — | — | — | — | 35.5 | 40 - 45 | ||

| DDA | ($M) | 63.4 | 95 - 105 | 12.6 | 13 | 79.9 | 110 - 130 | ||

| Taxes | ($M) | 3.4 | ‘5 - 10 | 21.7 | 20 - 30 | 36.5 | 25 - 40 | ||

- The Mount Milligan Streaming Arrangement entitles Royal Gold to 35% and 18.75% of gold ounces and copper pounds sold, respectively, and requires Royal Gold to pay $435 per ounce of gold and 15% of the spot price per metric tonne of copper delivered. Assuming a market gold price of $1,650 per ounce and market copper price of $3.25 per pound in the fourth quarter of 2022, Mount Milligan Mine’s average realized gold and copper price would be $1,220 per ounce and $2.65 per pound in the fourth quarter of 2022, respectively, after giving effect to the hedges and further mark-to-market adjustments on 25.0 million copper pounds outstanding and 41,559 ounces of gold outstanding at September 30, 2022 under contracts awaiting final pricing in future months.

- Unit costs and consolidated unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costs. Production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and metal deductions, subject to metal content, levied by smelters.

- Gold and copper production at the Mount Milligan Mine assumes recoveries of 68% and 81%, respectively. 2022 gold ounces and copper pounds sold are expected to be consistent with production.

- Costs do not include the impact of any future standby charges at the Öksüt Mine as the Company assesses the operational implications of suspending certain activities.

- The exploration and project development cost Current Guidance reflects the addition of the Goldfield Project exploration and project development costs. Exploration and project development costs include both expensed exploration and project development costs as well as capitalized exploration costs and exclude business development expenses. Project development costs related to the Goldfield Project were $10.8 million in the nine months ended September 30, 2022. Capitalized exploration costs are included in sustaining capital expendituresNG.

Production Profile

The Company’s consolidated 2022 gold production outlook of 245,000 to 265,000 ounces is unchanged from the Current Guidance disclosed in the Company’s MD&A for the second quarter of 2022. The consolidated gold production Current Guidance reflects only 54,691 ounces of the actual gold produced at the Öksüt Mine in the first quarter of 2022 in addition to Mount Milligan Mine’s gold production range of 190,000 to 210,000 ounces. The expected gold production from the Mount Milligan Mine remains unchanged from Current Guidance, however, primarily due to localized adjustments to the oxide transition zone on the current bench in the higher-grade gold areas (HGLC ore) which were observed in October 2022, the Company expects its full year gold production will be towards the lower end of the guidance range. Mount Milligan Mine’s 2022 production outlook for copper production remains in the range of 70 to 80 million pounds, unchanged from the Current Guidance.

At the Öksüt Mine, 2022 gold production guidance includes only the gold produced in the first quarter of 2022, prior to the suspension of gold room operations at the ADR plant. The Öksüt Mine continued mining, crushing, stacking and leaching activities in order to process ore and extract contained gold into a gold-in-carbon form through to late-August 2022. Leaching and gold extraction activities have been suspended since late-August awaiting submission and approval of the mine’s amended EIA. The extent of mining activity for the remainder of the year will be evaluated as the Company works through ongoing permitting matters and may be significantly reduced before the end of the year. Please refer to the “Update on Öksüt Mine Operations” section for further details. The gold-in-carbon inventory is expected to be stored until the re-start of the electrowinning process, where the recovery of gold from concentrated solution occurs. As of September 30, 2022, the Öksüt Mine accumulated a total of approximately 100,000 recoverable ounces in stored gold-in-carbon.

The Company expects to complete the capital equipment upgrades to remove the mercury generated in the gold recovery process by the end of 2022 and will resume gold doré bar production at the ADR plant as soon as all regulatory approvals are obtained. Once the electrowinning process has resumed and is at steady state capacity, the ADR plant is expected to have sufficient production capacity to process up to approximately 35,000 ounces of gold-in-carbon inventory per month, which would allow stored gold-in-carbon inventory to be processed on a timely basis.

Cost Profile

Consolidated gold production costs in the nine months ended September 30, 2022 were $653 per ounce sold, including $759 per ounce sold at the Mount Milligan Mine and $386 per ounce sold at the Öksüt Mine. Full year consolidated gold production costs are expected to be in the range of $675 to $725 per ounce sold in 2022, which is unchanged from the Current Guidance. The consolidated gold production cost of $653 per ounce sold in the nine months ended September 30, 2022 was lower than the full year Current Guidance range primarily due to a higher cost of ounces produced at the Mount Milligan Mine through the remainder of the year. With no further gold sales at the Öksüt Mine assumed for the remainder of the year, Mount Milligan Mine’s higher cost gold production component will constitute a larger share of consolidated production for the year than that of the Öksüt Mine, resulting in higher average consolidated production cost through the remainder of the year.

The gold production cost outlook at the Mount Milligan Mine is unchanged from the Current Guidance range of $775 to $825 per ounce sold. Gold production costs in the nine months ended September 30, 2022 were $759 per ounce sold, similar to the low end of the full year Current Guidance range. Full year gold production cost per ounce sold Current Guidance is slightly higher than the result through the first nine months of 2022 primarily due to higher allocation of production costs to gold due to changes in the relative market prices of gold and copper assumed for the fourth quarter of the year compared to those in the nine month period ended September 30, 2022. Production costs at the Mount Milligan Mine have not changed significantly from amounts incorporated in the Current Guidance for 2022 as inflationary pressures on consumables and labour costs were anticipated in the revised full year guidance.

Gold production costs at the Öksüt Mine are expected to remain $386 per ounce sold for full year, consistent with the gold production costs per once sold in the nine months ended September 30, 2022 due to no further gold sales projected for the remainder of the year as a result of the suspension of certain operations.

Copper production costs at the Mount Milligan Mine in the nine months ended September 30, 2022 were $1.63 per copper pound sold and are expected to be in the range of $1.55 to $1.70 per pound sold for the full year, which is unchanged from the Current Guidance.

The Mount Milligan Mine’s all-in sustaining costs on a by-product basisNG for the full year of 2022 are expected to be in the range of $775 to $825 per ounce sold, unchanged from the Current Guidance. Mount Milligan Mine’s all-in sustaining costs on a by-product basisNG were $629 per ounce sold in the nine months ended September 30, 2022 and are expected to continue to trend towards the Current Guidance range. Full year all-in sustaining costs on a by-product basisNG are expected to increase from the result from the first nine months of 2022 due to lower copper credits from lower copper prices assumed in the fourth quarter than for the first nine months of the year and higher production costs forecast in the fourth quarter of 2022, partially offset by lower full-year capital expenditures and the impact of the weakening of the Canadian dollar relative to the US dollar.

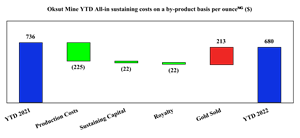

The Öksüt Mine’s all-in sustaining costs on a by-product basis per ounceNG for the full year of 2022 are expected to be in the range of $875 to $925 per ounce sold, unchanged from the Current Guidance range. Actual all-in sustaining costs on a by-product basisNG were $680 per ounce sold in the nine months ended September 30, 2022, but are expected to increase through the end of the year on the expectation that gold doré bar production and sales at the Öksüt Mine will continue to be suspended through the end of the year while sustaining capital expendituresNG will continue to be incurred during the fourth quarter of 2022. The potential impact of future standby charges from the suspension of certain operating activities has not been included in all-in sustaining costs.

The Current Guidance range for consolidated all-in sustaining costs on a by-product basis per ounceNG of $1,000 to $1,050 is higher than the consolidated all-in sustaining costs on a by-product basis per ounceNG of $826 in the nine months ended September 30, 2022 primarily due to lower copper credits from lower copper prices and higher operating costs at the Mount Milligan Mine forecast in the fourth quarter of 2022, compared to the nine months ended September 30, 2022 and the expected continued suspension of gold production and sales at the Öksüt Mine through the end of 2022.

Consolidated all-in costs on a by-product basisNG are expected to be in the range of $1,225 to $1,275 per ounce sold for the full year of 2022, compared to $1,105 per ounce sold in the nine months ended September 30, 2022 and are unchanged from the Current Guidance. The Mount Milligan Mine’s all-in costs on a by-product basisNG are expected to be in the range of $825 to $875 per ounce sold for the full year of 2022, unchanged from the Current Guidance. Mount Milligan Mine’s all-in costs on a by-product basisNG were $713 per ounce sold in the nine months ended September 30, 2022 and were lower than the revised full year Current Guidance range due to an increase in all-in sustaining costs on a by-product basis per ounceNG expected in the fourth quarter of 2022. The Öksüt Mine’s all-in costs on a by-product basisNG are expected to be in the range of $950 to $1,000 per ounce sold, a significant increase compared to $732 per ounce sold in the nine months ended September 30, 2022 due to additional capital expenditures planned in the fourth quarter of 2022, and no further gold sales expected during 2022.

Capital Expenditures

Additions to PP&E, which is an IFRS accounting figure, include certain non-cash additions to PP&E such as changes in future reclamation costs and capitalization of leases, while capital expendituresNG, comprised of sustaining capital expendituresNG and non-sustaining capital expendituresNG, which are both non-GAAP measures, exclude them. Consolidated additions to PP&E in 2022 are expected to be in the range of $285 to $295 million compared to $247.2 million in the nine months ended September 30, 2022 and are unchanged from the Current Guidance. The consolidated additions to PP&E Current Guidance range includes the acquisition of the Goldfield Project of $208.2 million and net additions to ARO and Right-of-Use assets amounting to approximately $19.0 million.

Sustaining capital expendituresNG in 2022 are expected to be in the range of $90 to $100 million, which is unchanged from the Current Guidance, though the Company expects sustaining capital expendituresNG to be closer to the lower end of the Current Guidance range due to lower capital expenditures at both the Mount Milligan Mine and the Öksüt Mine. Sustaining capital expendituresNG in 2022 at the Mount Milligan Mine are estimated to be in the range of $65 to $70 million, which is unchanged from the Current Guidance and relates primarily to the tailings storage facility (“TSF”) costs, a tailings pumping system, major overhauls and water management costs. Sustaining capital expendituresNG in 2022 at the Öksüt Mine are expected to be $20 to $25 million, which is unchanged from the Current Guidance, and includes the estimated $5 million cost for the gold room retrofit at the ADR plant. As noted above, sustaining capital expendituresNG in 2022 at both sites are expected to be closer to the lower end of the Current Guidance range due to postponement of certain capital projects to 2023 and reduced costs due to the weakening of the Canadian dollar and Turkish lira relative to the US dollar.

Non-sustaining capital expendituresNG expected in 2022 are consistent with the Current Guidance and relate to the staged flotation reactor project at Mount Milligan Mine, which was commissioned in May 2022 and is expected to improve future metal recoveries.

Molybdenum Business Unit

In the nine months ended September 30, 2022, the Company incurred $12.8 million of care and maintenance expenses related to the Molybdenum BU and $3.1 million of reclamation expenditures at the Endako Mine. The free cash flow deficitNG at the Molybdenum BU in the nine months ended September 30, 2022, was $19.0 million due to care and maintenance and reclamation expenses noted and the effect of timing of cash collection on molybdenum sales driven by longer average collection periods at the Langeloth Facility. These impacts were partially offset by a reduction in molybdenum inventories held at site. The Company is maintaining its full year Current Guidance for the Molybdenum BU with care and maintenance expenses estimated to be between $20 and $25 million, including approximately $5 to $7 million of reclamation expenditures at the Endako Mine. The free cash flow deficitNG at the Langeloth Facility in the first nine months of 2022 is expected to decline in the fourth quarter of the year with further expected reductions in working capital resulting from lower inventories. The net cash required to maintain the Molybdenum BU is expected to be in the range of $15 to $20 million, which is unchanged from the Current Guidance. The Company’s assumed molybdenum price for 2022 is $17.50 per pound, compared to $17.00 per pound assumed in the Current Guidance.

Depreciation, Depletion, and Amortization

Consolidated DDA expense included in the costs of sales for 2022 is expected to be in the range of $110 to $130 million, compared to $79.9 million in the nine months ended September 30, 2022 and is unchanged from the Current Guidance. The Mount Milligan Mine’s DDA expense in the nine months ended September 30, 2022 was $63.4 million and the full year of 2022 DDA expense is expected to be in the range of $95 to $105 million, which is unchanged from the Current Guidance. The Öksüt Mine’s DDA expense in the nine months ended September 30, 2022 was $12.6 million and is expected to remain unchanged for the rest of 2022 as DDA continues to be capitalized to inventory during the period of the suspension of leaching operations at the heap leach pad and refinery operations at the ADR plant.

Taxes

Income tax related to the Öksüt Mine in the nine months ended September 30, 2022 was $21.7 million and is estimated to be between $20 to $30 million, unchanged from the Current Guidance range. The Mount Milligan Mine is subject to British Columbia mineral tax which was approximately $3.4 million in the nine months ended September 30, 2022 and is expected to be between $5 and $10 million for the full year of 2022, which is unchanged from the Current Guidance.

2022 Material Assumptions

Material assumptions or factors used to forecast production and costs for the fourth quarter of 2022, after giving effect to the hedges in place as at September 30, 2022, include the following:

- no gold doré production or sales at the Öksüt Mine for the remainder of the year.

- a market gold price of $1,650 per ounce, compared to $1,700 per ounce in the Current Guidance, and an average realized gold price at the Mount Milligan Mine of $1,220 per ounce in the fourth quarter of 2022 after reflecting the streaming arrangement with Royal Gold (35% of the Mount Milligan Mine’s gold is sold for $435 per ounce) and mark-to-market adjustments on gold ounces that have yet to settle at September 30, 2022 compared to the previous assumption of $1,230 per ounce.

- a market copper price of $3.25 per pound and an average realized copper price at the Mount Milligan Mine of $2.65 per pound in the fourth quarter of 2022 after reflecting the streaming arrangement with Royal Gold (18.75% of the Mount Milligan Mine’s copper is sold at 15% of the spot price per metric tonne) and further mark-to-market adjustments on copper pounds that have yet to settle at September 30, 2022, compared to the assumptions of $3.25 per pound and $2.34 per pound, respectively, which reflects changes in the commodities markets, and settlements of some of the outstanding copper sales under contracts awaiting final settlement during the third quarter of 2022.

- molybdenum price of $17.50 per pound, compared to $17.00 per pound previously assumed.

- revised exchange rates: $1USD:$1.30 CAD; $1USD:18.0 Turkish lira; with a Turkish inflation assumption of approximately 80% for the full year, compared to the previous assumptions of $1USD:$1.27 CAD; $1USD:15.0 Turkish lira; a Turkish inflation assumption of 80%.

- diesel fuel price assumption of $0.90/litre (CAD$1.17/litre) compared to the previous assumption of $0.90/litre (CAD$1.14/litre) at the Mount Milligan Mine.

Mount Milligan Streaming Arrangement

The Mount Milligan Mine is an open pit mine located in north central British Columbia, Canada producing a gold and copper concentrate. Production at the Mount Milligan Mine is subject to an arrangement with RGLD Gold AG and Royal Gold, Inc. (together, “Royal Gold”) pursuant to which Royal Gold is entitled to purchase 35% of the gold produced and 18.75% of the copper production at the Mount Milligan Mine for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered (the “Mount Milligan Streaming Arrangement”). To satisfy its obligations under the Mount Milligan Streaming Arrangement the Company purchases refined gold and copper warrants and arranges for delivery to Royal Gold. The difference between the cost of the purchases of refined gold and copper warrants, and the corresponding amounts payable to the Company under the Mount Milligan Streaming Arrangement is recorded as a reduction of revenue and not a cost of operating the mine.

Other Material Assumptions

Other material assumptions used in forecasting production and costs for the fourth quarter of 2022 can be found under the heading “Caution Regarding Forward-Looking Information” in this document. Production, cost, and capital expenditure forecasts for the fourth quarter of 2022 are forward-looking information and are based on key assumptions and subject to material risk factors that could cause actual results to differ materially and which are discussed under the heading “Risks That Can Affect Centerra’s Business” in the Company’s most recent AIF.

2022 Sensitivities

Centerra’s revenues, earnings, and cash flows for the fourth quarter of 2022 are sensitive to changes in certain key inputs or currencies. The Company has estimated the impact of any such changes on revenues, net earnings, and cash flows on the fourth quarter as follows:

| Impact on ($millions) | Impact on ($ per ounce sold) | ||||||||||

| Production Costs & Taxes | Capital Costs | Revenues | Cash flows | Net Earnings (after tax) | All-in sustaining costs on a by-product basis per ounceNG | ||||||

| Gold price | $50/oz | 0.1 - 0.2 | — | 4.5 - 5.2 | 4.4 - 5.0 | 4.4 - 5.0 | 1.5 - 1.7 | ||||

| Copper price(1)(2) | 10% | 0.3 - 0.4 | — | 7.1 - 10.0 | 6.8 - 9.6 | 6.8 - 9.6 | 130.0 - 140.0 | ||||

| Diesel fuel(1) | 10% | 0.4 - 0.5 | 0.1 - 0.2 | — | 0.5 - 0.7 | 0.4 - 0.5 | 8.0 - 9.5 | ||||

| Canadian dollar(1)(3) | 10 cents | 2.5 - 2.6 | 0.3 - 0.5 | — | 2.8 - 3.1 | 2.5 - 2.6 | 35.0 - 55.0 | ||||

(1) Includes the effect of the Company’s copper, diesel fuel and Canadian dollar hedging programs, with current exposure coverage for the fourth quarter of 2022 approximately 56%, 62% and 72%, respectively.

(2) Includes the effect of adjusting 25.0 million pounds of copper outstanding under contracts awaiting final settlement in future months as of September 30, 2022 to a market price of $3.25 per pound from the copper price of $3.42 used at the end of the quarter partially offset by the effect of copper hedges bringing the expected average blended copper price to $3.40 per pound in the fourth quarter of 2022.

(3) Appreciation of currency against the US dollar results in higher costs and lower cash flow and earnings, depreciation of currency against the US dollar results in decreased costs and increased cash flow and earnings.

Recent Events and Developments

Update on Öksüt Mine Operations

On March 18, 2022, Centerra announced that it had temporarily suspended gold doré bar production at the Öksüt Mine due to mercury detected in the gold room at the ADR plant. Subsequent to the detection of mercury in the gold room, urine samples were collected from full-time employees and contractors working in and around the gold room and analyzed at an independent certified medical laboratory. Although elevated mercury values were detected in 12 individuals, following their medical examinations, each of them have been cleared to return to full time duty at the mine. The Company continues to monitor and support the health care needs of its workers. In conjunction with the engineered solution for the gold room at the ADR plant, the Company is revising all related health and safety protocols necessary for the installation and safe operation of the new equipment and systems in accordance with the manufacturer instructions and regulatory standards.