Cobalt 27 Announces Friendly Acquisition of Highlands Pacific to Create a Leading High-Growth, Diversified Battery-Metals Streaming Company

Transaction expected to add increased attributable nickel and cobalt production from a long-life,

world-class mine

TSX Venture: KBLT

OTCQX: CBLLF

FRA: 27O

TORONTO, Jan. 1, 2019 /CNW/ - Cobalt 27 Capital Corp. ("Cobalt 27") (TSXV: KBLT) (OTCQX: CBLLF)(FRA: 27O) is pleased to announce that it has entered into a definitive scheme implementation agreement (the "Implementation Agreement") with Highlands Pacific Limited ("Highlands") (ASX: HIG; POMSoX: HIG) dated January 1, 2019, pursuant to which Cobalt 27 will acquire all of the issued ordinary shares of Highlands that it does not own by means of a scheme of arrangement (the "Scheme") under Part XVI of the PNG Companies Act in Papua New Guinea.

Key highlights of the transaction include:

- Creation of a leading high-growth, diversified battery metals streaming and royalty company

- Increases exposure to a large, long-life, low-cost, high-growth nickel-cobalt mine (Ramu)

- Expands and diversifies existing portfolio with increased nickel exposure

- Accretive to Cobalt 27 shareholders

- Attractive re-rating potential

- Repayment of Ramu partner loans after closing will accelerate cash to Cobalt 27

Anthony Milewski, Chairman and CEO of Cobalt 27, stated: "The acquisition of Highlands will allow Cobalt 27 to gain a direct interest in the Ramu nickel-cobalt mine and materially increase its attributable exposure to the mine's nickel production from 27.5% to 100% and cobalt production from 55% to 100%, relative to the previously announced Ramu Cobalt Nickel Stream. It does so at nearly half the cost of the previously announced Ramu Cobalt Nickel Stream, provides increased balance sheet flexibility, and enhances value for Cobalt 27 shareholders. It also brings cash flow to our business, something we have told our shareholders was important from the beginning."

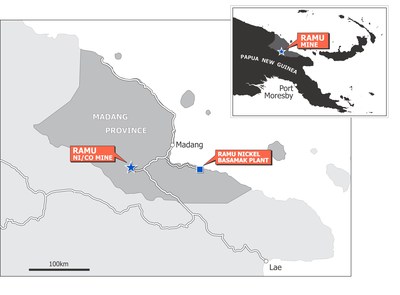

Highlands' key asset is its 8.56% interest in the Ramu nickel-cobalt mine ("Ramu") located near Madang on the north coast of PNG. Following repayment of Highlands' attributable Ramu construction and development loans, Highlands' ownership would increase to 11.3%. Ramu is majority-owned and operated by Metallurgical Corporation of China Limited ("MCC") which holds a 67.02% stake in MCC-JJ Mining which owns 100% of MCC Ramu NiCo Ltd. ("MCC – Ramu"), holder of an 85% joint venture interest in Ramu. The Government of PNG and local landowners (the "PNG Stakeholders") own a 6.44% stake in Ramu, which would increase to 8.7% upon repayment of construction and development loans. The Ramu mine was financed and constructed by MCC for US$2.1 billion which, at the time, was China's largest overseas mining investment. MCC is listed on the Hong Kong Stock Exchange and Shanghai Stock Exchange with a market capitalization of approximately US$9 billion.

As previously announced by Highlands on October 8, 2018, MCC is evaluating a potential expansion of the Ramu mine, which could cost in the order of ~US$1.5 billion. Details in respect of any potential expansion have not been finalized. Cobalt 27 would have the opportunity to participate in any potential expansion and increase its attributable production through its acquisition of Highlands pursuant to the Scheme.

Highlands also holds interests in the Star Mountains Copper Gold exploration project in PNG and is evaluating the Sewa Bay laterite nickel project in PNG in conjunction with Japanese trading house Sojitz Group. Cobalt 27 intends to evaluate strategic alternatives with respect to these non-core assets.

Scheme Summary

Under the terms of the Scheme, Cobalt 27 will acquire all of the issued ordinary shares of Highlands that it does not already own (the "Scheme Shares") for an all-cash offer price of A$0.105 per share (the "Base Purchase Price"). The Base Purchase Price consideration offered for all of the Scheme Shares is valued at approximately US$70 or C$96 million, of which US$61 or C$83 million is anticipated to be funded with cash consideration and available credit assuming the PanAust Buy-Back Agreement (as defined below) is completed. The Base Purchase Price consideration offered implies a value of A$115 million for all of Highlands' shares, including those already held by Cobalt 27 and PanAust Limited and its subsidiaries ("PanAust").

The Base Purchase Price to be received by Highlands shareholders represents a 44% premium over Highlands' closing share price on the ASX on December 24, 2018 prior to its trading halt, and a 30% premium to Highlands' volume-weighted average share prices for the 20 trading days up to and including December 24, 2018.

If before December 31, 2019 the London Metal Exchange ("LME") official closing cash settlement price for nickel is US$13,220 per tonne or higher for a period of 5 consecutive trading days, Highlands' scheme shareholders will receive contingent consideration of A$0.010 per Scheme Share payable in cash (the "Contingent Purchase Price"). If the Contingent Purchase Price becomes payable, the total consideration, including the Base Purchase Price and the Contingent Purchase Price, would represent a 58% premium over Highlands' closing share price on the ASX on December 24, 2018 prior to its trading halt, and a 43% premium to Highlands' volume-weighted average share prices for the 20 trading days up to and including December 24, 2018.

Also under the terms of the Scheme, Highlands will use its best endeavours to enter into a buy-back agreement with PanAust (the "PanAust Buy-Back Agreement") pursuant to which PanAust would transfer to Highlands legal and beneficial ownership of 128,865,980 Highlands shares currently held by PanAust, and agree to the cancellation of any outstanding liabilities owed by Highlands to PanAust, in return for Highlands transferring to PanAust all of the shares in Highlands Frieda Limited (which is the entity holding Highlands' participating interest in the joint venture established under the Frieda River JV Agreement) and an estimated US$0.3 million in cash, an amount equal to the difference between the net carrying value of 20% of Frieda River in Highlands' financial statements and the value of PanAust's current shareholding of Highlands at the offer price. If the PanAust Buy-Back Agreement closes, such shares in Highlands will be bought back by Highlands and cancelled, and will not be acquired by Cobalt 27 under the Scheme.

Directors of Highlands (other than Anthony Milewski, because Anthony is also Chairman and CEO of Cobalt 27) have stated that they intend to vote shares that they own in favour of the Scheme in the absence of a superior proposal and subject to the independent expert concluding the Scheme is in the best interest of shareholders. Shareholders holding in aggregate of approximately 30% of Highlands' shares outstanding have stated an intention to vote in favour of the Scheme, in the absence of a superior proposal. Those shareholders comprise PanAust holding 11.79%, funds associated with LIM Advisors Limited holding 9.42% and Tribeca Investment Partners Pty Ltd. holding 8.92% of Highlands' shares outstanding. PanAust's intention to vote in favour of the Scheme, in the absence of a superior proposal is subject to board and regulatory approval in China. PanAust is a subsidiary of Guangdong Rising Assets Management Co ("GRAM"), a Chinese state-owned enterprise.

Benefits to Cobalt 27 Shareholders:

- Spending less to get more relative to proposed Ramu Cobalt-Nickel Stream

- Greater nickel and cobalt exposure

- Lower transaction cost

- Significantly lower pro forma debt

- Consistent with strategy of gaining exposure to battery metals

- Increased exposure to low-cost, long-life Ramu mine

- Expands and diversifies existing portfolio with increased nickel exposure

- Accretive to shareholders on a NAV basis

- Superior platform in Australasia to review and invest in regional opportunities

- Simplifies the ownership and future funding mechanism for Ramu

The transaction Scheme is expected to close in the second quarter of 2019, subject to approval of the Scheme by the shareholders of Highlands, court approval, regulatory and applicable stock exchange approvals and certain other closing conditions customary in transactions of this nature. Further details regarding the terms of the Scheme are set out in the Implementation Agreement which will be publicly filed by Cobalt 27 under its profile at www.sedar.com.

On May 22, 2018, Cobalt 27 previously announced a stream transaction with Highlands pursuant to which Electric Metals Streaming Corp., a wholly-owned subsidiary of Cobalt 27, would have purchased the equivalent of 55% of the cobalt and 27.5% of the nickel from Highlands' attributable share of Ramu production for US$113 million. Under the stream transaction, Cobalt 27's implied production exposure would have amounted to approximately 450,000 pounds of cobalt and approximately 1,000 tonnes of nickel, based on 2018 Ramu production guidance for Highlands' pro forma 11.3% interest in Ramu. By comparison, the corporate acquisition of Highlands pursuant to the Scheme would imply an increase in attributable production to Cobalt 27 to over 600,000 pounds of cobalt and over 2,900 tonnes of nickel (based on 2018 Ramu production guidance for Highlands' 8.56% interest). Upon repayment of Highlands' attributable partner loans, Highlands' interest in Ramu would increase to 11.3%, which would imply 2018 attributable production of over 800,000 pounds of cobalt and over 3,800 tonnes of nickel. The Scheme therefore enables Cobalt 27 to acquire significantly more attributable cobalt and nickel production at a lower transaction cost compared to the stream transaction. In light of the current commodity price environment for cobalt and nickel, Cobalt 27 declined to extend the stream transaction, which has been mutually terminated.

About the Ramu Mine

- Construction and commissioning of the US$2.1 billion Ramu mine was completed in 2012 by owner/operator MCC, as its cornerstone asset in a nickel-focused resource portfolio.

- Ramu is a large scale nickel-cobalt mine with total estimated reserves of 1 billion pounds of nickel and 100 million pounds of cobalt. Management of Highlands currently estimates a mine life of 30+ years. Ramu produces approximately 3% of annual global mined cobalt as a co-product.

- Ramu exceeded annual production projections in 2017, reporting net cash flow of US$170 million (unaudited), on production of 34,666 tonnes of contained nickel and 3,308 tonnes of contained cobalt, both in excess of nameplate capacity.

- Ramu is among the most efficient integrated lateritic nickel-cobalt operations in the world, ranking in the bottom half of the 2018 global nickel asset cost curve.

A regional map shows the location of the assets of the Ramu mine:

In addition to MCC's investment in Ramu, a number of other prominent resource companies successfully operate in PNG and are responsible for significant and widespread investment in, and economic development of, the country in recent years. The most notable of these include Harmony Gold and Newcrest Mining's proposed US$2.8 billion Wafi-Golpu Joint Venture copper and gold mine; Newcrest's US$7.2 billion merger with Lihir Gold Limited in 2010; and, Barrick Gold's US$298 million sale of 50% interest in the producing Barrick Niugini (Porgera) Gold Mine to China's Zijin Mining Group in 2015. Additionally, oil and gas majors, ExxonMobil and France's Total recently announced plans to invest an additional US$13 billion in LNG assets and Repsol has had upstream operations in PNG since 2015.

Advisors and Counsel

Scotiabank and Argonaut are acting as financial advisors to Cobalt 27. Stikeman Elliott LLP and Piper Alderman are acting as legal counsel to Cobalt 27.

About Highlands Pacific

Highlands is a mining and exploration company listed on the Australian Stock Exchange and the Port Moresby Stock Exchange in PNG. Highlands' primary assets include an 8.56% interest in the producing Ramu mine and a 20% interest in Frieda River Copper-Gold Project, both located in PNG. Highlands also holds 49% interest in a joint venture with Anglo American on the Star Mountains Copper Gold exploration project in PNG and has exploration tenements on Normanby Island (Sewa Bay).

About Cobalt 27 Capital Corp.

Cobalt 27 Capital Corp. is a leading electric metals investment vehicle offering exposure to metals integral to key technologies of the electric vehicle and battery energy storage markets. The Company has acquired a cobalt stream on Vale's world-class Voisey's Bay mine beginning in 2021, including the announced underground expansion and holds one of the world's largest stockpiles of physical cobalt. The Company also manages a portfolio of nine royalties and intends to continue to invest in a cobalt-focused portfolio of streams, royalties and direct interests in mineral properties containing cobalt

For further information please visit the Company website at www.cobalt27.com

Scientific and Technical Information

The majority owner and operator of Ramu is MCC Ramu Nico Ltd., a wholly-owned subsidiary of MCC which is listed on the Hong Kong Stock Exchange (Stock Code "1618") and on the Shanghai Stock Exchange, and has a market capitalization of approximately US$9 billion. The scientific and technical information in this news release, as well as additional material scientific and technical information with respect to the Ramu project, has been prepared by MCC in its capacity as operator of Ramu and disclosed by MCC and Highlands and is available on MCC's HKEX profile at http://www.hkexnews.hk/index.htm as well as on Highlands' website at http://www.highlandspacific.com/asx-announcements.

All estimates of mineral reserves and mineral resources in respect of Ramu in this news release are presented in compliance with the 2012 Australasian Code for Reporting of Exploration Results, Mineral Reserves and Ore Reserves established by the Australasian Joint Ore Reserves Committee (the "JORC Code").

Disclosures of a scientific or technical nature in this news release have been reviewed on behalf of Cobalt 27 by Robert Osborne, a "Qualified Person" as defined by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Mineral Resource and Ore Reserve Estimates

The following are the ore reserves and mineral resources (inclusive) for Ramu as at June 15, 2018, reported under the JORC Code. The report on reserves and resources was prepared for and are the responsibility of Ramu NiCo Management (MCC) Limited, the operator and manager of Ramu. For reporting in a NI 43-101 format, the inferred resources are not totaled with the measured and indicated mineral resources. The Ramu technical report has been reviewed for scope and content of JORC and NI 43-101 reporting by an independent qualified person on behalf the Company.

In the following table note:

- Ni and Co grades shown to 1 decimal only. Totals are rounded.

- Dry ore tonnes reflect -2mm economic portion of the recoverable resource.

- Ore reserve based on US$12,000/t nickel and US$48,501/t cobalt.

- 0.5% Nickel cut-off grade for the mineral resource and the ore reserve.

Ore Reserves | Nickel | Cobalt | ||||

(Mt) | (%) | (%) | ||||

Proven | 24 | 0.9 | 0.1 | |||

Probable | 33 | 0.9 | 0.1 | |||

Total Reserves | 56 | 0.9 | 0.1 | |||

Mineral Resources | ||||||

Measured | 34 | 0.9 | 0.1 | |||

Indicated | 42 | 0.9 | 0.1 | |||

Measured and Indicated | 76 | 0.9 | 0.1 | |||

Inferred | 60 | 1.0 | 0.1 | |||

Forward-Looking Information

This news release contains certain information which constitutes 'forward-looking statements' and 'forward-looking information' within the meaning of applicable Canadian securities laws. Forward-looking statements in this news release include, without limitation: statements as to Cobalt 27's management's expectations with respect to the proposed combination of Cobalt 27 and Highlands, including the combined company's financial position, cash flows and growth prospects; statements as to the anticipated benefits of the Scheme transaction; certain combined operational, financial and other information and projections; statements pertaining to the anticipated completion of the Scheme and the timing thereof; and the receipt of any court, regulatory and stock exchange approvals therefor; statements pertaining to the timing and amounts of cash consideration related to the acquisition of Highlands; statements pertaining to estimates of mineral resources and mineral reserves at Ramu; statements pertaining to future production and mining costs at Ramu; statements pertaining to future prices of cobalt, nickel and other commodities; and statements pertaining to the adoption of electric vehicles globally. Forward-looking statements involve known and unknown risks and uncertainties, most of which are beyond the Company's control. For more details on these and other risk factors see the Company's most recent Annual Information Form on file with Canadian securities regulatory authorities on SEDAR at www.sedar.com under the heading "Risk Factors". Should one or more of the risks or uncertainties underlying these forward-looking statements materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements. Accordingly, undue reliance should not be placed on these forward-looking statements. This news release also contains references to estimates of mineral resources and mineral reserves. The estimation of mineral resources is inherently uncertain and involves subjective judgments about many relevant factors. Estimates of mineral reserves provide more certainty but still involve similar subjective judgments. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the company's projects, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral resource or mineral reserve estimates may have to be re-estimated based on: (i) fluctuations in mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

The forward-looking statements contained herein are made as of the date of this release and, other than as required by applicable securities laws, the Company does not assume any obligation to update or revise it to reflect new events or circumstances. The forward-looking statements contained in this release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this news release.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/cobalt-27-announces-friendly-acquisition-of-highlands-pacific-to-create-a-leading-high-growth-diversified-battery-metals-streaming-company-300771636.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/cobalt-27-announces-friendly-acquisition-of-highlands-pacific-to-create-a-leading-high-growth-diversified-battery-metals-streaming-company-300771636.html

SOURCE Cobalt 27 Capital Corp

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2019/01/c2419.html