Cornerstone Board Rejects Hostile Bid Proposal by SolGold

OTTAWA, March 08, 2019 (GLOBE NEWSWIRE) -- Cornerstone Capital Resources Inc. (“Cornerstone” or “the Company”) (TSXV:CGP) (Frankfurt:GWN) (Berlin:GWN) (OTC:CTNXF) today announced that its Board of Directors, upon the unanimous recommendation of an independent committee of the Board and following a detailed review conducted in consultation with its financial and legal advisors, has unanimously determined to reject SolGold plc’s (“SolGold”) unsolicited proposal to acquire Cornerstone (the “Hostile Bid”) on the basis that it is not in the best interests of Cornerstone’s shareholders.

|

||||||||||

The Board has rejected the proposed Hostile Bid without having received the formal bid given SolGold’s consistent track record of delays:

- late to publish drill results and updates to the market on Cascabel with the last press released update on exploration in November 2018;

- late on releasing the Cascabel maiden resource statement;

- late on releasing the preliminary economic assessment for Cascabel which was originally expected in January 2019, then Q1 2019 and now the most recent SolGold presentation is suggesting Q2 2019; and

- now nearly 40 days since announcing its intention to make a takeover bid for Cornerstone.

“The Board is unanimous that SolGold’s proposal substantially undervalues Cornerstone, a fact that has clearly been recognized by our shareholders with holders of approximately 59% of the outstanding common shares having now advised Cornerstone that they will not support SolGold’s proposed bid” said Greg Chamandy, Chairman of the Cornerstone Board.

The Cornerstone Board firmly believes that SolGold’s proposed Hostile Bid has no chance of success and has determined to highlight the following for the benefit of Cornerstone’s shareholders:

1. THE PROPOSED HOSTILE BID HAS BEEN REJECTED BY SHAREHOLDERS AND IS INCAPABLE OF MEETING THE STATUTORY MINIMUM TENDER CONDITION

Shareholders that collectively own or exercise control of approximately 59% of the outstanding common shares of the Company have advised Cornerstone that they will not support the terms announced by SolGold. Canadian takeover rules require the majority of Cornerstone’s outstanding common shares (excluding those shares held by SolGold) be tendered to a formal offer before any shares can be taken up. Given that the statutory minimum tender condition cannot be waived by SolGold, the proposed Hostile Bid is incapable of being completed on the basis that it lacks sufficient shareholder support.

2. THE PROPOSED HOSTILE BID SIGNIFICANTLY UNDERVALUES CORNERSTONE

SolGold is offering 0.55 of a SolGold share for each Cornerstone common share tendered into the proposed Hostile Bid. At current market prices, this would be approximately C$0.35 per common share, or total consideration for all of Cornerstone’s outstanding common shares of approximately C$226 million. The Board views this consideration as inadequate based on the substantial value of Cornerstone’s assets.

The Hostile Bid Fails to Recognize the Strategic Value of the Company’s Asset Base

Exploraciones Novomining S.A. (“ENSA”), an Ecuadorean company owned by SolGold and Cornerstone, holds 100% of the Cascabel concession. Subject to the satisfaction of certain conditions, including SolGold fully funding the project through to feasibility, SolGold will own 85% of the equity of ENSA and Cornerstone 15%. Cornerstone also owns approximately 9.2% of the outstanding shares of SolGold. In effect, Cornerstone has a combined direct and indirect 22.8% interest in the Cascabel concession in addition to Cornerstone’s ENAMI joint venture and other assets.

SolGold is responsible for funding 100% of the exploration at Cascabel, including funding Cornerstone’s 15% interest, until completion of a bankable feasibility study. Following completion of a bankable feasibility study, SolGold is entitled to receive 90% of Cornerstone's distribution of earnings or dividends from ENSA until such time as the amounts so received equal the aggregate amount of expenditures incurred by SolGold that would have otherwise been payable by Cornerstone, plus interest thereon from the dates such expenditures were incurred at a rate per annum equal to LIBOR plus 2%.

The benefit to Cornerstone’s shareholders of the Company’s strategic 15% carried interest in ENSA is apparent considering the significant dilution SolGold’s shareholders have experienced and are likely to continue to experience as a result of SolGold’s attempts to finance the substantial ongoing development costs associated with the Cascabel project. In less than 18 months Cornerstone’s former 11.25% ownership interest in SolGold’s shares has been diluted by over 18% to 9.2%.

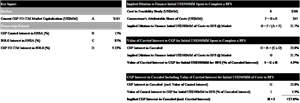

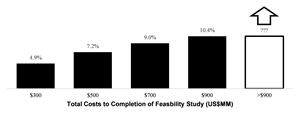

The significant value of Cornerstone’s carried interest is clearly demonstrated in the following example. Assuming that the total costs of the Cascabel project to completion of feasibility will be US$300 million, SolGold must fund US$45 million to cover Cornerstone’s portion of the development costs in addition to the US$255 million required for SolGold’s interest. In effect SolGold must fund US$100 million for every US$85 million it needs to finance for its 85% interest. If SolGold finances its development costs by issuing equity, the resultant incremental dilution borne solely by SolGold’s shareholders is at least 18% (which doesn’t account for commissions, fees, discounts and other costs associated with any such financing).

Please see accompanying "BFS Example" image.

More generally, the value of Cornerstone’s carried interest can be expressed by the following equation:

Please see accompanying "Value of Carried Interest to Cornerstone (% of Cascabel Interest)" image.

Conservatively assuming that Cornerstone could otherwise finance its carried interest on a zero discount and zero cost basis, the value of Cornerstone’s carried interest is equal to approximately an additional 5% interest in the Cascabel project. The strategic benefit and value to Cornerstone of its carried interest is even greater when considering the costs of development through to a bankable feasibility study on comparable projects are well in excess of US$300 million.

Furthermore, as noted above, Cornerstone’s attributable costs prior to feasibility will be repaid in the future out of 90% of Cornerstone’s share of earnings from ENSA. If a mine is built, Cornerstone repays its carried interest at an interest cost per annum equal to LIBOR plus 2%, which is well below the cost of capital for both Cornerstone and SolGold. In effect, SolGold is required to fund Cornerstone’s 15% carried interest on terms much more favourable to Cornerstone than SolGold’s cost to finance, which accretes additional value to Cornerstone’s shareholders and further dilutes SolGold’s shareholders.

The Proposed Hostile Bid is Well Below Precedent Transactions

The proposed Hostile Bid represents a significant discount to the multiples in precedent transactions involving other mineral exploration companies. Assuming SolGold had liquid shares acceptable to Cornerstone’s shareholders, the proposed Hostile Bid implies a valuation for Cornerstone of approximately US$0.02 per copper equivalent resource pound whereas precedent transactions with assets of lower grade and smaller size represent an average implied valuation of approximately US$0.07 per copper equivalent resource pound. SolGold would need to approximately triple their implied bid for Cornerstone to match the average from precedent transactions.

The Hostile Bid is at a Significant Discount to the Implied Value for Cornerstone Paid by BHP and Newcrest for their Non-Controlling Interest in SolGold

On October 15, 2018, BHP Billiton Holdings Limited (“BHP”) acquired 100,000,000 SolGold shares at a price of £0.45 per SolGold share, which implied a price of ~C$0.63 per Cornerstone common share.

Similarly, on December 14, 2018, Newcrest Mining Limited (“Newcrest”) acquired 27,870,000 SolGold shares at a price of £0.40 per SolGold share, which implied a price of ~C$0.56 per Cornerstone common share.

SolGold would need to increase their implied price for Cornerstone’s common shares by approximately 62% and 84% to match the implied price paid by Newcrest and BHP, respectively, for their non-controlling interests in SolGold.

The Proposed Exchange Ratio is Vastly Out of Proportion to Cornerstone’s Combined Direct and Indirect Interest

As of January 30, 2019, the exchange ratio proposed by SolGold would result in Cornerstone’s shareholders owning approximately 18.4% of SolGold on a fully diluted in-the-money basis (assuming cancellation of cross-held shares) compared to Cornerstone’s combined direct and indirect 22.8% interest in the Cascabel concession (assuming zero additional value for Cornerstone’s carried interest). This represents an approximate 20% reduction for Cornerstone’s shareholders (assuming zero value is ascribed to Cornerstone’s other assets). Including the value of Cornerstone’s carried interest as described above, the discount for Cornerstone’s shareholders increases to over approximately 33%. Assuming SolGold had liquid shares acceptable to Cornerstone’s shareholders, SolGold would need to increase the exchange ratio to in excess of 0.89 SolGold shares per Cornerstone common share to avoid a reduction in value for Cornerstone’s shareholders.

The Proposed Exchange Ratio is Below the Exchange Ratio at which SolGold Shareholders Swapped their SolGold Shares for a Non-Controlling Interest in Cornerstone

In 2017, Cornerstone acquired SolGold shares in consideration for the issuance of Cornerstone common shares at an effective exchange ratio of approximately 0.65 SolGold shares per Cornerstone common share as compared to the exchange ratio under the proposed Hostile Bid of 0.55. SolGold shareholders that participated in the share swaps received 18% fewer shares in Cornerstone for a non-controlling interest as compared to the proposed Hostile Bid for control of Cornerstone. In comparison, this suggests that no premium is being offered as part of the consideration under the proposed Hostile Bid and that the consideration under the proposed Hostile Bid is at a significant discount.

The Timing of the Proposed Hostile Bid is Highly Suspect

The Board believes that SolGold announced the proposed Hostile Bid to:

- exploit its inside knowledge about the Cascabel project prior to the release of the preliminary economic assessment for Cascabel and before material information was appropriately disseminated to Cornerstone and the market;

- pre-empt Cornerstone’s ability to enter into a value enhancing transaction with third parties such as BHP given its unusual standstill that does not expire until October 2020; and

- deny Cornerstone’s shareholders the opportunity to realize the value of Cornerstone’s carried interest in the Cascabel project.

3. SOLGOLD’S SHARES ARE HIGHLY ILLIQUID WITH A HISTORY OF SIGNIFICANT DILUTION AND NO CERTAINTY OF VALUE

SolGold Shares are Illiquid both in the U.K. and Canada

SolGold’s average daily liquidity is extremely limited which would adversely impact the ability for Cornerstone’s shareholders to monetize their SolGold shares without creating significant selling pressure. Based on the last 12 months’ average daily trading of SolGold’s shares in both the U.K. and Canada, it would take over five years of trading (over 1,300 trading days) to monetize the SolGold shares that would be issued as consideration under the proposed Hostile Bid, assuming responsible trading at 15% of the total volume on the LSE. On the TSX, where the SolGold shares are even more illiquid, it would take over 183 years or over 46,000 trading days to monetize the SolGold shares.

SolGold is expected to Dilute Existing Shareholders Further to Fund through to Feasibility

SolGold shareholders have experienced and are likely to continue to experience significant dilution as a result of SolGold’s efforts to finance the substantial ongoing development costs associated with the Cascabel project. Ongoing drilling and work towards completing various stage-gate studies including the feasibility study are expected to require further dilutive financings by SolGold. On the other hand, to maintain Cornerstone’s current direct interest in Cascabel, no financing is required until after the completion of the feasibility study. Cornerstone’s shareholders will benefit if a robust feasibility study is delivered, following which Cornerstone will be required to fund its 15% interest in Cascabel and SolGold will be required to fund its 85% interest.

4. SOLGOLD IS MIRED BY SUSPECT CORPORATE GOVERNANCE AND SELF-DEALING PRACTICES

SolGold is Largely Controlled by a Group with Conflicting Loyalties and Divided Attention

Many of SolGold’s directors and officers overlap with those of one of its major shareholders, DGR Global Limited (“DGR”). DGR was founded by Nicholas Mather, the Chief Executive Officer of SolGold, who also acts as Managing Director and Chief Executive Officer of DGR. As founder, Mather owns 19.43% of DGR and appears to commonly staff his associates to the management team and/or board of directors of DGR’s “portfolio” companies, including SolGold.

Many of SolGold’s directors and officers split their attention with three other publicly traded entities related to DGR: Aus Tin Mining, IronRidge Resources and Dark Horse Resources Limited. Brian Moller, the chairman of the board of SolGold, is perhaps the most egregious example of Mather staffing his associates at DGR’s various portfolio companies, as he serves alongside Mather as a non-executive director of DGR itself as well as two of its publicly traded portfolio companies. Yet despite the common directorship and clear connection to Mather, Moller is touted as the “independent” chairman of SolGold.

This pattern of rewarding associates for their loyalty continues with SolGold’s management team, as each of Mather, Karl Schlobohm (SolGold’s Corporate Secretary) and Priy Jayasuriya (SolGold’s Chief Financial Officer) all fill similar positions with each of DGR and its three publicly traded portfolio companies.

Mather and his team’s influence on SolGold through DGR is important – given their control and conflicting loyalties, Mather and his team could effectively exclude independent shareholders from major decisions, or favour actions to benefit his own or his associates’ interests at the expense of SolGold’s other shareholders.

SolGold’s Largest Independent Shareholder has Limited Say and Non-Related SolGold Shareholders are Effectively Neutered

Newcrest is SolGold’s largest independent shareholder with 15.2% of SolGold and is required to vote alongside the non-independent SolGold Board until October 2019 on certain matters. This provides Mather and his associates with significant influence over SolGold and in the words of Mather: “[Newcrest] can’t make life difficult for [SolGold]”1.

Cornerstone estimates that the vast majority of SolGold’s independent shareholders (excluding votes in favour of the resolutions attributable to Newcrest, SolGold board members and other insiders) voted against several egregious resolutions put forward by the SolGold board at SolGold’s 2017 AGM, including:

- Over 90% voted AGAINST increasing the directors annual remuneration by over 60%;

- Over 74% voted AGAINST adoption of the share option plan which enables SolGold to issue 10% of the basic shares outstanding, which as of the date of this release would be in excess of 184,632,100 options to acquire shares; and

- Over 60% voted AGAINST granting 26,250,000 share options to Samuel Holdings Pty Ltd, a company controlled by Mather.

All three of the above resolutions were passed given the self-interested voting by Mather and his associates, at the expense of all other SolGold shareholders.

The SolGold Board has a History of Diverting Benefits to Insiders at the Expense of all other Shareholders

SolGold’s board of directors has authorized punitively dilutive financings for the benefit of SolGold insiders and associates of Mather at the expense of SolGold’s other shareholders. For example, in March 2016, SolGold issued 87,449,092 shares at 2.3p to DGR and Tenstar Trading Limited for settlement of loans and convertible notes, notwithstanding that it is highly unusual for any exploration company to finance its operations with debt given the destructive effect it can have on equity value. A total of 142,311,592 shares were issued to DGR and Tenstar Trading Limited in 2016 for settlement of debts.

In addition, SolGold has established a loan plan in order to “assist” employees in exercising stock options. The plan essentially allows certain insiders of SolGold to pay for the exercise of options using an interest free loan from SolGold. On October 29, 2018, SolGold enabled certain insiders to exercise 19,950,000 options through an interest free loan. However, these employee benefits were not disclosed to SolGold’s shareholders or the market until February 13, 2019 – over 108 days after the loans were made. Further, independent shareholders of SolGold were not asked to approve these loans. As the same concessions were not available to SolGold’s other securityholders, the interest free loans demonstrate the self-interested and rapacious conduct of Mather and Moller.

5. CORNERSTONE IS UNIQUELY POSITIONED, MAKING IT AN ATTRACTIVE OPTION FOR THOSE LOOKING TO ACQUIRE A DIRECT INTEREST IN CASCABEL

As enumerated above, Cornerstone’s combined direct and indirect 22.8% interest in the Cascabel concession is unique, as it provides an attractive opportunity for a potential acquirer to secure a strategic position in the Cascabel project, widely considered to have the potential to be a world class mineral property due to its significant copper and gold resources. The Board believes that this, in part, may be why many of Cornerstone’s shareholders have advised the Company that they do not support the proposed Hostile Bid.

The Board believes it is entirely reasonable for parties other than SolGold to consider a possible acquisition transaction of Cornerstone appealing, as interested third parties have an opportunity to secure a position in Cascabel that is superior to both BHP and Newcrest. Sophisticated mineral resource companies could leverage Cornerstone’s strategic position to acquire an even larger interest in the Cascabel concession.

The strategic value of Cornerstone could enable an acquiror to do a creeping takeover of SolGold (either alone or with BHP and/or Newcrest) and severely limit the financing options for SolGold.

The Board does not consider an acquisition of Cornerstone to only be attractive to those looking to acquire a controlling interest in Cascabel. Maintaining both a direct and indirect stake in SolGold creates competitive pressure that would not exist if the Cascabel concession was consolidated under one umbrella. In the Board’s view, Cornerstone’s combined interest also significantly increases the buyer universe for Cornerstone, making it attractive to royalty companies and private equity participants in addition to mining companies.

On March 7, 2019 Cornerstone delivered the following letter to SolGold’s board of directors proposing an obvious alternative in which both Cornerstone and SolGold conduct a formal auction for 100% of Cascabel with all potential acquirors, including BHP, released from any and all standstills and unnecessary encumbrances:

VIA EMAIL

March 7, 2019

Board of Directors

SolGold plc

Level 27, 111 Eagle Street

Brisbane, Australia 4000

Re: SolGold’s Proposed Hostile Bid

Cornerstone, with the assistance of our financial and legal advisors, has undertaken a detailed review and analysis of SolGold’s press releases dated January 31, 2019 and February 8, 2019 proposing to acquire all of the outstanding common shares of Cornerstone Capital Resources Inc. under a takeover bid. Consistent with its focus on the best interests of our company and its stakeholders and on maximizing shareholder value, our board has determined that the proposal set forth in your press releases is not in the best interests of Cornerstone shareholders. The proposed hostile bid has now been rejected by Cornerstone shareholders that collectively own approximately 59% of the outstanding Cornerstone shares and simply cannot succeed – prior to your proposal even being formalized, it has already failed.

The proposed hostile bid is a significant waste of time and resources. We previously discussed a potential combination between SolGold and Cornerstone that you declined for non-commercial reasons. Specifically, Cornerstone wanted to ensure proper stewardship of the Cascabel project under a professional and competent CEO and Chairman and with an appropriately qualified board of directors at the helm to maximize value for all shareholders.

As Cornerstone is focused on maximizing shareholder value, one obvious alternative that we propose Cornerstone and SolGold pursue is to conduct a formal auction for 100% of Cascabel with all potential acquirers, including BHP, released from any and all standstills and unnecessary encumbrances. This would level the playing field plus all remaining assets in our respective companies would be spun-out to our respective shareholders. Otherwise SolGold can continue down the current path of a failed hostile bid and SolGold shareholders are likely to face a creeping takeover and never receive a proper control premium.

SolGold’s directors and officers should also clearly and transparently disclose their direct and indirect ownership in Cornerstone. We suspect many SolGold shareholders would be very surprised to discover that certain directors and officers may have misaligned interests where they indirectly benefit from the proposed hostile bid through their shareholdings in Cornerstone. This would also answer the question we have received dozens of times on why would SolGold launch a hostile bid, well below fair value and simply an attempt to put Cornerstone in play, when they could never get the necessary shareholder support to be successful.

We expect SolGold’s board of directors will see the rationale in conducting a formal auction for 100% of Cascabel, to the benefit of all shareholders, and look forward to your prompt response.

On behalf of our board of directors,

/s/ GREG CHAMANDY

Greg Chamandy

Chairman of the Board

Advisors

Cornerstone’s financial advisor is Maxit Capital LP and its legal counsel is Davies Ward Phillips & Vineberg LLP.

About the Cascabel Joint Venture with SolGold:

Exploraciones Novomining S.A. (“ENSA”), an Ecuadorean company owned by SolGold Plc and Cornerstone, holds 100% of the Cascabel concession. Subject to the satisfaction of certain conditions, including SolGold’s fully funding the project through to feasibility, SolGold Plc will own 85% of the equity of ENSA and Cornerstone will own the remaining 15% of ENSA. SolGold is funding 100% of the exploration at Cascabel and is the operator of the project. SolGold is entitled to receive 90% of Cornerstone’s distribution of earnings or dividends from ENSA to which Cornerstone would otherwise be entitled until such time as the amounts so received equal the aggregate amount of expenditures incurred by SolGold that would have otherwise been payable by Cornerstone, plus interest thereon from the dates such expenditures were incurred at a rate per annum equal to LIBOR plus 2%.

About Cornerstone:

Cornerstone Capital Resources Inc. is a mineral exploration company with a diversified portfolio of projects in Ecuador and Chile, including in the Cascabel gold-enriched copper porphyry joint venture in north west Ecuador.

Further information is available on Cornerstone’s website: www.cornerstoneresources.com and on Twitter. For investor, corporate or media inquiries, please contact:

Investor Relations:

Mario Drolet (Montreal); Email: Mario@mi3.ca;

Tel. (514) 346-3813

Corporate Matters: David Loveys, CFO; Email: loveys@cornerstoneresources.ca;

Tel. (343) 689-0714

Due to anti-spam laws, many shareholders and others who were previously signed up to receive email updates and who are no longer receiving them may need to re-subscribe at http://www.cornerstoneresources.com/s/InformationRequest.asp

Cautionary Notice:

This news release may contain ‘Forward-Looking Statements’ that involve risks and uncertainties, such as statements of Cornerstone’s beliefs, plans, objectives, strategies, intentions and expectations. The words “potential,” “anticipate,” “forecast,” “believe,” “estimate,” “intend,” “trends,” “indicate,” “expect,” “may,” “likely,” “should,” “could,” “potential,” “project,” “plan,” or the negative or other variations of these words and similar expressions are intended to be among the statements that identify ‘Forward-Looking Statements.’ Examples of such ‘Forward Looking Statements’ in this news release include, but are not limited to, expectations regarding Cornerstone’s and ENSA’s prospects for growth, profitability and shareholder value creation; the availability of financing to fund Cornerstone’s and SolGold’s obligations; the development costs associated with the Cascabel project; the value and trading volumes of SolGold shares; the response to, likelihood of success and consequences of the Hostile Bid; the terms of the Hostile Bid; and the availability of strategic alternative transactions emerging. Although Cornerstone believes that its expectations reflected in these ‘Forward-Looking Statements’ are reasonable, such statements may involve unknown risks, uncertainties and other factors disclosed in our regulatory filings, viewed on the SEDAR website at www.sedar.com. These uncertainties may cause actual results and developments to be materially different than those expressed in our Forward-Looking Statements. Although Cornerstone believes the facts and information contained in this news release to be as correct and current as possible, Cornerstone does not warrant or make any representation as to the accuracy, validity or completeness of any facts or information contained herein and these statements should not be relied upon as representing its views after the date of this news release. While Cornerstone anticipates that subsequent events may cause its views to change, it expressly disclaims any obligation to update the Forward-Looking Statements contained herein except where outcomes have varied materially from the original statements.

On Behalf of the Board,

Brooke Macdonald

President and CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

___________________

1 Company Presentation by SolGold CEO Nick Mather at the Denver Gold Forum, 2018.

Images accompanying this release are available at:

http://www.globenewswire.com/NewsRoom/AttachmentNg/db239031-5214-4861-886e-6d3eb0b6977e

http://www.globenewswire.com/NewsRoom/AttachmentNg/1229c03b-bc52-4742-8875-be30a016024e