Denison Announces Decision to Adopt Freeze Wall Design for ISR Mining at Phoenix

TORONTO, ON, Dec. 1, 2020 /CNW/ - Denison Mines Corp. ("Denison" or the "Company") (TSX: DML) (NYSE American: DNN) is pleased to announce the completion of a trade-off study assessing the merit of adopting a freeze wall design as part of the in-situ recovery ("ISR") mining approach planned for the high-grade Phoenix uranium deposit ("Phoenix"), at the Company's 90% owned Wheeler River Uranium Project ("Wheeler River" or the "Project"). Based on the results of the trade-off study, discussed below, a freeze wall design has the potential to offer significant environmental, operational, and financial advantages compared to the freeze cap (or freeze "dome") design previously planned for the project and included in the project's Pre-Feasibility Study ("PFS") (see news release dated Sept. 24, 2018). View PDF version

Accordingly, the Company has decided to adapt its plans for the Project to use a freeze wall in future Project design and environmental assessment efforts. The trade-off study (see details below) highlights the following significant benefits of a freeze wall design:

- Enhanced environmental design: The freeze wall design provides full hydraulic containment of the ISR well field by establishing a physical perimeter around the mining area, which will extend from the basement rock underlying Phoenix to surface – enhancing environmental protection in the area of the ISR mining operation, thereby minimizing potential environmental impacts during the life of the operation, while still establishing a defined area for decommissioning and reclamation;

- Lower technical complexity and operational risks: A freeze wall is expected to be installed using existing and proven vertical or angled diamond drilling methods, rather than the directional / horizontal drilling approach proposed to establish a freeze cap. The use of conventional diamond drilling methods is expected to substantially decrease the technical complexity associated with project construction. Similarly, the adaptation of previous plans (described in the PFS), to remove the cap design is expected to significantly reduce operational risks by eliminating the potential intersection of freeze holes during the installation of future ISR wells – as the ISR wells will no longer have to pierce a freeze cap to access the mining horizon;

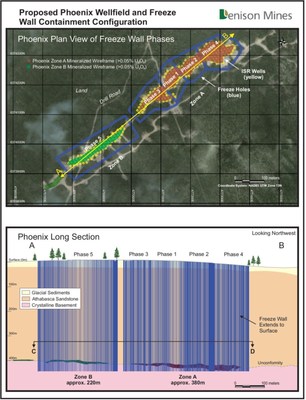

- Expected reduction in initial capital costs, with phased mining approach: The freeze cap design contemplated the use of a small number of large horizontal freeze holes to encapsulate the entire Phoenix deposit at depth prior to first production. In contrast, the freeze wall design, which consists of vertical / angled freeze holes, provides the flexibility for a phased mining approach that requires only a limited initial freeze wall installation to commence mining – with additional ground freezing occurring throughout the life of the mine in sequential phases. Preliminary designs for mining of the Phoenix deposit, using a freeze wall approach, now call for five phases, thus reducing the Project's upfront capital requirements and initial ground freezing time. The planned phases are expected to target the least capital-intensive areas of the deposit first (higher grades, smaller footprint) to defer capital costs as much as possible and simultaneously shorten the Project construction schedule;

- Strengthened project sustainability: The predominant drilling method used in the freeze wall design is conventional diamond drilling. This existing and proven method is widely employed and established in northern Saskatchewan. Accordingly, it is anticipated that Denison will be able to leverage the existing skilled work force in the region to increase business and employment opportunities for residents of Saskatchewan's north.

This press release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated November 13, 2020 to its short form base shelf prospectus dated April 2, 2020.

David Bronkhorst, Denison's Vice President Operations, commented, "The adoption of the freeze wall design for ISR mining at Phoenix is potentially transformational for the Project. The phased approach allows for targeted mining of select areas of the deposit, thus potentially allowing for a meaningful reduction in upfront capital costs and project construction timelines. The new configuration, whereby freeze holes are drilled parallel to and surrounding the ISR wells, also alleviates a number of technical and environmental complexities by using established diamond drilling techniques, reducing the potential for unplanned interactions between the ISR mining operation and the environment, and also effectively eliminating the possibility of intersections of freeze well infrastructure during the installation of ISR mining wells."

The freeze wall design for Phoenix incorporates knowledge acquired through the development of the hydrogeologic model for Phoenix (see news release dated June 4, 2020) and builds on Denison's efforts to assess a freeze wall design as part of the Preliminary Economic Assessment ("PEA") for the Waterbury Lake Property ("Waterbury") (see news release dated Nov. 17, 2020).

Trade-Off Study Background

As part of its ongoing efforts to advance Phoenix towards a future feasibility study, Denison completed a detailed freeze design trade-off study comparing the risks and benefits of the freeze cap design included in the Wheeler River PFS to a freeze wall design similar to that outlined in the Waterbury PEA. The study confirmed that the freeze wall design has the potential to offer significantly lower overall Project risk and complexity in a number of areas evaluated – including health and safety, environment, regulatory acceptance, community relations, and technical feasibility.

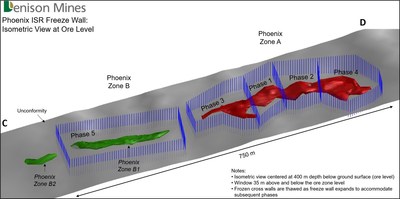

The key difference between the freeze wall and freeze cap configurations at Phoenix is the containment geometry. The freeze wall encompasses the deposit vertically from the surface down to the impermeable basement rocks, and the mining solution is contained to the area in and above the deposit (Figure 1 and Figure 2), keeping it isolated from the surrounding groundwater. The freeze cap geometry described in the PFS provided a horizontal layer of containment directly above the deposit, providing localized containment in the immediate area around the ore body, but does not extend the full length of the ISR wells to surface.

A freeze wall is expected to be installed using conventional diamond drilling techniques – an established and low risk drilling method frequently used in the Athabasca Basin. By comparison, the freeze cap requires the use of specialized horizontal drilling techniques which, while successfully used in the oil and gas industry in southern Saskatchewan, increase the technical complexity of the Project.

The technical feasibility of the freeze wall approach has been further validated by key qualified persons in the areas of hydrogeology, freeze containment, commercial drilling, and metallurgy, as discussed below.

Phased Mining Approach

The trade-off study identified a key opportunity associated with the flexible design of a freeze wall – allowing for the freeze wall to be installed in phases and to adopt a phased mining approach at Phoenix. In a phased mining approach, only a limited initial freeze wall is required to support first production, with the subsequent expansion of the freeze wall perimeter allowing for additional mining phases to be brought into production.

The phased approach is expected to allow for the targeted extraction of the least capital-intensive reserves first, based on the average ore grade in various areas of the deposit. The trade-off study provides for mining to occur over 5 phases, as outlined in Table 1 and Table 2 below, and illustrated in Figure 1 and Figure 2. This approach is expected to match the overall mine production schedule of the PFS.

Table 1. Freeze Wall Phased Mining Approach | ||||||

Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 | Total | |

Reserves (% of total)* | 36% | 26% | 14% | 15% | 9% | 100% |

Expected Life (months) | 43 | 31 | 17 | 19 | 11 | 121 |

*Note: These amounts are estimates and projections only and do not include Phoenix Zone B2 reserves of 133,000 lbs U3O8. The aggregate reserves, and many of the assumptions and qualifications related thereto, as well as the mine plan associated with the declared reserves are set forth in the Wheeler River PFS. |

Table 2. Freeze Wall Holes Drilled Per Phase | ||||||

Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 | Total | |

Expected (# of holes) | 57 | 41 | 54 | 52 | 118 | 322 |

Expected Meterage | 24,500 | 17,600 | 23,200 | 22,400 | 50,700 | 138,400 |

The freeze wall construction requirements for Phase 1 include 57 vertical freeze holes with 24,500 metres of diamond drilling. For comparison, the PFS model for the freeze cap included 30 horizontal freeze holes installed during construction for an overall drilling meterage of 32,700 m, using much more expensive horizontal drilling methods. With the freeze wall design, subsequent mining phase areas would be established prior to completion of mining in the previous phase area to provide uninterrupted mine production. Current plans for the freeze wall design excludes the reserves included in the PFS for Phoenix Zone B2 (illustrated in Figure 2), which contains approximately 133,000 lbs U3O8 in reserves per the PFS – representing 0.2% of the total reserves for Phoenix outlined in the PFS. This expected change is driven by the estimated costs and other assumptions set forth in the PFS, plus the estimated incremental cost of an expansion of the freeze wall, rendering mining in this area uneconomic.

As is evident from the tables above, the freeze wall phased approach is anticipated to minimize initial capital and construction timeline requirements for the Project by spreading out the freeze wall construction over the life of mine. Only the Phase 1 freeze wall is required during initial construction to achieve first mine production. A reduced initial freeze wall also has a reduced initial freeze plant capacity requirement. As the freeze plant is modular in design, the freezing capacity can also be deferred over the life of mine. The projected lower initial capital requirements associated with the phased freeze wall approach are expected to have positive impacts on the economics of the Project.

Technical Considerations

The freeze wall approach at Phoenix is expected to reduce technical complexity and operational risk during construction and the life of mine operations.

During construction, the freeze wall design makes use of established diamond drilling methods and ground freezing techniques currently in use at various existing mining operations in the Athabasca Basin region. This drilling method and design has a significantly lower technical risk profile than the horizontal drilling required as part of the freeze cap design included in the Wheeler River PFS – which is expected to result in greater certainty around both costs and schedule during the critical Project construction phase.

During operations, there is lower risk of unplanned interaction between ISR wells and freeze holes with the freeze wall design when compared to the freeze cap in the Wheeler River PFS. As the freeze wall holes are vertical and situated around the perimeter of the mining zone, there is minimal risk of the subsequent drilling of ISR wells intersecting and damaging a freeze hole. The freeze wall design is also much more flexible as it can be installed in phases over the mine life. This could allow for adjustments in parameters such as freeze hole spacing, ISR well patterns, and mine planning based on actual operating results. This approach also allows for the potential to extend the mine life to include additional uranium mineralization outside of the existing mine plan (and extents of the previously planned freeze cap) that may be discovered subsequent to initial construction of the mine.

Freeze Modelling

As part of the trade-off study, third party expert assessments were conducted to validate the freeze wall design by Newmans Geotechnique Inc. ("Newmans"). The assessment successfully confirmed the viability of adopting the freeze wall configuration with a phased approach over the life of mine.

In addition to validating the freeze wall design, freeze modelling also identified an opportunity to reduce the initial refrigerant capacity of the freeze plant, compared to the estimates included in the Wheeler River PFS, due to the phased approach of freeze wall development, with refrigeration capacity being added as required throughout the life of operations.

Hydrogeologic Modeling

The freeze wall and freeze cap designs both offer a form of hydrogeologic containment for the ISR mining solution that is required to move through the host rock at the mining horizon as part of the use of the ISR mining method at Phoenix. The validity of the freeze wall design was evaluated by Petrotek Corporation ("Petrotek") as part of the trade-off study. The comprehensive hydrogeologic groundwater model developed for the Project (see press release dated June 4, 2020) was updated to assess potential hydrogeologic and operational impacts of the use of a freeze wall compared to the freeze cap. The key revisions to the hydrogeologic model were the placement of a vertical freeze wall, the removal of the horizontal freeze cap, and the inclusion of the full sequence of sandstone units above the deposit (no longer isolated by the freeze cap). All other parameters, including ISR operating rates, were unchanged between the original and revised models.

The resultant modelling and flow-path analysis indicated that, under the simulated operating conditions, the maximum height that injected fluids will move above the ore zone horizon is generally less than 1 metre. As this is an important environmental and operational consideration, additional sensitivity analysis was conducted to evaluate the potential for upward migration of mining solutions during ISR operations. Horizontal and vertical hydraulic conductivity values in the model were increased by a factor of 10 to test the sensitivity of the model to extreme circumstances, which lead to a maximum upward migration of mining solution above the ore zone horizon between 11 and 13 metres. In both operational scenarios the mining solutions are fully contained within the freeze wall perimeter.

Environmental Considerations

The objective of a freeze wall is the same as the freeze cap, as outlined in the Wheeler River PFS, which is to protect the surrounding environment from interactions with the ISR mining process – by providing containment of the ISR mining solution through the creation of a physical barrier between the mining horizon and surrounding environment. Compared to the freeze cap, the freeze wall extends the containment area beyond the area immediately surrounding the ore zone, from deposit depth up to surface – thereby providing physical containment around the entire ISR well field from well screen (at depth) to well head (at surface). Accordingly, in the event of an ISR well failure at any depth along the well, any released mining solutions will be contained by the freeze wall perimeter. This is expected to provide enhanced environmental protection for the Project.

About Wheeler River

Wheeler River is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region, in northern Saskatchewan – including combined Indicated Mineral Resources of 132.1 million pounds U3O8 (1,809,000 tonnes at an average grade of 3.3% U3O8), plus combined Inferred Mineral Resources of 3.0 million pounds U3O8 (82,000 tonnes at an average grade of 1.7% U3O8). The project is host to the high-grade Phoenix and Gryphon uranium deposits, discovered by Denison in 2008 and 2014, respectively, and is a joint venture between Denison (90% and operator) and JCU (Canada) Exploration Company Limited (10%).

The scientific and technical information in this press release, with respect to the Project, is supported by the Wheeler River PFS. While potential advantages of the adaptation of the design of freeze containment have been described herein, the freeze wall design is not expected to constitute a material change to the information in the PFS.

The PFS was completed for Wheeler River in late 2018, considering the potential economic merit of developing the Phoenix deposit as an ISR operation and the Gryphon deposit as a conventional underground mining operation. Taken together, the project is estimated to have mine production of 109.4 million pounds U3O8 over a 14-year mine life, with a base case pre-tax NPV of $1.31 billion (8% discount rate), Internal Rate of Return ("IRR") of 38.7%, and initial pre-production capital expenditures of $322.5 million. The Phoenix ISR operation is estimated to have a stand-alone base case pre-tax NPV of $930.4 million (8% discount rate), IRR of 43.3%, initial pre-production capital expenditures of $322.5 million, and industry leading average operating costs of US$3.33/lb U3O8. The PFS is prepared on a project (100% ownership) and pre-tax basis, as each of the partners to the Wheeler River Joint Venture are subject to different tax and other obligations.

Further details regarding the PFS, including additional scientific and technical information, as well as after-tax results attributable to Denison's ownership interest, are described in greater detail in the NI 43-101 Technical Report titled "Pre-feasibility Study for the Wheeler River Uranium Project, Saskatchewan, Canada" dated October 30, 2018 with an effective date of September 24, 2018. A copy of this report is available on Denison's website and under its profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.shtml.

Denison suspended certain activities at Wheeler River during 2020, including the formal Environmental Assessment ("EA") process, which is on the critical path to achieving the project development schedule outlined in the PFS. On November 9, 2020, Denison announced its decision to resume the formal EA process for the Project in January 2021. The Company is not currently able to estimate the impact to the project development schedule outlined in the PFS, and users are cautioned against relying on the estimates provided therein regarding the start of pre-production activities in 2021 and first production in 2024.

About Denison

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. In addition to the Wheeler River project, Denison's Athabasca Basin exploration portfolio consists of numerous projects covering over 250,000 hectares. Denison's interests in the Athabasca Basin also include a 22.5% ownership interest in the McClean Lake joint venture ("MLJV"), which includes several uranium deposits and the McClean Lake uranium mill, which is currently processing ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest and Midwest A deposits, and a 66.90% interest in the The Heldeth Túé ("THT", formerly J Zone) and Huskie deposits on the Waterbury Lake property. Each of Midwest, Midwest A, THT and Huskie are located within 20 kilometres of the McClean Lake mill.

Denison is engaged in mine decommissioning and environmental services through its Closed Mines group (formerly Denison Environmental Services), which manages Denison's Elliot Lake reclamation projects and provides post-closure mine care and maintenance services to a variety of industry and government clients.

Denison is also the manager of Uranium Participation Corp., a publicly traded company which invests in uranium oxide and uranium hexafluoride.

Follow Denison on Twitter @DenisonMinesCo

Qualified Persons

The results and interpretations contained in this release related to the hydrogeological model for Phoenix were prepared by Mr. Errol Lawrence, PG (Senior Hydrogeologist), and Mr. Aaron Payne, PG (Senior Hydrogeologist), at Petrotek, each of whom is an independent Qualified Person in accordance with the requirements of NI 43-101.

The results and interpretations contained in this release related to ground freezing components and modeling for Phoenix were prepared by Mr. Greg Newman, BE (mechanical) M.Sc. (geotechnical), P. Eng. (SK, NWT), at Newmans Geotechnique Inc., who is an independent Qualified Person in accordance with the requirements of NI 43-101.

The technical information contained in this release has been reviewed and approved by Mr. David Bronkhorst, P.Eng, Denison's Vice President, Operations, who is a Qualified Person in accordance with the requirements of NI 43-101.

Cautionary Statement Regarding Forward-Looking Statements

Certain information contained in this news release constitutes 'forward-looking information', within the meaning of the applicable United States and Canadian legislation concerning the business, operations and financial performance and condition of Denison.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as 'plans', 'expects', 'budget', 'scheduled', 'estimates', 'forecasts', 'intends', 'anticipates', or 'believes', or the negatives and/or variations of such words and phrases, or state that certain actions, events or results 'may', 'could', 'would', 'might' or 'will be taken', 'occur', 'be achieved' or 'has the potential to'.

In particular, this news release contains forward-looking information pertaining to the following: the results of the trade-off study and its underlying assumptions and the Company's intentions with respect thereto; the duration and scope of impacts of the COVID-19 pandemic and affiliated operational adjustments; the availability of third party experts and services; the results of the PFS and expectations with respect thereto; development and expansion plans and objectives, including plans for a feasibility study; and expectations regarding its joint venture ownership interests and the continuity of its agreements with its partners.

Forward looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking statements. For example, the results of the freeze wall trade-off study discussed herein may not be maintained after further testing or be representative of actual mining plans for the Phoenix deposit after further design and studies are completed. In addition, Denison may decide or otherwise be required to discontinue testing, evaluation and development work at Wheeler River if it is unable to maintain or otherwise secure the necessary resources (such as testing facilities, capital funding, regulatory approvals, etc.) or operations are otherwise affected by COVID-19 and its potentially far-reaching impacts. Denison believes that the expectations reflected in this forward-looking information are reasonable but no assurance can be given that these expectations will prove to be accurate and results may differ materially from those anticipated in this forward-looking information. For a discussion in respect of risks and other factors that could influence forward-looking events, please refer to the factors discussed in Denison's Annual Information Form dated March 13, 2020 or subsequent quarterly financial reports under the heading 'Risk Factors'. These factors are not, and should not be construed as being exhaustive.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking information contained in this news release is expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this news release. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this news release to conform such information to actual results or to changes in Denison's expectations except as otherwise required by applicable legislation.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources and Probable Mineral Reserves: This press release may use the terms 'measured', 'indicated' and 'inferred' mineral resources. United States investors are advised that while such terms have been prepared in accordance with the definition standards on mineral reserves of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 Mineral Disclosure Standards ('NI 43-101') and are recognized and required by Canadian regulations, these terms are not defined under Industry Guide 7 under the United States Securities Act and, until recently, have not been permitted to be used in reports and registration statements filed with the United States Securities and Exchange Commission ('SEC'). 'Inferred mineral resources' have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally mineable. In addition, the terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" for the purposes of NI 43-101 differ from the definitions and allowable usage in Industry Guide 7. Effective February 2019, the SEC adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act and as a result, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding definitions under the CIM Standards, as required under NI 43-101. However, information regarding mineral resources or mineral reserves in Denison's disclosure may not be comparable to similar information made public by United States companies.

Figure 1: Proposed Phoenix Wellfield and Freeze Wall Containment Configuration.

Plan view of Phoenix freeze wall at surface and long section view of Phoenix freeze wall from A to B. Long section C to D indicates the ore zone horizon cut away for Figure 2

Figure 2. Isometric View of Phoenix Freeze Wall at Ore Level.

C to D indicates the ore zone horizon cut away from the Phoenix long section in Figure 1.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/denison-announces-decision-to-adopt-freeze-wall-design-for-isr-mining-at-phoenix-301182255.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/denison-announces-decision-to-adopt-freeze-wall-design-for-isr-mining-at-phoenix-301182255.html

SOURCE Denison Mines Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/01/c1023.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/01/c1023.html