Dundee Precious Metals Extends Life of Mine Plan to 2031 for the Chelopech Mine in Bulgaria and Provides Updated Mineral Resource and Mineral Reserve Estimate

(All monetary figures in this news release are expressed in U.S. dollars unless otherwise stated)

TORONTO, March 30, 2023 (GLOBE NEWSWIRE) -- Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or “the Company”) is pleased to provide an updated Mineral Resource and Mineral Reserve estimate for the Chelopech mine in Bulgaria.

Highlights

- Mine life extended to 2031: Proven and Probable Mineral Reserves of 1.6 million ounces (“Moz.”) of gold and 312 million pounds (“Mlbs.”) of copper supports a mine life that now extends to 2031. In 2022, DPM successfully added approximately 1.1 million tonnes (“Mt”) to Mineral Reserves, replacing about half of its 2022 production depletion of 2.1 Mt.

- Growth of Measured and Indicated Mineral Resource base: Total Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, of 1.3 Moz. of gold and 281 Mlbs. of copper add further potential to extend mine life.

- Additional potential with in-mine and brownfield exploration: Significant drilling program planned for 2023, including 44,000 metres of in-mine drilling for Mineral Resource development, and 50,000 metres of brownfield drilling, focused on infill drilling at the Sharlo Dere prospect and conceptual targets on the mine concession and Brevene exploration licence.

“The updated Mineral Reserve estimate demonstrates our consistent track record of replacing Mineral Reserves at Chelopech,” said David Rae, President and Chief Executive Officer of Dundee Precious Metals.

“With mining now expected to extend into 2031, a strong Mineral Resource base and increased in-mine and brownfield exploration drilling, we believe there is strong potential for this trend to continue at Chelopech.”

Updated Mineral Reserve and Resource Estimate

The 2022 Mineral Resource and Mineral Reserve estimate is based on a net smelter return (“NSR”) equation that informs a profitability indicator that considers, among other things, metal price, metallurgical recoveries, treatment charges and market forecasts.

The updated Proven and Probable Mineral Reserves at Chelopech of 1.55 Moz. of gold and 311.5 Mlbs. of copper support a nine-year mine life that extends to 2031, excluding expected further conversions of existing Mineral Resources and potential additional exploration success.

The updated Mineral Reserves estimate is shown below and is effective as of December 31, 2022:

| Chelopech Proven and Probable Mineral Reserve Estimate (As at December 31, 2022) | ||||||||

| Ore Type | Reserve Classification | Tonnes (Mt) | Grades | Metal Content | ||||

| Au (g/t) | Ag (g/t) | Cu (%) | Au (Moz.) | Ag (Moz.) | Cu (Mlbs.) | |||

| General | Proven | 8.1 | 2.47 | 6.8 | 0.78 | 0.65 | 1.77 | 140.1 |

| Probable | 9.5 | 2.70 | 8.1 | 0.81 | 0.82 | 2.48 | 168.8 | |

| Block 700 | Probable | 0.1 | 4.13 | 113.1 | 0.03 | 0.02 | 0.47 | 0.1 |

| Block 152 | Probable | 0.5 | 4.04 | 4.3 | 0.23 | 0.06 | 0.07 | 2.5 |

| All | Proven | 8.1 | 2.47 | 6.8 | 0.78 | 0.65 | 1.77 | 140.1 |

| Probable | 10.1 | 2.78 | 9.3 | 0.77 | 0.90 | 3.01 | 171.4 | |

| Total | 18.2 | 2.64 | 8.2 | 0.77 | 1.55 | 4.78 | 311.5 | |

Footnotes:

- The Mineral Reserves disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Definition Standards”, adopted by CIM Council on May 10, 2014).

- Mineral Reserves have been depleted for mining as of December 31, 2022.

- The Inferred Mineral Resources do not contribute to the financial performance of the project and are treated in the same way as waste.

- The reference point at which the Mineral Reserves are defined is where the ore is delivered to the crusher.

- Long term metal prices assumed for the evaluation of the Mineral Reserves are $1,500/oz. for gold, $17.00/oz. for silver, and $3.25/lb. for copper.

- Mineral Reserves are based on a net smelter return-less-costs cut-off value of $0/t. The total cost applied was $55/t which is a sum of operational costs of approximately $50/t and sustaining capital of $5/t.

- All blocks include a complex NSR formula that differs for the three ore types within the Mineral Reserve and Mineral Resource. The NSR formula utilizes long-term metal prices, metallurgical recoveries, payability terms, treatment charges, refining charges, penalty charges (deleterious arsenic), concentrate transport costs, and royalties. For clarity of understanding of ore value, a simplified formula is presented here that correlates to the complex formula for the average head grade. The simplified formula for general ore which comprises 97% of the Mineral Reserve is NSR $/t = 26.091 x Cu% + 0.196 x Ag_g//t + 30.773 x Au_g/t.

- Mineral Reserves account for unplanned mining dilution and ore loss that varies by orebody dimension and experience per mining block area, which on average were 8.1% for unplanned ore loss and 7.3% for unplanned dilution.

- Mineral Reserves account for planned mining dilution and mining recovery through stope optimization and stope design. The stopes are optimized to maximize net cash flow within the constraints of dilution and orebody extractable geometry. The planned dilution and recovery depend on geotechnical, mineralization continuity controls and ore zone dimensions.

- All stopes have been verified that they are profitable after considering the cost of capital development.

- There is no known likely value of mining, metallurgical, infrastructure, permitting or other relevant factors that could materially affect the estimate. The final one and a half years of operation occurs after the expiry of the mining concession contract. It is the opinion of DPM that the mining permit will be extended.

- The Proven Mineral Reserve includes broken stocks of 58 kt at 2.54 g/t Au, 5.4 g/t Ag and 0.64% Cu as well as stockpiles of 5 kt at 3.74 g/t Au, 5.0 g/t Ag and 0.75% Cu.

- Sum of individual table values may not equal due to rounding.

A three-dimensional block model using 10 metres (E) x 10 metres (N) x 10 metres (RL) cell dimensions was created. This model honours wireframe volumes and was based on geological interpretations of the mineralization. Grade estimation of economic elements of interest, namely copper, gold and silver were completed, with the addition of potentially deleterious elements (sulphur and arsenic) using ordinary kriging. Block tonnage was estimated from the material in-situ dry bulk density values by using ordinary kriging where adequate density samples were available, and from the positive relationship to sulphur grade where density sampling was limited.

The Mineral Resource estimate has been depleted by all mining and development work completed as of December 31, 2022 and is reported using a NSR calculation based on assumed long-term metal prices, current operating costs and metal revenue to meet the “reasonable prospects for eventual economic extraction” criteria.

Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, increased by 2.7Mt compared with 2021, as a result of changes to NSR parameters, grade estimation and interpretation, partly offset by conversion to Mineral Reserves.

The Mineral Resource estimate is shown below and is effective as at December 31, 2022:

| Chelopech Mineral Resource Estimate, exclusive of Mineral Reserves (As at December 31, 2022) | |||||||

| Classification | Tonnes | Gold | Silver | Copper | |||

| (Mt) | Grade (g/t) | Moz. | Grade (g/t) | Moz. | Grade (%) | Mlbs. | |

| Measured | 8.5 | 2.54 | 0.695 | 8.57 | 2.344 | 0.83 | 156 |

| Indicated | 7.9 | 2.39 | 0.609 | 10.06 | 2.566 | 0.71 | 125 |

| Total Measured & Indicated | 16.4 | 2.47 | 1.303 | 9.29 | 4.909 | 0.78 | 281 |

| Inferred | 4.4 | 1.93 | 0.276 | 8.57 | 1.225 | 0.70 | 69 |

Footnotes:

- The Mineral Resources disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Tonnages are rounded to the nearest 0.1 million tonnes to reflect that this is an estimate.

- Metal content is rounded to the nearest 1 thousand ounces or 1 million pounds to reflect that this is an estimate.

- The Mineral Resources are reported exclusive of Mineral Reserves.

- Metal prices assumed for the evaluation of the Mineral Resources are $1,700/oz. for gold, $17.00/oz. for silver, and $3.75/lb. for copper.

- Mineral Resources are based on a NSR less costs cut-off value of US$0/t in support of reasonable prospects of eventual economic extraction. The total cost applied was approximately $55/t which is a sum of operational costs of approximately $50/t and sustaining capital of approximately $5/t.

- All blocks include a complex NSR (Net Smelter Return) formula that differs for the three ore types. The NSR formula utilises long term metal price, metallurgical recoveries, payability terms. treatment charges, refining charges, penalty charges, concentrate transport costs, and royalties. For clarity of understanding of ore value, a simplified formula is presented here for the Measured and Indicated Resource where NSR US$/t = 33.870 x Cu % + 0.171 x Ag g/t + 37.937 x Au g/t.

Life of Mine Plan

The table below shows the updated LOM plan, reflecting the updated Mineral Reserve estimate. The updated LOM plan adds approximately 24,000 oz. of gold production and 9 Mlbs. of copper production between 2023 and 2031, relative to the previous mine plan outlined in the news release “Dundee Precious Metals Provides Updated Mineral Resource and Mineral Reserve Estimates for the Chelopech Mine in Bulgaria” dated March 31, 2022.

The tables below show the current LOM plan compared to the previous 2022 LOM plan.

| Current 2023 Life of Mine Plan | |||||||||||

| Unit | Total / Average | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Total Ore Processed | Mt | 18.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 0.6 |

| Grade | |||||||||||

| Au | g/t | 2.64 | 2.84 | 2.93 | 2.99 | 2.76 | 2.52 | 2.27 | 2.89 | 2.16 | 1.91 |

| Cu | % | 0.77 | 0.84 | 0.72 | 0.80 | 0.69 | 0.84 | 0.75 | 0.82 | 0.74 | 0.75 |

| Recoveries – Copper Concentrate | |||||||||||

| Au | % | 52.6 | 55.8 | 56.2 | 55.6 | 54.4 | 41.5 | 55.5 | 49.6 | 52.2 | 48.2 |

| Cu | % | 84.4 | 83.5 | 83.4 | 83.6 | 85.3 | 84.2 | 86.0 | 84.2 | 86.6 | 78.2 |

| Recoveries – Pyrite concentrate | |||||||||||

| Au | % | 24.9 | 24.1 | 24.2 | 24.4 | 24.8 | 25.8 | 25.8 | 24.7 | 26.1 | 24.8 |

| Total Au Production | K oz. | 1,202 | 160 | 167 | 169 | 155 | 120 | 131 | 152 | 120 | 28 |

| Total Cu Production | Mlbs. | 289 | 37 | 32 | 36 | 32 | 38 | 34 | 37 | 34 | 9 |

| Previous 2022 Life of Mine Plan | ||||||||||

| Unit | Total / Average | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| Total Ore Processed | Mt | 17.1 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 1.71 |

| Grade | ||||||||||

| Au | g/t | 2.69 | 2.73 | 2.94 | 2.94 | 2.63 | 2.71 | 2.56 | 2.53 | 2.47 |

| Cu | % | 0.80 | 0.90 | 0.82 | 0.78 | 0.76 | 0.74 | 0.81 | 0.91 | 0.62 |

| Recoveries – Copper Concentrate | ||||||||||

| Au | % | 54.4 | 55.8 | 57.8 | 58.3 | 55.6 | 56.5 | 50.9 | 55.3 | 40.4 |

| Cu | % | 84.9 | 84.0 | 84.3 | 85.5 | 84.7 | 84.8 | 85.3 | 87.2 | 82.6 |

| Recoveries – Pyrite concentrate | ||||||||||

| Au | % | 25.0 | 25.3 | 25.0 | 24.8 | 25.1 | 24.1 | 25.6 | 25.9 | 24.2 |

| Total Au Production | K oz. | 1,177 | 157 | 172 | 173 | 150 | 155 | 138 | 145 | 88 |

| Total Cu Production | Mlbs. | 280 | 37 | 33 | 32 | 31 | 30 | 34 | 39 | 19 |

Three-Year Outlook

The updated Mineral Reserve estimate is in-line with the Company’s previously issued 2023 guidance and three-year outlook for Chelopech, as shown below.

| 2022 Results | 2023 Guidance | 2024 Outlook | 2025 Outlook | |

| Metals contained in concentrate produced | ||||

| Gold (K oz.) | 179 | 150 – 170 | 160 – 180 | 160 – 185 |

| Copper (Mlbs.) | 31 | 30 – 35 | 29 – 34 | 29 – 34 |

| Cost of sales per tonne of ore processed(1) ($/t) | 63 | N/A | N/A | N/A |

| Cash cost per tonne of ore processed(1) ($/t) | 50 | 53 – 58 | N/A | N/A |

| Sustaining capital expenditures ($ millions) | $24 | 20 – 24 | 14 – 18 | 12 – 15 |

- Cost of sales per tonne of ore processed represents Chelopech cost of sales divided by the volume of ore processed. Cash cost per tonne of ore processed is a non-GAAP ratio and has no standardized meaning under International Financial Reporting Standards (“IFRS”) and may not be comparable to similar measures presented by other companies. Refer to the “Non-GAAP Financial Measures” section contained in the Company’s Management’s Discussion and Analysis (the “MD&A”) for the year ended December 31, 2022 commencing at page 44, which is available on the Company’s website at www.dundeeprecious.com and on SEDAR at www.sedar.com, for a detailed description and reconciliation of this measure to the most directly comparable measure under IFRS.

For more information regarding the Company’s 2023 guidance and three-year outlook, including key assumptions, qualifications and risks associated thereto, refer to the MD&A for the year ended December 31, 2022, issued on February 16, 2023, available on the Company’s website at www.dundeeprecious.com and on SEDAR at www.sedar.com.

Further extending mine life through additional in-mine and brownfield exploration

DPM continues to aggressively focus on extending Chelopech’s mine life through its successful in-mine exploration program and a growing brownfield exploration program, which for 2023 includes:

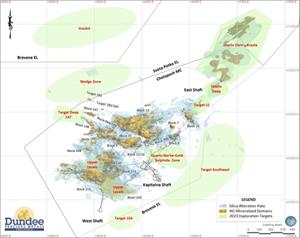

- Approximately 44,000 metres of in-mine drilling for Mineral Resource development with particular focus on the upper levels of Blocks 103, 150, 151 and 153, Target 11 and Target 147 zones (see Figure 1).

- Approximately 50,000 metres of brownfield exploration, aiming to test conceptual targets on the Brevene exploration licence, which surrounds the Sveta Petka exploration licence, as well as in the Chelopech mine concession (see Figure 1).

The brownfield exploration program is designed to follow-up on conceptual targets on the mine concession, including testing for deeper and lateral extensions of the Chelopech deposit, as well as targets on the Brevene exploration licence.

A focused infill drilling program is planned at Sharlo Dere, which is located on the east flank of the mine. The planned drilling will be used to potentially support the inclusion of this prospect within subsequent Mineral Resource estimates for the Chelopech mine. Additionally, extensional drilling will test the Target 11 and Sharlo Dere Deeps targets, both of which are under-explored and demonstrate strong potential to host additional mineral resources.

In March 2023, the Company filed a Commercial Discovery application with the Bulgarian authorities for the Sveta Petka exploration licence, which includes the Wedge, West Shaft, Krasta and Petrovden prospects. The Sveta Petka exploration licence is expected to be registered as a Commercial Discovery by the end of 2023 and subsequent to that, the Company intends to apply for concession rights in 2024.

In line with DPM’s 2023 guidance, the Company has budgeted between $5 million to $6 million on in-mine exploration activities at Chelopech, and $5 million to $6 million for brownfields exploration activities.

Figure 1: Plan view of the Chelopech mining concession and Sveta Petka and Brevene exploration licences, indicating target zones for DPM’s 2023 in-mine and brownfield exploration program is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/cbfc42ee-214e-456c-9775-a224cf0f1603.

Technical Information

The Mineral Resource and Mineral Reserve estimates for the Chelopech mine and other scientific and technical information which supports this news release was prepared by DPM with review and guidance at various stages provided by CSA Global (UK) Ltd. (“CSA Global”). The Qualified Persons (“QP”) are satisfied as to the appropriateness and quality of the technical work completed and accept responsibility for the disclosure, in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The QP for the Mineral Resource estimate is Galen White, BSc, FAusIMM, Partner and Principal Consultant of CSA Global (UK) Limited, and the QP for the Mineral Reserve estimate is Andrew Sharp, B.Eng. (Mining), P.Eng. (BC), FAusIMM, Associate Principal Mining Engineer of CSA Global. Both Galen White and Andrew Sharp are Qualified Persons as defined under NI 43-101, and are independent of the Company.

Ross Overall, Corporate Mineral Resource Manager, of the Company, who is a QP, as defined under NI 43-101, has reviewed and approved the contents of this news release.

About Dundee Precious Metals Inc.

Dundee Precious Metals Inc. is a Canadian-based international gold mining company with operations and projects located in Bulgaria, Namibia, Ecuador and Serbia. The Company’s purpose is to unlock resources and generate value to thrive and growth together. This overall purpose is supported by a foundation of core values, which guides how the Company conducts its business and informs a set of complementary strategic pillars and objectives related to ESG, innovation, optimizing our existing portfolio, and growth. The Company’s resources are allocated in-line with its strategy to ensure that DPM delivers value for all of its stakeholders. DPM’s shares are traded on the Toronto Stock Exchange (symbol: DPM).

For further information please contact:

| David Rae President and Chief Executive Officer Tel: (416) 365-5092 drae@dundeeprecious.com | Jennifer Cameron Director, Investor Relations Tel: (416) 219-6177 jcameron@dundeeprecious.com | |

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward looking statements” or “forward looking information” (collectively, “Forward Looking Statements”) that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward Looking Statements in this news release relate to, among other things; the estimation of Mineral Reserves and Mineral Resources and the realization of such mineral estimates; the LOM; production, processing and recoveries forecasts; financial metrics, including those set out in the three-year outlook provided by the Company; success of exploration activities, the price of gold, copper, and silver, and other commodities; and successful registration of the Sveta Petka exploration licence as a Commercial Discovery. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and the QPs, as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others, risks relating to the Company’s business, including possible variations in ore grade and recovery rates; uncertainties inherent to the conclusions of economic evaluations and economic studies; changes in project parameters, including schedule and budget, as plans continue to be refined; uncertainties with respect to actual results of current exploration activities; uncertainties and risks inherent to developing and commissioning new mines into production, which may be subject to unforeseen delays; uncertainties inherent to the estimation of Mineral Reserves and Mineral Resources, which may not be fully realized; uncertainties inherent with conducting business in foreign jurisdictions where corruption, civil unrest, political instability and uncertainties with the rule of law may impact the Company’s activities; the impact of the conflict in the Ukraine and COVID-19, including resulting changes to the Company’s supply chain and costs of supplies; product shortages; delivery and shipping issues; closures and/or failure of plant, equipment or processes to operate as anticipated; employees and contractors become infected with COVID-19 or being affected by the war; lost work hours; labour force shortages; fluctuations in metal and acid prices, toll rates and foreign exchange rates; limitation on insurance coverage; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; actual results of current and planned reclamation activities; opposition by social and non-government organizations to mining projects and smelting operations; unanticipated title disputes; claims or litigation; cyber attacks and other cybersecurity risks; as well as those risk factors discussed or referred to in any other documents (including without limitation the Chelopech Technical Report and the Company’s most recent Annual Information Form) filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR at www.sedar.com. The reader has been cautioned that the foregoing list is not exhaustive of all factors which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Unless required by securities laws, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management’s estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources

The Mineral Reserve and Mineral Resource estimates presented in this news release have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101.

The United States Securities and Exchange Commission (“SEC”) adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934, as amended. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining issuers that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) – Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”), incorporated by reference in NI 43-101.

Readers are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any Mineral Reserves or Mineral Resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Readers are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, it should not be assumed that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, readers are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, readers are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

For the above reasons, information contained in this news release containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.