Dundee Precious Metals Extends Life of Mine Plan to 2032 for the Chelopech Mine in Bulgaria; Provides Mineral Reserve and Mineral Resource Update and Highlights from Exploration Activities

(All monetary figures in this news release are expressed in U.S. dollars unless otherwise stated)

TORONTO, Nov. 29, 2023 (GLOBE NEWSWIRE) -- Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or “the Company”) is pleased to provide an interim update to the Mineral Resource and Mineral Reserve estimate and life of mine (“LOM”) plan for its Chelopech mine in Bulgaria. In 2023, DPM advanced its annual update for Mineral Reserves and Mineral Resources in order to better align with the Company’s planning and budgeting cycle.

Highlights

- Mine life extended to 2032: Proven and Probable Mineral Reserves of 1.6 million ounces (“Moz.”) of gold and 305 million pounds (“Mlbs.”) of copper supports a mine life that now extends to 2032. DPM successfully added 1% to contained ounces of gold with contained pounds of copper decreasing by 2% relative to the previous Mineral Reserve estimate.

- Updated LOM plan with improved grades and recoveries: The updated LOM plan adds approximately 128,000 ounces of recovered gold and 9 Mlbs. of recovered copper between 2024 and 2032. During this period, average LOM gold grade and copper grades increased by 5% and 3% respectively, and recoveries for gold increased by approximately 5%.

- Updated Measured and Indicated and Inferred Mineral Resource: Total Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, of 1.2 Moz. of gold and 265 Mlbs. of copper add further potential to extend mine life. Additional Inferred Mineral Resource of 0.274 Moz. of gold and 67 Mlbs. of copper.

- Upside potential with in-mine and brownfield exploration: DPM continues to focus on extending Chelopech’s mine life through its successful in-mine exploration program and an aggressive brownfield exploration program. Positive results from drilling at the Sharlo Dere West and Sharlo Dere prospects, located within the mine concession and proximal to existing Chelopech underground development, highlight potential for further mine life extensions. Highlights from drilling include 37.5 metres at 7.34 g/t AuEq, 5.69 g/t Au and 0.98% Cu from 184.5 metres depth (including 27 metres at 9.70 g/t AuEq, 7.58 g/t Au and 1.26% Cu from 193.5 metres) on EXT_555_04.1 DPM has completed its initial phase of infill drilling with the objective of including a Mineral Resource estimate for Sharlo Dere within its next Mineral Resource update for the Chelopech mine.

“I am pleased to report that we have continued our consistent track record of extending mine life at Chelopech,” said David Rae, President and Chief Executive Officer of Dundee Precious Metals.

“Next month will mark the 20-year anniversary of DPM’s acquisition of the Chelopech mine. Over this period, we have transformed the mine into a modern and highly efficient operation, developed a strong local team and established strong relationships with local stakeholders.

“Chelopech today has a mine life that extends to 2032 based on Mineral Reserves, a strong Mineral Resource base, compelling exploration prospects and significant opportunities to continue our strong track record of mine life extensions.”

Updated Mineral Reserve and Resource Estimate

The 2023 Mineral Reserve and Mineral Resource estimate reflects the results of in-mine drilling and production depletion as at May 31, 2023.

The updated Proven and Probable Mineral Reserve estimate for Chelopech of 1.6 Moz. of gold and 305 Mlbs. of copper support a nine-year mine life that extends to 2032, not including potential for further conversions of existing Mineral Resources and potential additional exploration success. Proven and Probable Mineral Reserves decreased by 0.6 Mt of ore with contained gold increasing by 22,000 ounces and contained copper decreasing by 6.3 Mlbs. relative to the previous 2022 Mineral Reserve estimate.

The updated Mineral Reserves estimate is shown below:

| Chelopech Proven and Probable Mineral Reserve Estimate (As at May 31, 2023) | ||||||||

| Classification | Tonnes (kt) | Grades | Metal Content | |||||

| Au (g/t) | Ag (g/t) | Cu (%) | Au (Koz.) | Ag (Koz.) | Cu (Mlbs.) | |||

| Proven | Stopes | 6,346 | 2.78 | 7.50 | 0.83 | 567 | 1,531 | 115.7 |

| Broken stocks | 48 | 3.45 | 8.53 | 0.83 | 5 | 13 | 0.9 | |

| Stockpiles | 17 | 3.33 | 6.79 | 0.78 | 2 | 4 | 0.3 | |

| Total Proven | 6,412 | 2.79 | 7.51 | 0.83 | 575 | 1,548 | 116.9 | |

| Probable | Stopes | 10,146 | 2.76 | 9.34 | 0.76 | 902 | 3,048 | 169.0 |

| Development | 1,082 | 2.78 | 8.63 | 0.81 | 97 | 300 | 19.4 | |

| Total Probable | 11,228 | 2.77 | 9.28 | 0.76 | 998 | 3,348 | 188.4 | |

| Total Proven and Probable | 17,639 | 2.77 | 8.63 | 0.79 | 1,573 | 4,896 | 305.3 | |

- The Mineral Reserves disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Definition Standards”, adopted by CIM Council on May 10, 2014).

- Mineral Reserves have been depleted for mining as of May 31, 2023.

- The Inferred Mineral Resources do not contribute to the financial performance of the project and are treated in the same way as waste.

- The reference point at which the Mineral Reserves are defined is where the ore is delivered to the crusher.

- Long term metal prices assumed for the evaluation of the Mineral Reserves are $1,500/oz. for gold, $17.00/oz. for silver, and $3.25/lb. for copper.

- Mineral Reserves are based on a net smelter return-less-costs cut-off value of $0/t. The total cost applied was $55/t which is a sum of operational costs of approximately $50/t and sustaining capital of $5/t.

- All blocks include a complex NSR formula that differs for the three ore types within the Mineral Reserve and Mineral Resource. The NSR formula utilizes long-term metal prices, metallurgical recoveries, payability terms, treatment charges, refining charges, penalty charges (deleterious arsenic), concentrate transport costs, and royalties. For clarity of understanding of ore value, a simplified formula is presented here that correlates to the complex formula for the average head grade. The simplified formula for general ore which comprises 97% of the Mineral Reserve is NSR $/t = 26.091 x Cu% + 0.196 x Ag_g//t + 30.773 x Au_g/t.

- Mineral Reserves account for unplanned mining dilution and ore loss that varies by orebody dimension and experience per mining block area, which on average were 6.9% for unplanned ore loss and 7.4% for unplanned dilution.

- Mineral Reserves account for planned mining dilution and mining recovery through stope optimization and stope design. The stopes are optimized to maximize net cash flow within the constraints of dilution and orebody extractable geometry. The planned dilution and recovery depend on geotechnical, mineralization continuity controls and ore zone dimensions.

- All stopes have been verified that they are profitable after considering the cost of capital development.

- There is no known likely value of mining, metallurgical, infrastructure, permitting or other relevant factors that could materially affect the estimate. The final two and a half years of operation occurs after the expiry of the mining concession contract. It is the opinion of DPM that the mining permit will be extended.

- Sum of individual table values may not equal due to rounding.

Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, decreased by 1.0 million tonnes (“Mt”), 120,000 ounces of gold and 16 Mlbs. of copper relative to the 2022 Mineral Resource estimate. The decrease was largely a result of conversion to Mineral Reserves, partially offset by new extensions to Mineral Resources achieved from in-mine drilling as well as a review of estimation parameters during the update.

The Mineral Resource estimate is shown below and is effective as at May 31, 2023:

| Chelopech Mineral Resource Estimate, exclusive of Mineral Reserves (As at May 31, 2023) | |||||||

| Classification | Tonnes | Gold | Silver | Copper | |||

| (Mt) | Grade (g/t) | Moz. | Grade (g/t) | Moz. | Grade (%) | Mlbs. | |

| Measured | 8.1 | 2.49 | 0.649 | 8.76 | 2.283 | 0.85 | 152 |

| Indicated | 7.3 | 2.28 | 0.537 | 10.14 | 2.387 | 0.70 | 113 |

| Total Measured & Indicated | 15.4 | 2.39 | 1.185 | 9.41 | 4.669 | 0.78 | 265 |

| Inferred | 4.3 | 2.00 | 0.274 | 8.90 | 1.219 | 0.71 | 67 |

- The Mineral Resources disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Tonnages are rounded to the nearest 0.1 million tonnes to reflect that this is an estimate.

- Metal content is rounded to the nearest 1 thousand ounces or 1 million pounds to reflect that this is an estimate.

- The Mineral Resources are reported exclusive of Mineral Reserves.

- Metal prices assumed for the evaluation of the Mineral Resources are $1,700/oz. for gold, $17.00/oz. for silver, and $3.75/lb. for copper.

- Mineral Resources are based on a NSR less costs cut-off value of US$0/t in support of reasonable prospects of eventual economic extraction. The total cost applied was approximately $55/t which is a sum of operational costs of approximately $50/t and sustaining capital of approximately $5/t.

- All blocks include a complex NSR (Net Smelter Return) formula. The NSR formula utilises long term metal price, metallurgical recoveries, payability terms. Treatment charges, refining charges, penalty charges, concentrate transport costs, and royalties. For clarity of understanding of value, a simplified formula is presented here for the Measured and Indicated Resource where NSR US$/t = 33.870 x Cu % + 0.171 x Ag g/t + 37.937 x Au g/t.

Life of Mine Plan

The table below shows the updated LOM plan, reflecting the updated Mineral Reserve estimate. Annual throughput rates have been optimized over the LOM, taking into account recent development rates as mining extends into areas of the mine located further from existing infrastructure, as well as the grade profile to maximize value.

Between 2024 and 2032, the updated LOM plan adds approximately 128,000 ounces of additional gold production and 9 Mlbs of copper, with the average LOM gold and copper grades increasing by 5% and 3%, respectively, relative to the previous LOM plan outlined in the news release “Dundee Precious Metals Provides Updated Mineral Resource and Mineral Reserve Estimates for the Chelopech Mine in Bulgaria” dated March 30, 2023.

The improved average grade is expected to be achieved by mining the crown pillars from Blocks 103 and 151 from 2025 onwards. During this period, gold recoveries increased by 5% relative to the previous mine plan as a result of an improved ore blend over the LOM and updated recovery regression models based on recent plant performance. This is partially offset by a reduction to the mining rate in order to maintain development rates at 7,500 metres per annum and to optimize sustaining capital required. In 2026, the mining rate is planned to be reduced to 2 million tonnes per annum (“Mtpa”) and to 1.8 Mtpa from 2027 onwards.

| Current Life of Mine Plan | |||||||||||

| Unit | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | Total / Average | |

| Total Ore Processed | Mt | 2.2 | 2.2 | 2.0 | 1.8 | 1.8 | 1.8 | 1.8 | 1.8 | 0.8 | 16.2 |

| Grade | |||||||||||

| Au | g/t | 2.90 | 2.92 | 2.92 | 3.07 | 2.56 | 2.75 | 2.54 | 2.54 | 2.02 | 2.75 |

| Cu | % | 0.77 | 0.85 | 0.93 | 0.77 | 0.76 | 0.81 | 0.69 | 0.71 | 0.74 | 0.79 |

| Recoveries | |||||||||||

| Copper Concentrate | |||||||||||

| Au | % | 54.3 | 58.3 | 53.7 | 54.1 | 57.1 | 62.0 | 61.3 | 56.2 | 56.1 | 56.9 |

| Cu | % | 83.7 | 84.8 | 83.1 | 83.1 | 84.3 | 85.8 | 85.6 | 84.8 | 85.0 | 84.4 |

| Pyrite concentrate | |||||||||||

| Au | % | 25.8 | 24.6 | 24.7 | 27.9 | 24.1 | 21.7 | 23.3 | 27.1 | 22.5 | 24.9 |

| Production | |||||||||||

| Total Au | K oz. | 164 | 172 | 148 | 146 | 121 | 134 | 125 | 123 | 38 | 1,170 |

| Total Cu1 | Mlbs. | 31 | 35 | 34 | 26 | 26 | 28 | 23 | 24 | 10 | 238 |

Note: Totals in the table above do not include 2023 production and therefore do not add to the Mineral Reserve estimate, which reflects from May 2023 onward.

1. Total copper production reflects copper recovered from copper concentrate only. Copper recovered from pyrite concentrate is not payable.

| Previous Life of Mine Plan | |||||||||||

| Unit | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total / Average | ||

| Total Ore Processed | Mt | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 0.6 | 16.0 | |

| Grade | |||||||||||

| Au | g/t | 2.93 | 2.99 | 2.76 | 2.52 | 2.27 | 2.89 | 2.16 | 1.91 | 2.62 | |

| Cu | % | 0.72 | 0.80 | 0.69 | 0.84 | 0.75 | 0.82 | 0.74 | 0.75 | 0.77 | |

| Recoveries | |||||||||||

| Copper Concentrate | |||||||||||

| Au | % | 56.2 | 55.6 | 54.4 | 41.5 | 55.5 | 49.5 | 52.3 | 48.2 | 52.1 | |

| Cu | % | 83.4 | 83.6 | 85.3 | 84.2 | 86.0 | 84.2 | 86.6 | 78.2 | 84.5 | |

| Pyrite concentrate | |||||||||||

| Au | % | 24.2 | 24.4 | 24.8 | 25.8 | 25.8 | 24.7 | 26.1 | 24.8 | 25.0 | |

| Production | |||||||||||

| Total Au | K oz. | 167 | 169 | 155 | 120 | 131 | 152 | 120 | 28 | 1,041 | |

| Total Cu1 | Mlbs. | 29 | 32 | 29 | 34 | 32 | 33 | 31 | 8 | 229 | |

1. Total copper production reflects copper recovered from copper concentrate only. Copper recovered from pyrite concentrate is not payable.

Several Optimization Activities Planned for 2024

DPM has several initiatives underway aimed at further optimizing Chelopech’s estimated Mineral Reserves and Resources, and the life of mine plan, including:

- Recontouring the block model at a lower gold equivalent cut-off grade to align with the latest NSR cut-off value assumptions, providing further potential to convert Mineral Resource into Mineral Reserves;

- Enhancing development rates to improve productivity as the mine plan progresses into areas in the mine located further from infrastructure; and

- Evaluating ore sorting technologies to unlock orebodies currently below existing NSR cut-off values and minimize ore dilution from structurally controlled orebodies.

Three-Year Outlook

The updated LOM plan is in-line with the Company’s previously issued 2023 guidance and three-year outlook for Chelopech, as shown below.

| 2022 Results | 2023 Guidance | 2024 Outlook | 2025 Outlook | |

| Metals contained in concentrate produced | ||||

| Gold (K oz.) Copper (Mlbs.) | 179 31 | 150 – 170 30 – 35 | 160 – 180 29 – 34 | 160 – 185 29 – 34 |

| Cost of sales per tonne of ore processed(1) ($/t) | 63 | N/A | N/A | N/A |

| Cash cost per tonne of ore processed(1) ($/t) | 50 | 53 – 58 | N/A | N/A |

| Sustaining capital expenditures ($ millions) | $24 | 20 – 24 | 14 – 18 | 12 – 15 |

- Cost of sales per tonne of ore processed represents Chelopech cost of sales divided by the volume of ore processed. Cash cost per tonne of ore processed is a non-GAAP ratio and has no standardized meaning under International Financial Reporting Standards (“IFRS”) and may not be comparable to similar measures presented by other companies. Refer to the “Non-GAAP Financial Measures” section contained in the Company’s Management’s Discussion and Analysis (the “MD&A”) for the period ended September 30, 2023, which is available on the Company’s website at www.dundeeprecious.com and on SEDAR+ at www.sedarplus.ca, for a detailed description and reconciliation of this measure to the most directly comparable measure under IFRS.

For more information regarding the Company’s 2023 guidance and three-year outlook, including key assumptions, qualifications and risks associated thereto, refer to the MD&A for the three and nine months ended September 30, 2023, issued on November 7, 2023, available on the Company’s website at www.dundeeprecious.com and on SEDAR+ at www.sedarplus.ca.

Further extending mine life through additional in-mine and brownfield exploration

DPM continues to focus on extending Chelopech’s mine life through its successful in-mine exploration program and an aggressive brownfield exploration program. Priority initiatives include:

- In-mine drilling for Mineral Resource development;

- Infill drilling at the Sharlo Dere prospect within the mine concession to support a Mineral Resource estimate;

- Converting the Sveta Petka exploration licence to a Commercial Discovery, after which DPM intends to apply for concession rights in 2024 for the area, which is now designated as Chelopech North; and

- Completion of an intensive drilling program at the Brevene exploration licence and application for a Geological Discovery.

In-mine exploration: DPM continues to advance in-mine exploration activities focused on extending Chelopech’s mine life. Priority targets within the Company’s near-term plans include:

- The Target North zone, which is located on the northern flank of the Chelopech mine concession and is manifested as an isolated, structurally and lithologically controlled intervals of high-sulphidation type of mineralization. Several extensional drilling programs are planned for the target, including testing the northern area of Block 19 for high-grade structurally controlled orebodies between levels 450 to 500, and drilling to the west of Block 147 to explore for similar bodies at a depth of levels 200 to 500.

- Extensional drilling south-east from Block 700 is planned to better assess the economic significance of the Quartz-Barite-Gold-Sulphide (QBGS) zone. This program is a continuation of previous successful drilling campaigns and will focus on identifying an extension of the mineralized system to the south-east and at depth.

Sharlo Dere: At the Sharlo Dere prospect, which is located approximately 500 metres northeast of the eastern-most orebodies of the Chelopech mine and approximately 400 metres from current underground infrastructure, DPM completed 8,407 metres of infill drilling at a 50-metre by 50-metre spacing which was designed to evaluate the continuity of the mineralized zones. The prospect comprises the main Sharlo Dere zone (SD), as well as the lateral extensions termed the Sharlo Dere East (SDE) and the Sharlo Dere West-Target 11 zones (SDW).

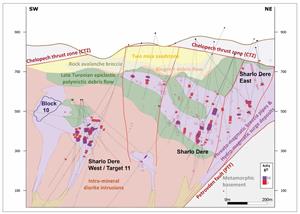

Results from recent drilling highlight the prospect’s potential for copper-gold mineralization along the northeastern flank of the mine concession as a continuation of the Chelopech high-sulphidation system (see Figure 2 and Appendix table 1).

Recent (2022 until present) significant intercepts from the Sharlo Dere prospects include:

- EX_SD_40 – 11 metres at 3.07 g/t AuEq, 1.85 g/t Au and 0.73% Cu from 303 metres depth and 6 metres at 4.18 g/t AuEq, 3.56 g/t Au and 0.37 % Cu from 327 metres depth

- EX_SD_51 – 14 metres at 3.76 g/t AuEq, 2.59 g/t Au and 0.70% Cu from 250 metres depth

- EX_SD_53 – 8 metres at 14.15 g/t AuEq, 9.34 g/t Au and 2.87% Cu from 610 metres depth

- EX_SDW_02 – 14 metres at 3.07 g/t AuEq, 1.61 g/t Au and 0.87% Cu from 573 metres depth

- EX_SD_51 – 14 metres at 3.76 g/t AuEq, 2.59 g/t Au and 0.70% Cu from 250 metres depth

- EXT11_555_03 – 6.2 metres at 7.54 g/t AuEq, 6.70 g/t Au and 0.50% Cu from 165 metres depth

- EXT11_555_04 – 37.5 metres at 7.34 g/t AuEq, 5.69 g/t Au and 0.98% Cu from 184.5 metres depth (including 27 metres at 9.70 g/t AuEq, 7.58 g/t Au and 1.26% Cu from 193.5 metres)

See Appendix Table 1 on pages 14 to 18 for full results from drilling.

The Sharlo Dere, Sharlo Dere East and Sharlo Dere West prospects share the same geological environment and show many similarities with the high-sulphidation style Chelopech copper-gold mineralization. Mineralization is constrained by east-northeast and west-northwest striking deep structural feeders and highly permeable sub-vertical phreatomagmatic breccia contacts within the sedimentary Turonian Unit, that was intruded by a multi-phase dioritic intrusive complex. The distal and upper part of the phreatomagmatic breccia pipes are represented by strata-bound hydro-magmatic injections and surge flow deposits accompanied with sub-horizontal mineralized lenses/layers, which were subsequently tilted according to the synformal basin architecture. A particular characteristic of the Sharlo Dere area is the better preservation of the shallow syn-sedimentary exhalative sulphide mineralization and subsequent reworked mineralized clasts in syn- to post-mineral debris flow deposits (see Figure 3).

DPM has completed its initial phase of infill drilling with the objective of including a Mineral Resource estimate for Sharlo Dere within the next Mineral Resource estimate update for the Chelopech mine, with the longer-term goal to potentially convert these Mineral Resources into Mineral Reserves.

Sveta Petka: In March 2023, the Company filed a Commercial Discovery application with the Bulgarian authorities for the Sveta Petka exploration licence, which includes the Wedge, West Shaft, Krasta and Petrovden prospects, to allow the Company to apply for concession rights in 2024 for the area which is now designated as Chelopech North.

Brevene: On the Brevene exploration licence surrounding the Chelopech mine concession, target delineation and scout drill testing has been completed. The evaluation of Mineral Resource potential is ongoing, and the data collected will be used to support an application for a Geological Discovery, which is expected to be submitted before the end of the year.

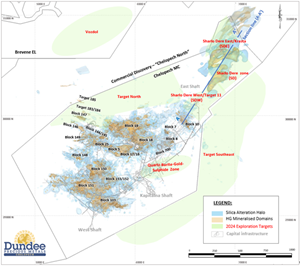

Figure 1: Plan view of the Chelopech mining concession, Chelopech North Commercial Discovery and Brevene exploration licences, indicating target zones for DPM’s 2024 in-mine and brownfield exploration program as well as the section line (A-A’) shown in Figure 2.

Available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8d6c1c05-6037-43b1-beef-f4255d0e6ffb

Figure 2. Long-section (A-A’) through Sharlo Dere looking northwest, displaying drilling intercepts, interpreted geology, and exploration targets.

Available at https://www.globenewswire.com/NewsRoom/AttachmentNg/06f61c97-f111-484f-8f98-153705d1c216

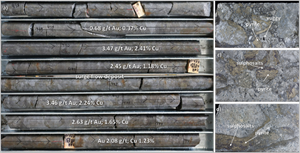

Figure 3. Photographs of representative high-grade copper-gold mineralized drill core from hole EX_SD_27 at the Sharlo Dere zone.

Available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e0ece51b-d6da-4a94-9f5d-4346f786f531

The above picture highlights:

a) Core interval from 437.90 meters to 445.10 meters downhole: Pervasive advanced argillic altered surge flow deposit with fluidal and angular magmatic sourced clasts, and lithic clasts presented by fragments of sediments and tuffisite material within a fine-grained matrix (HQ size drill core).

b) Close-up view of cut core at 444.10 metres downhole: primary altered, mineralized and leached clasts of diorite within fine-grained matrix, replaced by secondary clay minerals, sulfides and minor sulphosalts (pyrite, enargite/tennantite) which formed rims and halos around the clasts and filled gaps, cavities, and cracks.

c) and d) Close-up view of cut core at 443 metres downhole: clasts of magmatic rocks with differing levels of alteration intensity: strong phyllic to advanced argillic with sulfide and sulphosalt mineralization (pyrite, enargite/ luzonite, tennantite/tetrahedrite) around clasts and in the matrix.

Technical Information

The Mineral Resource and Mineral Reserve estimates for the Chelopech mine and other scientific and technical information which supports this news release was prepared by DPM with review and guidance at various stages provided Environmental Resources Management (“ERM”), trading as CSA Global. The Qualified Persons (“QP”) are satisfied as to the appropriateness and quality of the technical work completed and accept responsibility for the disclosure, in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The QP for the Mineral Resource estimate is Maria O’Connor, BSc, MAIG, Technical Director, ERM, and the QP for the Mineral Reserve estimate is Garth Liukko, B.Eng. (Mining), P.Eng. (Ontario), Principal Mining Engineer of ERM Consultants Canada Ltd. Both Maria O’Connor and Garth Liukko are Qualified Persons as defined under NI 43-101 and are independent of the Company.

Ross Overall, Corporate Mineral Resource Manager, of the Company, who is a QP, as defined under NI 43-101, has reviewed and approved the contents of this news release.

Refer to annual information form dated March 30, 2023, and the technical report entitled “NI 43-101 Technical Report – Mineral Resource and Mineral Reserve Update, Chelopech Mine, Chelopech, Bulgaria” (the “Chelopech Technical Report”) dated and effective March 31, 2022, and filed on SEDAR+ for additional information related to Chelopech, including, without limitations, risks and uncertainties that may impact the estimates and other information presented herein.

Sampling, Analysis and QAQC of Exploration Drill Core Samples

Most surface exploration diamond drill holes are collared with PQ size, continued with HQ, and are rarely finished with NQ. Triple tube core barrels and short runs are used whenever possible to improve recovery. All drill core is cut lengthwise into two halves using a diamond saw; one half is sampled for assaying and the other half is retained in core trays. The common length for sample intervals within mineralized zones is one metre. Weights of drill core samples range from three to eight kilograms, depending on the size of core, rock type, and recovery. A numbered tag is placed into each sample bag, and the samples are grouped into batches for laboratory submissions.

Drill core samples are shipped to the Company’s own exploration laboratory in Bor, Serbia, which is managed by SGS Minerals (“SGS”). Quality control samples, comprising certified reference materials, blanks, and field duplicates, are inserted into each batch of samples and locations for crushed duplicates and pulp replicates are specified. All drill core and quality control samples are tabulated on sample submission forms that specify sample preparation procedures and codes for analytical methods. For internal quality control, the laboratory includes its own quality control samples comprising certified reference materials, blanks and pulp duplicates. All quality assurance and quality control (“QAQC”) monitoring data are reviewed and signed off by an independent QAQC geologist. Chain of custody records are maintained from sample shipments to the laboratory until analyses are completed and remaining sample materials are returned to the Company. The chain of custody is transferred from the Company to SGS at the laboratory door.

At the SGS Bor laboratory, the submitted drill core samples are dried at 105°C for a minimum of 12 hours, and then jaw crushed to about 80% passing 4 millimetres. Sample preparation duplicates are created by riffle splitting crushed samples on a 1 in 20 basis. Larger samples are riffle split prior to pulverizing, whereas smaller samples are pulverized entirely. Pulverizing specifications are 90% passing 75 microns. Gold analyses are done using a conventional 50-gram fire assay and atomic absorption spectrometry (“AAS”) finish. Multi-element analyses for 49 elements, including Ag, Cu, Mo, As, Bi, Pb, Sb, and Zn, are done using a four-acid digestion and an ICP-MS finish. Samples returning over 10 ppm for Ag and 1% for Cu, Pb and Zn are re-analyzed using high grade methods with AAS.

All underground diamond drilling is completed by Chelopech Technical Services. Drill cores are sampled in intervals up to a maximum of three metres, with 1.5 metre sample intervals being the common length within mineralized zones. Following DPM exploration standard procedures and internationally accredited standards, a full suite of certified reference materials, blanks and field duplicates are submitted to the laboratory with each batch of samples. The overall quality control sample insertion rate is approximately 5% for reference materials, 2% for blanks, and 5% for field duplicates. Samples are assayed at the SGS Minerals managed laboratory at Chelopech in Bulgaria, which is independent of the Company. Samples are routinely assayed for copper, gold, silver, sulphur and arsenic. Gold analyses are done using a 25-gram fire assay and AAS finish. Assay values over 20 ppm gold are re-analyzed using gravimetric finish. Copper, silver and arsenic analyses are completed using a two -acid digestion and AAS finish. Samples returning over 100 ppm for silver and 3% for copper are re-analyzed using high-grade methods with AAS finish.

Both laboratories operate to SGS Global and international standards under SGS’s international accreditation. All methods and procedures are implemented together with international quality control protocols.

The QP has verified the technical data within this disclosure. Verification by the qualified person included review of QAQC performance, analytical results, geologic interpretations, and logging data.

About Dundee Precious Metals Inc.

Dundee Precious Metals Inc. is a Canadian-based international gold mining company with operations and projects located in Bulgaria, Namibia, Ecuador and Serbia. The Company’s purpose is to unlock resources and generate value to thrive and growth together. This overall purpose is supported by a foundation of core values, which guides how the Company conducts its business and informs a set of complementary strategic pillars and objectives related to ESG, innovation, optimizing our existing portfolio, and growth. The Company’s resources are allocated in-line with its strategy to ensure that DPM delivers value for all of its stakeholders. DPM’s shares are traded on the Toronto Stock Exchange (symbol: DPM).

For further information please contact:

| David Rae President and Chief Executive Officer Tel: (416) 365-5092 drae@dundeeprecious.com | Jennifer Cameron Director, Investor Relations Tel: (416) 219-6177 jcameron@dundeeprecious.com |

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward looking statements” or “forward looking information” (collectively, “Forward Looking Statements”) that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward Looking Statements in this news release relate to, among other things; the estimation of Mineral Reserves and Mineral Resources and the realization of such mineral estimates; mine life; the LOM plan; production, processing and recoveries forecasts; expected financial, cost and other metrics, including those set out in the three-year outlook provided by the Company; success of exploration activities, the price of gold, copper, and silver, and other commodities; expectation with respect to potential for an initial Mineral Resource estimate for Sharlo Dere; proposed optimization activities and proposed exploration activities; and successful registration of the Sveta Petka exploration licence as a Commercial Discovery. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and the QPs, as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others, risks relating to the Company’s business, including possible variations in ore grade and recovery rates; uncertainties inherent to the conclusions of economic evaluations and economic studies; uncertainties inherent to mine plans; changes in project parameters, including schedule and budget, as plans continue to be refined; uncertainties inherent to the estimation of Mineral Reserves and Mineral Resources, which may not be fully realized; uncertainties inherent with conducting business in foreign jurisdictions where corruption, civil unrest, political instability and uncertainties with the rule of law may impact the Company’s activities; the impact of the conflict in the Ukraine and post COVID-19 economic recovery, including resulting changes to the Company’s supply chain and costs of supplies; product shortages; delivery and shipping issues; closures and/or failure of plant, equipment or processes to operate as anticipated; risks associated with the recurrence of COVID-19 or future pandemics; labour force shortages; fluctuations in metal and acid prices, toll rates and foreign exchange rates; limitation on insurance coverage; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; actual results of optimization activities not being realized; actual results of current and planned reclamation activities; opposition by social and non-government organizations to mining projects and smelting operations; unanticipated title disputes; claims or litigation; cyber attacks and other cybersecurity risks; as well as those risk factors discussed or referred to in any other documents (including without limitation the Chelopech Technical Report and the Company’s most recent Annual Information Form) filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR+ at www.sedarplus.ca. The reader has been cautioned that the foregoing list is not exhaustive of all factors which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Unless required by securities laws, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management’s estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources

The Mineral Reserve and Mineral Resource estimates presented in this news release have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101.

The United States Securities and Exchange Commission (“SEC”) adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934, as amended. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining issuers that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) – Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”), incorporated by reference in NI 43-101.

Readers are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any Mineral Reserves or Mineral Resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Readers are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, it should not be assumed that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, readers are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, readers are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

For the above reasons, information contained in this news release containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

APPENDIX

Table 1: Significant new drill intercepts (2022 to 2023) at the Sharlo Dere prospect.

Sharlo Dere Mineralized Zone (SD)

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| EX_SD_25 | 7090 | 30711 | 789 | 250 | -63 | 284 | 294 | 10 | 10 | 1.53 | 1.22 | 1.08 | 0.18 |

| and | 422 | 439 | 17 | 17 | 2.19 | 1.40 | 2.77 | 0.47 | |||||

| including | 422 | 434 | 12 | 12 | 2.61 | 1.65 | 3.15 | 0.57 | |||||

| and | 451 | 498 | 47 | 46 | 1.99 | 1.33 | 5.12 | 0.39 | |||||

| including | 469 | 485 | 16 | 16 | 3.32 | 2.07 | 7.23 | 0.74 | |||||

| EX_SD_26 | 7091 | 30712 | 788 | 230 | -70 | 290 | 326 | 36 | 36 | 3.03 | 2.02 | 8.59 | 0.60 |

| including | 293 | 326 | 33 | 33 | 3.20 | 2.11 | 9.10 | 0.65 | |||||

| and | 354 | 411 | 57 | 57 | 3.66 | 2.23 | 7.32 | 0.86 | |||||

| including | 376 | 406 | 30 | 30 | 5.49 | 3.30 | 10.30 | 1.30 | |||||

| EX_SD_27 | 7038 | 30611 | 788 | 280 | -64 | 427 | 450 | 23 | 23 | 1.88 | 0.99 | 2.87 | 0.53 |

| including | 440 | 446 | 6 | 6 | 5.31 | 2.65 | 7.61 | 1.59 | |||||

| and | 456 | 464 | 8 | 8 | 2.20 | 1.46 | 6.06 | 0.44 | |||||

| and | 471 | 499 | 28 | 28 | 3.33 | 2.18 | 8.69 | 0.68 | |||||

| including | 478 | 490 | 12 | 12 | 6.64 | 4.33 | 16.30 | 1.37 | |||||

| EX_SD_28 | 7091 | 30715 | 789 | 203 | -68 | completed / no significant intervals | |||||||

| EX_SD_29 | 7040 | 30611 | 787 | 260 | -60 | completed / no significant intervals | |||||||

| EX_SD_30 | 7091 | 30714 | 789 | 238 | -65 | 223 | 229 | 6 | 6 | 1.26 | 0.91 | 2.26 | 0.20 |

| and | 417 | 428 | 11 | 11 | 3.08 | 1.62 | 4.37 | 0.87 | |||||

| including | 418 | 427 | 9 | 9 | 3.32 | 1.74 | 4.70 | 0.94 | |||||

| EX_SD_31 | 6949 | 30907 | 865 | 187 | -66 | completed / no significant intervals | |||||||

| EX_SD_32 | 7040 | 30609 | 788 | 212 | -58 | 646 | 651 | 5 | 4 | 11.87 | 9.85 | 1.70 | 1.20 |

| EX_SD_33 | 6949 | 30910 | 865 | 172 | -62 | completed / no significant intervals | |||||||

| EX_SD_34 | 6886 | 30600 | 865 | 192 | -63 | completed / no significant intervals | |||||||

| EX_SD_35 | 6948 | 30908 | 865 | 200 | -65 | 561 | 568 | 7 | 6 | 3.25 | 2.01 | 6.10 | 0.74 |

| and | 575 | 582 | 7 | 6 | 7.45 | 4.48 | 14.87 | 1.76 | |||||

| EX_SD_36 | 6888 | 30601 | 865 | 310 | -78 | 548 | 553 | 5 | 4 | 1.26 | 0.90 | 3.30 | 0.21 |

| EX_SD_37 | 6831 | 30676 | 898 | 200 | -52 | completed / no significant intervals | |||||||

| EX_SD_38 | 6644 | 30506 | 893 | 79 | -67 | 427 | 436 | 9 | 8 | 1.07 | 0.85 | 1.80 | 0.13 |

| EX_SD_39 | 6626 | 30764 | 945 | 158 | -65 | completed / no significant intervals | |||||||

| EX_SD_40 | 6645 | 30507 | 895 | 130 | -45 | 301 | 315 | 14 | 14 | 2.72 | 1.66 | 3.53 | 0.63 |

| including | 303 | 314 | 11 | 11 | 3.07 | 1.85 | 4.10 | 0.73 | |||||

| and | 325 | 357 | 32 | 31 | 1.91 | 1.54 | 10.40 | 0.22 | |||||

| including | 327 | 333 | 6 | 6 | 4.18 | 3.56 | 16.22 | 0.37 | |||||

| EX_SD_41 | 6627 | 30764 | 946 | 150 | -58 | completed / no significant intervals | |||||||

| EX_SD_42 | 6643 | 30507 | 893 | completed / no significant intervals | |||||||||

| EX_SD_43 | 6627 | 30764 | 945 | 135 | -67 | 578 | 611 | 33 | 30 | 1.70 | 1.24 | 3.61 | 0.27 |

| EX_SD_44 | 6740 | 30370 | 845 | 156 | -65 | 177 | 194 | 17 | 15 | 1.84 | 1.19 | 4.57 | 0.39 |

| including | 182 | 190 | 8 | 7 | 2.70 | 1.70 | 7.45 | 0.60 | |||||

| EX_SD_45 | 7113 | 30823 | 822 | 188 | -66 | completed / no significant intervals | |||||||

| EX_SD_46 | 6832 | 30676 | 898 | 144 | -69 | completed / no significant intervals | |||||||

| EX_SD_47 | 6975 | 30938 | 885 | 164 | -57 | completed / no significant intervals | |||||||

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| EX_SD_48 | 6797 | 30821 | 923 | 193 | -47 | completed / no significant intervals | |||||||

| EX_SD_50 | 6975 | 30938 | 885 | 164 | -54 | completed / no significant intervals | |||||||

| EX_SD_51 | 6797 | 30821 | 923 | 198 | -55 | 249 | 266 | 17 | 15 | 3.32 | 2.28 | 3.57 | 0.62 |

| including | 250 | 264 | 14 | 12 | 3.76 | 2.59 | 4.02 | 0.70 | |||||

| and | 280 | 305 | 25 | 22 | 1.29 | 0.90 | 2.12 | 0.23 | |||||

| and | 323 | 364 | 41 | 36 | 1.47 | 1.08 | 2.33 | 0.24 | |||||

| EX_SD_52 | 6973 | 30940 | 885 | 195 | -60 | completed / no significant intervals | |||||||

| EX_SD_53 | 6905 | 30944 | 875 | 197 | -59 | 609 | 624 | 15 | 14 | 8.12 | 5.33 | 15.93 | 1.66 |

| including | 610 | 618 | 8 | 7 | 14.15 | 9.34 | 26.13 | 2.87 | |||||

| EX_SD_54 | 6807 | 30527 | 843 | 165 | -57 | 230 | 248 | 18 | 16 | 1.08 | 0.81 | 1.30 | 0.16 |

| EX_SD_55 | 6865 | 30777 | 893 | 196 | -61 | 475 | 494 | 19 | 18 | 1.68 | 1.26 | 3.61 | 0.25 |

| EX_SD_56 | 6806 | 30525 | 843 | 182 | -59 | 248 | 257 | 9 | 8 | 1.66 | 1.19 | 0.28 | 4.61 |

| EX_SD_57 | 6863 | 30775 | 894 | 173 | -67 | completed / no significant intervals | |||||||

| EX_SD_58 | 6807 | 30524 | 843 | 146 | -67 | completed / no significant intervals | |||||||

| EX_SD_59 | 6906 | 30944 | 875 | 191 | -65 | completed / no significant intervals | |||||||

| EX_SD_60 | 6972 | 30938 | 885 | 178 | -48 | completed / no significant intervals | |||||||

| EX_SD_61 | 6906 | 30944 | 875 | 192 | -55 | completed / no significant intervals | |||||||

Sharlo Dere East / Krasta (SDE)

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| EX_SD_24 | 7093 | 30711 | 789 | 288 | -70 | 419 | 425 | 6 | 5 | 1.75 | 1.38 | 2.26 | 0.22 |

| EX_SD_49 | 6797 | 30822 | 922 | 193 | -64 | 370 | 386 | 16 | 13 | 1.36 | 1.11 | 1.96 | 0.15 |

| and | 392 | 399 | 7 | 6 | 1.93 | 1.43 | 2.99 | 0.30 | |||||

| EX_SD_51 | 6797 | 30821 | 923 | 198 | -55 | 249 | 266 | 17 | 15 | 3.32 | 2.28 | 3.57 | 0.62 |

| including | 250 | 264 | 14 | 12 | 3.76 | 2.59 | 4.02 | 0.70 | |||||

| and | 280 | 305 | 25 | 22 | 1.29 | 0.90 | 2.12 | 0.23 | |||||

| and | 323 | 364 | 41 | 36 | 1.47 | 1.08 | 2.33 | 0.24 |

Sharlo Dere West / Target 11 (SDW)

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| EX_SDW_01 | 6600 | 30375 | 836 | 170 | -65 | 446 | 464 | 18 | 18 | 3.38 | 2.73 | 39.46 | 0.39 |

| *EX_SDW_02 | 555 | 566 | 11 | 11 | 2.00 | 1.26 | 3.77 | 0.44 | |||||

| and | 572 | 587 | 15 | 15 | 3.02 | 1.59 | 4.28 | 0.85 | |||||

| including | 573 | 587 | 14 | 14 | 3.07 | 1.61 | 4.32 | 0.87 | |||||

| and | 612 | 632 | 20 | 20 | 2.06 | 1.78 | 4.05 | 0.17 | |||||

| and | 648 | 655 | 7 | 7 | 7.74 | 4.39 | 8.70 | 2.00 | |||||

| *EX_SDW_03 | 473 | 500 | 27 | 27 | 2.19 | 1.79 | 10.19 | 0.23 | |||||

| including | 473 | 492 | 19 | 19 | 2.65 | 2.11 | 13.03 | 0.32 | |||||

| and | 510.8 | 519 | 8.2 | 8 | 1.91 | 1.25 | 8.82 | 0.40 | |||||

| and | 535 | 540 | 5 | 5 | 1.80 | 1.29 | 3.71 | 0.30 | |||||

| EX_SDW_04 | 6643 | 30506 | 893 | 169 | -55 | completed / no significant intervals | |||||||

| EX_SDW_05 | 6643 | 30507 | 893 | 168 | -63 | completed / no significant intervals | |||||||

| EX_SDW_06 | 6739 | 30368 | 845 | 196 | -52 | completed / no significant intervals | |||||||

| EXT11_505_07 | 6349 | 29901 | 510 | 54 | -28 | 321 | 333 | 12 | 10 | 1.79 | 1.21 | 6.11 | 0.35 |

| EXT11_505_08 | 6349 | 29901 | 511 | 36 | -11 | 358.5 | 403.5 | 45 | 35 | 1.44 | 1.21 | 23.53 | 0.14 |

| EXT11_555_01 | 6638 | 30084 | 558 | 32 | -80 | 213 | 225.7 | 12.7 | 10 | 3.11 | 1.78 | 8.56 | 0.79 |

| EXT11_555_02 | 6638 | 30084 | 558 | 35 | -79 | 211.5 | 219.7 | 8.2 | 7 | 3.22 | 2.62 | 7.77 | 0.36 |

| EXT11_555_03 | 6638 | 30085 | 558 | 354 | -61 | 165 | 171.2 | 6.2 | 6 | 7.54 | 6.70 | 12.93 | 0.50 |

| EXT11_555_04 | 6639 | 30084 | 558 | 30 | -30 | 184.5 | 222 | 37.5 | 28 | 7.34 | 5.69 | 9.12 | 0.98 |

| including | 193.5 | 220.5 | 27 | 20 | 9.70 | 7.58 | 10.67 | 1.26 | |||||

| EXT11_555_05 | 6639 | 30084 | 558 | 39 | -45 | 441 | 447 | 6 | 6 | 4.09 | 3.58 | 1.90 | 0.31 |

| EXT11_555_06 | 6642 | 30029 | 557 | 66 | -72 | completed / no significant intervals | |||||||

| EXT11_555_07 | 6642 | 30031 | 557 | 353 | -84 | completed / no significant intervals | |||||||

| EXT11_555_08 | 6641 | 30031 | 557 | 353 | -84 | completed / no significant intervals | |||||||

1) AuEq calculation is based on the following formula: Au g/t + 1.68 x Cu %, based on a gold price of $1,600 per ounce and a copper price of $4.00 per pound and long- term average metallurgical recoveries of 89% for gold and 87% for copper from the Chelopech mine.

2) Significant intercepts are reported using a minimum downhole width of 5 metres, a maximum dilution of 5 metres at a 1 g/t AuEq, including 2.5 g/t AuEq cutoff. No upper cuts applied.

3) Coordinates are in Chelopech mine-grid.

4) *Directional drilled (‘daughter’) holes.

5) Drillholes with the prefix ‘EXT’ in the hole ID were drilled from underground by Chelopech technical services with assaying completed at the SGS Minerals Chelopech Laboratory, all other holes were completed from Surface by the Chelopech exploration department with assaying completed at the SGS Minerals Bor Laboratory.

Table 2: Significant previously reported and selected (2015-2020) drill intercepts at the Sharlo Dere prospect.

The previously disclosed intercepts from Sharlo Dere prospect and the northeastern area of the Chelopech deposit drilled prior to 2022, have been re-reported using the significant intercepts criteria outlined in the footnotes of the table below. These updated results are presented in Table 2, along with other significant intercepts from pre-2022 drilling at the Sharlo Dere prospect.

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| SVP004 | 6555 | 30784 | 980 | 145 | -55 | 577 | 585 | 8 | 8 | 2.14 | 1.71 | 1.44 | 0.26 |

| SVP005 | 6554 | 30784 | 980 | 133 | -58 | 616 | 638 | 22 | 21 | 2.29 | 1.61 | 3.66 | 0.40 |

| including | 621 | 638 | 17 | 16 | 2.47 | 1.77 | 4.00 | 0.42 | |||||

| EX_NE10_01 | 6640 | 30029 | 557 | 44 | -44 | 216 | 223 | 7 | N/A | 2.22 | 2.11 | 6.30 | 0.07 |

| EX_NE10_02 | 6637 | 30029 | 557 | 340 | -45 | 174 | 181 | 7 | 7 | 3.60 | 2.29 | 13.79 | 0.78 |

| and | 197 | 209 | 12 | 12 | 2.13 | 1.64 | 9.55 | 0.29 | |||||

| EX_KR_04 | 7020 | 30885 | 856 | 305 | -45 | 141 | 147 | 6 | 5 | 1.08 | 0.82 | 1.14 | 0.16 |

| EX_KR_05 | 7020 | 30882 | 856 | 265 | -50 | 181.2 | 191 | 9.8 | 8 | 1.21 | 0.77 | 1.39 | 0.26 |

| and | 206 | 214 | 8 | 7 | 1.01 | 0.57 | 0.99 | 0.26 | |||||

| EX_KR_16 | 7223 | 30779 | 782 | 290 | -44 | 357 | 371 | 14 | 13 | 2.62 | 2.1 | 2.53 | 0.31 |

| including | 358 | 364 | 6 | 6 | 3.81 | 3.02 | 2.71 | 0.47 | |||||

| and | 397 | 415 | 18 | 17 | 2.14 | 0.88 | 1.48 | 0.75 | |||||

| including | 406 | 415 | 9 | 8 | 3.29 | 1.34 | 2.26 | 1.16 | |||||

| EX_KR_23 | 7134 | 30721 | 782 | 310 | -41 | 346.7 | 373 | 26.3 | 25 | 2.42 | 1.47 | 1.71 | 0.57 |

| including | 349 | 358 | 9 | 9 | 4.63 | 2.81 | 2.76 | 1.08 | |||||

| EX_KR_28 | 7111 | 30823 | 822 | 310 | -40 | 272.3 | 292 | 19.7 | 19 | 1.95 | 0.96 | 1.56 | 0.59 |

| including | 287 | 292 | 5 | 5 | 3.08 | 1.29 | 1.55 | 1.07 | |||||

| EX_KR_39 | 7111 | 30822 | 822 | 307 | -32 | 260 | 270 | 10 | 10 | 2.11 | 1.15 | 1.98 | 0.58 |

| including | 265 | 270 | 5 | 5 | 2.92 | 1.48 | 2.91 | 0.86 | |||||

| EX_SD_05 | 6810 | 30528 | 844 | 143 | -53 | 254 | 263 | 9 | 9 | 1.06 | 0.80 | 7.45 | 0.16 |

| EX_SD_06 | 6948 | 30674 | 851 | 290 | -60 | 315 | 320 | 5 | 4 | 1.70 | 1.05 | 2.01 | 0.39 |

| and | 340 | 351 | 11 | 10 | 1.90 | 1.15 | 1.82 | 0.45 | |||||

| EX_SD_09 | 7092 | 30711 | 789 | 295 | -57 | 375 | 407 | 32 | 29 | 1.11 | 0.84 | 1.86 | 0.16 |

| and | 414 | 421 | 7 | 6 | 3.07 | 1.98 | 2.64 | 0.65 | |||||

| EX_SD_10 | 6534 | 30487 | 855 | 185 | -50 | 473 | 479 | 6 | N/A | 4.93 | 4.01 | 66.17 | 0.55 |

| and | 585 | 623 | 38 | N/A | 8.34 | 5.55 | 7.97 | 1.66 | |||||

| including | 604 | 618 | 14 | N/A | 14.18 | 8.17 | 13.37 | 3.58 | |||||

| including | 607 | 612 | 5 | N/A | 35.37 | 19.41 | 34.48 | 9.50 | |||||

| and | 731 | 736 | 5 | N/A | 3.94 | 2.14 | 7.36 | 1.07 | |||||

| EX_SD_13 | 6887 | 30602 | 865 | 288 | -58 | 271 | 288 | 17 | 15 | 1.29 | 0.87 | 2.11 | 0.25 |

| EX_SD_14 | 7093 | 30712 | 789 | 305 | -45 | 370 | 379 | 9 | 9 | 1.46 | 1.12 | 1.52 | 0.20 |

| and | 411 | 424 | 13 | 12 | 3.43 | 1.38 | 57.94 | 1.22 | |||||

| including | 412 | 423.1 | 11.1 | 11 | 3.78 | 1.47 | 64.16 | 1.38 | |||||

| and | 440 | 445 | 5 | 5 | 2.64 | 1.81 | 3.03 | 0.49 | |||||

| EX_SD_18 | 7039 | 30611 | 788 | 310 | -42 | 364 | 384 | 20 | 20 | 1.00 | 0.74 | 1.11 | 0.15 |

| EX_SD_19 | 6885 | 30601 | 864 | 6 | -47 | 416 | 448 | 32 | 31 | 1.70 | 1.09 | 1.04 | 0.37 |

| including | 427 | 432 | 5 | 5 | 3.97 | 2.48 | 1.45 | 0.89 | |||||

| HOLEID | EAST | NORTH | RL | AZ | DIP | FROM | TO | LENGTH | TRUE WIDTH | AuEq | Au | Ag | Cu |

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (%) | ||||||

| EXT10_555_17 | 6625 | 30030 | 558 | 359 | -57 | 169.7 | 206.3 | 36.6 | 36 | 5.44 | 5.28 | 6.30 | 0.10 |

| including | 185.1 | 199.6 | 14.5 | 14 | 13.44 | 13.11 | 14.65 | 0.20 | |||||

| EXT10_555_28 | 6635 | 30077 | 558 | 257 | -80 | 159 | 186 | 27 | 22 | 1.89 | 1.12 | 6.32 | 0.46 |

| including | 159 | 172.5 | 13.5 | 11 | 2.49 | 1.59 | 9.93 | 0.54 | |||||

| EXT10_555_37 | 6634 | 30076 | 558 | 330 | -70 | 150.9 | 172.85 | 21.95 | 20 | 3.07 | 2.25 | 14.77 | 0.49 |

| EXT10_555_39 | 5376 | 29215 | 396 | 16 | -8 | 148.2 | 159 | 10.8 | 10 | 2.32 | 1.11 | 3.53 | 0.72 |

| and | 192 | 197.7 | 5.7 | 5 | 1.50 | 0.94 | 4.58 | 0.33 | |||||

| EXT10_555_40 | 6535 | 30078 | 558 | 273 | -69 | 153 | 165 | 12 | 11 | 1.55 | 0.93 | 4.15 | 0.37 |

| and | 196.85 | 207 | 10.15 | 9 | 1.29 | 0.79 | 4.55 | 0.30 |

1) AuEq calculation is based on the following formula: Au g/t + 1.68 x Cu %, based on a gold price of $1,600 per ounce and a copper price of $4.00 per pound and long- term average metallurgical recoveries of 89% for gold and 87% for copper from the Chelopech mine.

2) Significant intercepts are reported using a minimum downhole width of 5 metres, a maximum dilution of 5 metres at a 1 g/t AuEq, including 2.5 g/t AuEq cutoff. No upper cuts applied.

3) Coordinates are in Chelopech mine-grid.

4) True widths not reported are shown as N/A for certain drillholes. Further drilling is required to determine the true widths of these intervals.

5) Drillholes with the prefix ‘EXT’ in the hole ID were drilled from underground by Chelopech technical services with assaying completed at the SGS Minerals Chelopech Laboratory, all other holes were completed from Surface by the Chelopech exploration department with assaying completed at the SGS Minerals Bor Laboratory.

1 Refer to the Appendix on pages 16 to 20 of this news release for the full results from drilling at the Sharlo Dere and Sharlo Dere West prospects.