Eloro Resources Files NI 43-101 Technical Report for Initial Mineral Resource Estimate for Iska Iska Project, Potosi Department, Southwestern Bolivia

- Due to the multi-metal nature of the deposit, the resources are reported using Net Smelter Return (NSR) cut-off values which are as follows: Polymetallic Domain (Zn-Pb-Ag) = US$9.20/t for open pit (OP) mining and US$34.00/t for underground (UG) mining; Tin Domain (Sn-Ag-Pb) = US$6.00/t for OP mining. Costs have been significantly reduced due to the major impact of the positive “ore-sorting” tests.

- Potentially open pittable inferred mineral resource in Polymetallic Domain (Zn-Pb-Ag) of 541 million tonnes grading 0.69% Zn, 0.28% Pb and 13.6 g Ag/t with an NSR value of US$20.32/t at an NSR cut-off of US$9.20/t which is equal to the estimated operating cost.

- Polymetallic Domain includes a core inferred mineral resource at an NSR cutoff of US$15/t of 342 million tonnes grading 0.85% Zn, 0.35% Pb and 17 g Ag/t with an NSR value of US$25.22/t which is 2.74 times estimated operating cost of US $9.20/t

- This core mineral resource includes a higher grade near surface inferred mineral resource at an NSR cut-off of US25/t of 132 million tonnes grading 1.11% Zn, 0.50% Pb and 24.3 g Ag/t with an NSR value of US$34.50/t which is 3.75 times estimated operating cost of US $9.20/t

- Potentially open pittable inferred mineral resource in the Tin Domain (Sn-Pb-Ag) of 110 million tonnes grading 0.12% Sn, 0.14% Pb and 14.2 g Ag/t with an NSR value of US$12.22/t at an NSR cut-off of US$6.00/t

- Potential underground inferred mineral resource in the Polymetallic Domain of 19 million tonnes grading 1.88% Zn, 0.36% Pb and 18.8 g Ag/t with an NSR value of US$42.23 at an NSR cut-off of US$34.40/t.

- The open pit and underground NSR cut-off grades defining the overall mineral resource consider estimated mining costs, G&A expenses, processing costs, metallurgical recoveries, smelter deductions, treatment charges, penalties, and transportation costs for all metals of potential economic interest and, accordingly, are equal to estimated total operating costs.

- Potential open pit defining the bulk of the mineral resource is 1.4km in diameter, extends to a maximum depth of 750m below the Santa Barbara hill and has a stripping ratio of 1:1.

- Total in situ metal is estimated to be 298 million ounces Ag (silver), 4.09 million tonnes Zn (zinc), 1.74 million tonnes Pb (lead) and 130,000 tonnes Sn (tin).

- Resource estimate is based on 139 diamond drill holes totalling 96,386m. All holes intersected significant reportable mineralization and the deposit is open in all directions.

TORONTO, Oct. 17, 2023 (GLOBE NEWSWIRE) -- Eloro Resources Ltd. (TSX: ELO; OTCQX: ELRRF; FSE: P2QM) (“Eloro”, or the “Company”) is pleased to announce the filing of the National Instrument 43-101 (NI 43-101) Technical Report in support of the initial mineral resource estimate (“MRE”) for the Iska Iska silver-tin polymetallic project in the Potosi Department of southwestern Bolivia. The MRE, as set out in Table 1 below, has been prepared by independent qualified persons (“QPs”) with Micon International Limited as defined under NI-43-101.

Table 1: Summary of the Iska Iska Initial Mineral Resources as of August 19, 2023

| Item | Average Value | |||||||

| Category | Domain | Mining Method | Zn-Pb-Ag NSR Cut-off (US$) | Tonnage (Mt) | Zn-Pb-Ag NSR ($/t) | Zn (%) | Pb (%) | Ag (g/t) |

| Inferred | Polymetallic | OP | 9.20 | 541 | 20.32 | 0.69 | 0.28 | 13.6 |

| UG | 34.40 | 19 | 42.23 | 1.88 | 0.36 | 18.8 | ||

| OP+UG | - | 560 | 21.08 | 0.73 | 0.28 | 13.8 | ||

| Category | Domain | Mining Method | Sn-Pb-Ag NSR Cut-off (US$) | Tonnage (Mt) | Sn-Pb-Ag NSR ($/t) | Sn (%) | Pb (%) | Ag (g/t) |

| Inferred | Tin | OP | 6.00 | 110 | 12.22 | 0.12 | 0.14 | 14.2 |

Notes:

- The mineral resources have been estimated in accordance with the CIM Best Practice Guidelines (2019) and the CIM Definition Standards (2014).

- It is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The OP Mineral Resources are reported within a constrained pit shell (slope angle 45 degrees) at NSR cut-off values of US$6/t and US$9.20/t, for the Tin Domain and Polymetallic Domain, respectively. The UG resource is a coherent mass (less 20 m thick crown pillar) beneath the pit reported at an NSR cut-off of US$34.40/t.

- Metallurgical recoveries for the Polymetallic Domain are based on pre-concentration recoveries of 97% for Zn, Pb and Ag, followed by the concentrator recoveries of Zn = 87%%, Pb = 80%, and Ag = 88%.

- Metallurgical recoveries for the Tin Domain are based on pre-concentration recoveries of 62% for Sn followed by concentrator recoveries of Sn = 50%, Pb = 64% and Ag = 53%.

- The mineral resource estimate is based on 3-year trailing average metal prices of Ag = US$22.52/oz, Pb = 0.95/lb, Sn = US$12.20/lb, Zn = US$1.33/lb, and an exchange rate of 1.30 C$: 1 US$.

- Other economic factors include: mining costs = US$3.41/t and US$25.22/t for open pit and underground, respectively; G & A costs = US$0.55/t for the Polymetallic Domain and US$0.68/t for the Tin Domain; all-inclusive processing costs for the Polymetallic Domain = US$8.62/t comprising US$0.40/t for pre-concentration followed by US$12.66/t for concentrator, and all-inclusive processing costs for the Tin Domain = US$5.29/t comprising US$0.40/t for pre-concentration followed by US$13.80/t for concentrator. Concentrate transportation, smelting and refining terms have been included for the Polymetallic Domain. Tin fuming recoveries and costs, and concentrate transportation, smelting and refining terms have been included for the Tin Domain.

- Mineral resources unlike mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The QPs are not aware of any known permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource Estimate.

- The UG resources include the ‘must take’ minor material below cut-off grade which is interlocked with masses of blocks above the cut-off grade within the MSO stopes.

- Figures may not tally due to rounding.

- Average stripping ratio for the open pit is 1:1. The open pit has a diameter of approximately 1.4km and extends to a maximum depth of approximately 750 m from the summit of the Santa Barbara hill.

The Micon QPs with responsibility for the Initial Mineral Resource Estimate are Charley Murahwi, MSc., P.Geo., FAusIMM., Alan San Martin, MAusIMM (CP), and Abdoul Aziz Dramé, B.Eng., P. Eng.

Initial Mineral Resource Estimate

1. Definition – Net Smelter Return (NSR) & Metal Equivalent:

The Iska Iska deposit is polymetallic in nature and, as such, the value of its mineralized material will result from the extraction and sale of a combination of metals which include Ag, Pb, Sn and Zn for the Initial Mineral Resource. Pending further success in metallurgical testwork, Cu (copper), Au (gold), and In (indium) may be added to the economic equation.

Based on the CIM Best Practice Guidelines of November 2019: Two methods are widely applied in the mining industry to address the polymetallic nature of such deposits. These include the use of a metal-equivalent or the calculation of the Net Smelter Return (NSR). For the NSR method, the estimated dollar value that each metal contributes towards the total value of each tonne is calculated and is expressed as one value referred to as the NSR value per tonne. The calculation of an NSR value per tonne considers estimated revenues, mining costs, G&A expenses, processing costs, metallurgical recoveries, smelter deductions, treatment charges, penalties, and transportation costs for all metals of potential economic interest. This NSR value per tonne can then be used to derive a cut-off value, where the NSR cut-off value per tonne is equal to the estimated total operating costs of mining, processing and recovering the metals per tonne of the resource.

In some cases where there are multiple elements in the deposit that contribute to the deposit value, a one-commodity equivalent calculation is sometimes used as the cut-off grade or value. In this approach, all the grades for the various commodities are converted to an equivalent metal grade by consideration of the metal prices and recoveries. The calculation of equivalent cut-off grade or value is based on a formula developed by the Practitioners. This formula, and the parameters used for its development, must be clearly stated. The metal-equivalent grades are then used as the cut-off grades to estimate the Mineral Reserves.

2. NSR versus Metal equivalent grade cut-off grades:

Based on the Micon’s QP Experience: In multi-metal deposits where there is a primary product supported by secondary products, it is more appropriate to use a Metal Equivalent cut-off grade based/denominated on the primary commodity. Conversely, in multi-metal deposits where the deposit constituents/metals are considered largely as co-products with no obvious dominant commodity, it is better to employ a NSR value in applying a cut-off grade. The second scenario suits the Iska Iska deposit better at this stage of exploration in the definition of the deposit.

3. ISKA ISKA Initial MRE Statement

Due to the multi-metal nature of the deposit, the resources are reported using Net Smelter Return (NSR) cut-off values per tonne which are as follows:

Polymetallic (Zn-Pb-Ag) Domain = US$9.20/t for open pit (OP) mining and US$34.00/t for underground (UG) mining; Tin (Sn-Ag-Pb) Domain = US$6.00/t for OP mining. Costs have been significantly reduced due to the major impact of the positive “ore-sorting” tests (see Eloro press release of July 26, 2023).

Note that the open pit Mineral Resources are reported within a constrained pit shell (slope angle 45 degrees) at NSR cut-off values of US$6/t and US$9.20/t, for the Tin Domain and Polymetallic Domain, respectively. The UG resource is a coherent mass (less 20 m thick crown pillar) beneath the pit reported at an NSR cut-off of US$34.40/t. The open pit and underground NSR cut-off grades consider estimated mining costs, G&A expenses, processing costs, metallurgical recoveries, smelter deductions, treatment charges, penalties, and transportation costs for all metals of potential economic interest and, accordingly, are equal to estimated total operating costs.

In the section below, areas of higher-grade resource within the overall constraining pit in the Polymetallic Domain are highlighted at higher NSR cut-offs of US$15/t and US$25/t, respectively. It is important to recognize that this highlighting of the higher-grade resource does NOT in any way change the overall total estimated operating cost per tonne which for the Polymetallic Domain is US$9.20/t. The mineral resource defined by using a US$25/t cut-off to identify and define a high-grade zone is particularly important as it is near surface and would be mined in the early years of production generating potential for earlier payback. The average NSR value of this higher-grade resource is US$34.49/t which is 3.75 times total estimated operating cost.

Using the above cut-off values, the Initial Mineral Resources for the Iska Iska deposit as of August 19, 2023, are shown in Table 1 above. The economic and technical assumptions used are stated in the notes beneath the Table. All the resources are in the Inferred Category. It is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

The potential open pit defining the bulk of the mineral resource is 1.4km in diameter, extends to a maximum depth of 750m below the Santa Barbara hill and has a stripping ratio of 1:1. Total in situ metal is estimated to be 298 million ounces Ag (silver), 4.09 million tonnes Zn (zinc), 1.74 million tonnes Pb (lead) and 130,000 tonnes Sn (tin).

Resource estimate is based on 139 diamond drill holes totalling 96,386m. All holes intersected significant reportable mineralization and the deposit is open in all directions.

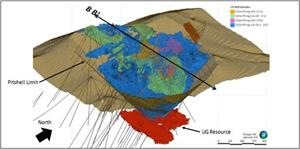

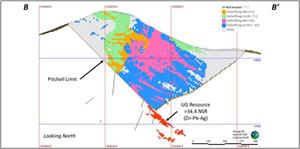

Figure 1 below is a 3D image of the resource block model while Figure 2 below is a representative cross section showing distribution of the resource blocks.

Figure 1: 3D Perspective of the Iska Iska Pit Constrained Resource Showing Distribution of Resources in Major Domains as of August 19, 2023.

Note: For Tin Domain (Sn-Pb-Ag), high grade (HG) = NSR > US$12/t and low grade (LG) = NSR between US$6/t and US$12/t. For Polymetallic Domain (Zn-Pb-Ag), HG = NSR > US$25/t & LG = NSR between US$9.2/t and US$25/t. UG Resource = NSR > US$34.40/t.

Figure 2: Cross Section B-B’ of the Iska Iska Pit Constrained Resource

as of August 19, 2023.

Note: For Tin Domain (Sn-Pb-Ag), HG = NSR > US$12/t & LG = NSR between US$6/t and US$12/t. For Polymetallic Domain (Zn-Pb-Ag), HG = NSR > US$25/t & LG = NSR between US$9.2/t and US$25/t. UG Resource = NSR > US$34.40/t.

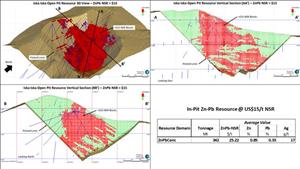

4. Higher Grade Resources in Polymetallic Domain

As shown in Figure 3, there is a core higher-grade inferred mineral resource in the Polymetallic Domain at an NSR cut-off of US$15/t of 342 million tonnes grading 0.85% Zn, 0.35% Pb and 17 g Ag/t for an NSR value of US$25.22/t which is 2.74 times the total estimated operating cost of US $9.20/t

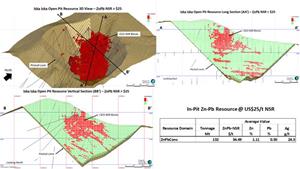

This core mineral resource includes a higher grade near surface inferred mineral resource at an NSR cut-off of US25/t of 132 million tonnes at 1.11% Zn, 0.50% Pb and 24.3 g Ag/t for an NSR value of US$34.50/t which is 3.75 times total estimated operating cost of US $9.20/t as shown in Figure 4.

Figure 3 : Summary of the Distribution of Higher Grade Polymetallic (Zn-Pb-Ag) Resource

at NSR Cut-off Value of US$15/t

Figure 4: Summary of the Distribution of Higher Grade Polymetallic (Zn-Pb-Ag) Resource

at NSR Cut-off Value of US$25/t

5. Use of Silver Equivalent Calculation

Previous disclosure by Eloro of drill results had employed silver equivalent calculations using current metal prices to provide comparative results for polymetallic mineralization. Metallurgical recoveries were recently assessed and are now available for the major elements in both Polymetallic and Tin Domains as outlined in the Notes in Table 1. Going forward, Eloro will use these recoveries, as well as current metal prices, for determining any disclosure of silver equivalent calculations. The previous disclosure of silver equivalent estimates should no longer be relied upon.

6. Estimates of In-Situ Metal Value

Eloro withdraws the previously released estimates of in-situ metal value for the Iska Iska mineral resource in the press release of August 30, 2023 and in the webinar of September 5, 2023. Eloro’s corporate presentation has been updated to remove references to these estimates and the link to the webinar has been removed from the corporate website.

Qualified Person

The initial MRE for Iska Iska has been prepared by Micon International Limited. Independent Qualified Persons (each a “QP”) for the Technical Report are Charley Murahwi, P.Geo., FAusIMM, Richard Gowans, P.Eng., Ing. Alan J. San Martin, MAusIMM (CP) and Abdul Aziz, Drame, P.Eng., all of whom are independent QPs as defined by NI 43-101. Mr. Murahwi completed site visits in January 2020 and November 2022.

Dr. Osvaldo Arce, P. Geo., General Manager of Eloro’s Bolivian subsidiary, Minera Tupiza S.R.L., and a Qualified Person in the context of NI 43-101, has reviewed and approved the technical content of this news release. Dr. Bill Pearson, P.Geo., Executive Vice President Exploration Eloro, who has more than 45 years of worldwide mining exploration experience, including extensive work in South America, manages the overall technical program, working closely with Dr. Osvaldo Arce, P.Geo. Dr. Quinton Hennigh, P.Geo., Senior Technical Advisor to Eloro and Independent Technical Advisor, Mr. Charley Murahwi P. Geo., FAusIMM of Micon are regularly consulted on technical aspects of the project.

Eloro is utilizing both ALS and AHK for drill core analysis, both of whom are major international accredited laboratories. Drill samples sent to ALS are prepared in both ALS Bolivia Ltda’s preparation facility in Oruro, Bolivia and the preparation facility operated by AHK in Tupiza with pulps sent to the main ALS Global laboratory in Lima for analysis. More recently Eloro has had ALS send pulps to their laboratory at Galway in Ireland. Eloro employs an industry standard QA/QC program with standards, blanks and duplicates inserted into each batch of samples analyzed with selected check samples sent to a separate accredited laboratory.

Drill core samples sent to AHK Laboratories are prepared in a preparation facility installed and managed by AHK in Tupiza with pulps sent to the AHK laboratory in Lima, Peru. Au and Sn analysis on these samples is done by ALS Bolivia Ltda in Lima. Check samples between ALS and AHK are regularly done as a QA/QC check. AHK is following the same analytical protocols used as with ALS and with the same QA/QC protocols.

About Iska Iska

Iska Iska silver-tin polymetallic project is a road accessible, royalty-free property, wholly controlled by the Title Holder, Empresa Minera Villegas S.R.L. and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi in southern Bolivia. Eloro has an option to earn a 100% interest in Iska Iska.

Iska Iska is a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene possibly collapsed/resurgent caldera, emplaced on Ordovician age rocks with major breccia pipes, dacitic domes and hydrothermal breccias. The caldera is 1.6km by 1.8km in dimension with a vertical extent of at least 1km. Mineralization age is similar to Cerro Rico de Potosí and other major deposits such as San Vicente, Chorolque, Tasna and Tatasi located in the same geological trend.

Eloro began underground diamond drilling from the Huayra Kasa underground workings at Iska Iska on September 13, 2020. On November 18, 2020, Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. On November 24, 2020, Eloro announced the discovery of the Santa Barbara Breccia Pipe (“SBBP”) approximately 150m southwest of the Huayra Kasa underground workings.

Subsequently, on January 26, 2021, Eloro announced significant results from the first drilling at the SBBP including the discovery hole DHK-15 which returned 29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu and 0.056%Sn from 0.0m to 257.5m. Subsequent drilling has confirmed significant values of Ag-Sn polymetallic mineralization in the SBBP and the adjacent Central Breccia Pipe (“CBP”). A substantive mineralized envelope which is open along strike and down-dip extends around both major breccia pipes. Continuous channel sampling of the Santa Barbara Adit located to the east of SBBP returned 164.96 g Ag/t, 0.46% Sn, 3.46% Pb and 0.14% Cu over 166m including 446 g Ag/t, 9.03% Pb and 1.16% Sn over 56.19m. The west end of the adit intersects the end of the SBBP.

Since the initial discovery hole, Eloro has released a number of significant drill results in the SBBP and the surrounding mineralized envelope which along with geophysical data has defined an extensive target zone. In its September 20, 2022 press release, the Company reported that new downhole geophysical data has significantly extended the strike length of the high-grade feeder zone at Santa Barbara a further 250m along strike to the south-southeast from existing drilling. The 3D inverse magnetic model which correlates very strongly with the conductive zone suggested that the high-grade feeder zone may extend across the entire caldera for as much as a further 1 km along strike for a total potential strike length of at least 2 km. As reported, the definition drill program was modified to sectionally drill this potential extension with the intention of defining a major open pittable deposit in the valley of the caldera.

The Company completed 84,495m of drilling in 122 holes from the definition drill program in the Santa Barbara target area, as previously announced on November 27, 2022.

On November 22, 2022, Eloro announced the pending acquisition of the Mina Casiterita and Mina Hoyada properties covering 14.75 km2 southwest and west of Iska Iska. These properties connect with the TUP-3 and TUP-6 claims previously staked by Eloro. Eloro has also staked additional land in the area. Subject to the finalization of the granting of the mining rights process and the completion of the acquisition transaction for the Mina Casiterita and Mina Hoyada properties, the total land package in the Iska Iska area to be controlled by Eloro will total 1,935 quadrants covering 483.75 km2.

Artisanal mining in the 1960’s identified high grade tin (Sn) veins on the Mina Casiterita property that are hosted in an intrusive dacite. Production from 1962 to 1964 is reported by the Departamento Nacional de Geología in Bolivia to be 69.85 tonnes grading 50.60% Sn.

Recently completed magnetic surveys by Eloro has outlined an extensive, near surface, magnetic intrusive body on the Mina Casiterita property immediately southwest of Iska Iska. This intrusive hosts the previously mined high-grade tin veins and is very likely the continuation of the porphyry tin intrusion projected to be below the epithermal Ag-Sn-Zn-Pb mineralization at Iska Iska. Initial reconnaissance drilling at Casiterita returned 0.17% Sn over 52.75m in the vicinity of these old artisanal workings.

On July 26, 2023, Eloro released results of substantial metallurgical work on samples from the Polymetallic and Tin Domains. Preliminary tests at TOMRA in Germany indicate the mineralization at Iska Iska is amenable to “ore-sorting” with removal of at least 40% of the waste in the Polymetallic Domain and up to 80% in the Tin Domain which would substantially increase concentrator feed grades as well as reduce future operating costs and significantly lower the cut-off grades.

Positive “ore-sorting” results were obtained from composite samples of both the Tin (Sn-Pb-Ag) and Polymetallic (Zn-Pb-Ag) Domains in the Santa Barbara deposit indicating its wide applicability throughout the entire deposit.

Further metallurgical studies conducted by Wardell Armstrong International on a composite sample of the tin mineralization has improved tin concentrator stage recovery to 50%. This recovery is un-optimised and has been achieved using a mixture of Multi Gravity and tin flotation techniques which are specifically designed to recover the finer grained cassiterite.

The concentrator could produce an approximately 5%Sn concentrate grade amenable to the tin fuming process that ultimately could produce a 60-70%Sn concentrate for smelting.

The level of metallurgical and pyrometallurgical work that has been conducted is exceptionally high for an initial MRE but is justifiable due to the significance of this large potentially open pittable tin and polymetallic resource. The additional metallurgical/mineralogical knowledge will enable Eloro to rapidly move towards a preliminary economic assessment (PEA).

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of gold and base-metal properties in Bolivia, Peru and Quebec. Eloro has an option to acquire a 100% interest in the highly prospective Iska Iska Property, which can be classified as a polymetallic epithermal-porphyry complex, a significant mineral deposit type in the Potosi Department, in southern Bolivia. A recent NI 43-101 Technical Report on Iska Iska, which was completed by Micon International Limited, is available on Eloro’s website and under its filings on SEDAR. Iska Iska is a road-accessible, royalty-free property. Eloro also owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of Barrick’s Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine.

For further information please contact either Thomas G. Larsen, Chairman and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/902b1463-ee23-442e-bfc0-60d584c3c39d

https://www.globenewswire.com/NewsRoom/AttachmentNg/4d5d16b2-1f20-48c4-9039-f12e6c3b93f0

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4d7db13-214a-4b45-9896-85b140830523

https://www.globenewswire.com/NewsRoom/AttachmentNg/7a2c020b-802c-4fba-acae-93c809ebd2fa