Eloro Resources Granted Option to Acquire the Iska Iska Polymetallic Property, Potosi Department, Southern Bolivia

TORONTO, Oct. 08, 2019 (GLOBE NEWSWIRE) -- Eloro Resources Ltd. (TSX-V: ELO; FSE: P2Q) (“Eloro”, or the “Company”) is pleased to announce it has signed a Letter of Intent (the “Agreement”) with a private arm’s-length Bolivian-based corporation (the “Title Holder”), granting Eloro an option to acquire up to a 100% interest in the Iska Iska Polymetallic Property (“Iska Iska” or the “Property”), consisting of one mineral concession totalling 900 hectares. The Property is located in a world-class polymetallic mining district in the Potosi Department in the southern half of the Bolivian tin belt, which hosts the largest silver deposit in the world, the Cerro Rico de Potosi, and the polymetallic mining districts of Chorolque, Animas, Choroma, Siete Suyos, Chocaya and Tasna, situated in the same geological trend.

The Agreement

Under the terms of the Agreement, Eloro will conduct an exploration and development program on the Property during the four-year period following the signing of a definitive agreement (the “Definitive Agreement”), which is due on or before December 31, 2019. Within 30 days following the completion of the four year period the Title Holder will convey to Eloro’s, Bolivian subsidiary, a 100% interest in the Property upon Eloro paying the amount indicated in the table below, which amount is based on the number of mineral resource tonnes at Iska Iska in the “Inferred” and/or “Indicated” categories, as such terms are defined by National Instrument 43-101 (“NI 43-101”).

| Number of Mineral Resource Tonnes at the Iska Iska Polymetallic Property in the “Inferred” and/or “Indicated” Categories as per NI 43-101. | Amount Payable |

| More than 300 million tonnes | US $10 million |

| More than 100 million tonnes but less than 300 million tonnes | US $5 million |

| More than 20 million tonnes but less than 100 million tonnes | US $3 million |

| Less than 20 million tonnes | US $1 million |

Pursuant to the Agreement, Eloro has also agreed to issue to the Title Holder 250,000 common shares within 30 days of the signing of the Definitive Agreement and a further 250,000 common shares on or before the date which is two years from the signing of the Definitive Agreement, should Eloro elect to continue with the Iska Iska exploration program at that time.

Eloro and the Title Holder have agreed to proceed to the execution and delivery of a definitive agreement (“Definitive Agreement”) on or before December 31, 2019, incorporating the terms contained in the Agreement. The execution of the Definitive Agreement is subject to the satisfactory completion by Eloro of its ongoing due diligence investigation of the Property and also subject to the approval by the Boards of Directors of Eloro and the Title Holder, and the approval of the TSX Venture Exchange, as well as the laws of the Plurinational State of Bolivia.

The Iska Iska Polymetallic Property and Due Diligence Work Completed to Date

Iska Iska is a road accessible, royalty-free property, wholly-owned by the Title Holder and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi (see Figure 1). The Property can be classified as a polymetallic (Ag, Zn, Pb, Au, Cu, Bi, Sn, In) epithermal-porphyry complex, which overprints an early higher temperature xenothermal phase.

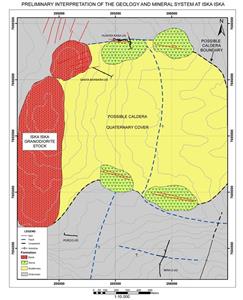

Geological mapping on the Property has revealed the spatial and temporal zonation of alteration and vein minerals in an area of about 5 square kilometres through the property area (Fig. 2). Alteration minerals include quartz, chlorite, pyrite, illite, sericite, and hematite. The polymetallic mineralization occurs mainly as veins, subsidiary vein swarms, veinlets, stockworks, and disseminated, forming a subvertical vein system in both the stock, the volcanic and sedimentary rocks. Some of the veins are "rosary" type in shear zones and tension fractures, which locally form bonanza zones and stockworks in an extensive mineralized system. Veins are typically less than 50 cm wide and have orientations between N10º at 45ºE and dips ranging from 64º SE to vertical.

The identified metallic minerals are pyrite, galena, sphalerite, complex silver-rich phases, argentite electrum, native gold, chalcopyrite and cassiterite. Gangue minerals are quartz, kaolinite, arsenopyrite, pyrrhotite, marcasite, sericite, and siderite. The mineralization represents a multiple phase (telescoped) polymetallic system with at least two stages of mineralization; an early stage with high temperature minerals as cassiterite and bismuthinite, and a lower temperature with the silver, gold, zinc, lead and copper minerals.

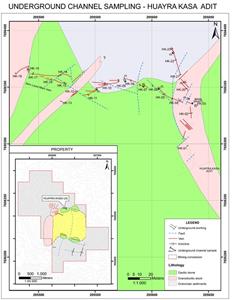

In August 2019, Eloro performed preliminary evaluation work at Iska Iska that included geological mapping and sampling, whereby 42 channel samples were collected. All of the channel samples included altered wall rock with widths ranging between 1.20 to 5.55 m, averaging 2.90 m. Four underground workings were sampled, including the Huayra Kasa which has two branches, one bearing a W-NW direction and the second oriented in a North-South direction, with the latter appearing to be more enriched in gold. Additionally, the Santa Barbara, Porco and Mine 2 adits were sampled, together with two sectors on surface. Chemical assays were performed at the ALS Laboratory in both Oruro, Bolivia (preparation) and in Lima, Peru (analysis).

The results of the channel sampling program are detailed in Table 1, and are summarized below:

- Silver. Anomalous silver values range between 35.5-694 g/t Ag (46% of channel samples).

- Gold. Anomalous gold values range between 0.31-28.6 g/t Au (42% of channel samples).

- Zinc. Anomalous zinc values range between 1.05-16.95% Zn (37% of channel samples).

- Lead. Anomalous lead values range between 0.41- 16.95% Pb (49% of channel samples).

- Copper. Anomalous copper values range between 0.1->1% (22% of channel samples).

- Bismuth. Anomalous bismuth values range between 967-7,380 g/t Bi (22% of channel samples).

- Indium. Anomalous indium values range between 10.35 - >500 g/t In (34% of channel samples).

It is significant to note that the due diligence and sampling program was performed only on approximately 15% of the total Property area.

FIGURE 1 – Iska Iska Property Location And Main Deposits In Bolivia

https://www.globenewswire.com/NewsRoom/AttachmentNg/e0b25196-9627-470a-b62e-26a4f08de467

International Mining Presence in the Department of Potosi, Bolivia

In addition to various state mining ventures, the main projects in the private/mixed mining sector in Bolivia include the San Cristobal open-pit silver, lead and zinc mine (owned by the Sumitomo Group), the San Vicente silver mine (95% owned by Pan American Silver) and the San Bartolome silver mine (owned by Argentum Investments, AB). As well, recent foreign investment and exploration in the Potosi mining district is currently being undertaken by New Pacific Metals Corp. at their flagship Silver Sand project and by Prophecy Development Corp. at its Pulacayo-Paca project.

Tom Larsen, Eloro CEO stated, “We are delighted to sign the Letter of Intent to acquire this exciting project in Bolivia, especially as this country is starting to be recognized as a “go-to” destination for foreign investment in the mineral resource sector. The results of our initial due diligence, supervised by Dr. Osvaldo Arce, P. Geo., are very positive and suggest the potential for a large polymetallic mineralized system in a similar geological setting to other major deposits in the belt. It is significant to note that this property has not been drilled to date. We look forward to finalizing the Definitive Agreement and advancing the exploration effort at Iska Iska.”

TABLE 1 – Eloro Iska Iska Channel Sampling Results

| Channel Sample No. | Width (m) 1 | Au g/t | Ag g/t | Zn % | Pb % | Cu g/t | Bi g/t | In g/t | Sn g/t | |

| HK-01 | 2.35 | 0.01 | 0.53 | 0.01 | 0.01 | 171.00 | 12.50 | 1.08 | 44.9 | Granodiorite, tr-1% py-aspy dissem |

| HK-02 | 4.10 | 0.36 | 1.39 | 0.51 | 0.44 | 519.00 | 123.00 | 4.72 | 57.8 | Granodiorite, 1% py-aspy dissem |

| HK-03 | 3.10 | 2.50 | 25.50 | 2.15 | 0.63 | 569.00 | 967.00 | 9.76 | 107.5 | Granodiorite, brecciated 3% py dissem |

| HK-04 | 3.60 | 0.85 | 10.50 | 1.99 | 0.28 | 439.00 | 52.50 | 26.30 | 71.7 | Granodiorite, py, gal, sph 3mm veinlets |

| HK-05 | 3.10 | 0.04 | 1.68 | 0.32 | 0.04 | 187.00 | 6.51 | 6.74 | 67 | Dacite, minor py, sph veinlets |

| HK-06 | 2.60 | 0.07 | 46.10 | 3.01 | 0.77 | 541.00 | 40.80 | >500 | 77.6 | Dacite, abundant dissem sulphides, massive sulphide veinlets. |

| HK-07 | 3.20 | 0.35 | 204.00 | 4.81 | 4.13 | 479.00 | 30.70 | 384.00 | 131 | Dacite, 4 veinlets 1cm wide; massive sulphides, 30cm breccia |

| HK-08 | 3.70 | 0.02 | 75.10 | 1.40 | 1.35 | 219.00 | 40.40 | 101.50 | 65.6 | Sandstone brecciated; py, aspy, gal, sph veinlets |

| HK-09 | 3.30 | 0.02 | 266.00 | 5.75 | 8.24 | 127.50 | 71.00 | 46.40 | 215 | Sandstone brecciated, 3-5cm gal, sph, py veins |

| HK-10 | 2.70 | 0.01 | 570.00 | 10.60 | 9.72 | 1510.00 | 73.00 | >500 | 250 | Sandstone brecciated, abundant sph, gal, py, aspy veinlets |

| HK-11 | 2.40 | <0.01 | 1.67 | 0.69 | 0.15 | 83.80 | 23.70 | 9.68 | 36.6 | Granodiorite, tr-1% fine sulph dissem. |

| HK-12 | 3.15 | <0.01 | 3.78 | 1.29 | 0.80 | 105.50 | 1.94 | 5.67 | 81.4 | Dacite, local fine dissem sulphides, sph, gal; 5 veinlets |

| HK-13 | 2.25 | <0.01 | 3.10 | 0.39 | 0.15 | 111.00 | 1.25 | 9.55 | 68.8 | Dacite, local fine dissem sulphides |

| HK-14 | 2.90 | 0.04 | 13.60 | 0.38 | 0.43 | 171.50 | 4.12 | 2.82 | 52.1 | Granodiorite fine disseminated py |

| HK-15 | 2.50 | <0.01 | 1.82 | 1.05 | 0.03 | 104.50 | 1.81 | 2.07 | 66.8 | Dacite, boxworks FeOx, 3cm sph, py veinlets |

| HK-16 | 2.15 | <0.01 | 0.85 | 0.08 | 0.01 | 148.00 | 2.02 | 0.99 | 38.7 | Granodiorite 1% fine dissem sulphides |

| HK-17 | 3.00 | <0.01 | 5.99 | 0.31 | 0.25 | 130.00 | 3.06 | 1.83 | 102.5 | Dacite 1% fine dissem sulphides |

| HK-18 | 3.85 | 0.03 | 362.00 | 9.23 | 9.53 | 327.00 | 66.80 | 23.00 | >500 | Dacite carbonaceous, 5mm sph, gal veinlets, abundant sulphides dissem |

| HK-19 | 3.00 | 0.03 | 37.70 | 1.51 | 1.33 | 435.00 | 44.10 | 8.95 | >500 | Mine front-end, granodiorite cpy, py, gn, sph veinlets & dissem |

| HK-20 | 2.95 | 15.50 | 7.58 | 0.25 | 0.07 | 617.00 | 5860.00 | 1.04 | 23.4 | N-S gallery, brecciated granodiorite 1 cm 3 gn veins, 1-2% dissem py |

| HK-21 | 3.35 | 0.34 | 2.60 | 0.51 | 0.07 | 150.00 | 100.50 | 3.95 | 25 | Sandstone FeOx stockwork-sulphides |

| HK-22 | 2.90 | 9.10 | 73.70 | 3.80 | 1.70 | 750.00 | 1230.00 | 323.00 | 65.5 | Sandstone networkpy, boxwork FeOx, massive aspy, 3% dissem sulphides |

| HK-23 | 2.90 | 12.35 | 57.40 | 1.86 | 1.44 | 191.00 | 1200.00 | 19.35 | 42 | Sandstone 2-5cm abundant veins gn-sph |

| HK-24 | 2.56 | 0.03 | 3.03 | 0.01 | 0.21 | 423.00 | 36.70 | 7.09 | 185 | Granodiorite 10 py veinlets, 1% fine dissem sulphides |

| HK-25 | 2.55 | 0.32 | 26.90 | 0.01 | 1.16 | 401.00 | 162.50 | 28.50 | >500 | Mine front-end granodiorite fine dissem sulphides |

| HK-26 | 2.55 | 2.71 | 295.00 | 0.02 | 0.48 | >10000 | 3160.00 | 24.10 | >500 | Qtz Sandstone py-aspy veinlets, 10cm massive sulphide veins |

| HK-27 | 1.25 | 1.61 | 55.70 | 0.01 | 0.11 | >10000 | 503.00 | 4.78 | >500 | Similar to former channel sample, abund py, pyrrh, cpy, calcoc |

| HK-28 | 3.35 | 1.65 | 321.00 | 0.00 | 0.35 | 2920.00 | 1850.00 | 16.85 | >500 | Qtz sandstone, euhedral crystalspy, po, fine dissem sulphides |

| HK-29 | 1.96 | 0.60 | 68.70 | 0.01 | 0.01 | >10000 | 1500.00 | 10.35 | >500 | Qtz sandstone massive sulph vns, py-aspy intergrowths,-veinlets |

| HK-30 | 2.10 | 0.01 | 1.72 | 0.01 | 0.00 | 129.00 | 6.31 | 0.50 | 127.50 | Qtz sandstone with 3% dissem sulphides, sporadic coarse py dissem |

| HK-31 | 2.30 | 2.60 | 288.00 | 0.01 | 0.42 | 1430.00 | 2850.00 | 10.60 | >500 | Qtz sandstone oxidized-bleached, stockwork FeOx |

| HK-32 | 4.60 | 0.02 | 2.90 | 0.02 | 0.01 | 1375.00 | 21.40 | 0.83 | 75.40 | Granodiorite oxidized micaceous, 5 mm FeOx veinlets |

| HK-33 | 5.55 | 0.11 | 4.06 | 0.02 | 0.17 | 1025.00 | 18.35 | 5.21 | 40.40 | Similar to former channel sample |

| HK-34 | 2.10 | 0.02 | 1.61 | 0.00 | 0.01 | 47.40 | 17.70 | 0.69 | 59.00 | Granodiorite brecciated, specularite matrix, dacite clasts |

| HK-35 | 2.30 | 0.01 | 0.55 | 0.00 | 0.01 | 20.20 | 6.17 | 0.58 | 43.60 | Similar to former channel sample |

| HK-36 | 1.60 | 2.14 | 8.99 | 0.01 | 0.72 | 166.50 | 646.00 | 5.84 | 30.90 | Granodiorite brecciated, massive sulphide vein |

| HK-37 | 1.80 | 0.08 | 1.43 | 0.01 | 0.07 | 112.50 | 8.97 | 3.88 | 90.00 | Granodiorite, FeOx veinlets |

| HK-38 | 1.20 | 28.60 | 61.60 | 0.01 | 0.41 | 3140.00 | 7380.00 | 4.37 | 17.00 | Massive sulphide vein 30 cm, py, po, cpy in altered granodiorite |

| HK-39 | 5.30 | 0.15 | 1.15 | 0.00 | 0.01 | 137.50 | 42.10 | 1.13 | 65.50 | Granodiorite brecciated w/sulphidic matrix |

| HK-40 | 3.16 | 2.18 | 68.90 | 3.75 | 3.75 | 539.00 | 334.00 | 5.44 | 311.00 | Qtz Sandstone massive sulphides cpy, py, gn, sph, dissem, veinlets |

| HK-41 | 2.15 | 0.19 | 73.40 | 1.08 | 1.08 | 348.00 | 428.00 | 32.20 | 171.50 | Similar to former channel sample, though includes stockwork py |

| HK-42 | 2.70 | 0.01 | 694.00 | 16.95 | 16.95 | 644.00 | 37.00 | >500 | 181.50 | Sandstone brecciated, abundant sph, gn, py, aspy vnlts |

1. Reported channel sample widths are approximately 90% of true widths.

2. Abbreviations py=pyrite, gn=galena, sph=sphalerite, dissem=disseminated, aspy=arsenopyrite, qtz=quartz, FeOx=iron oxide, po=pyrrhotite, tr=trace, mm=millimetre, cm=centimetre

FIGURE 2 – Preliminary Interpretation of Iska Iska Geology and Mineral System (see Figure 3 for location map).

https://www.globenewswire.com/NewsRoom/AttachmentNg/f67b745c-e94a-4c20-84b2-a03493ae3151

FIGURE 3 – Underground Channel Sampling Iska Iska Property (Huayra Kasa Adit)

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0dfd6fc-084b-4c0f-8faf-154a2678d827

Qualified Person

Dr. Osvaldo Arce, P. Geo., an expert on Bolivian geology and a Qualified Person in the context of NI 43-101 supervised the due diligence work completed at Iska Iska by Eloro. Dr. Bill Pearson, P.Geo., a Qualified Person in the context of National Instrument 43-101 has reviewed and approved the technical content of this news release. Chemical assays were performed at the ALS Laboratory in both Oruro, Bolivia (preparation) and in Lima, Peru (analysis). ALS Laboratory employs an industry standard QA/QC program. Eloro Resources will utilize an independent QA/QC program including blanks, duplicates and external standards for its planned exploration program at Iska Iska.

Quality Assurance Quality Control Procedures and Protocol Employed by Eloro Resources Ltd.

The integrity of a resource database is fundamental to Eloro’s success in securing debt or equity finance for a new mining project. The validity and quality of data can only be guaranteed when appropriate sampling and assaying protocols have been implemented. Eloro has implemented Quality Assurance/Quality Control (QA/QC) programs in its projects applied during all phases of sampling programmes. QA/QC programmes are carefully designed and implemented at all stages of exploration and development where sampling of material is undertaken. Furthermore, QA/QC programs will require review prior to, and during, each sampling programme with modifications made where necessary based on numerous factors such as sample type, size, and the proposed sample processing and treatment methods.

Eloro acknowledges that QA/QC is required to ensure all chemical data generated over the course of a sampling programme during the overall exploration. The key areas subject to QA/QC auditing prior to mineral resource estimation will be project-specific protocols and available sample data from QA/QC sampling and analysis.

Project-specific protocols, often in the form of Standard Operations Procedures (“SOPs”), will be in place before any sampling commences. SOPs should outline the procedures and operating practices to be implemented during the sampling programmes, from the initial set up of the drill rig through to the analysis of QA/QC data upon receipt of the sampling results. SOPs help to ensure that a culture of QA/QC is established throughout sampling programmes, and also aid in identifying areas of risk within a procedure where errors could occur.

Three essential stages which are applicable to all projects are the following:

- It will be standard practice to include the right mix of QA/QC materials in every batch of samples submitted to a laboratory.

- The geologist/technician initiating the analysis will critically review the results of all QA/QC samples within a sample batch as soon as the results are received from the laboratory. This will be undertaken prior to the associated data being included within the resource database, and used to update any resource models.

- Action must be taken when QA/QC results fall outside of predetermined acceptable limits.

QA/QC materials inserted into sample streams will be used to assess the three fundamental aspects (precision, accuracy, identification of errors) of QA/QC. Best practice QA/QC programmes will include a combination of the following QA/QC materials:

Primary Standards (or Standards, Certified Reference Materials (“CRMs”)

Material with a known metal content and specific chemical characteristics similar to the mineralisation being sampled, will be utilised to evaluate bias within a sample dataset. These can be externally sourced commercial standards (CRMs) or company ‘in house’ standards (which require a specific QA/QC analytical testing programme). For example Eloro has reviewed projects in the past where in order of 10 different standards were used with some standards being only inserted into the sample stream 2 or 3 times, therefore not providing a large enough population for meaningful assessment.

Blank Samples

Samples containing no detectable trace of the key mineral(s) identified within the resource will be inserted into sample streams to identify the presence of any contamination introduced at the laboratory or in sample preparation. Alternatively, quantities of material suitable for use as blanks will be purchased commercially. Blank samples allow the QP to monitor the cleanliness of the sample preparation equipment (on site or at the laboratory) and calibration of analytical equipment.

Duplicates

‘Field’ duplicate samples will be formed from splitting the original sample interval into equal portions and submitting both samples for analysis (pulp duplicates should be taken by the laboratory of choice during sample preparation). A drawback with following pre-determined duplication (i.e. every 20 samples) is that it can lead to many repeats of background (waste) material.

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of gold and base-metal properties in Peru and Quebec. Eloro owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of Barrick's Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine. The Property consists of eight mining concessions and eight mining claims encompassing approximately 89 square kilometres. The Property has good infrastructure with access to road, water and electricity and is located at an altitude that ranges from 3,100 m to 4,200 m above sea level.

For further information please contact either Thomas G. Larsen, President and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.