Eloro Resources Intersects 198.00 g Ag eq/t (67.79 g Ag/t, 1.44% Zn and 1.04% Pb) over 134.47m in Silver-Rich Area of High-Grade Feeder Zone in Santa Barbara Target Area at the Iska Iska Silver-Tin Polymetallic Project, Potosi Department, Bolivia

- This intersection in hole DSB-31, drilled 200m southeast of the Santa Barbara adit, includes a higher-grade portion grading 566.36 g Ag eq/t (246.26 g Ag/t, 3.72% Zn and 3.88% Pb) over 25.51m.

- Additional significant intersections in this hole include:

- 161.54 g Ag eq/t (32.14 g Ag/t, 1.94% Zn and 0.76% Pb) over 82.12m,

- 123.24 g Ag eq/t (9.23 g Ag/t, 1.44% Zn, 0.26% Pb and 0.07% Sn) over 62.23m, and

- 126.21 g Ag eq/t (6.05 g Ag/t, 1.58% Zn and 0.52% Pb) over 81.12m

- Overall, 51% of the overall length of this 987.99m long hole yielded reportable intersections, which collectively average 139.44 g Ag eq/t.

- The high-grade silver zone intersected in hole DSB-31 appears to be in the same structural-mineralized corridor as the silver-rich zone in the Santa Barbara adit. As previously reported channel sampling along the adit returned 441.98 g Ag eq/t (164.96 g Ag/t, 0.23 g Au/t, 3.46% Pb and 0.46% Sn) over 165.89m. Adjusted to prices used in this current release, the overall Ag eq/t value is 493.61 g Ag eq/t.

- Hole DSB-33 drilled at an azimuth of 2250 with a dip of -600 to test the southwest limit of the high-grade feeder zone in the vicinity of the Central Breccia intersected 18 reportable intersections including a very high tin intersection grading 1.41% Sn over 21.25m which included a 9.04m section that graded 3.08% Sn. A total of 26% of this hole contained reportable intersections which collectively averaged 123.39 g Ag eq/t.

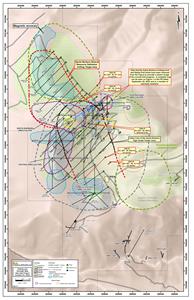

TORONTO, Oct. 05, 2022 (GLOBE NEWSWIRE) -- Eloro Resources Ltd. (TSX-V: ELO; OTCQX: ELRRF; FSE: P2QM) (“Eloro”, or the “Company”) is pleased to announce assay results from two (2) additional diamond drill holes from its on-going drilling program at the Iska Iska silver-tin polymetallic project in the Potosi Department, southern Bolivia. One drill hole, DSB-31, tested the potential south-southeastern extension of the high-grade feeder zone at Santa Barbara while the second hole, DSB-33, tested the southwest limit of the zone in the vicinity of the Central Breccia, as shown in Figure 1.

In its September 20, 2022 press release, the Company reported that new downhole geophysical data has significantly extended the strike length of the high-grade feeder zone at Santa Barbara a further 250m along strike to the south-southeast from existing drilling. The 3D inverse magnetic model which correlates very strongly with the conductive zone suggests that the high-grade feeder zone may extend across the entire caldera for as much as a further 1 km along strike for a total potential strike length of at least 2 km. As previously reported, the definition drill program has been modified to sectionally drill this potential extension with the intention of defining a major open-pittable deposit in the valley of the caldera. As a result, the estimated completion date for the maiden National Instrument 43-101 mineral resource has been pushed back to the end of Q1 2023.

Overall, the Company has completed 77,182m in 119 drill holes to-date at Iska Iska, including four holes in progress, as shown in Figure 1. Tables 1 and 2 list significant assay results for the drill holes reported. Prices used for calculating Ag equivalent grades are as outlined in Eloro’s July 21, 2022 press release. Table 3 summarizes drill holes with assays pending. Highlights for the drilling are as follows:

Santa Barbara High Grade Feeder Zone Extension Definition Drilling

Hole DSB-31 was drilled to test the potential south-southeastern extension of the Santa Barbara High Grade Feeder Zone shown in Figure 1. This hole was collared approximately 200m south-southeast of the underground drill bay in the Santa Barbara adit and was drilled at an azimuth of 2250 with a dip of -600. This hole intersected several extensive high grade silver zones:

- 198.00 g Ag eq/t (67.79 g Ag/t, 1.44% Zn and 1.04% Pb) over 134.47m from 11.61m to 146.06m, including a higher-grade portion of 566.36 g Ag eq/t (246.26 g Ag/t, 3.72% Zn and 3.88% Pb) over 25.51m from 113.09m to 138.60m,

- 161.54 g Ag eq/t (32.14 g Ag/t, 1.94% Zn and 0.76% Pb) over 82.12m from 168.46m to 250.58m including a higher-grade portion of 384.21 g Ag eq/t (104.09 g Ag/t, 3.74% Zn and 2.34% Pb) over 19.14m from 210.45m to 229.59m,

- 123.24 g Ag eq/t (9.23 g Ag/t, 1.44% Zn, 0.26% Pb and 0.07% Sn) over 62.23m from 466.48m to 528.65m including higher-grade portions of 202.40 g Ag eq/t (13.75 g Ag/t, 2.46% Zn, 0.33% Pb and 0.12 Sn) over 20.63m from 480.00 to 500.63m and 166.76 g Ag eq/t (9.76 g Ag/t, 1.83% Zn, 0.50% Pb and 0.11 Sn) over 13.05m from 515.60 to 528.65m.

- 126.21 g Ag eq/t (6.05 g Ag/t, 1.58% Zn and 0.52% Pb) over 81.12m from 614.21m to 695.33m

- 120.39 g Ag eq/t (8.32 g Ag/t, 1.78% Zn and 0.06% Pb) over 11.99m from 900.33m to 912.32m

- Overall, 51% of the overall length of this 987.99m long hole yielded reportable intersections, which collectively average 139.44 g Ag eq/t.

The high-grade silver zone intersected in hole DSB-31 appears to be in the same structural-mineralized corridor as the silver-rich zone in the Santa Barbara adit. As previously reported (see press release dated April 13, 2021), channel sampling along the adit returned 441.98 g Ag eq/t (164.96 g Ag/t, 0.23 g Au/t, 3.46% Pb and 0.46% Sn) over 165.89m. Adjusted to prices used in this current release, the overall Ag eq/t value is 493.61 g Ag eq/t.

Hole DSB-33 was drilled at an azimuth of 2250 with a dip of -600 to test the southwest limit of the high-grade feeder zone in the vicinity of the Central Breccia (Figure 1). This hole intersected 18 reportable intersections including a very high tin intersection grading 1.41% Sn over 21.25m from 354.98m to 376.23m. This included a 9.04m section from 356.56m to 365.60m that graded 3.08% Sn. A total of 26% of this 825.82m hole contained reportable intersections which collectively averaged 123.39 g Ag eq/t.

Tom Larsen, CEO of Eloro said: “Hole DSB-31 and Hole DSB-33 continue to confirm high grade values of metals, especially silver to the south-southeast and tin to the southwest of the ever-expanding Santa Barbara feeder system. The geophysical surveys have been remarkable as a tool in determining where these highly conductive areas of potential commercial mineralization are located.

On behalf of the Eloro shareholders, I congratulate Dr. Bill Pearson, P.Geo., Dr. Chris Hale, P.Geo. and Dr. Osvaldo Arce, P.Geo., in systematically defining the Santa Barbara feeder system through geophysics and follow up drilling. The added strike length along the collapsed caldera valley floor will further extend the likely open pit dimensions resulting in potentially stronger economics. These recently released holes at Iska Iska further demonstrate both high grade metal zonation and substantial tonnage potential.”

Dr. Bill Pearson, P.Geo. Eloro’s Executive Vice President, Exploration commented: “We are continuing our 100m-spaced sectional definition diamond drill program focusing on testing the south-southeastern extension of the high-grade feeder zone across the valley of the Iska Iska Caldera. Figure 1 shows holes in progress and planned. Our aim is to complete this program by November so that assay results can be received by early Q1 2023 to facilitate completion of the inaugural NI 43-101 mineral resource by the end of Q1 2023. We are also continuing to work closely with GeologicAI and our mineralogists in Blue Coast Research and Lisa Can Analytical Solutions to calibrate the AI in the scanning system to track the mineral and metal zoning more accurately. The drilling results reported herein, as well as previous results, along with on-site work by Dr. Osvaldo Arce, P.Geo. and his geological team, support the potential for outlining significant zones of high-grade silver and high-grade tin. The high-grade silver is typically shallower whereas the high-grade tin is generally deeper. The remarkable feeder zone at Iska Iska continues to be open along strike and down-dip especially to the south-southeast and it likely extends across a width of least 500m for potentially as much as 2km along strike.”

Figure 1 – Geological Plan Map showing Drilling in Santa Barbara Area with Holes referred to in this release highlighted: https://www.globenewswire.com/NewsRoom/AttachmentNg/3c88f4da-0f6f-4d43-8335-35382ad973fb

Table 1: Significant Results, Surface Diamond Drilling, Santa Barbara Resource Definition High Grade Feeder Zone Extension as at October 5, 2022.

| SANTA +A1:M40BARBARA RESOURCE DEFINITION - HIGH GRADE FEEDER ZONE EXTENSION | ||||||||||||

| SURFACE DIAMOND DRILLING | ||||||||||||

| Hole No. | From (m) | To (m) | Length (m) | Ag | Au | Zn | Pb | Cu | Sn | Bi | Cd | Ag eq |

| g/t | g/t | % | % | % | % | % | % | g/t | ||||

| DSB-31 | 4.95 | 6.95 | 2.00 | 5.00 | 0.01 | 0.00 | 0.08 | 0.01 | 0.12 | 0.002 | 0.001 | 57.14 |

| 11.61 | 146.06 | 134.47 | 67.79 | 0.02 | 1.44 | 1.04 | 0.11 | 0.03 | 0.002 | 0.006 | 198.00 | |

| Incl. | 63.57 | 81.01 | 17.44 | 30.89 | 0.01 | 2.84 | 0.28 | 0.50 | 0.01 | 0.001 | 0.013 | 245.09 |

| Incl. | 113.09 | 138.60 | 25.51 | 246.26 | 0.01 | 3.72 | 3.88 | 0.02 | 0.03 | 0.001 | 0.013 | 566.36 |

| 159.65 | 161.00 | 1.35 | 6.00 | 0.01 | 1.34 | 0.14 | 0.01 | 0.01 | 0.001 | 0.002 | 83.05 | |

| 168.46 | 250.58 | 82.12 | 32.14 | 0.03 | 1.94 | 0.76 | 0.01 | 0.01 | 0.003 | 0.006 | 161.54 | |

| Incl. | 210.45 | 229.59 | 19.14 | 104.09 | 0.10 | 3.74 | 2.34 | 0.02 | 0.02 | 0.010 | 0.012 | 384.21 |

| 264.11 | 267.08 | 2.97 | 6.51 | 0.04 | 1.30 | 0.20 | 0.01 | 0.01 | 0.001 | 0.003 | 85.59 | |

| 307.67 | 327.03 | 19.36 | 3.54 | 0.21 | 0.94 | 0.14 | 0.01 | 0.01 | 0.001 | 0.003 | 78.57 | |

| 345.24 | 348.19 | 2.95 | 3.00 | 0.16 | 0.54 | 0.09 | 0.01 | 0.01 | 0.001 | 0.001 | 52.70 | |

| 364.59 | 378.07 | 13.48 | 5.79 | 0.08 | 0.94 | 0.41 | 0.02 | 0.02 | 0.001 | 0.003 | 82.02 | |

| 394.48 | 403.47 | 8.99 | 4.47 | 0.11 | 1.36 | 0.22 | 0.01 | 0.02 | 0.001 | 0.007 | 97.48 | |

| 420.12 | 424.66 | 4.54 | 5.69 | 0.01 | 0.97 | 0.58 | 0.01 | 0.04 | 0.001 | 0.005 | 90.06 | |

| 433.72 | 435.27 | 1.55 | 4.00 | 0.01 | 0.90 | 0.16 | 0.01 | 0.02 | 0.001 | 0.003 | 62.06 | |

| 447.40 | 448.67 | 1.27 | 5.00 | 0.01 | 1.45 | 0.16 | 0.01 | 0.02 | 0.001 | 0.006 | 89.96 | |

| 466.48 | 528.65 | 62.23 | 9.23 | 0.05 | 1.44 | 0.26 | 0.01 | 0.07 | 0.001 | 0.007 | 123.24 | |

| Incl. | 480.00 | 500.63 | 20.63 | 13.75 | 0.10 | 2.46 | 0.33 | 0.02 | 0.12 | 0.001 | 0.012 | 202.40 |

| Incl. | 515.60 | 528.65 | 13.05 | 9.76 | 0.06 | 1.83 | 0.50 | 0.01 | 0.11 | 0.001 | 0.007 | 166.76 |

| 536.20 | 537.71 | 1.51 | 5.00 | 0.01 | 1.11 | 0.22 | 0.01 | 0.11 | 0.001 | 0.004 | 110.12 | |

| 546.66 | 551.16 | 4.50 | 13.06 | 0.07 | 1.33 | 0.37 | 0.01 | 0.09 | 0.001 | 0.006 | 131.42 | |

| 560.18 | 561.68 | 1.50 | 2.00 | 0.52 | 0.57 | 0.02 | 0.00 | 0.01 | 0.004 | 0.002 | 83.36 | |

| 579.65 | 584.14 | 4.49 | 3.96 | 0.10 | 1.08 | 0.09 | 0.01 | 0.07 | 0.001 | 0.004 | 95.98 | |

| 597.54 | 603.69 | 6.15 | 3.48 | 0.01 | 0.95 | 0.08 | 0.01 | 0.06 | 0.001 | 0.003 | 76.70 | |

| 614.21 | 695.33 | 81.12 | 6.05 | 0.11 | 1.58 | 0.52 | 0.01 | 0.03 | 0.008 | 0.007 | 126.66 | |

| 720.94 | 722.52 | 1.58 | 6.00 | 0.01 | 1.88 | 0.38 | 0.01 | 0.01 | 0.001 | 0.008 | 118.30 | |

| 751.11 | 752.57 | 1.46 | 11.00 | 0.07 | 1.49 | 0.24 | 0.01 | 0.01 | 0.039 | 0.007 | 113.89 | |

| 785.82 | 787.27 | 1.45 | 1.00 | 0.01 | 0.91 | 0.08 | 0.02 | 0.03 | 0.001 | 0.004 | 62.35 | |

| 801.06 | 802.50 | 1.44 | 7.00 | 0.01 | 1.36 | 0.20 | 0.01 | 0.04 | 0.002 | 0.006 | 97.34 | |

| 812.88 | 841.63 | 28.75 | 4.05 | 0.05 | 0.60 | 0.24 | 0.01 | 0.06 | 0.006 | 0.002 | 71.20 | |

| 874.65 | 876.18 | 1.53 | 2.00 | 0.23 | 0.44 | 0.28 | 0.01 | 0.02 | 0.008 | 0.001 | 65.06 | |

| 880.67 | 883.63 | 2.96 | 7.00 | 1.08 | 0.17 | 0.06 | 0.01 | 0.07 | 0.019 | 0.001 | 144.91 | |

| 895.70 | 897.22 | 1.52 | 0.50 | 0.02 | 0.43 | 0.01 | 0.01 | 0.15 | 0.001 | 0.001 | 82.37 | |

| 900.33 | 912.32 | 11.99 | 8.32 | 0.05 | 1.78 | 0.06 | 0.03 | 0.04 | 0.007 | 0.008 | 120.39 | |

| 919.97 | 921.50 | 1.53 | 3.00 | 0.33 | 0.22 | 0.27 | 0.10 | 0.04 | 0.050 | 0.001 | 91.51 | |

| 924.46 | 929.01 | 4.55 | 10.68 | 0.45 | 0.13 | 0.07 | 0.06 | 0.07 | 0.022 | 0.001 | 98.80 | |

| 975.85 | 981.93 | 6.08 | 1.76 | 0.15 | 0.54 | 0.01 | 0.06 | 0.01 | 0.005 | 0.002 | 55.16 | |

| 986.50 | 987.99 | 1.49 | 1.00 | 0.51 | 0.04 | 0.01 | 0.04 | 0.01 | 0.014 | 0.001 | 61.61 | |

Note: True width of the mineralization is not known at the present time, but based on the current understanding of the relationship between drill orientation/inclination and the mineralization within the breccia pipes and the host rocks such as sandstones and dacites, it is estimated that true width ranges between 70% and 90% of the down hole interval length but this will be confirmed by further drilling and geological modelling.

Chemical symbols: Ag= silver, Au = gold, Zn = zinc, Pb = lead, Cu = copper, Sn = tin, Bi = bismuth, Cd = cadmium and g Ag eq/t = grams silver equivalent per tonne. Quantities are given in percent (%) for Zn, Pb Cu, Sn, Bi and Cd and in grams per tonne (g/t) for Ag, Au and Ag eq.

Metal prices and conversion factors used for calculation of g Ag eq/t (grams Ag per grams x metal ratio) are as follows: (Prices updated as of July 21, 2022, to more accurately reflect current metal prices):

| Element | Price $US (per kg) | Ratio to Ag | |

| Ag | $ | 607.00 | 1.0000 |

| Sn | $ | 23.55 | 0.0589 |

| Zn | $ | 2.98 | 0.0046 |

| Pb | $ | 1.92 | 0.0032 |

| Au | $ | 54,932.80 | 79.7221 |

| Cu | $ | 7.00 | 0.0134 |

| Bi | $ | 12.76 | 0.0177 |

| Cd | $ | 5.50 | 0.0076 |

In calculating the intersections reported in this press release a sample cutoff of 30 g Ag eq/t was used with generally a maximum dilution of 3 continuous samples below cutoff included within a mineralized section unless more dilution is justified geologically.

The equivalent grade calculations are based on the stated metal prices and are provided for comparative purposes only, due to the polymetallic nature of the deposit. Metallurgical tests are in progress by Blue Coast Ltd. to establish levels of recovery for each element reported but currently the potential recovery for each element has not yet been established. While there is no assurance that all or any of the reported concentrations of metals will be recoverable, Bolivia has a long history of successfully mining and processing similar polymetallic deposits which is well documented in the landmark volume “Yacimientos Metaliferos de Bolivia” by Dr. Osvaldo R. Arce Burgoa, P.Geo.

Table 2: Significant Results, Surface Diamond Drilling, Santa Barbara Resource Definition High Grade Feeder Zone Extension as at October 5, 2022.

| SANTA BARBARA RESOURCE DEFINITION - HIGH GRADE FEEDER ZONE EXTENSION | ||||||||||||

| SURFACE DIAMOND DRILLING | ||||||||||||

| Hole No. | From (m) | To (m) | Length (m) | Ag | Au | Zn | Pb | Cu | Sn | Bi | Cd | Ag eq |

| g/t | g/t | % | % | % | % | % | % | g/t | ||||

| DSB-33 | 20.83 | 46.70 | 25.87 | 4.08 | 0.03 | 0.00 | 0.07 | 0.00 | 0.20 | 0.004 | 0.001 | 87.32 |

| 100.80 | 102.32 | 1.52 | 27.00 | 0.02 | 0.00 | 0.00 | 0.01 | 0.05 | 0.003 | 0.001 | 50.05 | |

| 106.83 | 108.34 | 1.51 | 35.00 | 0.06 | 0.00 | 0.00 | 0.02 | 0.05 | 0.005 | 0.001 | 61.23 | |

| 121.94 | 136.62 | 14.68 | 6.73 | 0.04 | 0.00 | 0.02 | 0.06 | 0.09 | 0.002 | 0.001 | 51.83 | |

| 144.28 | 153.26 | 8.98 | 7.28 | 0.01 | 0.00 | 0.01 | 0.29 | 0.05 | 0.002 | 0.001 | 60.17 | |

| 201.04 | 202.51 | 1.47 | 38.00 | 0.02 | 0.00 | 0.00 | 0.22 | 0.19 | 0.001 | 0.001 | 139.68 | |

| 208.60 | 216.10 | 7.50 | 50.59 | 0.06 | 0.00 | 0.00 | 0.03 | 0.03 | 0.001 | 0.001 | 73.61 | |

| 259.92 | 282.51 | 22.59 | 16.39 | 0.05 | 0.00 | 0.02 | 0.12 | 0.11 | 0.008 | 0.001 | 77.88 | |

| Incl. | 262.93 | 268.89 | 5.96 | 32.45 | 0.08 | 0.00 | 0.06 | 0.15 | 0.16 | 0.012 | 0.001 | 124.97 |

| 285.57 | 287.07 | 1.50 | 12.00 | 0.01 | 0.00 | 0.00 | 0.08 | 0.14 | 0.006 | 0.001 | 76.95 | |

| 293.00 | 294.53 | 1.53 | 12.00 | 0.01 | 0.00 | 0.00 | 0.14 | 0.08 | 0.028 | 0.001 | 64.42 | |

| 308.15 | 344.40 | 36.25 | 9.07 | 0.04 | 0.00 | 0.05 | 0.10 | 0.11 | 0.013 | 0.001 | 71.97 | |

| 354.98 | 376.23 | 21.25 | 8.86 | 0.11 | 0.00 | 0.01 | 0.01 | 1.41 | 0.003 | 0.001 | 566.51 | |

| Incl. | 356.56 | 365.60 | 9.04 | 16.16 | 0.20 | 0.00 | 0.02 | 0.00 | 3.08 | 0.004 | 0.001 | 1,230.26 |

| 385.32 | 386.83 | 1.51 | 0.50 | 0.01 | 0.00 | 0.00 | 0.01 | 0.13 | 0.001 | 0.001 | 51.09 | |

| 391.35 | 392.86 | 1.51 | 1.00 | 0.04 | 0.00 | 0.01 | 0.01 | 0.19 | 0.003 | 0.001 | 81.11 | |

| 414.03 | 418.62 | 4.59 | 2.34 | 0.01 | 0.00 | 0.00 | 0.08 | 0.11 | 0.003 | 0.001 | 55.48 | |

| 438.20 | 442.73 | 4.53 | 1.50 | 0.02 | 0.00 | 0.00 | 0.10 | 0.20 | 0.058 | 0.001 | 104.47 | |

| 450.28 | 459.46 | 9.18 | 37.12 | 0.06 | 0.00 | 0.01 | 0.00 | 0.04 | 0.003 | 0.001 | 61.31 | |

| 464.05 | 465.51 | 1.46 | 9.00 | 0.28 | 0.00 | 0.02 | 0.01 | 0.05 | 0.004 | 0.001 | 55.65 | |

| 483.70 | 485.23 | 1.53 | 1.00 | 0.01 | 0.00 | 0.00 | 0.56 | 0.00 | 0.002 | 0.001 | 67.89 | |

| 491.26 | 495.82 | 4.56 | 1.66 | 0.01 | 0.00 | 0.00 | 0.79 | 0.00 | 0.001 | 0.001 | 94.74 | |

| 503.50 | 515.53 | 12.03 | 8.41 | 0.14 | 0.01 | 0.02 | 0.14 | 0.05 | 0.034 | 0.001 | 67.13 | |

| 543.06 | 544.51 | 1.45 | 0.50 | 0.02 | 0.03 | 0.00 | 0.00 | 0.15 | 0.053 | 0.001 | 74.71 | |

| 576.00 | 579.08 | 3.08 | 1.25 | 0.02 | 1.26 | 0.01 | 0.00 | 0.01 | 0.001 | 0.002 | 67.01 | |

| 589.42 | 592.47 | 3.05 | 2.00 | 0.02 | 0.15 | 0.01 | 0.14 | 0.09 | 0.030 | 0.001 | 70.21 | |

| 596.95 | 598.45 | 1.50 | 0.50 | 0.02 | 0.06 | 0.01 | 0.00 | 0.16 | 0.005 | 0.001 | 67.93 | |

| 613.44 | 619.40 | 5.96 | 3.91 | 0.27 | 0.06 | 0.01 | 0.01 | 0.05 | 0.017 | 0.001 | 57.66 | |

| 664.45 | 665.95 | 1.50 | 10.00 | 0.09 | 0.82 | 0.03 | 0.02 | 0.03 | 0.001 | 0.001 | 74.02 | |

| 673.43 | 682.44 | 9.01 | 15.66 | 0.26 | 0.01 | 0.01 | 0.10 | 0.11 | 0.125 | 0.001 | 121.80 | |

| 706.44 | 707.96 | 1.52 | 5.00 | 0.03 | 1.14 | 0.07 | 0.01 | 0.02 | 0.004 | 0.003 | 76.52 | |

| 800.12 | 801.63 | 1.51 | 1.00 | 0.08 | 0.02 | 0.02 | 0.01 | 0.02 | 0.236 | 0.001 | 66.65 | |

| 822.87 | 825.82 | 2.95 | 13.39 | 0.01 | 0.21 | 0.02 | 0.20 | 0.14 | 0.013 | 0.001 | 104.16 | |

See Note Table 1.

Table 3: Summary of Diamond Drill Holes Completed with Assays Pending and Drill Holes in Progress at Iska Iska from October 5, 2022 press release.

| SUMMARY DIAMOND DRILLING ISKA ISKA | |||||||

| Hole No. | Type | Collar Easting | Collar Northing | Elev | Azimuth | Angle | Hole Length (m) |

| Surface Drilling Santa Barbara Resource Definition South-Southeast Extension | |||||||

| DSB-34 | S | 205274.0 | 7655896.1 | 4224.5 | 225° | -60° | 851.4 |

| DSB-35 | S | 205016.0 | 7656179.1 | 4360.0 | 225° | -60° | 1061.4 |

| DSB-36 | S | 205729.9 | 7656034.6 | 4054.8 | 225° | -60° | 935.4 |

| DSB-37 | S | 205588.0 | 7655893.0 | 4087.0 | 225° | -60° | 917.4 |

| DSB-38 | S | 205823.1 | 7655981.9 | 4035.0 | 225° | -60° | 851.5 |

| DSB-39 | S | 205684.3 | 7655839.5 | 4062.3 | 225° | -60° | 857.4 |

| DSB-40 | S | 205540.3 | 7655695.5 | 4092.7 | 225° | -60° | 1052.4 |

| DSB-41 | S | 205653.0 | 7656253.0 | 4125.0 | 225° | -60° | 842.4 |

| DSB-42 | S | 205277.0 | 7656316.0 | 4156.3 | 225° | -65° | 845.4 |

| DSB-43 | S | 205157.0 | 7656038.0 | 4301.0 | 225° | -55° | 833.1 |

| Subtotal | 9,047.8 | ||||||

| DSB-44 | S | 205611.0 | 7655624.7 | 4075.7 | 225° | -60° | In progress |

| DSB-45 | S | 205263.4 | 7656426.4 | 4240.3 | 225° | -60° | In progress |

| DSB-46 | S | 205681.7 | 7655554.1 | 4061.4 | 225° | -60° | In progress |

| Surface Drilling Santa Barbara Resource Definition Northeast Extension | |||||||

| DHK-26 | S | 205700.3 | 7656454.4 | 4180.0 | 225° | -65° | 929.4 |

| DHK-27 | S | 205529.4 | 7656222.5 | 4153.1 | 270° | -45° | 860.0 |

| DHK-28 | S | 205597.3 | 7656479.6 | 4151.4 | 225° | -65° | 968.0 |

| DHK-29 | S | 205485.7 | 7656489.5 | 4158.0 | 225° | -70° | 827.6 |

| Subtotal | 3,585.00 | ||||||

| DHK-30 | S | 205439.9 | 7656182.8 | 4192.1 | 225° | -60° | In progress |

| Santa Barbara Underground Metallurgical Hole | |||||||

| METSBUG-03 | UG | 205284.5 | 7656080.0 | 4167.1 | 270° | -35° | 707.8 |

| Subtotal | 707.8 | ||||||

| Mina 2 Target Area - Surface Drill Program Testing Magnetic Inverse Model | |||||||

| DM2-01 | S | 205943.0 | 7654215.9 | 3663.6 | 30° | -60° | 860.3 |

| Subtotal | 860.3 | ||||||

| TOTAL | 14,200.9 | ||||||

S = Surface UG=Underground; collar coordinates in metres; azimuth and dip in degrees. Total drilling completed since the start of the program on September 20, 2020 is 77,182.47m in 119 drill holes (32 underground drill holes and 87 surface drill holes) including 4 holes in progress.

Qualified Person

Dr. Osvaldo Arce, P. Geo., General Manager of Eloro’s Bolivian subsidiary, Minera Tupiza S.R.L., and a Qualified Person in the context of NI 43-101, has reviewed and approved the technical content of this news release. Dr. Bill Pearson, P.Geo., Executive Vice President Exploration Eloro, and who has more than 45 years of worldwide mining exploration experience, including extensive work in South America, manages the overall technical program, working closely with Dr. Osvaldo Arce, P.Geo. Dr. Quinton Hennigh, P.Geo., Senior Technical Advisor to Eloro and Independent Technical Advisor, Mr. Charley Murahwi P. Geo., FAusIMM of Micon are regularly consulted on technical aspects of the project.

Eloro is utilizing both ALS and AHK for drill core analysis, both of whom are major international accredited laboratories. Drill samples sent to ALS are prepared in both ALS Bolivia Ltda’s preparation facility in Oruro, Bolivia and the preparation facility operated by AHK in Tupiza with pulps sent to the main ALS Global laboratory in Lima for analysis. More recently Eloro has had ALS send pulps to their laboratory at Galway in Ireland. Eloro employs an industry standard QA/QC program with standards, blanks and duplicates inserted into each batch of samples analyzed with selected check samples sent to a separate accredited laboratory.

Drill core samples sent to AHK Laboratories are prepared in a preparation facility installed and managed by AHK in Tupiza with pulps sent to the AHK laboratory in Lima, Peru. Au and Sn analysis on these samples is done by ALS Bolivia Ltda in Lima. Check samples between ALS and AHK are regularly done as a QA/QC check. AHK is following the same analytical protocols used as with ALS and with the same QA/QC protocols. Turnaround time continues to improve, as laboratories return to more normal staffing levels.

About Iska Iska

Iska Iska silver-tin polymetallic project is a road accessible, royalty-free property, wholly controlled by the Title Holder, Empresa Minera Villegas S.R.L. and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi in southern Bolivia. Eloro has an option to earn a 99% interest in Iska Iska.

Iska Iska is a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene possibly collapsed/resurgent caldera, emplaced on Ordovician age rocks with major breccia pipes, dacitic domes and hydrothermal breccias. The caldera is 1.6km by 1.8km in dimension with a vertical extent of at least 1km. Mineralization age is similar to Cerro Rico de Potosí and other major deposits such as San Vicente, Chorolque, Tasna and Tatasi located in the same geological trend.

Eloro began underground diamond drilling from the Huayra Kasa underground workings at Iska Iska on September 13, 2020. On November 18, 2020, Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. On November 24, 2020, Eloro announced the discovery of the SBBP approximately 150m southwest of the Huayra Kasa underground workings.

Subsequently, on January 26, 2021, Eloro announced significant results from the first drilling at the SBBP including the discovery hole DHK-15 which returned 129.60 g Ag eq/t over 257.5m (29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu, 0.056%Sn, 0.0022%In and 0.0064% Bi from 0.0m to 257.5m. Subsequent drilling has confirmed significant values of Ag-Sn polymetallic mineralization in the SBBP and the adjacent CBP. A substantive mineralized envelope which is open along strike and down-dip extends around both major breccia pipes. Continuous channel sampling of the Santa Barbara Adit located to the east of SBBP returned 442 g Ag eq/t (164.96 g Ag/t, 0.46%Sn, 3.46% Pb and 0.14% Cu) over 166m including 1,092 g Ag eq/t (446 g Ag/t, 9.03% Pb and 1.16% Sn) over 56.19m. The west end of the adit intersects the end of the SBBP.

Since the initial discovery hole, Eloro has released a number of significant drill results in the SBBP and the surrounding mineralized envelope which along with geophysical data has defined an extensive target zone. In its September 20, 2022 press release, the Company reported that new downhole geophysical data has significantly extended the strike length of the high-grade feeder zone at Santa Barbara a further 250m along strike to the south-southeast from existing drilling. The 3D inverse magnetic model which correlates very strongly with the conductive zone suggests that the high-grade feeder zone may extend across the entire caldera for as much as a further 1 km along strike for a total potential strike length of at least 2 km. As reported, the definition drill program has been modified to sectionally drill this potential extension with the intention of defining a major open-pittable deposit in the valley of the caldera. As a result, the estimated completion date for the maiden National Instrument 43-101 mineral resource has been pushed back to the end of Q1 2023.

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of gold and base-metal properties in Bolivia, Peru and Quebec. Eloro has an option to acquire a 99% interest in the highly prospective Iska Iska Property, which can be classified as a polymetallic epithermal-porphyry complex, a significant mineral deposit type in the Potosi Department, in southern Bolivia. A recent NI 43-101 Technical Report on Iska Iska, which was completed by Micon International Limited, is available on Eloro’s website and under its filings on SEDAR. Iska Iska is a road-accessible, royalty-free property. Eloro also owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of Barrick’s Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine.

For further information please contact either Thomas G. Larsen, Chairman and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.