Endeavour Increases 2021 Production Guidance by 50% to 1.4 - 1.5 Million Ounces

ENDEAVOUR INCREASES 2021 PRODUCTION GUIDANCE BY 50% TO 1.4 - 1.5 MILLION OUNCES

Sabodala-Massawa expansion underway AISC guidance reduced by $40/oz Exploration budget increased by 40%

HIGHLIGHTS

- 2021 guidance has been updated to reflect the newly integrated Sabodala-Massawa and Wahgnion mines:

- Production guidance for continuing operations increased by 50% to 1.4 - 1.5Moz

- AISC guidance for continuing operations decreased by $40/oz to $840 - 890/oz

- 2021 exploration budget increased by 40% to $70 - $90m with strong focus on newly acquired assets and greenfield properties

- Construction for Sabodala-Massawa Phase 1 expansion expected to be completed by year-end; DFS for Phase 2 expansion expected by year-end

George Town, February 25, 2021 – Endeavour Mining (TSX:EDV) (OTCQX:EDVMF) is pleased to announce that it has increased its guidance for 2021 to include production from the recently integrated Sabodala-Massawa and Wahgnion mines, following completion of the Teranga Gold Corporation (“Teranga”) acquisition.

As shown in Table 1 below, consolidated 2021 production guidance for continuing operations has increased from 900,000 – 990,000 ounces to 1,350,000 – 1,475,000 ounces, while consolidated AISC guidance has decreased by $40/oz to $840 – $890/oz. The change reflects the inclusion of the Sabodala-Massawa and Wahgnion operations from February 11, 2021, which results in the addition of 450,000 – 485,000 ounces of production at AISC of below $900/oz for the 11-month period.

Table 1: Consolidated Production Guidance for Continuing Operations

| PREVIOUS GUIDANCE | UPDATED GUIDANCE | VARIANCE | |||||||

| Gold Production, koz | 900 | - | 990 | 1,350 | - | 1,475 | +450 | - | +485 |

| AISC, $/oz | 880 | - | 930 | 840 | - | 890 | (40) | - | (40) |

In addition, Endeavour is progressing with the two-phase expansion project at the Sabodala-Massawa mine to unlock the value of the Massawa deposits. The first phase, which is expected to increase production by approximately 90kozpa, has commenced and is expected to be completed by year-end. Following the positive outcome of the 2020 Pre-Feasibility Study (“PFS”) for the second phase, which outlined the potential to increase production to above 400koz per year1, a Definitive Feasibility Study (“DFS”) is underway and is expected to be completed by year-end. Further details for each phase are outlined below.

Sébastien de Montessus, President & CEO, commented: “Today’s updated 2021 guidance confirms our position as a senior, low cost, global gold producer and re-affirms our confidence in the potential of the newly acquired mines.

The integration of the Sabodala-Massawa and Wahgnion mines is progressing well as we remain focused on optimizing operations and delivering on the anticipated synergies. We are therefore moving forward with the Phase 1 expansion at the Sabodola-Massawa mine, which is the first stage in unlocking value from the large, high grade Massawa deposits, and in parallel we are advancing the DFS on Phase 2 and ramping-up exploration.

Given the significant potential within our portfolio, our sole strategic priority is to unlock value organically through mine life extensions, asset optimization initiatives, and by advancing our brownfield and greenfield projects through studies and further exploration. As such, investment in exploration remains a core focus and consequently we have increased our 2021 budget to $70-90 million, one of the largest in West Africa, with 40% allocated to greenfield exploration.

Our corporate efforts continue to be focused on maximizing shareholder returns, with the goal of augmenting our shareholder return program, which may include increasing our dividend or initiating a share buyback program as part of our capital allocation framework. In addition, we are on track to obtain a listing on the Premium segment of the London Stock Exchange in late Q2-2021, which we believe will boost investor appeal.”

ABOUT THE SABODALA-MASSAWA MINE

2021 Outlook

From the date of Sabodala-Massawa’s acquisition by Endeavour, which closed on February 10, 2021, the mine is expected to produce between 300-320koz at an AISC of $690 - $740/oz compared to production of 229koz at an AISC of circa $885/oz for FY-2020.

Ore mined is expected to be higher than in 2020 due to increased availability of the mobile equipment fleet for mining in 2021, as compared to 2020, when a portion of the fleet was used for the construction of the Massawa haul road. The two Sofia pits, Sofia Main and Sofia North, on the Massawa mining permit will contribute close to 85% of the ore mined in 2021.

Plant throughput and recovery rates are expected to decrease slightly from the 4.1Mt and 89% achieved in 2020, due to an increased proportion of fresh ore from the Sofia pits. Mill feed will be comprised of approximately 30% oxide and 70% fresh material. Head grade is expected to materially increase in H2-2021 with higher grades mined at the Sofia pits. Throughout the year, the Phase 1 upgrades will assist in debottlenecking the back-end of the plant, as described in the section below.

Sustaining capital expenditures are expected to amount to $35 million, mainly related to replacement of mobile equipment, a portion of which was deferred from 2020, an additional tailings storage facility (“TSF”) lift, and waste capitalization. Non-sustaining capital expenditure is expected to amount to $47 million, primarily to complete relocation activities of the Sabodala village. Other non-sustaining capital relates to new haul road and infrastructure developments at the Massawa permit mining areas. Growth capital expenditure is expected to amount to approximately $25 million, with $20 million allocated to Phase 1 upgrades and $5 million for the Phase 2 DFS, as outlined below.

Sabodala-Massawa Expansion Phase 1

The Massawa deposit is being integrated into the Sabodala mine through a two-phased approach, as outlined in the 2020 PFS. Phase 1 of the expansion will facilitate processing of an increased proportion of high grade, free-milling Massawa ore through the Sabodala processing plant, which will avoid bottlenecks and prevent gold loss to tailings. The addition of the Massawa ore will increase the average processing head grade from 1.5 g/t, up to a peak head grade of 2.8 g/t, while maintaining milling capacity at the current 4.0 – 4.2Mtpa level. The plant upgrades are expected to increase the Sabodala-Massawa gold production by up to 90kozpa2.

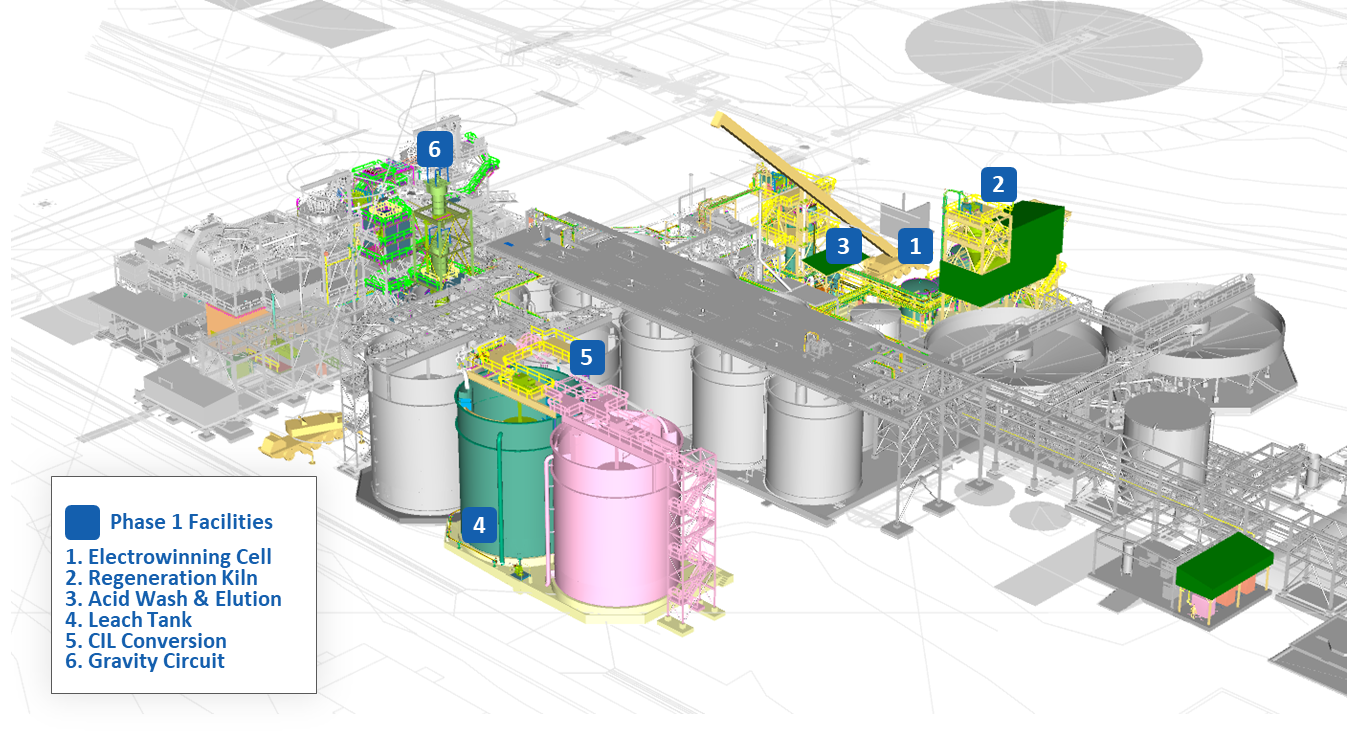

As shown in Figure 1 below, Phase 1 will increase the Sabodala plant’s overall gold production capacity through additions to the gold separation, concentration, elution and electrowinning facilities at the back-end of the plant. The detailed engineering for Phase 1 was completed by Lycopodium Limited. Procurement is largely complete with some packages already delivered, and the civil engineering contractor is currently mobilizing to site.

Figure 1: Upgraded Sabodala-Massawa Processing Plant Layout

As shown in Figure 1, the upgrades are focused on six key areas as detailed below:

- An additional electrowinning cell will be added to the gold room to increase its capacity to process high grade ore

- An additional carbon regeneration kiln will be added to increase carbon regeneration capacity

- An additional acid wash and elution circuit will be added to increase the total average capacity from 5 to 13 tonnes per day

- One additional leach tank will be added, increasing the leaching and CIL residence time from 24 to 32 hours, which is expected to improve the recoveries from Massawa ore

- One existing leach tank will be converted to a CIL tank to increase capacity

- A gravity circuit, consisting of a gravity feed scalping screen and a gravity concentrator will be added to reduce the load on the downstream circuit. The gravity circuit will process the coarse free-milling ore through the intensive leach circuit.

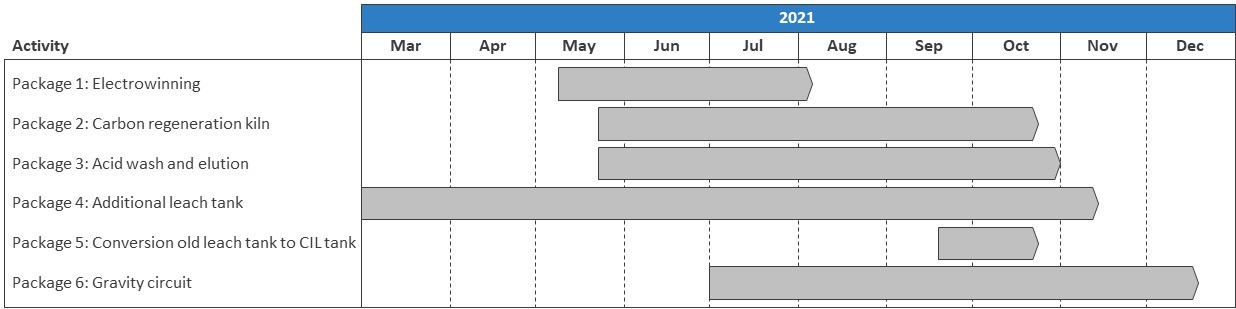

Completion of Phase 1 is expected in Q4-2021, as detailed in Figure 2 below.

Figure 2: Phase 1 timeline

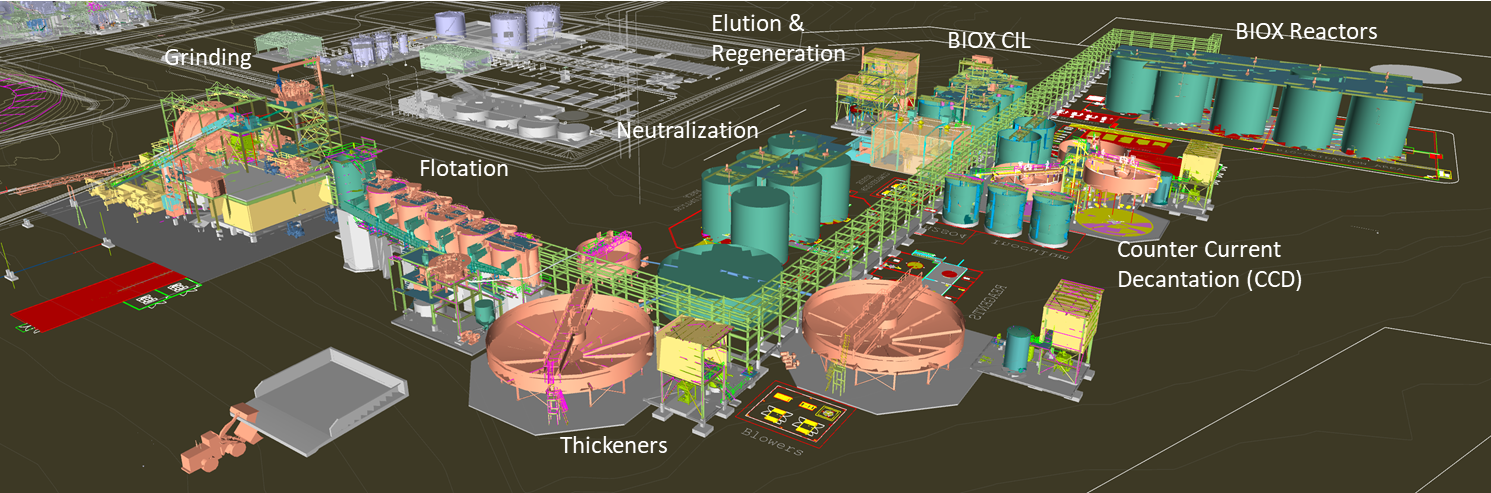

Sabodala-Massawa Expansion Phase 2

Phase 2 of the expansion will add an additional processing circuit to process the high grade refractory ore from the Massawa deposit, through the addition of a new refractory ore plant. A DFS for Phase 2 is underway and due for completion in Q4-2021, focusing on the following optimizations:

- Improved geometallurgical modelling incorporating a wider range of elements into the resource block model, to improve the quality of the mill feed blend resulting in improved plant efficiencies and recoveries

- Pit optimization to redefine the boundary between refractory ore and non-refractory ore to minimize losses due to dilution

- Processing optimization testwork to investigate operating cost and recovery improvements

- Metallurgical optimization testwork focused on comminution and variability, leaching and flotation

Figure 3: Proposed Sabodala-Massawa Phase 2 PFS Plant Layout

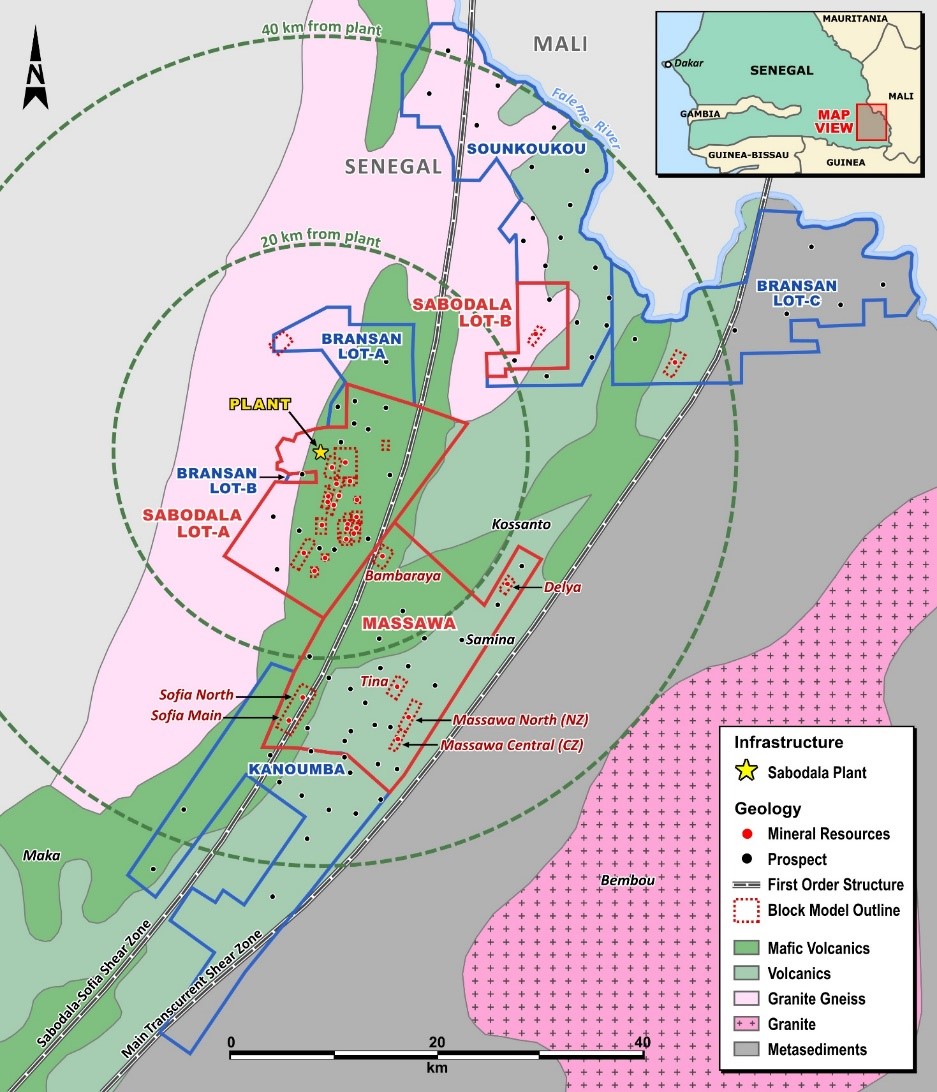

Exploration upside

Significant exploration potential exists within 30km of the processing facility, which includes the Sabodala mining license, the Massawa mining license, and additional exploration permits which respectively cover 291km2, 320km2 and 915km2, as shown in Figure 4 below.

Over 36,000 metres were drilled in 2020 with activity planned to ramp up significantly in 2021, specifically on the Massawa deposits, with a budget of $13 million for the year, representing Endeavour’s largest single spend.

During 2021, drilling will be concentrated on the Sofia deposit and the satellite deposits Samina, Tina and Delya. At Sofia North, drilling will be directed towards extending the non-refractory ore resources. Samina, Tina and Delya have had limited shallow drilling to date and show potential for additional mineralization at depth. Initial drill results at Samina demonstrate possible oxide mineralization at depth, which will be tested during 2021. Tina is a target where some reconnaissance drilling has been conducted.

A number of other prospects, located within the structural corridor between the Sabodala Sofia Shear Zone and the Main Transcurrent Shear Zone, will also be explored.

Figure 4: Sabodala-Massawa Plan Map

ABOUT THE WAHGNION MINE

2021 Outlook

From the date of Wahgnion’s acquisition by Endeavour, which closed on February 10, 2021, the mine is expected to produce between 140 - 155koz at an AISC of $940 - 990/oz, compared to a production of 175koz at AISC of circa $898/oz for FY-2020.

In 2021, total tonnes mined will remain in line with the strong performance seen in 2020, as the supplemental mining contractors will be retained to meet the continued above nameplate throughput. Mining activity is expected to focus on the Nogbele North and South pits, supplemented with ore from the Fourkoura pits, which commenced mining operations at the start of 2021.

Plant throughput and gold recovery rate are expected to decrease slightly in 2021, compared to the 3.6Mt and 95% achieved in 2020, due to greater volumes of fresh ore. Mill feed is expected to be composed of a higher proportion of fresh ore, resulting in an even split between oxide ore and fresh ore.

Sustaining capital of $14 million is planned for 2021, mainly related to waste capitalization and a number of small-scale mining and processing upgrades and infrastructure improvements. Non-sustaining capital expenditures of $26 million relate to construction of a second TSF cell, which significantly increases the overall TSF capacity, additional mining fleet and the construction of an airstrip.

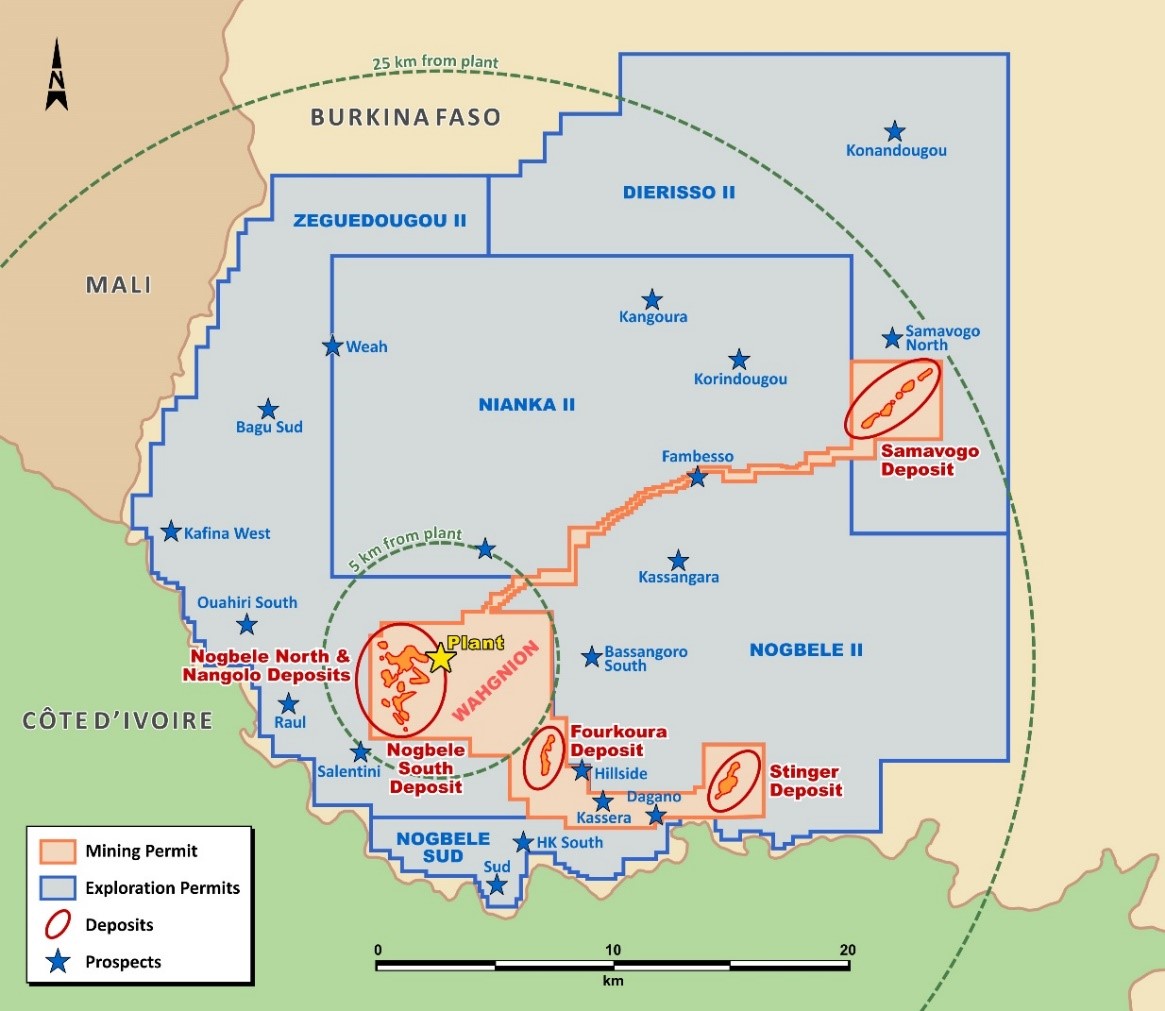

Exploration upside

Given the recent commissioning of the Wahgnion mine in late 2019, significant exploration potential exists within the permitted mine license and five surrounding exploration permits, which respectively cover an area of 89km2 and

920km2, as shown in Figure 5 below.

The 2021 exploration program, with a budget of $10 million, will focus on the Nogbele, Nogbele North and Nogbele South deposits, targeting the down dip continuation of mineralized structures between the Nogbele pits. Additionally, the north-northeast continuation of the Fourkoura deposit and the Hillside target will be tested for extensions. On the exploration permits, efforts will be focused on various attractive targets such as Kafina West and Korindougou.

Figure 5: Map of Wahgnion Mine and Permit Area

UPDATED 2021 OUTLOOK

As shown in Tables 2 and 3 below, consolidated total production guidance for 2021 has increased from 915,000 – 1,010,000 ounces to 1,365,000 – 1,495,000 ounces, while consolidated AISC guidance has decreased by $50/oz to $850 – $900/oz. The change reflects the inclusion of the Sabodala-Massawa and Wahgnion operations from February 11, 2021, which results in the addition of 450,000 – 485,000 ounces of production at AISC below $900/oz for the 11-month period.

Consolidated production from continuing operations, which excludes Agbaou following its sale, is expected to be between 1,350,000 – 1,475,000 ounces at AISC of $840/oz to $890/oz. Production is expected to be higher and AISC lower during the second half of the year, due to a combination of higher grades and capex weighted towards the first half of the year. More details on the Sabodala-Massawa and Wahgnion mines can be found in the individual mine sections above, with details of Endeavour’s other mines provided in the initial guidance press release, dated January 25, 2021.

Table 2: 2021 Consolidated Production Guidance

| (All amounts in koz, on a 100% basis) | PREVIOUS GUIDANCE | UPDATED GUIDANCE | ||||

| Ity | 230 | — | 250 | 230 | — | 250 |

| Karma | 80 | — | 90 | 80 | — | 90 |

| Houndé | 240 | — | 260 | 240 | — | 260 |

| Mana | 170 | — | 190 | 170 | — | 190 |

| Boungou | 180 | — | 200 | 180 | — | 200 |

| Sabodala-Massawa | n.a. | — | n.a. | 310 | — | 330 |

| Wahgnion | n.a. | — | n.a. | 140 | — | 155 |

| PRODUCTION FROM CONT. OPERATIONS OPERATIONS | 900 | 990 | 1,350 | — | 1,475 | |

| Agbaou (sale on March 1, 2021) | 15 | — | 20 | 15 | — | 20 |

| TOTAL PRODUCTION | 915 | — | 1,010 | 1,365 | — | 1,495 |

Table 3: 2021 Consolidated AISC Guidance1

| (All amounts in US$/oz) | PREVIOUS GUIDANCE | UPDATED GUIDANCE | ||||||

| Ity | 800 | — | 850 | 800 | — | 850 | ||

| Karma | 1,220 | — | 1,300 | 1,220 | — | 1,300 | ||

| Houndé | 855 | — | 905 | 855 | — | 905 | ||

| Mana | 975 | — | 1,050 | 975 | — | 1,050 | ||

| Boungou | 690 | — | 740 | 690 | — | 740 | ||

| Sabodala-Massawa | n.a. | — | n.a. | 690 | — | 740 | ||

| Wahgnion | n.a. | — | n.a. | 940 | — | 990 | ||

| Corporate G&A | 30 | 30 | ||||||

| Sustaining exploration | 5 | 5 | ||||||

| AISC FROM CONT. OPERATIONS | 880 | — | 930 | 840 | — | 890 | ||

| Agbaou (sale on March 1, 2021) | 1,050 | — | 1,125 | 1,050 | — | 1,125 | ||

| TOTAL AISC | 900 | — | 950 | 850 | — | 900 | ||

1This is a non-GAAP measure. Refer to the non-GAAP measure section of the most recent MD&A for Endeavour and refer to the non-IFRS measures note in this press release

As detailed in the table below, consolidated total sustaining and non-sustaining capital allocations for 2021 amount to $173 million and $201 million, respectively. Details on the Sabodala-Massawa and Wahgnion mine capital expenditures have been provided in the sections below. Details on Endeavour’s other mines, for which guidance has not changed, were provided in the initial guidance press release, dated January 25, 2021.

Table 4: 2021 Consolidated Mine Capital Expenditure Guidance

| (All amounts in US$m) | SUSTAINING CAPITAL | NON-SUSTAINING CAPITAL |

| Ity | 28 | 27 |

| Karma | 11 | 5 |

| Houndé | 39 | 13 |

| Mana | 27 | 62 |

| Boungou | 19 | 22 |

| Sabodala-Massawa | 35 | 47 |

| Wahgnion | 14 | 26 |

| MINE CAPITAL EXPENDITURES FROM CONT. OPERATIONS | 172 | 201 |

| Agbaou | 1 | 0 |

| TOTAL MINE CAPITAL EXPENDITURES | 173 | 201 |

As detailed in the table below, growth capital spend is expected to amount to approximately $46 million, mainly related to the ongoing Phase 1 expansion at Sabodala-Massawa mine and studies and holding costs at the Kalana and Fetekro projects, as well as for IT and integration projects. More details on the Sabodala-Massawa mine expansion can be found in the section above.

Table 5: 2021 Consolidated Growth and Corporate Capital Spend

| (All amounts in US$m) | 2021 GUIDANCE |

| Sabodala-Massawa | 25 |

| Fetekro | 6 |

| Kalana | 6 |

| Golden Hill | 3 |

| Bantou | 1 |

| Corporate | 5 |

| TOTAL | 46 |

As detailed in the table below, exploration will continue to be a strong focus in 2021 with the Group exploration budget revised upwards from $55 - $60 million to $70 - $90 million, inclusive of the newly integrated Teranga assets.

Table 6: Consolidated Exploration Guidance

| (All amounts in US$m) | 2021 GUIDANCE |

| Sabodala-Massawa | ~13 |

| Wahgnion | ~12 |

| Ity | ~9 |

| Mana | ~8 |

| Hounde | ~7 |

| Karma | ~0 |

| MINE SUBTOTAL | ~50 |

| Greenfield and development projects | ~20 - 40 |

| TOTAL | $70 - 90 |

UPCOMING CATALYSTS

Key upcoming expected catalysts are summarized in the table below.

Table 7: Key Upcoming Catalysts

| TIMING | CATALYST | |

| March 1 | Corporate | Closing of Agbaou sale transaction |

| H1-2021 | Afema | Initial resource estimate |

| Late Q2-2021 | Corporate | Premium LSE Listing |

| Q4-2021 | Sabodala-Massawa | Completion of Phase 1 plant upgrades |

| Q4-2021 | Sabodala-Massawa | Completion of Definitive Feasibility Study |

| Q4-2021 | Fetekro | Completion of Definitive Feasibility Study |

FY-2020 FINANCIAL RESULTS CONFERENCE CALL AND LIVE WEBCAST

Management will host a conference call and webcast on Thursday March 18, at 8:30am Toronto time (ET) to discuss the Company's FY-2020 financial and operating results.

The conference call and webcast are scheduled at:

5:30am in Vancouver

8:30am in Toronto and New York

12:30pm in London

8:30pm in Hong Kong and Perth

The webcast can be accessed through the following link:

https://edge.media-server.com/mmc/p/uwqj86xn

Analysts and investors are also invited to participate and ask questions using the dial-in numbers below:

International: +44 (0) 2071 928338

North American toll-free: +18778709135

UK toll-free: 08002796619

Confirmation Code: 4447534

The conference call and webcast will be available for playback.

QUALIFIED PERSONS

Clinton Bennett, Endeavour's VP Metallurgy and Process Improvement - a Fellow of the Australasian Institute of Mining and Metallurgy, is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and approved the technical information in this news release.

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com Vincic Advisors in Toronto John Vincic, Principal +1 (647) 402 6375 john@vincicadvisors.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is one of the world’s top ten senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the Toronto Stock Exchange, under the symbol EDV and will be seeking a secondary listing as a Premium issuer on the London Stock Exchange during Q2-2021.

For more information, please visit www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This press release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of Endeavour with respect to future business activities and operating performance. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes information regarding Endeavour’s production guidance for 2021, AISC guidance for 2021, ability to create sustainable shareholder value over the long term, the potential for continued or future dividends or a share buy back program and Endeavour’s ability and the expected timing to list on the LSE .

Investors are cautioned that forward-looking information is not based on historical facts but instead reflect Endeavour management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although Endeavour believes that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of Endeavour. This forward-looking information may be affected by risks and uncertainties in the business of Endeavour and market conditions, including (1) there being no significant disruptions affecting the operations of the Company, whether due to extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment, pit wall slides or otherwise; (2) permitting, development, operations and production from the Company’s operations and development projects being consistent with Endeavour’s current expectations; (3) political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations; (4) the completion of studies on the timelines currently expected, and the results of those studies being consistent with Endeavour’s current expectations; (5) certain price assumptions for gold; (6) prices for diesel, electricity and other key supplies being approximately consistent with the Company’s expectations; (7) production and cost of sales forecasts for the Company meeting expectations; (8) the accuracy of the current mineral reserve and mineral resource estimates of the Company, and Endeavour’s analysis thereof, being consistent with expectations; (9) labour and materials costs increasing on a basis consistent with Endeavour’s current expectations; (10) the terms and conditions of the legal and fiscal stability agreements for the Sabodala-Massawa and Wahgnion mines being interpreted and applied in a manner consistent with their intent and Endeavour’s expectations and without material amendment or formal dispute; (11) potential direct or indirect operational impacts resulting from infectious diseases or pandemics; and (12) the Company’s financial results, cash flows and future prospects being consistent with Company expectations in amounts sufficient to permit sustained dividend payments. This information is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by Endeavour with the Canadian securities regulators, including Endeavour’s and Teranga’s respective annual information forms, financial statements and related MD&A for the financial year ended December 31, 2019 filed with the securities regulatory authorities in certain provinces of Canada and available at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Endeavour has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Endeavour does not intend, and do not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

NON-IFRS MEASURES

All-in sustaining costs is a non-IFRS performance measure referred to in this press release, and may not be comparable to similar measures presented by other companies. Endeavour believes that, in addition to conventional measures prepared in accordance with IFRS, Endeavour and certain investors use this information to evaluate performance. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

“Cash costs” is a common performance measure in the gold mining industry, but does not have any standardized definition. Endeavour reports cash cost per ounce based on ounces sold. Cash costs include mine site operating costs, administration, royalties and by-product credits but are exclusive of depreciation, accretion expense, interest on capital leases, capital expenditures, and exploration and project evaluation costs.

All-in sustaining costs or “AISC” is an extension of the existing “cash costs” metric and incorporates costs related to sustaining production. Endeavour believes that, although relevant, the “cash costs” metric does not capture the sustaining expenditures incurred, and therefore, may not present a complete picture of its operating performance or its ability to generate free cash flows from its operations. AISC includes cost of sales, excluding depreciation, and includes by-product credits, sustaining capital expenditures, sustaining exploration and project evaluation costs, corporate general and administrative costs, and environmental rehabilitation accretion and depreciation.

Readers should refer to the reconciliation between the non-IFRS measures presented in this press release to the most directly comparable IFRS measures in Endeavour’s management’s discussion and analysis of financial condition and results of operations as at and for the financial year ended December 31, 2019 and 2018 and as at and for the financial period ended September 30, 2020.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

1 Teranga Gold, Sabodala-Massawa PFS press release dated July 27, 2020 available under Teranga’s SEDAR profile

2 Teranga Gold, Sabodala-Massawa PFS press release dated July 27, 2020 available under Teranga’s SEDAR profile

Attachments

- Figure 1 Upgraded Sabodala Massawa Processing Plant Layout.png

- Figure 5 Map of Wahgnion Mine and Permit Area.jpg

- Figure 4 Sabodala-Massawa Plan Map.jpg

- Figure 3 Proposed Sabodala-Massawa Phase 2 PFS Plant Layout.png

- Figure 2 Phase 1 timeline.jpg

- View News Release in PDF