Endeavour Reports Q3 Results

|

||||||||||

ENDEAVOUR REPORTS Q3 RESULTS

On-track to achieve upper-end of production guidance and bottom-end of AISC guidance

View News Release in PDF

View Presentation

OPERATIONAL AND FINANCIAL Highlights

- Production from continuing operations of 139koz in Q3 and 438koz for YTD-2018, on-track to meet the upper-end of the FY-2018 guidance of 555-590koz

- AISC from continuing operations of $820/oz in Q3 and $759/oz for YTD-2018, on-track to meet the bottom-end of the FY-2018 guidance of $760-810/oz

- All-In Sustaining Margin of $40m for Q3 totalling $207m for YTD-2018, up 43% over YTD-2017

- Operating Cash Flow per share (before non-cash working capital) of $0.42 for Q3 totalling $1.94 for

- YTD-2018, up 30% over YTD-2017

- EPS from continuing operations of $0.14 in Q3 and $0.29 for YTD-2018, up from $(0.13) for YTD-2017

- Net Debt of $535m at quarter-end, up from $410m at end of Q2 due to Ity CIL construction progressing ahead of schedule

- Well positioned to finance the remaining Ity CIL construction cash outflow of ~$122m with $213m in available sources of financing and liquidity in addition to cash flow being generated from operations

UPCOMING CATALYSTS

- Q4 production expected to increase over Q3 following end of rainy season

- Maiden resource for Kari Pump discovery at Houndé expected to be released in the coming weeks

- Ity CIL construction progressing on-budget and two months ahead of schedule with first gold pour expected in early-Q2

George Town, November 7, 2018 - Endeavour Mining (TSX:EDV) (OTCQX:EDVMF) is pleased to announce its financial and operating results for the third quarter of 2018, with highlights provided in the table below.

Table 1: Key Operational and Financial Highlights

| QUARTER ENDED | NINE MONTHS ENDED | ||||||

| Sep. 30 2018 | Jun. 30, 2018 | Sep. 30, 2017 | Sep. 30, 2018 | Sep. 30, 2017 | VAR YTD-18 vs. YTD-17 | ||

| PRODUCTION AND AISC HIGHLIGHTS (from continuing operations only) | |||||||

| Gold Production, koz | 139 | 147 | 79 | 438 | 252 | +74% | |

| Realized Gold Price2, $/oz | 1,161 | 1,257 | 1,198 | 1,240 | 1,183 | +5% | |

| All-in Sustaining Cost1, $/oz | 820 | 780 | 854 | 759 | 834 | (9%) | |

| All-in Sustaining Margin1,3, $/oz | 341 | 478 | 344 | 482 | 349 | +38% | |

| CASH FLOW HIGHLIGHTS (includes discontinued operations) 1 | |||||||

| All-in Sustaining Margin4, $m | 40 | 69 | 49 | 207 | 144 | +43% | |

| All-in Margin5, $m | 18 | 48 | 34 | 134 | 100 | +35% | |

| Operating Cash Flow Before Non-Cash Working Capital, $m | 45 | 69 | 39 | 208 | 145 | +43% | |

| Operating Cash Flow Before Non-Cash Working Capital, $/share | 0.42 | 0.64 | 0.41 | 1.94 | 1.49 | +30% | |

| PROFITABILITY HIGHLIGHTS (from continuing operations only) | |||||||

| Revenues, $m | 156 | 190 | 95 | 544 | 299 | +82% | |

| Adjusted EBITDA1, $m | 49 | 68 | 24 | 208 | 88 | +138% | |

| Net Earnings Attr. to Shareholders, $m | 15 | 4 | (15) | 31 | (13) | n.a. | |

| Net Earnings Attr. to Shareholders, $/share | 0.14 | 0.04 | (0.15) | 0.29 | (0.13) | n.a. | |

| Adjusted Net Earnings Attr. to Shareholders1, $m | (1) | 9 | 2 | 33 | 5 | n.a. | |

| Adjusted Net Earnings1, $/share | (0.01) | 0.09 | 0.03 | 0.31 | 0.05 | n.a. | |

| BALANCE SHEET HIGHLIGHTS1 | |||||||

| Net Debt, $m | 535 | 410 | 221 | 535 | 221 | +142% | |

1This is a non-GAAP measure. Refer to the non-GAAP measure section of the MD&A. 2Realized Gold Price inclusive of Karma stream; 3Realized Gold Price less AISC per ounce; 4Net revenue less All-in Sustaining Cost; 5Net revenue less All-in Sustaining Costs and Non-Sustaining capital

Sébastien de Montessus, President & CEO, stated: "Our operations have performed well through the third quarter and we are now well positioned to meet all of our key guidance metrics for 2018. Production across our portfolio is expected to increase in Q4-2018 due to the end of the rainy season in West Africa. Group production is therefore on track to meet the top end of our guidance of between 555-590koz, while we expect All-In Sustaining Costs to achieve the lower end of guidance of $760-810/oz.

We continue to make significant progress against a number of key strategic initiatives which leave us well positioned to finish the year successfully and enter 2019 with momentum from the commissioning of the Ity CIL project, which is expected to be our next flagship mine. The first gold pour is now anticipated to occur in early Q2 as the project is tracking two months ahead of schedule. As a result of the pace of construction, we accelerated the Ity CIL capital spend, which has been possible due to financial flexibility provided by our strong balance sheet. With Ity CIL's low projected production costs, we expected to quickly deleverage from current levels once the project goes into commercial production.

Lastly, in Q3 we continued to achieve positive results from our exploration programme. We recently announced a maiden resource at our greenfield Fetekro property in Côte D'Ivoire, and we expect to follow this with a maiden resource at the Kari Pump discovery at Houndé in Burkina Faso in the coming weeks."

PRODUCTION & AISC WELL ON-TRACK TO MEET GUIDANCE

- Group production from continuing operations totaled 139koz in Q3-2018 and 438koz for YTD-2018, on track to meet the upper-end of full year guidance of 555-590koz.

- Production from continuing operations significantly increased in Q3-2018 compared to Q3-2017 due to the commissioning of the Houndé mine and increases at the Ity and Karma mines (which both benefited from higher recovery rates, better grades, and increased stacked tonnage). This more than offset the expected decline at the Agbaou mine (due to lower grade stockpiles continuing to supplement mill feed as mining focused on waste capitalization).

- As announced in September 2018, Endeavour entered into a binding sale agreement for its interest in the non-core Tabakoto mine to Algom Resources Limited ("Algom"), a subsidiary of BCM Investments Ltd, for total cash consideration of $60 million. The consideration is payable upon closing of the transaction, which is expected to occur during the fourth quarter of 2018 and as such Tabakoto is classified as a discontinued operation.

- Inclusive of the discontinued Tabakoto mine, group production amounted to 165koz in Q3-2018 and 524koz for YTD-2018, also on-track to meet full year guidance of 670-720koz.

- Group AISC from continuing operations was $820/oz in Q3 and $759/oz for YTD-2018, on track to meet the bottom-end of the full year guidance of $760-810/oz.

- AISC from continuing operations decreased in Q3-2018 compared to Q3-2017 mainly due to the commissioning of the Houndé mine and decreases at both the Ity and Karma mines, which more than offset the anticipated increase at Agbaou.

- Group AISC inclusive of the discontinued Tabakoto mine amounted to $917/oz in Q3-2018 and $853/oz for YTD-2018, also on track to meet full year guidance of $840-890/oz.

Table 2: Group Production

| (All amounts in koz, on a 100% basis) | QUARTER ENDED | NINE MONTHS ENDED | 2018 FULL-YEAR GUIDANCE | ||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||||

| 2018 | 2018 | 2017 | 2018 | 2017 | |||||

| Agbaou | 31 | 34 | 46 | 97 | 134 | 140 | - | 150 | |

| Ity | 21 | 25 | 12 | 64 | 42 | 60 | - | 65 | |

| Karma | 26 | 21 | 21 | 75 | 77 | 105 | - | 115 | |

| Houndé | 61 | 67 | - | 201 | - | 250 | - | 260 | |

| PRODUCTION FROM CONTINUING OPERATIONS | 139 | 147 | 79 | 438 | 252 | 555 | - | 590 | |

| Tabakoto (sale expected to close in Q4-2018) | 26 | 27 | 32 | 86 | 116 | 115 | - | 130 | |

| Nzema (divested in December 2017) | - | - | 27 | - | 91 | n.a. | - | n.a. | |

| TOTAL PRODUCTION | 165 | 173 | 138 | 524 | 459 | 670 | - | 720 | |

Table 3: Group All-In Sustaining Costs

| (All amounts in US$/oz) | QUARTER ENDED | NINE MONTHS ENDED | 2018 FULL-YEAR GUIDANCE | ||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||||

| 2018 | 2018 | 2017 | 2018 | 2017 | |||||

| Agbaou | 954 | 818 | 638 | 838 | 634 | 860 | - | 900 | |

| Ity | 730 | 713 | 1,141 | 750 | 920 | 790 | - | 850 | |

| Karma | 841 | 885 | 973 | 864 | 811 | 780 | - | 830 | |

| Houndé | 638 | 617 | - | 555 | - | 580 | - | 630 | |

| Corporate G&A | 44 | 41 | 39 | 42 | 61 | 30 | - | 30 | |

| Sustaining Exploration | 14 | 21 | 15 | 4 | 38 | 10 | - | 10 | |

| GROUP AISC FROM CONTINUING OPERATIONS | 820 | 780 | 854 | 759 | 834 | 760 | - | 810 | |

| Tabakoto (sale expected to close in Q4-2018) | 1,420 | 1,397 | 1,278 | 1,335 | 1,085 | 1,200 | - | 1,250 | |

| Nzema (divested in December 2017) | - | - | 985 | - | 859 | n.a. | - | n.a | |

| GROUP AISC | 917 | 878 | 906 | 853 | 903 | 840 | - | 890 | |

HOUNDÉ MINE

Q3-2018 vs Q2-2018 Insights

- Houndé performed well, despite the rainy season, as the plant continued to operate above nameplate capacity. As expected, production declined over the previous quarter as the rainy season limited access to higher grade ore which was partially offset by increased mill throughput.

- Tonnes of ore mined increased slightly due to the addition of new mining equipment improving productivity. The strip ratio was flat, and for the time being remains below the life of mine average.

- Transitional and fresh ore from the Vindaloo Main deposit continued to be the main ore mined, supplemented by oxide ore from the Vindaloo North deposit where mining began in late Q1-2018, and from the Vindaloo Central deposit where mining began in Q2-2018.

- Tonnes milled increased slightly, continuing to perform nearly 30% above nameplate capacity. The ore blend continued to be mainly transitional/fresh ore. Oxide ore represented 32% of the mill feed, up from 25% in Q2-2018.

- The average grade milled decreased slightly as the rainy season limited access to higher grade ore.

- Recovery rates decreased slightly to 94% but remained at high levels.

- As expected, AISC increased mainly due to the lower anticipated processed grade, and higher unit mining and processing costs which were partially offset by lower unit G&A costs and lower sustaining capital.

- Mining unit costs increased from $2.00 to $2.14 per tonne due to increased vehicle hours and longer hauling distances which was partially offset by the increased volumes moved.

- Processing unit costs increased from $11.41 to $12.71 per tonne due to the fresh ore being utilized, offset by the increased throughput volumes.

- Sustaining capital decreased from $3.3m to $2.7m (from $49/oz to $47/oz), following the purchase of water pumps in Q2-2018 in anticipation of the rainy season.

- There was no non-sustaining capex incurred during the quarter.

- Depreciation decreased for the quarter mainly due to the production decrease.

YTD-2018 vs YTD-2017 Insights

- Commercial production began in Q4-2017.

Table 4: Houndé Quarterly Performance Indicators

| For The Quarter | Q3-2018 | Q2-2018 | Q3-2017 |

| Tonnes ore mined, kt | 1,413 | 1,312 | n.a. |

| Strip ratio (incl. waste cap) | 6.00 | 6.13 | n.a. |

| Tonnes milled, kt | 1,006 | 982 | n.a. |

| Grade, g/t | 2.02 | 2.20 | n.a. |

| Recovery rate, % | 94% | 95% | n.a. |

| PRODUCTION, KOZ | 61 | 67 | n.a. |

| Cash cost/oz | 519 | 484 | n.a. |

| AISC/OZ | 638 | 617 | n.a. |

Table 5: Houndé Half Year Performance Indicators

| For The Nine Months Ended | Sep. 30, | Sep. 30, |

| 2018 | 2017 | |

| Tonnes ore mined, kt | 4,086 | n.a. |

| Strip ratio (incl. waste cap) | 6.20 | n.a. |

| Tonnes milled, kt | 2,886 | n.a. |

| Grade, g/t | 2.26 | n.a. |

| Recovery rate, % | 95% | n.a. |

| PRODUCTION, KOZ | 201 | n.a. |

| Cash cost/oz | 441 | n.a. |

| AISC/OZ | 555 | n.a. |

Q4-2018 Outlook

- Houndé is comfortably on track to meet the top of end its full-year 2018 production guidance of 250,000 - 260,000 ounces and the low end of its AISC guidance of $580-630 per ounce.

- Relocation activities at the Bouere deposit are continuing as planned and pre-stripping is expected to occur in early 2019.

Exploration Activities

- Houndé has been the strongest exploration focus for Endeavour in 2018 with 44,000 meters drilled in Q3-2018 totalling more than 165,000 meters since the start of the year, mainly focused on the Kari anomaly.

- In May, initial drill results were published for the Kari Pump and in addition to announcing the discovery of the nearby Kari Centre and Kari West.

- In Q3-2018, significant focus was placed on delineating an initial resource at Kari Pump with the result expected to be published in the coming weeks.

AGBAOU MINE

Q3-2018 vs Q2-2018 Insights

- As guided, 2018 is a transitional year for Agbaou with a focus on waste capitalisation activities which are expected to provide access to higher grade areas in the latter portion of Q4-2018. As such, production remained at low levels in Q3-2018 as mining continued to be constrained to low-grade areas and low-grade stockpiles continued to supplement the mine feed. Moreover, production decreased slightly over the previous quarter mainly due to the impact of the rainy season and lower tonnes milled.

- Tonnes of ore mined remained flat while total tonnes mined decreased by 11% due to the slowdown caused by the rainy season. Mining focused in West Pit 5, where the pre-strip was completed in Q3-2018, while sustaining waste capitalization activities accelerated in the South Pit.

- Mill throughput decreased because of lower availability attributed to scheduled plant maintenance and due to the proportion of fresh ore processed increasing to 32% from 28%, with the remainder being softer oxide ore.

- Average processed grades slightly decreased as low-grade stockpiles continued to supplement the mill feed.

- Recovery rates increased to 94% despite the higher blend of fresh ore processed.

- AISC increased as guided mainly due to the significant increase in sustaining waste capitalization activities and an increase in unit processing and G&A costs which were partially offset by lower unit mining costs.

- Mining unit costs decreased from $2.65 to $2.57 per tonne due to a reduction in load and haul costs as higher elevations of the newly commissioned West Pit 5 were mined.

- Processing unit costs increased from $7.54 to $7.77 per tonne to due lower tonnage and an increase in reagents consumed due to more fresh ore processed.

- Sustaining capital costs increased from $1.8 million to $3.6 million (from $51/oz to $119/oz) primarily due to the increase in capitalized waste.

- Non-sustaining capital decreased from $2.9 million to $0.1 million due to the completion of pre-stripping in West Pit 5.

- Depreciation decreased mainly due to the production decrease.

YTD-2018 vs YTD-2017 Insights

- As guided, production decreased and AISC increased as stockpiles supplemented the mine feed to allow waste capitalisation activities to progress.

Table 6: Agbaou Quarterly Performance Indicators

| For The Quarter | Q3-2018 | Q2-2018 | Q3-2017 |

| Tonnes ore mined, kt | 625 | 611 | 824 |

| Strip ratio (incl. waste cap) | 10.11 | 11.77 | 8.19 |

| Tonnes milled, kt | 669 | 727 | 770 |

| Grade, g/t | 1.54 | 1.60 | 1.96 |

| Recovery rate, % | 94% | 92% | 93% |

| PRODUCTION, KOZ | 31 | 34 | 46 |

| Cash cost/oz | 791 | 720 | 548 |

| AISC/OZ | 954 | 818 | 638 |

Table 7: Agbaou Half Year Performance Indicators

| For The Nine Months Ended | Sep. 30, | Sep. 30, |

| 2018 | 2017 | |

| Tonnes ore mined, kt | 1,918 | 2,157 |

| Strip ratio (incl. waste cap) | 10.83 | 8.68 |

| Tonnes milled, kt | 2,122 | 2,146 |

| Grade, g/t | 1.53 | 2.09 |

| Recovery rate, % | 93% | 94% |

| PRODUCTION, KOZ | 97 | 134 |

| Cash cost/oz | 711 | 541 |

| AISC/OZ | 838 | 634 |

Q4-2018 Outlook

- Agbaou is on track to meet to the low end of full-year 2018 production guidance of 140,000 - 150,000 ounces and the low end of AISC guidance of $860-$900 per ounce.

- Agbaou's profile is expected to improve in the latter portion of Q4-2018 as the waste capitalisation activities are expected to provide access to higher grade areas.

Exploration Activities

- Less than 1,000 meters were drilled in Q3-2018 due to the seasonal rain. Since the beginning of 2018 more than 27,000 meters have been drilled.

- A total of more than 20,000 meters, representing most of the drilling, was focused on open pit targets located along extensions of known deposits and on parallel trends. Mineralization was confirmed at the extensions of several deposits including the MPN, North Pit Satellite 3, West Pit 5 and Beta.

- The at-depth potential of the North pit was tested earlier in the year and mineralization was confirmed. However, as a potential resource in this area may not be suitable for open pit operations, the focus was directed to the open pit targets.

KARMA MINE

Q3-2018 vs Q2-2018 Insights

- As expected, production increased in Q3, despite the rainy season, due to the higher grades and better recovery rates associated with the Kao oxide ore.

- Tonnes mined decreased as expected due to the rainy season. Mining focused on oxide ore from the Kao pit after the completion of mining transitional ore from the GG2 pit in Q2-2018.

- Tonnes stacked increased due to improved throughput from oxide ore.

- The stacked grade increased as a result of higher grades from the Kao deposit.

- Recovery significantly increased due to timing associated with the leach cycle as well as higher usage of oxide ore.

- AISC decreased mainly due increased production, lower processing costs and G&A costs, which were partially offset by higher unit mining costs.

- Mining costs increased from $2.08 to $3.18 per tonne due to the volume effect of mining less ore as a result of the seasonal conditions.

- Processing costs decreased from $10.50 to $8.46 per tonne due to the higher stacked tonnes and lower reagent consumption for oxide material processed.

- Sustaining capital costs increased from $0.5 million to $1.0 million (from $24 to $41/oz) mainly due to an increase in capital waste.

- Non-sustaining capital spend increased from $5.5 million to $8.3 million mainly due to pre-stripping at the Kao deposit, as well as the resettlement costs associated to its development.

- Depreciation decreased due to reduced mined tonnages.

YTD-2018 vs YTD-2017 Insights

- Production decreased and AISC increased due to the lower recovery rate associated with treating the GG2 transitional ore in the first half of the year, while 2017 benefited from higher recovery rates associated with oxide high-grade ore from the mined-out Rambo deposit.

Table 8: Karma Quarterly Performance Indicators

| For The Quarter | Q3-2018 | Q2-2018 | Q3-2017 |

| Tonnes ore mined, kt | 755 | 1,636 | 593 |

| Strip ratio (incl. waste cap) | 3.01 | 2.02 | 5.13 |

| Tonnes stacked, kt | 981 | 838 | 720 |

| Grade, g/t | 1.02 | 0.93 | 0.91 |

| Recovery rate, % | 89% | 78% | 87% |

| PRODUCTION, KOZ | 26 | 21 | 21 |

| Cash cost/oz | 729 | 782 | 786 |

| AISC/OZ | 841 | 885 | 973 |

Table 9: Karma Half Year Performance Indicators

| For The Nine Months Ended | Sep. 30, | Sep. 30, |

| 2018 | 2017 | |

| Tonnes ore mined, kt | 3,927 | 2,678 |

| Strip ratio (incl. waste cap) | 2.00 | 3.33 |

| Tonnes stacked, kt | 3,060 | 2,526 |

| Grade, g/t | 0.94 | 1.08 |

| Recovery rate, % | 80% | 85% |

| PRODUCTION, KOZ | 75 | 77 |

| Cash cost/oz | 755 | 694 |

| AISC/OZ | 864 | 811 |

Q4-2018 Outlook

- Karma is on track to meet to the low-end of full-year 2018 production guidance of 105,000 - 115,000 ounces and the top end of AISC guidance of $780-830 per ounce.

- Karma's profile is expected to slightly improve in Q4-2018 following the end of the rainy season.

Exploration Activities

- More than 23,000 meters have been drilled since the start of the year, with no meters drilled in Q3-2018 due to the seasonal rain.

- Drilling this year has mainly focused on the Eastern extension of the North Kao deposit, on Yabonsgo and on Rambo West where indicated resources are expected to be delineated by year-end. In addition, auger drilling and soil geochemical sampling was conducted on earlier stage targets such as Rounga and Zanna.

ITY MINE: HEAP LEACH OPERATION

Q3-2018 vs Q2-2018 Insights

- As guided, 2018 is expected to be a transition year for the heap leach operation with greater priority given to the CIL construction activities, specifically in the second half of the year during which the aim was to mainly stack ore from lower grade stockpiles. However, Ity's heap leach operation performed above expectations in Q3-2018 as mining was opportunistically conducted based on equipment availability and the good progress made on Ity CIL construction.

- Production declined, however less than initially planned, over the previous quarter due to lower grades stacked and a lower recovery rate which was partially offset by an increase in tonnes stacked.

- Tonnes of ore mined decreased, in line with the strategy to reduce heap-leach mining activity and prioritize the CIL construction, and due to the rainy season. Mining focused on the high-grade Bakatouo pit (where mining stopped in late August and will be continued once the CIL is commissioned) and on the Ity pit.

- Ore stacked increased due to high plant availability and utilization.

- The stacked grade decreased as less high-grade tonnage was mined and feed was supplemented with lower grade stockpiles.

- Recovery rates decreased due to the blending of ore types stacked, however remained at a higher than anticipated level due to reagent optimization.

- AISC increased slightly, despite decreases in unit mining, processing, and G&A costs, due to the lower grade and recovery rates.

- Mining unit costs decreased from $7.72 to $7.02 per tonne mainly due to shorter haul distances and fewer fleet rentals as mining for the heap leach operations winds down.

- Processing unit costs decreased from $16.81 to $14.70 per tonne due to lower reagent usage and an increase in stacking volume.

- Sustaining capital costs decreased from $0.8 million to $0.4 million (from $30/oz to $18/oz) as the heap leach operation winds down.

- There was no non-sustaining capital spent in the quarter.

- Depreciation and depletion decreased in line with production.

YTD-2018 vs YTD-2017 Insights

- Production increased and AISC decreased mainly due to increased stacked tonnages and higher grades from the Bakatouo pit, which compensated for lower recovery rates.

Table 10: Ity Quarterly Performance Indicators

| For The Quarter | Q3-2018 | Q2-2018 | Q3-2017 |

| Tonnes ore mined, kt | 253 | 304 | 305 |

| Strip ratio (incl. waste cap) | 2.43 | 2.61 | 2.90 |

| Tonnes stacked, kt | 326 | 308 | 312 |

| Grade, g/t | 2.64 | 2.81 | 1.58 |

| Recovery rate, % | 78% | 88% | 74% |

| PRODUCTION, KOZ | 21 | 25 | 12 |

| Cash cost/oz | 667 | 639 | 933 |

| AISC/OZ | 730 | 713 | 1,141 |

Table 11: Ity Half Year Performance Indicators

| For The Nine Months Ended | Sep. 30, | Sep. 30, |

| 2018 | 2017 | |

| Tonnes ore mined, kt | 927 | 1,008 |

| Strip ratio (incl. waste cap) | 2.81 | 3.93 |

| Tonnes stacked, kt | 991 | 822 |

| Grade, g/t | 2.52 | 1.85 |

| Recovery rate, % | 79% | 85% |

| PRODUCTION, KOZ | 64 | 42 |

| Cash cost/oz | 672 | 762 |

| AISC/OZ | 750 | 920 |

Q4-2018 Outlook

- Due to the opportunistic mining carried out in Q3-2018, Ity has already surpassed full-year 2018 production guidance of 60,000 - 65,000 ounces and is on track to meet the bottom half of AISC guidance of $790-$850 per ounce.

- Q4-2018 production is expected to decline and AISC to increase as a greater proportion of low-grade stockpiles are expected to be processed as the heap leach operation winds down by year-end.

Exploration Activities (CIL Project)

- Nearly 3,000 meters were drilled in Q3-2018 totalling more than 38,000 meters since the start of the year, mainly focused on:

- The Le Plaque target where additional resources are expected to be delineated in H1-2019, with intention to initiate exploitation license application as soon as possible.

- The Daapleu deposit where mineralization was confirmed at-depth.

- In addition, a deep hole was drilled below the heap leach pad which confirmed the occurrence of mineralization 200 meters southwest of the Bakatouo deposit.

- The focus in Q4-2018 is expected to be placed on the Le Plaque target where an updated resource is expected to be delineated in H1-2019.

TABAKOTO MINE (DISCONTINUED OPERATION)

Sale expected to close in Q4-2018

- The strategic assessment completed in Q2-2018 demonstrated the potential to reduce the mines' AISC, mainly through capital investment to renew the underground fleet. These investments however do not meet Endeavours' capital allocation criteria and therefore a sale process was subsequently launched.

- On September 4, 2018, Endeavour announced that it had entered into a binding sale agreement for its interest in Tabakoto mine to Algom Resources Limited ("Algom"), a subsidiary of BCM Investments Ltd, for total cash consideration of $60 million. The consideration is payable upon closing of the transaction which is expected to occur in Q4-2018.

Q3-2018 vs Q2-2018 Insights

- Production remained flat, despite the impact of heavy rainfall, as a slightly higher mill throughput offset a slightly lower average processed grade.

- Open pit ore mined increased as a result of a significant decrease in the strip ratio.

- Underground ore mined remained flat, as equipment availability remains an issue due to the need for a new fleet.

- Processing activities continued to perform well, slightly increasing due to better mill availability and utilisation.

- The average grade milled decreased mainly due to lower open pit grades while underground grades slightly increased.

- The recovery rate remained at 92%.

- AISC increased mainly due to lower ounces sold, higher unit underground and open pit mining costs, and higher unit processing costs which were partially offset by lower unit G&A costs.

- Open pit mining costs increased from $3.45 to $5.36 per tonne due to additional drill and blast requirements at Kofi B.

- Underground mining unit costs increased from $68.32 to $85.92 due to increased fleet maintenance costs.

- Processing unit costs increased from $17.76 to $22.45 per tonne due to increased reagent consumption.

- Sustaining capital spend remained flat at $7.5m, compared to $7.6m in Q2-2018, however increasing on a per once basis from $264/oz to $290/oz due to lower ounces sold.

- Non-sustaining capital spend of $8.1 million, up from $0.9 million, was due to the receipt of new mining equipment late in the quarter.

YTD-2018 vs YTD-2017 Insights

- Production decreased and AISC increased mainly due to a decrease in processed grades following the completion of the high-grade Kofi C pit in 2017.

Table 12: Tabakoto Quarterly Performance Indicators

| For The Quarter | Q3-2018 | Q2-2018 | Q3-2017 |

| OP Tonnes ore mined, kt | 146 | 109 | 108 |

| OP Strip ratio (incl. waste cap) | 5.25 | 10.89 | 9.13 |

| UG tonnes ore mined, kt | 143 | 143 | 179 |

| Tonnes milled, kt | 433 | 423 | 392 |

| Grade, g/t | 2.08 | 2.11 | 2.64 |

| Recovery rate, % | 92% | 92% | 94% |

| PRODUCTION, KOZ | 26 | 27 | 32 |

| Cash cost/oz | 1,058 | 1,054 | 1,104 |

| AISC/OZ | 1,420 | 1,397 | 1,278 |

Table 13: Tabakoto Half Year Performance Indicators

| For The Nine Months Ended | Sep. 30, | Sep. 30, |

| 2018 | 2017 | |

| OP Tonnes ore mined, kt | 464 | 482 |

| OP Strip ratio (incl. waste cap) | 7.72 | 8.40 |

| UG tonnes ore mined, kt | 437 | 599 |

| Tonnes milled, kt | 1,297 | 1,204 |

| Grade, g/t | 2.24 | 3.16 |

| Recovery rate, % | 92% | 94% |

| PRODUCTION, KOZ | 86 | 116 |

| Cash cost/oz | 1,010 | 872 |

| AISC/OZ | 1,335 | 1,085 |

Q4-2018 Outlook

- Tabakoto is on track to meet to the low-end of full-year 2018 production guidance of 115,000 - 130,000, however it is expected to be above the guided $1,200 - $1,250 per ounce due to increased sustaining capital development work planned and poor equipment availability.

Exploration Activities

- During Q3-2018, no drilling was undertaken on the surface and nearly 6,000 meters were drilled underground.

- Since the start of the year nearly 5,000 meters were drilled on open pit targets while more than 19,000 meters were drilled in the underground mines with the aim of replenishing depletion.

ITY CIL PROJECT CONSTRUCTION: AHEAD OF SCHEDULE and on-budgeT

- Construction is progressing on-budget and two months ahead of schedule with the first gold pour expected in early Q2-2019

- The major milestones achieved to date include:

- More than 6 million man-hours worked with zero lost-time injuries.

- Overall project completion stands at over 75%, tracking approximately 2 months ahead of schedule.

- Nearly all of the total capital cost of $412 million has been committed. As at September 30, 2018, the project capital expenditure stands at $276 million, which includes approximately $232 million of cash outflow, $33 million of leased equipment and $11 million of non-cash working capital. The cash outflow for Q4-2018 is expected to be between $50 - $60 million, with the remaining cash outlay expected to occur in H1-2019.

- The process plant construction is over 70% complete, tracking ahead of schedule as the Ball and SAG mill installation commenced three months earlier than initially planned. Structural, mechanical, piping and electrical installation work is well underway.

- Tailings storage facility earthworks are progressing well against schedule with over 70% completed. Installation of the rubber lining has commenced.

- The 91kv transmission line and 29MW power station construction are progressing well against schedule with over 70% completed. First power drawdown is expected to in Q1-2019.

- The haul road bridge to access the Daapleau pit is 92% complete, with substructure concrete completed.

- The employee permanent camp construction is complete, with all 312 rooms available for occupation.

- The resettlement program is progressing well against schedule with over 90% completed.

- More than 2,800 personnel, including contractors, are currently employed on-site, approximately 90% of which are locals.

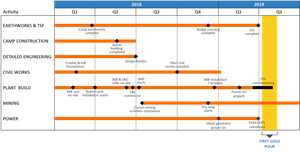

- The main upcoming milestones are presented in Figure 1 below:

Figure 1: Ity CIL Construction Milestones

Picture 1: Construction of Processing Plant

KALANA PROJECT UPDATE

- An intensive exploration program, consisting of 48,000 meters of drilling, was finalized in early Q2-2018 on the Kalana and Kalanako deposits. No drilling was conducted in Q3-2018 as efforts were directed on completing the resource model with an updated resource estimate expected to be published in upcoming weeks.

- At the Kalana deposit, the drilling confirmed the overall geological model and in-fill drilling is expected to convert a portion of the previously classified inferred resources in the northeastern part of the deposit, which will form the basis of the updated feasibility study.

- At the Kalanako deposit, drilling has confirmed the continuation of the mineralization and is expected to convert a portion of the previously classified inferred resources.

- In parallel with completion of the resource model, work has progressed on the updated feasibility study which is expected to be published in H1-2019.

EXPLORATION ACTIVITIES

- During Q3-2018, despite more difficult working conditions due to the rainy season, a total of 54,000 meters were drilled across the group for an exploration spend of $11 million, with details by asset provided in the above mine sections.

- The bulk of the Q3-2018 exploration spend was focused on infill drilling the Kari Pump discovery at Houndé, for which a maiden resource is expected to be published in the coming weeks. In addition, following the intensive drilling done in the first half of the year, analysis work progressed on the other assets.

- More than 346,600 meters were drilled across the group since the beginning of the year focusing mainly on the Kari discovery at Houndé, on the Fetekro greenfield target where an initial resource was published on October 29, 2018, on Kalana where an updated resource is expected to be published in the coming weeks, and on the Le Plaque deposit where a resource update is planned for H1-2019.

Table 14: Exploration Expenditures

| (in US$ million) | YTD-2018 EXPENDITURES | 2018 BUDGET ALLOCATION | |

| Agbaou | 4.1 | 4 | 8% |

| Tabakoto and greenfield Kofi areas | 4.9 | 7 | 15% |

| Ity and greenfield areas on its 100km trend | 6.1 | 8 | 18% |

| Karma | 2.6 | 2 | 4% |

| Kalana | 7.2 | 6 | 13% |

| Houndé | 12.7 | 9 | 21% |

| Other greenfield properties | 7.9 | 10 | 22% |

| TOTAL EXPLORATION EXPENDITURES* | 45.6 | 40-45 | 100% |

*Includes expensed, sustaining, and non-sustaining exploration expenditures

CASH FLOW BASED ON ALL-IN MARGIN APPROACH

- The table below presents the cash flow for the year-to-date periods ended September 30th based on the All-In Margin approach, with accompanying notes below.

Table 15: Simplified Cash Flow Statement

| NINE MONTHS ENDED, | ||||

| Sep. 30, | Sep. 30, | |||

| (in US$ million) | 2018 | 2017 | ||

| GOLD SOLD FROM CONTINUING OPERATIONS, koz | (Note 1) | 439 | 253 | |

| Gold Price, $/oz | (Note 2) | 1,240 | 1,183 | |

| REVENUE FROM CONTINUING OPERATIONS | 544 | 299 | ||

| Total cash costs | (258) | (158) | ||

| Royalties | (Note 3) | (31) | (14) | |

| Corporate costs | (19) | (15) | ||

| Sustaining capex | (Note 4) | (18) | (14) | |

| Sustaining exploration | (7) | (9) | ||

| ALL-IN SUSTAINING MARGIN FROM CONTINUING OPERATIONS | (Note 5) | 211 | 88 | |

| All-In-Sustaining Margin from discontinued operations | (Note 6) | (4) | 56 | |

| ALL-IN SUSTAINING MARGIN FROM ALL OPERATIONS | 207 | 144 | ||

| Less: Non-sustaining capital | (Note 7) | (41) | (23) | |

| Less: Non-sustaining exploration | (Note 8) | (31) | (22) | |

| ALL-IN MARGIN FROM ALL OPERATIONS | (Note 9) | 134 | 100 | |

| Working capital | (Note 10) | (89) | (6) | |

| Changes in long-term inventories | (Note 11) | (19) | 0 | |

| Taxes paid | (18) | (16) | ||

| Interest paid and financing fees | (Note 12) | (37) | (22) | |

| Cash settlements on hedge programs and gold collar premiums | (Note 13) | 1 | (4) | |

| NET FREE CASH FLOW FROM OPERATIONS | (28) | 52 | ||

| Growth project capital | (Note 14) | (231) | (221) | |

| Greenfield exploration expense | (8) | (6) | ||

| M&A activities | 0 | (54) | ||

| Cash paid on settlement of share appreciation rights, DSUs and PSUs | (4) | (4) | ||

| Net equity proceeds | (1) | 77 | ||

| Restructuring costs | 0 | (7) | ||

| Other (foreign exchange gains/losses and other) | (Note 15) | (14) | 2 | |

| NET CASH / (NET DEBT) VARIATION | (285) | (159) | ||

| Convertible senior bond | (Note 16) | 330 | 0 | |

| Proceeds (repayment) of long-term debt | (Note 17) | (130) | 160 | |

| CASH INFLOW (OUTFLOW) FOR THE PERIOD | (85) | 1 | ||

Certain line items in the table above are NON-GAAP measures. For more information and notes, please consult the Company's MD&A.

NOTES:

1. Gold sales from continuing operations increased mainly due to the commissioning of Houndé in Q4-2017.

2. The YTD-2018 realized gold price was $1,240/oz compared to $1,183/oz in YTD-2017. Both these amounts include the impact of the Karma stream, amounting to 15,000 ounces sold at 20% of spot prices.

3. Royalties paid increased due to both greater gold sales and a higher realized gold price, representing approximately $71/oz sold for YTD-2018 compared to $55/oz for the corresponding period of 2017.

4. Sustaining capital for continuing operations for the YTD-2018 increased compared to the corresponding period of 2017 due to the addition of Houndé and an increase at Agbaou, which were offset by decreases at Ity and Karma as illustrated in the below table. Further details by assets are provided in the above mine sections.

Table 16: Sustaining Capital for Continuing Operations

| (in US$ million) | THREE MONTHS ENDED | NINE MONTHS ENDED | ||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | ||

| 2018 | 2018 | 2017 | 2018 | 2017 | ||

| Agbaou | 4 | 2 | 2 | 8 | 6 | |

| Ity Heap Leach | 0 | 1 | 2 | 2 | 5 | |

| Karma | 1 | 1 | 2 | 2 | 3 | |

| Houndé | 3 | 3 | 0 | 6 | 0 | |

| Total | 8 | 6 | 6 | 18 | 14 | |

5. The All-In Sustaining Margin (inclusive of discontinued operations) increased due the inclusion of Houndé, higher realized gold prices, and an increase in gold sold at Ity, which offset the decrease in revenue generated by Agbaou.

6. For YTD-2018, the discontinued operation represents the Tabakoto mine, while for 2017 it also includes the Nzema mine. Tabakoto's All-In-Sustaining Margin decreased from $19 million for YTD-2017 to negative $4 million for YTD-2018 due to increased operating costs and sustaining costs, as detailed in the above mine section.

7. Non-sustaining capital spending increased by $18 million in YTD-2018 over YTD-2017 mainly due to an increase at Agbaou for waste capitalization activities, an increase at Tabakoto and the addition of the Houndé mine.

8. Non-sustaining exploration capital increased in line with Endeavour's strategy objective of unlocking exploration value.

9. The All-In Margin was higher as increased production at a lower AISC and higher realized gold price more than compensated for the increase in non-sustaining expenditures.

10. The working capital variation amounted to an outflow of $89 million for YTD-2018, which should be partially offset in Q4-2018 and in early 2019 as some inventories are expected to be monetized. More details are provided in the MD&A. The main components were:

- Receivables outflow of $12 million due to timing

- Inventories outflow of $43 million mainly due to a build up of stockpiles and consumables at Houndé

- Prepayments outflow of $8 million mainly due strategic spare parts at Houndé

- Trade and other payables outflow of $25 million mainly due to a build up of payables at Agbaou in 2017 driven by a regulatory issue in paying a key supplier

11. The changes in long-term inventories is a new policy adopted by the group whereby stockpiled material that will not be processed within 12 months is treated as a non-current asset. The outflow in the year represents the build-up of this newly classified item.

12. Interest and financing fees paid increased due to the increase in debt outstanding related to the construction of Houndé and Ity CIL.

13. The revenue protection program, based on a collar with a floor at $1,300/oz and a ceiling of $1,500/oz, has generated a realized gain of $0.7 million for the YTD-2018 (of which $3 million was in Q3-2018) and an unrealized gain of $17.5 million for the YTD-2018 (of which $9.0 million was in Q3-2018).

14. Growth project spending continued to be a strong focus in Q3-2018 with $68 million incurred, amounting to $231 million for the YTD, comprised mainly of:

- $206 million for the Ity CIL project

- $7 million on TSF construction at Houndé

- $9 million on Kalana

- $9 million on aviation equipment purchased to reduce travel costs and improve efficiency

15. A foreign exchange loss, mainly on the settlement of euro denominated supplier payments, occured because of a stronger US dollar

16. $330 million was recieved in Q1-2018 from the convertible notes issuance.

17. $280 million was repaid on the revolving credit facility ("RCF") in Q1-2018, and $70 million and $80 milllion were then redrawn in respectively Q2 and Q3-2018, mainly to fund the Ity CIL construction.

NET CASH FLOW, NET DEBT AND LIQUIDITY SOURCES

- At quarter-end, Endeavour's available sources of financing and liquidity remained strong at $213 million, which included its $33 million cash position and $180 million undrawn on the RCF. In addition to these liquidity sources, Endeavour also has strong cash flow generation, additional Ity CIL equipment financing, and the remaining proceeds from the Tabakoto and Nzema sales.

- The below table summarizes operating, investing, and financing activities, main balance sheet items and the resulting impact on the company's Net Debt position, with notes provide below.

Table 17: Cash Flow and Net Debt Position

| THREE MONTHS ENDED | NINE MONTHS ENDED | ||||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |||

| (in US$ million unless stated otherwise) | 2018 | 2018 | 2017 | 2018 | 2017 | ||

| Net cash from (used in), as per cash flow statement: | |||||||

| Operating activities | (Note 18) | 12 | 60 | 56 | 119 | 140 | |

| Investing activities | (Note 19) | (120) | (127) | (104) | (366) | (356) | |

| Financing activities | (Note 20) | 64 | 56 | 90 | 162 | 218 | |

| Effect of exchange rate changes on cash | 0 | 0 | (1) | (1) | (1) | ||

| INCREASE/(DECREASE) IN CASH | (45) | (12) | 40 | (85) | 1 | ||

| Cash position at beginning of period | 82 | 94 | 85 | 123 | 124 | ||

| Cash position discontinued operation | (4) | (3) | (28) | (4) | (28) | ||

| CASH POSITION AT END OF PERIOD | 33 | 79 | 97 | 33 | 97 | ||

| Equipment financing | (Note 21) | (69) | (69) | (31) | (69) | (31) | |

| Convertible senior bond | (330) | (330) | - | (330) | - | ||

| Drawn portion of revolving credit facility | (170) | (90) | (292) | (170) | (292) | ||

| NET DEBT POSITION | (Note 22) | 535 | 410 | 221 | 535 | 221 | |

| Net Debt / Adjusted EBITDA (LTM) ratio | 1.79 | 1.49 | 0.98 | 1.79 | 0.98 | ||

Net Debt and Adjusted EBITDA are NON-GAAP measures. For a discussion regarding the company's use of NON-GAAP Measures, please see "note regarding certain measures of performance" in the MD&A.

NOTES:

18. Net cash flow from operating activities during Q3-2018 was $12 million, down $48 million over Q2-2018, mainly due to a $34 million decrease in revenues (related to less ounces sold at a lower gold price) and a $25 million increase in negative non-cash working capital (reference Note 10 above).

19. Net cash used in investing activities during Q3-2018 was $120 million, down $7 million over Q2-2018, however remaining high due to the continued spend in growth project capital of $68 million (mainly for Ity CIL construction - reference Note 14 above).

20. Net cash generated in financing activities during Q3-2018 was $64 million, which was mainly due to $80 million drawn down on the RCF which was partially offset by $7 million of financing fees and $6 million of finance lease repayments.

21. Equipment lease financing stood at $69 million as at September 30, 2018, flat compared to June 30, 2018, as a $6 million repayment of current period obligations was made (total for Houndé and Ity) while $4 million was drawn for the Ity CIL project.

22. As anticipated, net debt increased from $410 million as at June 30, 2018, to $535 million as at September 30, 2018, mainly due to growth project spending.

OPERATING CASH FLOW PER SHARE

- Operating cash flow per share (before non-cash working capital) amounted to $0.42 for Q3-2018, a decrease from $0.64 for Q2-2018 mainly due less ounces sold at a lower gold price.

- Operating cash flow per share (before non-cash working capital) amounted to $1.94 for YTD-2018, up 30% over YTD-2017, mainly due to the start-up of Houndé.

Table 18: Operating Cash Flow Per Share

| (in US$ million unless stated otherwise) | THREE MONTHS ENDED | NINE MONTHS ENDED | ||||

| Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | ||

| 2018 | 2018 | 2017 | 2018 | 2017 | ||

| CASH GENERATED FROM OPERATING ACTIVITIES | 12 | 60 | 56 | 119 | 140 | |

| Add back changes in non-cash working capital | (34) | (9) | 17 | (89) | (6) | |

| OPERATING CASH FLOW BEFORE NON-CASH WORKING CAPITAL | 45 | 69 | 39 | 208 | 145 | |

| Divided by weighted average number of O/S shares, in millions | 108 | 108 | 96 | 108 | 98 | |

| OPERATING CASH FLOW BEFORE NON-CASH WORKING CAPITAL PER SHARE | 0.42 | 0.64 | 0.41 | 1.94 | 1.49 | |

Operating Cash Flow Per Share is a NON-GAAP measure. For a discussion regarding the company's use of NON-GAAP Measures, please see "note regarding certain measures of performance" in the MD&A.

ADJUSTED NET EARNINGS PER SHARE

- The basic earnings per share for Q3-2018 amounted to $0.14 compared to ($0.15) for Q3-2017 and $0.29 for YTD-2018 compared to ($0.13) for YTD-2017.

- Total adjustments amounted to $61 million for YTD-2018, primarily related to losses from discontinued operations, deferred income tax recovery and prior period adjustments, gains on financial instruments, and stock-based expenses.

- Adjusted net earnings per share from continuing operations amounted to $0.31 for YTD-2018, up from $0.05 for YTD-2017.

Table 19: Net Earnings and Adjusted Net Earnings

| THREE MONTHS ENDED | NINE MONTHS ENDED | |||||

| (in US$ million unless stated otherwise) | Sep. 30, | Jun. 30, | Sep. 30, | Sep. 30, | Sep. 30, | |

| 2018 | 2018 | 2017 | 2018 | 2017 | ||

| TOTAL NET EARNINGS | (20) | (15) | (65) | (8) | (43) | |

| Less adjustments (see MD&A) | 20 | 30 | 68 | 61 | 61 | |

| ADJUSTED NET EARNINGS FROM CONTINUING OPERATIONS | (0) | 15 | 4 | 53 | 17 | |

| Less portion attributable to non-controlling interests | 1 | 6 | 1 | 20 | 13 | |

| ATTRIBUTABLE TO SHAREHOLDERS | (1) | 9 | 2 | 33 | 5 | |

| Divided by weighted average number of O/S shares | 108 | 108 | 96 | 108 | 98 | |

| ADJUSTED NET EARNINGS PER SHARE (BASIC) | (0.01) | 0.09 | 0.03 | 0.31 | 0.05 | |

| FROM CONTINUING OPERATIONS | ||||||

Adjusted Net Earnings is a NON-GAAP measure. For a discussion regarding the company's use of NON-GAAP Measures, please see "Note Regarding Certain Measures of Performance" in the MD&A.

SUSTAINABILITY

- Endeavour has published its first sustainability report which has been independently assured and follows the requirements of the Global Reporting Initiative Standards, available on its website.

- Endeavour has based its sustainability approach on four main pillars:

- Health and Safety: ensuring the safety of Endeavour's employees is our number one priority, as no tasks are so important that they cannot be performed safely.

- Employees: developing our people and culture is a competitive strength which is critical to our current and future success.

- Community: maintaining positive interaction with all local communities and all stakeholders, including governments, is based on mutual respect and the creation of lasting partnerships and prosperity.

- Environment: managing our responsibilities in all operations to ensure the environment is protected today and preserved for future generations.

- Beyond traditional initiatives, Endeavour aims to go further to leave a sustainable economic footprint around our mines. To this end, Endeavour will soon be launching an economic development fund that seeks to work with local communities and governments to identify sectors and businesses in need of investment, and to provide them with funding to help them thrive. It is initiatives such as these that will allow Endeavour to become a partner of choice for its neighbouring communities and governments.

CONFERENCE CALL AND LIVE WEBCAST

Management will host a conference call and live webcast to discuss the Company's financial results which will take place on Wednesday, November 7th, 2018, at:

5:30am in Vancouver

8:30am in Toronto and New York

1:30pm in London

9:30pm in Hong Kong and Perth

The live webcast can be accessed through the following link:

https://edge.media-server.com/m6/p/re2xun8g

Analysts and investors are also invited to participate and ask questions using the dial-in numbers below:

International: +1 929 477 0448

North American toll-free: 888 599 8686

UK toll-free: 0800 358 6377

Confirmation code: 6221592

The conference call and webcast will be available for playback on Endeavour's website.

Click here to add the webcast reminder to Outlook Calendar

Access the live and On-Demand version of the webcast from mobile devices running iOS and Android:

QUALIFIED PERSONS

Jeremy Langford, Endeavour's Chief Operating Officer - Fellow of the Australasian Institute of Mining and Metallurgy - FAusIMM, is a Qualified Person under NI 43-101, and has reviewed and approved the technical information in this news release.

CONTACT INFORMATION

| Martino De Ciccio VP - Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate African gold producer with a solid track record of operational excellence, project development and exploration in the highly prospective Birimian greenstone belt in West Africa. Endeavour is focused on offering both near-term and long-term growth opportunities with its project pipeline and its exploration strategy, while generating immediate cash flow from its operations.

Endeavour operates 5 mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Houndé, Karma), and Mali (Tabakoto) which are expected to produce 670-720koz in 2018 at an AISC of $840-890/oz. Endeavour's high-quality development projects (recently commissioned Houndé, Ity CIL and Kalana) have the combined potential to deliver an additional 600koz per year at an AISC well below $700/oz between 2018 and 2020. In addition, its exploration program aims to discover 10-15Moz of gold between 2017 and 2021 which represents more than twice the reserve depletion during the period.

For more information, please visit www.endeavourmining.com.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION AND NON-GAAP MEASURES

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

Attachments

- View Presentation.pdf

- Production & AISC by Mine.pdf

- Figure 1: Ity CIL Construction Milestones.png

- View News Release in PDF.pdf

- Picture 1: Construction of Processing Plant.png