Erdene Commences 18,000 Metre Drill Program at the Khundii Gold District

Highlights1:

- Drilling commenced at Bayan Khundii on Monday, August 17 with a second drill rig scheduled to be operating the week of August 24

- Phase I includes ~ 8,700 metres of drilling at Bayan Khundii (“BK”) and Dark Horse

- The first drill rig is focused on BK with drill plans for ~ 4,800 metres in ~30 holes in areas within the economic pit, outside the economic pit and beyond the boundaries of the pit-constrained resource outlined in the BK Bankable Feasibility Study

- BK drilling will include follow up in two new shallow, high-grade discovery areas

- Striker SW: BKD-292 intersected 15 metres of 29 g/t gold including one metre of 353 g/t gold

- Midfield SE: BKD-288 results included 5.5 metres of 125.9 g/t, including 1 metre of 581.6 g/t gold

- BK drilling will include follow up in two new shallow, high-grade discovery areas

- The second drill rig will begin a Phase I, 10 hole, 1,200 metre program at the Dark Horse prospect

- Drilling will initially focus on the main structure and areas of recent trench results which included: 6 metres grading 8.8 g/t gold, including 1 metre of 50.8 g/t gold and 4 metres of 14 g/t gold, including 1 metre of 45.3 g/t gold, in KMT-01 and KMT-03, respectively

- An additional 2,700 metres (~15 holes) following up on initial results, will be drilled at BK and Dark Horse, completing Phase I by early October

- The first drill rig is focused on BK with drill plans for ~ 4,800 metres in ~30 holes in areas within the economic pit, outside the economic pit and beyond the boundaries of the pit-constrained resource outlined in the BK Bankable Feasibility Study

- Phase II Program: ~9,000 metre program scheduled to begin in mid-October

- Details will be finalized following the review and interpretation of Phase I results from BK and Dark Horse, and will include Altan Nar and Ulaan drilling where targeting is currently in progress

- Phase I includes ~ 8,700 metres of drilling at Bayan Khundii (“BK”) and Dark Horse

HALIFAX, Nova Scotia, Aug. 18, 2020 (GLOBE NEWSWIRE) -- Erdene Resource Development Corporation (TSX:ERD | MSE:ERDN) (“Erdene” or the “Company”) is pleased to announce commencement of drilling at its 100%-owned Khundii Gold Project licenses.

“We are very excited to initiate a major drill program in the Khundii Gold District, following up on the outstanding near-surface, high-grade gold intersections reported earlier in Q3,” said Peter Akerley, Erdene’s President and CEO. “Our recent financing, led by Eric Sprott, provides us with the resources to advance our Bayan Khundii Gold Project towards development and to aggressively explore the broader Khundii Gold District, which offers tremendous discovery potential as demonstrated by our high-grade gold discoveries to date.”

_____________________________________

1 Previous results in this release are stating apparent thicknesses

“An 18,000 metre drill program is planned to be completed before year-end, with drilling now underway at Bayan Khundii and a second drill rig scheduled to arrive at Dark Horse next week,” continued Mr. Akerley. “The program is designed to test new areas in the district, add additional resources adjacent to current deposits and increase confidence in current resource areas, potentially adding to existing reserves at Bayan Khundii.”

Drilling Highlights & Plans

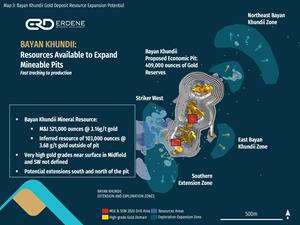

[See plan view maps below]

The Khundii Gold District provides a multitude of exploration and development opportunities beyond the initial proposed open-pit development at Bayan Khundii. These opportunities include recent near-surface drilling successes and expansion opportunities within the Bayan Khundii deposit area, the new Dark Horse gold discovery and the identification of very high-grade gold in the Discovery Zone at Altan Nar, reported earlier in 2020. A brief overview of the main target areas and planned program is outlined below.

Bayan Khundii Deposit Area

Midfield SE and Striker SW: Drilling in Q2 2020 discovered very high grade, near-surface gold zones in both Midfield SE and Striker SW. Midfield SE intersections included 5.5 metres of 125.9 g/t gold, including 1 metre of 581.6 g/t gold in BKD-288, beginning 11.5 metres downhole, and 15 metres of 25.6 g/t gold including 1 metre of 338 g/t gold beginning at 14.9 metres downhole in BKD-274, located 40 metres north of BKD-288. In total, 16 of 18 holes drilled at Midfield SE in Q2 2020 intersected anomalous gold (≥0.2 g/t) mineralization within 25 metres of surface. This discovery is interpreted as the intersection of the stacked NW trending quartz adularia veins, with a N-S trending conceptual feeder structure. The Midfield SE structure has been traced over a strike length of at least 200 metres with Q2 drill testing only the northern 50 metres. The Phase I drill program will target this conceptual feeder structure’s southeast continuation which remains largely untested. As this area was classified as waste or low-grade stockpile material in the current resource, it has the potential to have a significant impact early in the project mine life. The possibility of parallel en-echelon features is demonstrated by another outlier of high-grade gold in BKD-118 which intersected 1 metre of 159 g/t gold located 200 metres east of Midfield SE and outside of the proposed pit.

At Striker SW, recent drilling intersected anomalous gold (≥ 0.2 g/t) in all 11 holes in a 100m x 50m area within 25 metres of surface. Hole BKD-290 intersected 20 metres of 5.9 g/t gold beginning 8 metres from drill collar, including one metre of 91.2 g/t gold, and BKD-292 intersected 15 metres of 29 g/t gold beginning 0.9 metres from drill collar, including one metre of 353 g/t gold. This program established continuity of this very high-grade zone in an area currently classified predominantly as low-grade or below cut-off grade material, that is scheduled to be mined in the first year of the Bayan Khundii development. Western continuity and potentially southern extensions of the Striker SW area will be tested in the current drill program.

Bayan Khundii – Extensions and Exploration Beyond Planned Pit: The Bayan Khundii Mineral Resource2 includes 521,000 ounces of 3.16 g/t gold Measured and Indicated (“M&I”) and 103,000 ounces of Inferred resources at 3.68 g/t gold. Within the M&I resource, a proven and probable open-pit reserve3 totals 409,000 ounces at 3.7g/t (see the full press release here). Several mineralized zones and exploration areas peripheral to the planned open-pit at Bayan Khundii host intervals of exceptionally high-grade (30 to 150 g/t gold intersections over 1 meter) gold-bearing veins. This provides significant potential growth of reserves with the development of the remaining M&I and Inferred resources and areas beyond the current resources. In addition, the reported resource is an open-pit constrained resource beyond which drilling has previously intersected significant gold mineralized zones. These areas will also be the subject of Phase I drilling to evaluate resource expansion.

Striker West and Southern Extension: Located approximately 210 metres west of the planned Bayan Khundii open-pit, drilling in 2019 confirmed and extended the Striker West target with the best intersection of this deposit area to date with 3 metres of 40 g/t gold at a vertical depth of 136 metres (BKD-265). Results from this hole also broadened the mineralized domain at shallow depth and outside the defined resource boundary with a 16-metre interval of 1.1 g/t gold, including 5 metres of 2.7 g/t gold, beginning only 28 metres from the surface. This area is open to the south, where BKD-266 was drilled in Q2 2019, approximately 250 metres west-southwest of the planned open-pit, and outside the currently defined resource boundary. This hole intersected a high-grade, one-metre interval of 51.9 g/t gold at a depth of 264 metres within a broad zone of silica-illite and magnetite altered volcanic tuff, suggesting a down-dip continuation of high-grade gold mineralization from the currently defined Bayan Khundii pit. The 2020 drill programs will seek to increase confidence in the high-grade core of Striker West and expand this zone to the south.

Dark Horse (Khar Mori)

The Dark Horse prospect, and by extension, the Altan Arrow prospect, 3.5 km north of the Bayan Khundii gold deposit, will be the subject of drilling in both the Phase I and II drill programs. The Dark Horse prospect covers an approximately 1.5 by 3-kilometre area, connected to the northwesterly adjacent Altan Arrow gold prospect. Previous drilling along the subsidiary structures south of Altan Arrow (within 300 metres of the Dark Horse target area) have provided the highest-grade intersections to date, including 24 g/t and 70 g/t gold over 2 metres (AAD-03 and AAD-12) within 75 metres of surface.

Initially, drilling will focus along the main structure at Dark Horse which exhibits a 1.3-kilometre gold in soil anomaly as well as areas of recent trenching successes which include:

- 6 metres grading 8.8 g/t gold, including 1 metre of 50.8 g/t gold on the main Dark Horse structure in trench KMT-01

- 4 metres of 14 g/t gold, including 1 metre of 45.3 g/t gold at KMT-03 on a structural intersection zone 850 metres east southeast of KMT-01

_____________________________________

2 Bayan Khundii Mineral Resource M&I consists of: Measured 171,000 ounces and 350,000 ounces Indicated. For details of the Mineral Resources see Khundii Gold Project NI 43-101 Technical Report, Tetra Tech December 4, 2019 – SEDAR

3 Bayan Khundii Mineral Reserve consists of 166,000 ounces Proven and 244,000 ounces Probable

The main Dark Horse structure is characterized by gold in soil anomalism, very high gold grades in rock chip samples, residual quartz bodies, intense silicification and white mica alteration. The current interpretation of Dark Horse includes a series of structurally controlled gold mineralized comb quartz stockwork zones situated along or proximal to the dominant NE trending faults, where the NE structures are intersected by opposing NW trending. The intersection of these opposing structures may result in dilation zones, creating preferential conduits for fluid flow and subsequent gold deposition. These are all features characteristic of the Bayan Khundii deposit to the south. (see attached images).

As a large, untested gold prospect, Dark Horse provides significant discovery potential along strike of the main structure and at or near NE-NW structural intersections where several isolated but intense gold in soil anomalies are located, many of which contain high-grade gold in rock chip. The extent of drilling at Dark Horse in Phase II will be influenced by these initial results.

Altan Nar Gold Polymetallic Deposit

At Altan Nar, approximately 16 km north of the Bayan Khundii gold deposit, a growing gold and polymetallic resource provides a significant opportunity for growth. The current Altan Nar Gold resource includes 318,000 ounces of 2.0 g/t gold Indicated and 186,000 ounces of Inferred at 1.7 g/t gold in addition to significant silver and base metal content.

In early 2020 the company reported a high-grade discovery in the Discovery Zone (“DZ”), one of 18 high-priority targets along the 5.6-kilometre mineralized trend on its 100% owned Altan Nar project. Results included 23 metres of 17 g/t gold, 44.7 g/t silver, 0.75 % lead and 1.47 % zinc within a black, sulphide-rich epithermal breccia (TND-135) which targeted a previously untested area of the DZ high-grade core with additional holes providing further support for the continuity of high grades within the target zone. This proof of concept opened up multiple areas for targeted testing along the Altan Nar trend. Only a small portion of the Altan Nar licence has been drill tested, and 90% of the NI 43-101 Mineral Resource prepared by RPM Global in 2018 is within 150 metres of surface and contained mainly within 2 of the 18 targets with all zones open along strike and at depth. The Q1 2020 results demonstrate continuity in size and grade within the high-grade DZ core, providing confidence for future expansion. Wave Geophysics has recently completed a compilation project for Altan Nar, and interpretation work is underway to develop the next round of drilling expected to commence in Phase II of the 2020 program.

COVID-19 Precautions:

Throughout the 2020 field season, our team on the ground has worked to deliver an injury-free, effective field exploration program, rolling out increased preventive measures in response to COVID-19 risk. The Company has kept in place precautionary measures to protect against the spread of COVID-19. In the field, daily protocols are used to ensure basic hygiene, and daily briefing, induction and visitor reception procedures continue to include body temperature checks. Isolation facilities and personal protective equipment for emergency response have been prepared. Since late January, the Government of Mongolia has implemented a series of preventive measures in response to COVID-19, including limitations on public gatherings, suspension of in-person classroom learning, and international border controls. The most recent of these measures are currently in force until at least August 31, 2020. As of August 18, 2020, Mongolia has reported zero local transmissions of COVID-19 and zero deaths from the disease. All confirmed and reported cases to date have been amongst repatriated individuals.

Khundii Gold District

Erdene’s deposits are located in the Edren Terrane, within the Central Asian Orogenic Belt, host to some of the world’s largest gold and copper-gold deposits. The Company has been the leader in exploration in southwest Mongolia over the past decade and is responsible for the discovery of the Khundii Gold District comprised of multiple high-grade gold and gold/base metal prospects, two of which are being considered for development: the 100%-owned Bayan Khundii and Altan Nar projects. Together, these deposits comprise the Khundii Gold Project.

The Bayan Khundii Gold Resource1 includes 521,000 ounces of 3.16 g/t gold Measured and Indicated (“M&I”)² and 103,000 ounces of Inferred resources at 3.68 g/t gold. Within the M&I resource, a proven and probable open-pit reserve totals 422,000 ounces at 3.7 g/t (see the full press release here), providing significant potential growth of reserves with the development of the remaining M&I and Inferred resources4.

In July 2020, Erdene announced the results of an independent Feasibility Study for the Bayan Khundii Gold Project (press release here). The Feasibility Study results include an after-tax Net Present Value at a 5% discount rate and a US$1,400/oz gold price of US$100 million and Internal Rate of Return (“IRR”) of 42%. The Feasibility Study envisions an open-pit mine at Bayan Khundii, producing an average of 63,500 oz gold per year, for seven years, at a head grade of 3.71 g/t gold, utilizing a conventional carbon in pulp processing plant. Production is expected to commence in early 2022 based on the current project schedule.

Erdene Resource Development Corp. is a Canada-based resource company focused on the acquisition, exploration, and development of precious and base metals in underexplored and highly prospective Mongolia. The Company has interests in three mining licenses and two exploration licenses in Southwest Mongolia, where exploration success has led to the discovery and definition of the Khundii Gold District. Erdene Resource Development Corp. is listed on the Toronto and the Mongolian stock exchanges. Further information is available at www.erdene.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

_____________________________________

4 For details of the Mineral Resources see Khundii Gold Project NI 43-101 Technical Report, Tetra Tech December 4, 2019 – SEDAR

2 M&I: 171,000 ounces of 3.77 g/t gold Measured, and 349,700 ounces of 2.93 g/t gold Indicated

Qualified Person and Sample Protocol

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist for Erdene, is the Qualified Person as that term is defined in National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. All samples have been assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal checks by SGS Laboratory, the Company incorporates a QA/QC sample protocol utilizing prepared standards and blanks. All samples undergo standard fire assay analysis for gold and ICP-OES (Inductively Coupled Plasma Optical Emission Spectroscopy) analysis for 33 additional elements. For samples that initially return a grade greater than 5 g/t gold, additional screen-metallic gold analysis is carried out which provides a weighted average gold grade from fire assay analysis of the entire +75 micron fraction and three 30-gram samples of the -75 micron fraction from a 500 gram sample.

Erdene’s drill core sampling protocol consisted of collection of samples over 1 or 2 metre intervals (depending on the lithology and style of mineralization) over the entire length of the drill hole, excluding minor post-mineral lithologies and un-mineralized granitoids. Sample intervals were based on meterage, not geological controls or mineralization. All drill core was cut in half with a diamond saw, with half of the core placed in sample bags and the remaining half securely retained in core boxes at Erdene’s Bayan Khundii exploration camp. All samples were organized into batches of 30 including a commercially prepared standard, blank and either a field duplicate, consisting of two quarter-core intervals, or a laboratory duplicate. Sample batches were periodically shipped directly to SGS in Ulaanbaatar via Erdene’s logistical contractor, Monrud Co. Ltd.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. Although Erdene believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Erdene cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Erdene currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain required third party approvals, market prices, exploitation and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. The Company does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

| Peter C. Akerley, President and CEO, or | |

| Robert Jenkins, CFO | |

| Phone: | (902) 423-6419 |

| Email: | info@erdene.com |

| Twitter: | https://twitter.com/ErdeneRes |

| Facebook: | https://www.facebook.com/ErdeneResource |

| LinkedIn: | https://www.linkedin.com/company/erdene-resource-development-corp-/ |

| YouTube: | https://www.youtube.com/channel/UCILs5s9j3SLmya9vo2-KXoA |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/20ba7fe1-f127-4a2d-988d-d2faec804c64

https://www.globenewswire.com/NewsRoom/AttachmentNg/a3e5c178-8443-410b-996f-02b56368ba12

https://www.globenewswire.com/NewsRoom/AttachmentNg/bcd7b84b-0c2c-44d1-97f4-86aa0de92d66