Erdene Extends Ulaan Gold Discovery and Plans 2022 Exploration Program; Intersects 24 Metres of 2.22 g/t Gold, Including One Metre of 27.39 g/t Gold

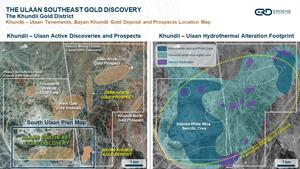

HALIFAX, Nova Scotia, Jan. 26, 2022 (GLOBE NEWSWIRE) -- Erdene Resource Development Corporation (TSX: ERD | MSE: ERDN) (“Erdene” or the “Company”) is pleased to provide an update on the 2021 exploration program at the recent Ulaan Southeast gold discovery, as well as plans for its 2022 Ulaan exploration program. Ulaan Southeast, located on the 100% owned Ulaan licence, is a growing, blind top gold discovery, announced in Q3 2021, 300 metres west of the construction-ready Bayan Khundii Gold Project.

Highlights

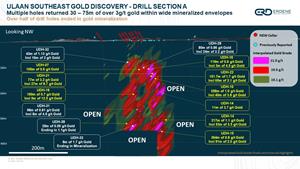

- Gold mineralization at Ulaan Southeast has been traced over a 200 x 250 metre area, to a maximum depth of 460 metres, that is open at depth and to the north and west

- Multiple holes returned wide zones (30 – 75 metres) averaging over 3 g/t gold

- Half of the 22 holes drilled ended in gold mineralization, including up to 22.0 g/t over 2 metres (UDH-17)

- Q4 2021 drilling intersected thick sequences of gold mineralization, approximately 100 metres southwest of the discovery hole (UDH-10)

- UDH-32: 43 metres of 1.13 g/t gold beginning 79 metres downhole, including 16 metres of 2.03 g/t gold

- UDH-29: 80 metres of 0.86 g/t gold beginning 91 metres downhole, including one metre of 27.39 g/t gold, within 24 metres of 2.22 g/t gold

- The Ulaan discovery bears many similarities to the adjacent Bayan Khundii deposit

- Characterized by a gold bearing, intense quartz ± adularia ± hematite veins and stockwork zones within a broad halo of silicified, white mica altered volcanics

- Comprehensive exploration program for Ulaan will be finalized in mid-Q1 2022 as part of a broader Khundii District program

- Will test potential extensions of the Ulaan Southeast Discovery, a 1.5km trend in the southern portion of Ulaan, and targets in the central and eastern portions of the license

- Q4 drilling results from the Dark Horse oxide gold discovery expected in mid-Q1

Quotes from the Company

“The Ulaan Discovery results continue to demonstrate the potential for large-scale, high grade gold discoveries in the Khundii District,” said Peter Akerley, Erdene’s President and CEO. “Recent drilling confirms broad zones of gold mineralization continuing westward, with surface indications of similar targets over a 1.5km trend in the south of the license.”

“Since acquiring full control of the Ulaan license, and with modest exploration expenditures, we’ve made a significant blind discovery and identified two high-priority targets elsewhere on the Ulaan property,” continued Mr. Akerley. “These results further support our thesis that the greater Khundii-Ulaan alteration trend, including Dark Horse and the Bayan Khundii Deposit, is part of a large-scale gold-bearing hydrothermal system that has the potential to host a multimillion-ounce gold deposit.”

Summary of Drill Results

The most recent Ulaan drill program, completed in December 2021, was designed to further define the extent of gold mineralization identified earlier in the year at the Ulaan Southeast discovery and to test expansion potential to the west. The program consisted of eight holes totaling 2,900 metres. Drill holes were spaced at 25 to 100 metres and drilled to an average depth of 362 metres, testing targets over an area of approximately 5 hectares. Highlights from the most recent drill holes are provided below in Table 1, and a drill hole plan map and section are attached to this release.

Table 1: Ulaan Q4 2021 Drilling Highlights

(Intervals averaging over 0.30 g/t gold)

| Hole | From | To | Interval (1) | g/t Au |

| UDH-27 | 278 | 296 | 18 | 0.36 |

| Incl | 282 | 288 | 6 | 0.73 |

| Incl | 328 | 330 | 2 | 0.50 |

| UDH-28 | 282 | 291 | 9 | 0.47 |

| And | 306 | 350(2) | 44 | 0.41 |

| Incl | 325 | 350(2) | 25 | 0.59 |

| UDH-29 | 91 | 171 | 80 | 0.86 |

| Incl | 97 | 121 | 24 | 2.22 |

| Incl | 108 | 109 | 1 | 27.39 |

| And | 220 | 260 | 40 | 0.37 |

| And | 315 | 316 | 1 | 0.46 |

| And | 334 | 336 | 2 | 0.33 |

| And | 340 | 342 | 2 | 0.38 |

| UDH-30 | 127 | 137 | 10 | 0.36 |

| UDH-31 | 88 | 110 | 22 | 0.40 |

| And | 135 | 144 | 9 | 0.30 |

| And | 252 | 350(2) | 98 | 0.81 |

| Incl | 272 | 286 | 14 | 1.60 |

| Incl | 315 | 323 | 8 | 4.54 |

| Incl | 320 | 321 | 1 | 25.90 |

| UDH-32 | 79 | 122 | 43 | 1.13 |

| Incl | 84 | 100 | 16 | 2.03 |

| And | 168 | 350(2) | 182 | 0.32 |

| Incl | 170 | 198 | 28 | 0.81 |

| UDH-33 | 84 | 86 | 2 | 0.32 |

| And | 145 | 148 | 3 | 0.50 |

| And | 202 | 244 | 42 | 0.30 |

| And | 342 | 350(2) | 8 | 1.66 |

| UDH-34 | 276 | 300 | 24 | 0.57 |

| And | 338 | 342 | 4 | 0.32 |

- Reported intervals in this release are downhole apparent widths. Continued exploration is required to confirm anisotropy of mineralization and true thicknesses

- End of hole

Significant, previously reported intersections include the following (see Table 2):

Table 2: Ulaan 2021 Drilling Highlights (Previously Reported)

| Hole ID | From | To | Interval (1) | Au g/t |

| UDH-10 | 92 | 350.2(2) | 258.2 | 0.98 |

| Incl | 99 | 139 | 40 | 3.77 |

| Incl | 103 | 104 | 1 | 39.57 |

| Incl | 123 | 124 | 1 | 58.40 |

| UDH-14 | 106 | 117 | 11 | 3.68 |

| Incl | 110 | 111 | 1 | 36.58 |

| And | 188 | 404.6(2) | 216.6 | 1.07 |

| Incl | 192 | 245 | 53 | 3.55 |

| Incl | 192 | 226 | 34 | 5.43 |

| Incl | 202 | 207 | 5 | 19.58 |

| Incl | 208 | 209 | 1 | 16.75 |

| UDH-15 | 97 | 461.3(2) | 364.3 | 0.79 |

| Incl | 124 | 215 | 91 | 1.98 |

| Incl | 130 | 140 | 10 | 7.29 |

| Incl | 130 | 131 | 1 | 15.13 |

| Incl | 138 | 139 | 1 | 49.36 |

| Incl | 214 | 215 | 1 | 10.47 |

| UDH-16 | 65 | 184 | 119 | 0.59 |

| Incl | 117 | 120 | 3 | 4.52 |

| Incl | 119 | 120 | 1 | 11.91 |

| UDH-19 | 82 | 272 | 190 | 0.73 |

| Incl | 87 | 92 | 5 | 12.52 |

| Incl | 87 | 88 | 1 | 60.55 |

| UDH-21 | 115 | 192 | 77 | 3.19 |

| Incl | 131 | 158 | 27 | 8.74 |

| Incl | 139 | 140 | 1 | 156.54 |

| Incl | 155 | 156 | 1 | 20.98 |

| And | 209 | 280 | 71 | 0.81 |

| Incl | 222 | 230 | 8 | 1.92 |

| Incl | 257 | 271 | 14 | 2.79 |

| UDH-22 | 85 | 236.7 | 151.7 | 1.71 |

| Incl | 85 | 150 | 65 | 3.11 |

| Incl | 87 | 94 | 7 | 18.50 |

| Incl | 93 | 94 | 1 | 119.80 |

- Reported intervals in this release are downhole apparent widths. Continued exploration is required to confirm anisotropy of mineralization and true thicknesses

- End of hole

Ulaan Southeast Discovery Overview

Results to date have confirmed a significant gold discovery at Ulaan Southeast. Multiple drill holes have returned hundreds of metres (up to 354 metres) of gold mineralization, often ending in mineralization, over an area 200 metres by 250 metres. Gold mineralization begins approximately 80 metres from surface with anomalous gold intersected as shallow as 4 metres depth (UDH-18) and remains open along strike to the west/northwest and at depth. Gold grades up to 156 g/t are related to intense quartz ± hematite veins and stockwork zones enveloped by the same gold bearing silicified, white mica altered lapilli tuff sequence which hosts Erdene’s Bayan Khundii epithermal gold deposit, located just east on the Khundii mining license. Structural controls are also similar with northwest striking, southwest dipping veins hosting the gold and intensifying adjacent to bounding structures and/or feeder conduits typically oriented northeast or north. Gold mineralization, particularly the low-grade envelope, also appears to be partially controlled by lithology with low permeability silicified ash tuffs focusing fluid flow and coarser lapilli tuffs acting as a preferred host to mineralization, stratigraphically dipping to the northwest.

In general, the highest-grade gold mineralization occurs within intervals of pervasive silicification combined with adularia and white mica alteration cut by epithermal style, irregular quartz-hematite, quartz-adularia, quartz-white mica veins and quartz-chlorite-magnetite veins. In many instances visible gold has been observed finely disseminated within the veins.

Ulaan License Potential

The Ulaan exploration license area geology is characterized by a large (over 3 kilomtre diameter) hydrothermal alteration zone which extends easterly across the Khundii mining license, host to the Bayan Khundii Gold deposit as well as the Dark Horse and Altan Arrow gold prospects. Geology at Ulaan is dominated by pervasive phyllic or QSP (Quartz-Sericite-Pyrite) alteration which in some instances has completely obliterated the primary host rock textures. Several residual vuggy quartz bodies are observed throughout the license area, as well as volcanoclastic and tuffaceous units exhibiting intense, low to high temperature clay alteration. Also observed are tourmaline shingle and crackle breccias anomalous in gold and copper indicating an active intrusive environment. Although exploration of the Ulaan license is early-stage, multiple geological indicators suggest the area was subjected to an early high temperature porphyry intrusive event overprinted by a low temperature epithermal gold mineralizing event (Bayan Khundii, SE Ulaan, Dark Horse). Quartz vein textures and clay compositions indicate a large-scale epithermal type of gold mineralizing environment existed within the Khundii-Ulaan system with the tuffaceous lithologies acting as preferred hosts for mineralization.

These discoveries were made by the Erdene technical team, beginning in 2016, with the first drilling of the Bayan Khundii deposit. In 2021, additional exploration resulted in two new substantial discoveries, Ulaan Southeast and Dark Horse. The greater Khundii-Ulaan alteration zone and known gold occurrences are believed to be part of the same, large scale, gold-bearing hydrothermal system which remains largely under-explored.

The Ulaan exploration license and adjoining Khundii mining license cover nearly 4,000 hectares of the Khundii-Ulaan hydrothermal alteration zone, which extends from Ulaan over 10 kilometres to the northeast. This alteration trend has a central zone of intense phyllic alteration and secondary silica with a peripheral halo of sericite alteration, and an outer zone of white mica, which hosts the Bayan Khundii gold deposit. This northeast trending alteration area, which incorporates the Ulaan, Bayan Khundii, Dark Horse, and other mineralized targets in the area, is associated with a regional structural dilational jog and associated major volcano-plutonic centre, along a northeast trending transform fault. The various styles of alteration and mineralization within the Khundii-Ulaan target area are consistent with a fertile magmatic island arc, with evidence for possible arc migration, and overlapping or telescoped mineralization along major structures.

To date, the Company has completed detailed surface mapping, geochemical sampling, and geophysical programs across the broader alteration zone. Except for drilling at Ulaan Southeast, reported above, which focused on a five hectare zone, Erdene has drilled only nine wide spaced exploration holes, totaling 1,846 metres in the central and eastern portions of the 1,780 hectare license. The Company is currently reviewing exploration results, with the assistance of technical experts, to develop a comprehensive exploration plan for 2022.

Khundii Gold District

Erdene’s deposits are in the Edren Terrane, within the Central Asian Orogenic Belt, host to some of the world’s largest gold and copper-gold deposits. The Company has been the leader in exploration in southwest Mongolia over the past decade and is responsible for the discovery of the Khundii Gold District comprised of multiple high-grade gold and gold/base metal prospects, one of which is currently being developed, the 100%-owned Bayan Khundii Gold Project, and another which is being considered for development, the 100%-owned Altan Nar Project. Together, these deposits comprise the Khundii Gold Project.

The Bayan Khundii Gold Resource1 includes 585,100 ounces of 2.19 g/t gold Measured and Indicated (“M&I”)2 and 35,900 ounces of Inferred resources at 2.18 g/t gold. Within the M&I resource, a Proven and Probable open-pit reserve totals 409,000 ounces at 3.7 g/t gold3 (press release here), providing significant potential for reserves growth with the development of the remaining M&I and Inferred resources1.

In July 2020, Erdene announced the results of an independent Feasibility Study for the Bayan Khundii Gold Project (press release here). The Feasibility Study results include an after-tax Net Present Value at a 5% discount rate and a US$1,400/oz gold price of US$100 million and Internal Rate of Return (“IRR”) of 42%. The Feasibility Study envisions an open pit mine at Bayan Khundii, producing an average of 63,500 oz gold per year, for seven years, at a head grade of 3.71 g/t gold, utilizing a conventional carbon in pulp processing plant. Production is expected to commence in 2023 based on the current project schedule.

Erdene Resource Development Corp. is a Canada-based resource company focused on the acquisition, exploration, and development of precious and base metals in underexplored and highly prospective Mongolia. The Company has interests in three mining licenses and two exploration licenses in Southwest Mongolia, where exploration success has led to the discovery and definition of the Khundii Gold District. Erdene Resource Development Corp. is listed on the Toronto and the Mongolian stock exchanges. Further information is available at www.erdene.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

Qualified Person and Sample Protocol

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist for Erdene, is the Qualified Person as that term is defined in National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. All samples have been assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal checks by SGS Laboratory, the Company incorporates a QA/QC sample protocol utilizing prepared standards and blanks. All samples undergo standard fire assay analysis for gold and ICP-OES (Inductively Coupled Plasma Optical Emission Spectroscopy) analysis for 33 additional elements. For samples that initially return a grade greater than 5 g/t gold, additional screen-metallic gold analysis is carried out which provides a weighted average gold grade from fire assay analysis of the entire +75 micron fraction and three 30-gram samples of the -75 micron fraction from a 500 gram sample.

Erdene’s drill core sampling protocol consisted of collection of samples over 1 or 2 metre intervals (depending on the lithology and style of mineralization) over the entire length of the drill hole, excluding minor post-mineral lithologies and un-mineralized granitoids. Sample intervals were based on meterage, not geological controls, or mineralization. All drill core was cut in half with a diamond saw, with half of the core placed in sample bags and the remaining half securely retained in core boxes at Erdene’s Bayan Khundii exploration camp. All samples were organized into batches of 30 including a commercially prepared standard, blank and either a field duplicate, consisting of two quarter-core intervals, or a laboratory duplicate. Sample batches were periodically shipped directly to SGS in Ulaanbaatar via Erdene’s logistical contractor, Monrud Co. Ltd.

Reported intervals are apparent thicknesses, i.e. downhole widths. The current Ulaan drill holes are all dipping at 85 degrees and oriented to intersect SW dipping WNW trending gold bearing veins. Additional study is required to confirm true widths. Reported grades for intervals are weighted averages based on length of sampling intervals. No top cut has been applied; however, all intervals greater than 10 g/t gold are reported individually for clarity

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance, or other statements that are not statements of fact. Although Erdene believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Erdene cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Erdene currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain required third party approvals, market prices, exploitation, and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. The Company does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

Peter C. Akerley, President and CEO, or

Robert Jenkins, CFO

| Phone: | (902) 423-6419 |

| Email: | info@erdene.com |

| Twitter: | https://twitter.com/ErdeneRes |

| Facebook: | https://www.facebook.com/ErdeneResource |

| LinkedIn: | https://www.linkedin.com/company/erdene-resource-development-corp-/ |

1 For details of the Mineral Resources see Erdene’s Q2/2021 results press release, dated August 16, 2021, and the Company’s Q2 2021 MD&A, available on the Company’s website or SEDAR.

2 M&I: 232,700 ounces of 2.39 g/t gold Measured and 352,400 ounces of 2.08 g/t gold Indicated

3 P&P: 165,000 ounces of 4.4 g/t gold Proven and 256,000 ounces of 3.4 g/t gold Probable; For details of the Mineral Reserves see Khundii Gold Project NI 43-101 Technical Report, Tetra Tech December 4, 2019 available on the Company’s website or SEDAR

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e35fb4f7-92e6-4dea-984e-d008c497b426

https://www.globenewswire.com/NewsRoom/AttachmentNg/f1a3f0f5-e63b-486b-ad76-9f70fe6accc4

https://www.globenewswire.com/NewsRoom/AttachmentNg/c14f2c96-7ebf-4a2f-b7a9-9dfc056ec8db

https://www.globenewswire.com/NewsRoom/AttachmentNg/de635d1c-8106-4cdc-8f8d-1c36839e704a