Erdene Reports New Discovery at Ulaan - Intersects 3.77 g/t Gold Over 40 Metres Within 258 Metres of 0.98 g/t Gold

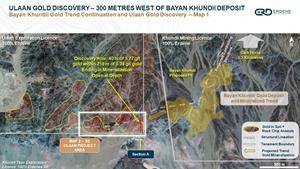

HALIFAX, Nova Scotia, Aug. 11, 2021 (GLOBE NEWSWIRE) -- Erdene Resource Development Corporation (TSX: ERD | MSE: ERDN) (“Erdene” or the “Company”) is pleased to announce results from its maiden drill program on the southern portion of its 100%-owned Ulaan exploration license. The program returned a significant new gold discovery 300 metres west of the Bayan Khundii deposit. Follow-up drilling on the Ulaan license is currently underway.

Highlights

- Significant gold discovery at Ulaan, 300 metres west of the Bayan Khundii Gold Deposit, with multiple holes intersecting mineralization, highlights include:

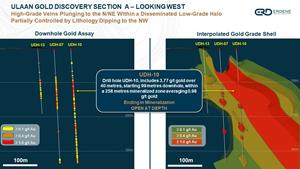

- 3.77 g/t gold over 40 metres, within 258 metres of 0.98 g/t gold beginning 92 metres downhole in UDH-10

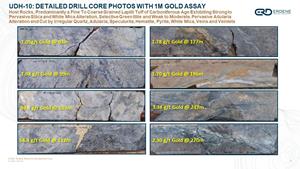

- High grade quartz-adularia veins in upper portion of zone – 39.6 g/t and 58.4 g/t gold over 1 metre intervals at 103 and 123 metres depth, respectively

- Hole ended in gold mineralization at 350 metres – bottom 20 metres averaging 0.48 g/t gold

- Open along strike to west-northwest and at depth

- 50 metres south of UDH-10, UDH-07 intersected 100 metres averaging 0.63 g/t gold, beginning 85 metres down hole

- 3.77 g/t gold over 40 metres, within 258 metres of 0.98 g/t gold beginning 92 metres downhole in UDH-10

- Adds a third development prospect within the Khundii-Ulaan alteration system alongside the Bayan Khundii Gold Deposit and the Dark Horse gold prospect

Quotes from the Company:

“These exceptional results confirm a significant new gold discovery just 300 metres west of the Bayan Khundii gold deposit,” said Peter Akerley, Erdene’s President and CEO. “This new discovery at Ulaan, combined with recent high-grade, near-surface, oxide gold intercepts at Dark Horse and the high-grade Bayan Khundii gold deposit demonstrates the existence of a very large gold-bearing hydrothermal alteration system underlying the Khundii and Ulaan licenses.”

“Although the Khundii and Ulaan licenses host a low sulfidation epithermal system, the broader Khundii District, including our Altan Nar intermediate sulfidation gold-polymetallic deposit and the molybdenum-copper porphyry deposit at Zuun Mod demonstrate the continuum and potential for discovery of arc related deposits in the Khundii Gold District,” concluded Mr. Akerley. “We are targeting the definition of over 2 million gold equivalent ounces by the end of 2022. Furthermore, we see the potential to add resources beyond this target through further discoveries in our unexplored portion of the prolific gold and copper producing Central Asian Orogenic Belt.”

Summary of the Drill Results

The maiden Ulaan gold drilling program was designed to test the southern portion of the Ulaan license for the presence of similar styles of mineralization to the Bayan Khundii gold deposit. The program consisted of seven drill holes totaling 1,543 metres. Holes were spaced between 50 to 450 metres apart and tested targets over an area of approximately 2 square kilometres to a maximum depth of 350 metres. Holes were drilled at an azimuth of 030 and at an 85 degree dip, and oriented core measurements were obtained throughout. Highlights from the drilling program are provided below in Table 1 and a drill hole plan map and section illustrating the location of the drill holes is attached to this news release.

Table 1: Ulaan Q3 2021 Drilling Highlights (All intervals averaging over 0.30 g/t gold)

| Hole | From | To | Interval (1) | g/t Au | |

| UDH-07 | 85 | 185 | 100 | 0.63 | |

| And | 250 | 254 | 4 | 1.39 | |

| And | 340 | 350(2) | 10 | 0.34 | |

| UDH-08 | 20 | 22 | 2 | 0.44 | |

| UDH-10 | 69 | 70 | 1 | 0.57 | |

| And | 92 | 350.2(2) | 258.2 | 0.98 | |

| Incl | 99 | 139 | 40 | 3.77 | |

| Incl | 103 | 104 | 1 | 39.57 | |

| Incl | 123 | 124 | 1 | 58.4 | |

| UDH-13 | 96 | 112 | 16 | 0.79 | |

| And | 134 | 154 | 20 | 0.38 | |

- Reported intervals in this release are downhole apparent widths. Continued exploration is required to confirm anisotropy of mineralization and true thicknesses.

- End of hole.

- Holes UDH-09, UDH-11 and UDH-12 did not intersect significant gold mineralization (over 0.3 g/t gold).

The gold mineralization intersected within the drill holes highlighted in Table 1 is associated with quartz-adularia veins within a white mica altered and silicified tuffaceous unit of the same style as Erdene’s Bayan Khundii Gold Deposit. Similarly, there is little to no associated sulfide. Drill holes UDH-07, UDH-08, UDH-10 and UDH-13 intersected thick sequences of coarse to fine grained lapilli tuff exhibiting intense silicification and white mica alteration cross-cut with intense quartz-hematite-adularia veins. Drill core analysis supports a west-northwest strike and north-northeast dip of the high grade veins while geologic interpretation supports a secondary control on low grade mineralization along the northwest dip of the volcanic sequence. However, additional work is necessary to determine preferred vein orientations and mineralization trends.

Scout drilling (UDH-11 and UDH-12) completed 200 to 250 metres north and west-southwest from the above highlighted holes, respectively, within southeast Ulaan, demonstrated continuity of geology both laterally and to depth. UDH-12 intersected anomalous gold (over 0.1g/t gold) associated with intense white mica alteration and quartz veining at 140 metres depth and both holes intersected and ended within thick intervals of the targeted tuffaceous host unit.

Moving Forward

Erdene’s Q3-Q4 drill program consists of 8,800 metres, with approximately 4,500 metres planned at Ulaan and 4,300 metres scheduled for Dark Horse (on the Khundii Mining License). The Ulaan program is currently underway and will delineate the extent of mineralization and test additional prospective areas. Results from Ulaan follow up drilling are expected to be released in the coming months. The Dark Horse program will commence following the completion and assessment of geophysical surveys currently underway, which were designed to assist in identifying deeper targets.

Ulaan Overview

Erdene holds a 100% interest in the Ulaan license after acquiring the remaining 49% interest in the property in December 2020. The Company acquired an initial 51% stake in the license in 2017, following the discovery of the Bayan Khundii Gold Deposit.

Ulaan lies at the southwest end of a major alteration zone, extending for over 10 kilometres to the northeast. This alteration trend has a central zone of intense secondary silica with a peripheral halo of sericite alteration, and an outer zone of white mica and sericite, which hosts the Bayan Khundii Gold Deposit. This northeast trending alteration area, which incorporates the Ulaan, Bayan Khundii and other mineralized targets in the area (including Erdene’s Dark Horse and Altan Arrow prospects), is associated with a regional structural dilational jog and associated major volcano-plutonic centre, along a northeast trending transform fault. The various styles of alteration and mineralization within the Ulaan target and the adjacent zone of alteration are consistent with a fertile magmatic island arc, with evidence for possible arc migration, and overlapping or telescoped mineralization along major structures.

The southern area of the 1,780-hectare Ulaan license is approximately 350 metres west of the Bayan Khundii Gold Deposit, separated by the Khuren Tsav license held by the Mongolian government-owned gold company, Erdenes Alt LLC (“EA”). In early 2021, EA announced plans to undertake further drilling and geologic work on the portion of license adjacent to Erdene’s Bayan Khundii and Ulaan licenses.

Based on the wide zone of gold mineralization intersected in this initial drilling program, combined with satellite imagery, geophysical analysis, and surface alteration, Erdene believes that the hydrothermal system that hosts the Bayan Khundii Gold Deposit extends west-southwest of the Bayan Khundii deposit, across the northern portion of the Khuren Tsav license, into the southern portion of Erdene’s Ulaan license. The northern portion of the Khuren Tsav license is wedge-shaped and separates the southern sections of the Bayan Khundii and Ulaan licenses. Erdene has an informal working relationship with EA and both companies will explore opportunities to work together, including the sharing of technical information, to ensure the development of their respective licenses in the best interests of all stakeholders.

The northern portion of the Ulaan license is situated along the western boundary of Erdene’s Khundii Mining license and has the potential to host the western extension of the Dark Horse mineralization based on preliminary review of the geology, alteration and mineralization at surface.

Khundii Gold District

Erdene’s deposits are in the Edren Terrane, within the Central Asian Orogenic Belt, host to some of the world’s largest gold and copper-gold deposits. The Company has been the leader in exploration in southwest Mongolia over the past decade and is responsible for the discovery of the Khundii Gold District comprised of multiple high grade gold and gold/base metal prospects, one of which is currently being developed, the 100%-owned Bayan Khundii Gold Project, and another which is being considered for development, the 100%-owned Altan Nar project. Together, these deposits comprise the Khundii Gold Project.

The Bayan Khundii Gold Resource1 includes 521,000 ounces of 3.16 g/t gold Measured and Indicated (“M&I”)² and 103,000 ounces of Inferred resources at 3.68 g/t gold. Within the M&I resource, a proven and probable open-pit reserve totals 409,000 ounces at 3.7 g/t gold (see the full press release here), providing significant potential for reserves growth with the development of the remaining M&I and Inferred resources1.

In July 2020, Erdene announced the results of an independent Feasibility Study for the Bayan Khundii Gold Project (press release here). The Feasibility Study results include an after-tax Net Present Value at a 5% discount rate and a US$1,400/oz gold price of US$100 million and Internal Rate of Return (“IRR”) of 42%. The Feasibility Study envisions an open-pit mine at Bayan Khundii, producing an average of 63,500 oz gold per year, for seven years, at a head grade of 3.71 g/t gold, utilizing a conventional carbon in pulp processing plant. Production is expected to commence in early 2023 based on the current project schedule.

Erdene Resource Development Corp. is a Canada-based resource company focused on the acquisition, exploration, and development of precious and base metals in underexplored and highly prospective Mongolia. The Company has interests in three mining licenses and two exploration licenses in Southwest Mongolia, where exploration success has led to the discovery and definition of the Khundii Gold District. Erdene Resource Development Corp. is listed on the Toronto and the Mongolian stock exchanges. Further information is available at www.erdene.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

Qualified Person and Sample Protocol

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist for Erdene, is the Qualified Person as that term is defined in National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. All samples have been assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal checks by SGS Laboratory, the Company incorporates a QA/QC sample protocol utilizing prepared standards and blanks. All samples undergo standard fire assay analysis for gold and ICP-OES (Inductively Coupled Plasma Optical Emission Spectroscopy) analysis for 33 additional elements. For samples that initially return a grade greater than 5 g/t gold, additional screen-metallic gold analysis is carried out which provides a weighted average gold grade from fire assay analysis of the entire +75 micron fraction and three 30-gram samples of the -75 micron fraction from a 500 gram sample.

Erdene’s drill core sampling protocol consisted of collection of samples over 1 or 2 metre intervals (depending on the lithology and style of mineralization) over the entire length of the drill hole, excluding minor post-mineral lithologies and un-mineralized granitoids. Sample intervals were based on meterage, not geological controls, or mineralization. All drill core was cut in half with a diamond saw, with half of the core placed in sample bags and the remaining half securely retained in core boxes at Erdene’s Bayan Khundii exploration camp. All samples were organized into batches of 30 including a commercially prepared standard, blank and either a field duplicate, consisting of two quarter-core intervals, or a laboratory duplicate. Sample batches were periodically shipped directly to SGS in Ulaanbaatar via Erdene’s logistical contractor, Monrud Co. Ltd.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance, or other statements that are not statements of fact. Although Erdene believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Erdene cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Erdene currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain required third party approvals, market prices, exploitation, and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. The Company does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

NO REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE CONTENTS OF THIS RELEASE

Erdene Contact Information

Peter C. Akerley, President and CEO, or

Robert Jenkins, CFO

| Phone: | (902) 423-6419 |

| Email: | info@erdene.com |

| Twitter: | https://twitter.com/ErdeneRes |

| Facebook: | https://www.facebook.com/ErdeneResource |

| LinkedIn: | https://www.linkedin.com/company/erdene-resource-development-corp-/ |

1 For details of the Mineral Resources see Khundii Gold Project NI 43-101 Technical Report, Tetra Tech December 4, 2019 – SEDAR

2 M&I: 171,000 ounces of 3.77 g/t gold Measured, and 349,700 ounces of 2.93 g/t gold Indicated

Graphics accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/df3dc363-3ef6-4e2f-82b4-0deaf3018141

https://www.globenewswire.com/NewsRoom/AttachmentNg/e42039ce-f34e-4e23-9ea5-56e29154cda0

https://www.globenewswire.com/NewsRoom/AttachmentNg/7595f4de-2ff7-4e3c-a9c8-49cce94e7315

https://www.globenewswire.com/NewsRoom/AttachmentNg/f30080cd-1596-407a-87ab-166aedabe06e

https://www.globenewswire.com/NewsRoom/AttachmentNg/5757a39d-04f5-458f-b56d-e10b79e819a7