Essex Announces Commencement of Phase 2 Drilling on Cumberland Gold-Silver JV Property

VANCOUVER, BC, Oct. 20, 2020 /CNW/ - Essex Minerals Inc. (the "Company" or "Essex") (TSXV: ESX) is pleased to announce that Phase 2 drilling is set to commence and provides an update on Phase 1 drilling at its Cumberland joint venture project in Queensland, Australia.

Highlights

- Phase 2 follow-up drilling commences next week and aims to be completed before the onset of the rainy season.

- This program will include a series of diamond drill holes in and around the RBZ Discovery Hole 1 which encountered high-grade gold and silver mineralization (18.8 g/t gold and 160.6 g/t silver over 6.4m from 139.5m down hole).

- Final assays from the Phase 1 regional prospecting program which tested six different regional targets have been received.

- Hole 5 (20RBZ-DD005), 2.3km NW of Hole 1, intersected narrow intervals of low-grade silver, base metals and arsenic-peripheral mineralization before encountering a major fault at 104m downhole. The intersected intervals do not explain the wide zone of anomalous gold and silver encountered in the soils at surface and requires follow-up.

- Hole 6 (20RBZ-DD006), 3.5km NW of Hole 1, intersected narrow zones of anomalous copper and base metal mineralization similar to results from earlier drilling by Kidston Gold Mines a further 2.5km NW along structure at Log Creek, suggesting fracture-controlled porphyry-style mineralization in the northern part of the RBZ Structural Zone which represents a potentially large target for future exploration.

- Petrology studies undertaken on samples from the first three holes confirm the RBZ Structural Zone has been subjected to at least three stages of alteration, with the bulk of the gold and silver being deposited in the third late stage carbonate (epithermal) over print. Importantly, the bulk of the gold and silver occurs as free particles.

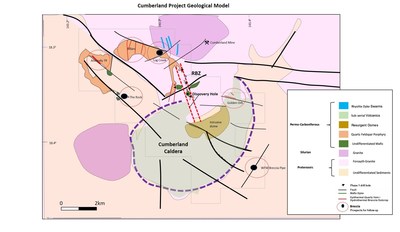

- Structural and geochemical interpretation from the drilling suggests that the northern part of the zone may have been subjected to block faulting and is therefore prospective for porphyry-style mineralization, while in the southern part of the zone, from Discovery Hole 1 and 2.5km SSE towards the caldera rim, the later stage mineralization has been preserved and is the most favourable target for large epithermal gold and silver deposits.

Essex President and CEO Paul Loudon said: "The first ever regional-scale drilling program on the Cumberland property has been a great success. We have tested a range of blind geochemical targets along 3.5km of the RBZ Structural Zone and encountered favourable geology for both epithermal and porphyry-style deposits in every hole, including the discovery of high-grade gold and silver mineralization in the south.

"The presence of porphyry-style mineralization in the north provides some potentially large targets for future exploration, while high-grade gold and silver in the south represents an exciting discovery which we are now following up with the Phase 2 drilling.

"The extent of the alteration and the size of the structures encountered suggest sufficient plumbing and architecture for the emplacement of large deposits within the property. Our focus between now and the end of the year will be follow-up drilling, surface geology and geophysical interpretation to target in as quickly as possible on extensions and repetitions of the high-grade gold and silver encountered in the Discovery Hole 1."

Cumberland Property

The northern Australian state of Queensland has a history of large epithermal gold deposits – Kidston (5M oz at 1.24 g/t Au), Mt Leyshon (3.4M oz at 1.43 g/t Au) and Pajingo (3M oz at 6 g/t Au) – but remains under-explored in comparison to Western Australia and more recently Victoria.

The Cumberland property was staked in 2012 by private Australian group KNX Resources Ltd following a regional search for targets with the potential to host low sulfidation epithermal carbonate-base metal deposits similar to the 5 million-ounce Kidston deposit discovered by Placer Dome in the 1980s in a similar geological setting, 70km to the southeast.

All rocks intersected in the Phase 1 drilling have been initially pervasively potassic altered and subsequentially overprinted by later stage phyllic and argillic alteration associated with silica flooding and veining over large intervals. Late stage carbonate infilling of fractures and veinlets is also evident.

Assays

All samples from the first phase drilling program were processed in Townsville by ALS Global, an independent accredited laboratory. Gold assays are completed by 50g screen fire assay with atomic absorption finish, with the over limit samples rechecked by fire assay with a gravimetric finish. Silver and multi-element analysis is undertaken by inductively coupled plasma atomic emission spectroscopy (ICP-AES) with over limits assayed by four acid digestion with ICP-AES.

Table of Drill Hole Collar Locations

Drill Hole | Easting | Northing | Elevation (m) | Hole Depth | Azimuth (degrees)

| Inclination (degrees) |

20RBZ-DD001 | 746830 | 7968800 | 241 | 203.7 | 271 | minus 55 |

20RBZ-DD002 | 745681 | 7969738 | 234 | 219.9 | 060 | minus 57 |

20RBZ-DD003 | 746922 | 7968620 | 239 | 191.7 | 270 | minus 50 |

20RBZ-DD004 | 745243 | 7970411 | 235 | 209.5 | 280 | minus 51 |

20RBZ-DD005 | 745700 | 7970762 | 240 | 192.6 | 093 | minus 54 |

20RBZ-DD006 | 745748 | 7972398 | 257 | 231.5 | 089 | minus 53 |

Total | 1248.9 |

KNX Joint Venture

Under the terms of the venture, Essex has the right to earn an initial first-stage earn in of 50% of KNX's interest in three properties – Cumberland, Compass Creek and Mt Turner - by spending AUD $1 million on exploration by May, 2021. KNX currently owns 80% of Cumberland and Compass Creek and 100% of Mt Turner. After completing the first stage earn-in, Essex has the right to buy out the balance of KNX's interest for cash or shares at independent valuation or earn an additional 20% interest in Cumberland and Compass Creek and an additional 25% interest in Mt Turner by spending a further AUD $3 million on exploration.

About Essex

Essex Minerals is an exploration and development company focused on mineral exploration and development opportunities where it can adopt an option earn-in and joint venture model without the issuance of vendor shares. By identifying geological teams that have already expended the time and capital to assemble top quality, advanced projects, with a particular emphasis on gold projects in Tier 1 jurisdictions. Management's time is shared across several different projects, as the geological teams already in place manage the approved exploration and development programmes. This strategy has the potential to accelerate the growth in shareholder value for Essex by earning an interest in a range of projects of merit in a much shorter time frame than otherwise would be possible.

Competent Person

All of the scientific and technical information contained in this news release has been reviewed and/or prepared by Mr Lee K. Spencer, BSc (Hons), MSc, MAusIMM, a "Qualified Person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Minerals Projects.

Paul Loudon

President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Essex Minerals Inc

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2020/20/c5716.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2020/20/c5716.html