First Cobalt Confirms Mineralization in 150-metre Step Out Hole and Announces Private Placement

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

TORONTO, March 4, 2019 /CNW/ - First Cobalt Corp. (TSX-V: FCC; ASX: FCC; OTCQX: FTSSF) (the "Company") is pleased to report that a 611-metre drill hole has extended mineralization by an additional 150 metres downdip in the central portion of the Iron Creek Cobalt Project in Idaho, USA.

Highlights

- Longest hole drilled to date at Iron Creek at 611m, extends No Name Zone mineralization by an additional 150m

- Broad intercepts such as 12.0m of 0.20% Co, including 3.9m of 0.35% Co (true width), extend the dip extent of the No Name Zone

- Dip extent of up to 400m from surface, extending mineralization well below the high grade cobalt zone that formed the basis of a historic resource estimate by Noranda

- Updated resource estimate scheduled for late March

Trent Mell, President & Chief Executive Officer, commented:

"We have doubled the depth extent of mineralization across the entire deposit and it still remains open. With good continuity of grade and thickness, we can now extend the deposit more quickly and cost-effectively with wider spaced step out holes. The future potential remains high beyond the next resource update as each step-out has shown mineralization remains open at depth and along strike. An updated resource estimate will be published in about a month, incorporating more than 13,000 metres of drilling.

"Confidence is returning to the cobalt market as EV sales continue to set new records in the face of lower mine production forecasts in 2019. Our Iron Creek Project and the near term cash flow potential of the First Cobalt Refinery provide direct exposure for investors seeking leverage to the electric vehicle revolution."

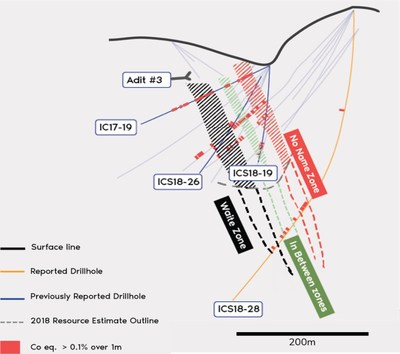

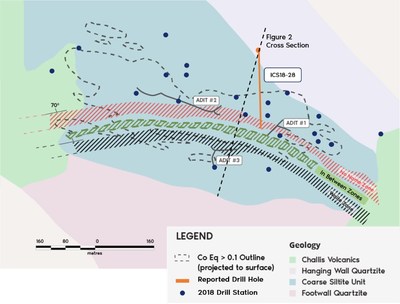

The No Name Zone has now been traced to 300m downdip in the central area of the deposit and 400m in the west, as mineralization follows steepening terrain. Hole ICS18-28 (Figure 1) was drilled into the centre portion of Iron Creek, below the current resource area, to test for downdip mineralization (Figure 2). The No Name Zone mineralization has now been intercepted 150m below the deepest previous intercept, reported in ICS18-19 earlier this year, and remains open at depth.

Drilling in the central area of the deposit has infilled much of the central portion of the 2018 resource estimate, which had depth extensions confined to the eastern and western portions of the deposit. This infill drilling and the resulting assays are expected to provide a meaningful increase in mineralization for the upcoming resource estimate expected in late March.

Assay results for ISC18-28 show the No Name Zone occurs as a broad mineralized zone containing a higher grade cobalt core (Table 1). This relationship is consistent with previous drilling higher up, including ICS18-19, ICS18-26, and IC17-19 (reported January 22, 2019 and September 26, 2018). Higher cobalt grade cores within broader mineralization are also prevalent in the Waite Zone in this area.

Drill hole, IC17-39 drilled northward from the hangingwall intersected cobalt mineralization at a comparable depth over 150m away along strike, suggesting continuity to the downdip extension (September 26, 2018 release) intersected in ICS18-28.

A high grade copper intercept, 1.22% Cu over 1.0m, was intercepted approximately 150m into the hangingwall. Previous drilling has intercepted several copper intervals in the hangingwall that were not the main target of drilling, so at this time they have not been modelled to determine continuity.

Cobalt was also intersected further downhole in ICS18-28 that may correspond to the Waite Zone and mineralization between the two main zones, but no other holes have been drilled to this depth nearby, so follow up is required to determine continuity.

Table 1. Summary of Assay Results

Hole ID | Zone | From | To | Drilled | True | True | Cobalt | Copper | CoEq |

ICS18-28 | Hangingwall | 192.0 | 193.9 | 1.9 | 1.0 | 3.2 | 0.00 | 1.22 | 0.12 |

No Name | 383.4 | 399.5 | 16.1 | 12.0 | 39.4 | 0.20 | 0.01 | 0.20 | |

including | 386.8 | 392.0 | 5.2 | 3.9 | 12.7 | 0.35 | 0.01 | 0.35 | |

Between | 442.9 | 444.9 | 2.0 | 1.5 | 5.0 | 0.13 | 0.01 | 0.13 | |

Waite | 458.9 | 463.2 | 4.2 | 3.3 | 10.9 | 0.12 | 0.00 | 0.12 | |

Footwall | 487.1 | 489.0 | 1.8 | 1.4 | 4.7 | 0.21 | 0.00 | 0.21 | |

Previously Reported Holes | |||||||||

ICS18-19 | No Name | 214.7 | 223.6 | 8.9 | 4.8 | 15.8 | 0.35 | 0.07 | 0.35 |

including | 216.3 | 218.5 | 2.2 | 1.2 | 3.9 | 0.51 | 0.11 | 0.52 | |

Between | 258.7 | 272.9 | 14.1 | 7.6 | 25.1 | 0.29 | 0.02 | 0.29 | |

including | 268.5 | 270.6 | 2.1 | 1.1 | 3.7 | 0.56 | 0.03 | 0.56 | |

Between | 273.3 | 274.5 | 1.2 | 0.7 | 2.2 | 0.04 | 4.46 | 0.49 | |

ICS18-26 | Hangingwall | 229.0 | 244.5 | 15.5 | 14.1 | 46.4 | 0.11 | 0.08 | 0.12 |

No Name | 255.6 | 285.4 | 29.8 | 27.1 | 88.9 | 0.13 | 0.19 | 0.15 | |

Between | 294.3 | 304.3 | 9.9 | 9.0 | 29.7 | 0.22 | 0.05 | 0.22 | |

including | 300.5 | 303.4 | 2.9 | 2.6 | 8.6 | 0.42 | 0.03 | 0.42 | |

Waite | 345.9 | 350.7 | 4.8 | 4.4 | 14.4 | 0.20 | 0.02 | 0.20 | |

Footwall | 370.5 | 384.9 | 14.4 | 13.1 | 42.9 | 0.16 | 0.00 | 0.16 | |

IC17-19 | No Name | 36.9 | 56.4 | 19.5 | 18.7 | 61.4 | 0.30 | 0.74 | 0.37 |

including | 39.6 | 45.7 | 6.1 | 5.9 | 19.2 | 0.43 | 0.32 | 0.46 | |

Between | 62.5 | 66.3 | 3.8 | 3.6 | 11.9 | 0.12 | 0.64 | 0.18 | |

Waite | 89.0 | 100.1 | 11.1 | 10.6 | 34.8 | 0.15 | 0.53 | 0.20 | |

including | 98.1 | 100.1 | 1.9 | 1.8 | 6.0 | 0.41 | 0.00 | 0.41 | |

Footwall | 111.3 | 119.8 | 8.5 | 8.2 | 26.9 | 0.23 | 0.00 | 0.23 | |

including | 112.8 | 116.9 | 4.1 | 4.0 | 13.1 | 0.37 | 0.00 | 0.37 | |

Footwall | 132.6 | 135.6 | 3.0 | 2.9 | 9.6 | 0.15 | 0.00 | 0.15 | |

True thickness estimated from 3D geological model also considering drill holes on strike. Cobalt equivalent is calculated as %CoEq = %Co + (%Cu/10) based on US$30/lb Co and US$3/lb Cu. No metallurgical recoveries were applied to either metal as it is expected that the metallurgical recoveries will be similar for both metals. Flotation tests support the Company's opinion that both cobalt and copper are of sufficient grade to be recovered.

Private Placement

First Cobalt also announces that it has entered into an agreement with an investor on a non-brokered private placement of 11,111,111 units (the "Units") of the Company at a price of $0.18 per Unit for gross proceeds of $2,000,000 (the "Offering"). Each Unit issued pursuant to the Offering will consist of one common share in the capital of the Company and one Common Share purchase warrant (a "Warrant"). Each Warrant entitles the holder thereof to purchase one additional Common Share at a price of $0.27 for a period of two years. The Warrants are subject to an acceleration clause such that, if the closing price of the common shares of the Company is equal to or greater than $0.37 per share for a period of ten consecutive trading days, the Company shall have the option, but not the obligation, to effect an accelerated expiration date that shall be 20 calendar days from the issuance of a notice of acceleration. There is no commission paid to any party as part of the arrangement. Proceeds of the Offering will be used by the Company to support ongoing work at the First Cobalt Refinery as well as general corporate purposes.

Closing of the Offering is expected to occur on or about March 18, 2019 and is subject to receipt of regulatory approvals, including the approval of the TSX Venture Exchange. The securities to be issued under the Offering will have a hold period of four months and one day from their issue. The securities being offered will not be registered under the United States Securities Act of 1933, as amended and may not be offered or sold within the United States absent registration or an exemption from the registration requirements. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States.

Quality Assurance and Quality Control

First Cobalt has implemented a quality control program to comply with industry best practices for sampling, chain of custody and analyses. Blanks, duplicates and standards are inserted at the core processing site as part of the QA/QC program. Samples are prepared and analyzed by American Assay Laboratories (AAL) in Sparks, Nevada. Over 15% of the samples analyzed are control samples consisting of checks, blanks, and duplicates inserted by the Company; in addition to the control samples inserted by the lab. Drill core samples are dried, weighed crushed to 85 % passing -6 mesh, roll crushed to 85% passing -10 mesh, split 250 gram pulps, then pulverized in a closed bowl ring pulverizer to 95% passing -150 mesh, then analyzed by a 5 acid digestion for ICP analysis. All samples have passed QA/QC protocols.

Qualified and Competent Person Statement

Dr. Frank Santaguida, P.Geo., is the Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the contents of this news release. Dr. Santaguida is also a Competent Person (as defined in the JORC Code, 2012 edition) who is a practicing member of the Association of Professional Geologists of Ontario (being a 'Recognised Professional Organisation' for the purposes of the ASX Listing Rules). Dr. Santaguida is employed on a full-time basis as Vice President, Exploration for First Cobalt. He has sufficient experience that is relevant to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code.

About First Cobalt

First Cobalt is a North American pure-play cobalt company whose flagship asset is the Iron Creek Cobalt Project in Idaho, USA, which has Inferred mineral resources of 26.9 million tonnes grading 0.11% cobalt equivalent, which has an alternative underground-only scenario of 4.4 million tonnes grading 0.3% cobalt equivalent. The Company also owns the only permitted primary cobalt refinery in North America. The refinery is currently on care and maintenance and the Company is exploring a potential restart of the Refinery, which has the potential to produce 2,000 tonnes of cobalt material per year.

On behalf of First Cobalt Corp.

Trent Mell

President & Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Estimates of Resources

Readers are cautioned that mineral resources are not economic mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The estimate of mineral resources may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "2014 CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for Preliminary Economic Assessment as defined under NI 43-101. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically. An Inferred Mineral Resource as defined by the CIM Standing Committee is "that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration."

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the management discussion and analysis and other disclosures of risk factors for First Cobalt, filed on SEDAR at www.sedar.com. Although First Cobalt believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, First Cobalt disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SOURCE First Cobalt Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2019/04/c8017.html