First Majestic Acquires Silver Stream on First Mining's Springpole Project

VANCOUVER, British Columbia, June 11, 2020 (GLOBE NEWSWIRE) -- First Majestic Silver Corp. (AG: NYSE; FR: TSX) (the "Company" or “First Majestic”) is pleased to announce that it has agreed to acquire from Gold Canyon Resources Inc., a wholly-owned subsidiary of First Mining Gold Corp., (“First Mining”) a stream on 50% of payable silver produced from the Springpole Gold Project (“Springpole” or the “Project”) located in Ontario, Canada. First Majestic will pay First Mining total consideration of $22.5 million in cash and shares, over three payments, for the silver stream which covers the life of the Project. In addition, First Majestic will make ongoing cash payments of 33% of the silver spot price per ounce, to a maximum of $7.50 per ounce, for all payable silver delivered by Springpole. First Mining is also granting First Majestic 30 million common share purchase warrants, each of which will entitle the Company to purchase one common share of First Mining at CAD$0.40 over a period of five years commencing at closing.

TRANSACTION HIGHLIGHTS

- First Majestic acquires a stream on 50% of the payable silver produced from Springpole over the life of the project for 33% of the silver spot price per ounce, to a maximum of $7.50 per ounce, for all payable silver delivered.

- According to the 2019 Preliminary Economic Assessment (“PEA”), average silver production from Springpole in years two through nine of the mine plan is expected to be 2.4 million ounces of silver per year. A total of 22 million ounces of silver is expected to be recovered over the life of the project - of which 50% would be purchased by First Majestic.

- Springpole is one of Canada’s largest, undeveloped gold projects with permitting underway and the results of a Pre-Feasibility study anticipated in early 2021. The project contains NI 43-101 compliant resources of 24.19 million ounces of silver in the Indicated category and 1.12 million ounces of silver in the Inferred category, plus 4.67 million ounces of gold in the Indicated category and 0.23 million ounces of gold in the Inferred category.

- The Springpole Project offers substantial exploration upside over its large land holdings of 41,913 hectares which are fully encompassed under the silver streaming agreement.

- Increases First Majestic’s silver exposure and is the Company’s first investment outside of Mexico in a mining friendly jurisdiction within Canada.

- Provides First Majestic with equity upside potential as First Mining increases shareholder value throughout the Springpole Pre-Feasibility and permitting process.

"This new silver stream gives First Majestic significant upside potential to higher silver prices while minimizing risks and costs," said Keith Neumeyer, President and CEO of First Majestic Silver. "With approximately 22 million ounces of silver expected to be produced over the life of the project, and additional exploration upside, Springpole has both the scale and location to make this an ideal investment for our long-term portfolio. In addition, this silver stream marks our first investment outside of Mexico in the Company’s 18-year history.”

TRANSACTION TERMS

- First Majestic has acquired a stream on 50% of the payable silver production from the Springpole project over the life of the project for a total consideration of $22.5 million, payable in cash and shares over three payments.

- Upon closing of the transaction, First Majestic will make an upfront payment to First Mining of $10.0 million consisting of $2.5 million in cash and $7.5 million in First Majestic common shares.

- Upon the completion and public announcement by First Mining of the results of a Pre-Feasibility Study for Springpole, First Majestic shall pay an additional $7.5 million to First Mining consisting of $3.75 million in cash and $3.75 million in First Majestic common shares.

- Upon receipt by First Mining of a Federal or Provincial Environmental Assessment approval for Springpole, First Majestic shall pay an additional $5.0 million to First Mining consisting of $2.5 million in cash and $2.5 million in First Majestic common shares.

- First Majestic shall make ongoing cash payments to First Mining for each ounce of silver purchased under the stream equal to 33% of the average spot price of silver, subject to a price cap of $7.50 per ounce of silver (the “Price Cap”). The Price Cap shall be subject to annual inflation escalation of 2%, commencing at the start of the 3rd anniversary of production at Springpole.

- First Mining shall have the right to repurchase 50% of the silver stream for $22.5 million at any time prior to the commencement of production at Springpole leaving the Company with a reduced silver stream of 25%.

- On the closing date, First Mining will issue to First Majestic, subject to regulatory approval, 30 million common share purchase warrants (“Warrants”), and each Warrant will entitle First Majestic to acquire one common share of First Mining. The exercise price of the Warrants shall be CAD$0.40, and the Warrants shall expire on the date that is five years after the closing date. The Warrants shall be subject to a statutory four month and one day hold period pursuant to applicable Canadian securities laws.

OTHER CONDITIONS AND TIMING

- The issuance of First Majestic shares as payment are subject to the approval of listing by the Toronto Stock Exchange (”TSX”) and the number to be issued will be based on the volume-weighted average trading price on the TSX for the 20 trading days up to the day prior to any payment. In addition, the shares shall be subject to a statutory four month and one day hold pursuant to applicable Canadian securities law.

- Closing of the transaction is expected to occur in early July 2020 and is subject to the completion of certain corporate matters and customary conditions.

ABOUT THE SPRINGPOLE GOLD PROJECT

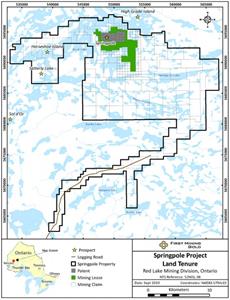

Springpole is one of Canada’s largest, undeveloped gold projects with the project covering a land position totaling 41,943 hectares. The Project is located in northwestern Ontario, approximately 110 kilometres northeast of the town of Red Lake, and is situated within the Birch-Uchi Greenstone Belt.

Figure 1: Map of Springpole is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dab73308-2145-450c-9706-91cb4d5c551e

The Springpole property contains a large, open-pittable deposit having an Indicated Resource of 139.1 million tonnes at 1.04 g/t gold and 5.4 g/t silver, containing 4,670,000 ounces of gold and 24,190,000 ounces of silver. In addition, the project has an Inferred Resource of 11.4 million tonnes at 0.63 g/t gold and 3.1 g/t silver, containing 230,000 ounces of gold and 1,120,000 ounces of silver. The project has significant infrastructure at site including a 72-person camp, winter road access, and nearby logging road and power lines.

Below are the total gold and silver resources in respect of the Springpole Project as of November 5, 2019.

| Category | Tonnes | Au Grade (g/t) | Ag Grade (g/t) | Contained Au (oz) | Contained Ag (oz) |

| Indicated | 139,100,000 | 1.04 | 5.4 | 4,670,000 | 24,190,000 |

| Inferred | 11,400,000 | 0.63 | 3.1 | 230,000 | 1,120,000 |

1. Based on the technical report titled "Preliminary Economic Assessment Update for the Springpole Gold Project, Ontario, Canada", dated November 5, 2019, which was prepared for First Mining by SRK Consulting (Canada) Inc. in accordance with NI 43-101 and is available at www.sedar.com under First Mining's SEDAR profile. Readers are cautioned that the PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2. Cut-off grades are based on US$1,400/oz. Au price and Au recoveries of 80%; and a US$15/oz. Ag price and 60% Ag recoveries.

3. All composites have been capped where appropriate.

4. The rounding of tonnes may result in apparent differences between tonnes, grade and contained ounces.

5. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

ABOUT THE COMPANY

First Majestic is a publicly traded mining company focused on silver production in Mexico and is aggressively pursuing the development of its existing mineral property assets. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver Mine.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward‐looking information” and "forward-looking statements” under applicable Canadian and U.S. securities laws (collectively, “forward‐looking statements”). These statements relate to future events or the Company's future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management's experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements include, but are not limited to, statements with respect to: the Company’s business strategy; future planning processes; commercial mining operations; cash flow; budgets; the timing and amount of estimated future production; recovery rates; mine plans and mine life; the future price of silver and other metals; costs of production; costs and timing of the development of new deposits; capital projects and exploration activities and the possible results thereof; closing of the stream; completion of milestones thereunder; payment of future tranches and issuance of additional shares under the stream; purchases of silver under the stream increases in shareholder value of First Mining; and development of and production from the Springpole mine. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. All statements other than statements of historical fact may be forward‐looking statements. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward‐looking statements to the extent that they involve estimates of the mineralization that will be encountered as and if the property is developed, and in the case of measured and indicated mineral resources or proven and probable mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “target”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward‐looking statements”.

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics on our operations and workforce, and the effects on global economies and society, risks related to the integration of acquisitions; actual results of exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; changes in national or local governments; changes in applicable legislation or application thereof; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks; reclamation expenses; outcomes of pending litigation; limitations on insurance coverage as well as those factors discussed in the section entitled "Description of the Business - Risk Factors" in the Company's most recent Annual Information Form, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although First Majestic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward‐looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.